Joint Replacement Market Report

Published Date: 31 January 2026 | Report Code: joint-replacement

Joint Replacement Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Joint Replacement market, offering crucial insights on market dynamics, trends, and forecasts from 2023 to 2033. It delves into size estimates, growth rates, technology advancements, and key regional analyses, supporting strategic decision-making for stakeholders in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

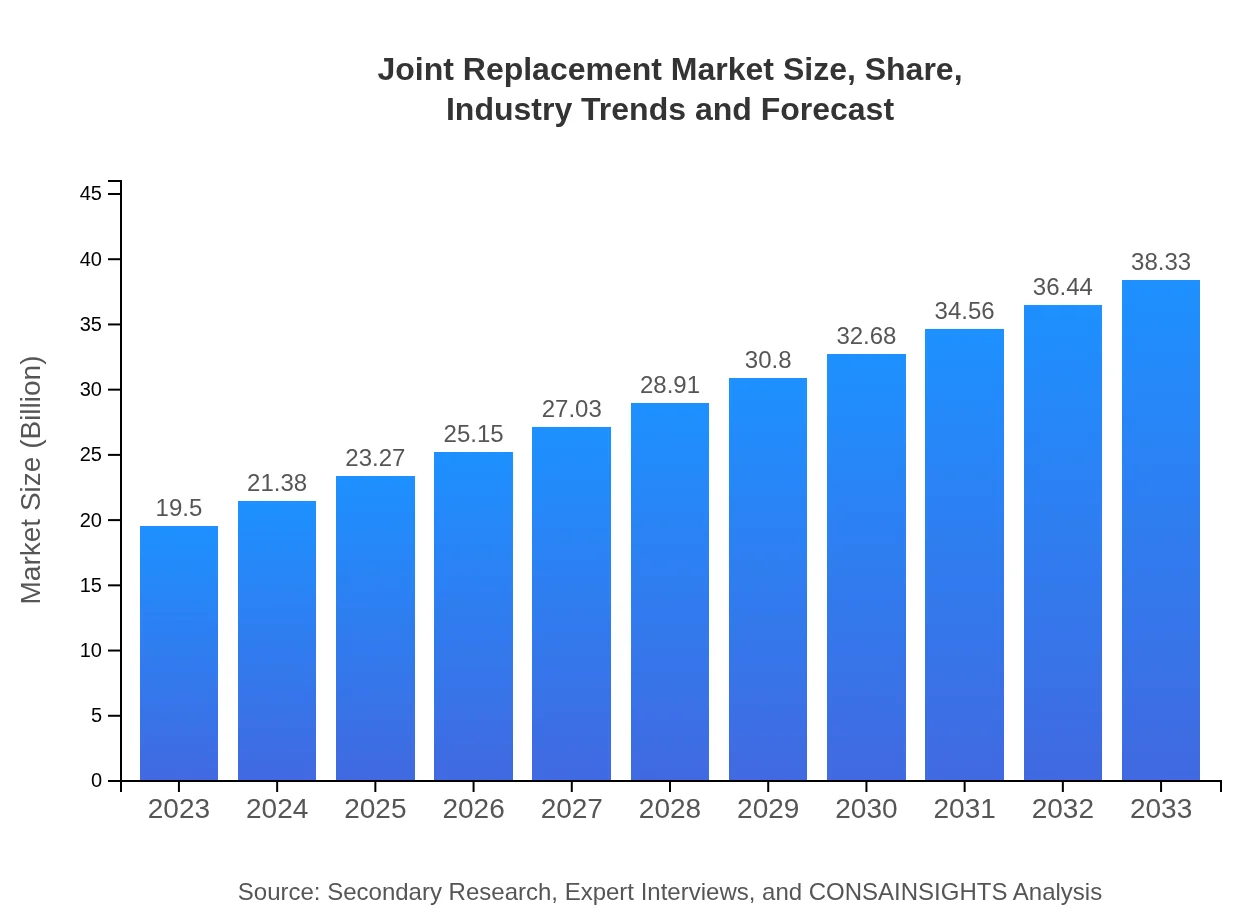

| 2023 Market Size | $19.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $38.33 Billion |

| Top Companies | Johnson & Johnson, Stryker Corporation, Zimmer Biomet, Smith & Nephew, Medtronic |

| Last Modified Date | 31 January 2026 |

Joint Replacement Market Overview

Customize Joint Replacement Market Report market research report

- ✔ Get in-depth analysis of Joint Replacement market size, growth, and forecasts.

