Laboratory Information Management System Lims Market Report

Published Date: 31 January 2026 | Report Code: laboratory-information-management-system-lims

Laboratory Information Management System Lims Market Size, Share, Industry Trends and Forecast to 2033

This report provides extensive insights into the Laboratory Information Management System (LIMS) market, covering market size, growth forecasts, industry dynamics from 2023 to 2033, and competitive landscape analysis.

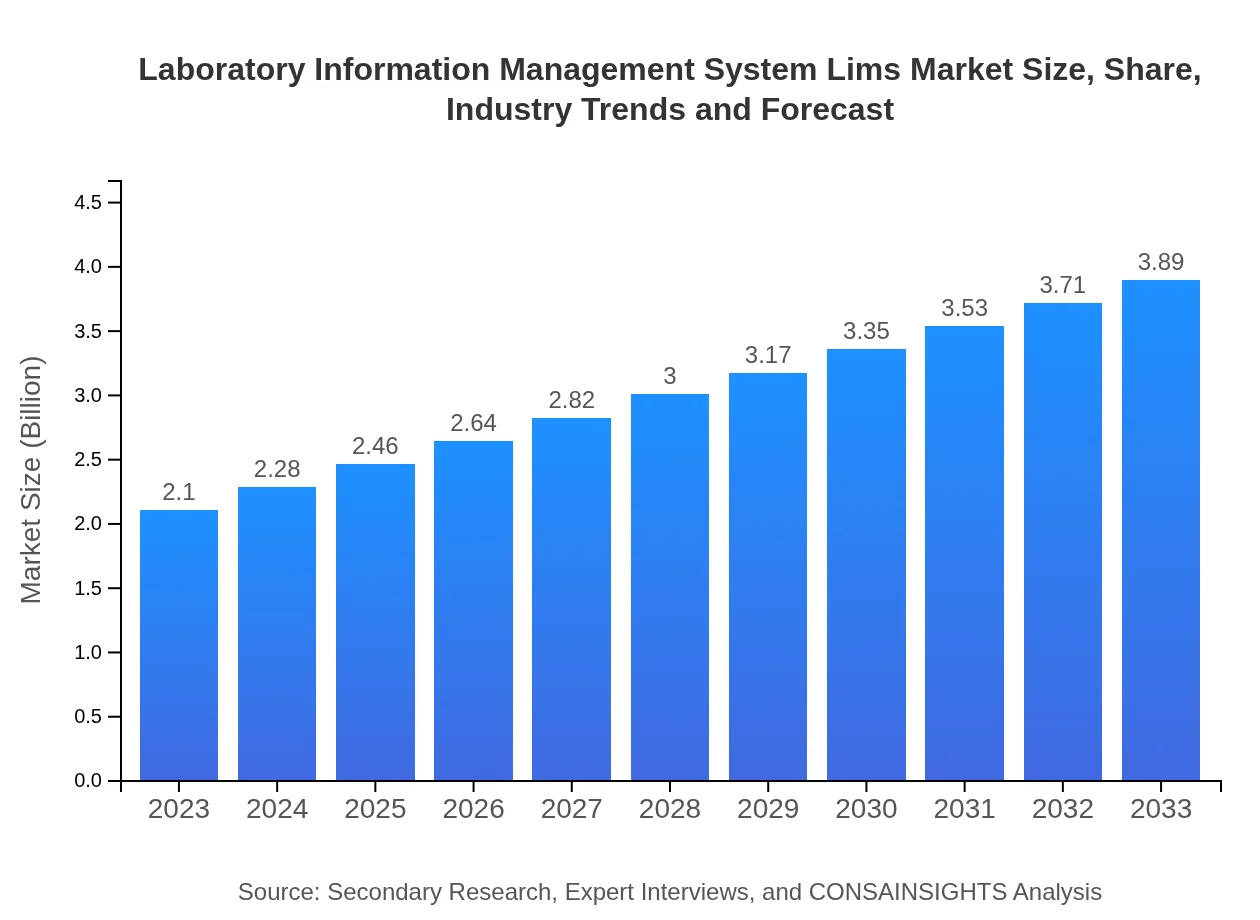

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.89 Billion |

| Top Companies | Thermo Fisher Scientific, LabWare, STARLIMS, PerkinElmer, Abbott Informatics |

| Last Modified Date | 31 January 2026 |

Laboratory Information Management System Lims Market Overview

Customize Laboratory Information Management System Lims Market Report market research report

- ✔ Get in-depth analysis of Laboratory Information Management System Lims market size, growth, and forecasts.

