Laminated Busbar Market Report

Published Date: 22 January 2026 | Report Code: laminated-busbar

Laminated Busbar Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Laminated Busbar market, covering market size, trends, and forecasts for 2023-2033. It offers insights into key regional markets, industry dynamics, and competitive landscape, aiding stakeholders in strategic decision-making.

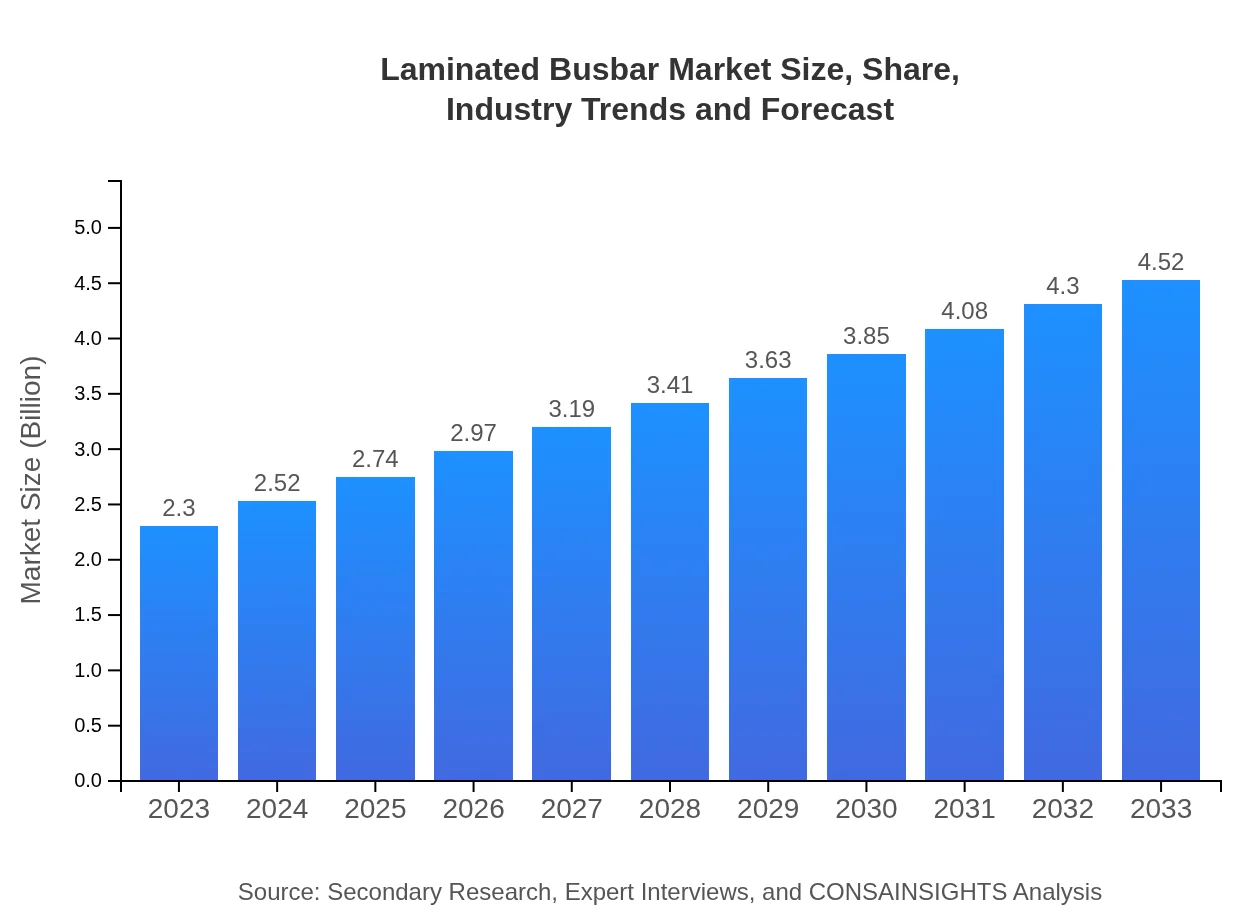

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Schneider Electric, Siemens AG, Eaton Corporation, ABB Group |

| Last Modified Date | 22 January 2026 |

Laminated Busbar Market Overview

Customize Laminated Busbar Market Report market research report

- ✔ Get in-depth analysis of Laminated Busbar market size, growth, and forecasts.

