Lab Informatics Market Report

Published Date: 31 January 2026 | Report Code: lab-informatics

Lab Informatics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Lab Informatics market from 2023 to 2033, highlighting market trends, size, regional insights, and key industry players. It aims to deliver valuable insights into the future of lab informatics and its critical role in the scientific and healthcare sectors.

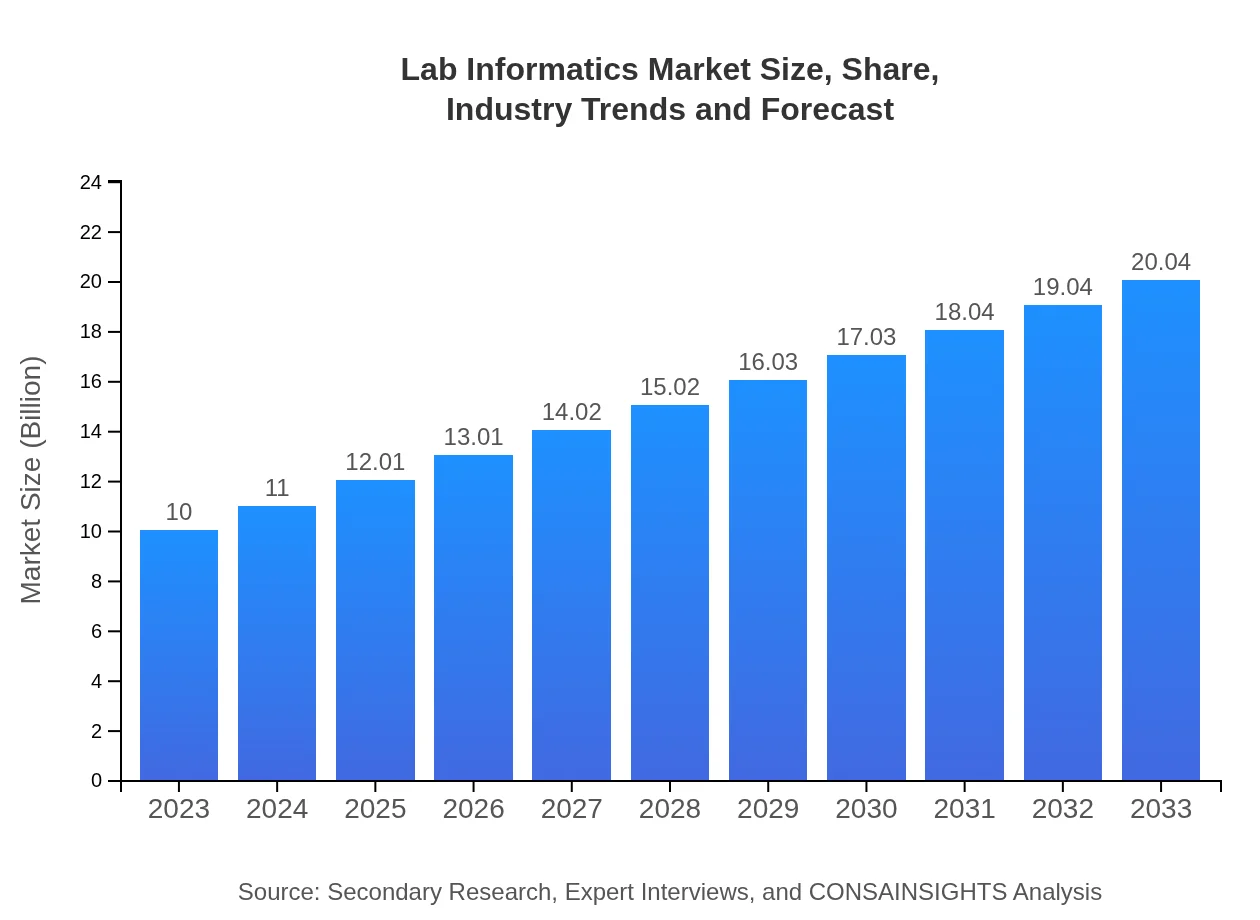

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | Thermo Fisher Scientific, Abbott Laboratories, LabWare, PerkinElmer |

| Last Modified Date | 31 January 2026 |

Lab Informatics Market Overview

Customize Lab Informatics Market Report market research report

- ✔ Get in-depth analysis of Lab Informatics market size, growth, and forecasts.

