Korea Pharmaceutical Market Report

Published Date: 31 January 2026 | Report Code: korea-pharmaceutical

Korea Pharmaceutical Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Korea Pharmaceutical market, exploring current market conditions, trends, and growth forecasts from 2023 to 2033. It highlights key insights, competitive landscapes, and potential opportunities within the industry.

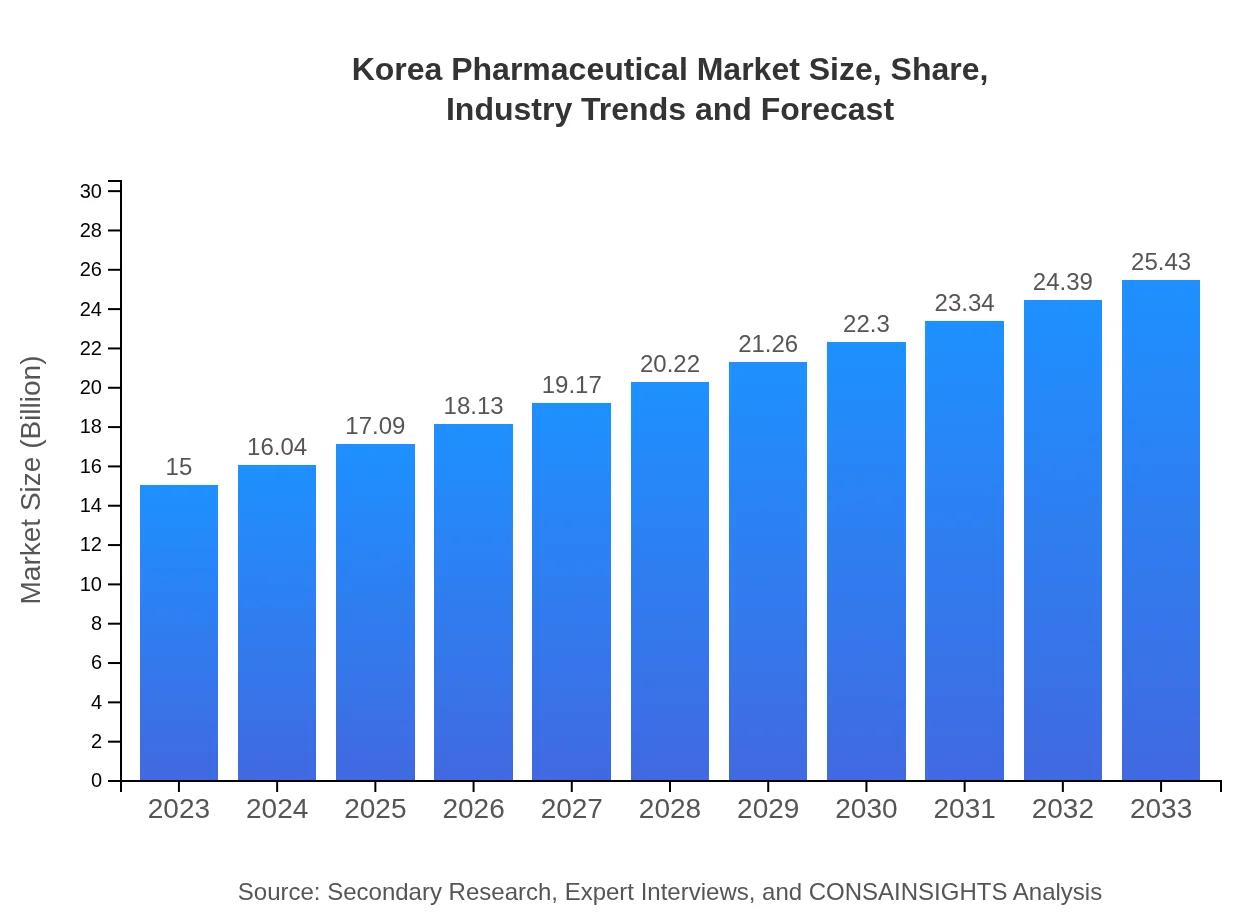

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $25.43 Billion |

| Top Companies | Samsung Biologics, Hanmi Pharmaceutical, LG Chem, Celltrion, SK Chemicals |

| Last Modified Date | 31 January 2026 |

Korea Pharmaceutical Market Overview

Customize Korea Pharmaceutical Market Report market research report

- ✔ Get in-depth analysis of Korea Pharmaceutical market size, growth, and forecasts.

