Laboratory Informatics Market Report

Published Date: 31 January 2026 | Report Code: laboratory-informatics

Laboratory Informatics Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the Laboratory Informatics market, covering market size, regional insights, product segments, and future forecasts for 2023 to 2033.

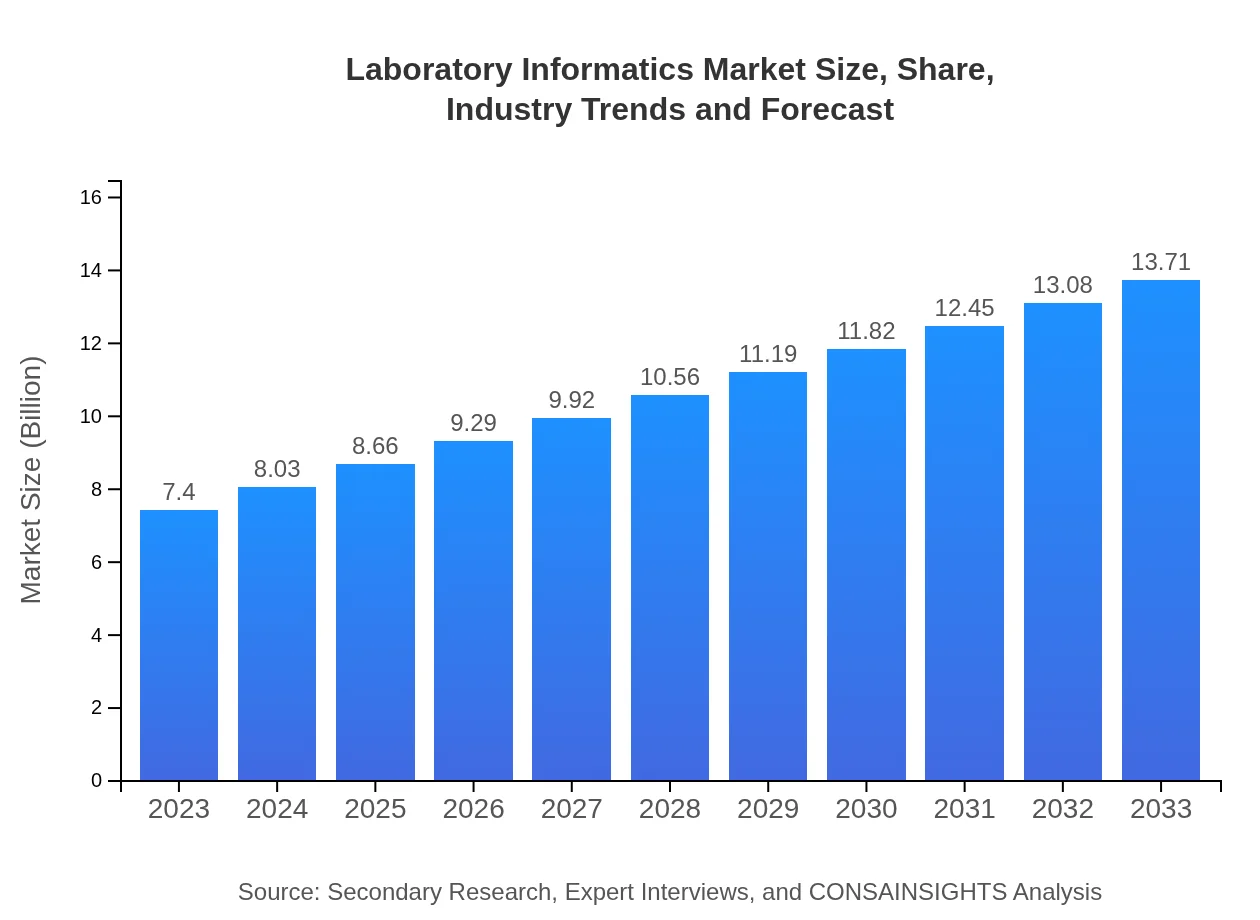

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $13.71 Billion |

| Top Companies | LabWare, Thermo Fisher Scientific, PerkinElmer, LabVantage Solutions, Agilent Technologies |

| Last Modified Date | 31 January 2026 |

Laboratory Informatics Market Overview

Customize Laboratory Informatics Market Report market research report

- ✔ Get in-depth analysis of Laboratory Informatics market size, growth, and forecasts.