- ✔ Understand Lab Informatics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lab Informatics

What is the Market Size & CAGR of Lab Informatics market in 2033?

Lab Informatics Industry Analysis

Lab Informatics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

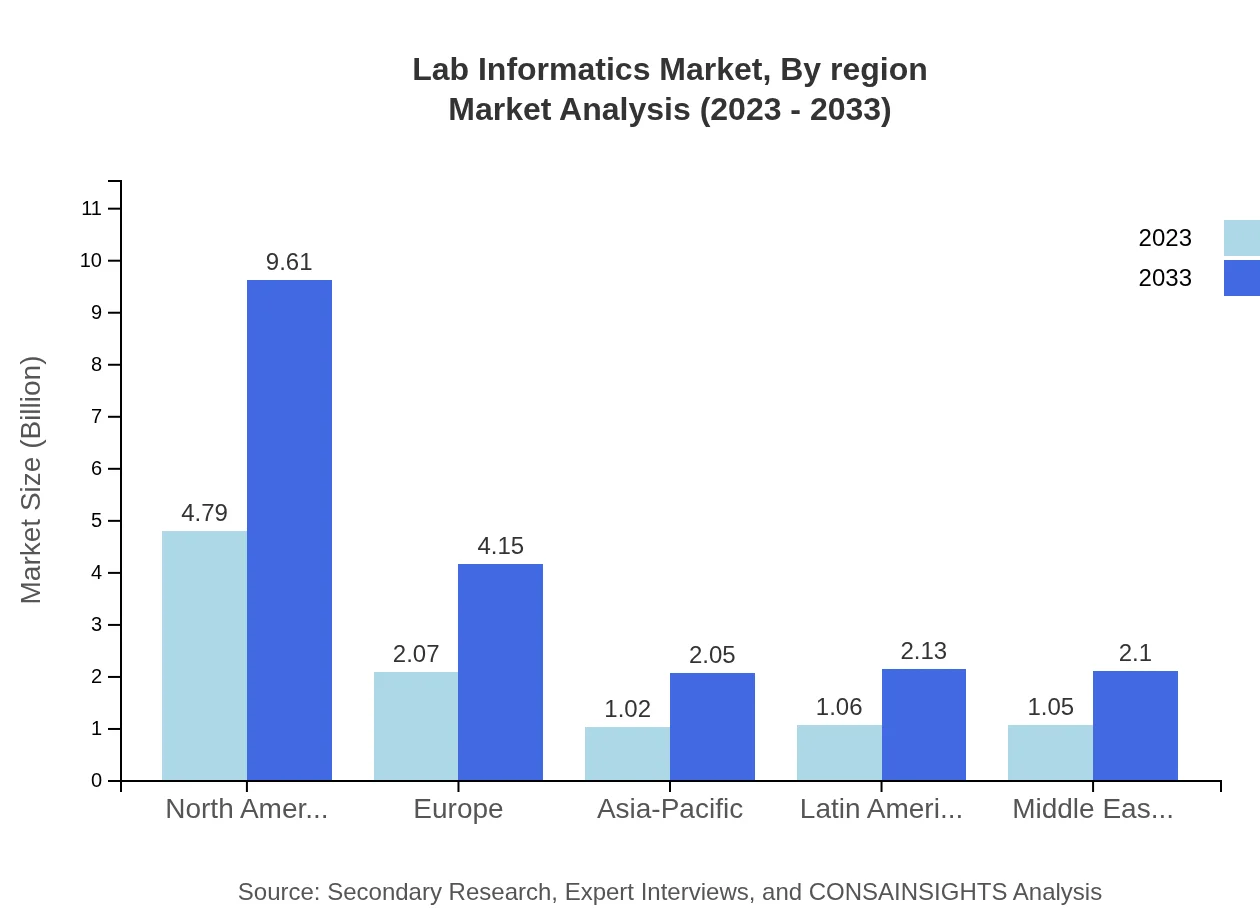

Lab Informatics Market Analysis Report by Region

Europe Lab Informatics Market Report:

In Europe, the Lab Informatics market is expected to grow from $2.71 billion in 2023 to approximately $5.44 billion by 2033. Factors such as strong regulatory frameworks and an emphasis on R&D in pharmaceuticals and life sciences drive the demand for efficient informatics solutions.Asia Pacific Lab Informatics Market Report:

The Asia Pacific region's Lab Informatics market was valued at $1.91 billion in 2023 and is expected to reach $3.83 billion by 2033, showing significant growth driven by the expanding pharmaceutical and biotech industries. The rising adoption of advanced technologies and increasing investments in R&D are contributing to the market's expansion in this region.North America Lab Informatics Market Report:

North America remains the largest market for Lab Informatics, estimated at $3.85 billion in 2023 and projected to nearly double to $7.73 billion by 2033. The region benefits from advanced infrastructure, high adoption rates of technology, and significant investment in clinical research processes.South America Lab Informatics Market Report:

South America, while currently smaller, shows potential growth from $0.64 billion in 2023 to $1.29 billion by 2033. The region is gradually recognizing the value of lab informatics as industries invest in modernization and compliance, fostering market growth.Middle East & Africa Lab Informatics Market Report:

The Middle East and Africa region mirrors growth from $0.88 billion in 2023 to $1.76 billion by 2033. The focus on improving laboratory processes and the increasing importance of compliance in healthcare is bolstering the adoption of lab informatics.Tell us your focus area and get a customized research report.

