Laboratory Proficiency Testing Market Report

Published Date: 31 January 2026 | Report Code: laboratory-proficiency-testing

Laboratory Proficiency Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Laboratory Proficiency Testing market from 2023 to 2033, analyzing market dynamics, size, trends, and CAGR. It includes in-depth regional analyses and competitive landscape evaluations to gauge future growth opportunities.

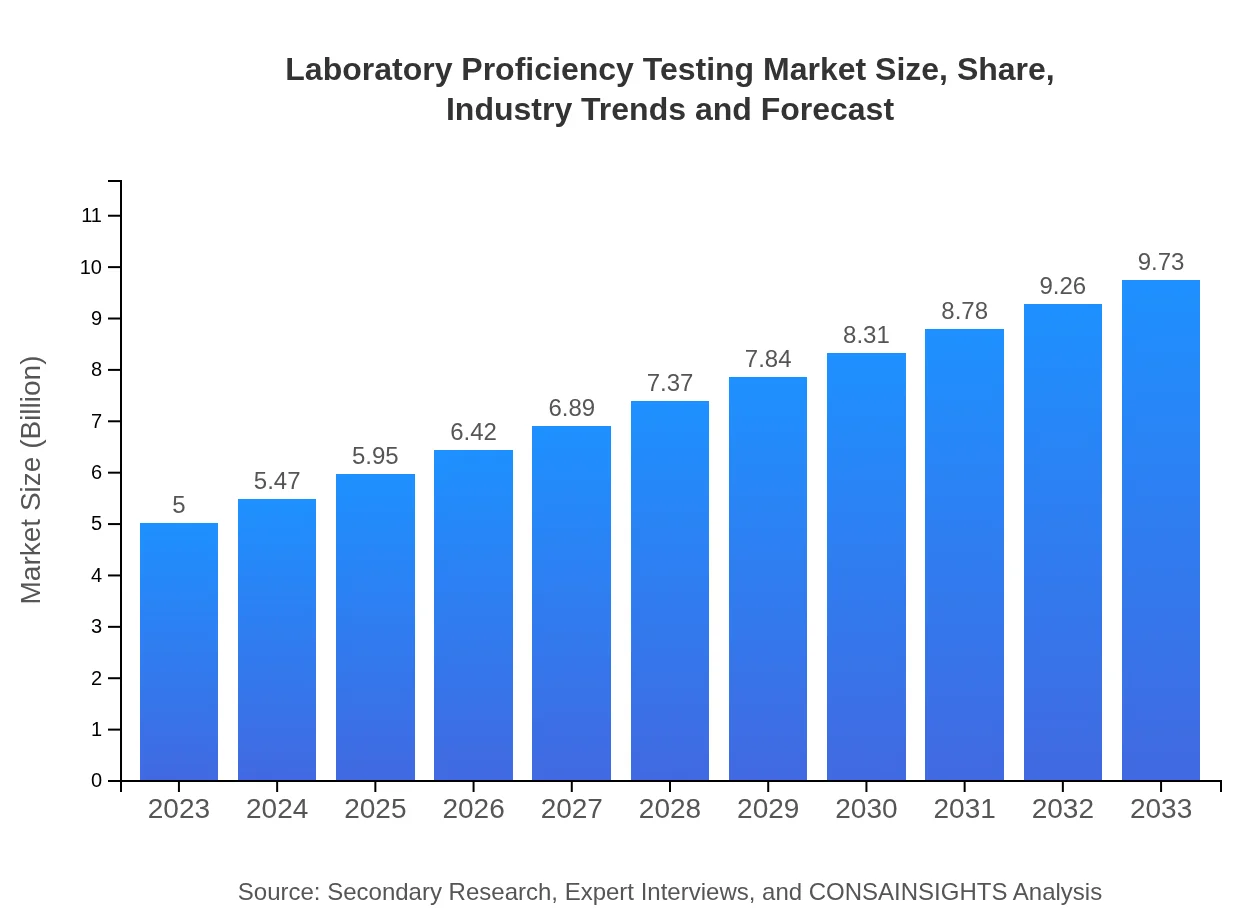

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $9.73 Billion |

| Top Companies | LGC Limited, CMSC (Clinical & Medical Services Corporation), QSI (Quality Services International), Bio-Rad Laboratories |

| Last Modified Date | 31 January 2026 |

Laboratory Proficiency Testing Market Overview

Customize Laboratory Proficiency Testing Market Report market research report

- ✔ Get in-depth analysis of Laboratory Proficiency Testing market size, growth, and forecasts.