- ✔ Understand Laminated Busbar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laminated Busbar

What is the Market Size & CAGR of Laminated Busbar market in 2023?

Laminated Busbar Industry Analysis

Laminated Busbar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laminated Busbar Market Analysis Report by Region

Europe Laminated Busbar Market Report:

Europe is anticipated to grow significantly, with a rise in market size from $0.61 billion in 2023 to $1.21 billion by 2033. The European market is heavily influenced by strict regulations on energy efficiency and a strong emphasis on renewable energy adoption.Asia Pacific Laminated Busbar Market Report:

The Asia Pacific region is projected to see substantial growth, with the market size increasing from $0.50 billion in 2023 to $0.99 billion in 2033. Rising industrialization, urbanization, and investments in renewable energy projects contribute to the demand for Laminated Busbars in this region.North America Laminated Busbar Market Report:

North America shows robust market expansion, increasing from $0.75 billion in 2023 to $1.48 billion in 2033. The region benefits from a high demand for energy efficiency solutions and innovation in power distribution and management systems.South America Laminated Busbar Market Report:

In South America, the market is expected to grow from $0.18 billion in 2023 to $0.36 billion in 2033. Factors such as improving infrastructure and energy requirements for industrial growth are key drivers in this region.Middle East & Africa Laminated Busbar Market Report:

The Middle East and Africa market is set to increase from $0.25 billion in 2023 to $0.49 billion in 2033. The focus on infrastructural developments and advancements in energy systems are crucial growth factors in this region.Tell us your focus area and get a customized research report.

