Laboratory Filtration Market Report

Published Date: 31 January 2026 | Report Code: laboratory-filtration

Laboratory Filtration Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Laboratory Filtration market, offering insights into market size, trends, and forecasts from 2023 to 2033. It covers segmentation, regional analyses, industry insights, and highlights key market players.

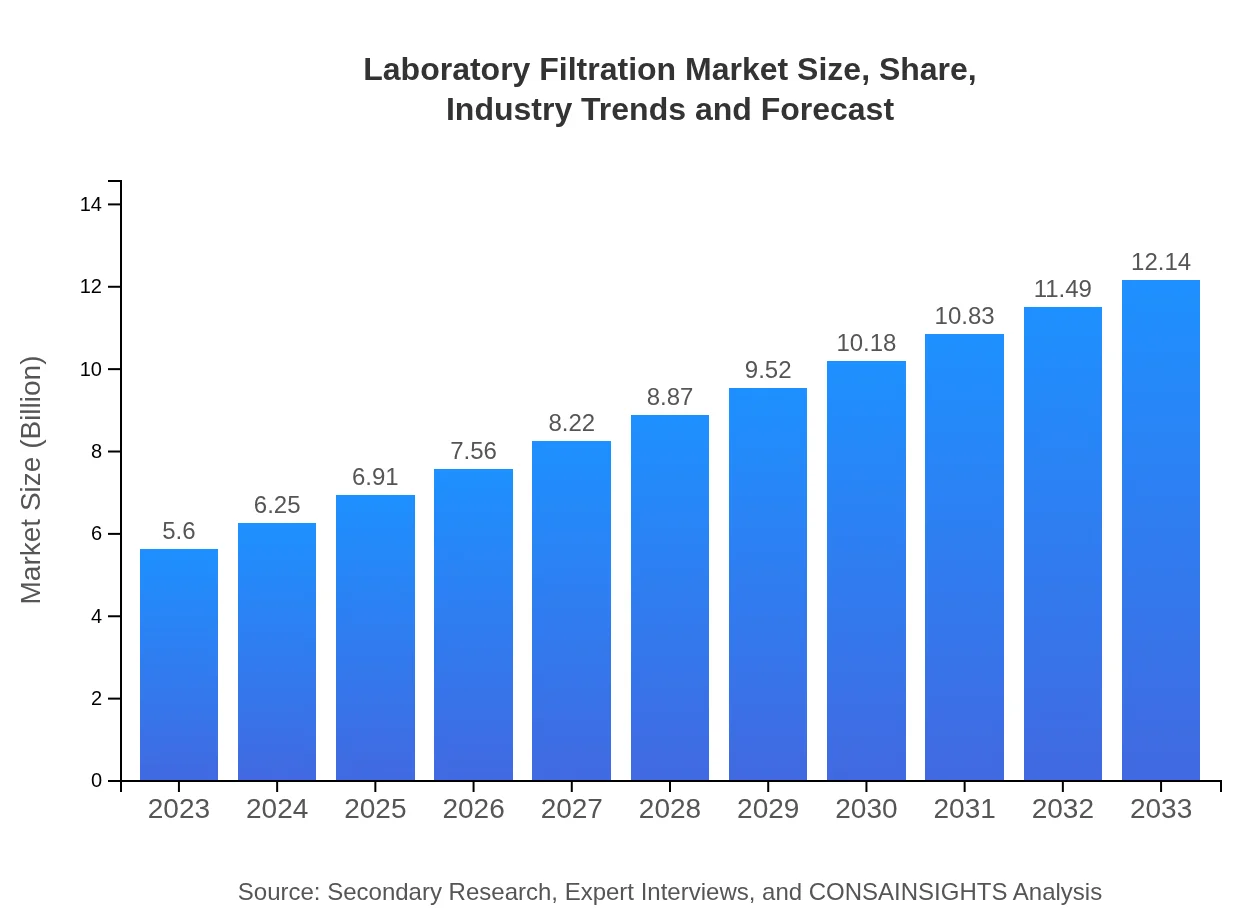

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Merck KGaA, Sartorius AG, Thermo Fisher Scientific, Pall Corporation |

| Last Modified Date | 31 January 2026 |

Laboratory Filtration Market Overview

Customize Laboratory Filtration Market Report market research report

- ✔ Get in-depth analysis of Laboratory Filtration market size, growth, and forecasts.