- ✔ Understand Korea Pharmaceutical's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Korea Pharmaceutical

What is the Market Size & CAGR of Korea Pharmaceutical market in 2023?

Korea Pharmaceutical Industry Analysis

Korea Pharmaceutical Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Korea Pharmaceutical Market Analysis Report by Region

Europe Korea Pharmaceutical Market Report:

The European pharmaceutical market's size is expected to increase from USD 3.78 billion in 2023 to USD 6.41 billion by 2033. European countries are focusing on enhancing their healthcare systems and increasing patient access to advanced medications, thereby driving demand for Korean pharmaceutical products.Asia Pacific Korea Pharmaceutical Market Report:

In the Asia Pacific region, the Korean pharmaceutical market is expected to grow from USD 3.02 billion in 2023 to USD 5.12 billion by 2033. Factors such as increasing healthcare investments and a growing consumer base drive this growth. The increasing prevalence of chronic diseases and an aging population further contribute to demand.North America Korea Pharmaceutical Market Report:

The North American market, valued at USD 5.66 billion in 2023, is forecasted to grow to USD 9.59 billion by 2033. This growth is primarily due to the demand for novel therapeutic solutions and advancements in biopharmaceuticals, bolstered by the regulatory environment favoring innovation.South America Korea Pharmaceutical Market Report:

South America presents a nascent opportunity for the Korea Pharmaceutical market, expected to rise from USD 0.56 billion in 2023 to USD 0.95 billion by 2033. Increased healthcare spending and the need for affordable medications are pivotal in driving market growth, alongside rising partnerships between Korean firms and South American healthcare providers.Middle East & Africa Korea Pharmaceutical Market Report:

The Middle East and Africa are anticipated to see growth from USD 1.99 billion in 2023 to USD 3.37 billion by 2033. The rising healthcare investment for diseases prevalent in these regions and increasing public-private partnerships in healthcare sector development are significantly contributing to market expansion.Tell us your focus area and get a customized research report.