- ✔ Understand Joint Replacement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Joint Replacement

What is the Market Size & CAGR of Joint Replacement market in 2023?

Joint Replacement Industry Analysis

Joint Replacement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Joint Replacement Market Analysis Report by Region

Europe Joint Replacement Market Report:

The European Joint Replacement market is projected to grow from USD 5.05 billion in 2023 to USD 9.93 billion by 2033. European countries are witnessing advancements in surgical procedures, propelling demand for joint replacements among aging populations. Increased focus on patient outcomes and innovative implant technologies are further contributing to market growth. Nevertheless, economic challenges in some EU countries might impose restrictions on healthcare spending, affecting growth rates.Asia Pacific Joint Replacement Market Report:

The Asia Pacific region is experiencing significant growth in the Joint Replacement market, with a projected market size of USD 7.70 billion by 2033, up from USD 3.92 billion in 2023. Factors such as a growing elderly population, increased healthcare expenditure, and enhanced access to minimally invasive surgical techniques are driving demand. Countries like Japan, China, and India are at the forefront of this growth, backed by improving healthcare infrastructure and rising awareness of joint replacement solutions.North America Joint Replacement Market Report:

North America dominates the Joint Replacement market, with a significant increase from USD 7.38 billion in 2023 to approximately USD 14.51 billion by 2033. This expansion is primarily driven by a high standard of healthcare, technological advancements in joint replacement procedures, and an increasing trend toward outpatient surgeries. The U.S. remains the largest market due to its advanced healthcare system and a favorable reimbursement environment facilitating surgeries.South America Joint Replacement Market Report:

In South America, the Joint Replacement market is anticipated to grow from USD 0.57 billion in 2023 to USD 1.12 billion by 2033. The market is fueled by an increasing prevalence of joint disorders linked to a more sedentary lifestyle and an aging demographic. However, the growth rate might be tempered by discrepancies in access to healthcare services and funding constraints in some regions, necessitating governmental and institutional interventions to improve service availability.Middle East & Africa Joint Replacement Market Report:

The Joint Replacement market in the Middle East and Africa is expected to grow from USD 2.58 billion in 2023 to USD 5.06 billion by 2033. Factors driving this growth include improving healthcare standards, increasing geriatric population, and rising incidence of orthopedic diseases, particularly in GCC countries. However, challenges such as infrastructure inadequacies in some regions pose potential growth constraints.Tell us your focus area and get a customized research report.