- ✔ Understand Laboratory Filtration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Filtration

What is the Market Size & CAGR of Laboratory Filtration market in 2023?

Laboratory Filtration Industry Analysis

Laboratory Filtration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Filtration Market Analysis Report by Region

Europe Laboratory Filtration Market Report:

Europe's Laboratory Filtration market, valued at $1.82 billion in 2023, is set to expand to $3.94 billion by 2033. The region is witnessing heightened regulatory pressures regarding pollution control in laboratories, thus increasing the adoption of effective filtration systems across various applications.Asia Pacific Laboratory Filtration Market Report:

In Asia Pacific, the Laboratory Filtration market size was $1.02 billion in 2023 and is projected to reach $2.20 billion by 2033, reflecting significant growth driven by technological advancements and increasing research activities in countries like China and India. The pharmaceutical and biotechnology sectors are major contributors to this demand, alongside rising quality standards in laboratories.North America Laboratory Filtration Market Report:

North America holds a strong position in the Laboratory Filtration market, with a size of $1.94 billion in 2023 projected to grow to $4.21 billion by 2033. The region’s advanced healthcare and pharmaceutical industries demand high-quality filtration solutions, further supported by stringent regulatory frameworks.South America Laboratory Filtration Market Report:

South America represents a smaller but growing market for Laboratory Filtration, with a size of $0.22 billion in 2023 expected to reach $0.48 billion by 2033. The growth is primarily fueled by increased investments in research and environmental testing, alongside a need for stringent quality assurance in laboratories.Middle East & Africa Laboratory Filtration Market Report:

The Middle East and Africa market for Laboratory Filtration is forecasted to grow from $0.60 billion in 2023 to $1.30 billion by 2033. This growth is linked to the rising establishment of laboratories and increased focus on environmental sustainability and food safety testing.Tell us your focus area and get a customized research report.

