Knee Reconstruction Devices Market Report

Published Date: 31 January 2026 | Report Code: knee-reconstruction-devices

Knee Reconstruction Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth examination of the Knee Reconstruction Devices market, covering key insights, market size, and growth forecasts from 2023 to 2033, as well as trends and regional breakdowns.

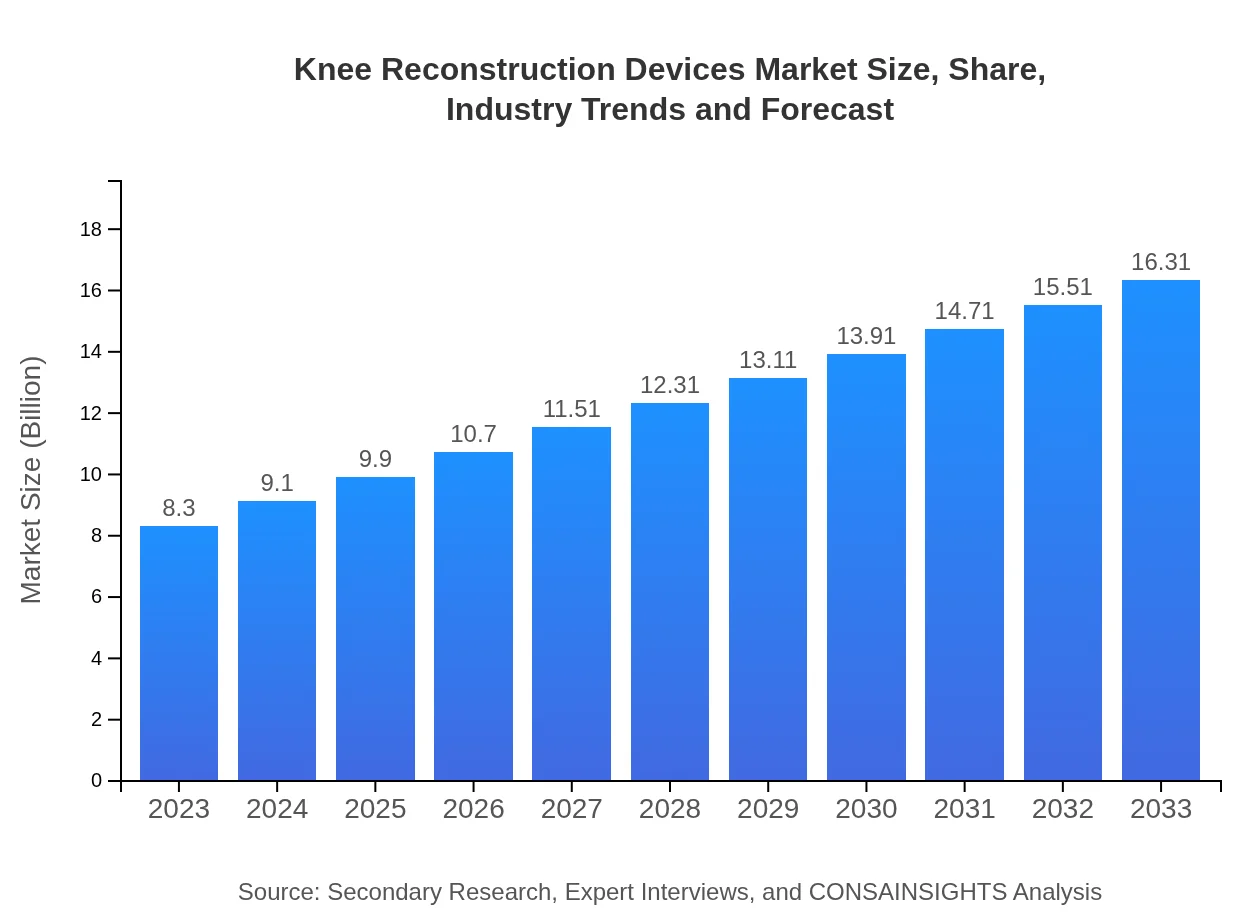

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.31 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet, Smith & Nephew, Johnson & Johnson (DePuy Synthes) |

| Last Modified Date | 31 January 2026 |

Knee Reconstruction Devices Market Overview

Customize Knee Reconstruction Devices Market Report market research report

- ✔ Get in-depth analysis of Knee Reconstruction Devices market size, growth, and forecasts.

