Knee Replacement Market Report

Published Date: 31 January 2026 | Report Code: knee-replacement

Knee Replacement Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Knee Replacement market from 2023 to 2033, providing valuable insights into market size, growth rates, industry trends, and regional analyses, along with the competitive landscape and future forecasts.

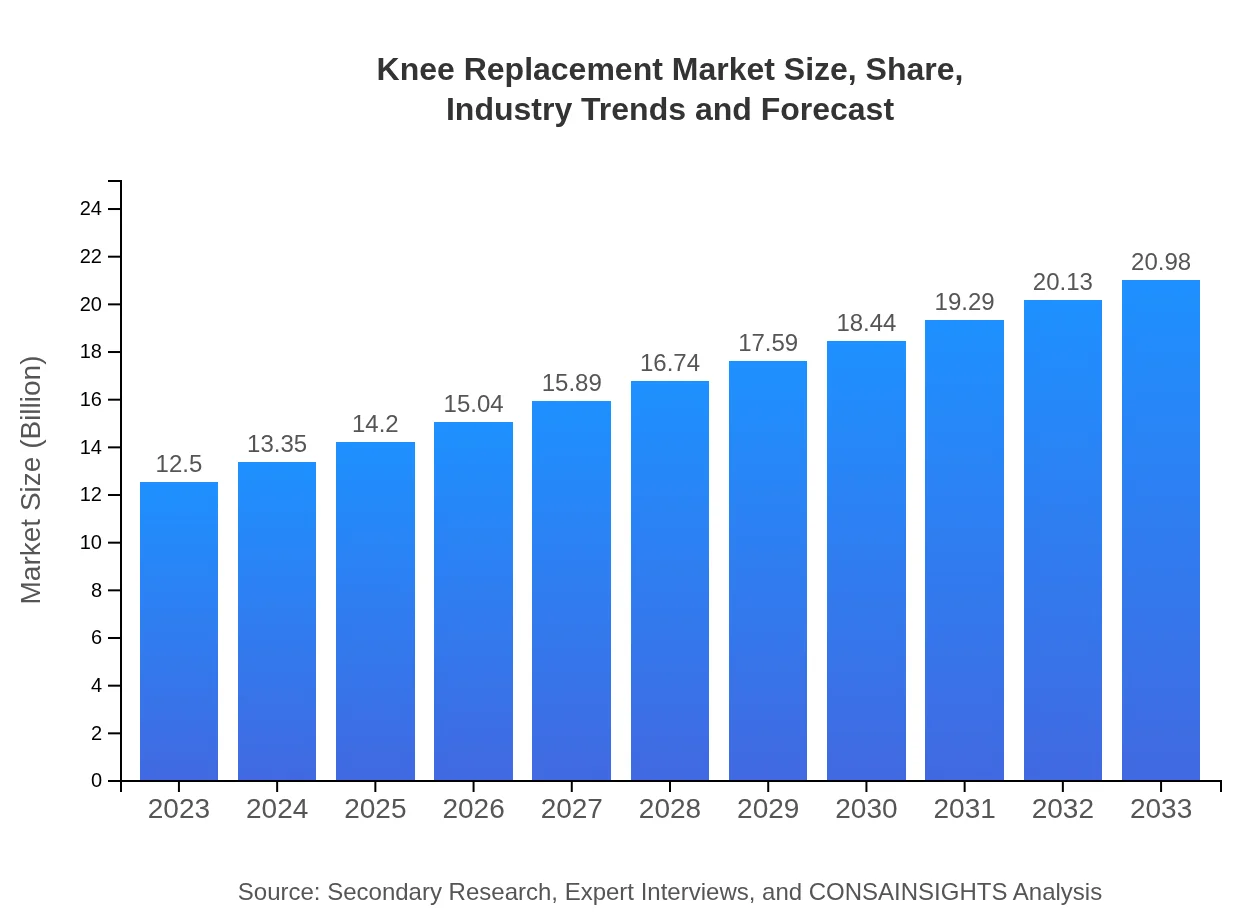

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $20.98 Billion |

| Top Companies | Zimmer Biomet, Stryker Corporation, DePuy Synthes, Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Knee Replacement Market Overview

Customize Knee Replacement Market Report market research report

- ✔ Get in-depth analysis of Knee Replacement market size, growth, and forecasts.

