Lab Automation For In Vitro Diagnostics Market Report

Published Date: 22 January 2026 | Report Code: lab-automation-for-in-vitro-diagnostics

Lab Automation For In Vitro Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Lab Automation for In Vitro Diagnostics market, including market size, trends, segmentation, and forecasts from 2023 to 2033. It aims to deliver a detailed overview for stakeholders and decision-makers.

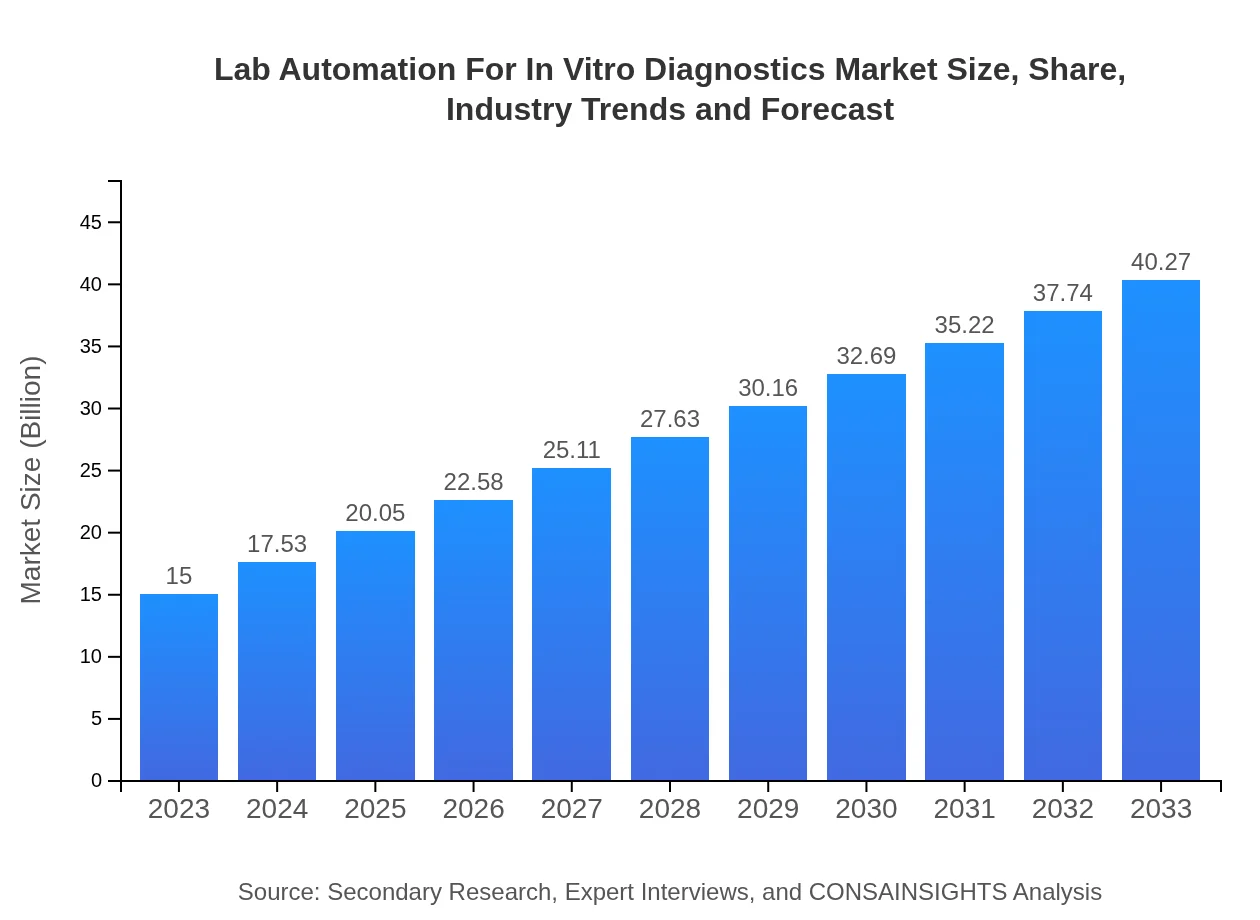

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $40.27 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 22 January 2026 |

Lab Automation For In Vitro Diagnostics Market Overview

Customize Lab Automation For In Vitro Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Lab Automation For In Vitro Diagnostics market size, growth, and forecasts.