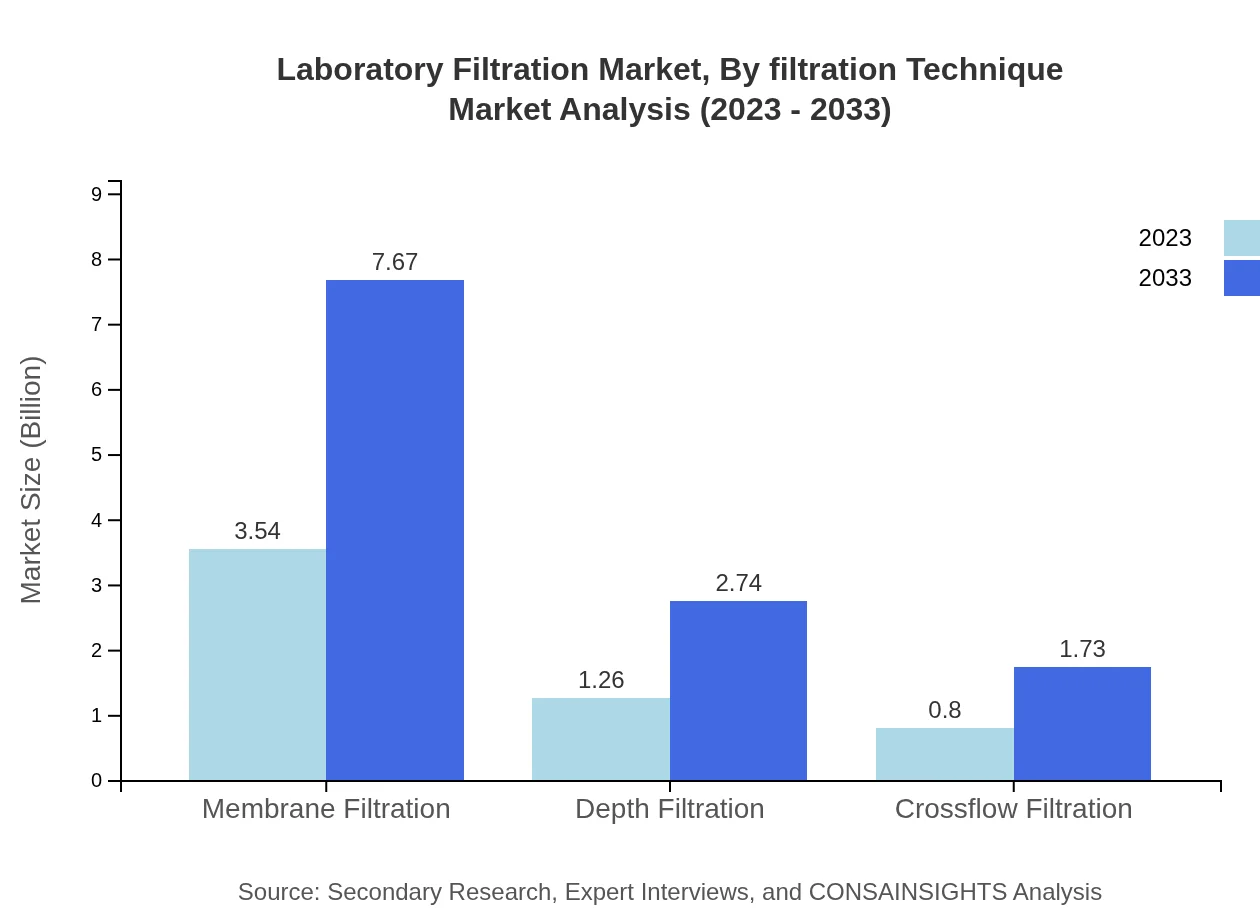

Laboratory Filtration Market Analysis By Filtration Technique

Filtration techniques dominate the market, particularly membrane filtration, which has a size of $3.54 billion in 2023 projected to reach $7.67 billion by 2033. Depth and crossflow filtration also play significant roles, catering to various applications that require specific filtration efficiencies.