- ✔ Understand Laboratory Informatics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Informatics

What is the Market Size & CAGR of Laboratory Informatics market in 2023?

Laboratory Informatics Industry Analysis

Laboratory Informatics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Informatics Market Analysis Report by Region

Europe Laboratory Informatics Market Report:

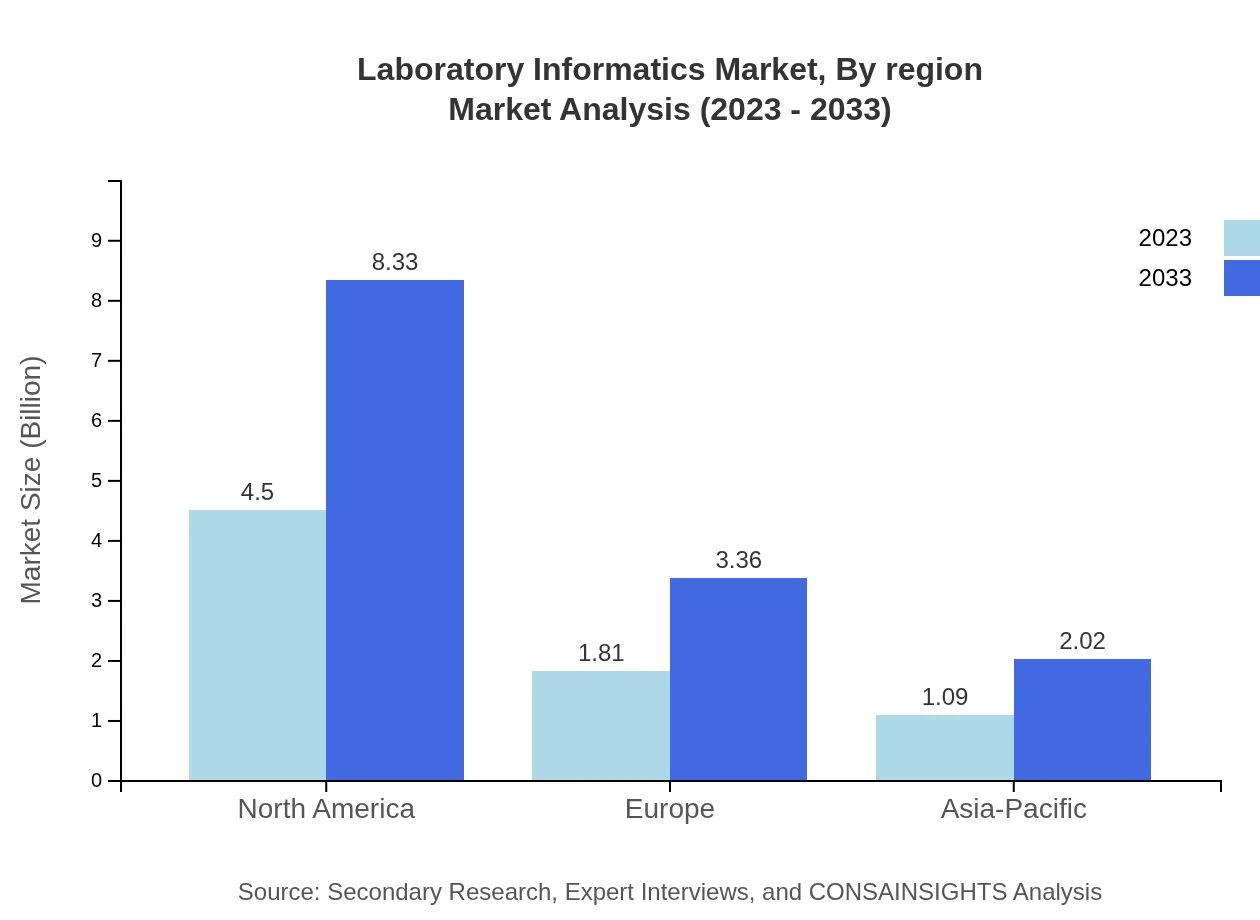

The European Laboratory Informatics market is anticipated to expand from $2.03 billion in 2023 to $3.76 billion by 2033. The rise in stringent regulatory requirements and the growing need for data management systems are primary growth factors. Countries such as Germany and the UK are adopting advanced informatics solutions to meet rising laboratory demands.Asia Pacific Laboratory Informatics Market Report:

The Laboratory Informatics market in the Asia Pacific region is projected to grow from $1.52 billion in 2023 to $2.81 billion by 2033. This growth is fueled by increasing investments in laboratory automation and an uptick in research activities in countries like China and India. The rising need for advanced data management tools in clinical and pharmaceutical labs is shifting the focus towards laboratory informatics solutions.North America Laboratory Informatics Market Report:

North America holds one of the largest shares of the Laboratory Informatics market, valued at $2.44 billion in 2023 and expected to reach $4.53 billion by 2033. The presence of major pharmaceutical companies and a well-established healthcare infrastructure drive robust growth in this region. Rapid advancements in technology and high expenditure on R&D are further elevating the demand for laboratory informatics.South America Laboratory Informatics Market Report:

In South America, the market is expected to rise from $0.65 billion in 2023 to approximately $1.21 billion by 2033. Factors contributing to this growth include increasing focus on environmental testing and improved healthcare infrastructure. Countries such as Brazil and Argentina are witnessing increased adoption of informatics systems to support their expanding laboratory sectors.Middle East & Africa Laboratory Informatics Market Report:

In the Middle East and Africa, the market is forecasted to rise from $0.75 billion in 2023 to $1.40 billion by 2033. Growth in this region is supported by improvements in laboratory infrastructure and increased healthcare spending.Tell us your focus area and get a customized research report.

