Laboratory Glassware And Plasticware Market Report

Published Date: 31 January 2026 | Report Code: laboratory-glassware-and-plasticware

Laboratory Glassware And Plasticware Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Laboratory Glassware and Plasticware market, covering market size, growth forecasts from 2023 to 2033, regional analyses, trends, and competitive landscape.

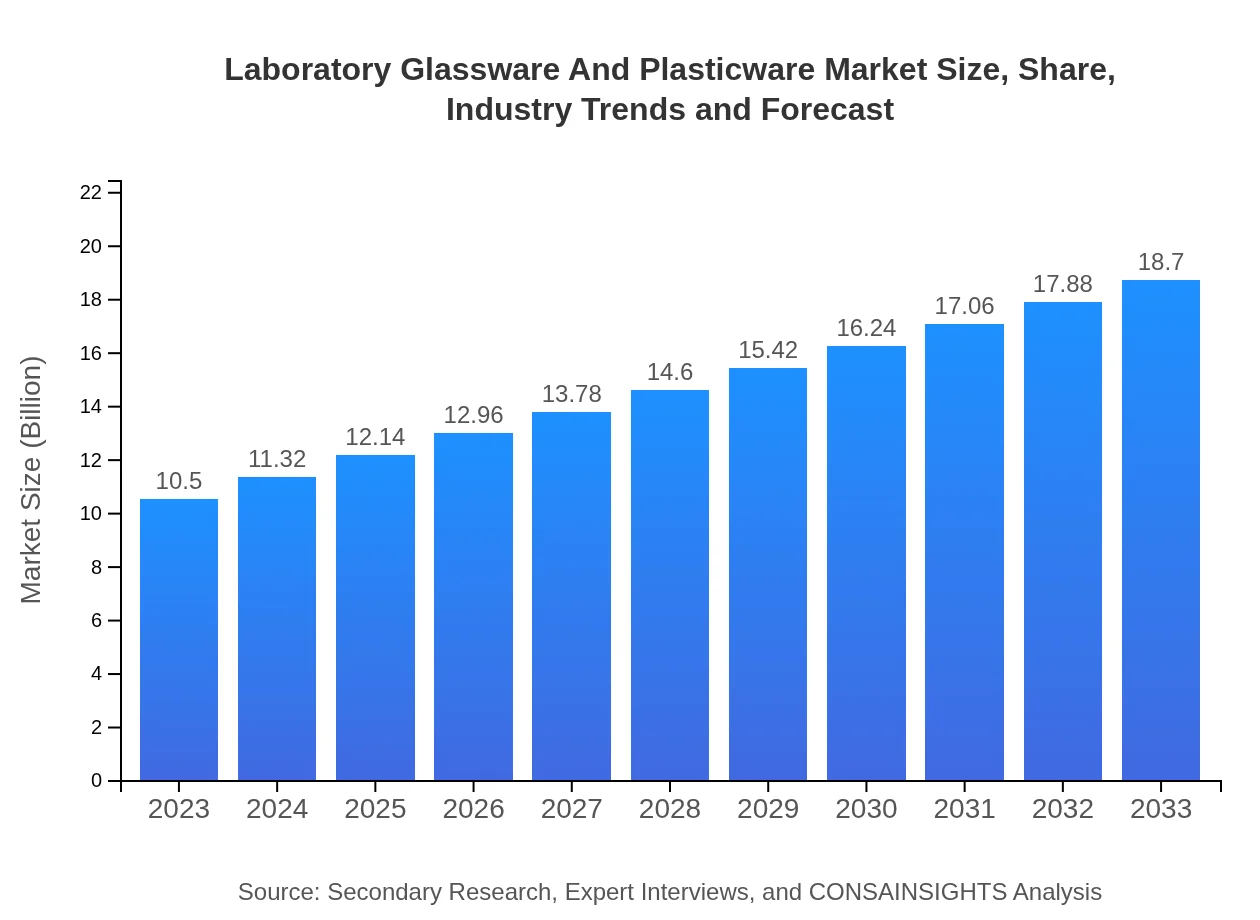

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Corning Inc., Thermo Fisher Scientific, VWR International |

| Last Modified Date | 31 January 2026 |

Laboratory Glassware And Plasticware Market Overview

Customize Laboratory Glassware And Plasticware Market Report market research report

- ✔ Get in-depth analysis of Laboratory Glassware And Plasticware market size, growth, and forecasts.

