Laboratory Equipment Services Market Report

Published Date: 31 January 2026 | Report Code: laboratory-equipment-services

Laboratory Equipment Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Laboratory Equipment Services market, including insights on market size, growth forecasts, segmentations, regional dynamics, and industry trends from 2023 to 2033.

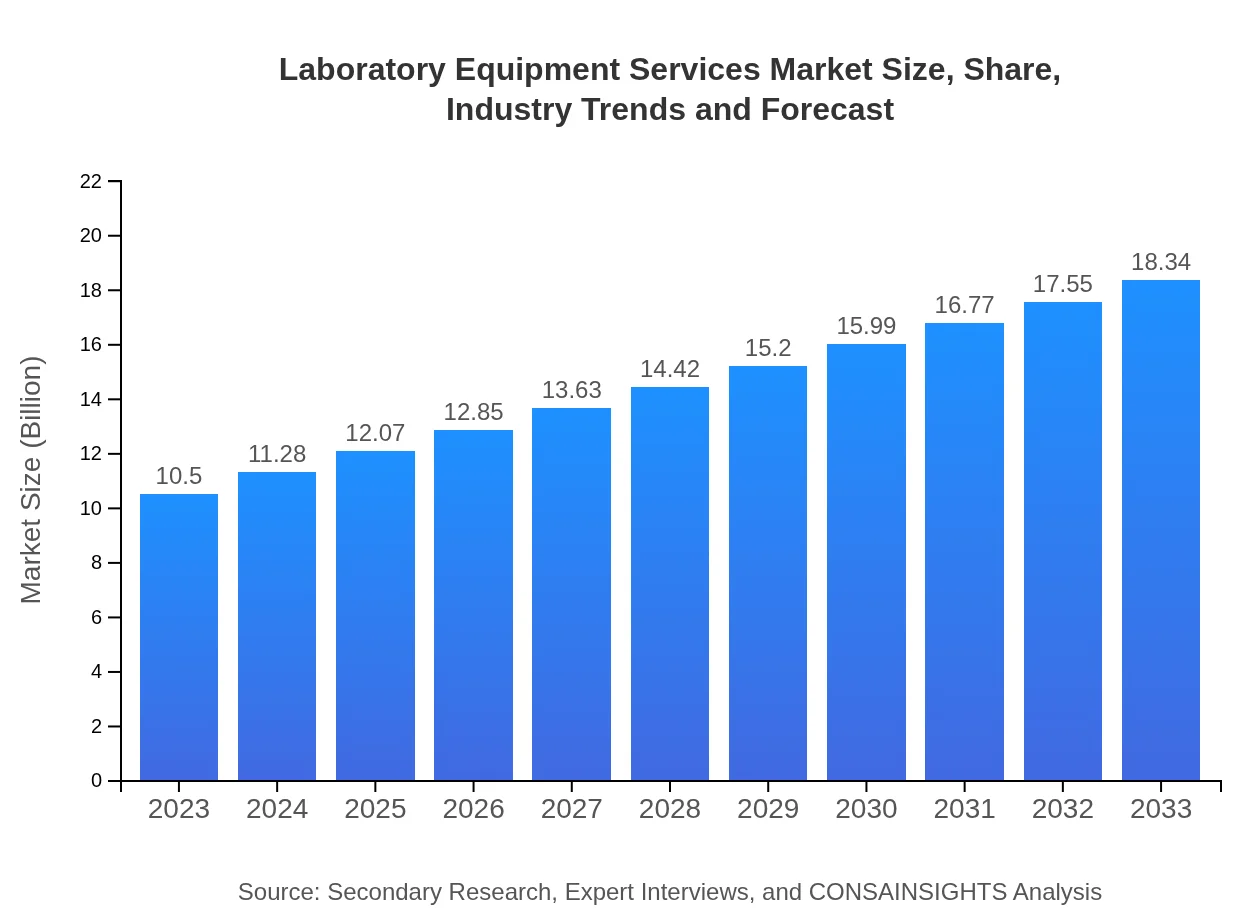

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $18.34 Billion |

| Top Companies | Thermo Fisher Scientific Inc., Agilent Technologies, Inc., PerkinElmer, Inc., Horiba, Ltd., VWR International, LLC. |

| Last Modified Date | 31 January 2026 |

Laboratory Equipment Services Market Overview

Customize Laboratory Equipment Services Market Report market research report

- ✔ Get in-depth analysis of Laboratory Equipment Services market size, growth, and forecasts.

