Land Based Military Electro Optical And Infrared Systems Market Report

Published Date: 03 February 2026 | Report Code: land-based-military-electro-optical-and-infrared-systems

Land Based Military Electro Optical And Infrared Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Land Based Military Electro Optical and Infrared Systems market from 2023 to 2033, highlighting key trends, market size, regional insights, and future forecasts essential for industry stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

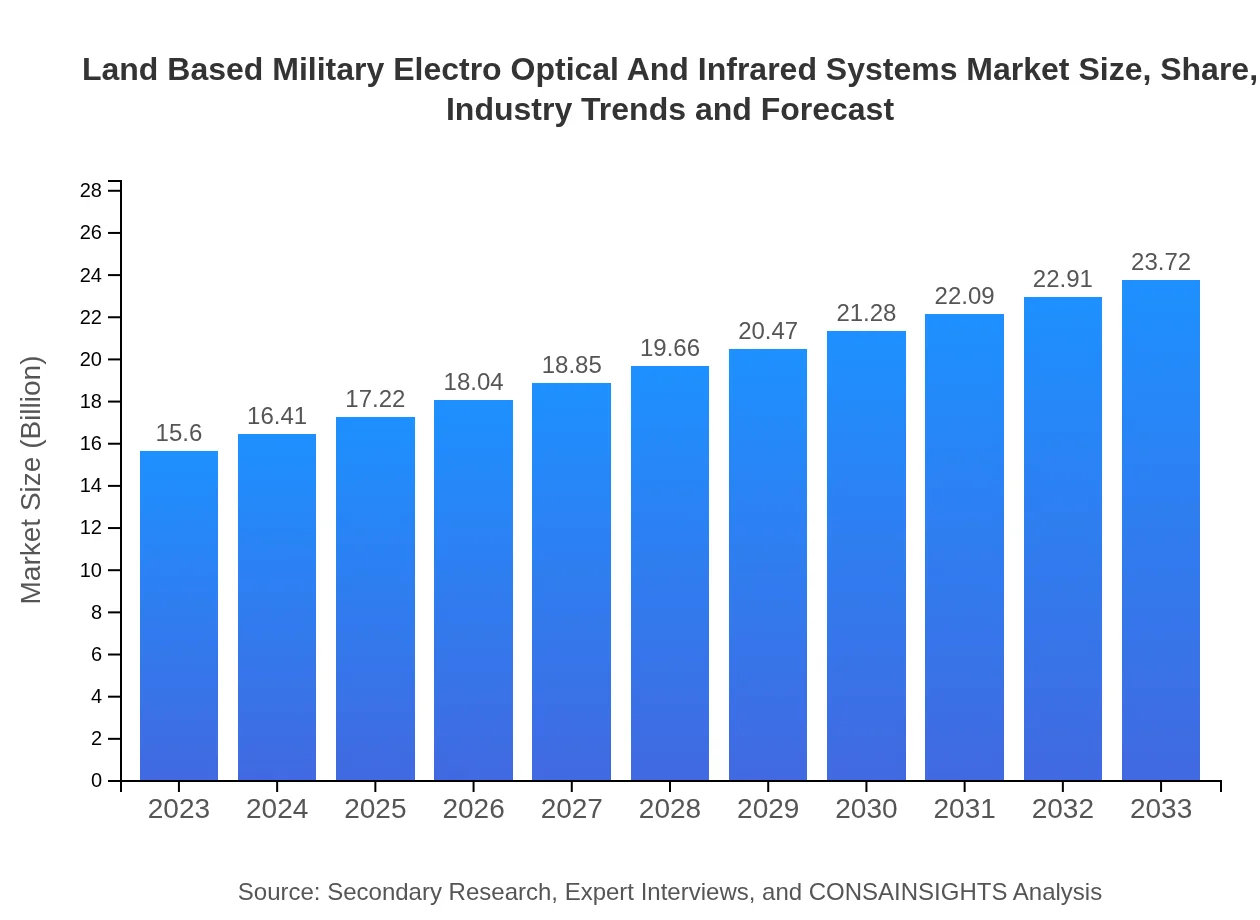

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $23.72 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Thales Group, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Land Based Military Electro Optical And Infrared Systems Market Overview

Customize Land Based Military Electro Optical And Infrared Systems Market Report market research report

- ✔ Get in-depth analysis of Land Based Military Electro Optical And Infrared Systems market size, growth, and forecasts.