- ✔ Understand Knee Reconstruction Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Knee Reconstruction Devices

What is the Market Size & CAGR of Knee Reconstruction Devices market in 2023?

Knee Reconstruction Devices Industry Analysis

Knee Reconstruction Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Knee Reconstruction Devices Market Analysis Report by Region

Europe Knee Reconstruction Devices Market Report:

Europe holds a market value of $2.46 billion in 2023, expected to grow to $4.83 billion by 2033. The region's robust healthcare infrastructure and availability of advanced surgical devices contribute to its expansion.Asia Pacific Knee Reconstruction Devices Market Report:

In the Asia Pacific region, the market is valued at $1.69 billion in 2023, projected to reach $3.31 billion by 2033, demonstrating a significant growth trajectory driven by increasing healthcare spending and a rising prevalence of knee disorders.North America Knee Reconstruction Devices Market Report:

North America leads with a market size of $2.66 billion in 2023, anticipated to reach $5.23 billion by 2033. Factors include a high number of surgical procedures and advancements in healthcare technologies.South America Knee Reconstruction Devices Market Report:

The South American market, with a value of $0.76 billion in 2023, is expected to grow to $1.50 billion by 2033. Growing awareness and accessibility to medical services are central to this growth.Middle East & Africa Knee Reconstruction Devices Market Report:

In the Middle East and Africa, the market size is estimated at $0.73 billion in 2023, climbing to $1.44 billion by 2033, driven by improvements in healthcare systems and surgical training.Tell us your focus area and get a customized research report.