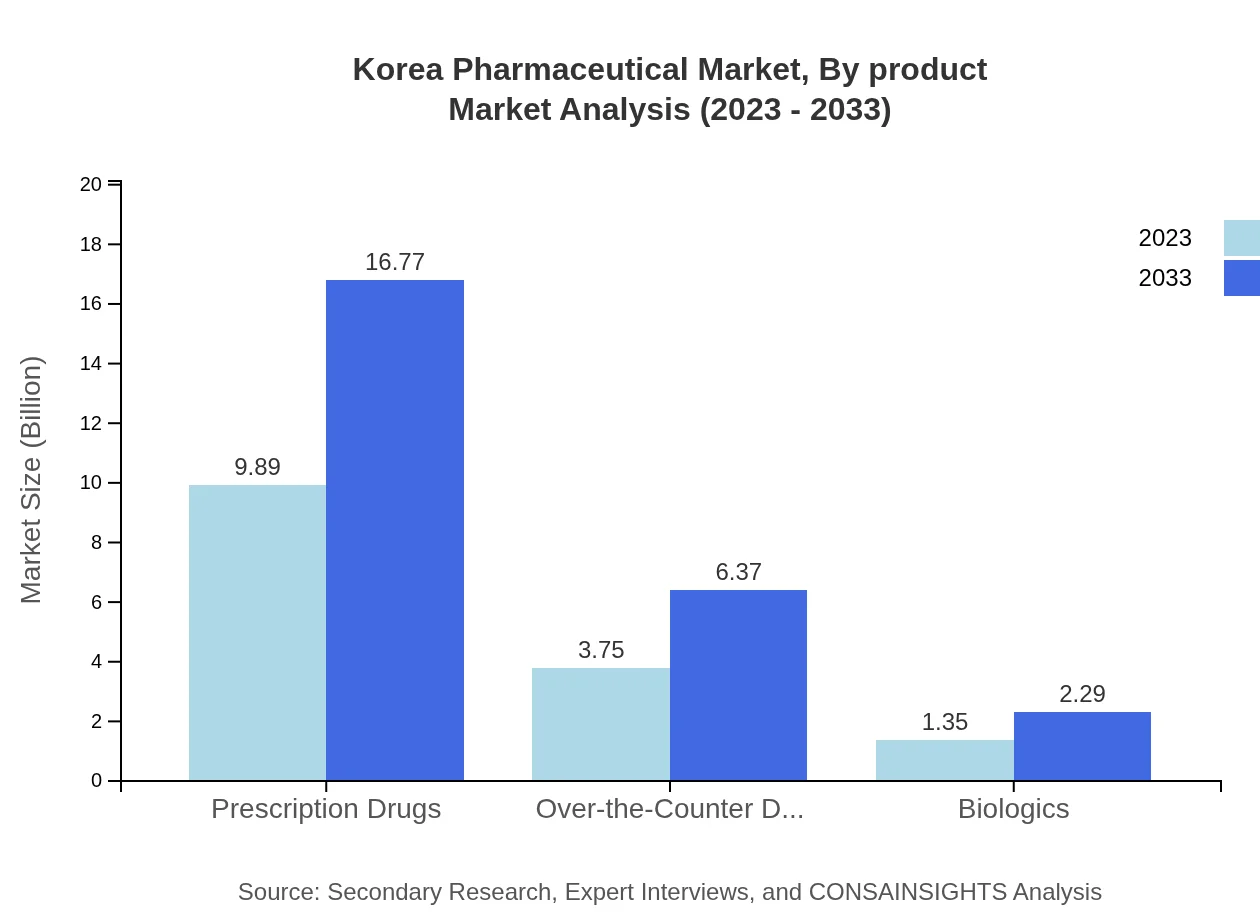

Korea Pharmaceutical Market Analysis By Product

The Korea Pharmaceutical Market is segmented by product types such as prescription drugs, OTC drugs, and biologics. Prescription drugs dominate with a market size of USD 9.89 billion in 2023, expected to grow to USD 16.77 billion by 2033, constituting 65.95% of the market share. OTC drugs follow, with USD 3.75 billion increasing to USD 6.37 billion, retaining a 25.03% market share. Biologics represent a growing segment, valued at USD 1.35 billion in 2023 and projected to reach USD 2.29 billion by 2033.