- ✔ Understand Land Based Military Electro Optical And Infrared Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Land Based Military Electro Optical And Infrared Systems

What is the Market Size & CAGR of Land Based Military Electro Optical And Infrared Systems market in 2023?

Land Based Military Electro Optical And Infrared Systems Industry Analysis

Land Based Military Electro Optical And Infrared Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Land Based Military Electro Optical And Infrared Systems Market Analysis Report by Region

Europe Land Based Military Electro Optical And Infrared Systems Market Report:

Europe's market is also showing robust growth, projected to increase from USD 4.95 billion in 2023 to USD 7.53 billion by 2033. The ongoing geopolitical tensions in Eastern Europe are driving European nations to strengthen their defense systems, significantly impacting demand for advanced military technologies.Asia Pacific Land Based Military Electro Optical And Infrared Systems Market Report:

In the Asia Pacific region, the market is expected to grow from USD 2.90 billion in 2023 to USD 4.41 billion by 2033. This growth is fueled by rising defense spending in countries like India and China, with a focus on modernizing military capabilities and enhancing border security.North America Land Based Military Electro Optical And Infrared Systems Market Report:

North America, particularly the USA, currently leads the market at USD 5.83 billion in 2023, with an expected rise to USD 8.87 billion by 2033. Ongoing military modernization programs and high R&D investments are key contributors to this growth.South America Land Based Military Electro Optical And Infrared Systems Market Report:

The South American market, valued at USD 1.35 billion in 2023, is projected to grow to USD 2.05 billion by 2033. Limited defense budgets and political instability in various countries could pose challenges to growth, although advancements in surveillance technologies may spur investment.Middle East & Africa Land Based Military Electro Optical And Infrared Systems Market Report:

The Middle East and Africa market is estimated to grow from USD 0.56 billion in 2023 to USD 0.86 billion by 2033. The focus on counter-terrorism and improved surveillance solutions in urban environments is bolstering the market growth in this region.Tell us your focus area and get a customized research report.

