Laboratory Chemicals Market Report

Published Date: 02 February 2026 | Report Code: laboratory-chemicals

Laboratory Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the global laboratory chemicals market from 2023 to 2033, covering market size, growth trends, key players, and regional insights to guide stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

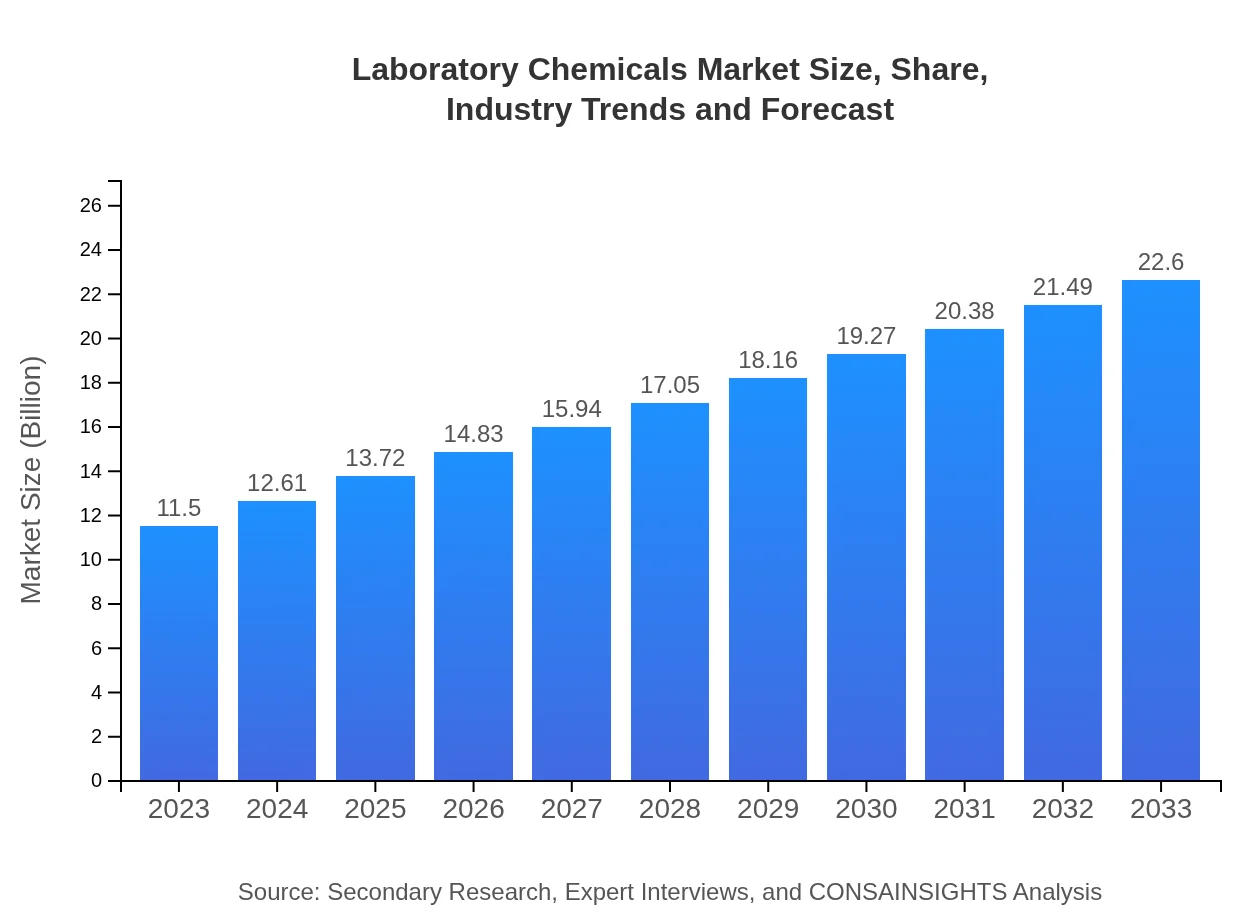

| 2023 Market Size | $11.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $22.60 Billion |

| Top Companies | Thermo Fisher Scientific, Merck Group, Sigma-Aldrich, Agilent Technologies |

| Last Modified Date | 02 February 2026 |

Laboratory Chemicals Market Overview

Customize Laboratory Chemicals Market Report market research report

- ✔ Get in-depth analysis of Laboratory Chemicals market size, growth, and forecasts.