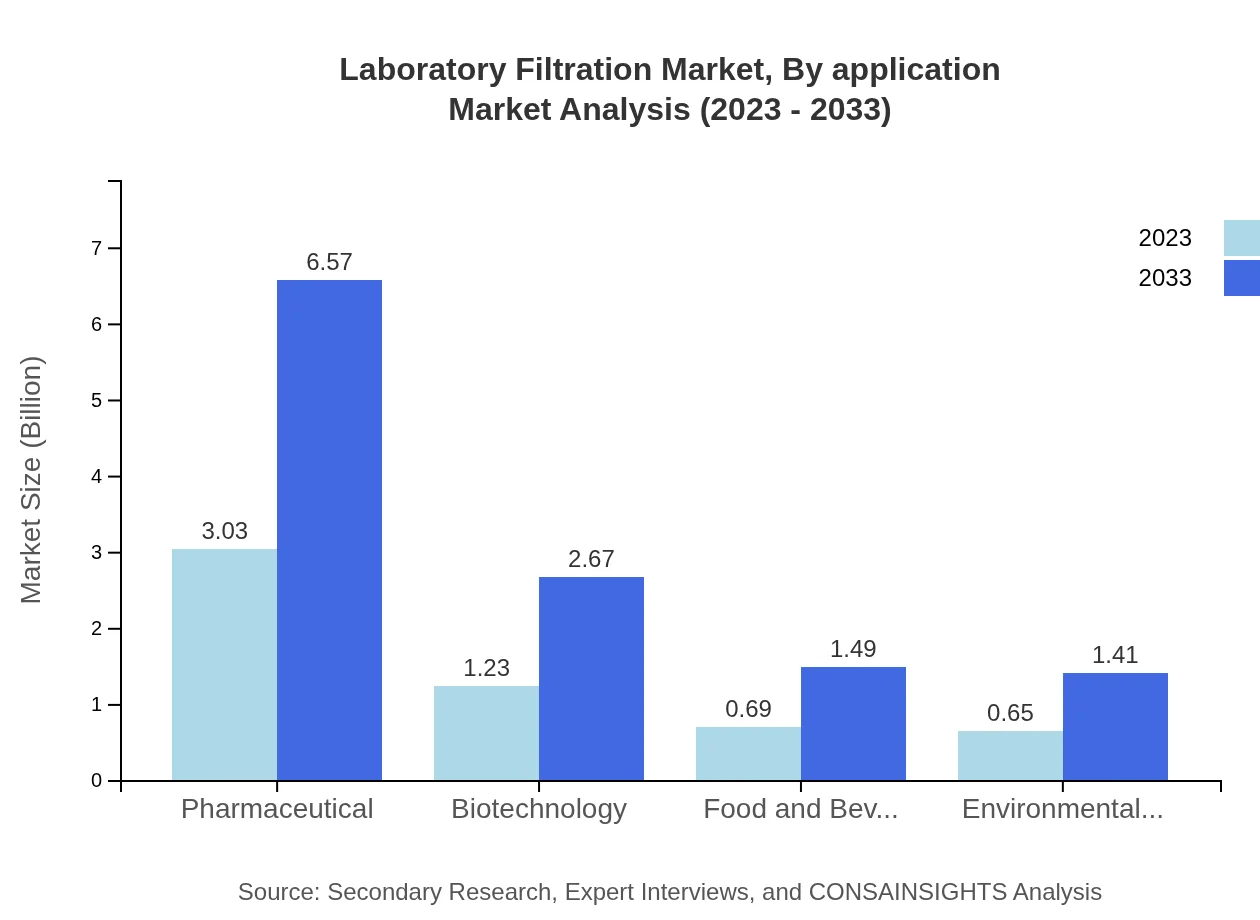

Laboratory Filtration Market Analysis By Application

The pharmaceutical sector leads the market with a size of $3.03 billion in 2023, anticipated to grow to $6.57 billion by 2033. Other important applications include biotechnology and food and beverage testing, each witnessing steady growth due to increasing safety demands.