- ✔ Understand Laboratory Glassware And Plasticware's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Glassware And Plasticware

What is the Market Size & CAGR of Laboratory Glassware And Plasticware market in 2033?

Laboratory Glassware And Plasticware Industry Analysis

Laboratory Glassware And Plasticware Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Glassware And Plasticware Market Analysis Report by Region

Europe Laboratory Glassware And Plasticware Market Report:

In Europe, the market is expected to rise from $2.82 billion in 2023 to $5.02 billion in 2033. The demand for innovative laboratory technologies and growing concerns regarding safety and sustainability in laboratory environments are key growth drivers.Asia Pacific Laboratory Glassware And Plasticware Market Report:

The Asia Pacific region is expected to witness substantial growth, increasing from $2.18 billion in 2023 to $3.88 billion in 2033. The rise in investment in research and development, coupled with an expanding pharmaceutical sector, fuels the demand for laboratory glassware and plasticware in this region.North America Laboratory Glassware And Plasticware Market Report:

North America leads the market with anticipated growth from $3.88 billion in 2023 to $6.92 billion in 2033. The region is characterized by significant pharmaceutical and biotechnology activities, contributing to high demand for laboratory supplies.South America Laboratory Glassware And Plasticware Market Report:

In South America, the market is projected to grow from $0.69 billion in 2023 to $1.23 billion by 2033. The growth is driven by increasing academic research activities and expanding healthcare facilities in emerging economies.Middle East & Africa Laboratory Glassware And Plasticware Market Report:

The Middle East and Africa region is expected to grow from $0.93 billion in 2023 to $1.65 billion in 2033, with increasing investment in healthcare infrastructure and laboratory development in GCC countries.Tell us your focus area and get a customized research report.