- ✔ Understand Laboratory Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Chemicals

What is the Market Size & CAGR of Laboratory Chemicals market in 2023 and 2033?

Laboratory Chemicals Industry Analysis

Laboratory Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Chemicals Market Analysis Report by Region

Europe Laboratory Chemicals Market Report:

The European laboratory chemicals market is poised for growth from USD 4.02 billion in 2023 to USD 7.90 billion by 2033. Increased regulations in environmental safety and healthcare coupled with extensive research activities support market expansion.Asia Pacific Laboratory Chemicals Market Report:

In 2023, the laboratory chemicals market in Asia Pacific is valued at USD 2.16 billion, growing to USD 4.24 billion by 2033. This growth is attributed to rapid industrialization, increasing R&D investments, and rising healthcare needs in countries like India and China.North America Laboratory Chemicals Market Report:

North America holds a significant share, with market values projected from USD 3.91 billion in 2023 to USD 7.68 billion by 2033. A strong focus on drug development and advancements in research techniques drive this region's growth.South America Laboratory Chemicals Market Report:

The South American market, initially valued at USD 0.28 billion in 2023, is expected to reach USD 0.54 billion by 2033. The growth is propelled by rising investments in pharmaceuticals and biotechnology sectors, alongside government initiatives supporting research activities.Middle East & Africa Laboratory Chemicals Market Report:

The Middle East and Africa market is anticipated to grow from USD 1.14 billion in 2023 to USD 2.24 billion by 2033. This growth is amplified by expanding research initiatives and a growing focus on environmental testing.Tell us your focus area and get a customized research report.