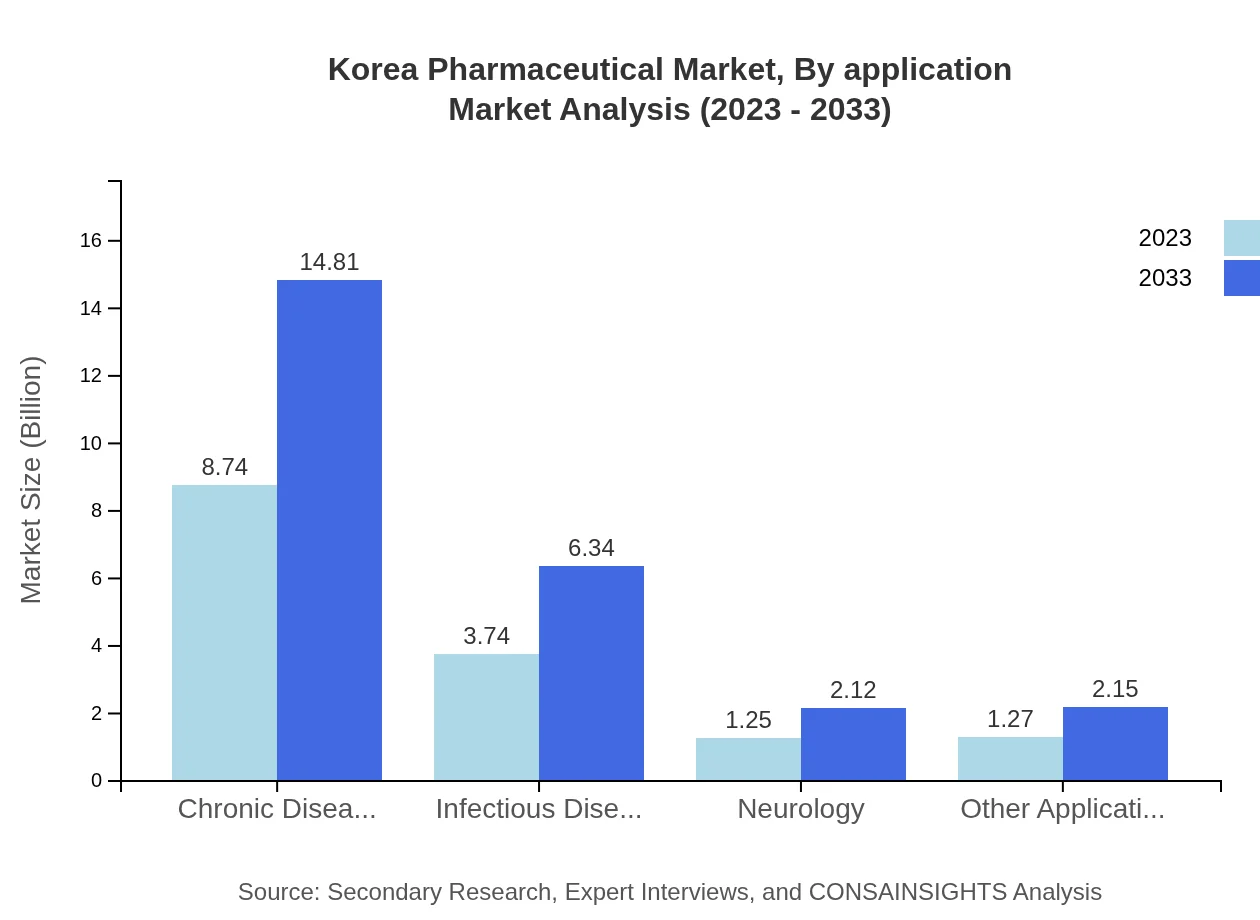

Korea Pharmaceutical Market Analysis By Application

In terms of application, chronic diseases lead the segment, with a market size of USD 8.74 billion in 2023, growing to USD 14.81 billion by 2033, driven by increased awareness and treatment improvements. Infectious diseases are projected to grow from USD 3.74 billion to USD 6.34 billion, comprising 24.94% of market share, while oncology sees comparable growth, retaining its significant share of 65.95%.