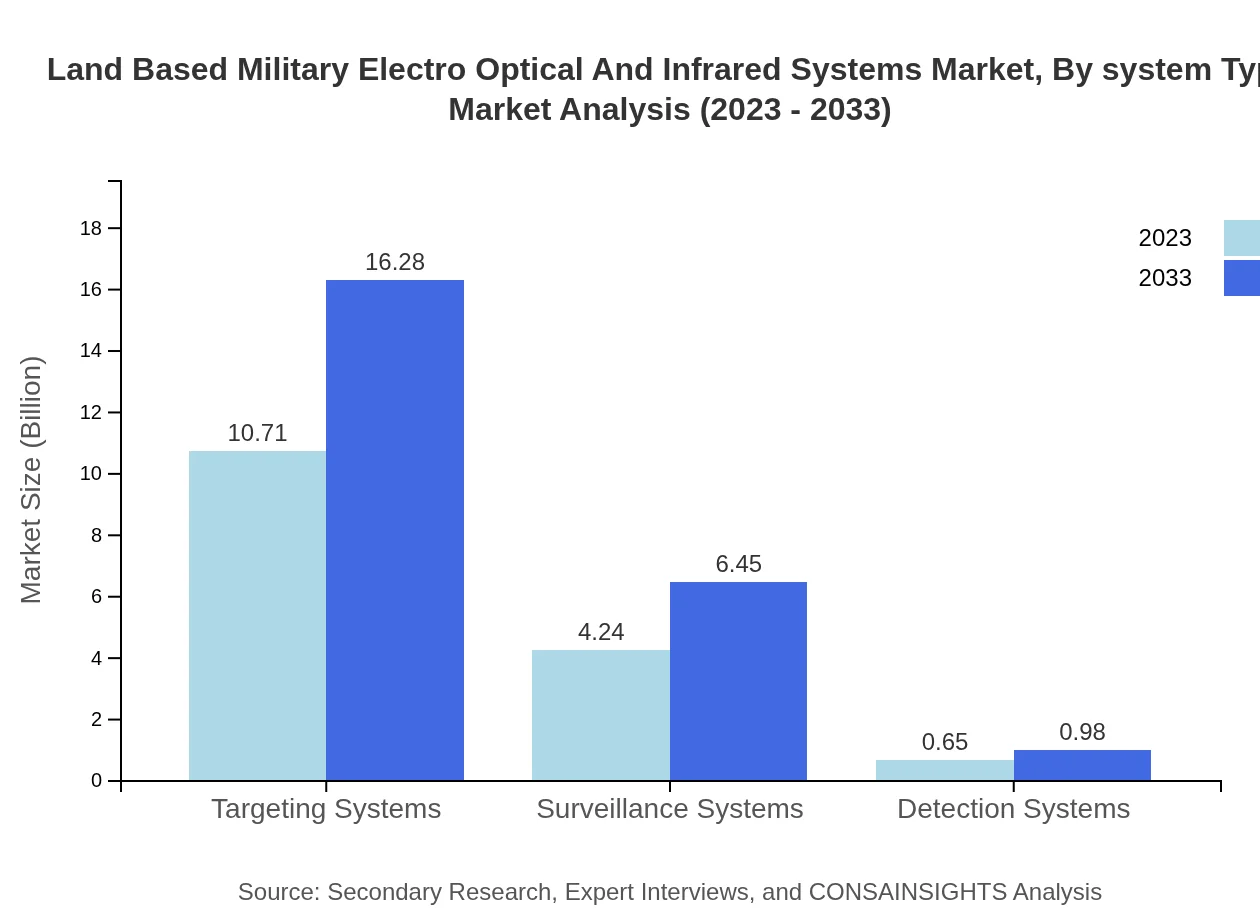

Land Based Military Electro Optical And Infrared Systems Market Analysis By System Type