- ✔ Understand Laboratory Proficiency Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laboratory Proficiency Testing

What is the Market Size & CAGR of Laboratory Proficiency Testing market in 2023?

Laboratory Proficiency Testing Industry Analysis

Laboratory Proficiency Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laboratory Proficiency Testing Market Analysis Report by Region

Europe Laboratory Proficiency Testing Market Report:

The European market is estimated to grow from $1.53 billion in 2023 to $2.97 billion in 2033. Europe’s stringent regulations for laboratory standards and quality assurance programs contribute significantly to this robust growth.Asia Pacific Laboratory Proficiency Testing Market Report:

The Asia Pacific market is expected to expand significantly, with a projected market size of $1.78 billion by 2033, up from $0.92 billion in 2023. Growing healthcare infrastructures and heightened awareness regarding laboratory quality standards boost the adoption of proficiency testing in the region.North America Laboratory Proficiency Testing Market Report:

North America is poised to maintain its leadership in the LPT market with anticipated growth from $1.92 billion in 2023 to $3.73 billion by 2033. The presence of established testing laboratories and stringent regulatory requirements are key catalysts for this growth.South America Laboratory Proficiency Testing Market Report:

In South America, the market is projected to grow from $0.15 billion in 2023 to $0.28 billion by 2033. Adoption rates of proficiency testing services remain low but are rapidly increasing due to enhancing quality regulations and public health initiatives.Middle East & Africa Laboratory Proficiency Testing Market Report:

In the Middle East and Africa, a gradual increase in the market from $0.49 billion in 2023 to $0.96 billion by 2033 is expected. Improved healthcare facilities and increased governmental support for compliance with international testing standards play critical roles in market advancement.Tell us your focus area and get a customized research report.