- ✔ Understand Knee Replacement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Knee Replacement

What is the Market Size & CAGR of Knee Replacement market in 2023?

Knee Replacement Industry Analysis

Knee Replacement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Knee Replacement Market Analysis Report by Region

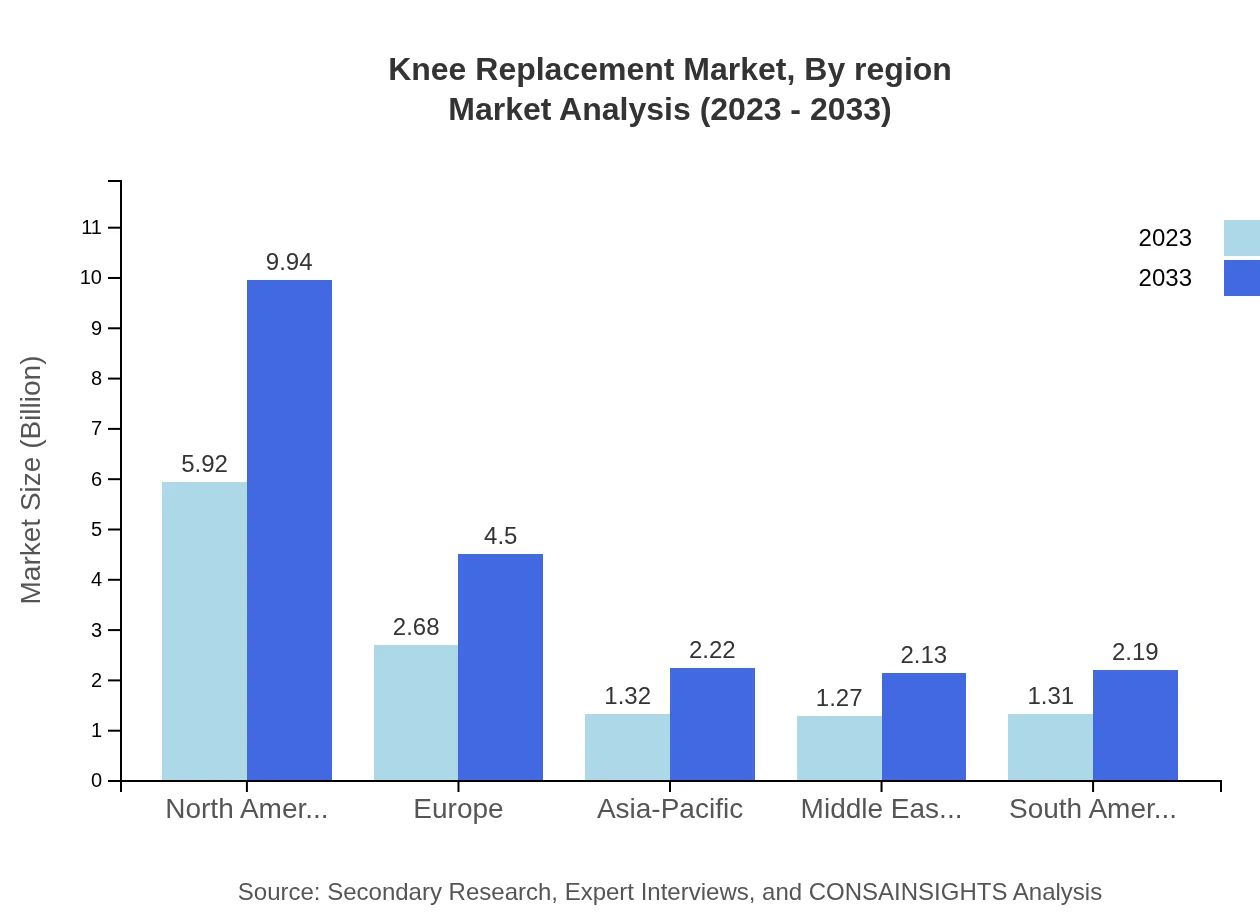

Europe Knee Replacement Market Report:

In Europe, the market is projected to grow from $3.71 billion in 2023 to $6.23 billion by 2033. The growing prevalence of knee ailments among the aging population and improvements in healthcare access contribute to this market expansion. Countries like Germany and the UK are at the forefront, showcasing advanced surgical approaches.Asia Pacific Knee Replacement Market Report:

In the Asia-Pacific region, the market size is projected to grow from $2.29 billion in 2023 to $3.84 billion by 2033. Factors driving this growth include increased healthcare spending, a growing elderly population, and rising awareness regarding orthopedic treatments. Regional key players are focusing on expanding their presence through partnerships and enhanced distribution networks.North America Knee Replacement Market Report:

The North American market, led by the United States, is the largest globally, with a market size of $4.75 billion in 2023, expected to reach $7.97 billion by 2033. High patient demand, advanced healthcare systems, and robust reimbursement policies drive growth. Innovations in minimally invasive techniques are further fueling demand.South America Knee Replacement Market Report:

The South American Knee Replacement market is relatively small, projected to grow from $0.07 billion in 2023 to $0.13 billion by 2033. Market growth is driven by improving healthcare infrastructure and increasing investments in medical technology. Nevertheless, challenges like economic instability may hinder rapid growth.Middle East & Africa Knee Replacement Market Report:

The Middle East and Africa Knee Replacement market, valued at $1.68 billion in 2023, is anticipated to reach $2.82 billion by 2033. Factors such as rising healthcare expenditure, increasing incidence of lifestyle diseases, and growing health awareness drive this market's expansion.Tell us your focus area and get a customized research report.

