Label Free Array Systems Market Report

Published Date: 31 January 2026 | Report Code: label-free-array-systems

Label Free Array Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Label Free Array Systems market, covering market size, trends, technological advancements, and regional insights from 2023 to 2033.

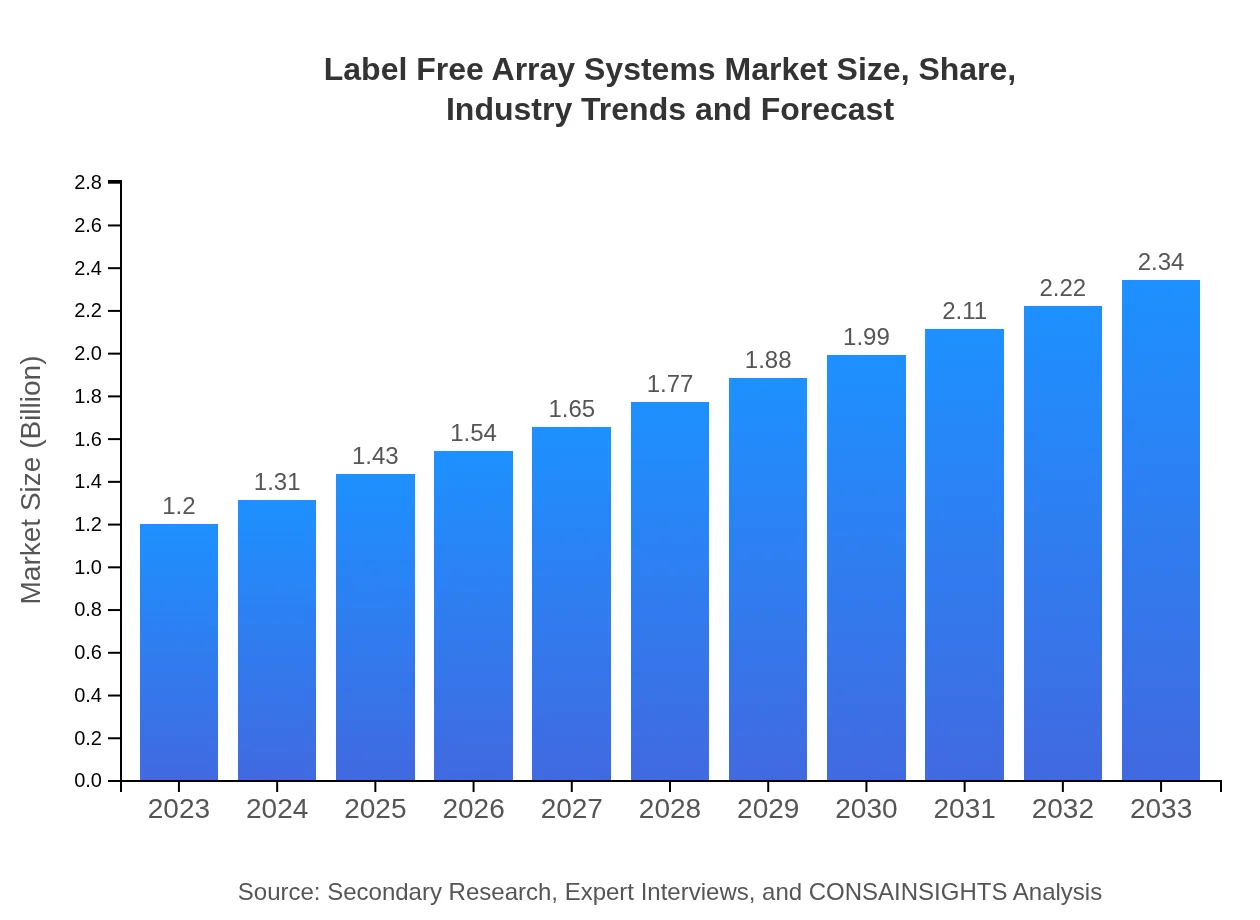

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $2.34 Billion |

| Top Companies | PerkinElmer, Inc., Corning Incorporated, Illumina, Inc., Agilent Technologies Inc., GE Healthcare |

| Last Modified Date | 31 January 2026 |

Label Free Array Systems Market Overview

Customize Label Free Array Systems Market Report market research report

- ✔ Get in-depth analysis of Label Free Array Systems market size, growth, and forecasts.

