Laboratory Information System Lis Market Report

Published Date: 31 January 2026 | Report Code: laboratory-information-system-lis

Laboratory Information System Lis Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Laboratory Information System (LIS) market, providing insights on market size, growth trends, regional analyses, and the future outlook for 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

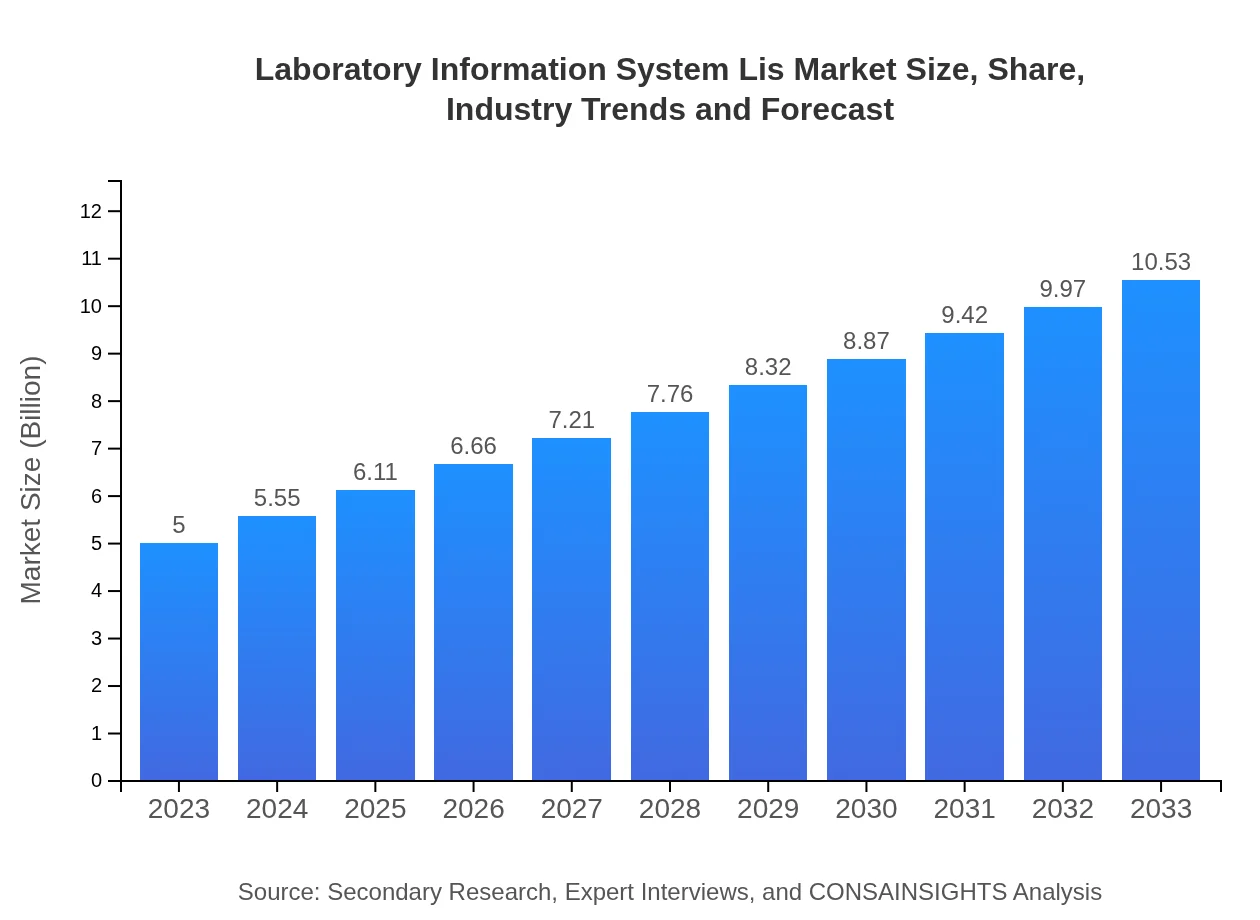

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Cerner Corporation, Medidata Solutions, Abbott Laboratories, Siemens Healthineers, Roper Technologies |

| Last Modified Date | 31 January 2026 |

Laboratory Information System Lis Market Overview

Customize Laboratory Information System Lis Market Report market research report

- ✔ Get in-depth analysis of Laboratory Information System Lis market size, growth, and forecasts.