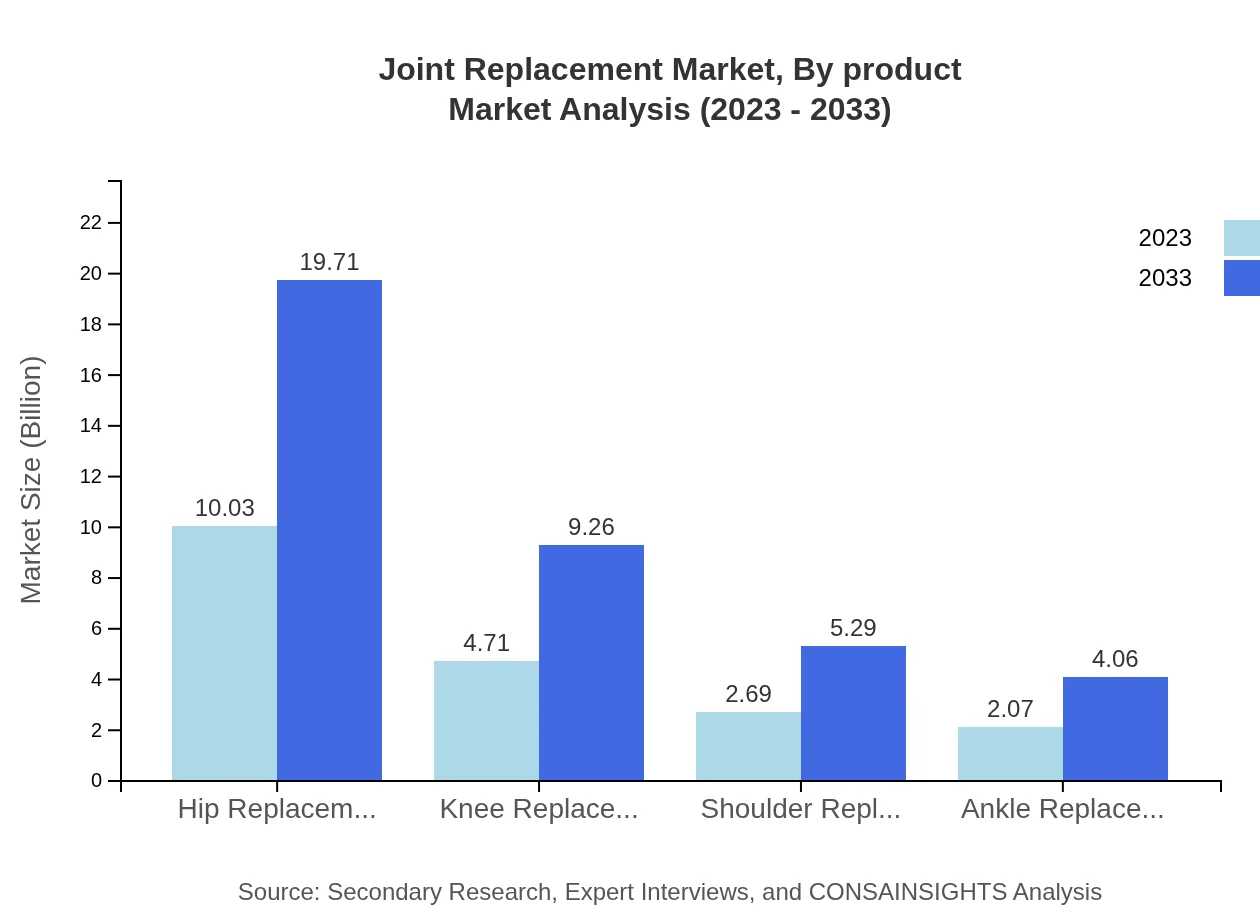

Joint Replacement Market Analysis By Product

The Joint Replacement market, segmented by product type, includes knees, hips, shoulders, and ankles. Hip replacements represent the largest share, expected to grow from USD 10.03 billion in 2023 to USD 19.71 billion by 2033, maintaining a consistent market share of 51.44%. Knee replacements are estimated to increase from USD 4.71 billion to USD 9.26 billion, holding 24.17% market share, while shoulder and ankle replacements are also gaining traction, reflecting growing consumer acceptance of these procedures.