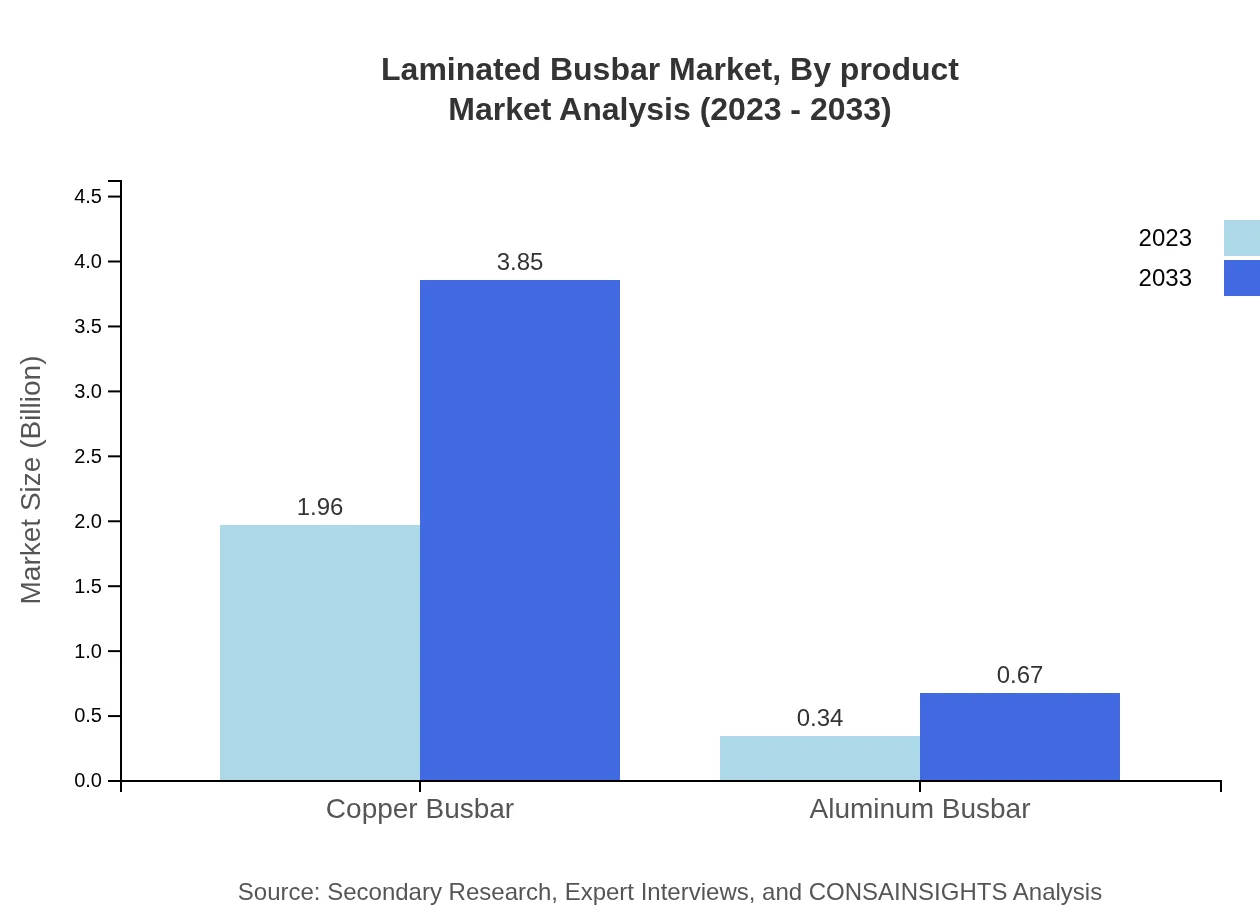

Laminated Busbar Market Analysis By Product

The product segmentation shows copper busbars leading with a market size set to grow from $1.96 billion in 2023 to $3.85 billion in 2033, maintaining an 85.13% share. Aluminum busbars also contribute, growing from $0.34 billion in 2023 to $0.67 billion by 2033, holding a 14.87% share.