- ✔ Understand Laboratory Information Management System Lims's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Information Management System Lims

What is the Market Size & CAGR of Laboratory Information Management System Lims market in 2033?

Laboratory Information Management System Lims Industry Analysis

Laboratory Information Management System Lims Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Information Management System Lims Market Analysis Report by Region

Europe Laboratory Information Management System Lims Market Report:

The European market for LIMS is forecast to rise from $0.71 billion in 2023 to $1.32 billion by 2033. The growth is attributed to the presence of a strong pharmaceutical sector, advancements in life sciences research, and increasing adoption of automated laboratory solutions.Asia Pacific Laboratory Information Management System Lims Market Report:

In the Asia Pacific region, the LIMS market is projected to grow from $0.39 billion in 2023 to $0.73 billion by 2033. The rise is fueled by increased investments in healthcare infrastructure and the growing demand for advanced laboratory solutions to ensure quality and compliance. Countries like China and India are emerging as significant players in the laboratory technology sector.North America Laboratory Information Management System Lims Market Report:

North America remains the largest market, projected to grow from $0.69 billion in 2023 to $1.28 billion by 2033. This is driven by a robust healthcare ecosystem, significant R&D investments, and stringent regulatory requirements demanding advanced LIMS solutions.South America Laboratory Information Management System Lims Market Report:

The South American LIMS market is expected to expand from $0.19 billion in 2023 to $0.34 billion by 2033. The growth is primarily linked to increasing governmental support for healthcare labs and rising awareness regarding laboratory automation and efficiencies.Middle East & Africa Laboratory Information Management System Lims Market Report:

The Middle East and Africa market is projected to grow from $0.12 billion in 2023 to $0.22 billion by 2033, driven by improvements in healthcare delivery systems and the integration of advanced technologies in laboratory settings.Tell us your focus area and get a customized research report.