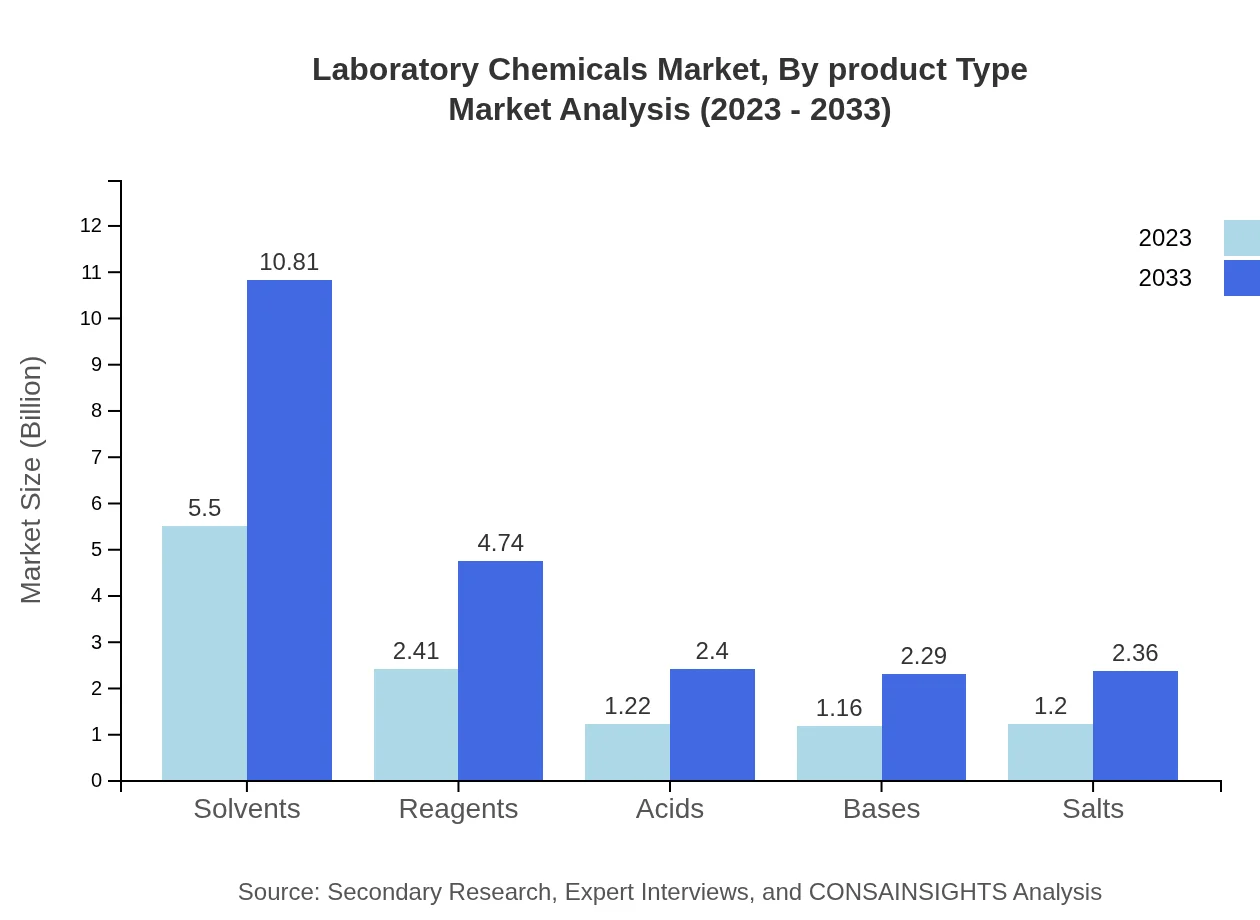

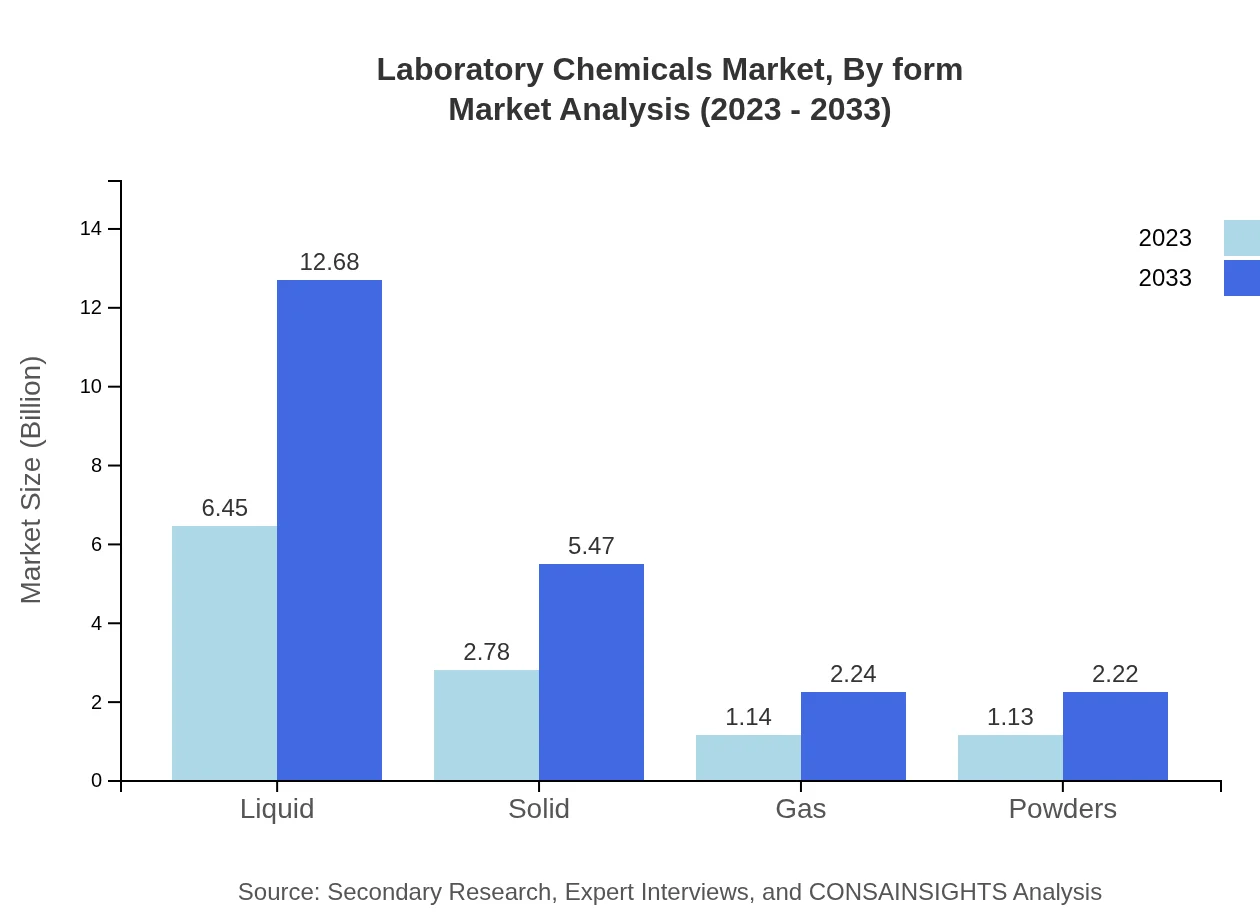

Laboratory Chemicals Market Analysis By Product Type

The laboratory chemicals market is segmented into liquid, solid, gas, and powder forms. The liquid segment dominates the market, estimated at USD 6.45 billion in 2023 and projected to reach USD 12.68 billion by 2033, due to high demand in various applications. Solid chemicals follow with a current value of USD 2.78 billion, but forecasted to grow to USD 5.47 billion, demonstrating a rising utilization in laboratory settings.