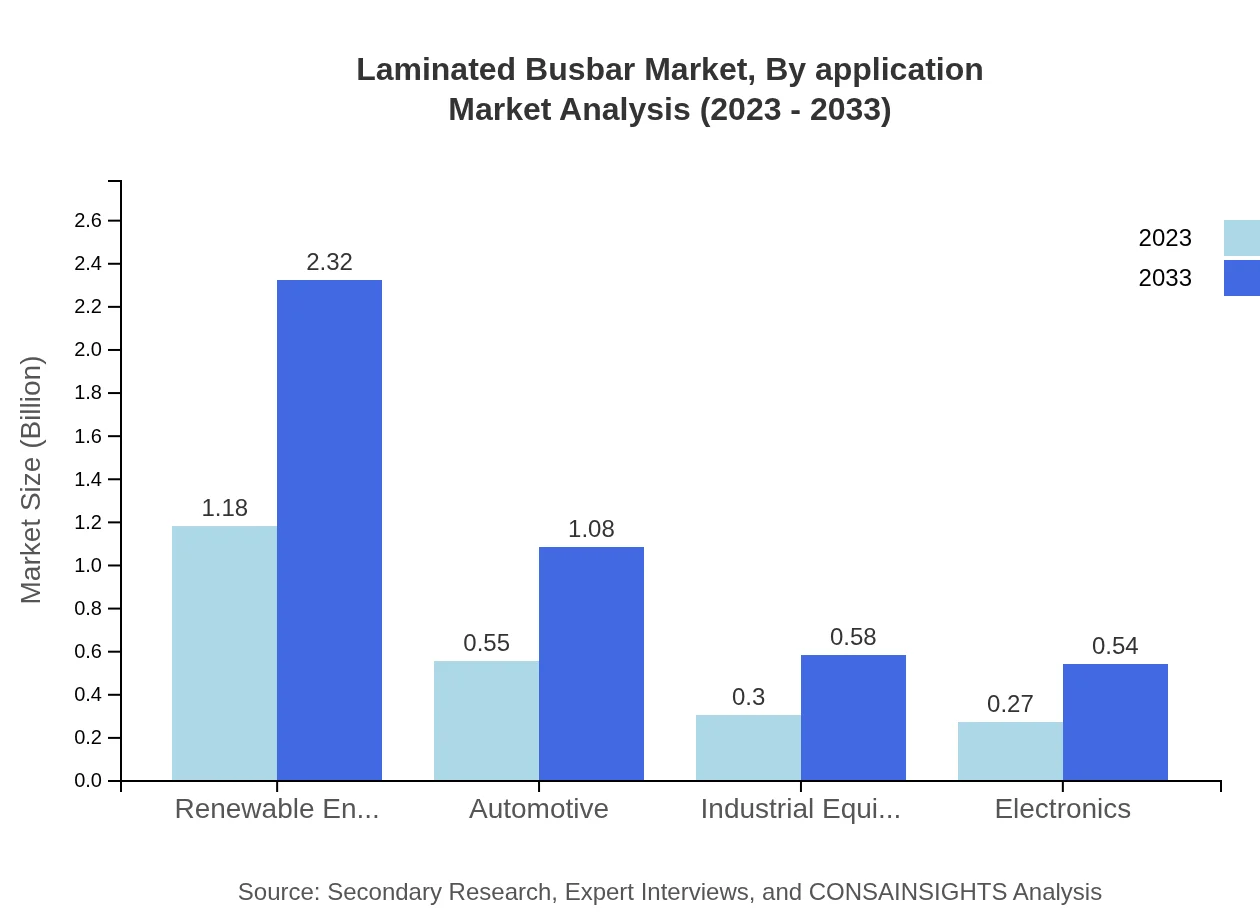

Laminated Busbar Market Analysis By Application

Applications of laminated busbars illustrate a diverse range, primarily in renewable energy, growing from $1.18 billion in 2023 to $2.32 billion in 2033 with a 51.35% market share. Commercial buildings and data centers also show growth, with market sizes of $0.56 billion and $0.35 billion in 2023, projected to reach $1.10 billion and $0.68 billion respectively by 2033.