- ✔ Understand Laboratory Equipment Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Equipment Services

What is the Market Size & CAGR of Laboratory Equipment Services market in 2023?

Laboratory Equipment Services Industry Analysis

Laboratory Equipment Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

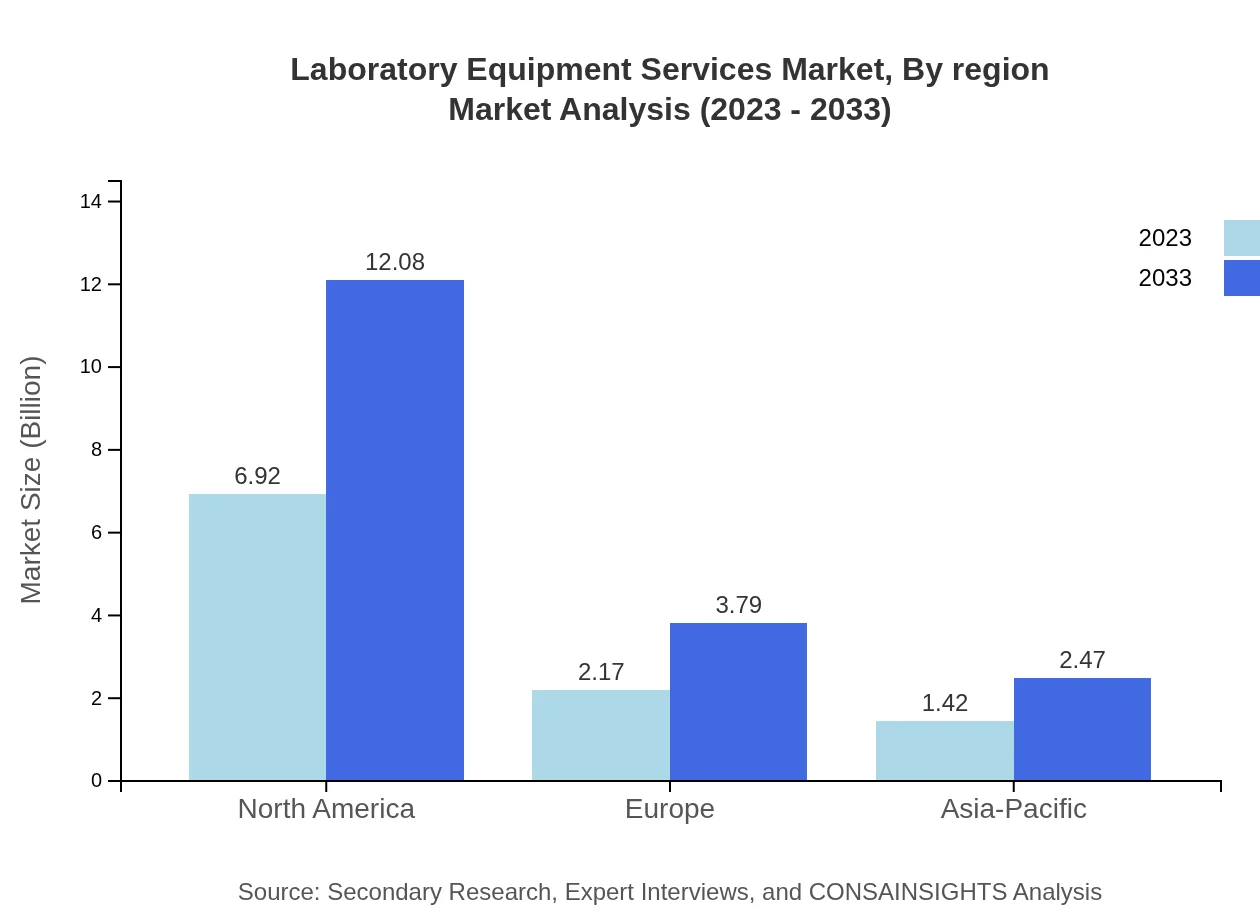

Laboratory Equipment Services Market Analysis Report by Region

Europe Laboratory Equipment Services Market Report:

Europe's market is projected to expand from USD 3.19 billion in 2023 to USD 5.56 billion by 2033. The growth is facilitated by an emphasis on research and innovation, particularly in countries like Germany and the UK, alongside the rising number of academic research institutes.Asia Pacific Laboratory Equipment Services Market Report:

In Asia Pacific, the market is expected to grow from USD 2.03 billion in 2023 to USD 3.54 billion by 2033, driven by increased demand for laboratory services and technology improvements. The rise of the biotechnology and pharmaceutical sectors in countries like China and India significantly contributes to this growth.North America Laboratory Equipment Services Market Report:

North America is anticipated to grow from USD 3.67 billion in 2023 to USD 6.40 billion by 2033. The region’s growth is driven by a robust healthcare sector, technological advancements, and a stringent regulatory environment that necessitates high-quality laboratory operations.South America Laboratory Equipment Services Market Report:

The South American laboratory equipment services market is projected to rise from USD 0.32 billion in 2023 to USD 0.56 billion by 2033. Growth is particularly due to governmental investments in healthcare infrastructure and increasing R&D initiatives in Brazil and Argentina.Middle East & Africa Laboratory Equipment Services Market Report:

The Middle East and Africa's market is expected to increase from USD 1.30 billion in 2023 to USD 2.27 billion by 2033, propelled by healthcare sector investments and a growing focus on quality control in laboratories.Tell us your focus area and get a customized research report.