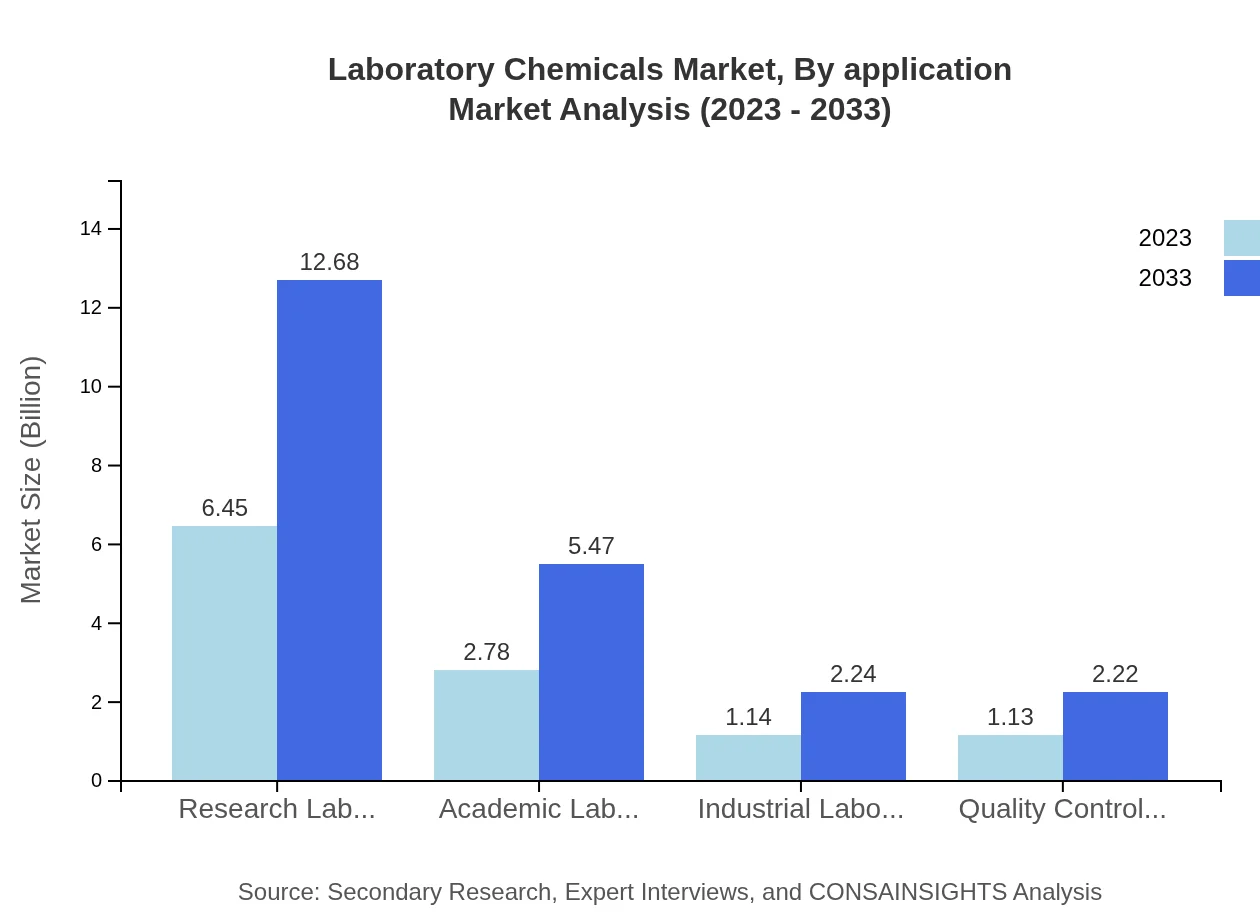

Laboratory Chemicals Market Analysis By Application

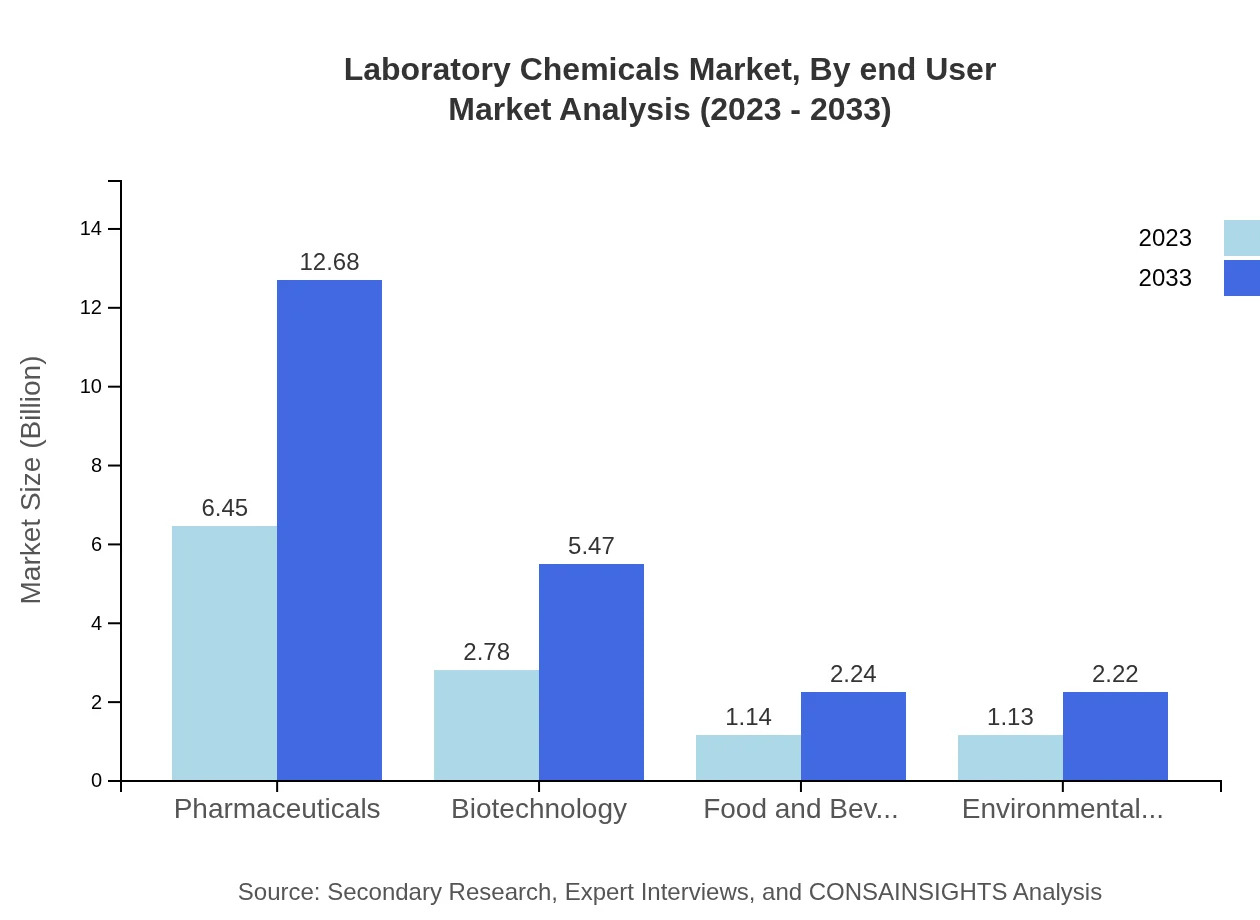

Applications of laboratory chemicals span pharmaceuticals, biotechnology, environmental testing, food and beverage, and research laboratories. Pharmaceuticals cover the largest share, currently valued at USD 6.45 billion with a forecast to reach USD 12.68 billion by 2033 as drug discovery intensifies. Biotechnology and environmental testing are increasingly gaining prominence, indicating a shift towards sustainable practices.

Laboratory Chemicals Market Analysis By End User

End-users of laboratory chemicals include academic laboratories, industrial laboratories, and quality control settings. Academic laboratories are projected to grow from USD 2.78 billion in 2023 to USD 5.47 billion by 2033, reflecting increasing educational initiatives and lab capacities. Industrial laboratories are also expected to increase, supporting R&D across various sectors.

Laboratory Chemicals Market Analysis By Form

The formulation of laboratory chemicals is crucial, with a focus on liquids, solids, gases, and powders. Liquid chemicals remain the most consumed form, attributed to their versatility in applications. Solid chemicals play an important role, particularly in laboratory synthesis processes. The other forms also cater to specialized requirements in research and analysis.