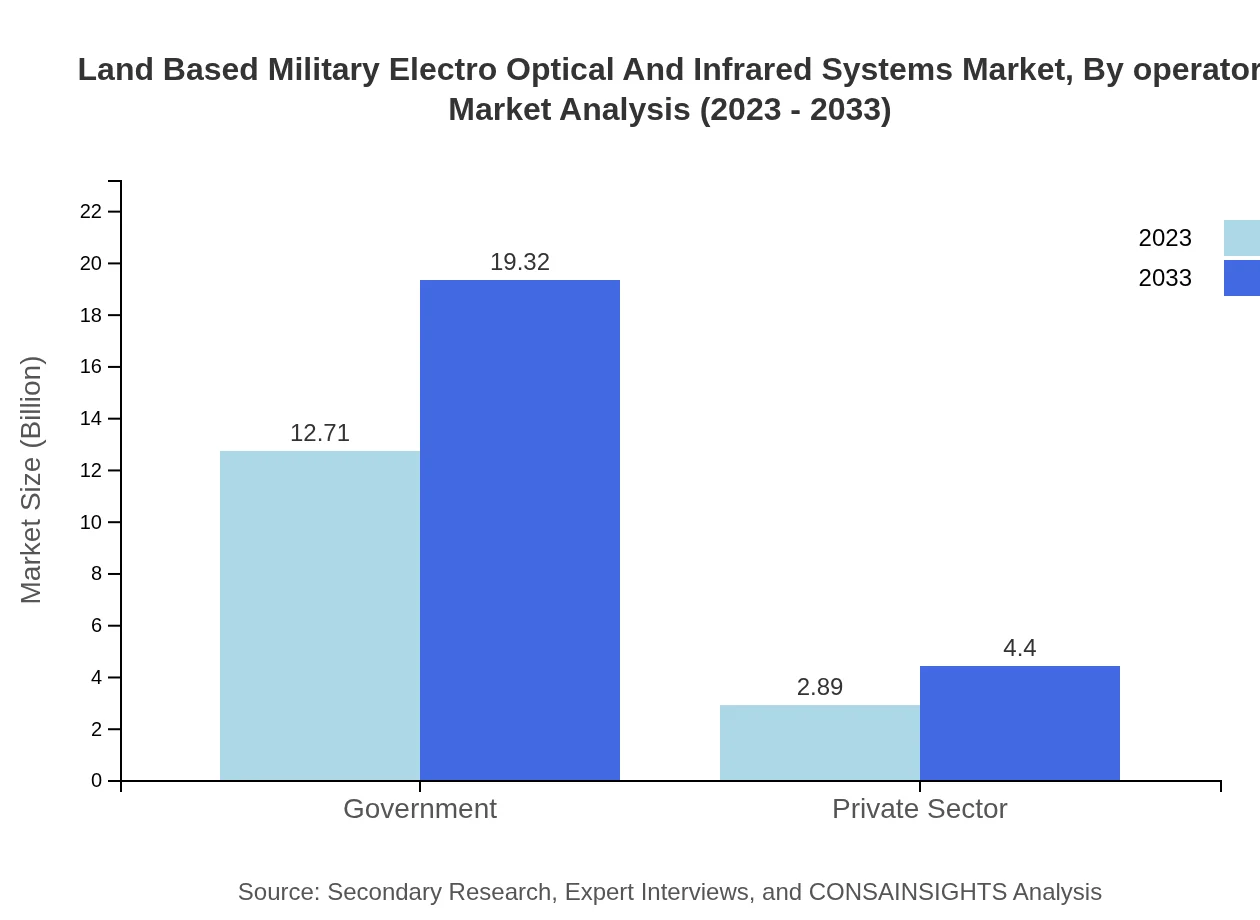

The Land-Based Military Electro-Optical and Infrared Systems market, by system type, shows two major segments - Infrared Technology and Electro-Optical Technology. The Infrared Technology segment is anticipated to dominate the market with a size of USD 12.71 billion in 2023 and a projected size of USD 19.32 billion in 2033, capturing a significant share of 81.45%. Meanwhile, the Electro-Optical Technology segment is expected to grow from USD 2.89 billion in 2023 to USD 4.40 billion by 2033, maintaining 18.55% of the market share.

