Joint Reconstruction Devices Market Report

Published Date: 31 January 2026 | Report Code: joint-reconstruction-devices

Joint Reconstruction Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Joint Reconstruction Devices market from 2023 to 2033, covering market size, growth trends, innovative technologies, and the competitive landscape, offering insights for strategic decision-making.

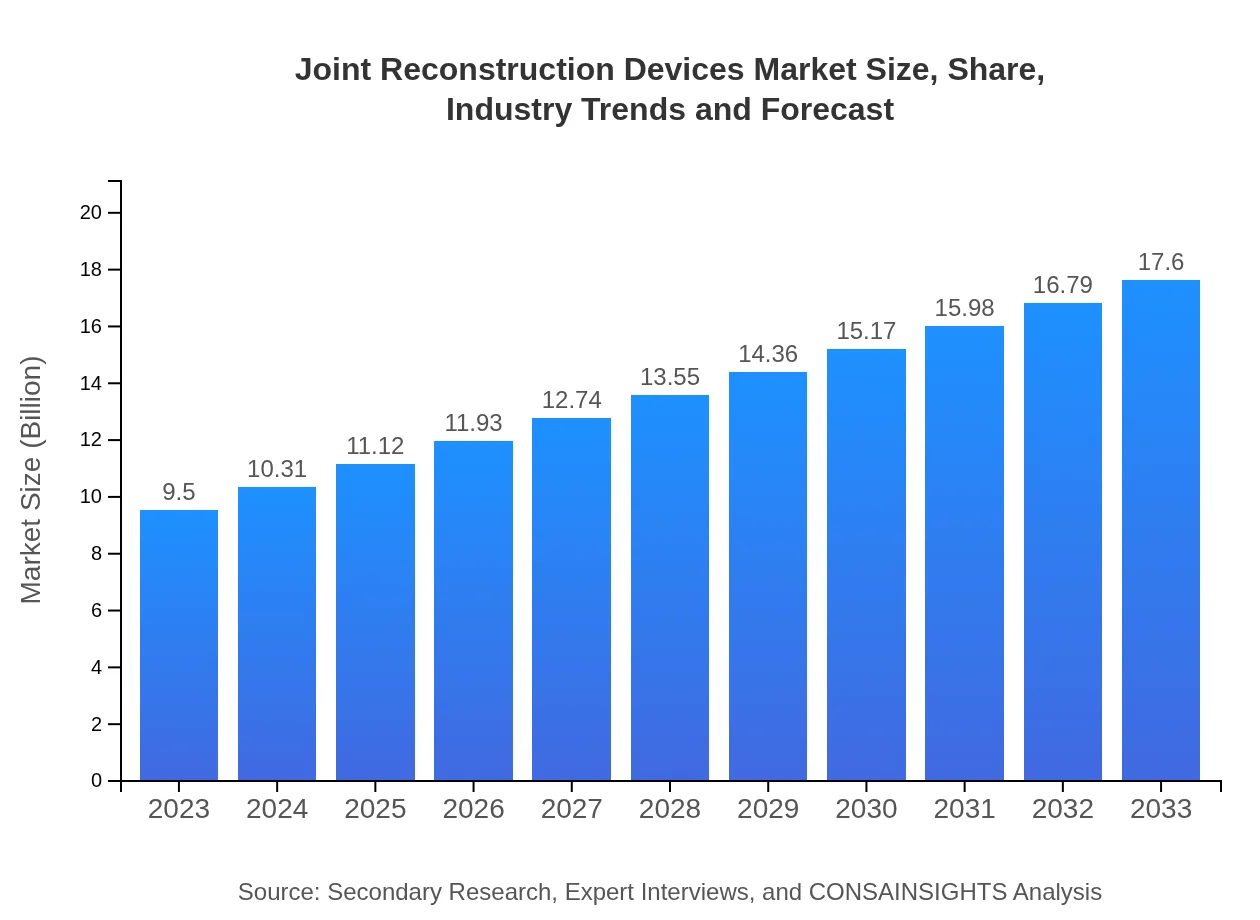

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $17.60 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Medtronic plc |

| Last Modified Date | 31 January 2026 |

Joint Reconstruction Devices Market Overview

Customize Joint Reconstruction Devices Market Report market research report

- ✔ Get in-depth analysis of Joint Reconstruction Devices market size, growth, and forecasts.