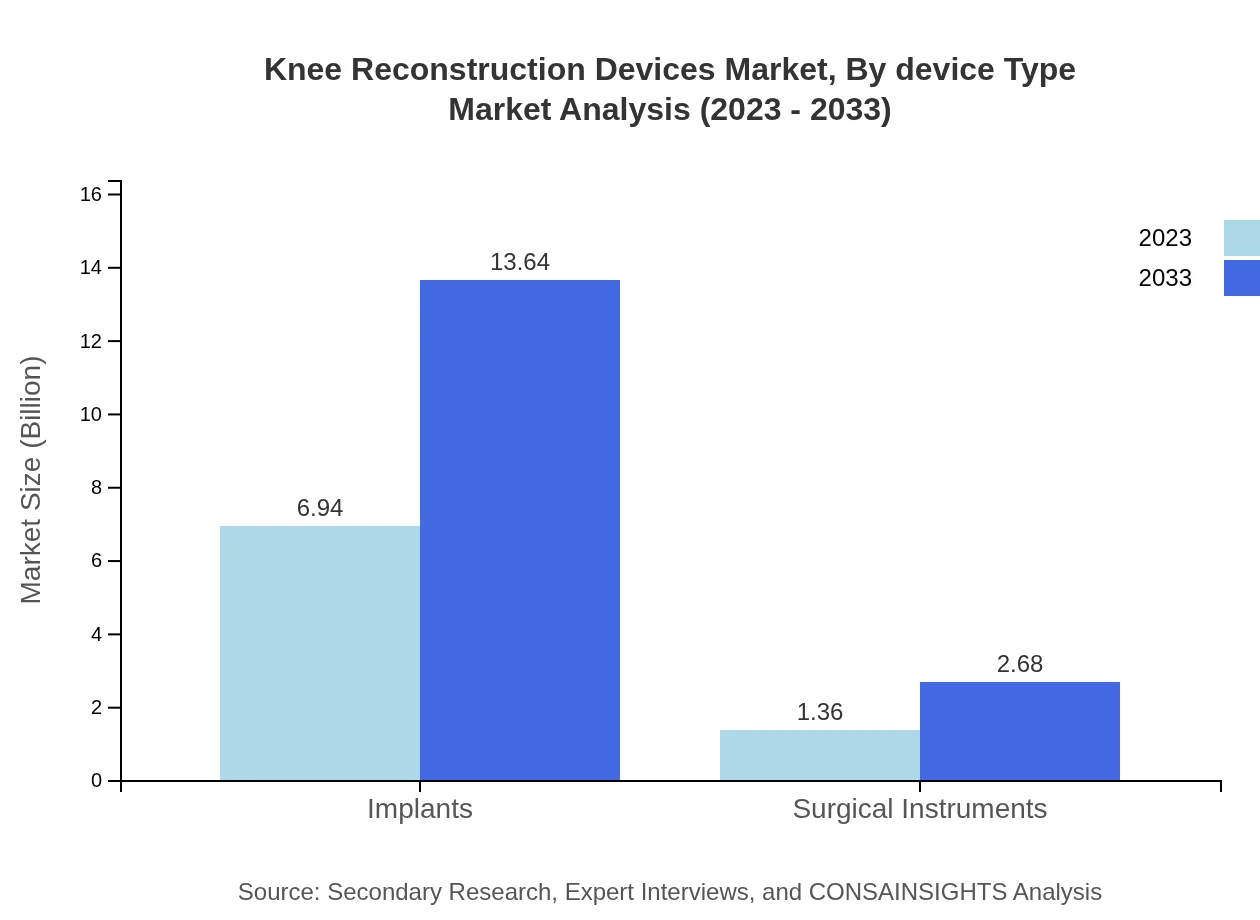

Knee Reconstruction Devices Market Analysis By Device Type

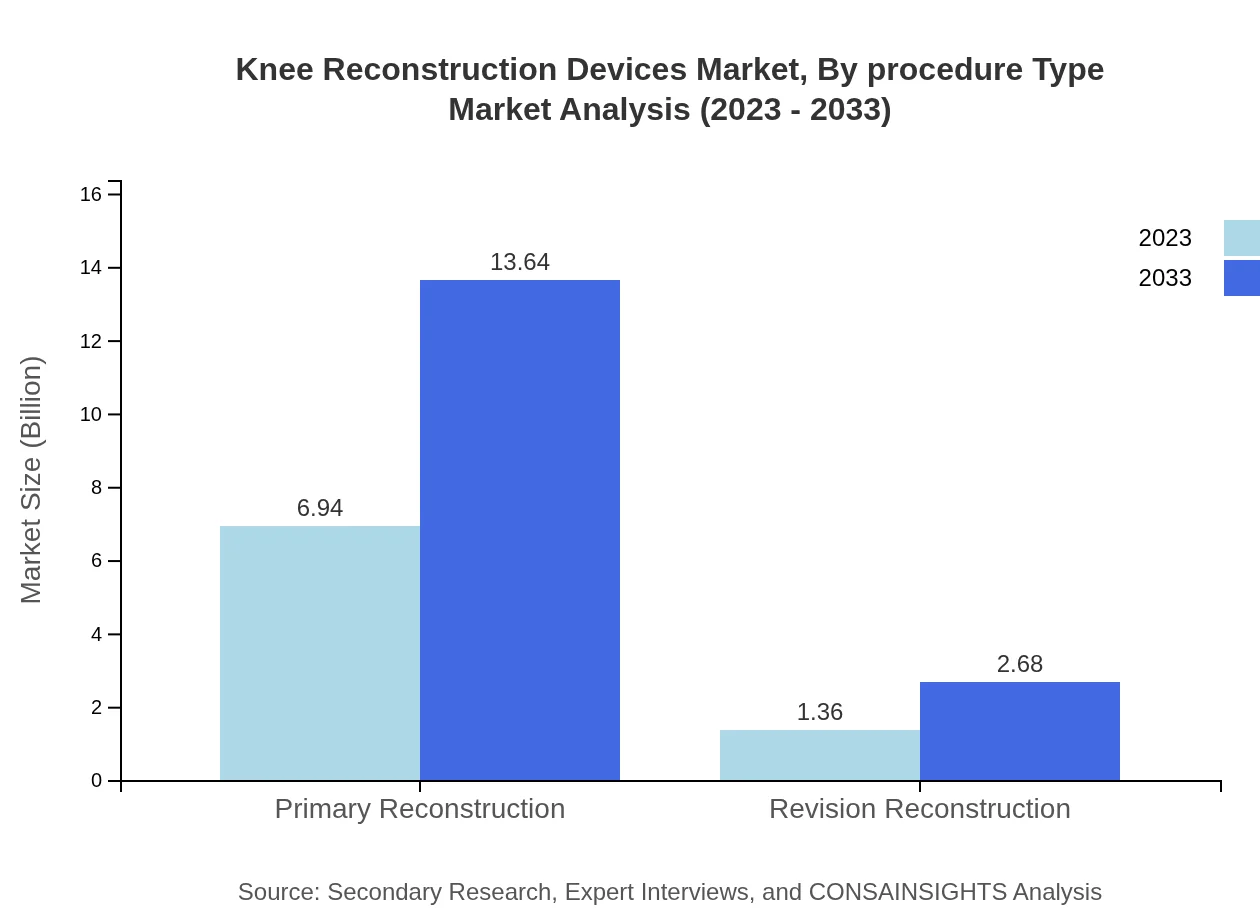

The market by device type highlights that implants constitute the majority share, valued at $6.94 billion in 2023 and expected to reach $13.64 billion by 2033, capturing 83.59% of the market share. Surgical instruments follow, projected to grow from $1.36 billion to $2.68 billion in the same period.