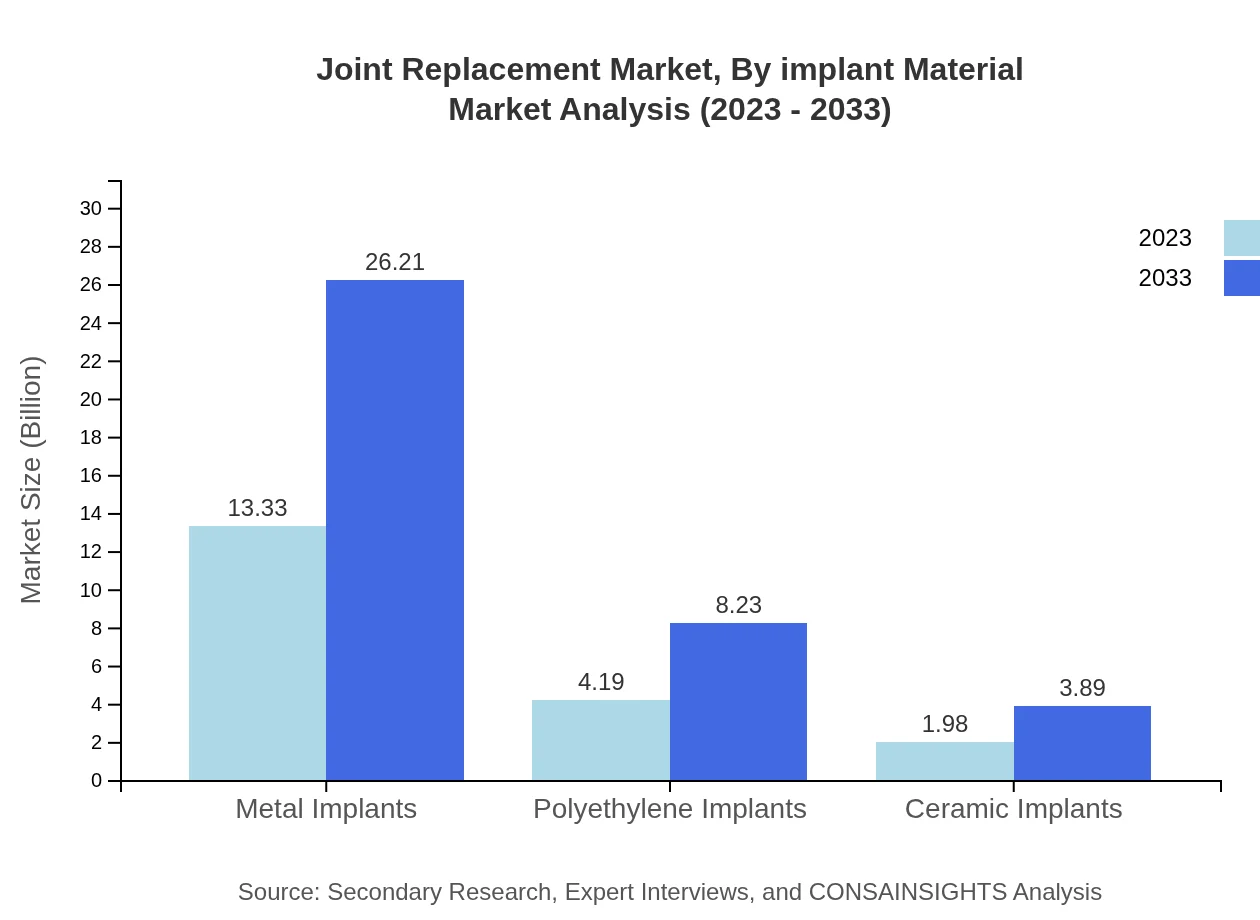

Joint Replacement Market Analysis By Implant Material

In terms of implant materials, metal implants dominate the Joint Replacement market, set to grow from USD 13.33 billion in 2023 to USD 26.21 billion by 2033, maintaining a strong market share of 68.38%. Polyethylene implants follow with significant growth prospects, expanding from USD 4.19 billion to USD 8.23 billion, while ceramic implants represent a smaller but equally competitive segment, increasing from USD 1.98 billion to USD 3.89 billion.