- ✔ Understand Label Free Array Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Label Free Array Systems

What is the Market Size & CAGR of Label Free Array Systems market in 2023?

Label Free Array Systems Industry Analysis

Label Free Array Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Label Free Array Systems Market Analysis Report by Region

Europe Label Free Array Systems Market Report:

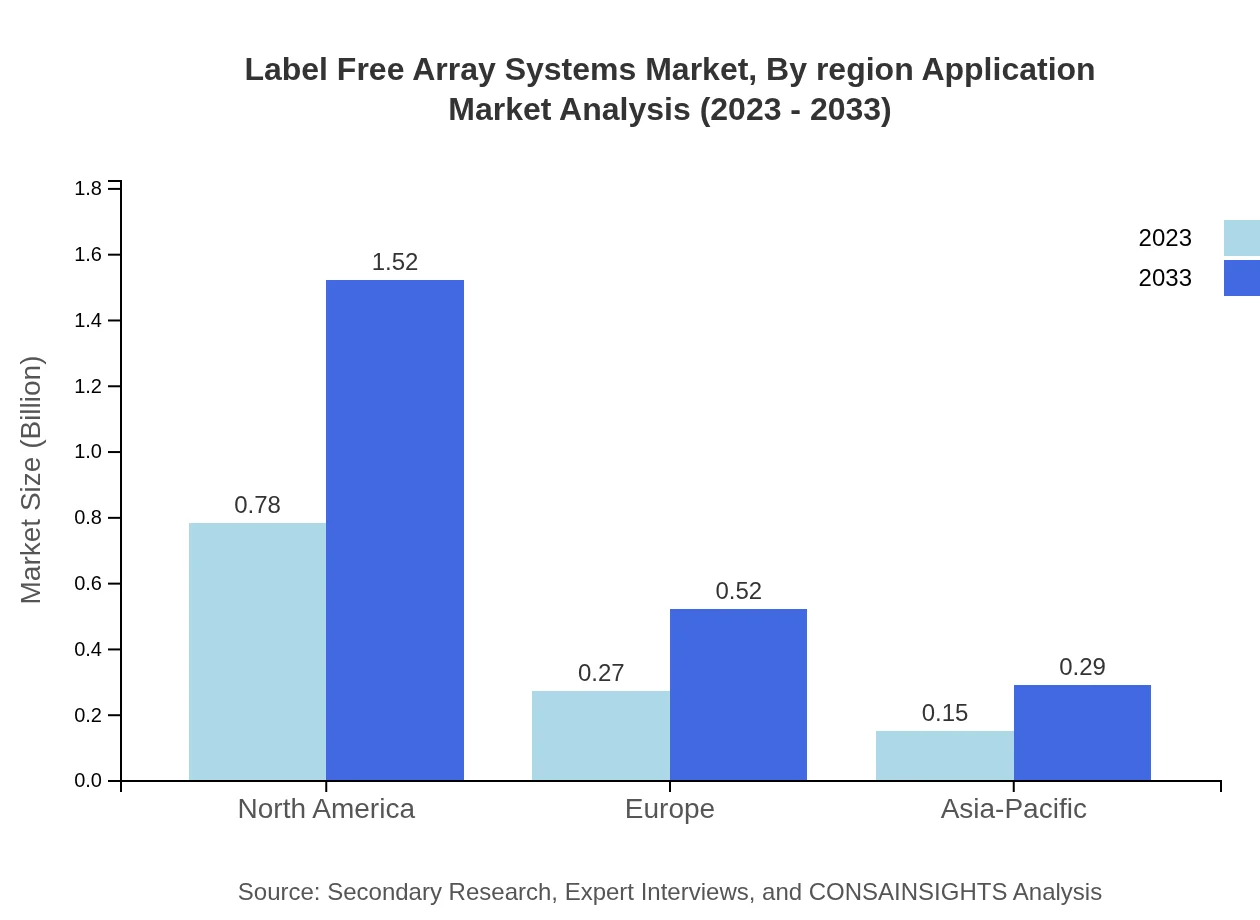

The European market is poised for growth, increasing from $0.30 billion in 2023 to $0.59 billion by 2033. The region benefits from robust regulatory frameworks supporting biotechnological advancements and a high level of R&D investment, particularly in countries like Germany and the UK.Asia Pacific Label Free Array Systems Market Report:

The Asia Pacific region is expected to grow substantially, with a market size forecasted to grow from $0.25 billion in 2023 to $0.48 billion by 2033. Factors contributing to this growth include increased investment in healthcare infrastructure, growing awareness about the benefits of label-free technology, and rising research activities in biotechnology.North America Label Free Array Systems Market Report:

North America is the largest market for Label Free Array Systems, projected to increase from $0.47 billion in 2023 to $0.91 billion by 2033. This growth is fueled by a high concentration of leading biotechnology firms, significant investments in research and development, and the demand for innovative diagnostic solutions in hospitals and clinics.South America Label Free Array Systems Market Report:

In South America, the Label Free Array Systems market is anticipated to grow modestly, from $0.03 billion in 2023 to $0.05 billion by 2033. The market is driven by an increase in government funding for biomedical research and improvements in healthcare facilities, although challenges related to economic stability may hinder rapid growth.Middle East & Africa Label Free Array Systems Market Report:

The Middle East and Africa market is projected to grow from $0.16 billion in 2023 to $0.30 billion by 2033. This region is witnessing improvements in healthcare services and increased investments in laboratory infrastructure, enhancing the adoption of advanced diagnostic tools.Tell us your focus area and get a customized research report.

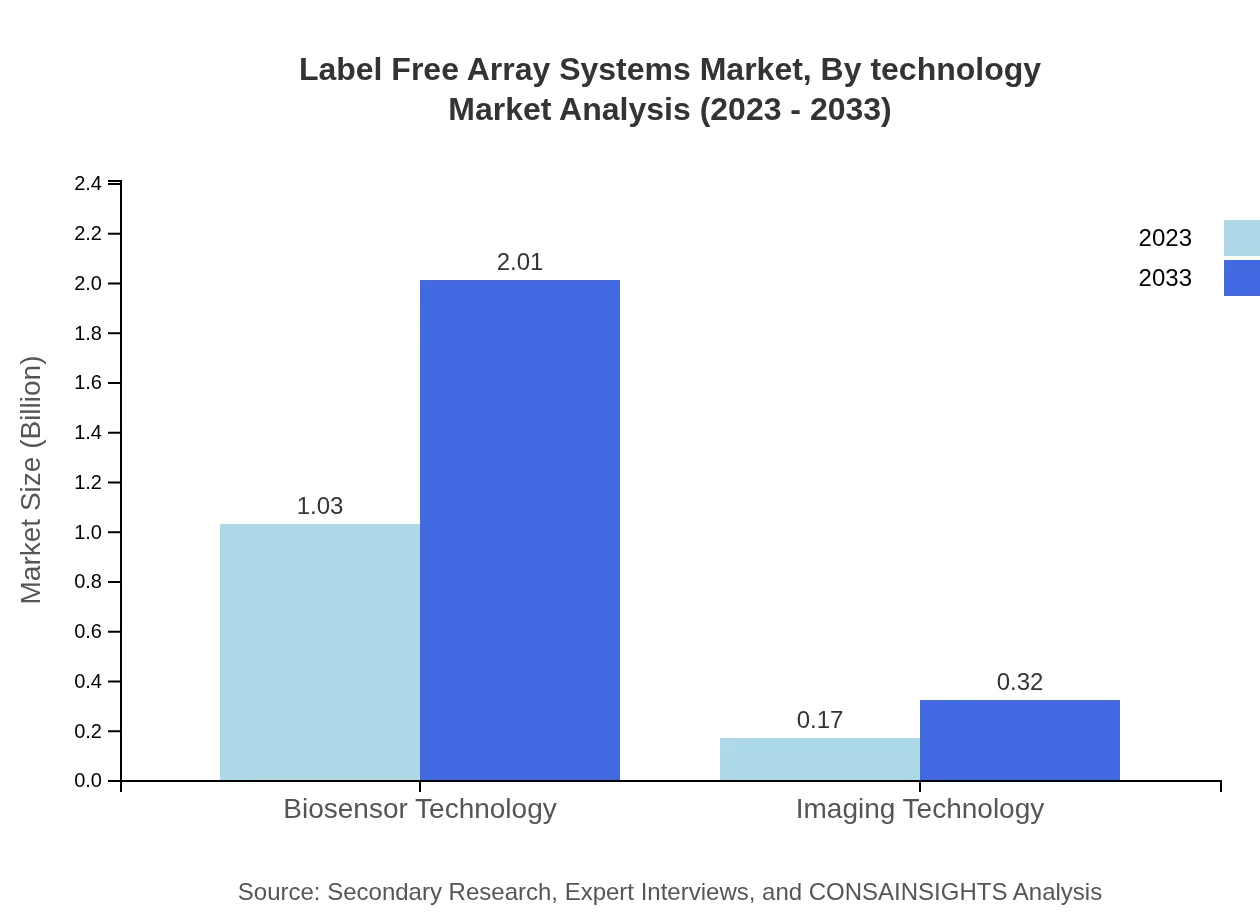

Label Free Array Systems Market Analysis By Technology

Biosensor technology dominates the Label Free Array Systems market, accounting for an estimated market value of $1.03 billion in 2023 and expected to grow to $2.01 billion by 2033. This is followed by imaging technology, which is projected to expand from $0.17 billion in 2023 to $0.32 billion by 2033. These advancements improve the capabilities and applications in biotechnology and pharmaceuticals.