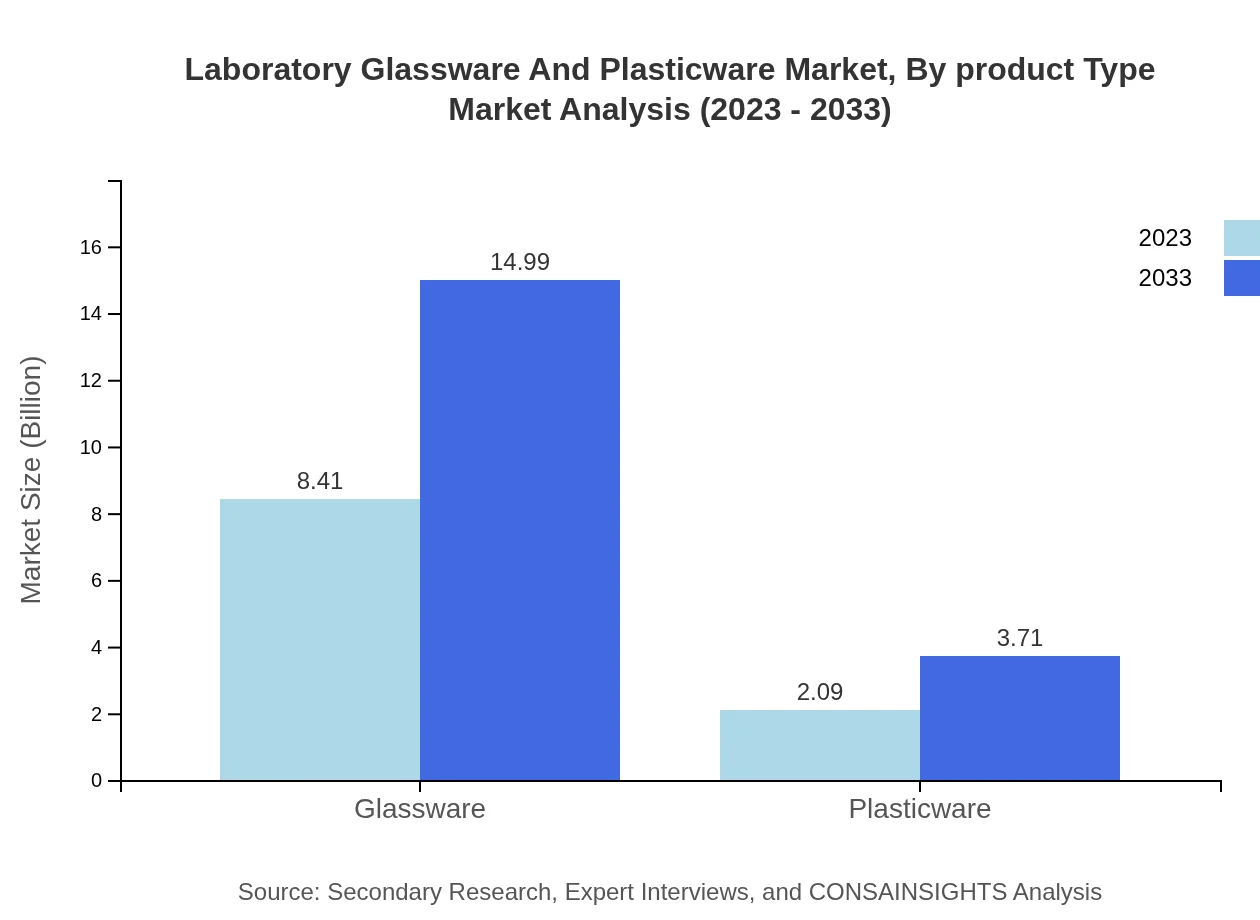

Laboratory Glassware And Plasticware Market Analysis By Product Type

The demand for laboratory glassware continues to dominate the market, driven predominantly by Borosilicate Glass, which is projected to grow from $8.41 billion in 2023 to $14.99 billion by 2033. This growth reflects around 80% market share in product type as Borosilicate Glass is favored for its resistance to thermal shock and chemical reactivity.