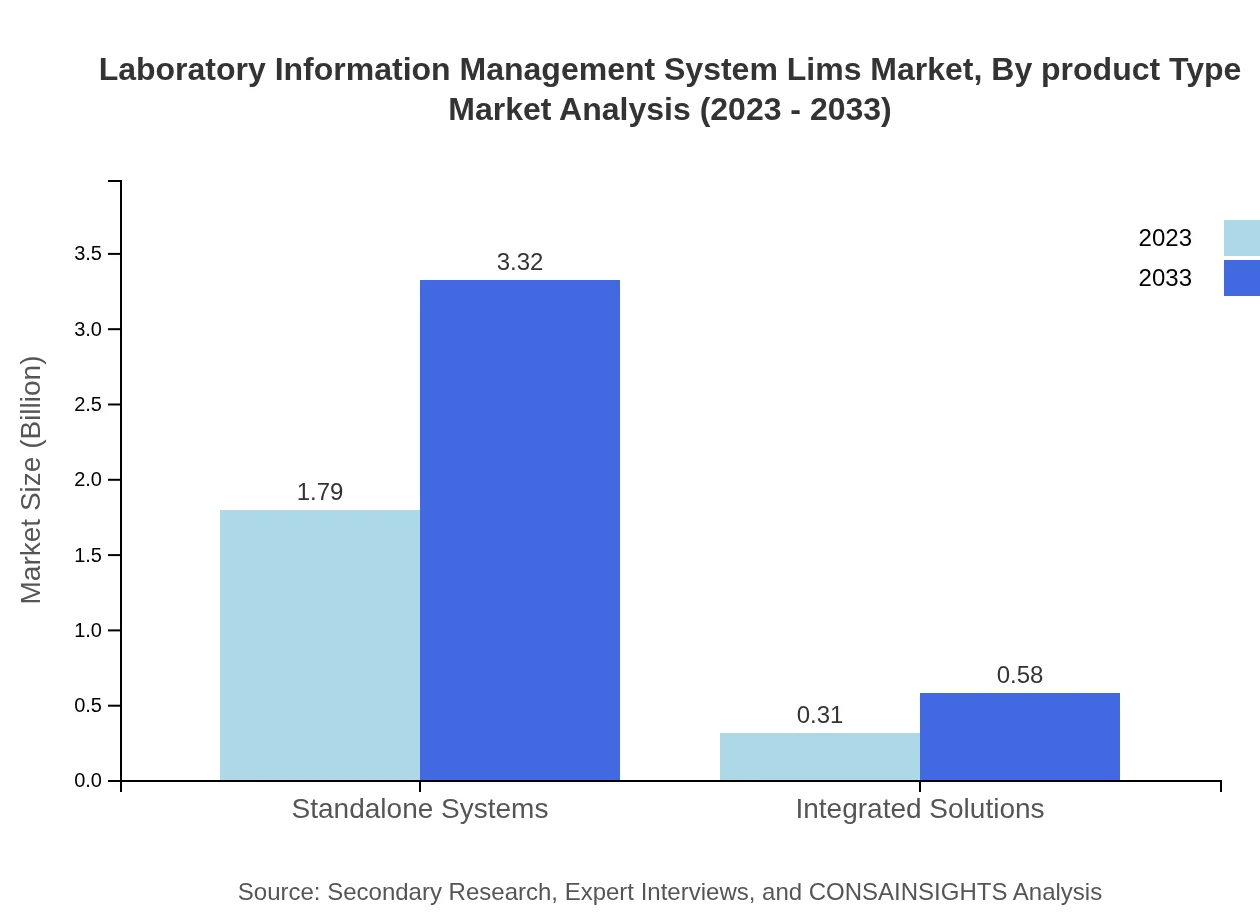

Laboratory Information Management System Lims Market Analysis By Product Type

In the product type segmentation, standalone systems hold a substantial market share with a size of $1.79 billion in 2023 expected to rise to $3.32 billion by 2033. Integrated solutions, growing in demand, are projected to increase from $0.31 billion to $0.58 billion during the same period.