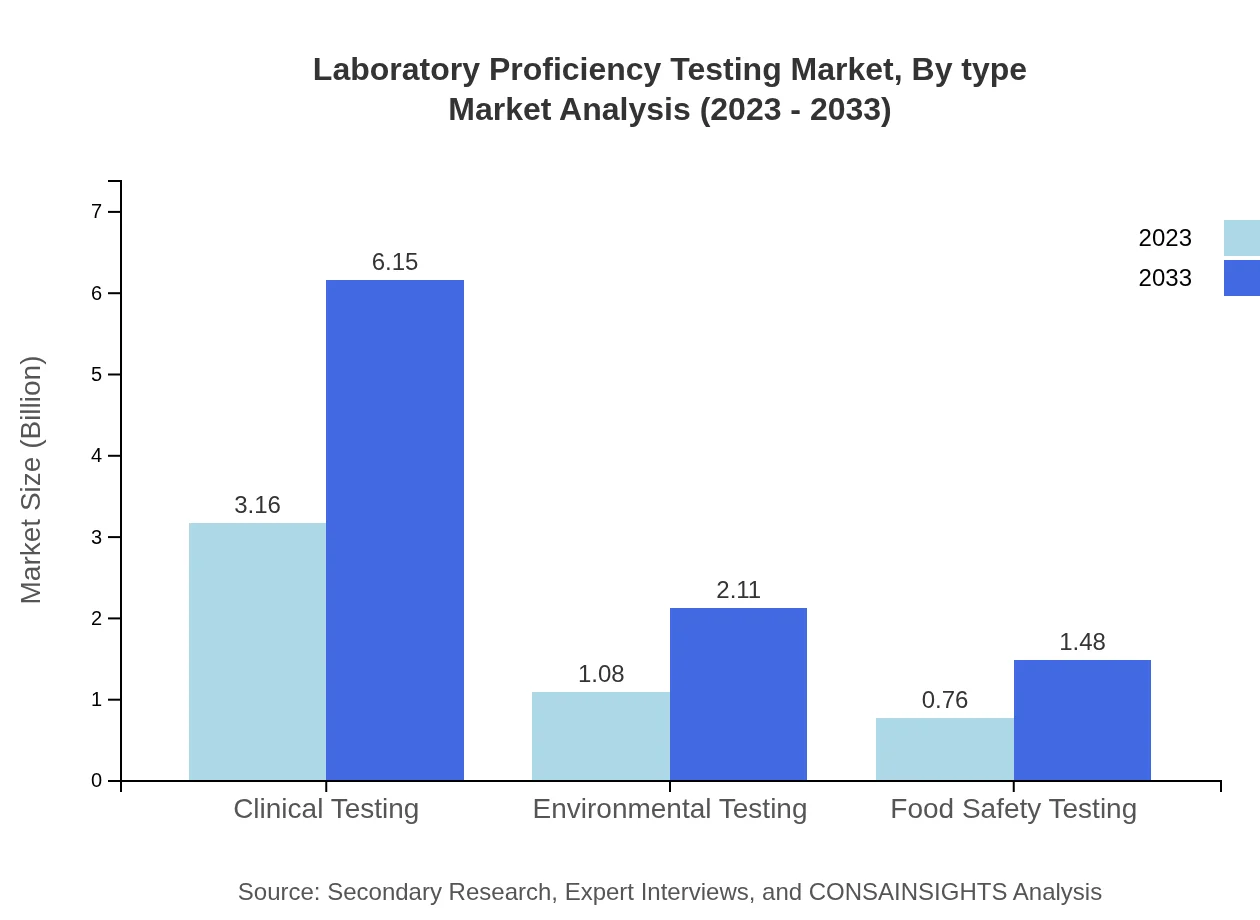

Laboratory Proficiency Testing Market Analysis By Type

The segment analysis indicates that Clinical Testing remains the most dominant field, valued at $3.16 billion in 2023 and projected to reach $6.15 billion by 2033, capturing approximately 63.18% market share. Environmental Testing follows closely, with forecasts showing growth from $1.08 billion to $2.11 billion and a consistent share of 21.66%. Food Safety Testing, while smaller, is projected to grow from $0.76 billion to $1.48 billion, emphasizing the growing importance of safety regulations in the food sector.