- ✔ Understand Joint Reconstruction Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Joint Reconstruction Devices

What is the Market Size & CAGR of Joint Reconstruction Devices market in 2023?

Joint Reconstruction Devices Industry Analysis

Joint Reconstruction Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Joint Reconstruction Devices Market Analysis Report by Region

Europe Joint Reconstruction Devices Market Report:

In Europe, the market is forecasted to grow from USD 3.04 billion in 2023 to USD 5.63 billion by 2033. The robust healthcare framework, coupled with an increasing number of elective surgeries and chronic joint disorders, is driving demand for joint reconstruction devices.Asia Pacific Joint Reconstruction Devices Market Report:

In the Asia Pacific region, the joint reconstruction devices market is expected to grow from USD 1.71 billion in 2023 to USD 3.17 billion by 2033. The rise is driven by increasing healthcare expenditure, improving medical infrastructure, and a heightened prevalence of orthopedic conditions, alongside greater awareness of surgical options among patients.North America Joint Reconstruction Devices Market Report:

The North American joint reconstruction devices market holds a substantial share, starting at USD 3.40 billion in 2023 and expected to rise to USD 6.29 billion by 2033. Factors contributing to this growth include advanced healthcare systems, strong emphasis on R&D, and a high rate of orthopedic surgeries among the aging population.South America Joint Reconstruction Devices Market Report:

The South American market, currently valued at USD 0.65 billion in 2023, is projected to expand to USD 1.20 billion by 2033. This growth is primarily fueled by emerging economies in the region investing in healthcare innovations and the improvement of orthopedic care access.Middle East & Africa Joint Reconstruction Devices Market Report:

The Middle East and Africa region will see growth from USD 0.71 billion in 2023 to USD 1.31 billion by 2033, stemming from improvements in healthcare infrastructure and greater healthcare awareness, which collectively enhance access to necessary treatments.Tell us your focus area and get a customized research report.