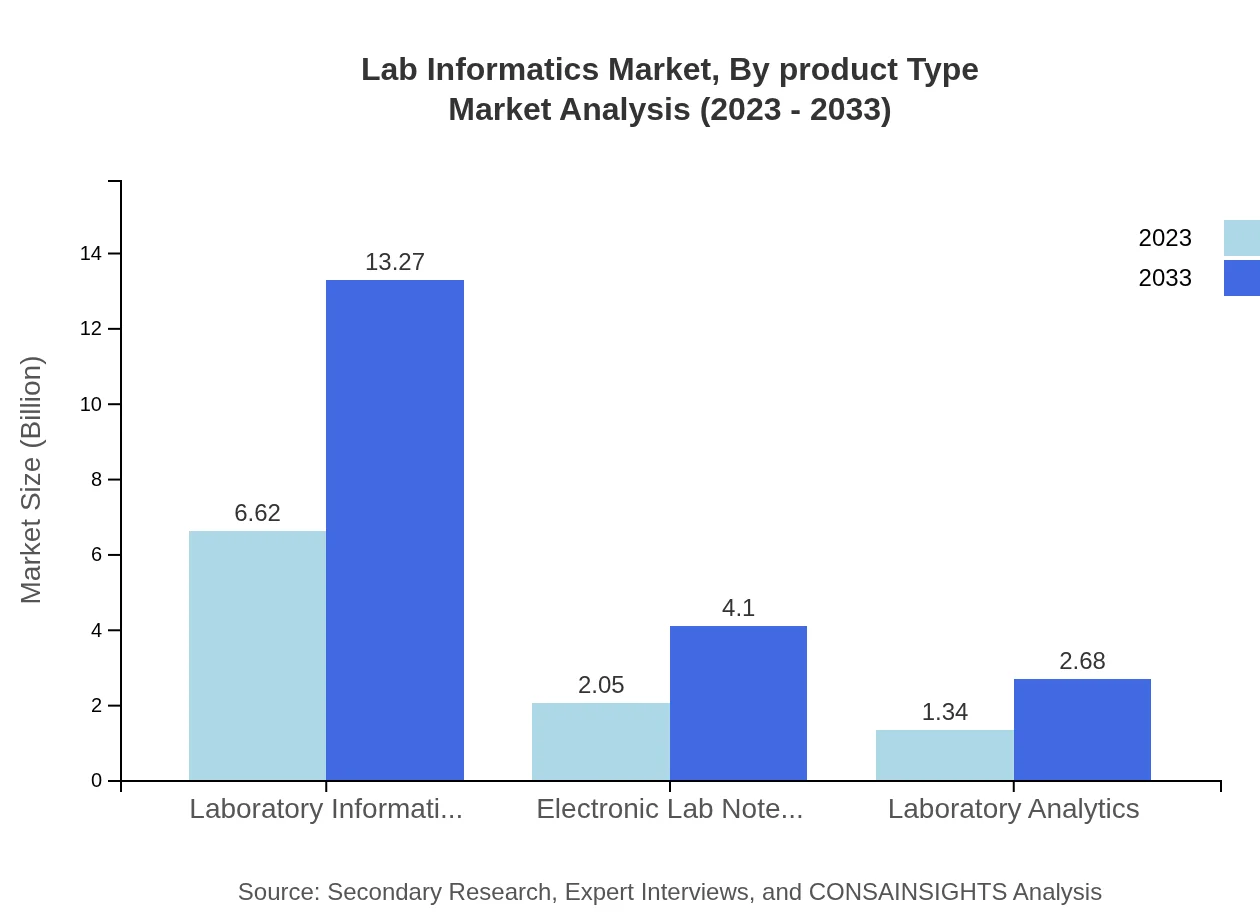

Lab Informatics Market Analysis By Product Type

The Lab Informatics market's product types include Laboratory Information Management Systems (LIMS), Electronic Lab Notebook (ELN), and Laboratory Analytics. LIMS holds the largest share at 66.18% in 2023, while ELN accounted for 20.46%. Both play crucial roles in data management and enhance laboratory productivity. Accordingly, product innovation and integration, such as AI in analytics tools, are gaining traction.