- ✔ Understand Laboratory Information System Lis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Information System Lis

What is the Market Size & CAGR of Laboratory Information System Lis market in 2023?

Laboratory Information System Lis Industry Analysis

Laboratory Information System Lis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Information System Lis Market Analysis Report by Region

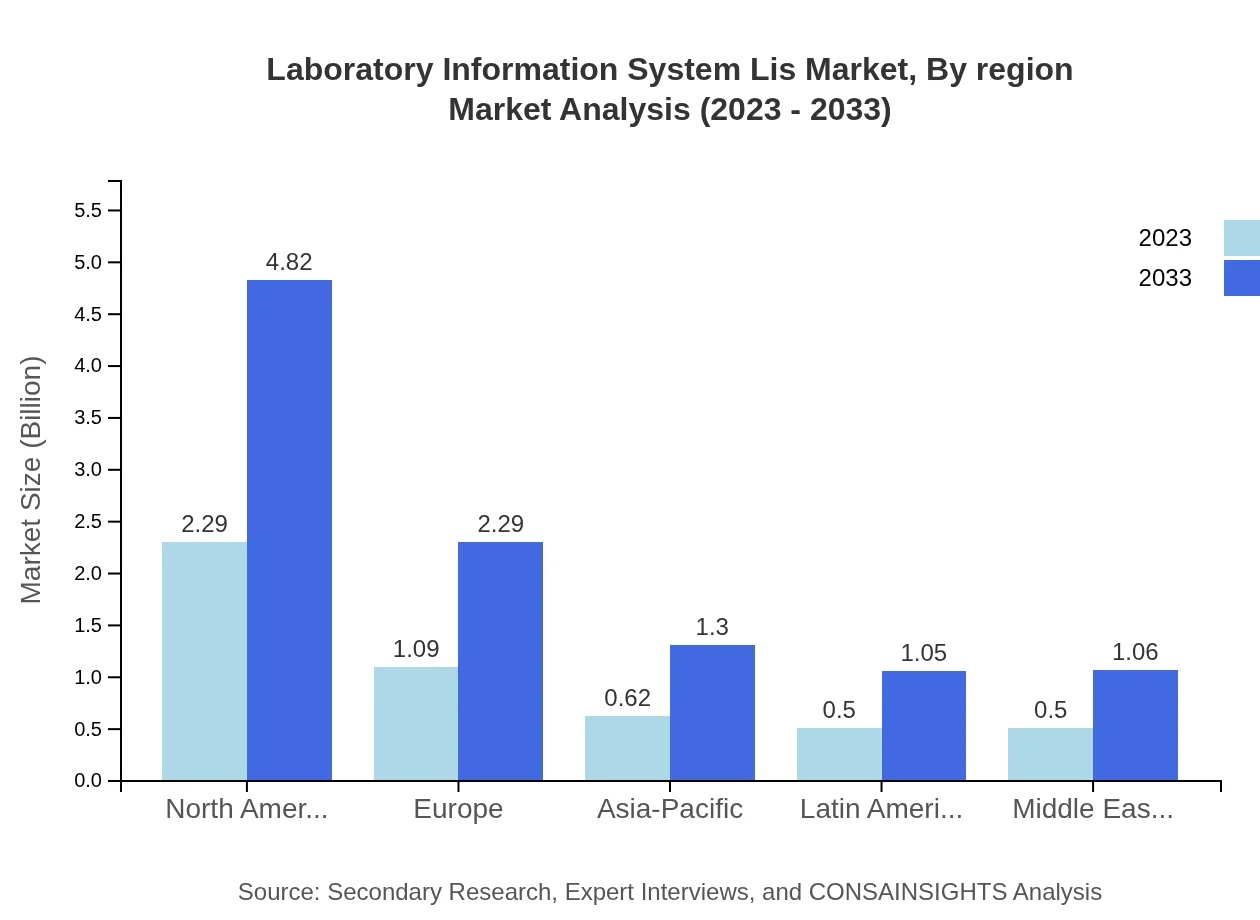

Europe Laboratory Information System Lis Market Report:

Europe's LIS market is projected to grow from $1.28 billion in 2023 to $2.69 billion by 2033. The region is characterized by strong regulatory frameworks and a focus on quality healthcare, promoting the adoption of innovative laboratory systems.Asia Pacific Laboratory Information System Lis Market Report:

The Asia-Pacific region is projected to witness significant growth, rising from a market size of $0.99 billion in 2023 to approximately $2.08 billion by 2033, driven by increasing investments in healthcare infrastructure and a growing patient population.North America Laboratory Information System Lis Market Report:

North America dominates the global LIS market, with a substantial increase from $1.93 billion in 2023 to $4.06 billion by 2033. Factors contributing to this growth include technological advancements, high healthcare expenditures, and the proliferation of advanced laboratory services.South America Laboratory Information System Lis Market Report:

In South America, the LIS market is expected to expand from $0.34 billion in 2023 to $0.72 billion by 2033, fueled by the rising adoption of digital health solutions and the need for improved laboratory efficiency.Middle East & Africa Laboratory Information System Lis Market Report:

The market in the Middle East and Africa is anticipated to increase from $0.47 billion in 2023 to approximately $0.99 billion by 2033, driven by ongoing improvements in healthcare infrastructure and rising awareness of laboratory automation.Tell us your focus area and get a customized research report.