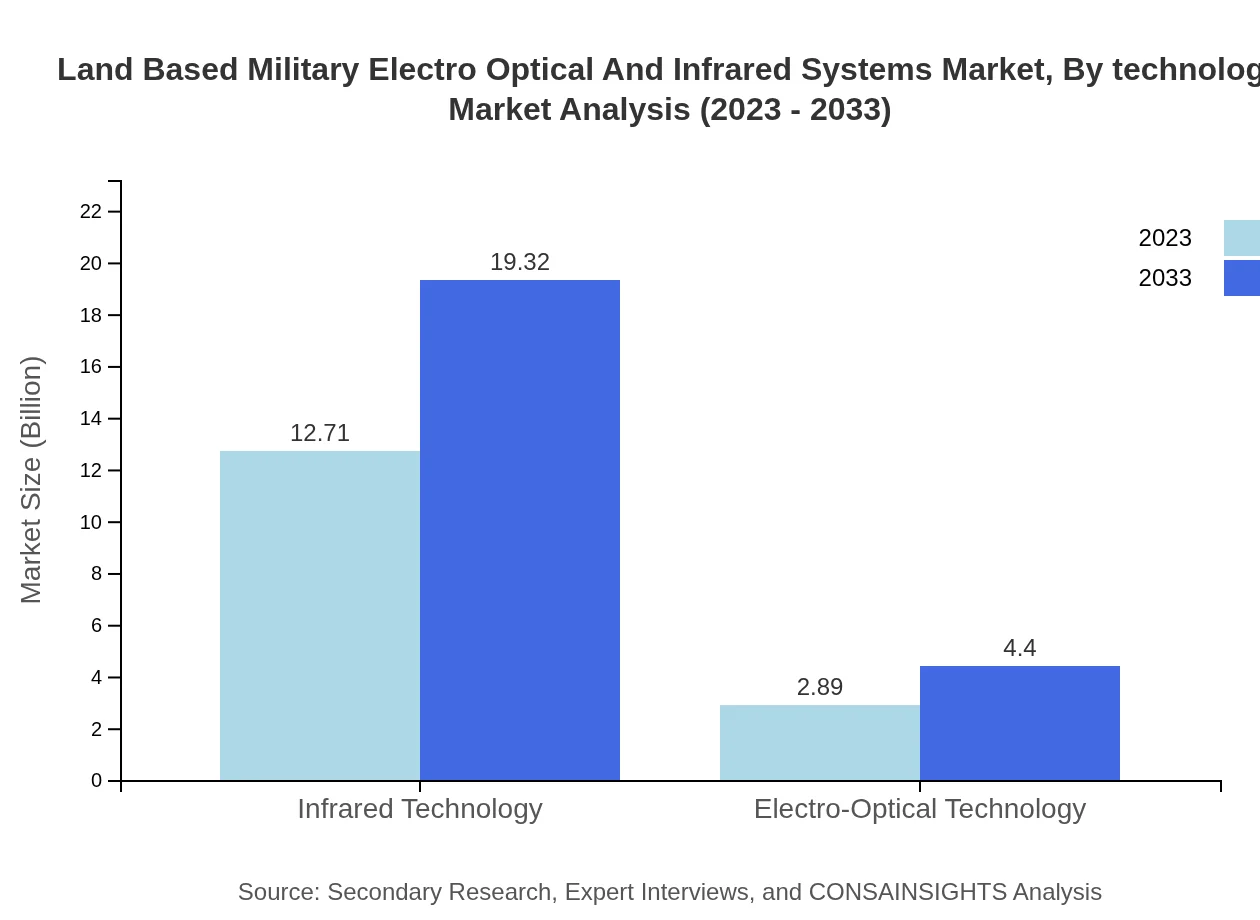

Land Based Military Electro Optical And Infrared Systems Market Analysis By Technology