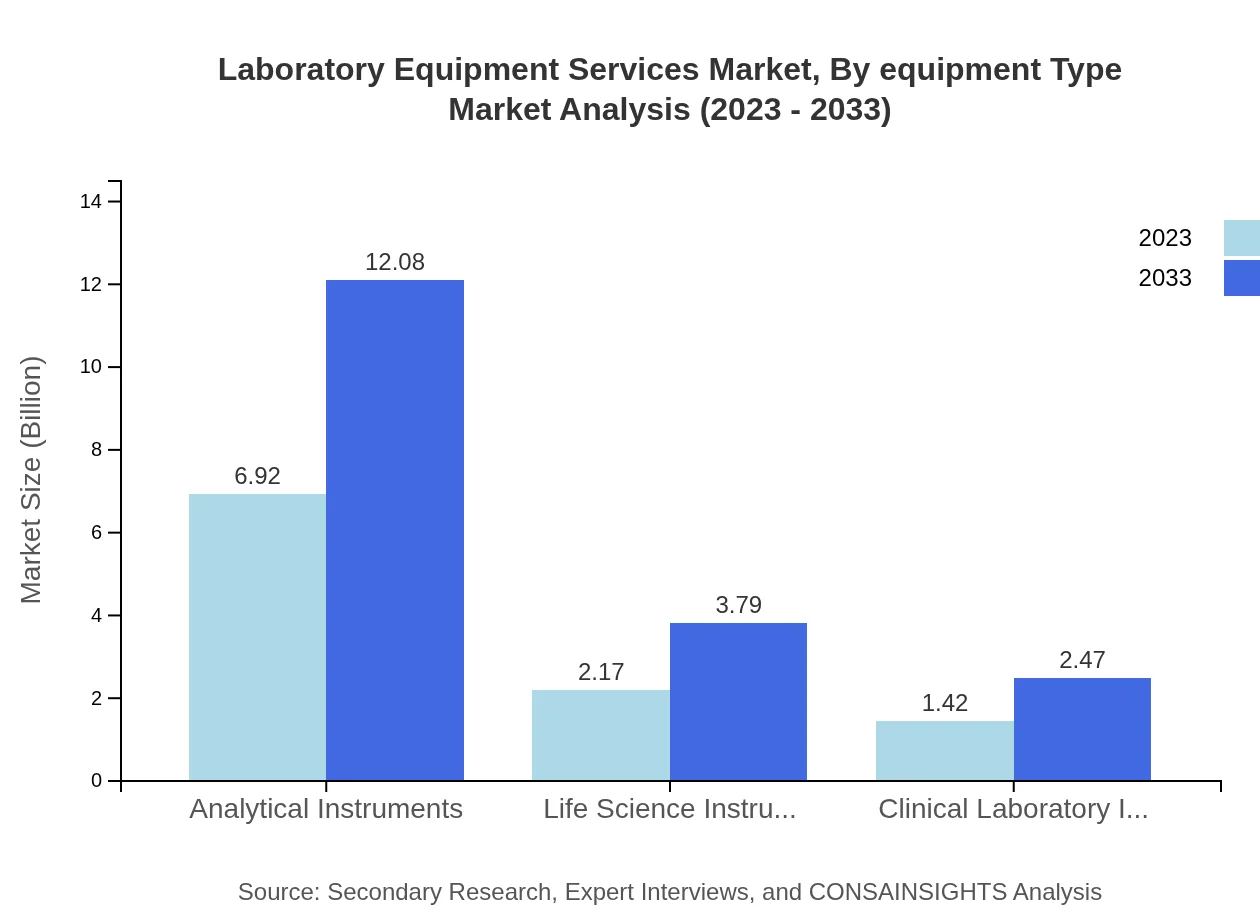

Laboratory Equipment Services Market Analysis By Equipment Type

The market for laboratory services by equipment type shows that analytical instruments dominate this segment, expected to reach USD 6.92 billion by 2033 from USD 6.92 billion in 2023. Life science instruments and clinical laboratory instruments are also significant contributors, with forecasts suggesting they will expand to USD 3.79 billion and USD 2.47 billion respectively by 2033, both demonstrating substantial growth prospects.