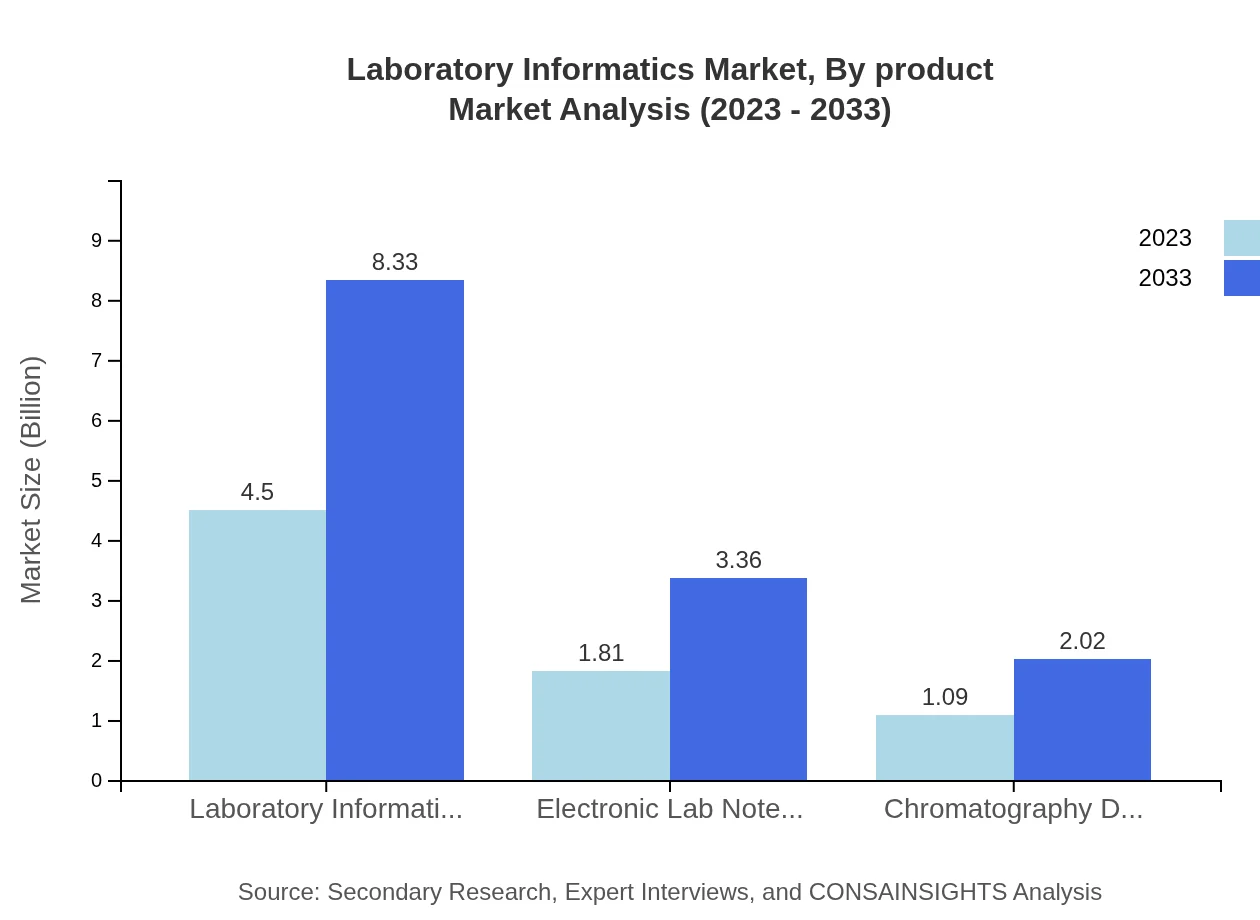

Laboratory Informatics Market Analysis By Product

In the Laboratory Informatics market, the product segment analysis shows strong performance from Laboratory Information Management Systems (LIMS), which accounted for about $4.50 billion in 2023. LIMS solutions provide comprehensive data management, enhancing operations across various laboratory environments. Electronic Lab Notebooks (ELN) follow closely, reaching $1.81 billion in the same year, showcasing significant utility in research documentation and collaboration processes.