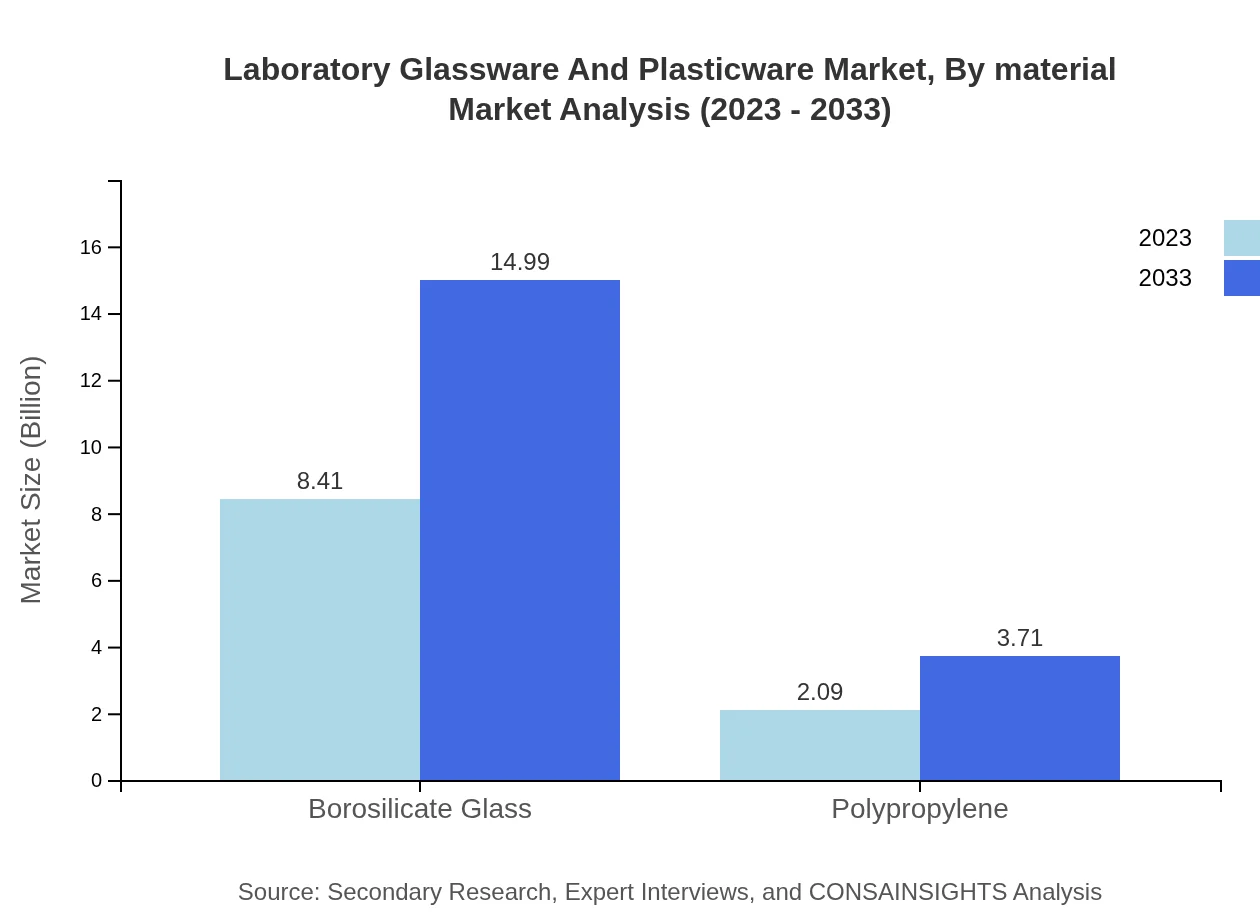

Laboratory Glassware And Plasticware Market Analysis By Material

Materials used in laboratory products include Borosilicate Glass and Polypropylene. Borosilicate Glass holds a dominant position with a market size forecast of $14.99 billion in 2033, while Polypropylene distribution is increasing but holds a modest market size of $3.71 billion.