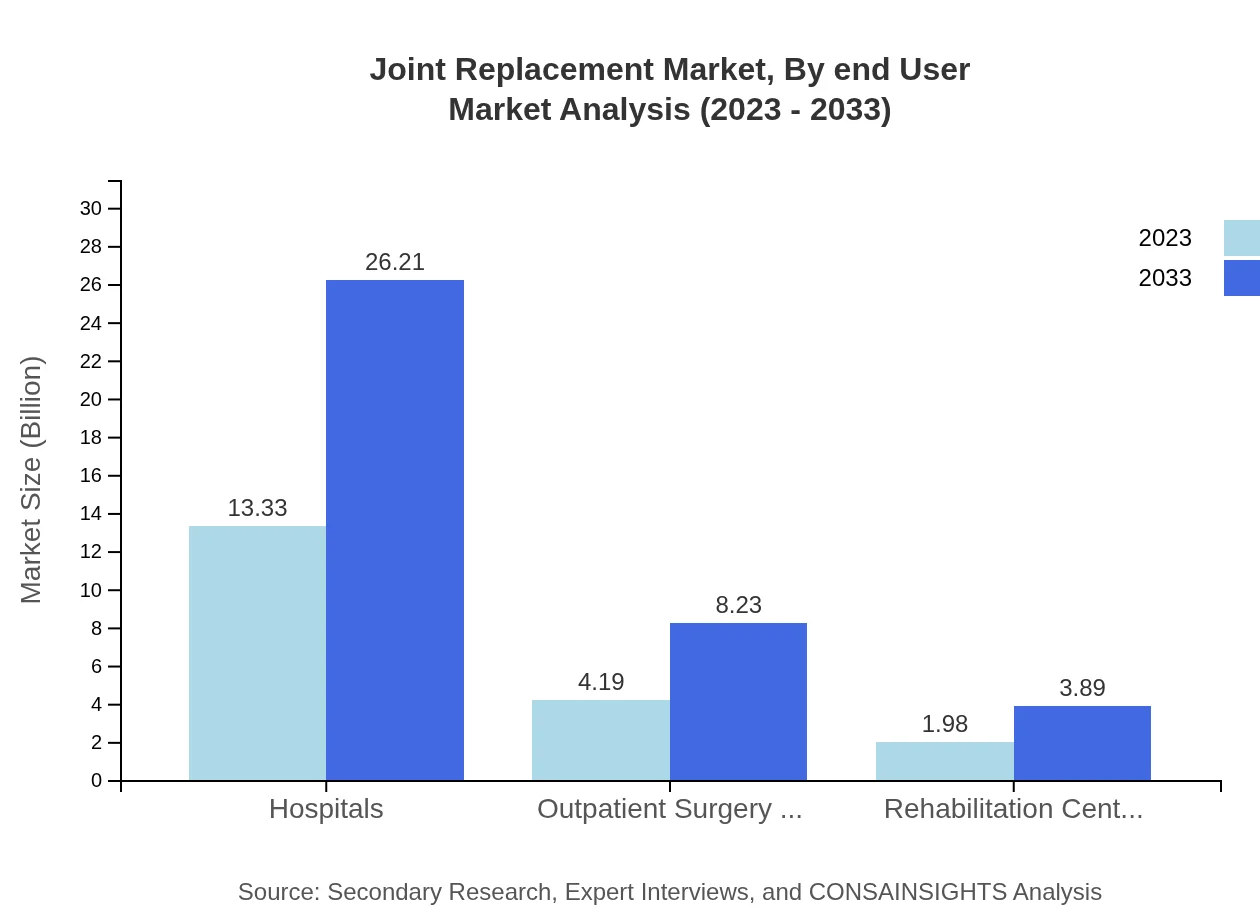

Joint Replacement Market Analysis By End User

The Joint Replacement market analysis by end-user shows hospitals dominating the market, projected to grow from USD 13.33 billion to USD 26.21 billion by 2033, capturing 68.38% market share. Outpatient surgery centers are also experiencing growth, expected to increase from USD 4.19 billion to USD 8.23 billion, with a 21.48% share. Rehabilitation centers, while smaller, represent a growing segment with expected growth from USD 1.98 billion to USD 3.89 billion.