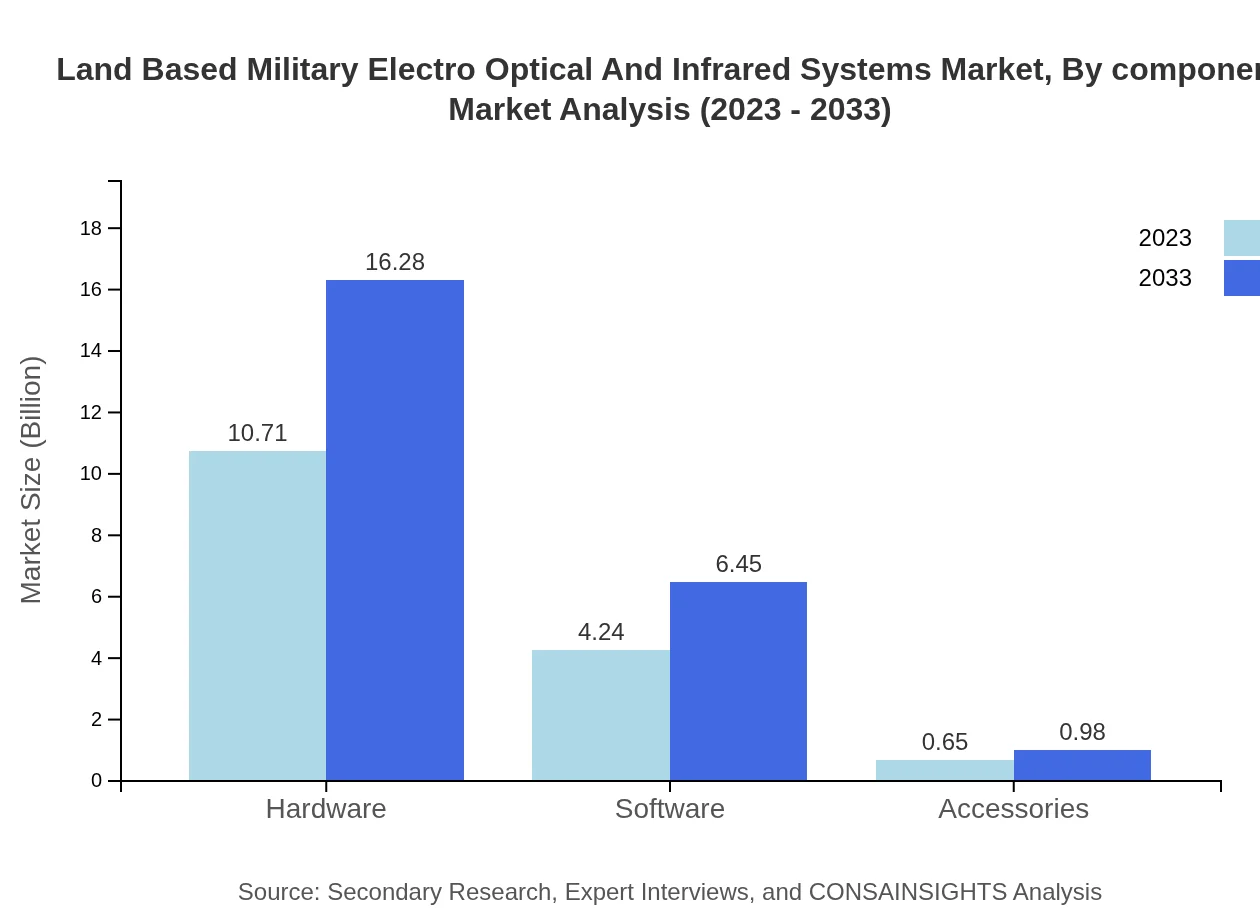

In terms of technology, the key segments include hardware, software, and accessories. The hardware segment leads with a market size of USD 10.71 billion in 2023, expected to reach USD 16.28 billion by 2033. The software segment accounts for USD 4.24 billion, projected to rise to USD 6.45 billion. The accessories segment also contributes minimally with a market size growing from USD 0.65 billion to USD 0.98 billion over the decade.