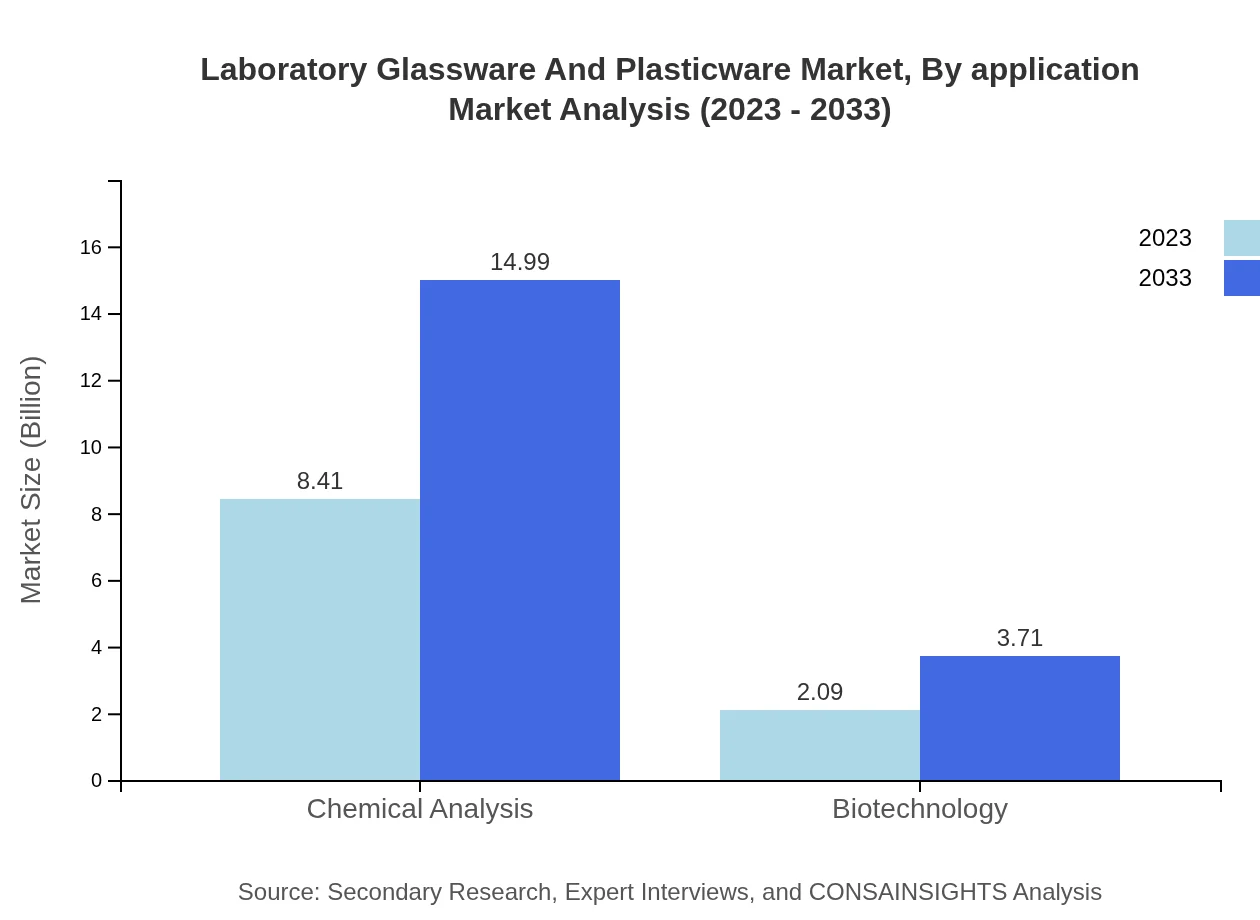

Laboratory Glassware And Plasticware Market Analysis By Application

The segments by application highlight significant revenue from Chemical Analysis and Biotechnology applications, with both expected to command market sizes of $14.99 billion by 2033. Academic and research institutions are key users, reflecting a market share of 64.25%.