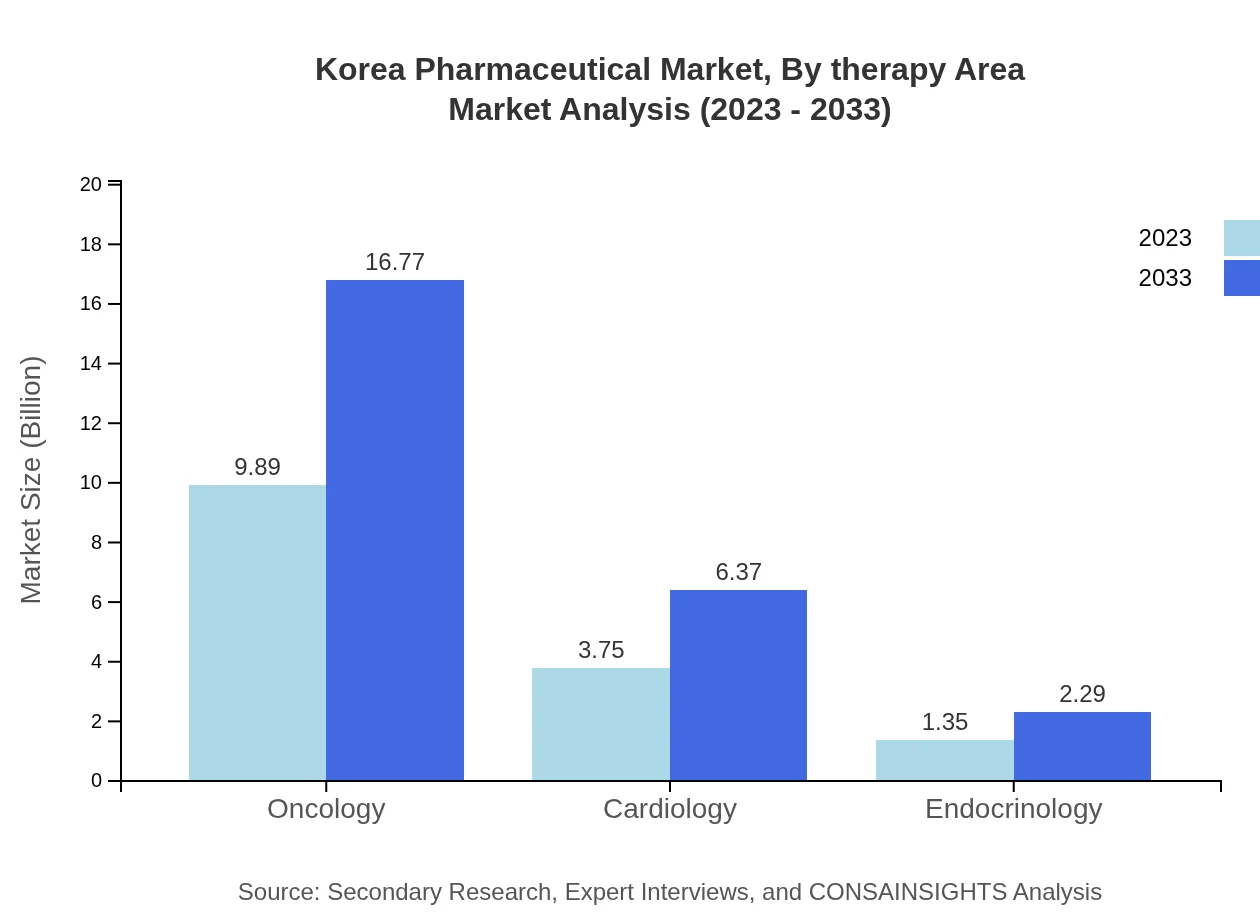

Korea Pharmaceutical Market Analysis By Therapy Area

Therapeutically, the oncology segment has a market size of USD 9.89 billion in 2023, expected to grow to USD 16.77 billion by 2033, emblematic of the higher prevalence of cancers in the region. Neurology and cardiology follow, projected to expand from USD 1.25 billion to USD 2.12 billion and from USD 3.75 billion to USD 6.37 billion respectively.