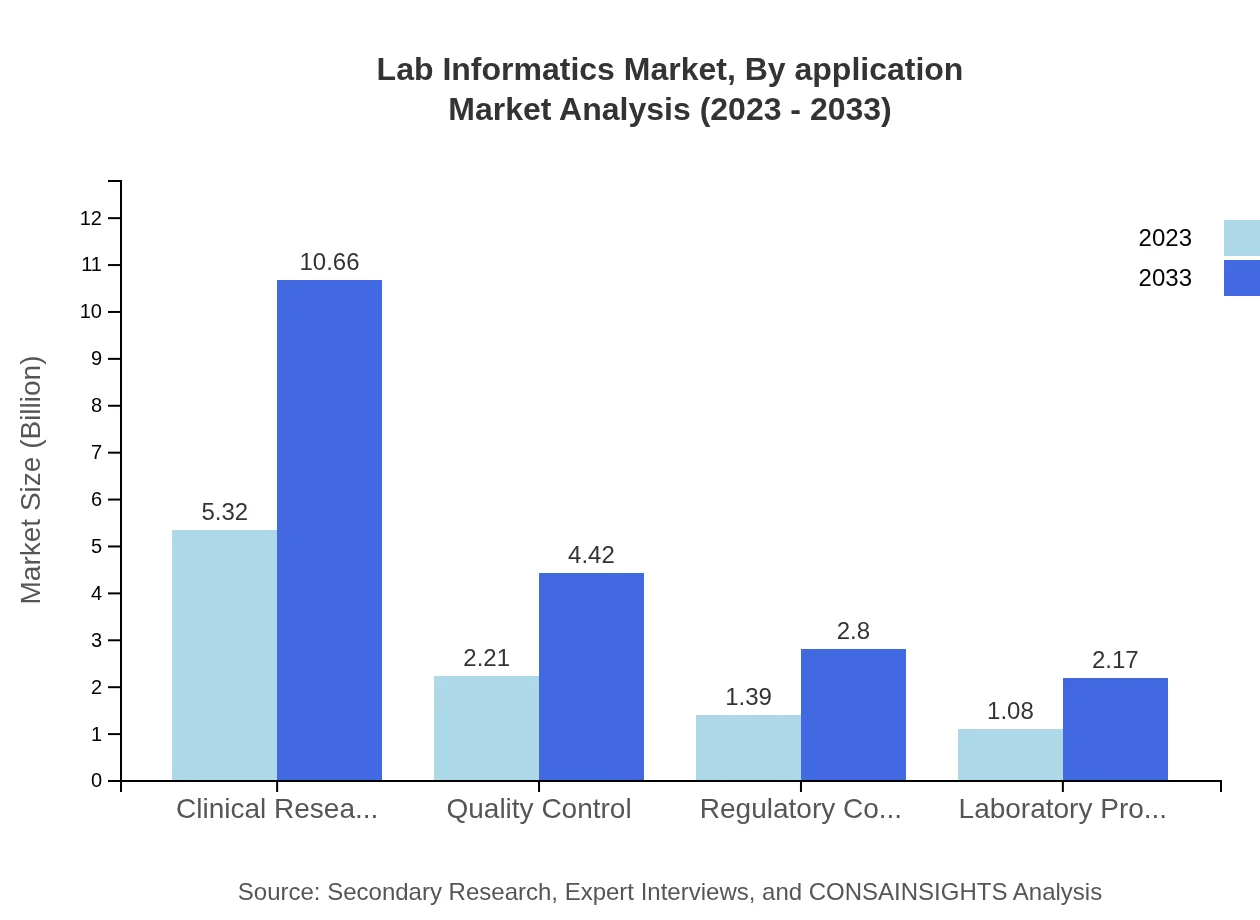

Lab Informatics Market Analysis By Application

Key applications in the Lab Informatics market include Pharmaceuticals, Biotechnology, Healthcare, Environmental Labs, and Academic Institutions. Pharmaceuticals lead with 47.93% market share in 2023, highlighting the essential role of informatics for regulatory compliance and efficiency in drug development processes.