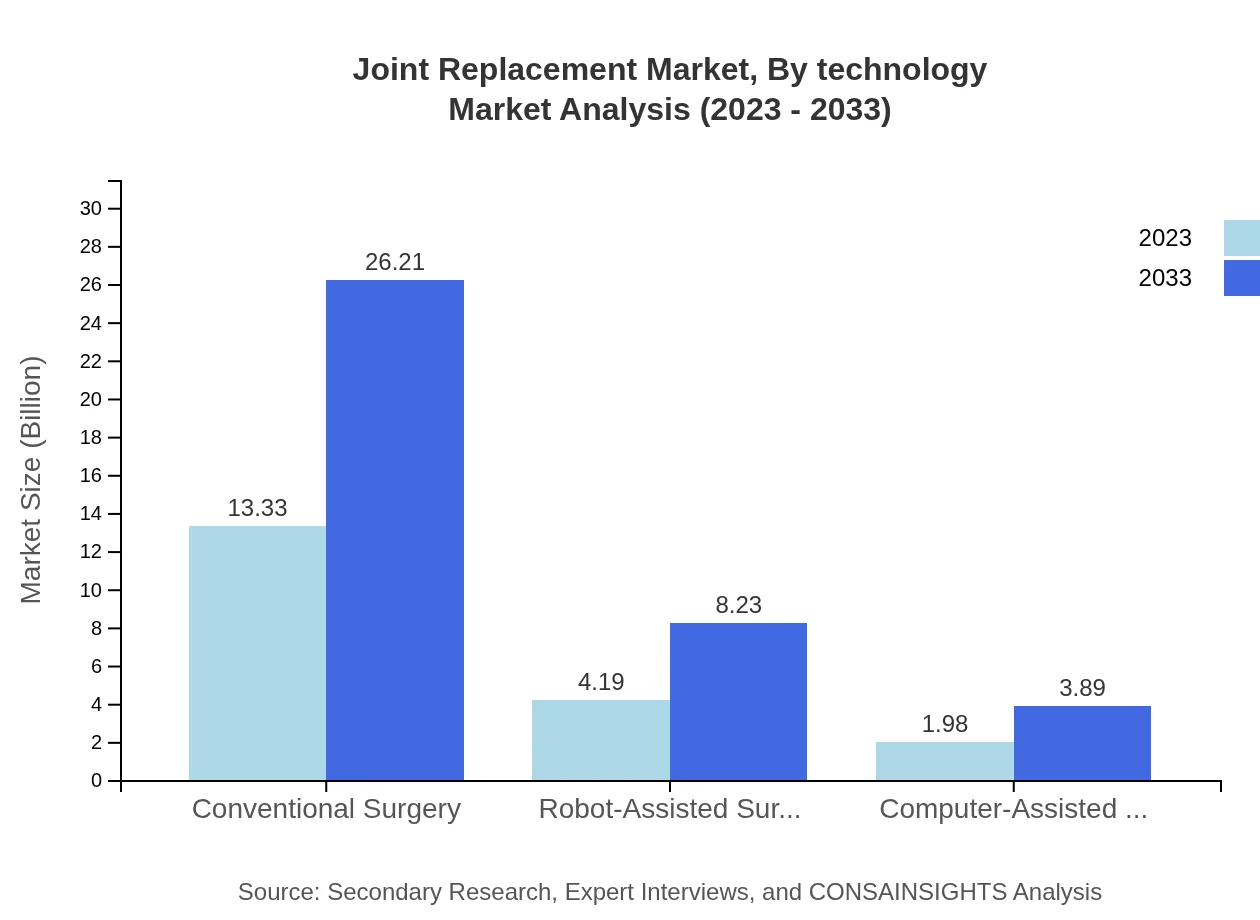

Joint Replacement Market Analysis By Technology

Technology analysis in the Joint Replacement market reveals a significant shift towards innovative surgical techniques. Conventional surgery retains a major portion of the market but robot-assisted and computer-assisted surgeries are on the rise, with robot-assisted surgery forecasted to grow from USD 4.19 billion in 2023 to USD 8.23 billion by 2033, and computer-assisted surgery rising from USD 1.98 billion to USD 3.89 billion. This growth caters to increasing demand for precision and reduced recovery times.