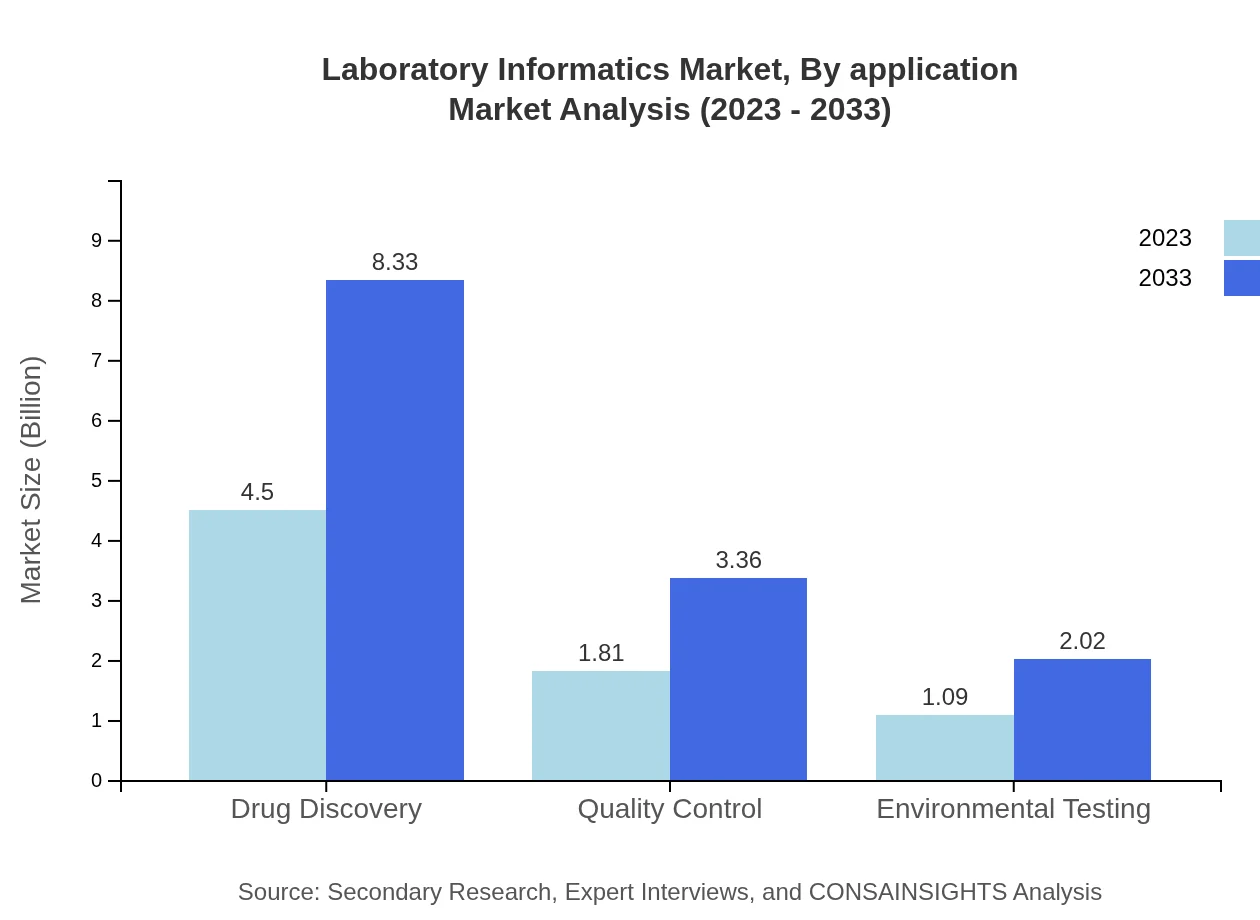

Laboratory Informatics Market Analysis By Application

From an application standpoint, the pharmaceutical industry emerges as a dominant segment, valuing at approximately $4.50 billion in 2023. The necessity for stringent quality controls and compliance fuels significant investments in informatics solutions. Other notable applications include academic and clinical laboratories, reflecting a collective value of around $2.90 billion, supporting research activities and patient testing.