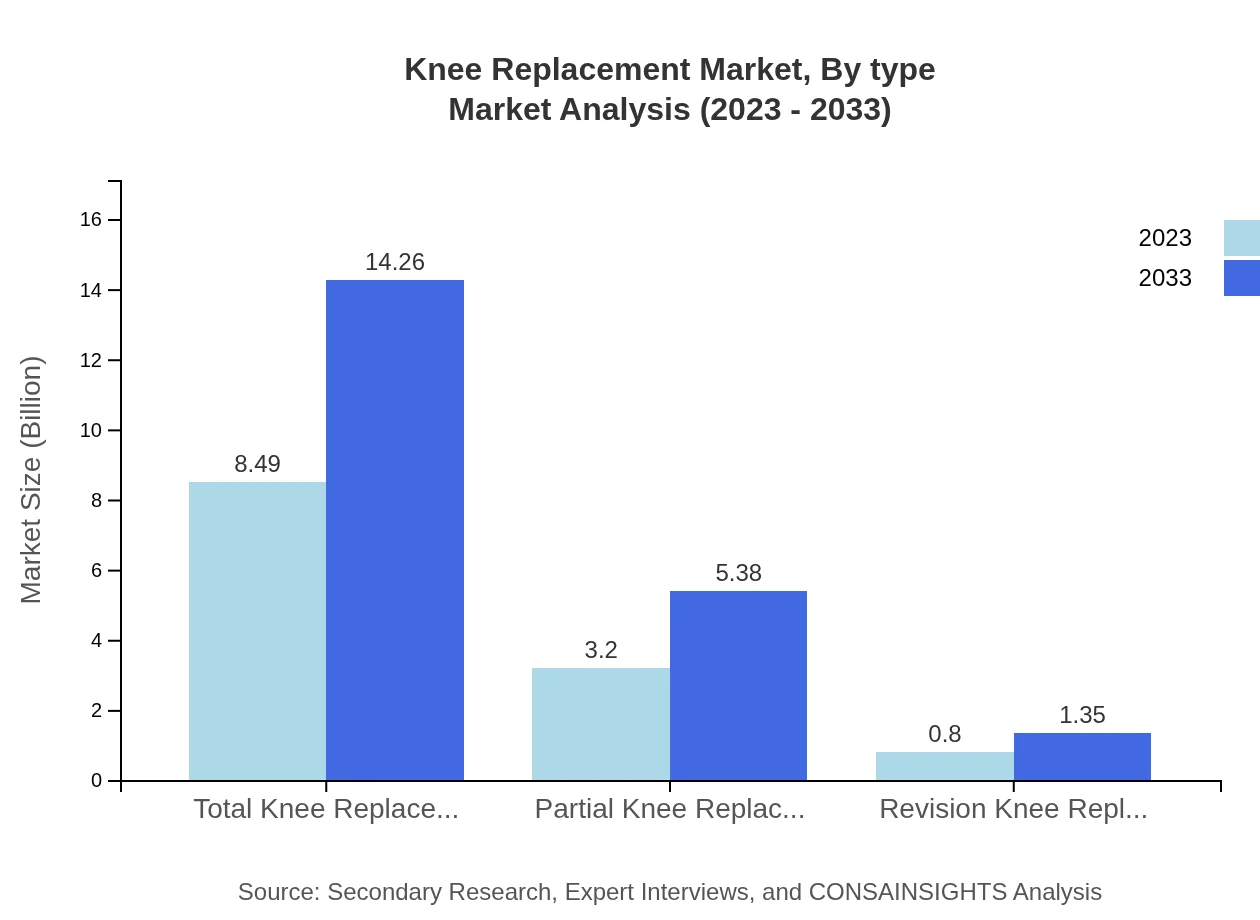

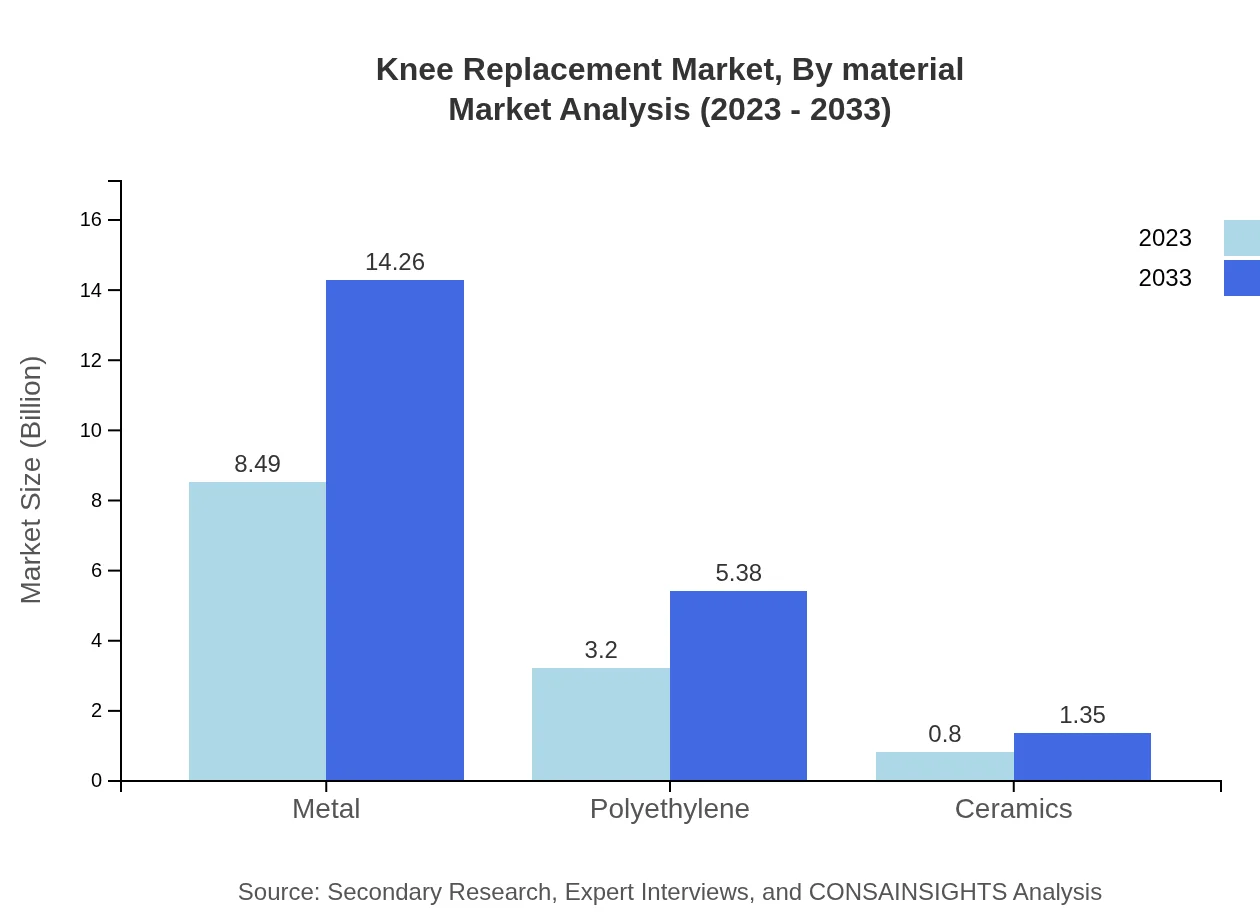

Knee Replacement Market Analysis By Type

The total knee replacement segment leads with a market size of $8.49 billion in 2023 and a projected growth to $14.26 billion by 2033. Partial knee replacement, accounting for $3.20 billion in 2023, is expected to reach $5.38 billion. Lastly, revision knee replacements are estimated to grow from $0.80 billion in 2023 to $1.35 billion by 2033, reflecting the continued need for knee revisions.