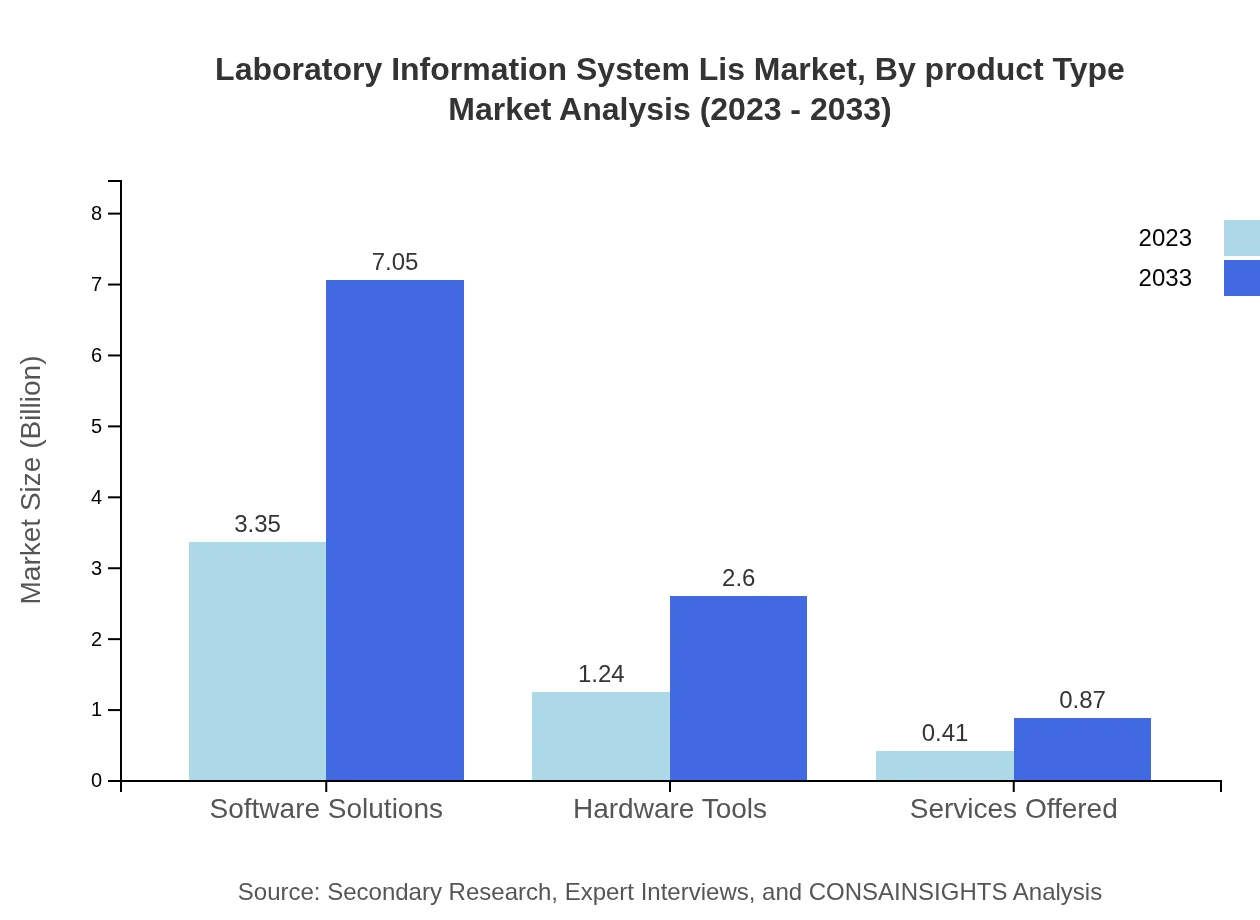

Laboratory Information System Lis Market Analysis By Product Type

The Laboratory Information System market is primarily segmented into software solutions, hardware tools, and services offered. Software solutions represent the largest segment, accounting for approximately 67% of the market share in 2023. This segment is forecasted to grow significantly due to the increasing demand for integrated systems that enhance operational efficiency. Hardware tools comprise around 24.74% of the market, while services focus on support and maintenance, which are essential for optimizing LIS utilization.