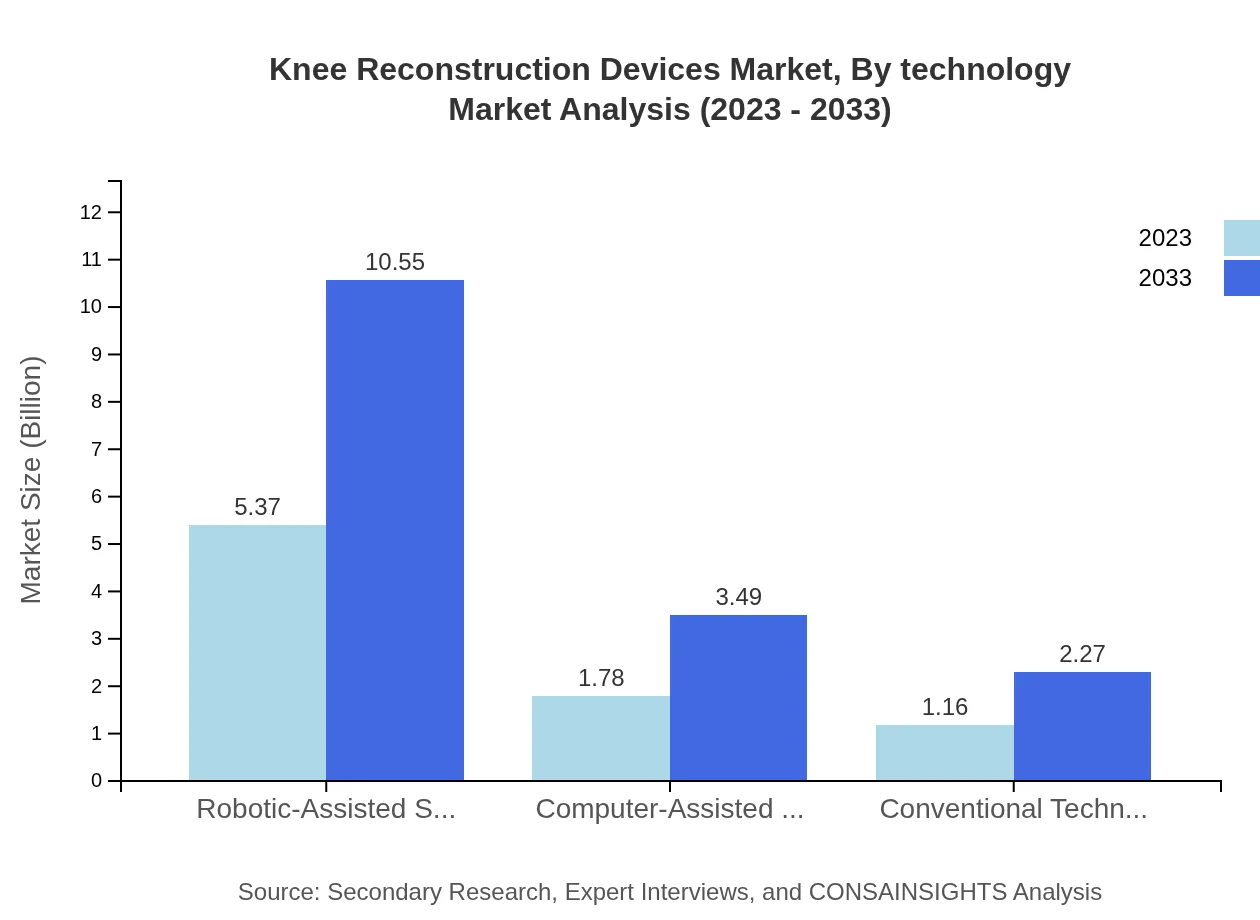

Knee Reconstruction Devices Market Analysis By Technology

The technology segment reveals that robotic-assisted surgeries represent a significant innovation, projected to grow from $5.37 billion in 2023 to $10.55 billion by 2033, retaining a 64.68% market share. Computer-assisted surgeries are also growing, expected to rise from $1.78 billion to $3.49 billion.