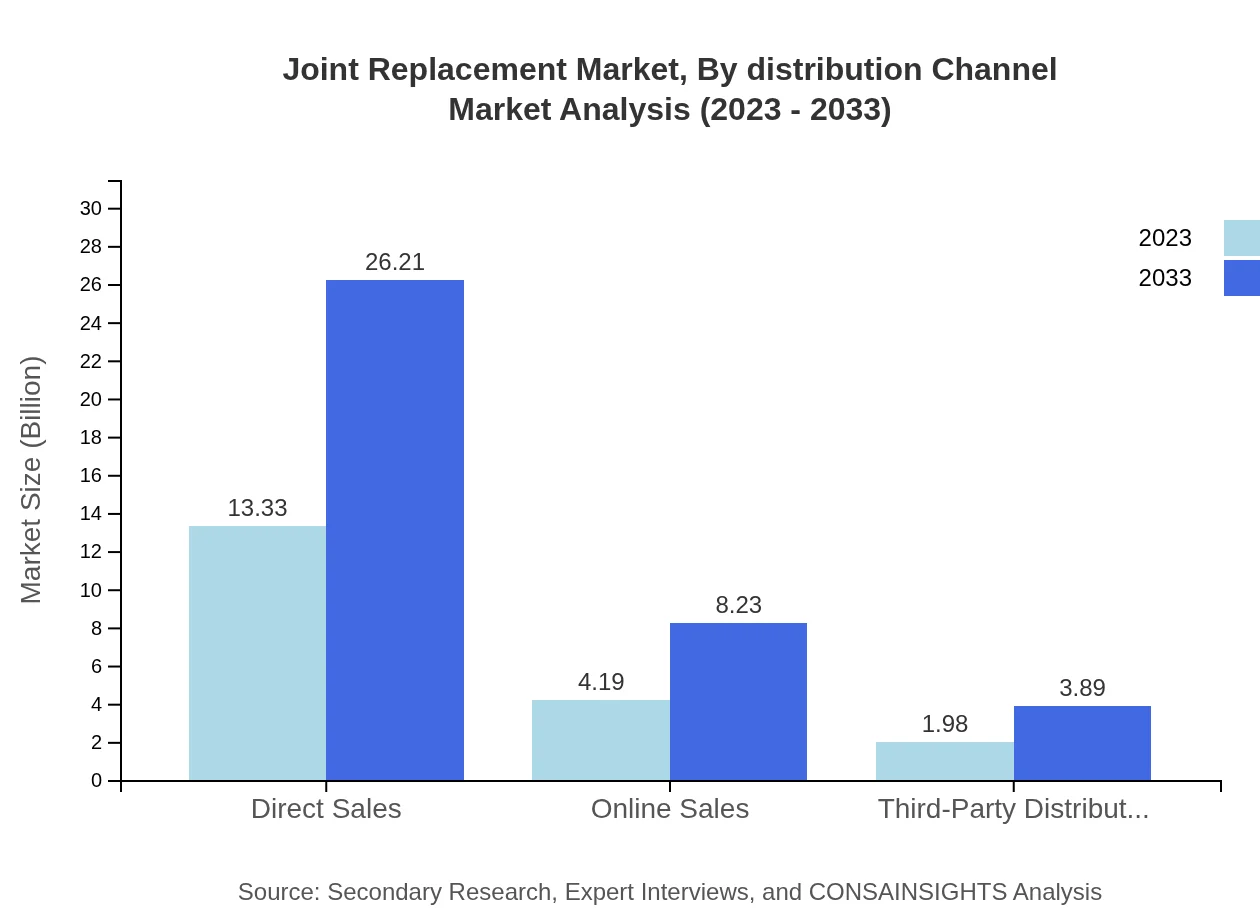

Joint Replacement Market Analysis By Distribution Channel

The Joint Replacement market's distribution channels reveal a significant preference for direct sales, which represents 68.38% of the total market, projected to grow from USD 13.33 billion to USD 26.21 billion by 2033. Online sales and third-party distributors will also see growth, with online sales projected to increase from USD 4.19 billion to USD 8.23 billion, reflecting changing consumer purchasing behaviors.

Joint Replacement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Joint Replacement Industry

Johnson & Johnson:

A leader in the medical devices sector with a strong portfolio in orthopedic solutions, including hip and knee implants, known for its advanced surgical techniques and high-quality products.Stryker Corporation:

Renowned for innovation in joint replacement technologies, Stryker offers a range of implants and surgical equipment focusing on improving patient outcomes and surgical efficiency.Zimmer Biomet:

A global leader in musculoskeletal healthcare, specializing in joint replacement solutions with robust research capabilities and a comprehensive product lineup.Smith & Nephew:

An international medical technology business that specializes in advanced wound management and joint reconstruction devices, known for its innovative products and solutions.Medtronic :

A leader in medical technology innovation, focusing on advanced implantable medical devices, including products that facilitate joint replacement surgeries.We're grateful to work with incredible clients.

FAQs

What is the market size of Joint Replacement?

The global joint replacement market is currently valued at approximately $19.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8% from 2023 to 2033.

What are the key market players or companies in the Joint Replacement industry?

Key players in the joint replacement market include major companies like Johnson & Johnson, Zimmer Biomet, Stryker Corporation, Smith & Nephew, and Medtronic. These companies lead in research, development, and innovation in orthopedic devices.

What are the primary factors driving the growth in the Joint Replacement industry?

Growth in the joint replacement market is driven by an increase in the aging population, rising prevalence of joint disorders, advancements in surgical techniques, and growing adoption of minimally invasive procedures, enhancing surgical recovery and rehabilitation.

Which region is the fastest Growing in the Joint Replacement market?

The Asia Pacific region is the fastest-growing area in the joint replacement market, projected to reach $7.70 billion by 2033, up from $3.92 billion in 2023, indicating significant demand and innovation in orthopedic solutions.

Does ConsaInsights provide customized market report data for the Joint Replacement industry?

Yes, ConsaInsights offers tailored market reports for the joint replacement industry, allowing for personalized insights and detailed analysis based on specific client needs and market demands.

What deliverables can I expect from this Joint Replacement market research project?

Deliverables from the joint replacement market research project will include comprehensive market analysis reports, trend assessments, regional insights, competitor analyses, and forecasts to guide strategic business decisions.

What are the market trends of Joint Replacement?

Current trends in the joint replacement market include the increasing demand for robotic-assisted surgeries, the rise of outpatient procedures, and the growing use of novel materials in implants, enhancing durability and patient outcomes.