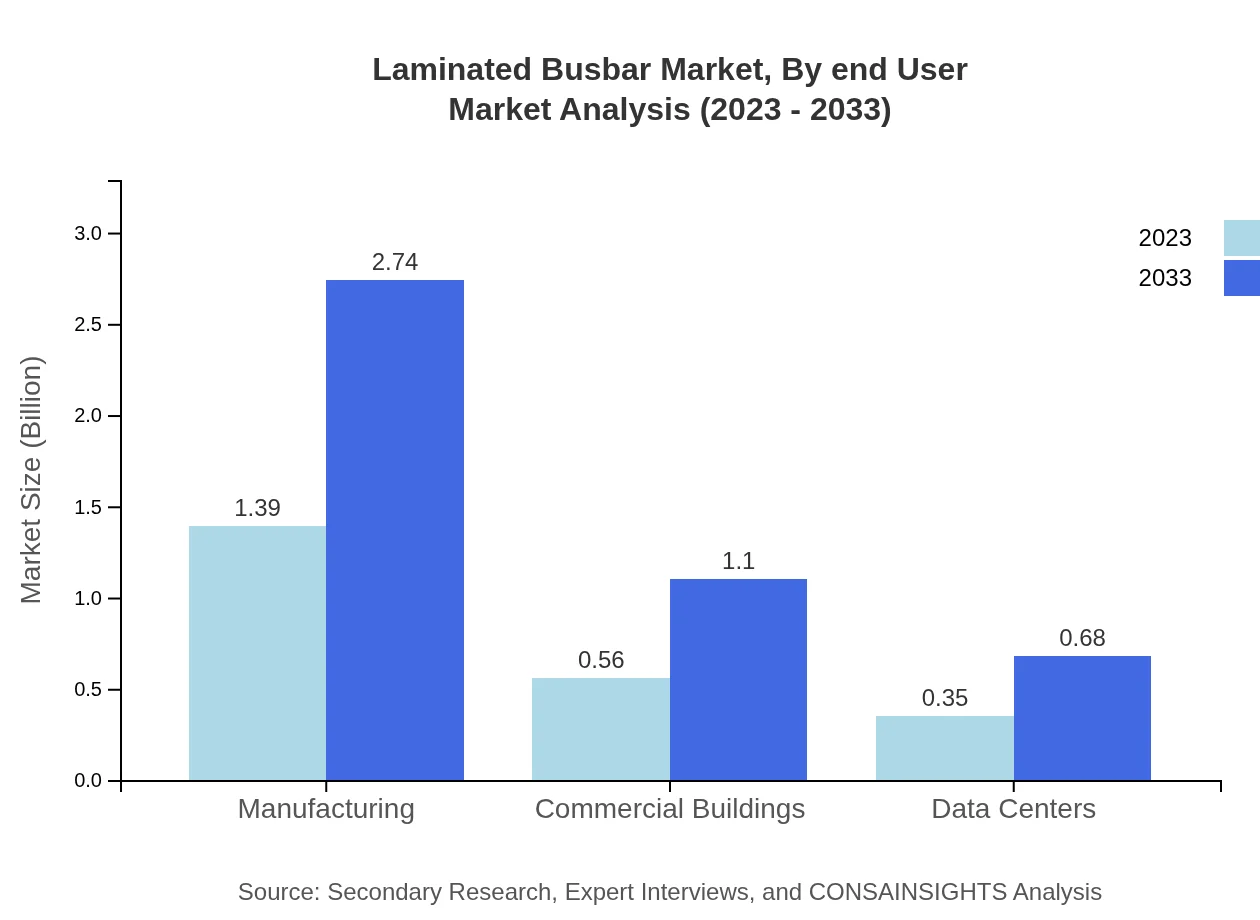

Laminated Busbar Market Analysis By End User

By end-user segment, manufacturing leads with a significant market size of $1.39 billion in 2023, projected to double to $2.74 billion by 2033. This sector highlights a 60.59% share, with notable growth coming from automotive and electronics sectors as well.