- ✔ Understand Lab Automation For In Vitro Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lab Automation For In Vitro Diagnostics

What is the Market Size & CAGR of Lab Automation For In Vitro Diagnostics market in 2023?

Lab Automation For In Vitro Diagnostics Industry Analysis

Lab Automation For In Vitro Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lab Automation For In Vitro Diagnostics Market Analysis Report by Region

Europe Lab Automation For In Vitro Diagnostics Market Report:

The European market for Lab Automation for In Vitro Diagnostics is projected to grow to $10.51 billion by 2033, up from $3.92 billion in 2023. Factors such as stringent regulations, a rising focus on improving healthcare outcomes, and the integration of advanced technologies are fueling this growth in Western European countries.Asia Pacific Lab Automation For In Vitro Diagnostics Market Report:

The Asia Pacific region is witnessing remarkable growth in the Lab Automation for In Vitro Diagnostics market, with a projected market size of approximately $8.08 billion by 2033, up from $3.01 billion in 2023. Growing investments in healthcare infrastructure and rising adoption of automation solutions in laboratories are driving this market in countries like China and India.North America Lab Automation For In Vitro Diagnostics Market Report:

North America maintains the largest share of the global market, with an estimated market size of $15.62 billion by 2033, rising from $5.82 billion in 2023. The region's dominance is led by the US, driven by high healthcare expenditure, technological adoption, and the presence of key market players.South America Lab Automation For In Vitro Diagnostics Market Report:

In South America, the market for Lab Automation for In Vitro Diagnostics is expected to grow from $0.64 billion in 2023 to $1.71 billion by 2033. This growth is attributed to increasing healthcare spending and the establishment of new diagnostic laboratories in countries like Brazil and Argentina.Middle East & Africa Lab Automation For In Vitro Diagnostics Market Report:

The Middle East and Africa market is expected to see growth from $1.62 billion in 2023 to $4.35 billion by 2033. The rising demand for advanced diagnostic solutions and the development of healthcare infrastructure in countries like the UAE and South Africa are expected to drive this growth.Tell us your focus area and get a customized research report.