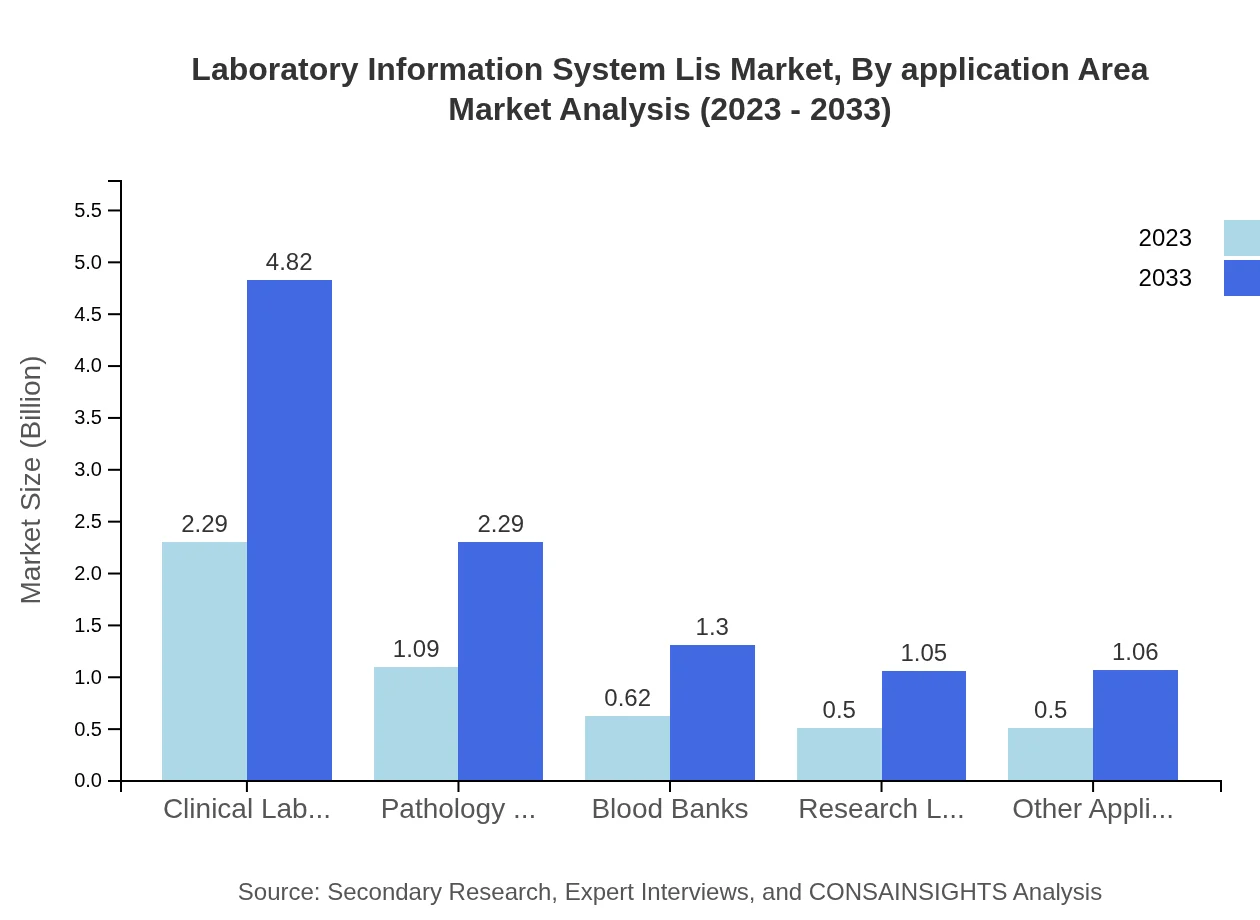

Laboratory Information System Lis Market Analysis By Application Area

Applications of LIS span multiple areas including clinical laboratories, pathology laboratories, blood banks, and research laboratories. Clinical laboratories account for the largest share of 45.78% in 2023 due to the heightened demand for diagnostics and patient management. Pathology laboratories follow, contributing to approximately 21.77% of the market. The growth in these segments reflects the increasing laboratory workloads and the necessity for effective data management and reporting.