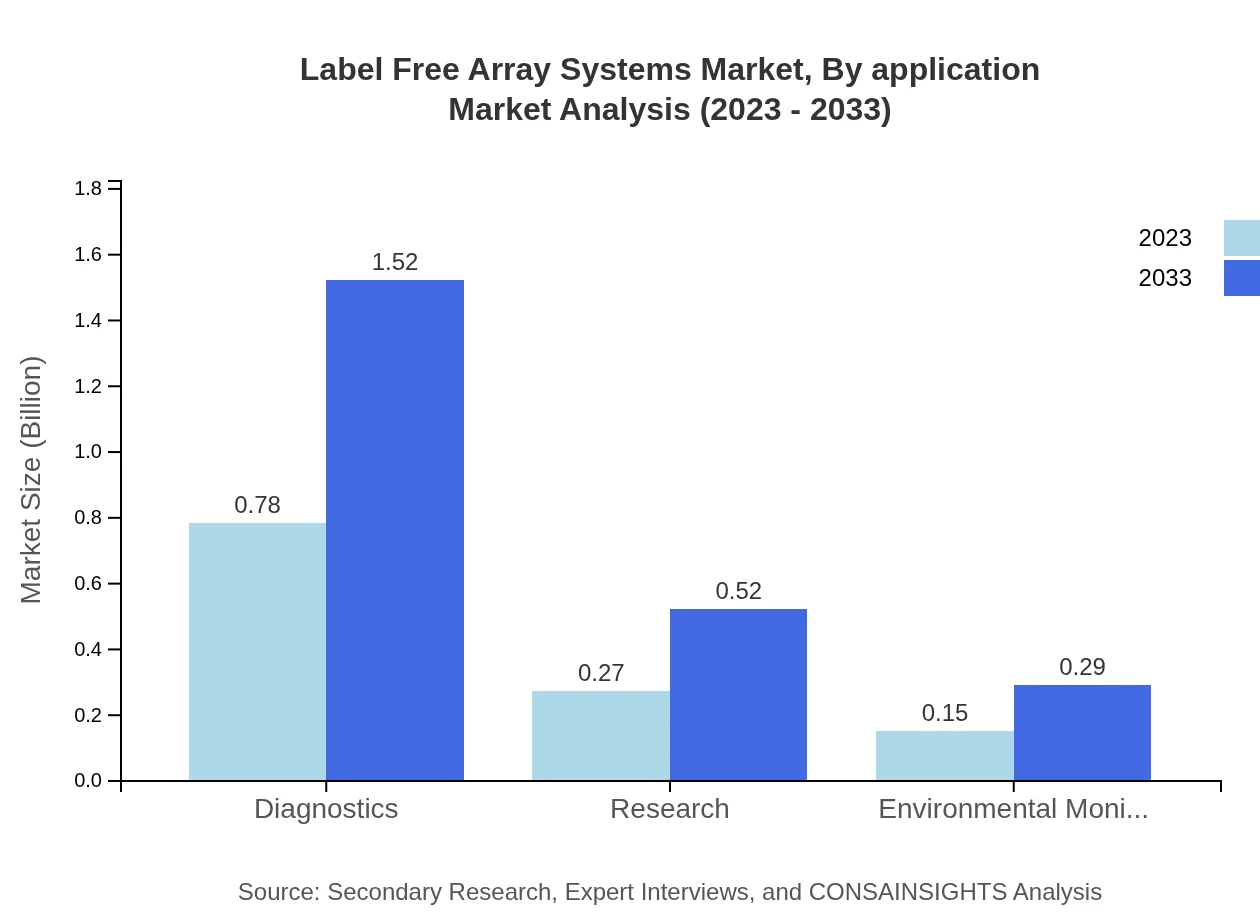

Label Free Array Systems Market Analysis By Application

Drug discovery is a major application segment of the Label Free Array Systems market, with a projected market size of $1.32 billion by 2033, up from $0.78 billion in 2023. Diagnostics follows closely, indicating significant trends in healthcare utilization of advanced array systems that enhance clinical outcomes.