Laboratory Proficiency Testing Market Analysis By Organization Type

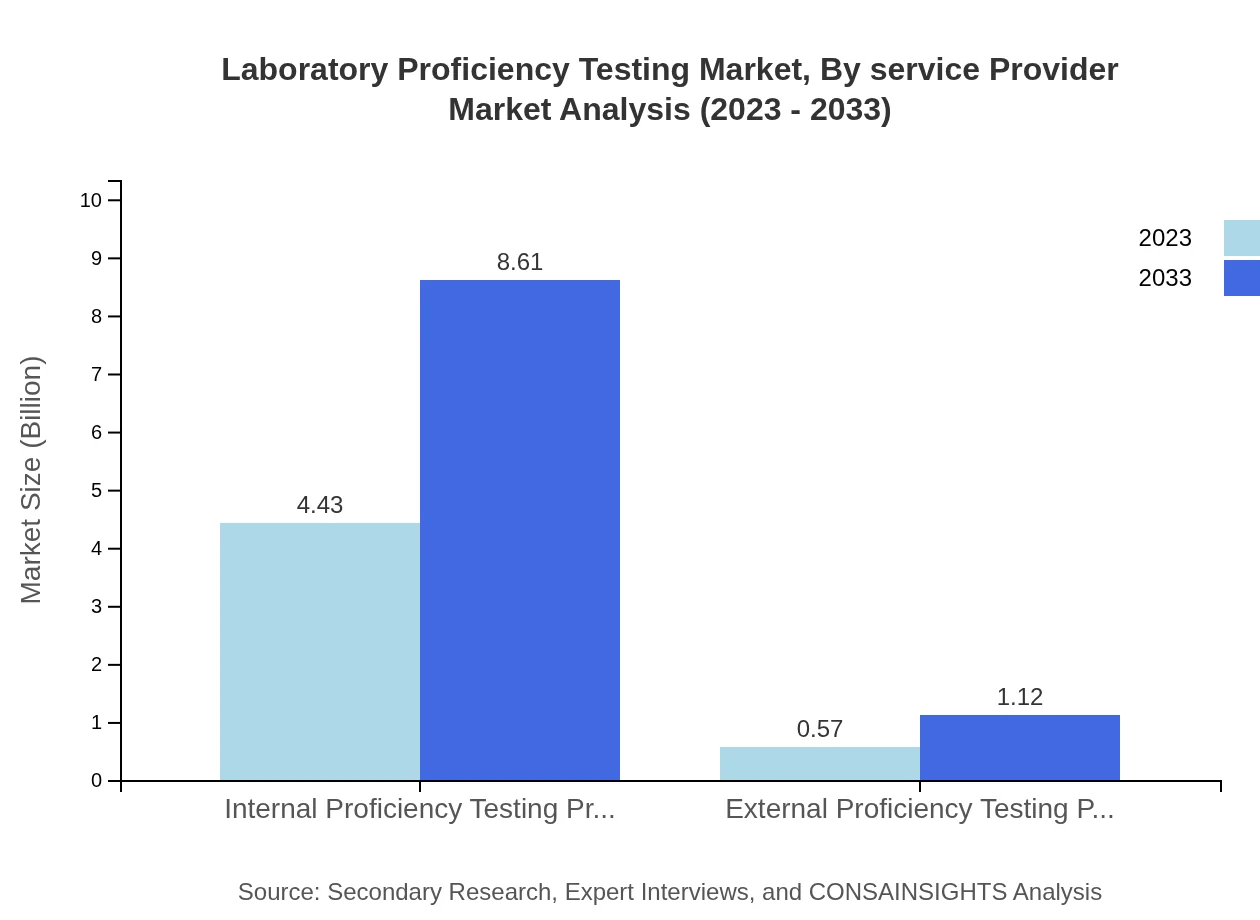

Within organizational types, internal proficiency testing providers dominate with a market size of $4.43 billion in 2023, expected to double to $8.61 billion by 2033, holding an 88.51% share. External proficiency testing providers, although smaller, are also set to grow from $0.57 billion to $1.12 billion, highlighting an increasing trend towards third-party assessments.