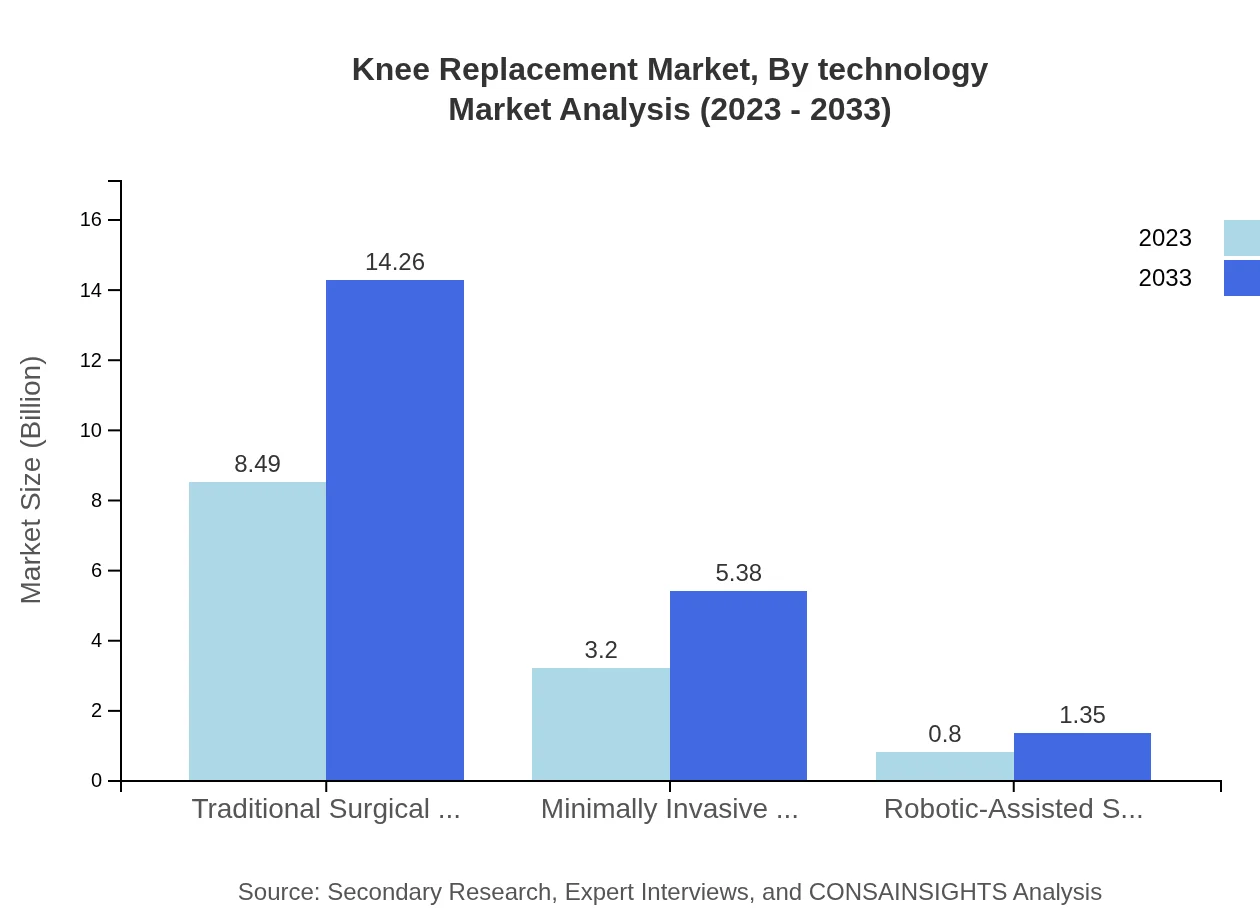

Knee Replacement Market Analysis By Technology

The market is segmented by technology into traditional surgical techniques, minimally invasive surgeries, and robotic-assisted surgeries. Traditional techniques dominate the market at $8.49 billion in 2023, while minimally invasive surgeries reach $3.20 billion. Robotic-assisted surgeries, though smaller in size at $0.80 billion in 2023, show significant potential for growth through technological advancements.