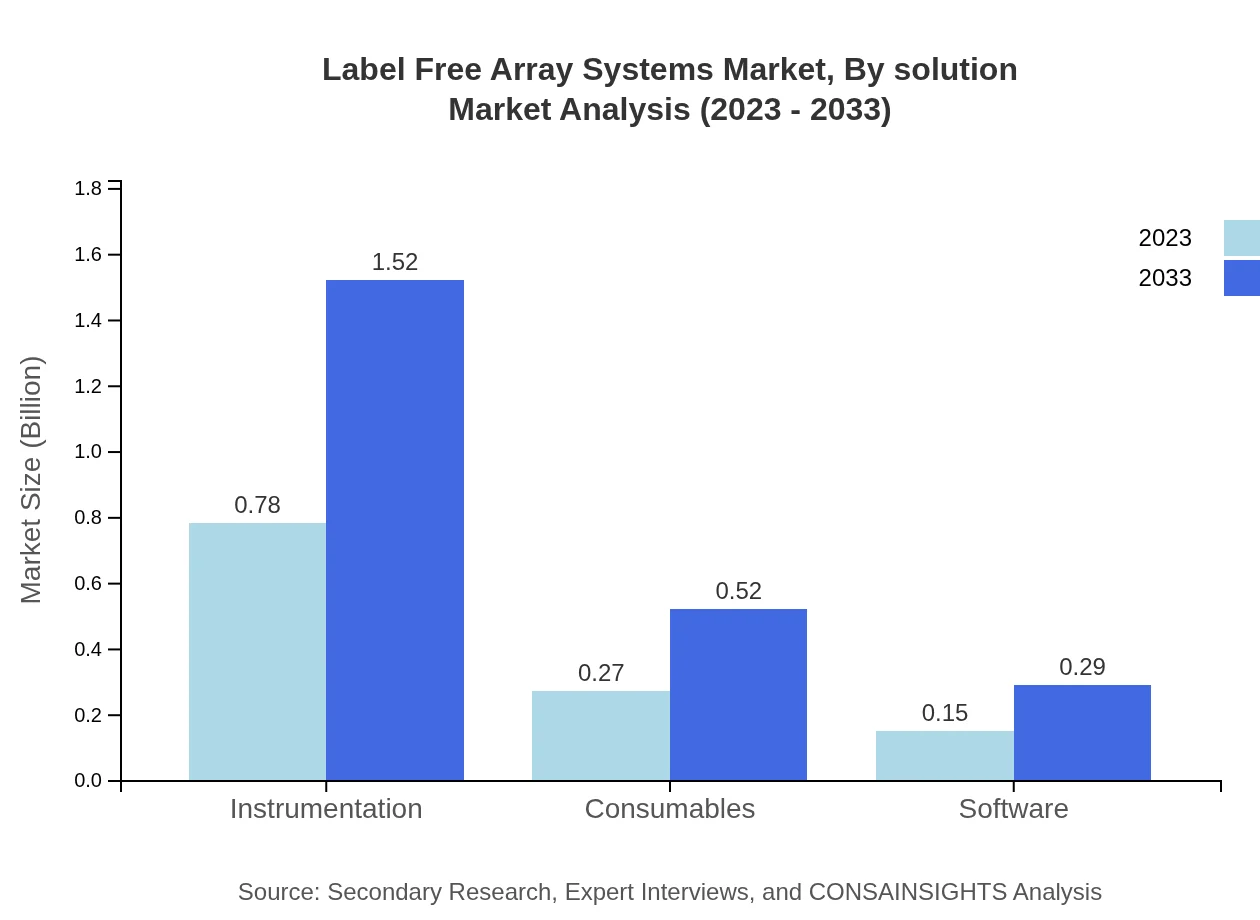

Label Free Array Systems Market Analysis By Solution

In terms of solutions, instruments are leading with a market value of $1.52 billion by 2033, while consumables are expected to grow from $0.27 billion in 2023 to $0.52 billion by 2033. Software solutions, although smaller, are critical for data management and analysis, reflecting the importance of comprehensive technology applications.