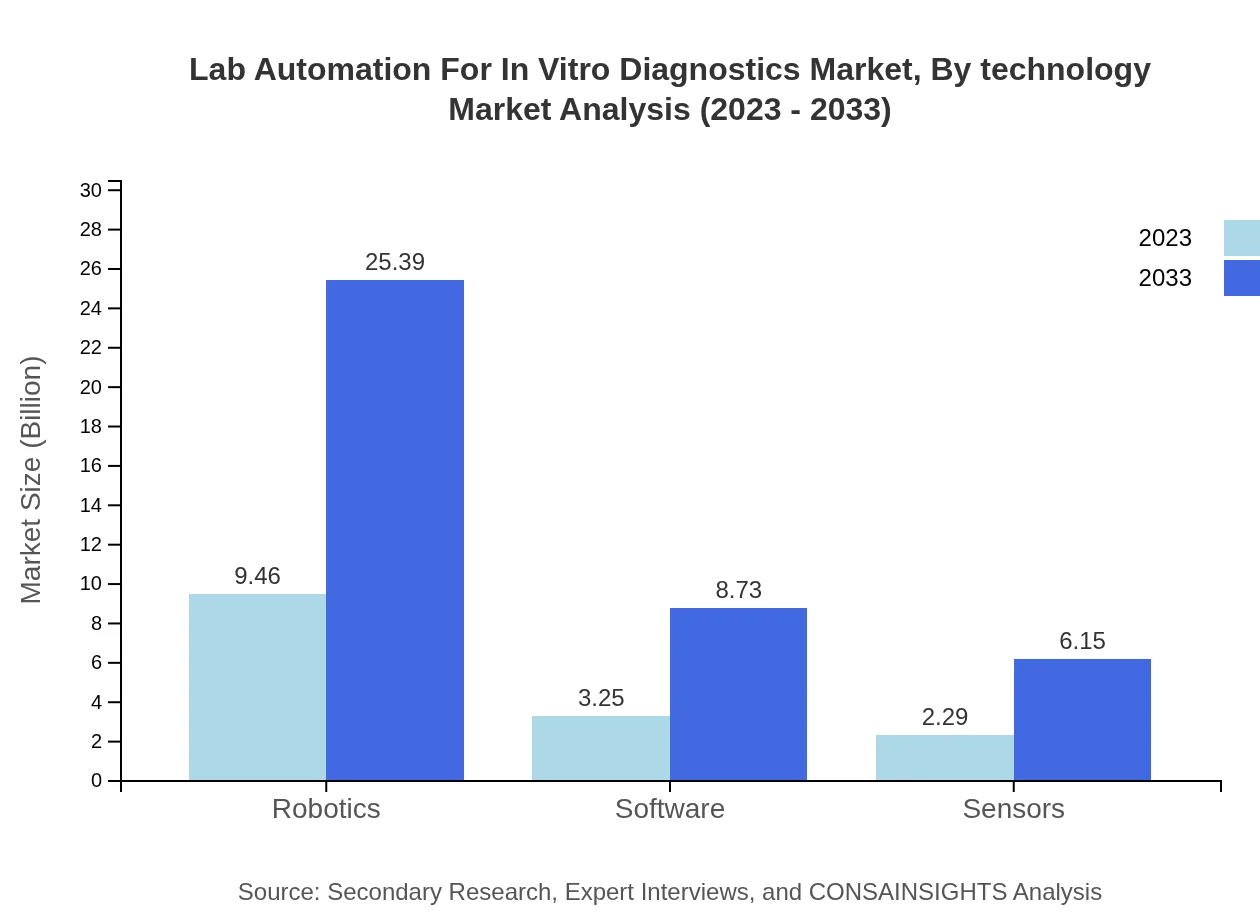

Lab Automation For In Vitro Diagnostics Market Analysis By Technology

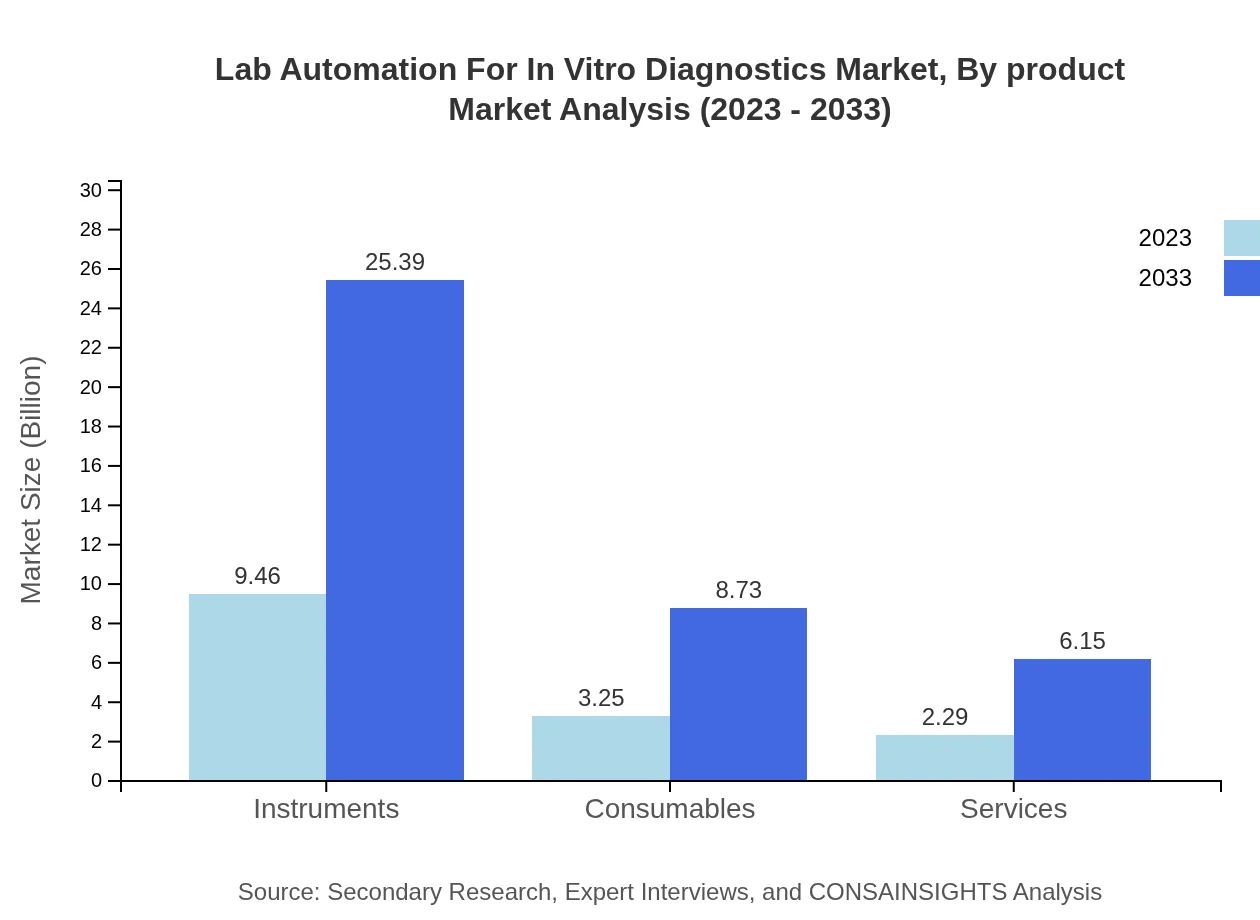

In the Lab Automation for In Vitro Diagnostics market, technology segmentation includes Instruments, Consumables, Software, and Robotics. Instruments dominate the market with a size of $9.46 billion in 2023, anticipated to reach $25.39 billion by 2033. Consumables contribute $3.25 billion in 2023 and are expected to reach $8.73 billion by 2033, highlighting their essential role in laboratory operations.