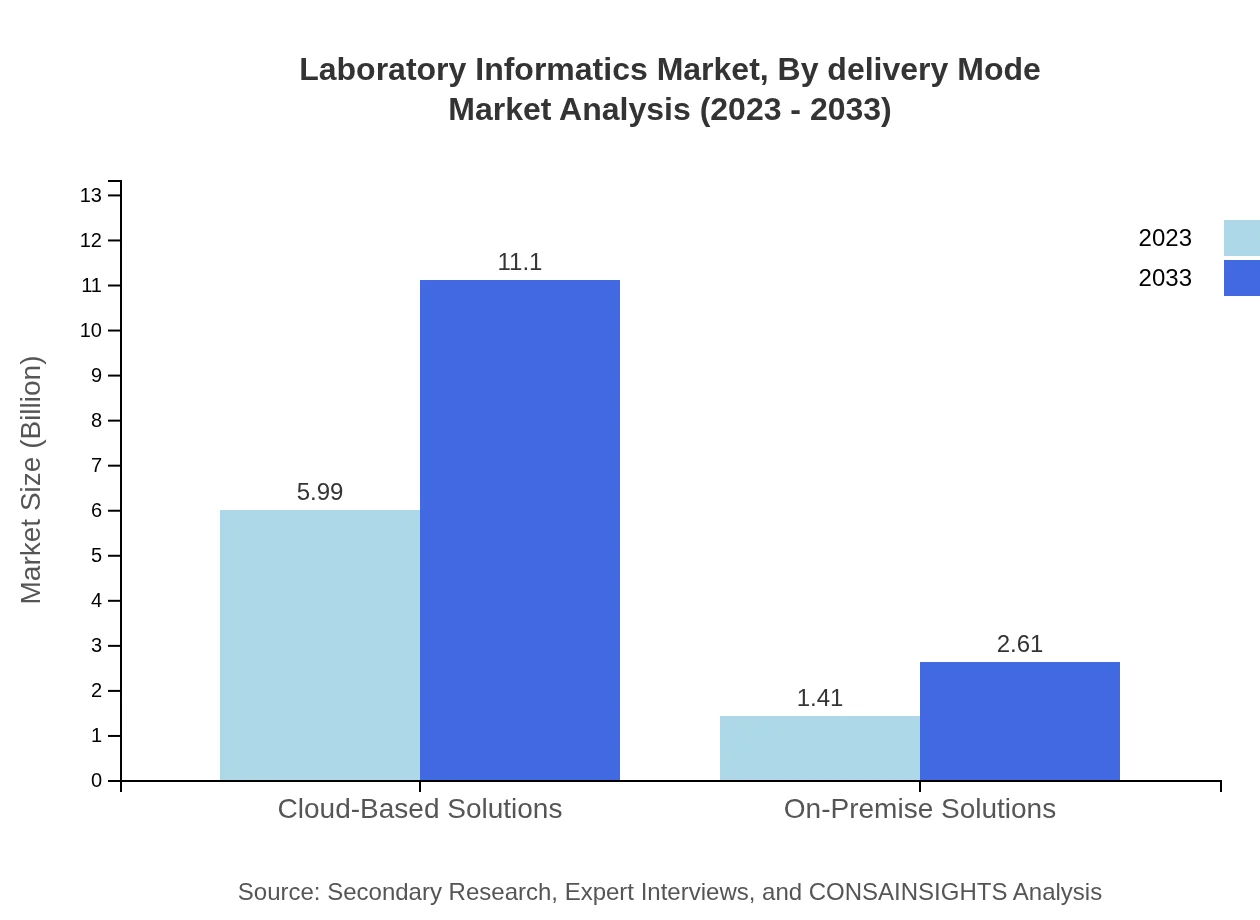

Laboratory Informatics Market Analysis By Delivery Mode

Cloud-based solutions are taking precedence in the Laboratory Informatics market, valued at $5.99 billion in 2023, ensuring flexibility and remote access to data management. On-Premise solutions, while traditionally favored, are valued at $1.41 billion, representing a shift towards cloud adoption to enhance data productivity and collaboration.