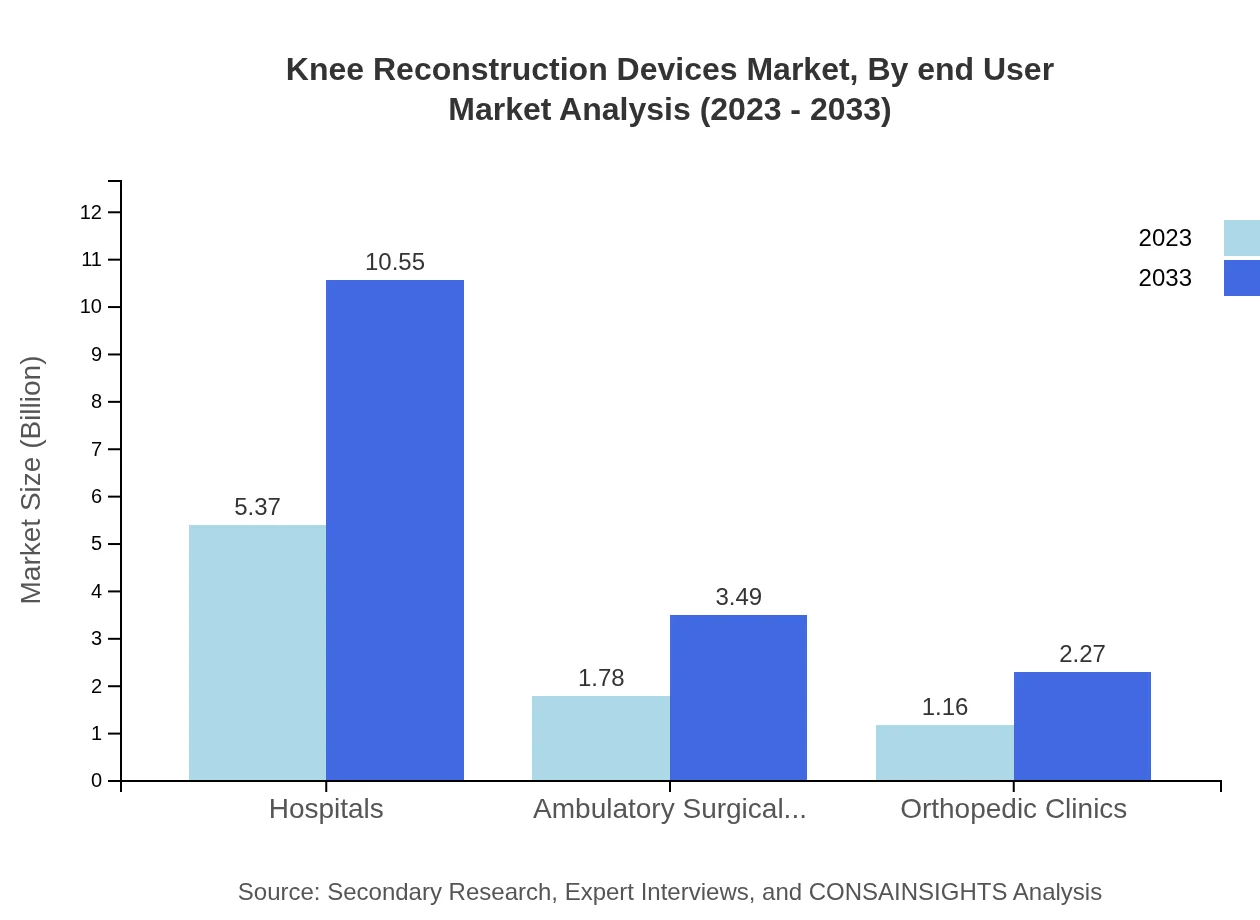

Knee Reconstruction Devices Market Analysis By End User

Among end-users, hospitals dominate the market with a size of $5.37 billion in 2023, expected to grow to $10.55 billion. Ambulatory surgical centers and orthopedic clinics are also notable, with projected values of $1.78 billion to $3.49 billion and $1.16 billion to $2.27 billion, respectively.