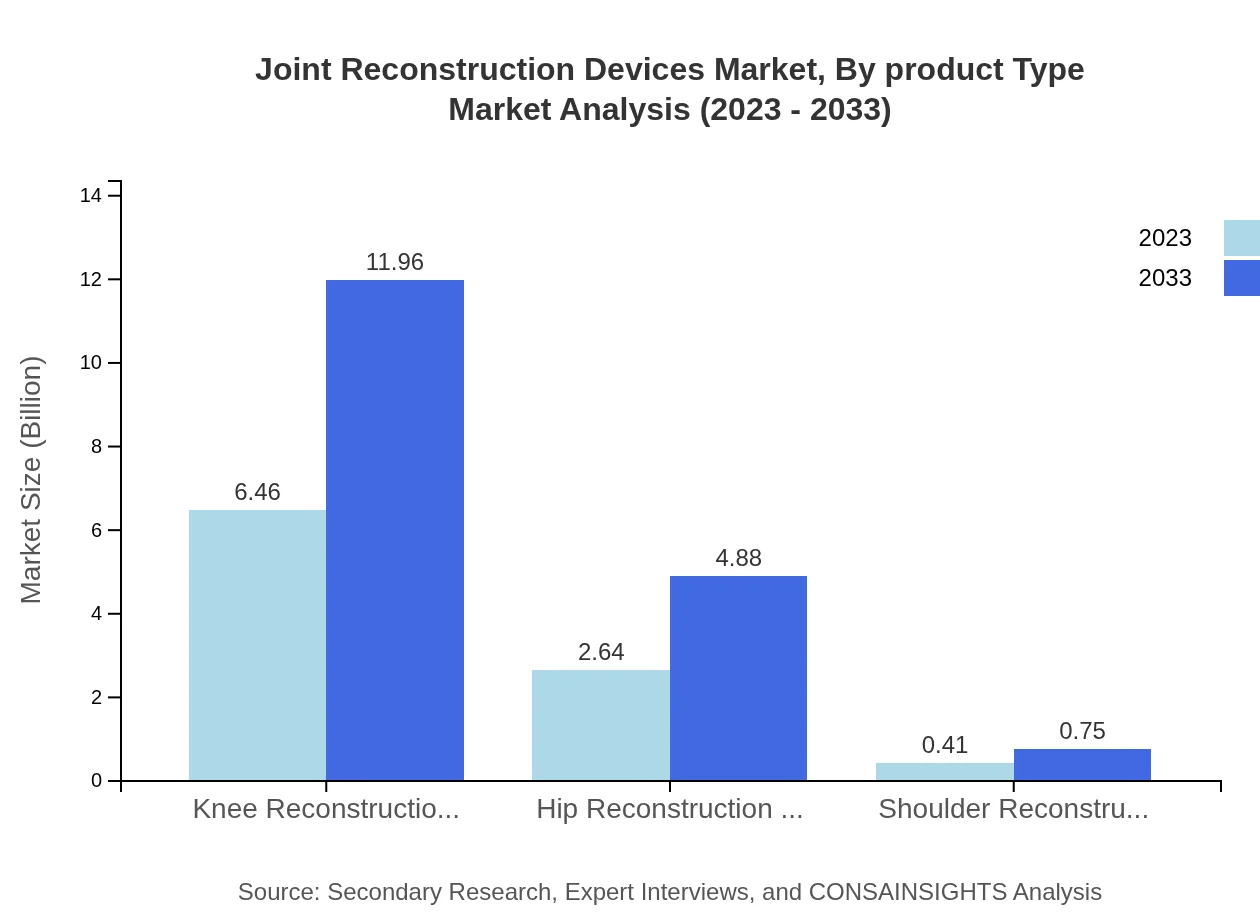

Joint Reconstruction Devices Market Analysis By Product Type

The predominant share of the Joint Reconstruction Devices market is held by knee reconstruction devices, expected to grow from USD 6.46 billion in 2023 to USD 11.96 billion by 2033, representing 67.97% market share. Hip reconstruction devices follow with growth from USD 2.64 billion to USD 4.88 billion, holding a 27.75% market share, while shoulder reconstruction devices account for the smallest segment with growth from USD 0.41 billion to USD 0.75 billion.