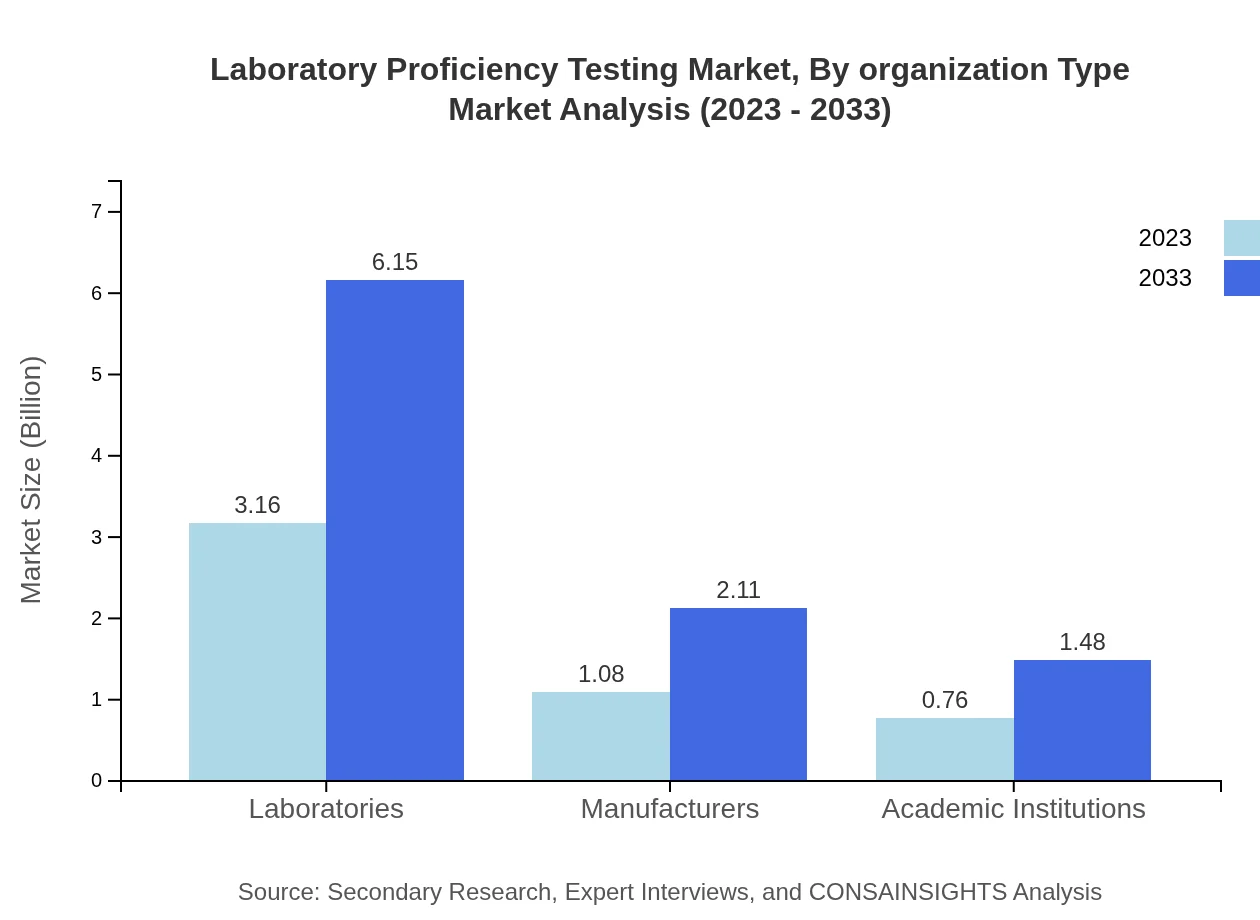

Laboratory Proficiency Testing Market Analysis By Service Provider

The performance of laboratories in the LPT market shows a steady growth trajectory from $3.16 billion in 2023 to $6.15 billion by 2033. Furthermore, manufacturers and academic institutions also play vital roles with respective shares of 21.66% and 15.16%. This showcases the collaborative efforts required to achieve high standards across laboratory operations.