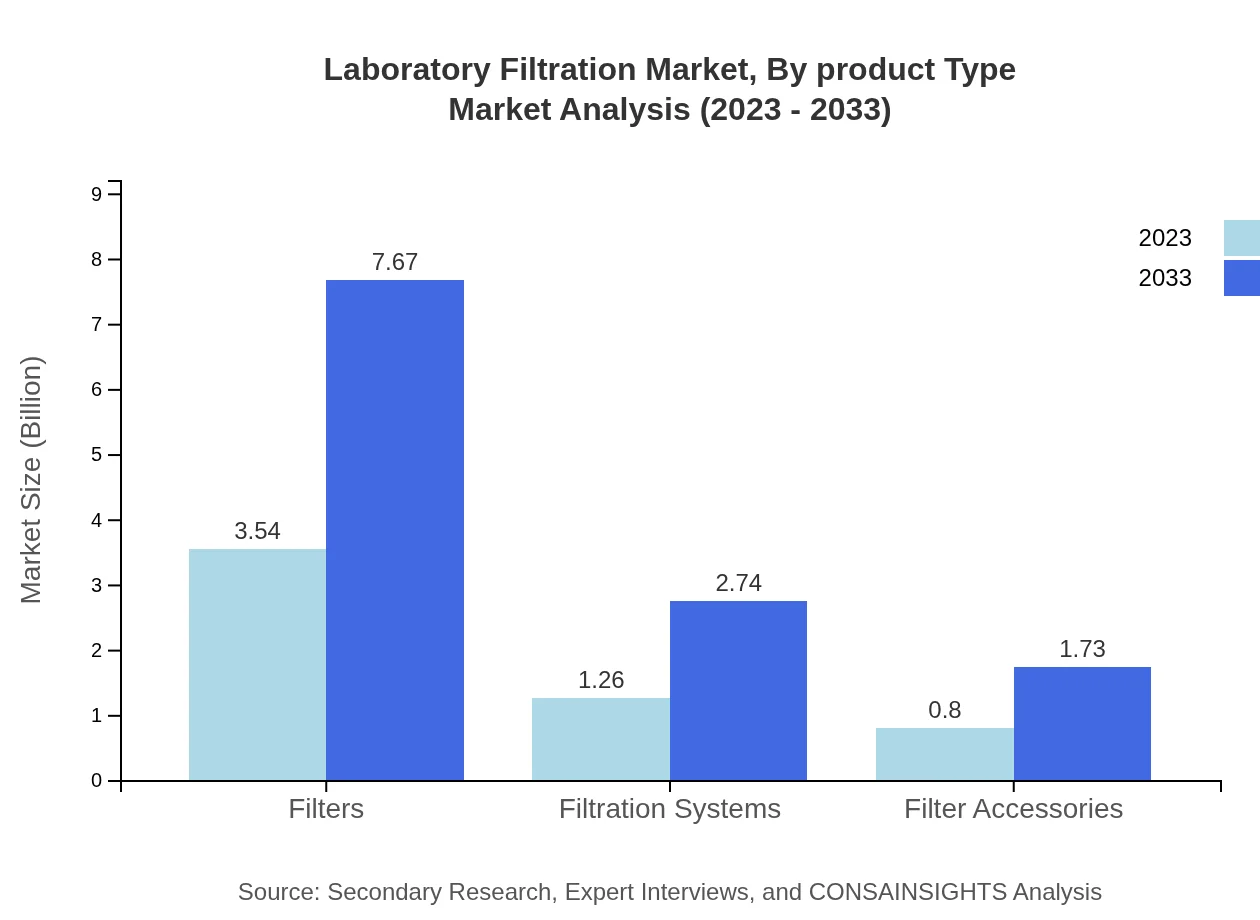

Laboratory Filtration Market Analysis By Product Type

Filters represent the largest segment with a market size of $3.54 billion in 2023, set to grow to $7.67 billion by 2033. Filtration systems and accessories are also essential segments, reflecting the robust demand for integrated solutions that enhance laboratory functions.