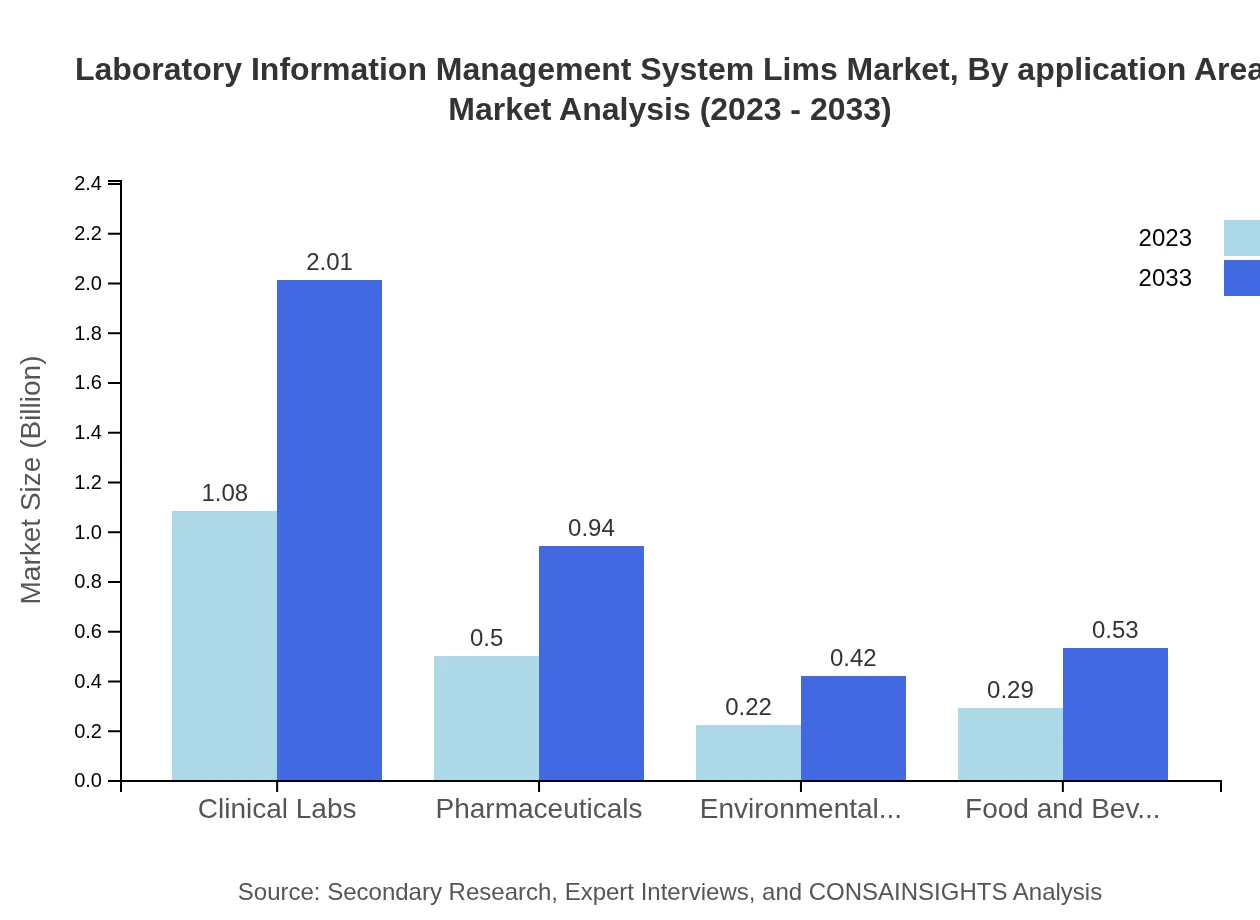

Laboratory Information Management System Lims Market Analysis By Application Area

Clinical labs are a leading application area for LIMS, ascending from $1.08 billion in 2023 to $2.01 billion by 2033, claiming a significant share of around 51.61%. Pharmaceuticals and healthcare follow suit, showcasing steady growth due to ongoing research and regulatory demands.