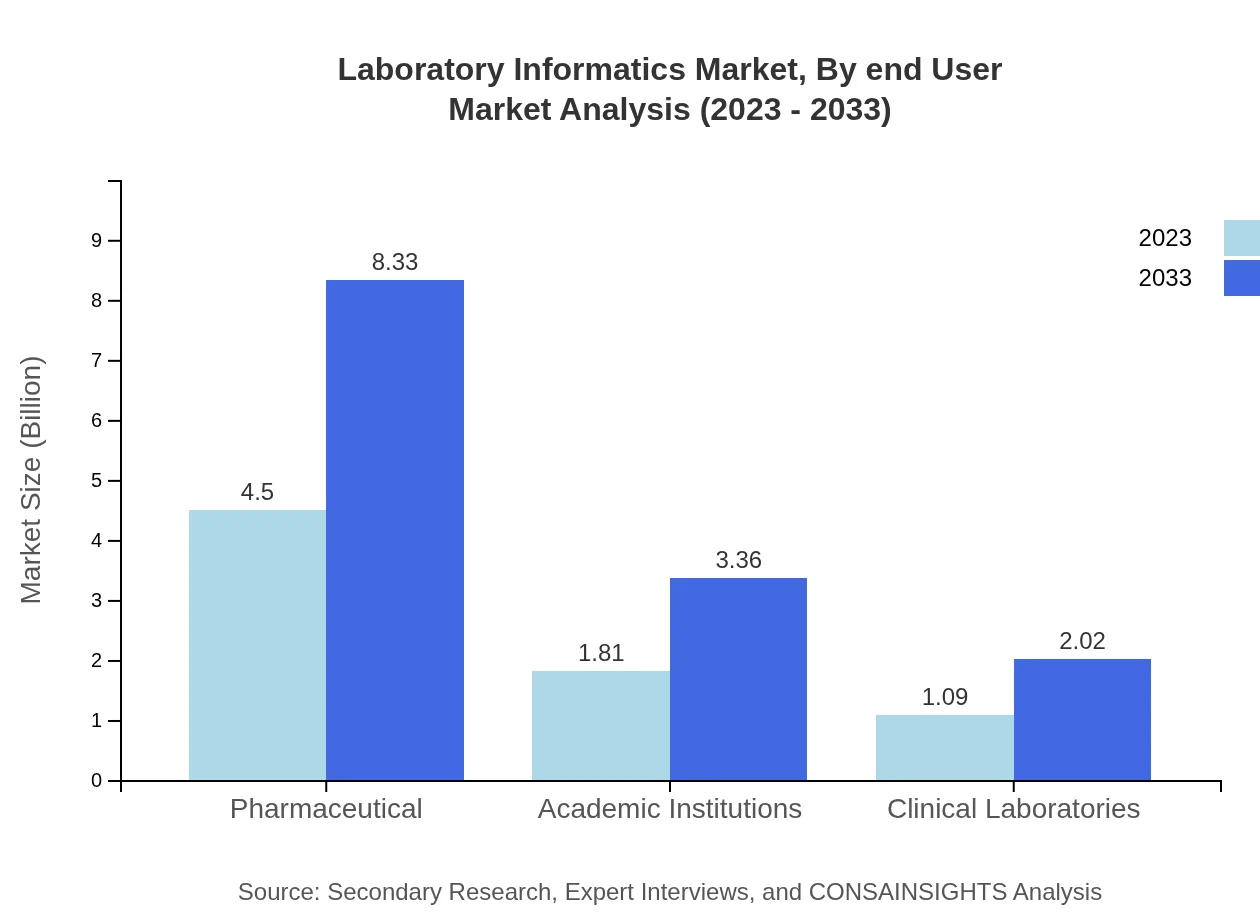

Laboratory Informatics Market Analysis By End User

Within the end-user segment, the pharmaceutical industry dominates, owing to high investment in R&D. In 2023, this segment represented $4.50 billion. Growing engagements from academic institutions and clinical laboratories also reflect pivotal roles in the overall market, with values of $1.81 billion and $1.09 billion respectively, highlighting the broad applicability of laboratory informatics.

Laboratory Informatics Market Analysis By Region

Regional insights reveal that North America possesses a sizeable market share of approximately 60.75% in 2023. Europe follows at 24.5%, driven by stringent regulations encouraging technology adoption, while Asia-Pacific contributes 14.75%. The global trend shows continuous investments in laboratory informatics, catering to a wide array of scientific applications across regions.

Laboratory Informatics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Informatics Industry

LabWare:

LabWare is a leading provider of Laboratory Information Management Systems (LIMS), recognized for its flexibility and comprehensive capabilities in laboratory data management.Thermo Fisher Scientific:

Thermo Fisher Scientific excels in providing innovative laboratory informatics solutions that enhance productivity and ensure regulatory compliance across various industries.PerkinElmer:

PerkinElmer focuses on advancing laboratory informatics strategies, delivering software solutions that enhance data management and workflows within life sciences and other industries.LabVantage Solutions:

LabVantage Solutions specializes in LIMS software, empowering laboratories with integrated informatics, streamlining operations across diverse scientific applications.Agilent Technologies:

Agilent Technologies offers comprehensive solutions that integrate laboratory informatics and life science applications, enabling efficient data analysis and regulatory compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Informatics?

The laboratory informatics market size is projected to reach approximately $7.4 billion by 2033, growing at a CAGR of 6.2% from its current valuation. This growth indicates an increasing reliance on sophisticated lab management technologies.

What are the key market players or companies in this laboratory Informatics industry?

Key players in the laboratory informatics market include Veeva Systems, LabWare, Thermo Fisher Scientific, PerkinElmer, and Abbott Laboratories. These companies dominate due to their innovative solutions and strong market presence.

What are the primary factors driving the growth in the laboratory Informatics industry?

Growth drivers in the laboratory informatics sector include the increasing demand for automation, the rise in biotech and pharmaceutical research activities, and the need for regulatory compliance, enhancing the overall efficiency of laboratory operations.

Which region is the fastest Growing in the laboratory Informatics?

North America shows the fastest growth in the laboratory informatics market, projected to expand from $2.44 billion in 2023 to $4.53 billion by 2033. Its technological advancements and heavy investment in R&D contribute significantly to this growth.

Does ConsaInsights provide customized market report data for the laboratory Informatics industry?

Yes, ConsaInsights offers customized market report data tailored to the laboratory informatics industry. Clients can choose specific segments, regions, and timeframes to gain insights that meet their unique business needs.

What deliverables can I expect from this laboratory Informatics market research project?

Deliverables from the laboratory informatics market research include detailed reports covering market size, growth forecasts, competitive analysis, trend identification, and segmented data across different geographical areas and sub-markets.

What are the market trends of laboratory Informatics?

Current trends in the laboratory informatics market involve a shift towards cloud-based solutions, increasing adoption of AI and machine learning, and growing emphasis on data integrity and security in laboratory environments.