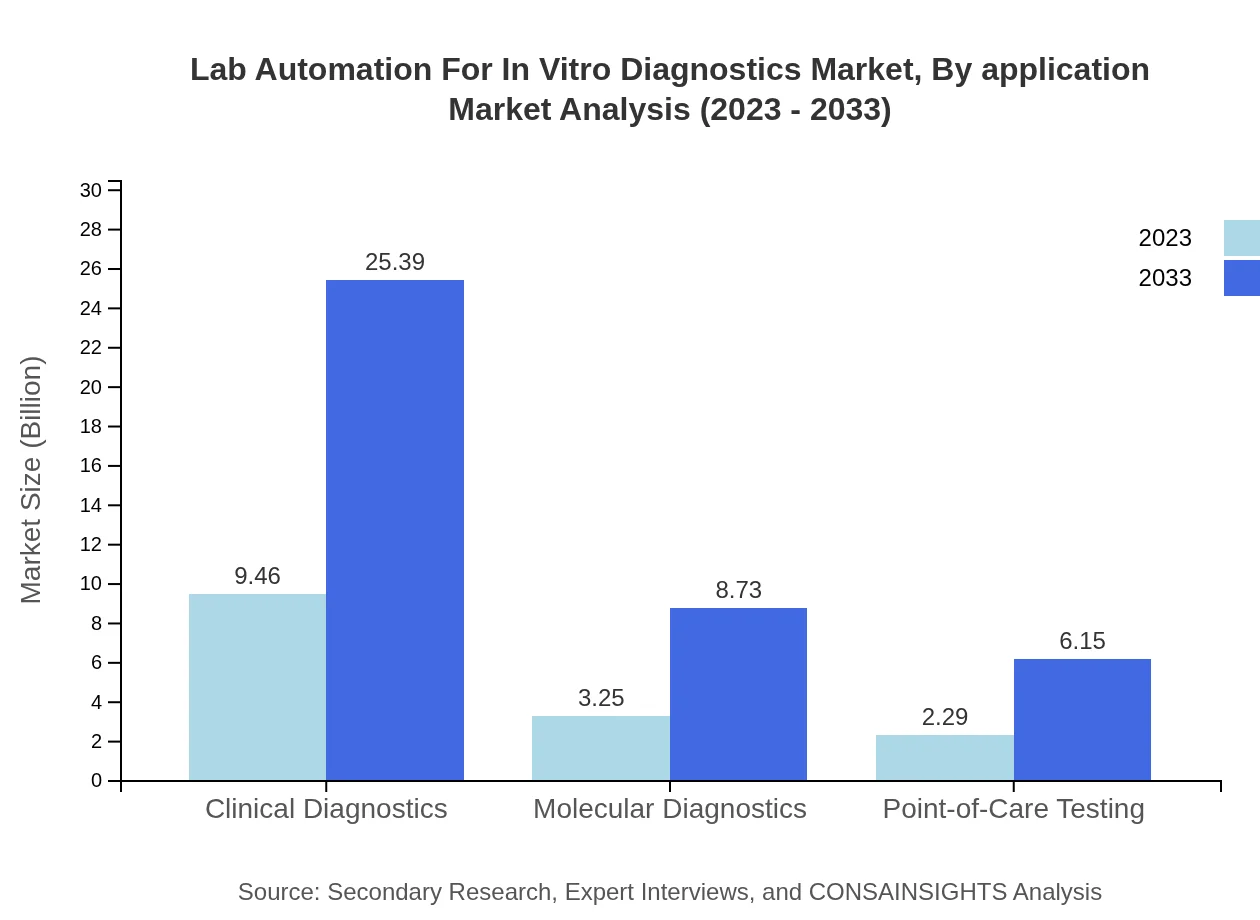

Lab Automation For In Vitro Diagnostics Market Analysis By Application

The application segments include Clinical Diagnostics, Molecular Diagnostics, and Point-of-Care Testing. Clinical Diagnostics remains the highest contributor at $9.46 billion in 2023, projected to grow significantly alongside Molecular Diagnostics, which is expected to increase from $3.25 billion to $8.73 billion by 2033.