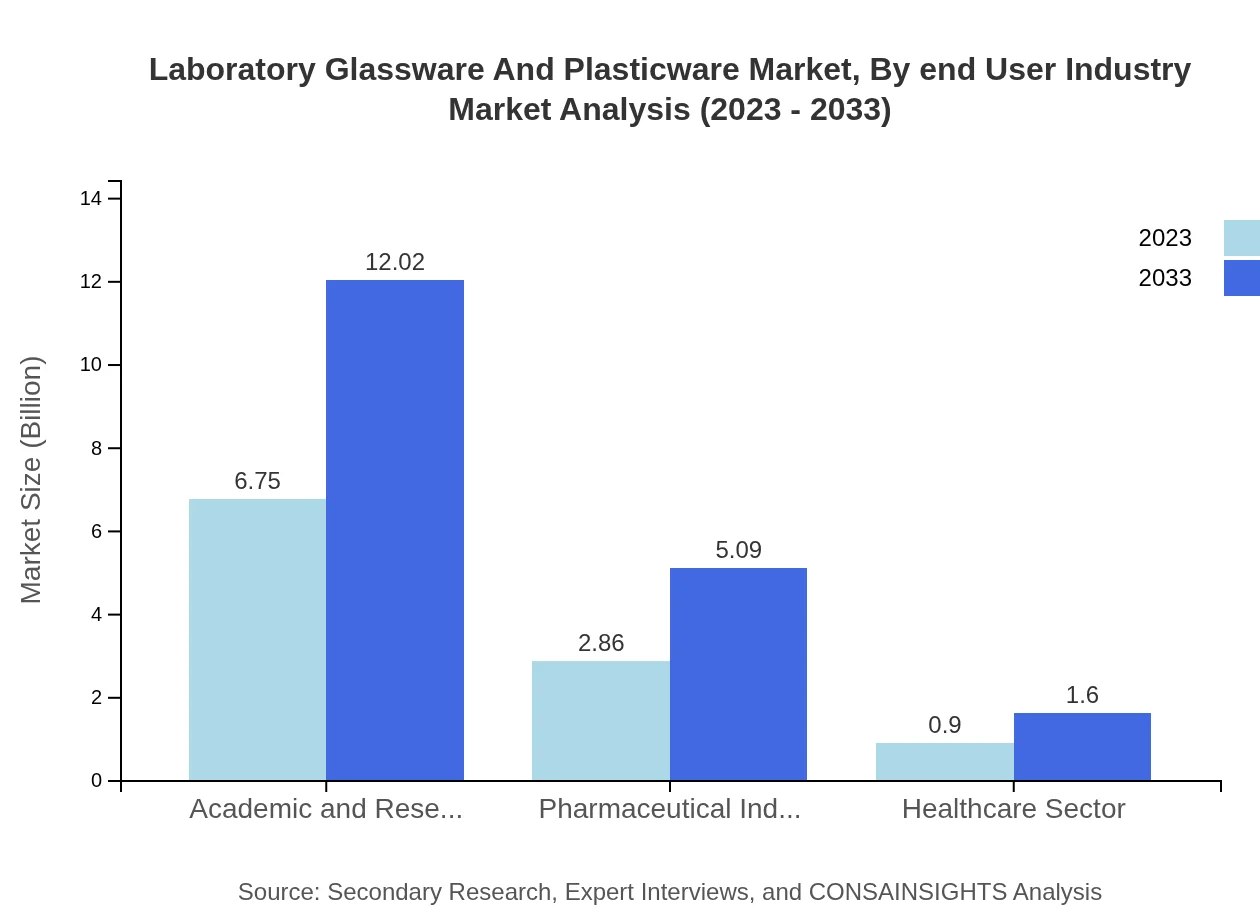

Laboratory Glassware And Plasticware Market Analysis By End User Industry

Industries utilizing laboratory glassware and plasticware primarily include Academic and Research Institutions, Pharmaceutical Industry, and Healthcare Sector. The Academic Institutions dominate with a revenue forecast from $6.75 billion in 2023 to $12.02 billion in 2033.