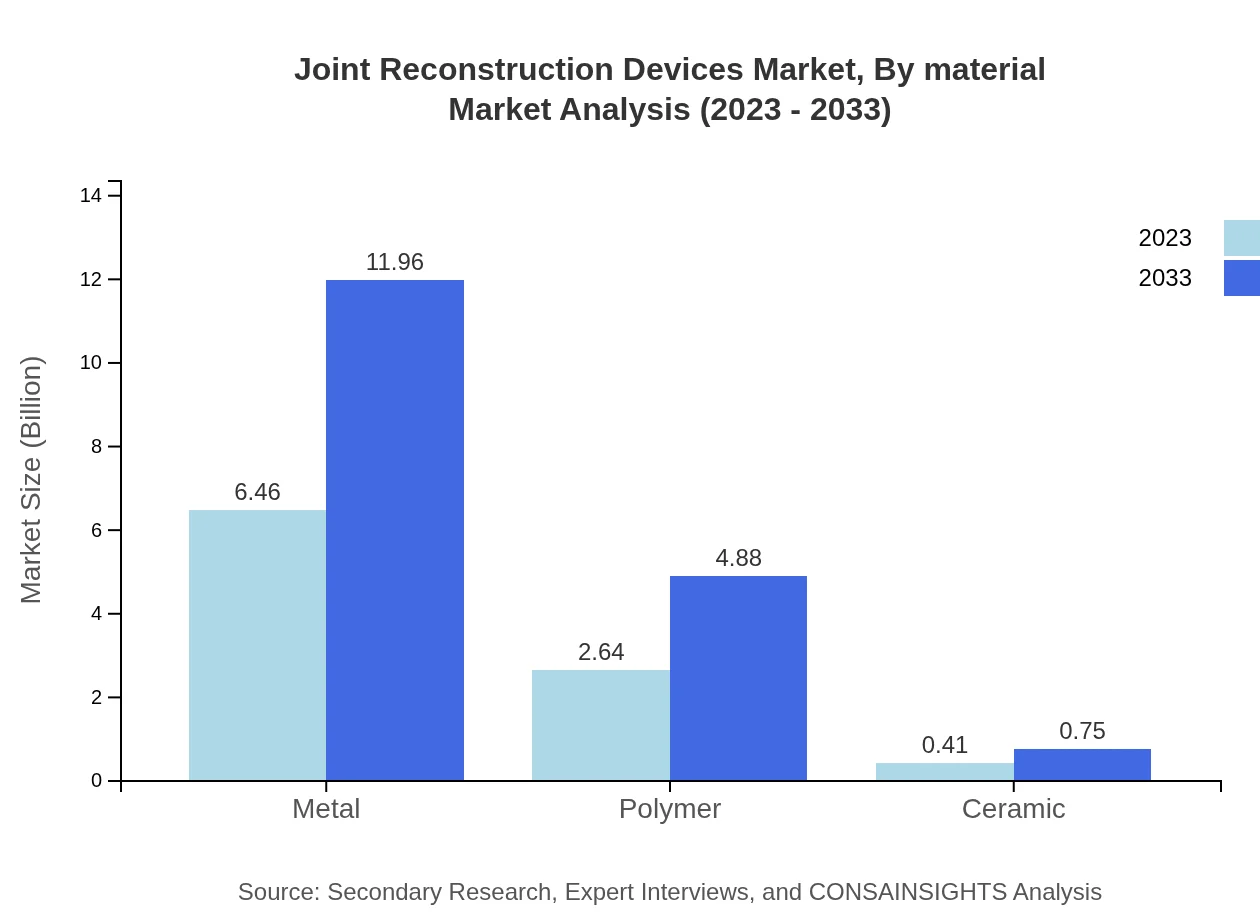

Joint Reconstruction Devices Market Analysis By Material

Metals are the most utilized material in joint reconstruction devices, with an estimated market size of USD 6.46 billion in 2023, projected to reach USD 11.96 billion by 2033, representing a 67.97% share. Polymers are gaining popularity, expected to grow from USD 2.64 billion to USD 4.88 billion, while ceramics will see modest growth from USD 0.41 billion to USD 0.75 billion.