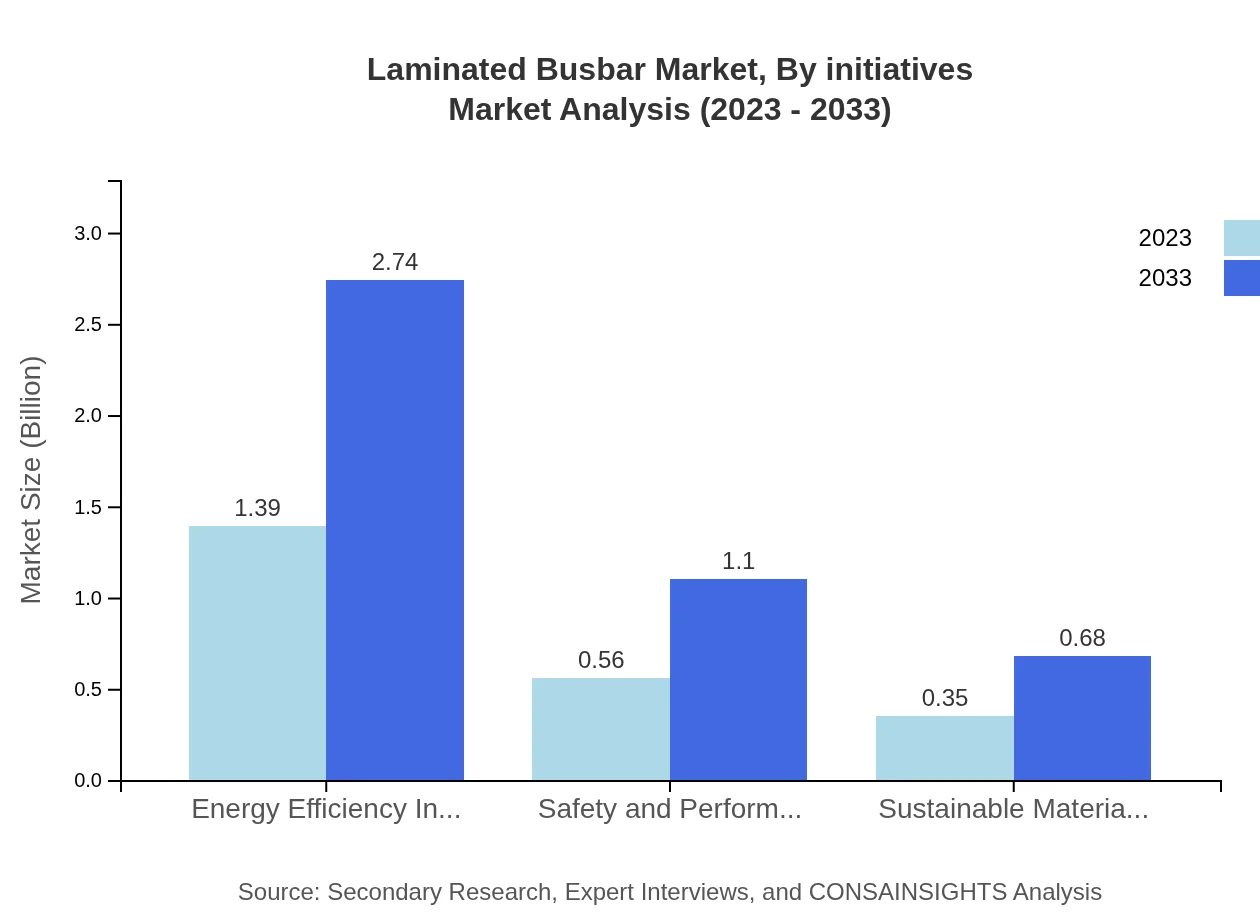

Laminated Busbar Market Analysis By Initiatives

The market also segments by initiatives aimed at improving energy efficiency and sustainability. This segment is pivotal, holding a market share of 60.59% at $1.39 billion in 2023, and expanding alongside energy safety and performance standards initiatives.

Laminated Busbar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laminated Busbar Industry

Schneider Electric:

A global player renowned for its energy management and automation solutions, Schneider Electric plays a crucial role in the Laminated Busbar market through innovative products that enhance efficiency and sustainability.Siemens AG:

Siemens AG is a leading technology company, offering advanced electrical components including Laminated Busbars that comply with high-performance standards in various industries.Eaton Corporation:

Eaton Corporation is recognized for its electrical systems, driving innovations in power distribution and providing high-quality Laminated Busbar solutions for various applications.ABB Group:

ABB Group is a prominent player in power and automation technologies; its Laminated Busbar products are integral in enhancing industrial productivity and energy efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of laminated Busbar?

The laminated busbar market is valued at approximately $2.3 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth indicates an increasing demand and a robust expansion in adoption across various applications.

What are the key market players or companies in this laminated Busbar industry?

Key players in the laminated busbar market include major electrical component manufacturers and suppliers, renowned for innovative solutions in busbar technology and a strong global presence, contributing significantly to the industry's expansion.

What are the primary factors driving the growth in the laminated Busbar industry?

The growth in the laminated busbar industry is primarily driven by increasing demand for energy-efficient solutions, advancements in manufacturing technologies, and the rising need for compact and reliable power distribution systems.

Which region is the fastest Growing in the laminated Busbar?

The fastest-growing region in the laminated busbar market is Europe, expected to grow from $0.61 billion in 2023 to $1.21 billion by 2033, reflecting a strong focus on renewable energy and energy efficiency initiatives.

Does ConsaInsights provide customized market report data for the laminated Busbar industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements in the laminated busbar industry, providing insights that are aligned with unique business goals and market challenges.

What deliverables can I expect from this laminated Busbar market research project?

Expect comprehensive deliverables including detailed market analysis, insights on trends, competitive landscape, and forecasts, segmented by region and type, assisting in strategic planning and decision-making.

What are the market trends of laminated Busbar?

Key market trends include increasing adoption of renewable energy, advancements in safety and performance standards, and a shift towards sustainable materials and processes, driving innovation in laminated busbar applications.