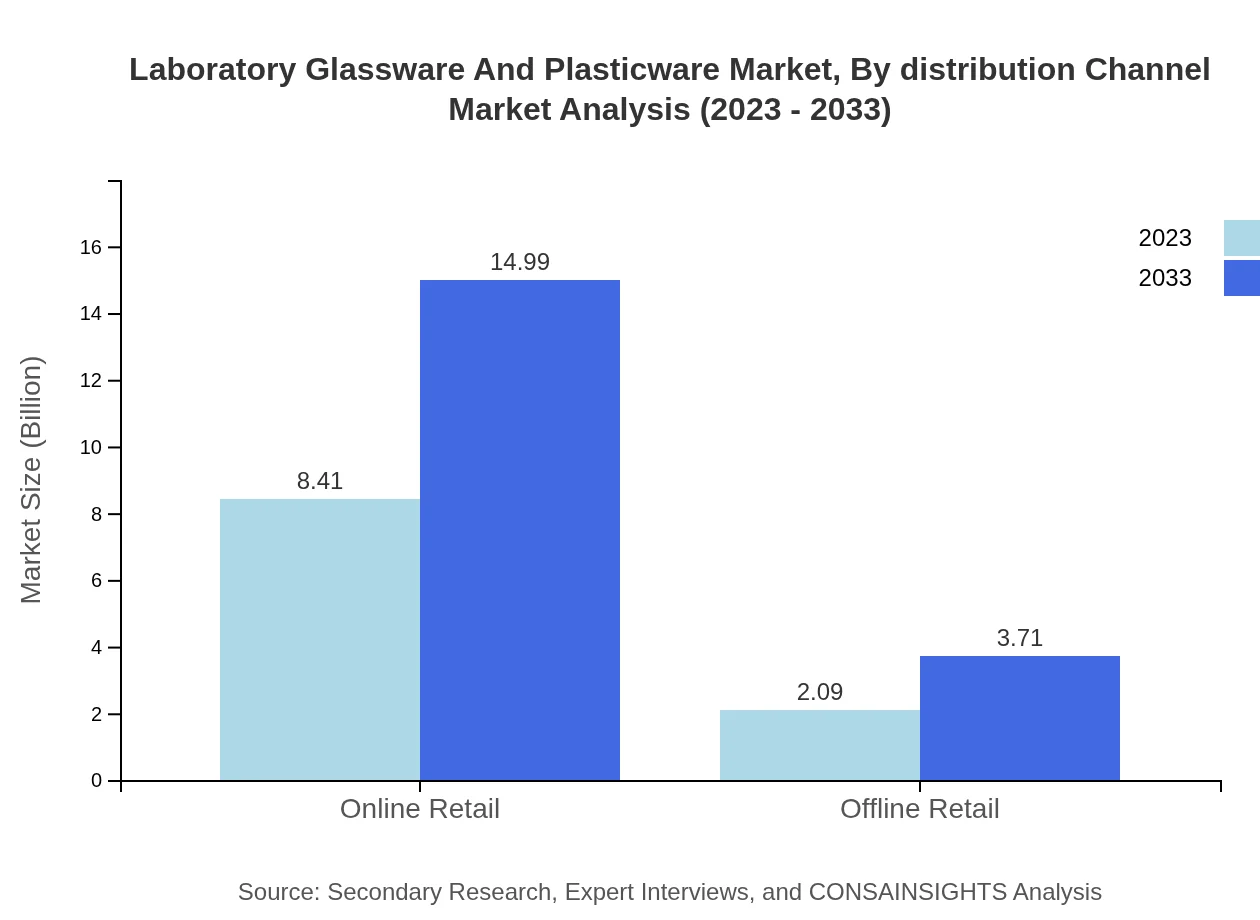

Laboratory Glassware And Plasticware Market Analysis By Distribution Channel

Distribution channels are classified into Online and Offline Retail. Online Retailing holds a significant share at 80.14%, with size projections increasing from $8.41 billion to $14.99 billion, reflecting a shifting purchasing behavior towards convenience.

Laboratory Glassware And Plasticware Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Glassware And Plasticware Industry

Corning Inc.:

A leading manufacturer of laboratory glassware and consumables, Corning is known for its innovation in laboratory technology and extensive product range.Thermo Fisher Scientific:

A global leader in serving science, Thermo Fisher provides a wide array of laboratory equipment including glassware, reagents, and laboratory instruments.VWR International:

VWR supplies a vast range of laboratory products including laboratory glassware, chemicals and assuring the quality and innovation in scientific research.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Glassware And Plasticware?

The laboratory glassware and plasticware market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8% reaching significant growth by 2033.

What are the key market players or companies in this laboratory Glassware And Plasticware industry?

Key players in the laboratory glassware and plasticware industry include prominent manufacturers and suppliers who lead innovation and quality in serving sectors such as healthcare, pharmaceuticals, and various research domains.

What are the primary factors driving the growth in the laboratory Glassware And Plasticware industry?

Growth drivers include increased investments in laboratory infrastructure, rising demand for analytical services, and advancements in laboratory technologies, further fueled by the pharmaceutical and biotechnology sectors.

Which region is the fastest Growing in the laboratory Glassware And Plasticware market?

The fastest-growing region for laboratory glassware and plasticware is Europe, with the market projected to grow from $2.82 billion in 2023 to $5.02 billion by 2033, indicating a robust demand in this market.

Does ConsaInsights provide customized market report data for the laboratory Glassware And Plasticware industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and insights within the laboratory glassware and plasticware industry, ensuring comprehensive decision-support.

What deliverables can I expect from this laboratory Glassware And Plasticware market research project?

Deliverables from the market research project typically include in-depth reports, trend analyses, regional insights, competitive landscapes, and projections across various segments of the laboratory glassware and plasticware market.

What are the market trends of laboratory Glassware And Plasticware?

Trends include an increasing adoption of eco-friendly materials, advancements in glassware technology, growing online retail channels, and rising customization demands in laboratory setups.