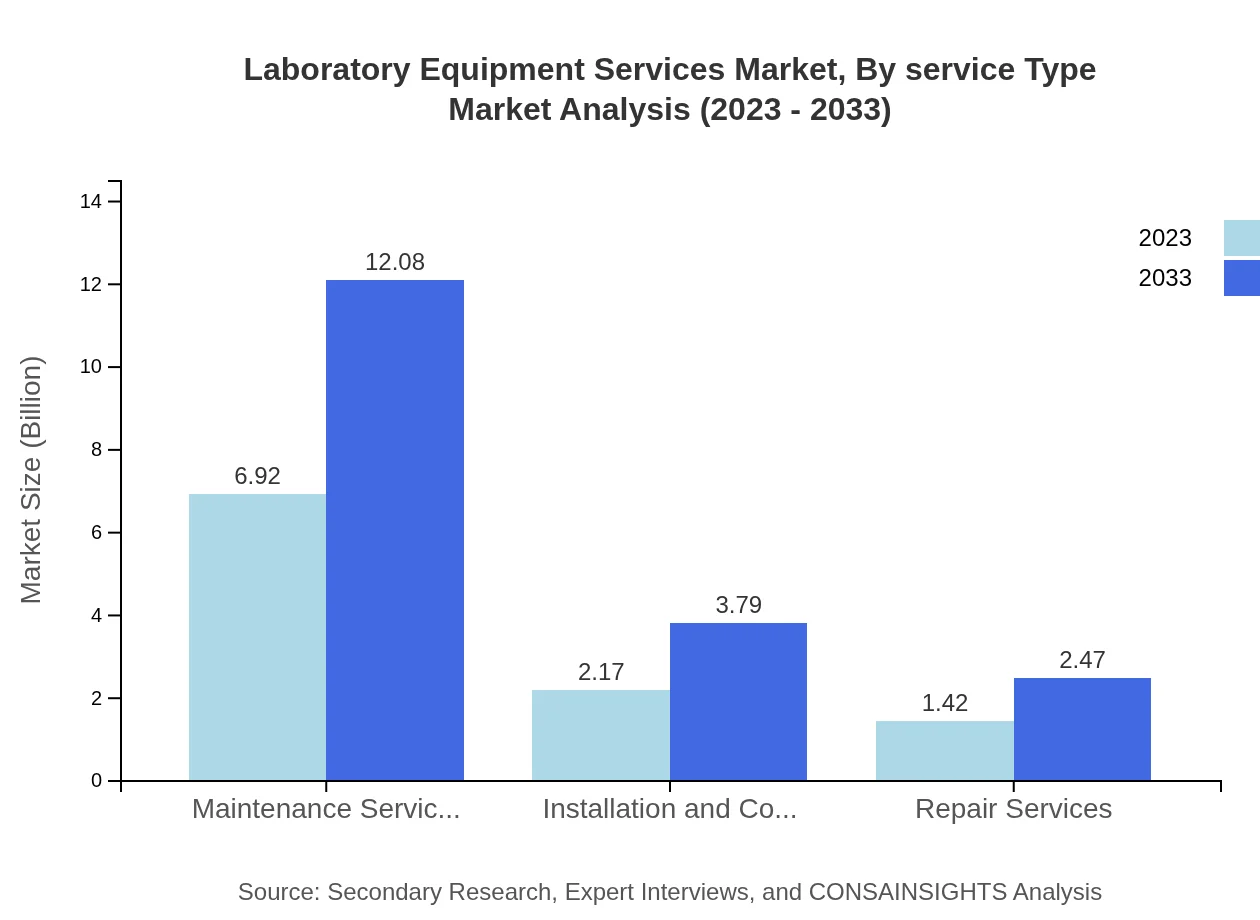

Laboratory Equipment Services Market Analysis By Service Type

By service type, maintenance services lead the market, projected to grow from USD 6.92 billion in 2023 to USD 12.08 billion in 2033. Installation and commissioning services, along with repair services, are also significant segments, with expected growth in response to increasing laboratory setups and demand for efficient service delivery.