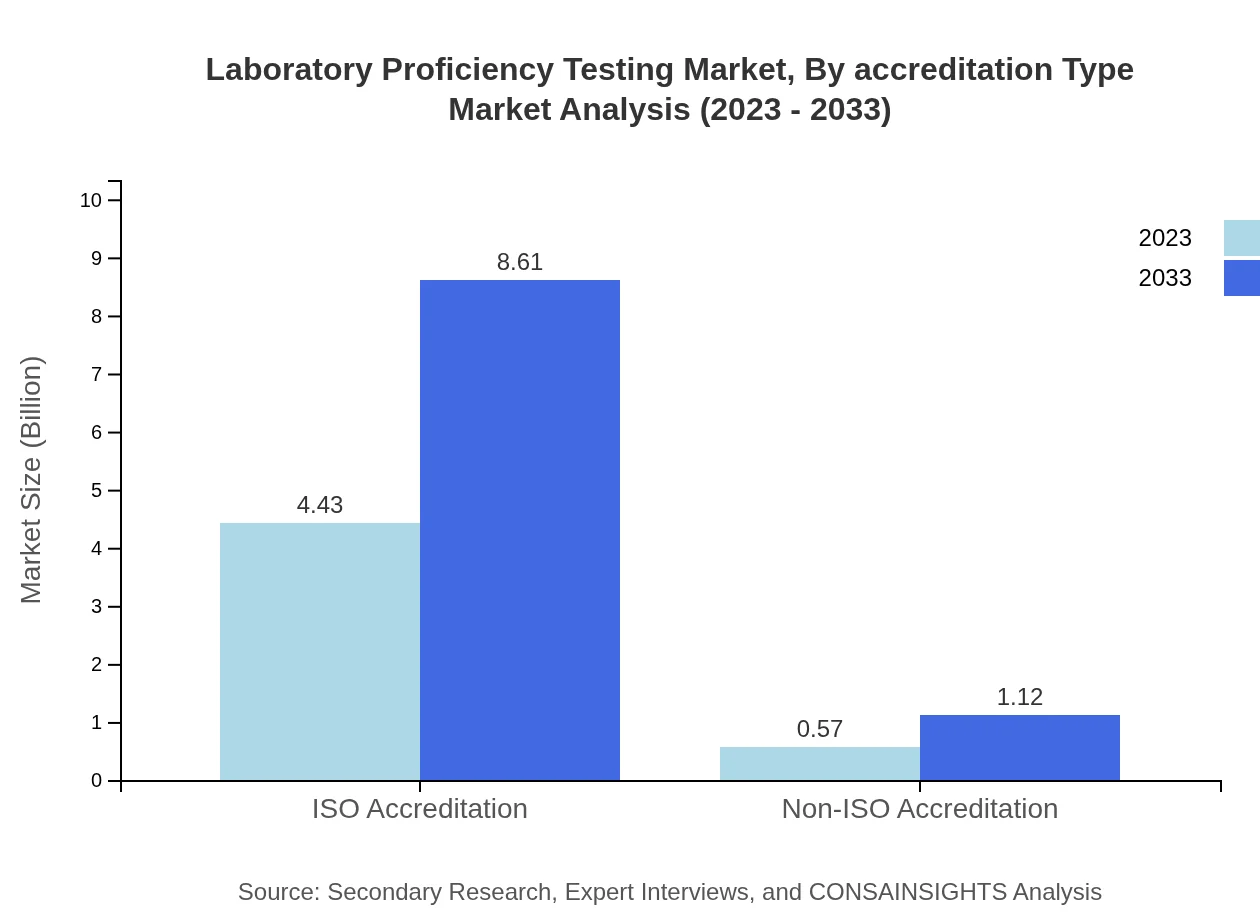

Laboratory Proficiency Testing Market Analysis By Accreditation Type

ISO accredited LPTs constitute a major portion of the market with sizes projected to grow from $4.43 billion to $8.61 billion over the next decade, maintaining a significant share of 88.51%. In contrast, non-ISO accredited testing providers exhibit growth potential from $0.57 billion to $1.12 billion, representing 11.49% of the total market.

Laboratory Proficiency Testing Market Analysis By Region

Global Laboratory Proficiency Testing Market, By Region Market Analysis (2023 - 2033)

Regional analyses further clarify market trends, emphasizing the diversifying needs in different geographic segments, each influenced by local regulatory frameworks, technological advancements, and healthcare reforms.

Laboratory Proficiency Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laboratory Proficiency Testing Industry

LGC Limited:

LGC Limited is a global leader in laboratory proficiency testing, providing innovative testing solutions across numerous sectors, emphasizing quality assurance and regulatory compliance.CMSC (Clinical & Medical Services Corporation):

CMSC focuses on clinical laboratory proficiency testing services, recognized for their comprehensive testing protocols and contributions to quality improvement initiatives.QSI (Quality Services International):

QSI is a prominent provider of proficiency testing and quality assurance solutions, renowned for their robust frameworks and extensive expertise across multiple industries.Bio-Rad Laboratories:

Bio-Rad Laboratories offers a wide range of laboratory proficiency testing services, known for their commitment to advancing scientific innovation with comprehensive testing solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of laboratory Proficiency Testing?

The laboratory proficiency testing market is valued at approximately $5 billion in 2023, with a projected CAGR of 6.7%, indicating continued growth and expansion through 2033.

What are the key market players or companies in this laboratory Proficiency Testing industry?

Key players in the laboratory proficiency testing market include major global testing organizations, specialized service providers, and academic institutions focused on quality assurance and compliance for laboratory testing.

What are the primary factors driving the growth in the laboratory Proficiency Testing industry?

Factors driving growth include increasing regulatory scrutiny, rising demand for quality assurance in diagnostics, advancements in testing technologies, and a growing emphasis on patient safety and lab accreditation.

Which region is the fastest Growing in the laboratory Proficiency Testing?

North America is the fastest-growing region, projected to expand from $1.92 billion in 2023 to $3.73 billion by 2033, followed closely by Europe and Asia-Pacific, each showing significant market growth.

Does ConsaInsights provide customized market report data for the laboratory Proficiency Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the laboratory proficiency testing industry, enabling clients to access market insights and trend analysis based on their unique requirements.

What deliverables can I expect from this laboratory Proficiency Testing market research project?

Deliverables typically include a comprehensive report covering market size, segmentation analysis, competitive landscape, regional insights, and trend forecasts, along with actionable recommendations to inform business strategy.

What are the market trends of laboratory Proficiency Testing?

Current trends in the laboratory proficiency testing market include increased digitalization of testing processes, broader adoption of proficiency tests across various sectors, and enhanced focus on environmental testing alongside traditional clinical assessments.