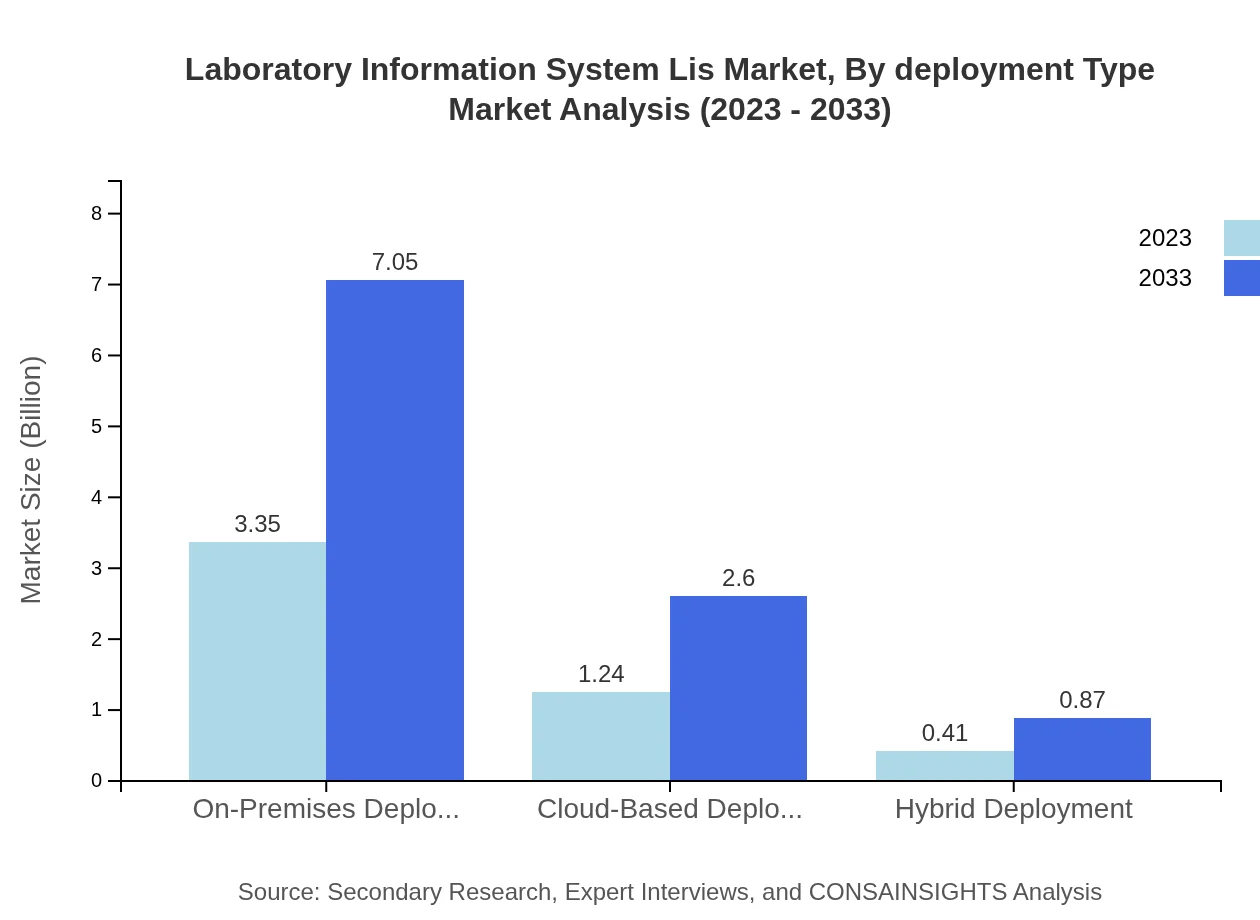

Laboratory Information System Lis Market Analysis By Deployment Type

The deployment types for LIS show a favorable trend towards cloud-based solutions, which are expected to capture about 24.74% of the market by 2033, thanks to their scalability and cost-effectiveness. On-premises deployments currently dominate with 67% of the market share, appealing to organizations favoring direct control over their systems.