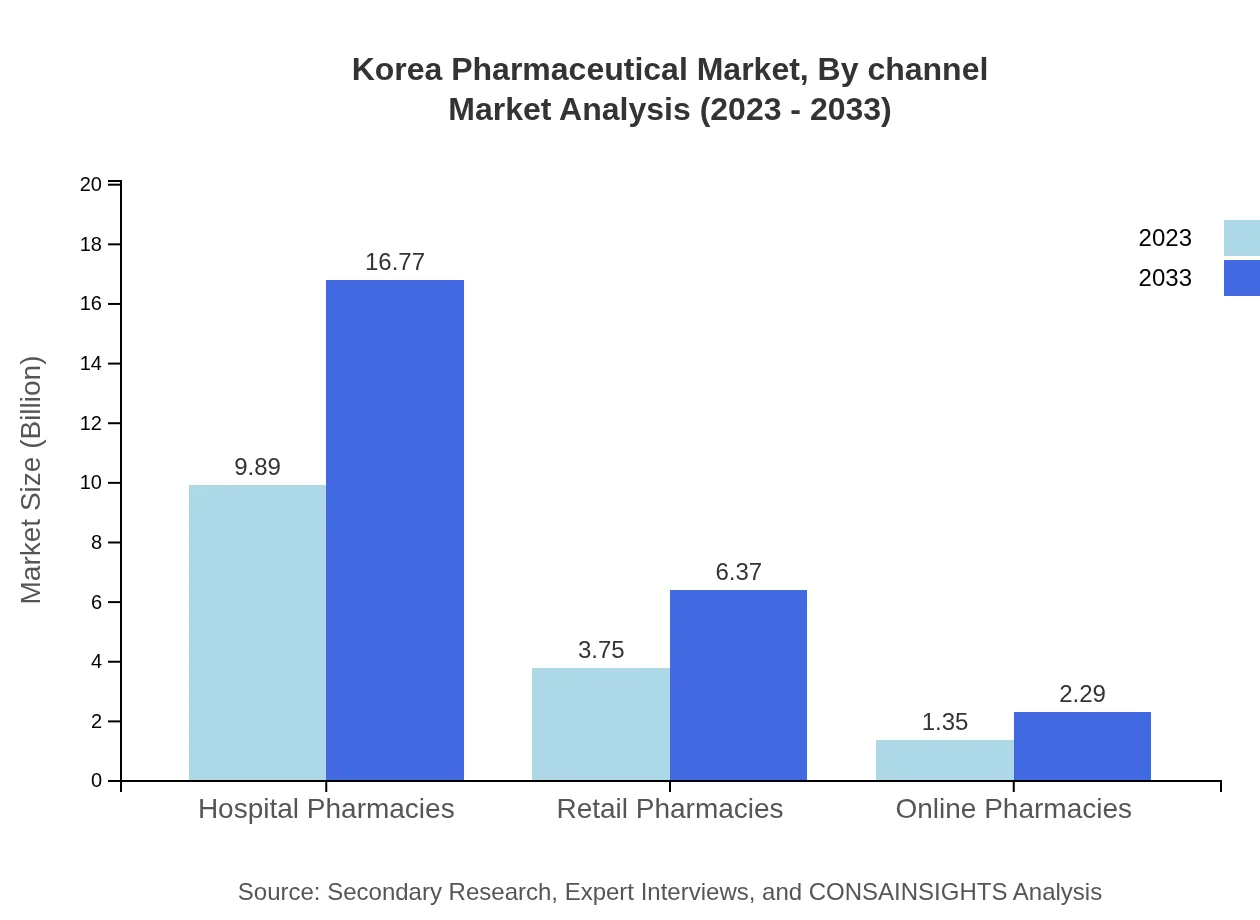

Korea Pharmaceutical Market Analysis By Channel

The distribution channels show a robust performance, with hospital pharmacies leading at USD 9.89 billion, with projections of USD 16.77 billion by 2033, reflecting the ongoing need for complex treatments. Retail channels also play a significant role, contributing USD 3.75 billion to the market size in 2023, growing to USD 6.37 billion by 2033.