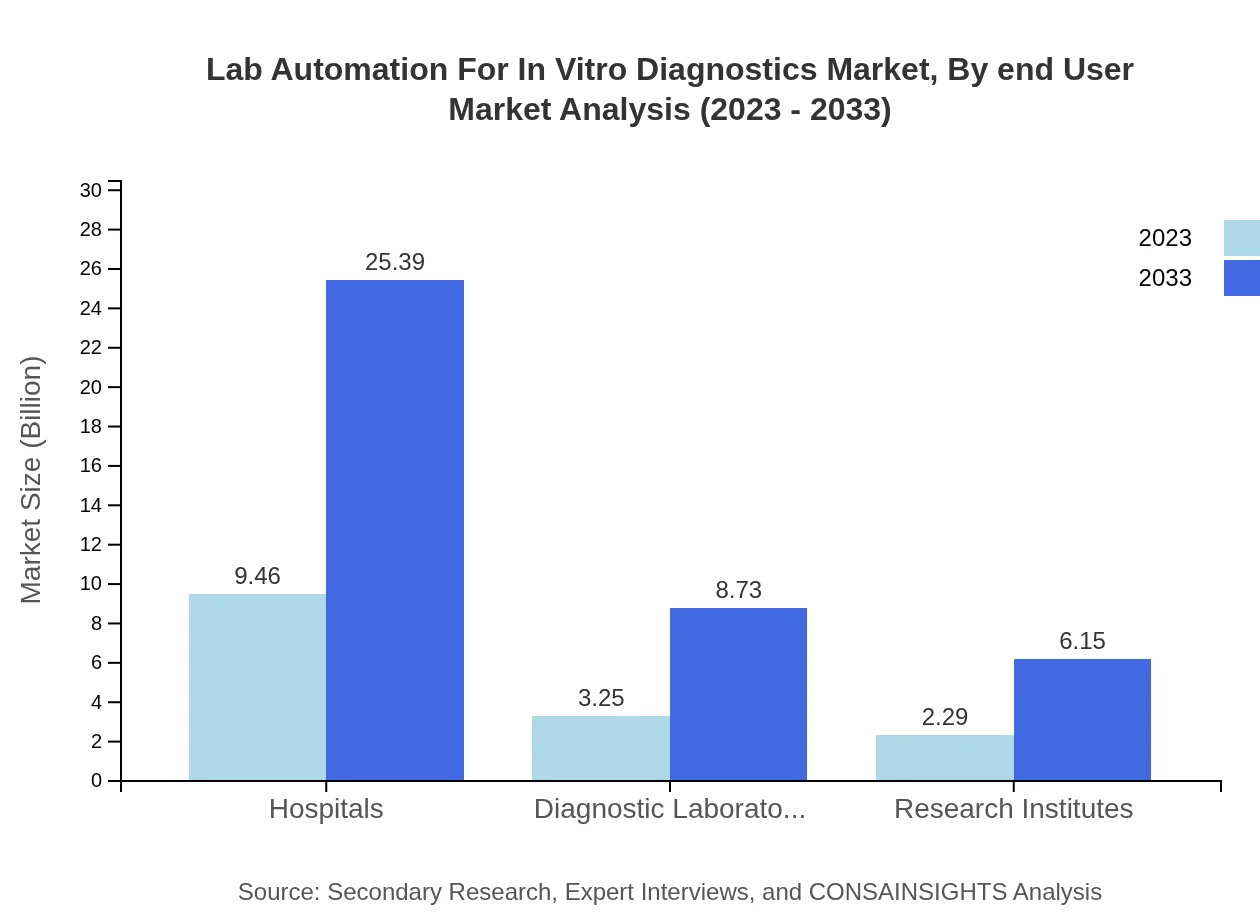

Lab Automation For In Vitro Diagnostics Market Analysis By End User

End-user segmentation comprises Hospitals, Diagnostic Laboratories, and Research Institutes. Hospitals hold a significant share at $9.46 billion in 2023, growing to $25.39 billion by 2033, indicating the critical role of hospitals in driving automation within in vitro diagnostics.

Lab Automation For In Vitro Diagnostics Market Analysis By Product

Product-wise analysis reveals that the market is largely driven by Instruments and Consumables. Instruments alone will grow from $9.46 billion in 2023 to $25.39 billion by 2033, demonstrating a robust demand for advanced automation solutions in laboratories.

Lab Automation For In Vitro Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lab Automation For In Vitro Diagnostics Industry

Abbott Laboratories:

Abbott is a global healthcare leader, providing a range of laboratory automation solutions that focus on enhancing efficiency and accuracy in diagnostic testing.Roche Diagnostics:

Roche is known for its innovative diagnostic solutions and laboratory automation technologies that improve workflow in clinical laboratories.Siemens Healthineers:

Siemens Healthineers offers advanced automation systems that integrate seamlessly into laboratory workflows, enhancing diagnostic accuracy and efficiency.Thermo Fisher Scientific:

As a leader in laboratory equipment and automation solutions, Thermo Fisher provides a wide range of products, fostering innovation in diagnostic workflows.We're grateful to work with incredible clients.

FAQs

What is the market size of lab Automation For In Vitro Diagnostics?

The lab automation for in vitro diagnostics market is valued at $15 billion in 2023 and is expected to grow at a CAGR of 10% over the next decade, reaching substantial growth by 2033.

What are the key market players or companies in this lab Automation For In Vitro Diagnostics industry?

Key players in this industry include major diagnostics firms, laboratory automation technology providers, and biotechnology companies that specialize in developing automation solutions for in vitro diagnostics.

What are the primary factors driving the growth in the lab Automation For In Vitro Diagnostics industry?

The growth is driven by increasing demand for rapid diagnostic procedures, advancements in automation technology, the need for high-throughput testing, and a rise in chronic diseases requiring regular testing.

Which region is the fastest Growing in the lab Automation For In Vitro Diagnostics?

North America is the fastest-growing region, with its market size expected to rise from $5.82 billion in 2023 to $15.62 billion by 2033, marking significant advancements in healthcare technologies.

Does ConsaInsights provide customized market report data for the lab Automation For In Vitro Diagnostics industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, which include detailed data on market trends, forecasts, and competitive analysis for the lab automation in vitro diagnostics sector.

What deliverables can I expect from this lab Automation For In Vitro Diagnostics market research project?

Expect deliverables such as comprehensive market analysis, segmented market data, forecasts, competitive landscape assessments, and executive summaries outlining key findings and strategic recommendations.

What are the market trends of lab Automation For In Vitro Diagnostics?

Current trends include the integration of AI in diagnostics, increased adoption of robotic systems for laboratory automation, and growing investments in health technology infrastructure to enhance diagnostic precision.