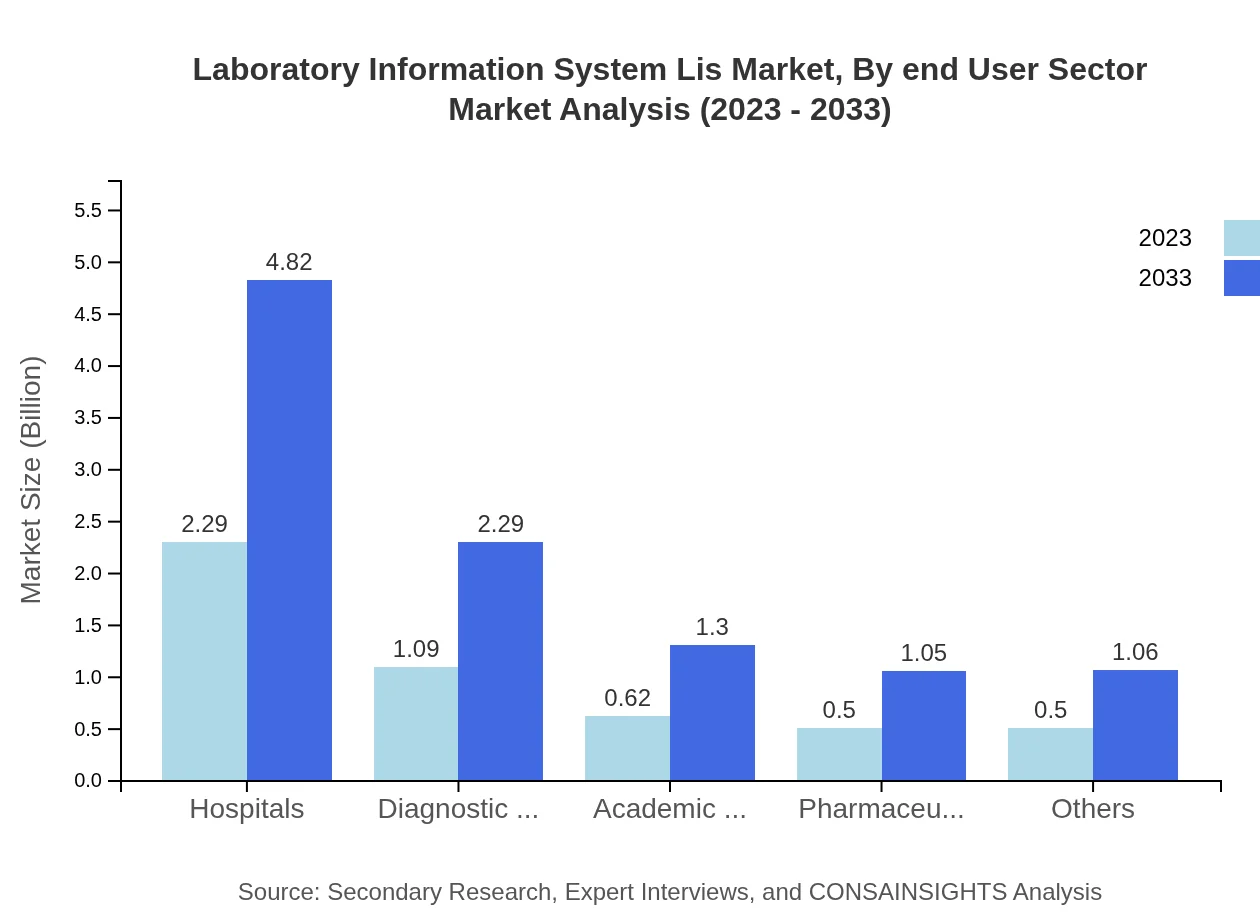

Laboratory Information System Lis Market Analysis By End User Sector

End-user sectors include hospitals, diagnostic centers, and academic research institutes. Hospitals lead the market at 45.78% in 2023, reflecting their critical need for sophisticated data management solutions. Diagnostic centers, contributing 21.77%, are rapidly adopting LIS to enhance their testing capabilities amidst growing demand for timely diagnostic results.

Laboratory Information System Lis Market Analysis By Region

The regional analysis indicates a robust demand for Laboratory Information Systems across all regions. North America remains the largest market, while rapid growth in Asia-Pacific and potential in emerging regions like South America highlight the global opportunities for market players.

Laboratory Information System Lis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Information System Lis Industry

Cerner Corporation:

A leading provider of health information technology solutions, Cerner specializes in creating comprehensive LIS tailored to improve patient care and operational efficiency.Medidata Solutions:

Medidata delivers cloud-based solutions for data collection and analysis in clinical research, including robust LIS functionalities that support pharmaceutical and biotechnology firms.Abbott Laboratories:

A global healthcare company that utilizes innovative technologies and solutions in laboratory management, enhancing efficiencies across multiple laboratory settings.Siemens Healthineers:

Siemens Healthineers offers integrated health solutions and laboratory information management systems, focusing on automation and streamlined workflows.Roper Technologies:

Roper Technologies has a diverse portfolio that includes LIS solutions, focusing on enhancing laboratory productivity through targeted technological integration.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory information system (LIS)?

The laboratory information system (LIS) market is valued at approximately $5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.5%. It is expected to expand significantly, reflecting increasing demand for advanced health informatics solutions.

What are the key market players or companies in this laboratory information system (LIS) industry?

Key players in the laboratory information system (LIS) sector include major companies such as Cerner Corporation, Siemens Healthineers, and Roche Diagnostics. These companies are known for their innovative solutions and extensive market reach, contributing significantly to industry growth.

What are the primary factors driving the growth in the laboratory information system (LIS) industry?

Growth in the laboratory information system (LIS) industry is primarily driven by the rise in healthcare digitization, demand for efficient laboratory operations, and the need for superior data management in diagnostics. Regulatory requirements also push labs towards adopting advanced LIS solutions.

Which region is the fastest Growing in the laboratory information system (LIS)?

The Asia Pacific region is currently the fastest-growing in the laboratory information system (LIS) market, with projections indicating growth from approximately $0.99 billion in 2023 to $2.08 billion by 2033. This growth is fueled by increasing healthcare investments and technological advancements.

Does ConsaInsights provide customized market report data for the laboratory information system (LIS) industry?

Yes, ConsaInsights offers customized market report data tailored to the laboratory information system (LIS) industry. Clients can request specific insights and data points to meet their unique research or strategic needs.

What deliverables can I expect from this laboratory information system (LIS) market research project?

From the laboratory information system (LIS) market research project, you can expect detailed reports, market forecasts, competitive analysis, and tailored insights. These deliverables will help in strategic planning and decision-making processes.

What are the market trends of laboratory information system (LIS)?

Key market trends in the laboratory information system (LIS) industry include increased adoption of cloud-based solutions, integration of artificial intelligence for data analysis, and a focus on interoperability among healthcare systems to enhance operational efficiency.