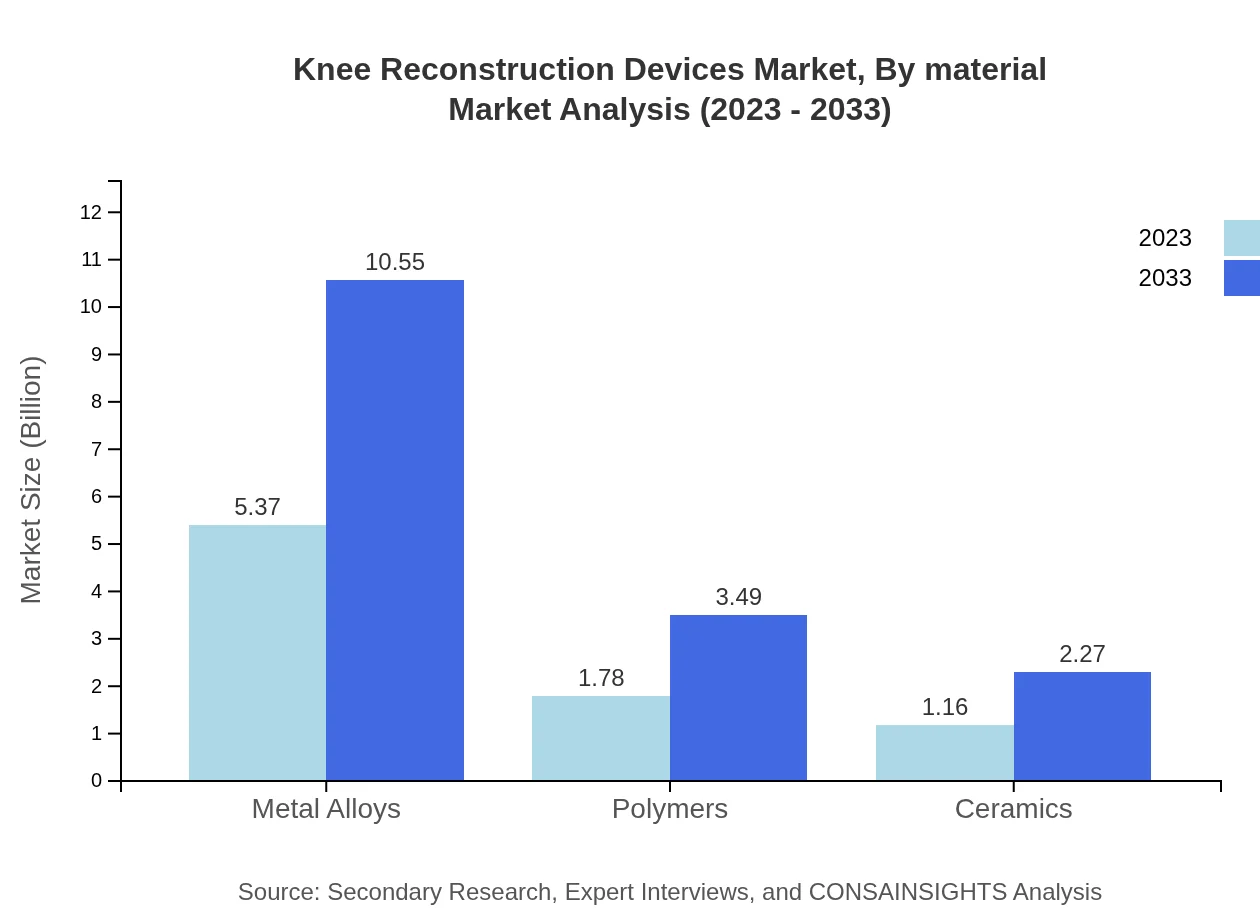

Knee Reconstruction Devices Market Analysis By Material

Metal alloys dominate the materials segment with an expected size of $5.37 billion in 2023, projected to reach $10.55 billion by 2033, maintaining a 64.68% share. Polymers and ceramics also show promising growth, highlighted by sizes expected to increase from $1.78 billion to $3.49 billion for polymers, and $1.16 billion to $2.27 billion for ceramics.

Knee Reconstruction Devices Market Analysis By Procedure Type

In terms of procedure types, primary reconstruction is the significant contributor with a size anticipated to rise from $6.94 billion to $13.64 billion, while revision reconstruction grows from $1.36 billion to $2.68 billion by 2033.

Knee Reconstruction Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Knee Reconstruction Devices Industry

Stryker Corporation:

A leading innovator in medical technologies and devices, Stryker Corporation specializes in reconstructive knee surgeries, known for their product range and surgical solutions.Zimmer Biomet:

Zimmer Biomet is recognized for pioneering orthopedic solutions, offering a comprehensive suite of knee reconstruction products, including advanced implant technologies.Smith & Nephew:

Smith & Nephew provides a wide variety of knee reconstruction devices focusing on enhancing surgical efficiency and patient recovery outcomes.Johnson & Johnson (DePuy Synthes):

DePuy Synthes, a subsidiary of Johnson & Johnson, offers cutting-edge knee implants and surgical tools aimed at improving surgical performance and patient satisfaction.We're grateful to work with incredible clients.

FAQs

What is the market size of knee Reconstruction Devices?

The knee reconstruction devices market is valued at approximately $8.3 billion in 2023. With a projected CAGR of 6.8%, it is expected to grow significantly by 2033, reflecting increasing demand for knee surgeries and advancements in medical technologies.

What are the key market players or companies in this knee Reconstruction Devices industry?

Key market players in the knee reconstruction devices industry include major global companies such as Johnson & Johnson, Stryker Corporation, and Zimmer Biomet. These companies lead by innovation and technological advancements, significantly contributing to market growth.

What are the primary factors driving the growth in the knee reconstruction devices industry?

The growth of the knee reconstruction devices industry is driven by factors such as the rising prevalence of knee injuries, increasing aging population, advancements in surgical techniques, and the growing adoption of minimally invasive procedures.

Which region is the fastest Growing in the knee reconstruction devices?

The North America region is the fastest-growing market for knee reconstruction devices, projected to increase from $2.66 billion in 2023 to $5.23 billion by 2033, driven by technological advancements and increasing healthcare expenditure.

Does ConsaInsights provide customized market report data for the knee reconstruction devices industry?

Yes, ConsaInsights offers customized market report data tailored to the knee reconstruction devices industry. Clients can request specific insights and data parameters to meet their unique research and analysis needs.

What deliverables can I expect from this knee reconstruction devices market research project?

Expected deliverables from the knee reconstruction devices market research project include comprehensive market analysis reports, data on market sizes and forecasts, competitive landscape insights, and segment analyses for various regions and demographics.

What are the market trends of knee reconstruction devices?

Current market trends in knee reconstruction devices include the increased use of robotic and computer-assisted surgical techniques, the growing preference for outpatient surgeries, and the development of innovative materials for implants, enhancing surgery outcomes.