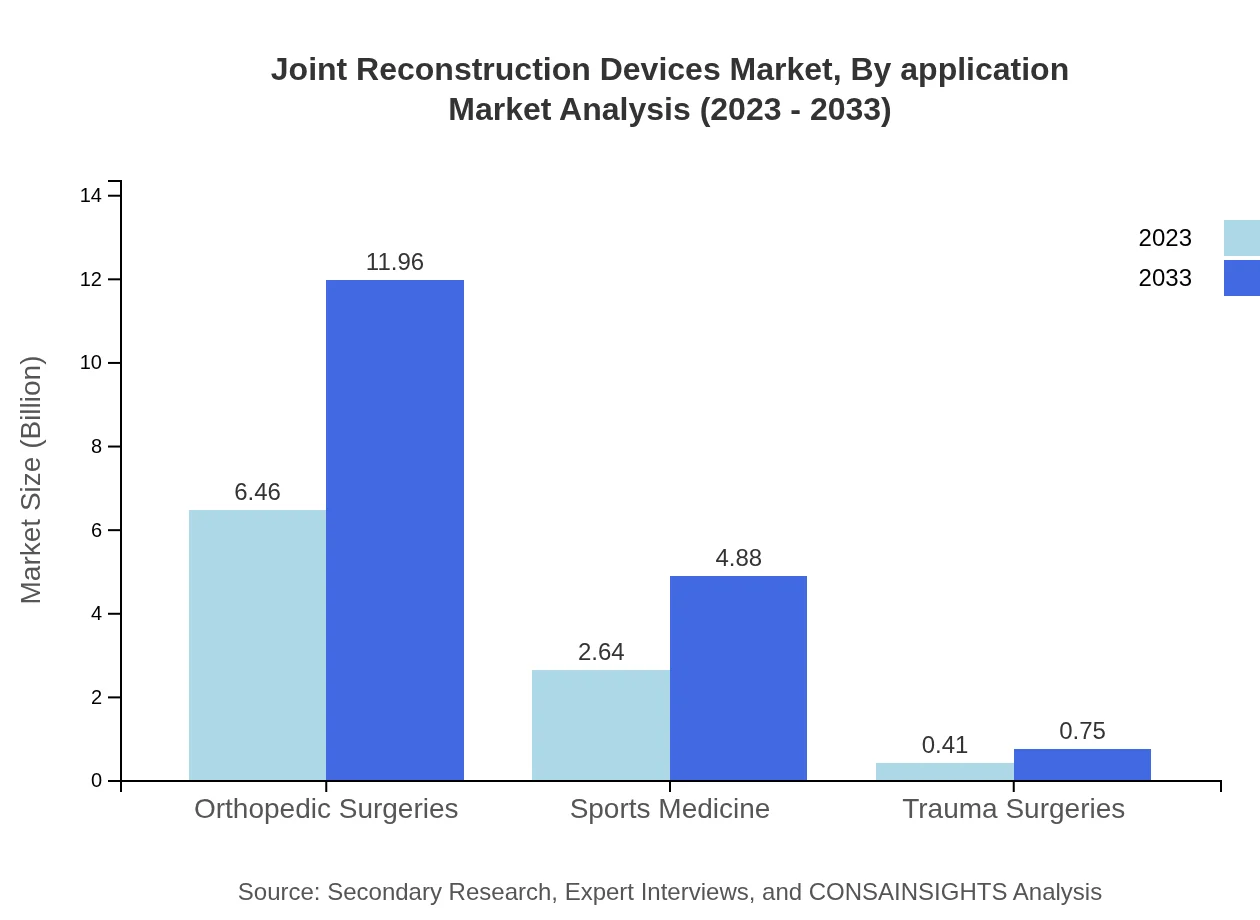

Joint Reconstruction Devices Market Analysis By Application

Orthopedic surgeries dominate the application landscape of the Joint Reconstruction Devices market, with the size expanding from USD 6.46 billion in 2023 to USD 11.96 billion by 2033, holding a 67.97% share. Sports medicine will see growth from USD 2.64 billion to USD 4.88 billion, while trauma surgeries represent a smaller share, increasing from USD 0.41 billion to USD 0.75 billion.