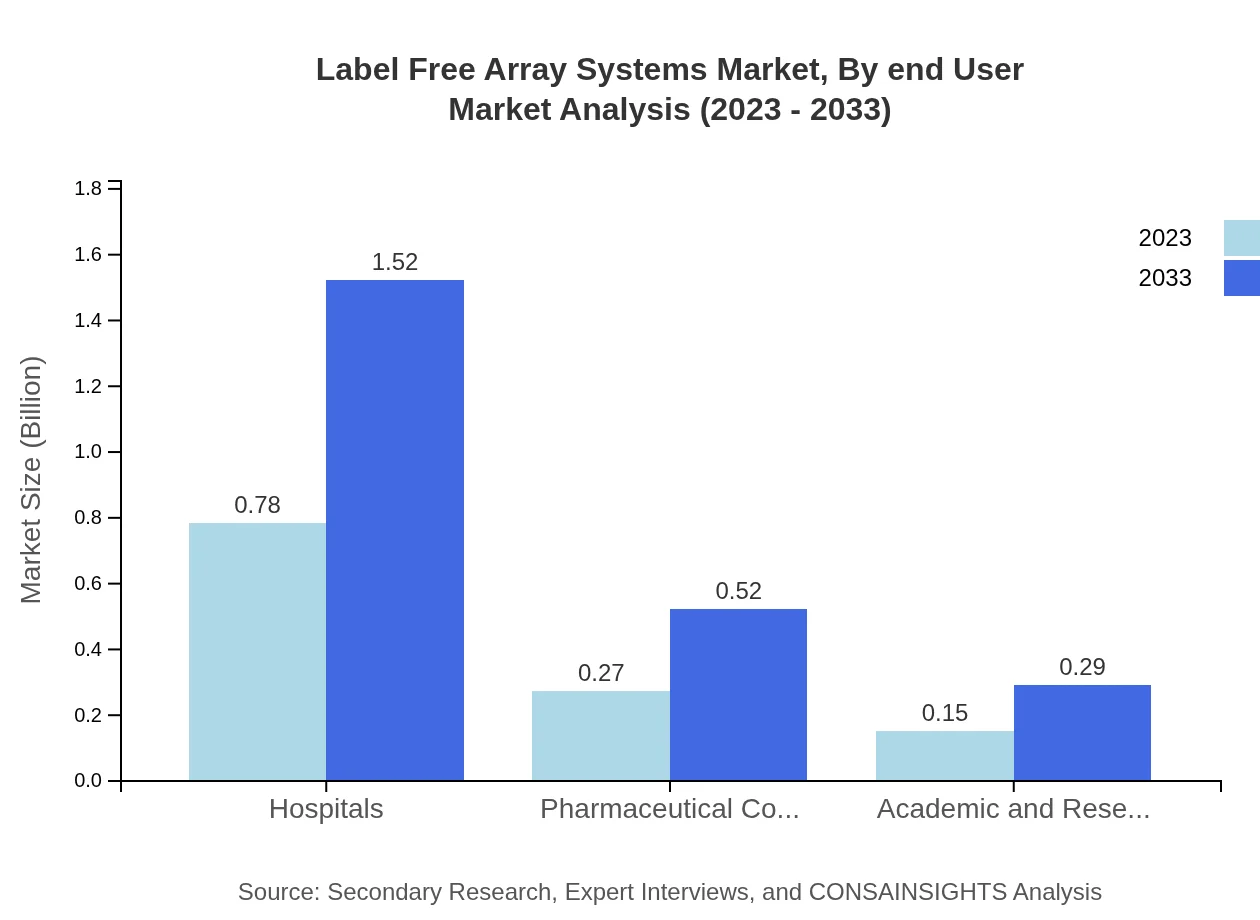

Label Free Array Systems Market Analysis By End User

Hospitals are the largest segment in the end-user category, projected to hold a market share of 65.26% throughout the forecast period with increasing adoption of complex diagnostic tools. Pharmaceutical companies follow, holding a significant share and emphasizing the integration of efficient research methodologies.

Label Free Array Systems Market Analysis By Region Application

Each region has unique applications, with North America leading in drug discovery, while Europe shows a high demand for diagnostics. The Asia-Pacific region is emerging as a significant player in both applications, supported by government spending on health innovations.

Label Free Array Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Label Free Array Systems Industry

PerkinElmer, Inc.:

A global leader in laboratory services and analysis, offering innovative solutions and technologies for drug discovery applications.Corning Incorporated:

A notable player known for its glass technology and advanced manufacturing processes in array systems, enhancing throughput in biomedical research.Illumina, Inc.:

Specializes in DNA sequencing and genomics solutions, leveraging label-free technologies in research and diagnostics.Agilent Technologies Inc.:

Provides comprehensive solutions for laboratories, focusing on advanced instrumentation and analytics in the life sciences sector.GE Healthcare:

Delivers precision health solutions combining diagnostics, biosensing, and imaging technologies for optimal patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of label Free Array Systems?

The market size of label-free array systems is projected to grow to $1.2 billion by 2033, with a compound annual growth rate (CAGR) of 6.7% from 2023.

What are the key market players or companies in the label Free Array Systems industry?

Key market players in the label-free array systems industry include major players involved in biosensors, imaging technologies, and consumables tailored for healthcare and research sectors.

What are the primary factors driving the growth in the label Free Array Systems industry?

Growth is driven by increasing demand for advanced diagnostics, technological advancements in biosensing, and a rise in R&D activities across pharmaceuticals and healthcare sectors.

Which region is the fastest Growing in the label Free Array Systems?

The fastest-growing region for label-free array systems is North America, projected to expand from $0.47 billion in 2023 to $0.91 billion in 2033.

Does ConsaInsights provide customized market report data for the label Free Array Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the label-free array systems industry.

What deliverables can I expect from this label Free Array Systems market research project?

Deliverables include comprehensive market analysis, regional insights, segment data, competitive landscape, and forecasts for the label-free array systems market.

What are the market trends of label Free Array Systems?

Current trends include increasing reliance on biosensor technology, growth in diagnostic applications, and enhanced integration of software solutions for data analysis.