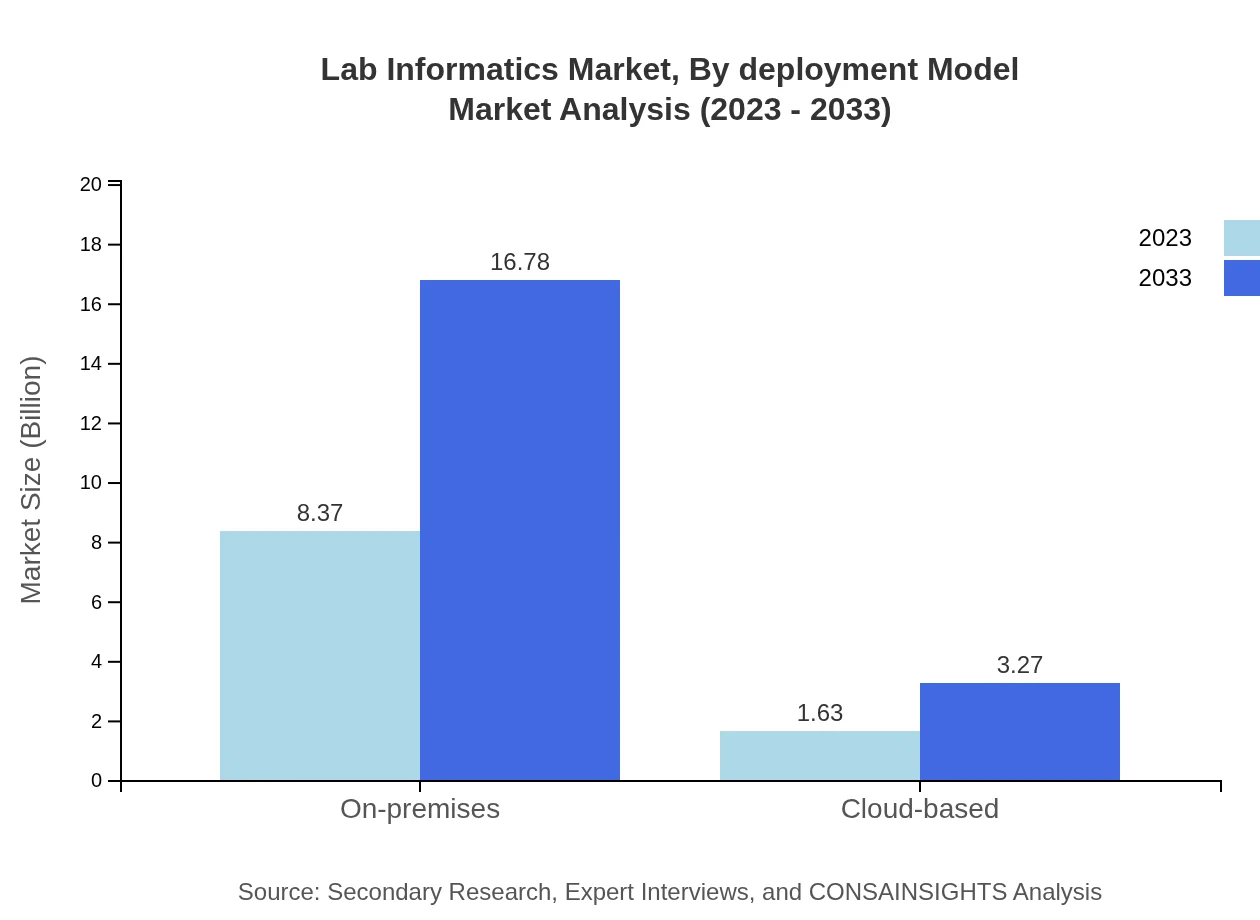

Lab Informatics Market Analysis By Deployment Model

The deployment models are divided into On-premises and Cloud-based solutions. On-premises systems dominated with a share of 83.71% in 2023, favored for security and control. However, the market is witnessing increased adoption of Cloud-based models (16.29%) due to their scalability and cost-effectiveness.