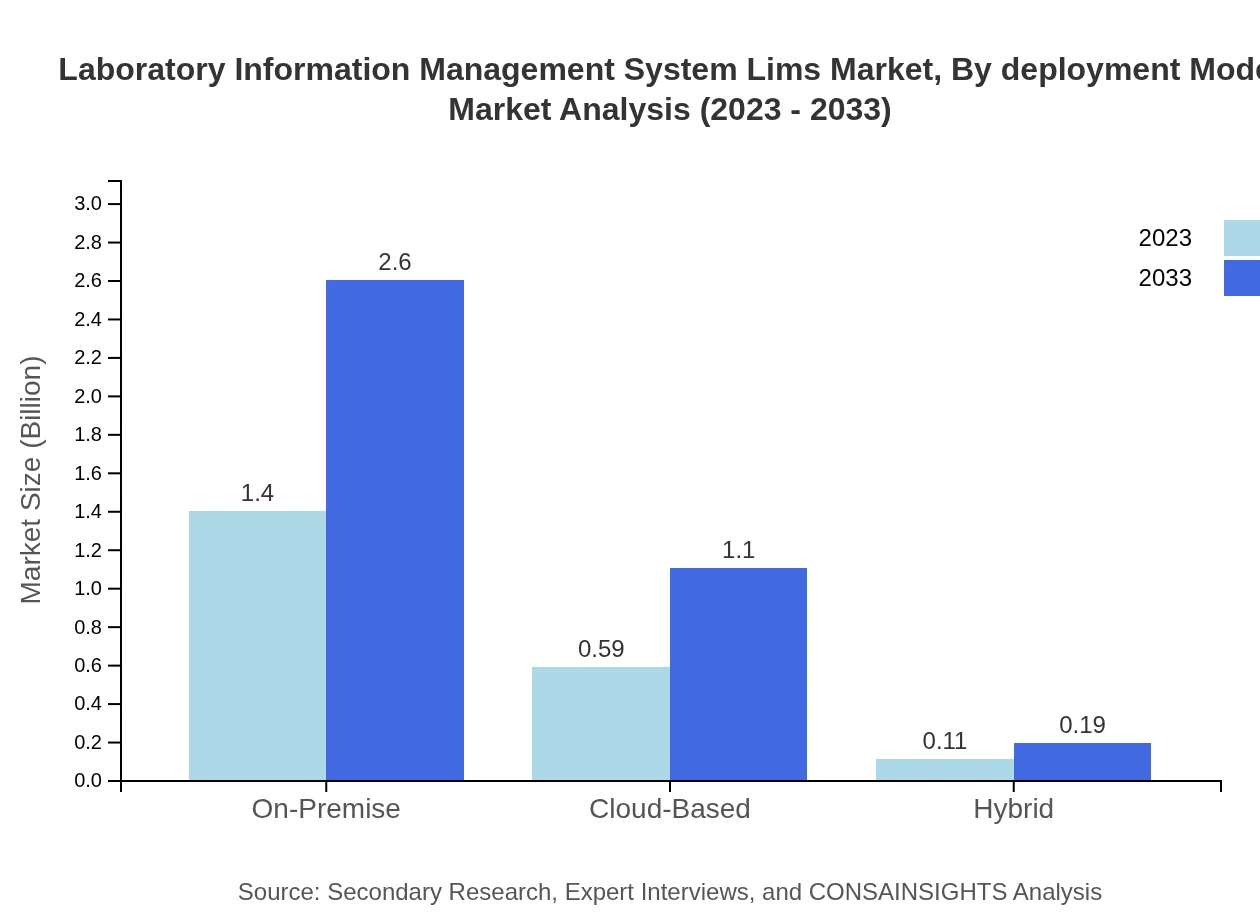

Laboratory Information Management System Lims Market Analysis By Deployment Model

By deployment model, on-premise LIMS solutions are expected to expand from $1.40 billion to $2.60 billion by 2033, maintaining a significant share of 66.83%. Cloud-based solutions will rise from $0.59 billion to $1.10 billion, reflecting the growing trend towards flexible and scalable laboratory information management.