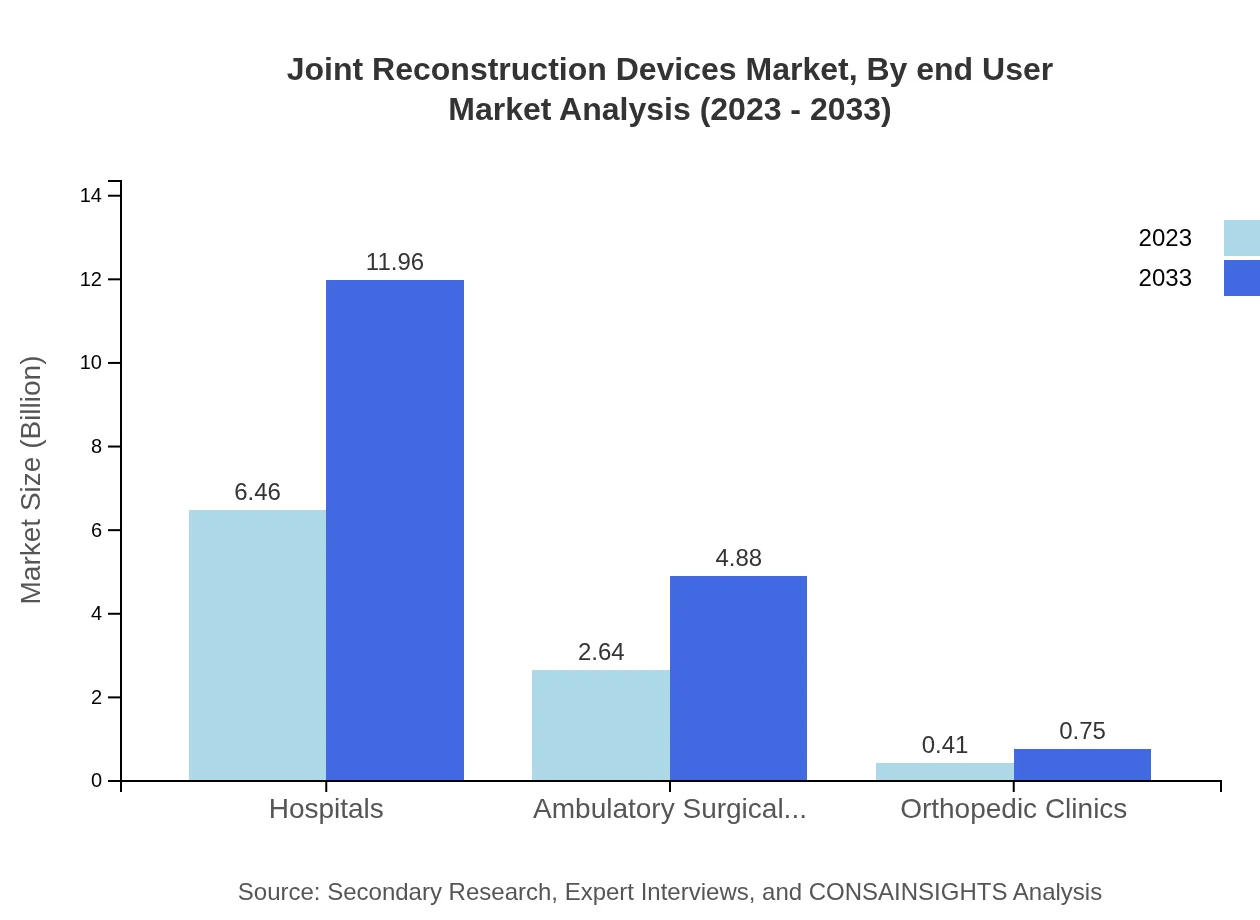

Joint Reconstruction Devices Market Analysis By End User

Hospitals are the primary end-user segment, exhibiting a market size of USD 6.46 billion in 2023, anticipated to grow to USD 11.96 billion by 2033. Ambulatory surgical centers will also see growth, from USD 2.64 billion to USD 4.88 billion, with orthopedic clinics growing from USD 0.41 billion to USD 0.75 billion.

Joint Reconstruction Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Joint Reconstruction Devices Industry

Stryker Corporation:

Stryker is a leading medical technology company with a strong focus on orthopedics, offering a wide range of joint reconstruction devices known for their innovation and quality.Zimmer Biomet Holdings, Inc.:

Zimmer Biomet develops advanced products for joint reconstruction and is known for its pioneering technologies in orthopedic solutions and surgical procedures.DePuy Synthes (Johnson & Johnson):

DePuy Synthes specializes in high-quality orthopedic implants, focusing on joint reconstruction and providing surgeons with advanced techniques and devices.Medtronic plc:

Medtronic focuses on medical technologies, providing a range of joint reconstruction solutions and emphasizing surgical innovation and patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of joint Reconstruction Devices?

The global joint reconstruction devices market is valued at approximately $9.5 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033. Significant growth is anticipated driven by advancements in surgical techniques and increased demand for orthopedic procedures.

What are the key market players or companies in this joint Reconstruction Devices industry?

Key players in the joint reconstruction devices industry include major companies like Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes, Medtronic, and Smith & Nephew. These companies lead in technological innovation and market share.

What are the primary factors driving the growth in the joint reconstruction Devices industry?

The growth in the joint reconstruction devices industry is driven by the aging population, increasing prevalence of joint disorders, advancements in technology, and rising healthcare expenditures across the globe, along with improved patient outcomes from surgery.

Which region is the fastest Growing in the joint reconstruction Devices?

Among global regions, North America is the fastest-growing market for joint reconstruction devices, expected to grow from $3.40 billion in 2023 to $6.29 billion by 2033, driven by healthcare infrastructure, technology, and a high prevalence of joint issues.

Does ConsaInsights provide customized market report data for the joint Reconstruction Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the joint reconstruction devices industry, providing valuable insights tailored to client requirements in various market segments and geographic areas.

What deliverables can I expect from this joint Reconstruction Devices market research project?

From this market research project, clients can expect detailed reports, market forecasts, competitive analysis, segmentation data, and actionable insights aimed at improving business strategies in the joint reconstruction devices industry.

What are the market trends of joint Reconstruction Devices?

Key trends in the joint reconstruction devices market include the shift towards minimally invasive procedures, increased production of patient-specific devices, advancements in materials used, and the growing popularity of robotic surgeries within orthopedic practices.