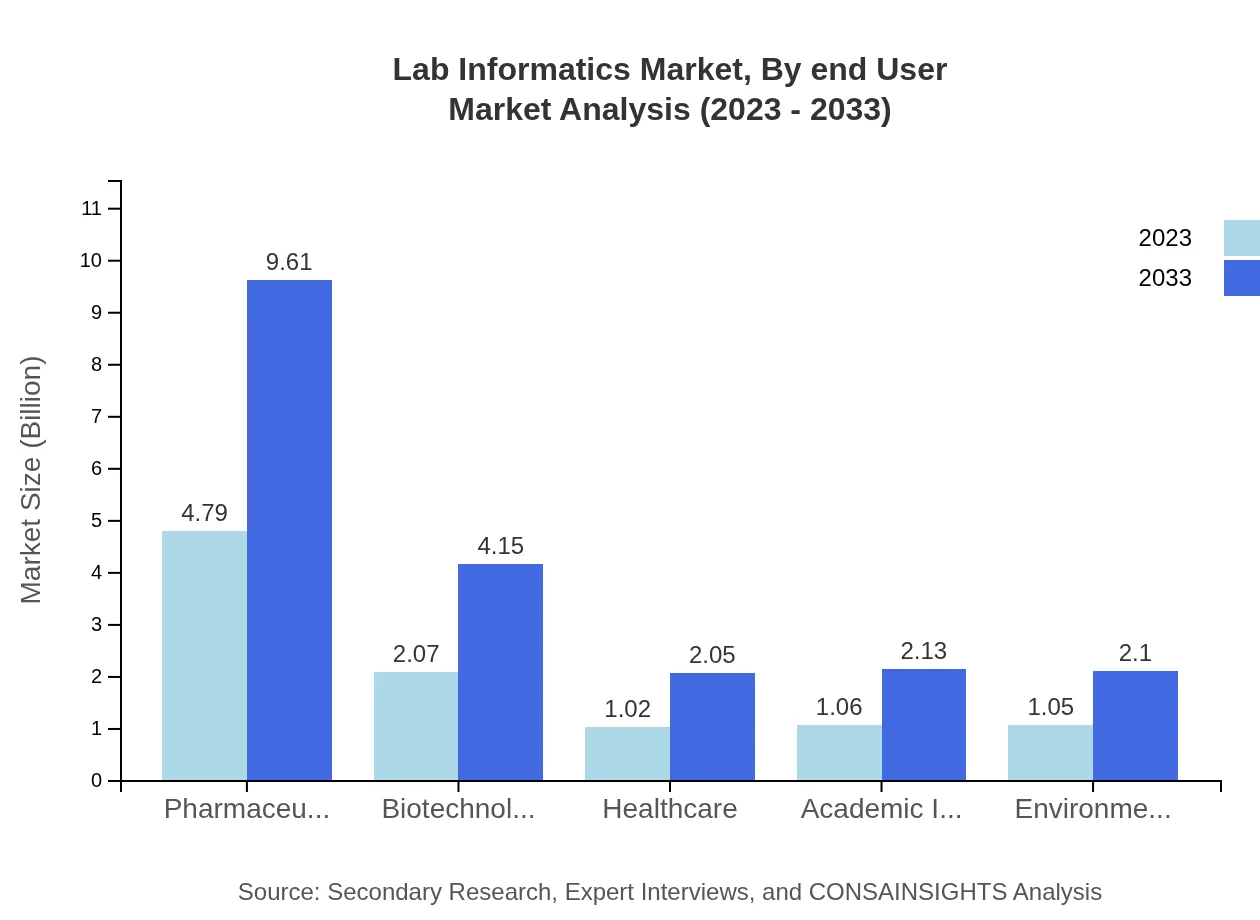

Lab Informatics Market Analysis By End User

End-users include Pharmaceuticals, Biotechnology, Healthcare Providers, Academic Institutions, and Environmental Organizations. Pharmaceutical companies account for a significant market share as they adapt informatics solutions to enhance research and compliance, while Academic Institutions utilize lab informatics to enhance educational and research capabilities.

Lab Informatics Market Analysis By Region

Regional analysis indicates North America leads the market, followed by Europe and Asia Pacific, highlighting varying adoption rates influenced by technology access, regulatory pressures, and infrastructure development. Each region presents unique opportunities for market players to tailor solutions offering high efficiency and compliance.

Lab Informatics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lab Informatics Industry

Thermo Fisher Scientific:

Thermo Fisher Scientific is a leading provider of laboratory informatics solutions, specializing in instruments and software designed to streamline laboratory processes and enhance data management efficiency.Abbott Laboratories:

Abbott Laboratories is renowned for developing diagnostics and laboratory management software tailored for the healthcare sector, promoting quality control and regulatory compliance.LabWare:

LabWare provides comprehensive laboratory information management systems (LIMS) solutions, recognized for their versatility and scalability across various laboratory settings.PerkinElmer:

PerkinElmer offers advanced lab informatics solutions, focusing on analytics and data management software that supports research and development across scientific disciplines.We're grateful to work with incredible clients.

FAQs

What is the market size of lab Informatics?

The global lab-informatics market is projected to grow from $10 billion in 2023 to an estimated size of $20 billion by 2033, exhibiting a CAGR of 7%. This robust growth indicates increasing demand for advanced laboratory solutions.

What are the key market players or companies in this lab Informatics industry?

Key players in the lab-informatics sector include Abbott Laboratories, Thermo Fisher Scientific, Agilent Technologies, LabWare, PerkinElmer, and Waters Corporation. These companies drive innovation and provide diverse technological solutions for laboratory operations.

What are the primary factors driving the growth in the lab Informatics industry?

The growth of the lab-informatics industry is primarily driven by the increasing need for data management, efficiency in lab operations, and advancements in laboratory automation technologies. Additionally, the rise in R&D investments and regulatory compliance requirements further fuels market expansion.

Which region is the fastest Growing in the lab Informatics?

North America is the fastest-growing region in the lab-informatics market, expected to increase from $3.85 billion in 2023 to $7.73 billion by 2033. Europe and Asia-Pacific also show strong growth potential within the same period.

Does ConsaInsights provide customized market report data for the lab Informatics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the lab-informatics industry. This includes in-depth analysis, forecasts, and detailed insights based on unique client requirements.

What deliverables can I expect from this lab Informatics market research project?

From this lab-informatics market research project, clients can expect comprehensive reports, executive summaries, market forecasts, trend analyses, and detailed segment breakdowns, all aimed at delivering actionable insights.

What are the market trends of lab Informatics?

Current trends in lab-informatics include the growing adoption of cloud-based solutions, integration of AI and machine learning technologies, and an emphasis on enhancing laboratory efficiency through automated systems. These trends indicate a significant shift towards digital transformation.