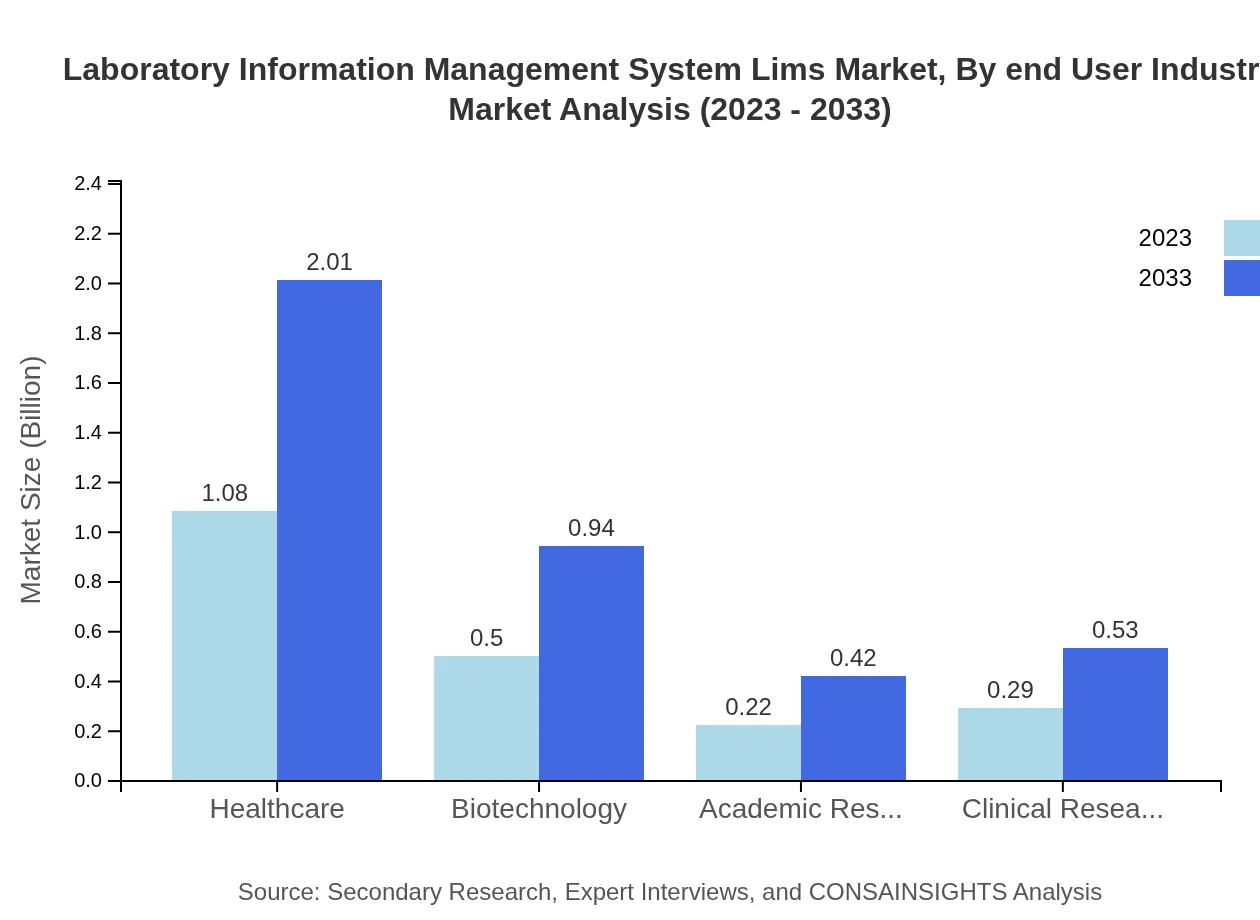

Laboratory Information Management System Lims Market Analysis By End User Industry

Key end-user industries include healthcare and biotechnology, with healthcare holding a dominant market share of 51.61% in 2023, projected to follow upward trends. The biotechnology segment is also expected to grow significantly due to innovation and demand for research data integrity.

Laboratory Information Management System Lims Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Information Management System Lims Industry

Thermo Fisher Scientific:

Thermo Fisher Scientific is a leader in the life sciences sector, providing a comprehensive range of LIMS solutions that enhance laboratory productivity and compliance.LabWare:

LabWare is renowned for its flexible and scalable LIMS products, catering to both small and large laboratory environments, ensuring operational efficiency.STARLIMS:

STARLIMS, a subsidiary of Abbott, offers innovative LIMS solutions that integrate laboratory workflows and data management, supporting various industries such as healthcare and pharmaceuticals.PerkinElmer:

PerkinElmer provides advanced LIMS solutions focusing on quality control and data integrity for laboratories, significantly enhancing efficiency.Abbott Informatics:

Abbott Informatics specializes in LIMS software that supports rigorous laboratory standards, streamlining processes and regulatory compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Information Management System Lims?

The Laboratory Information Management System (LIMS) market is projected to reach $2.1 billion in 2023, with a CAGR of 6.2%. By 2033, it is expected to significantly grow, amplifying its relevance in laboratory settings.

What are the key market players or companies in this laboratory Information Management System Lims industry?

Key players in the LIMS market include LabWare, Thermo Fisher Scientific, and STARLIMS. These companies dominate with innovative solutions that enhance laboratory management efficiency and data accuracy.

What are the primary factors driving the growth in the laboratory Information Management System Lims industry?

Growth drivers for the LIMS market include increasing automation in laboratories, stringent regulatory requirements for data management, and the rising demand for advanced analytics and data integrity in laboratory settings.

Which region is the fastest Growing in the laboratory Information Management System Lims?

The Asia Pacific region shows promising growth in the LIMS market, projected to reach $0.73 billion by 2033, reflecting an increasing investment in laboratory infrastructure and technological advancements in healthcare.

Does ConsaInsights provide customized market report data for the laboratory Information Management System Lims industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the LIMS industry, allowing organizations to focus on particular segments or geographic regions for a more detailed analysis.

What deliverables can I expect from this laboratory Information Management System Lims market research project?

Expect comprehensive reports including market size, growth forecasts, competitive analysis, regional insights, and segment data for the LIMS market, ensuring a holistic understanding of industry dynamics.

What are the market trends of laboratory Information Management System Lims?

Current trends in the LIMS market include the rise of cloud-based solutions, growing demand for integrated systems, and increased adoption in diverse sectors like healthcare and environmental testing.