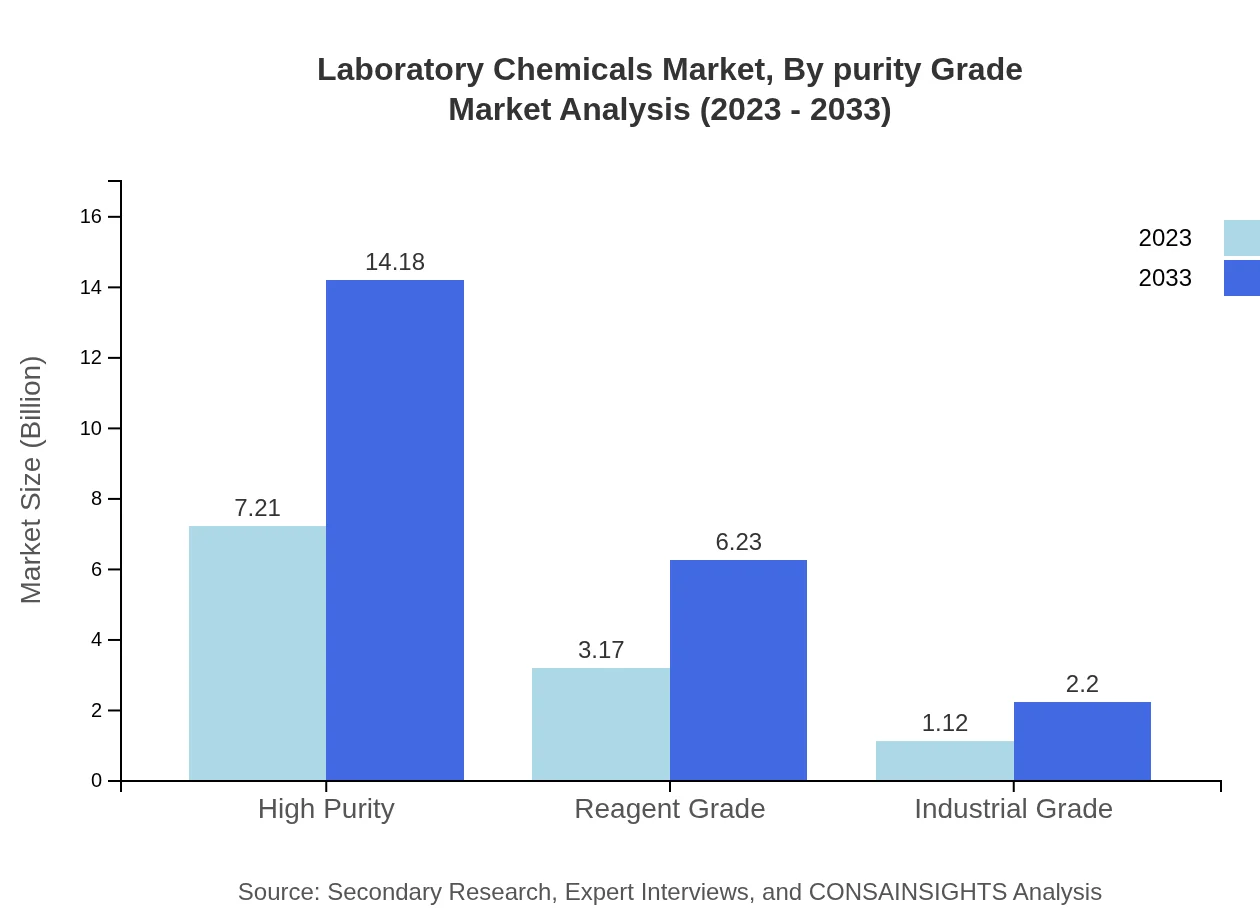

Laboratory Chemicals Market Analysis By Purity Grade

Within the laboratory chemicals market, high-purity and reagent-grade chemicals command substantial demand. High-purity chemicals, valued at USD 7.21 billion in 2023, are projected to grow significantly due to increased reliance on precise and accurate results in laboratory analyses.

Laboratory Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Chemicals Industry

Thermo Fisher Scientific:

A leading provider of laboratory chemicals and equipment, known for its extensive portfolio covering reagents, instruments, and consumables.Merck Group:

A global player in the life science sector, Merck offers a wide range of laboratory chemicals, catering to pharmaceuticals, biotechnology, and academia.Sigma-Aldrich:

Part of Merck Group, Sigma-Aldrich is recognized for its high-purity chemicals and being a leading supplier of scientific and laboratory materials.Agilent Technologies:

A key contributor to the laboratory chemicals market, Agilent focuses on analytical instruments and chemicals, aiding in critical research initiatives.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Chemicals?

The laboratory chemicals market is valued at approximately $11.5 billion in 2023 and is projected to grow at a CAGR of 6.8% over the next decade, reflecting increasing demand across various applications.

What are the key market players or companies in the laboratory Chemicals industry?

Key players in the laboratory chemicals industry include companies such as Thermo Fisher Scientific, Merck KGaA, and Sigma-Aldrich, all of whom significantly influence market trends and product innovations.

What are the primary factors driving the growth in the laboratory Chemicals industry?

Major drivers of growth in the laboratory chemicals market include advancements in life sciences research, increasing investments in R&D, and the rising demand for high-quality chemicals across pharmaceuticals and biotechnology sectors.

Which region is the fastest Growing in the laboratory Chemicals?

Asia Pacific emerges as the fastest-growing region, anticipated to expand from a market size of $2.16 billion in 2023 to $4.24 billion by 2033, fueled by increasing research activities.

Does ConsaInsights provide customized market report data for the laboratory Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring that clients receive relevant insights aligned with their strategic objectives.

What deliverables can I expect from this laboratory Chemicals market research project?

Deliverables from the laboratory chemicals market research project include comprehensive market analysis reports, segment data, regional insights, and forecasts to help guide strategic decision-making.

What are the market trends of laboratory Chemicals?

Current trends in the laboratory chemicals market include a shift towards sustainable and eco-friendly chemicals, increased automation in laboratories, and a growing focus on high-purity products for diverse applications.