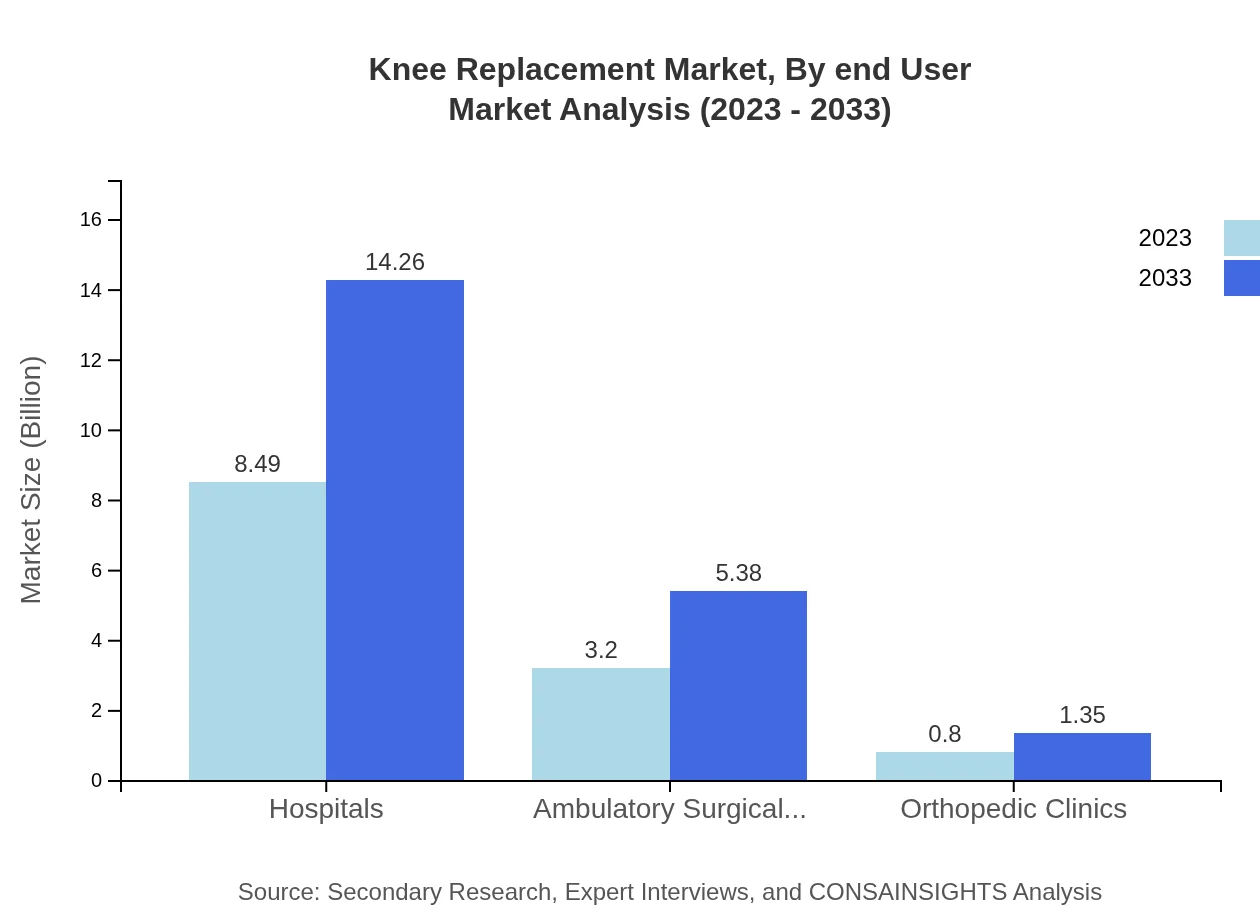

Knee Replacement Market Analysis By End User

The major end users in the Knee Replacement market include hospitals, ambulatory surgical centers, and orthopedic clinics. Hospitals command the largest market share at $8.49 billion in 2023, while ambulatory surgical centers are projected to grow from $3.20 billion. Orthopedic clinics account for $0.80 billion, contributing significantly to outpatient procedures.

Knee Replacement Market Analysis By Material

In terms of material, prostheses can be made from metals, polyethylene, and ceramics. Metal-based products, holding a significant market share at $8.49 billion, dominate the landscape. Polyethylene follows closely at $3.20 billion while ceramics encompass the smallest segment, valued at $0.80 billion in 2023.

Knee Replacement Market Analysis By Region

Regional analysis reveals varying growth potential across continents. North America holds the largest market share, the European market shows steady growth fueled by aging demographics, while the Asia-Pacific region is expanding rapidly due to healthcare improvements. South America remains the slowest but is gradually improving.

Knee Replacement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Knee Replacement Industry

Zimmer Biomet:

A leader in orthopedic implant technology, Zimmer Biomet focuses on innovations that enhance recovery and performance in knee surgeries.Stryker Corporation:

Stryker is renowned for its orthopedic products, emphasizing minimally invasive surgical techniques and robotic support in knee replacement.DePuy Synthes:

Part of Johnson & Johnson, DePuy Synthes leverages extensive research and development to deliver advanced knee replacement solutions.Smith & Nephew:

Smith & Nephew excels in developing innovative surgical implants and focuses on improving patient outcomes in knee surgeries.We're grateful to work with incredible clients.

FAQs

What is the market size of knee replacement?

The global knee replacement market is currently valued at approximately $12.5 billion and is projected to grow at a CAGR of 5.2% over the next decade, reaching substantial figures by 2033.

What are the key market players or companies in this knee replacement industry?

Key players in the knee replacement market include major orthopedic device companies like Johnson & Johnson, Stryker Corporation, Zimmer Biomet, and Medtronic. Their innovations significantly impact growth and product developments.

What are the primary factors driving the growth in the knee replacement industry?

Factors driving growth in the knee replacement industry include an aging population, increasing prevalence of osteoarthritis, advancements in surgical techniques, and heightened awareness of treatment options.

Which region is the fastest Growing in the knee replacement market?

The Asia-Pacific region is the fastest-growing market for knee replacements, projected to expand from $2.29 billion in 2023 to $3.84 billion in 2033, due to rising healthcare access and improving medical facilities.

Does ConsaInsights provide customized market report data for the knee replacement industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the knee replacement industry, providing in-depth insights and analysis according to client specifications.

What deliverables can I expect from this knee replacement market research project?

Expected deliverables include comprehensive market analysis, regional and segment data, growth forecasts, competitive landscape assessments, and actionable insights to inform strategic decision-making.

What are the market trends of knee replacement?

Current trends in the knee replacement market comprise a shift towards minimally invasive and robotic-assisted surgical techniques, a focus on patient-centric care models, and increased demand for personalized implant solutions.