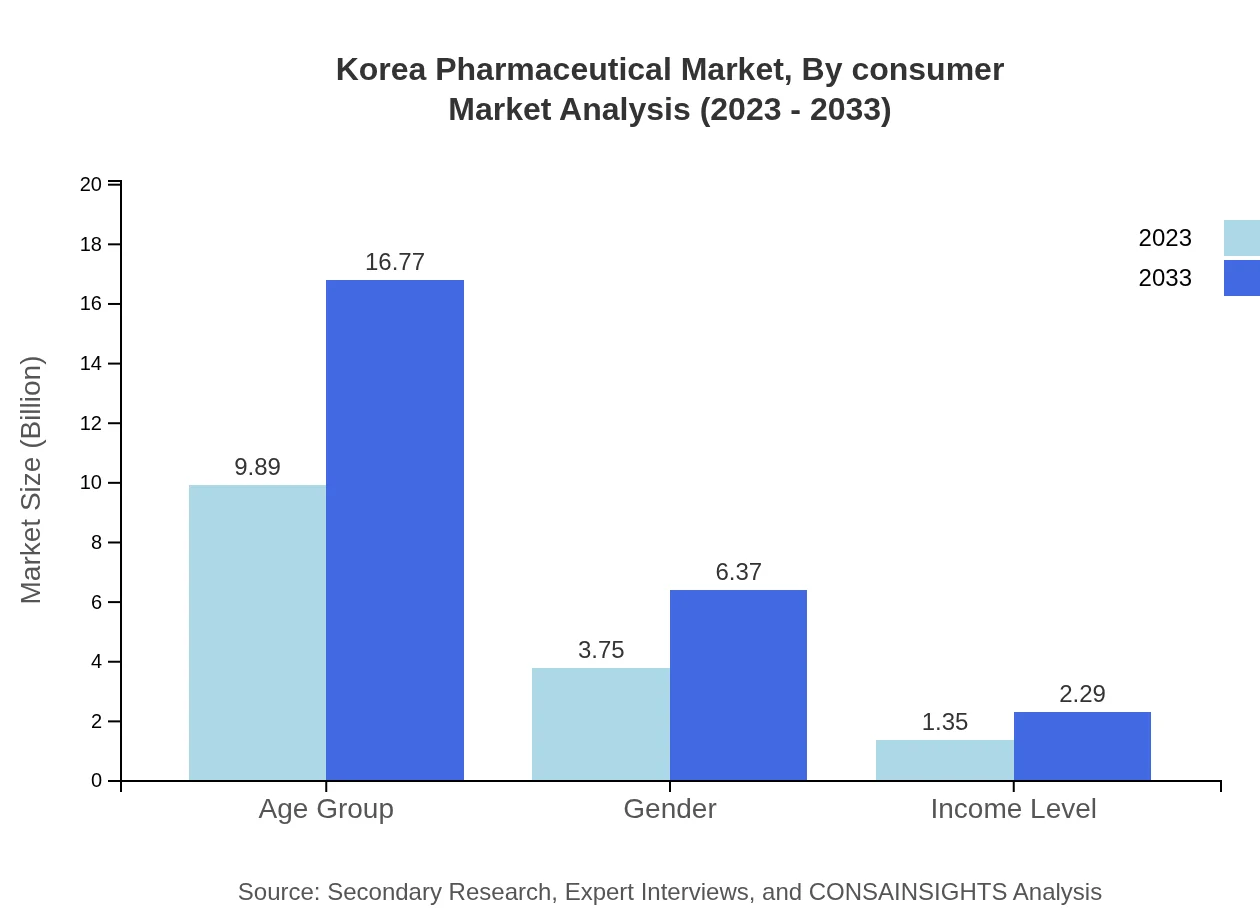

Korea Pharmaceutical Market Analysis By Consumer

In terms of consumer demographics, age groups reflecting chronic diseases show the largest market share, valued at USD 9.89 billion in 2023, escalating to USD 16.77 billion by 2033. Income level impacts purchasing behavior significantly, with lower-income groups slowly increasing their demand for generic drugs, currently valued at USD 1.35 billion, anticipated to reach USD 2.29 billion in the same timeframe.

Korea Pharmaceutical Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Korea Pharmaceutical Industry

Samsung Biologics:

A leading biopharmaceutical company in Korea, specializing in the development and manufacturing of biologic drugs. Samsung Biologics has been instrumental in providing contract manufacturing services to numerous global pharmaceutical firms.Hanmi Pharmaceutical:

One of the largest pharmaceutical companies in Korea, recognized for its innovative drug development, particularly in the fields of diabetes and cancer. Hanmi invests heavily in R&D and has a strong international presence.LG Chem:

A major player in both the chemicals and pharmaceutical industries, LG Chem focuses on specialty medicines and advanced delivery systems, contributing significantly to market development.Celltrion:

Known for its biosimilar products, Celltrion has gained worldwide acclaim, particularly in the treatment of autoimmune diseases, aiming to make healthcare more affordable worldwide.SK Chemicals:

A diverse company involved in pharmaceuticals and vaccines, SK Chemicals emphasizes sustainable practices and innovation, contributing to both local and global markets.We're grateful to work with incredible clients.

FAQs

What is the market size of Korea Pharmaceuticals?

The Korea Pharmaceutical Market is valued at approximately $15 billion in 2023 and is expected to grow at a CAGR of 5.3%, reaching significant market capacity by 2033.

What are the key market players or companies in the Korea Pharmaceuticals industry?

Major players in the Korea Pharmaceuticals industry include leading companies such as Hanmi Pharmaceutical, Samsung Biologics, and LG Chem, which are pivotal in driving innovation and competition within this growing market.

What are the primary factors driving the growth in the Korea Pharmaceuticals industry?

Growth in the Korea Pharmaceuticals sector is driven by an aging population, increased prevalence of chronic diseases, technological advancements in drug development, and supportive government policies enhancing pharmaceutical research.

Which region is the fastest growing in the Korea Pharmaceuticals?

North America is expected to be the fastest-growing region for the Korea Pharmaceuticals market, projected to increase from $5.66 billion in 2023 to $9.59 billion by 2033, showcasing robust demand and expansion opportunities.

Does ConsaInsights provide customized market report data for the Korea Pharmaceuticals industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific needs within the Korea Pharmaceuticals industry, enabling stakeholders to access detailed and focused insights.

What deliverables can I expect from this Korea Pharmaceuticals market research project?

From this project, clients can expect comprehensive market insights, growth forecasts, regional analyses, key player identification, market segmentation details, and actionable recommendations tailored for strategic planning.

What are the market trends of Korea Pharmaceuticals?

Current trends in the Korea Pharmaceuticals market include increased focus on biologics and personalized medicine, the rise of online pharmacies, and greater investment in chronic disease management solutions.