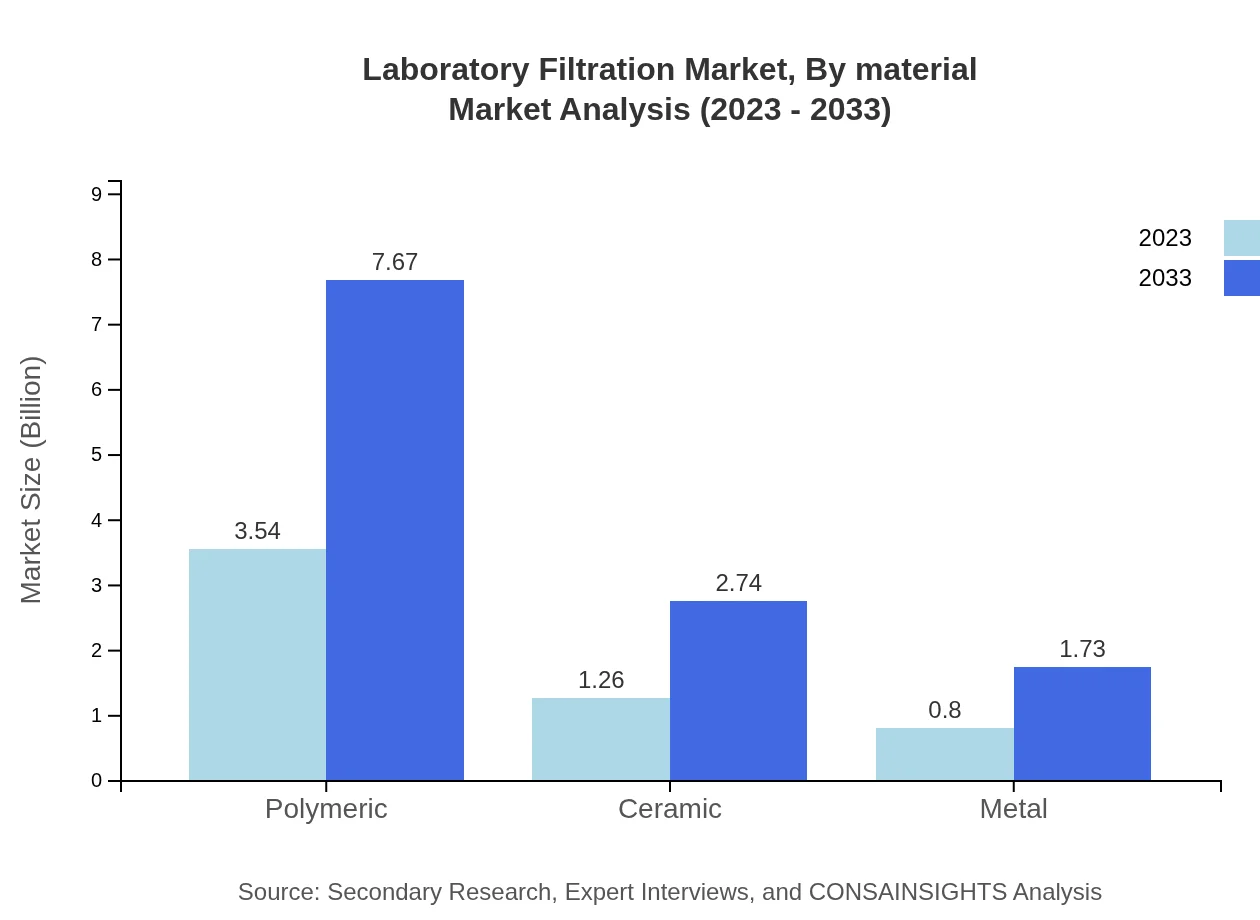

Laboratory Filtration Market Analysis By Material

Polymeric materials currently dominate the market, accounting for a market size of $3.54 billion in 2023 with high adaptability across various applications. The market for ceramic and metal filtration components is also significant, providing enhanced options tailored to specific laboratory needs.

Laboratory Filtration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Filtration Industry

Merck KGaA:

A global leader in laboratory filtration solutions, Merck KGaA offers a wide range of filters and filtration systems tailored to various scientific applications.Sartorius AG:

Recognized for its innovative filtration solutions, Sartorius AG focuses on laboratory processes and biopharmaceutical applications, significantly influencing the market.Thermo Fisher Scientific:

A major player in the life sciences sector, Thermo Fisher Scientific provides comprehensive filtration products and services to support laboratory activities.Pall Corporation:

Pall Corporation specializes in advanced filtration, separation, and purification solutions, catering to various industries including healthcare and environmental testing.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Filtration?

The laboratory filtration market is currently valued at approximately $5.6 billion, with a projected CAGR of 7.8% from 2023 to 2033, indicating robust growth in demand for filtration solutions.

What are the key market players or companies in this laboratory filtration industry?

Key players in the laboratory filtration market include Merck KGaA, Pall Corporation, Sartorius AG, Thermo Fisher Scientific, and 3M. These companies lead in product innovation and market presence.

What are the primary factors driving the growth in the laboratory filtration industry?

Growth in the laboratory filtration industry is driven by increasing laboratory automation, rising demand for pharmaceutical and biotechnology applications, and advancements in filtration technologies that enhance efficiency and safety.

Which region is the fastest Growing in the laboratory filtration?

The fastest-growing region in the laboratory filtration market is North America, with a market size projected to grow from $1.94 billion in 2023 to $4.21 billion by 2033, indicating a significant rise in laboratory operations.

Does ConsaInsights provide customized market report data for the laboratory filtration industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the laboratory filtration industry, allowing businesses to access precise data and insights essential for strategic decision-making.

What deliverables can I expect from this laboratory filtration market research project?

Deliverables from this project include comprehensive market analysis, detailed segment data, competitive landscape assessments, regional insights, and future market forecasts essential for strategic planning.

What are the market trends of laboratory filtration?

Current trends in the laboratory filtration market include increased adoption of membrane filtration technologies, a shift towards sustainable and eco-friendly products, and rising investments in R&D in the pharmaceutical sector.