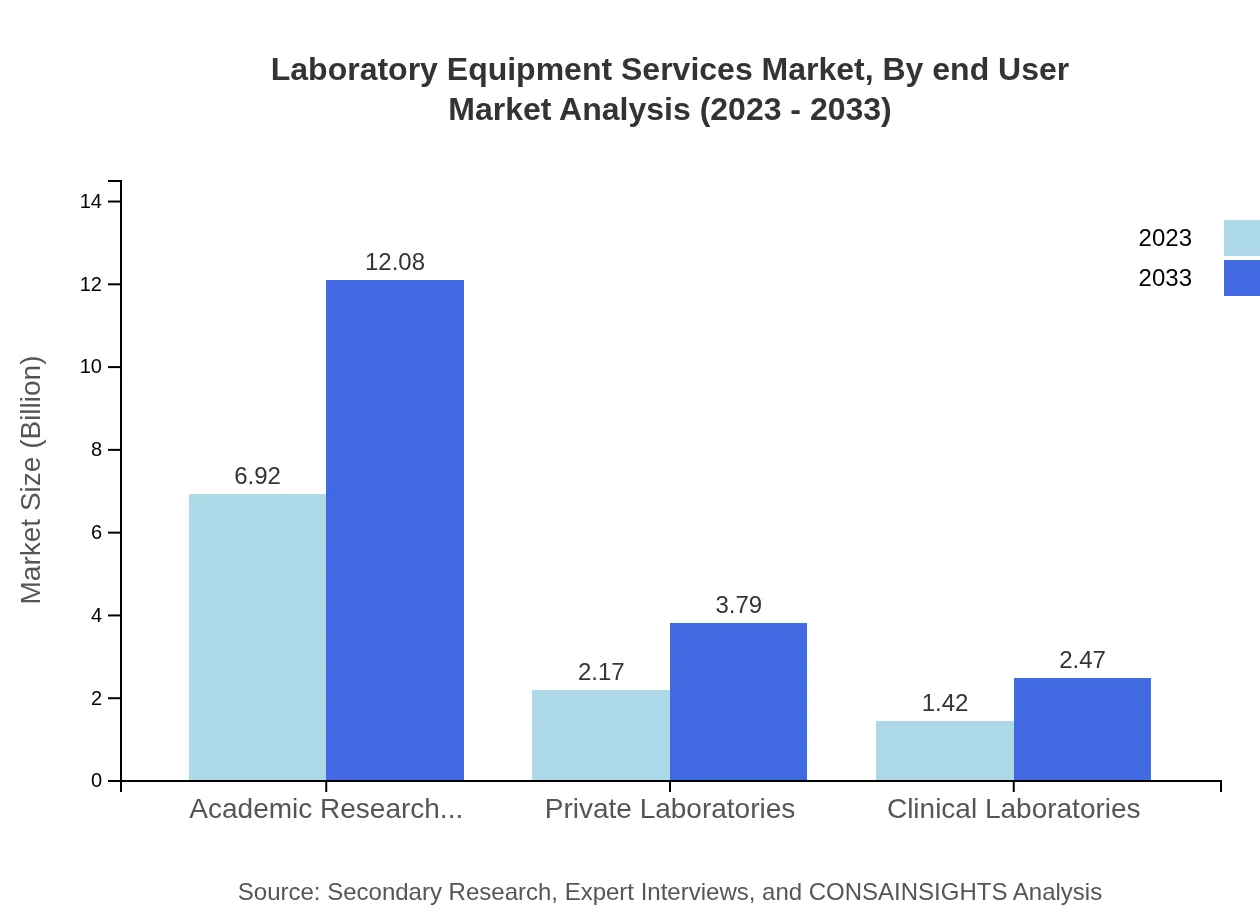

Laboratory Equipment Services Market Analysis By End User

The academic research institutes segment remains the largest end-user, with revenues soaring from USD 6.92 billion in 2023 to USD 12.08 billion in 2033. This trend is supported by rising educational investments and research initiatives globally. Private laboratories and clinical laboratories are also anticipated to see significant growth among end-users.

Laboratory Equipment Services Market Analysis By Region

Market dynamics differ by region, with North America holding a significant market share of 65.87%. Europe follows with 20.65%, while the Asia-Pacific region captures 13.48%. As global demand evolves, these regions will show unique growth patterns shaped by local industry needs and trends.

Laboratory Equipment Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Equipment Services Industry

Thermo Fisher Scientific Inc.:

A leading global provider of laboratory equipment, Thermo Fisher offers a range of services, from equipment maintenance to full lab setup, emphasizing innovation and customer support.Agilent Technologies, Inc.:

Known for its advanced laboratory instruments, Agilent provides comprehensive services aimed at enhancing laboratory operational efficiency and results accuracy.PerkinElmer, Inc.:

PerkinElmer specializes in laboratory solutions in diagnostics and life sciences, providing extensive service offerings that ensure equipment reliability and optimal performance.Horiba, Ltd.:

Horiba is renowned for its versatile analytical and measuring instruments that include robust service solutions, significantly impacting the laboratory services landscape.VWR International, LLC.:

VWR offers an extensive inventory of laboratory products coupled with personalized services, positioning itself strategically within the Laboratory Equipment Services market.We're grateful to work with incredible clients.

FAQs

What is the market size of Laboratory Equipment Services?

The global Laboratory Equipment Services market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 5.6% from 2023 to 2033, indicating strong and consistent growth in the sector.

What are the key market players or companies in the Laboratory Equipment Services industry?

Key players in the Laboratory Equipment Services industry include renowned companies like Thermo Fisher Scientific, Agilent Technologies, and Siemens Healthineers, which dominate through innovation, service quality, and extensive product portfolios.

What are the primary factors driving the growth in the Laboratory Equipment Services industry?

Growth in the Laboratory Equipment Services sector is driven by increased R&D investments, technological advancements in laboratory automation, the rising need for efficient maintenance services, and the expanding healthcare sector's demands.

Which region is the fastest Growing in the Laboratory Equipment Services industry?

The fastest-growing region in the Laboratory Equipment Services market is North America, projected to reach $6.40 billion by 2033, driven by significant investments in healthcare and rigorous research developments.

Does ConsaInsights provide customized market report data for the Laboratory Equipment Services industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, providing in-depth insights and analyses relevant to the Laboratory Equipment Services sector.

What deliverables can I expect from this Laboratory Equipment Services market research project?

From this market research project, expect detailed reports encompassing market size, growth projections, competitive analysis, regional insights, and comprehensive data on trends and segments.

What are the market trends of Laboratory Equipment Services?

Current trends in the Laboratory Equipment Services market include increased outsourcing of laboratory tasks, growth in preventive maintenance services, and the rising adoption of advanced analytical instruments and technologies.