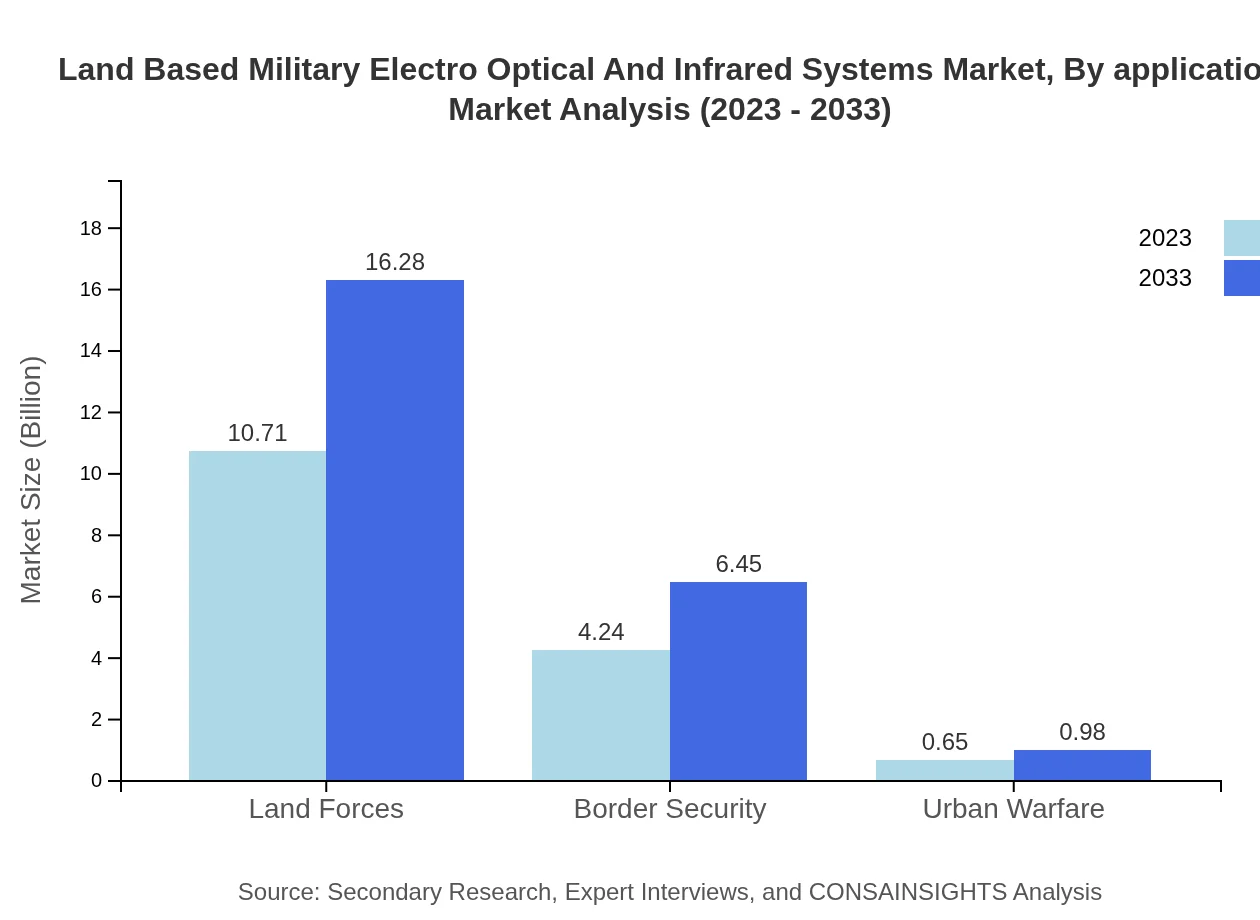

Land Based Military Electro Optical And Infrared Systems Market Analysis By Application

The application segments are categorized into Land Forces, Border Security, Urban Warfare, Targeting Systems, Surveillance Systems, and Detection Systems. Land Forces dominate with USD 10.71 billion in 2023, expected to grow significantly to USD 16.28 billion by 2033. Border Security and Surveillance Systems are also key applications, showing substantial growth from USD 4.24 billion and USD 4.24 billion respectively, to USD 6.45 billion by 2033.

Land Based Military Electro Optical And Infrared Systems Market Analysis By Component

Components include hardware, software, and accessories. As stated, the hardware segment is the largest, making up 68.66% of the market share. Software solutions which include analytics tools and algorithms represent about 27.19%, while accessories hold a smaller share of 4.15%. This division highlights the pivotal role of integrated hardware solutions within the market.

Land Based Military Electro Optical And Infrared Systems Market Analysis By Operator

This segment has been identified as government and private sector operators, where government expenditures dominate the landscape. The government sector is valued at USD 12.71 billion and is expected to reach USD 19.32 billion by 2033, capturing 81.45% of the total market share. The growing involvement of the private sector, projected to grow from USD 2.89 billion to USD 4.40 billion, indicates a temporary but increasing trend towards privatization within defense sectors.

Land Based Military Electro Optical And Infrared Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Land Based Military Electro Optical And Infrared Systems Industry

Lockheed Martin:

A leader in defense technology, contributing significantly through advanced electro-optical sensor systems and integrated defense platforms.Raytheon Technologies:

Specializes in defense and aerospace systems, providing innovative infrared systems for military applications.Thales Group:

Involved in developing a wide range of military electro-optical systems, focusing on enhanced situational awareness capabilities.Northrop Grumman:

A global aerospace and defense technology company known for its advanced sensing systems and operational systems integration.We're grateful to work with incredible clients.

FAQs

What is the market size of Land Based Military Electro Optical and Infrared Systems?

The global market size for Land Based Military Electro Optical and Infrared Systems is estimated at $15.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.2% leading up to 2033.

What are the key market players or companies in this industry?

Key players in the Land Based Military Electro Optical and Infrared Systems market include major defense contractors and technology firms, though specific company names are subject to market dynamics and updates.

What are the primary factors driving the growth in the industry?

Growth in this industry is driven by advancements in technology, increasing defense budgets globally, and the rising focus on surveillance and reconnaissance capabilities.

Which region is the fastest Growing in the market?

The fastest-growing region for Land Based Military Electro Optical and Infrared Systems is projected to be Europe, with market growth from $4.95 billion in 2023 to $7.53 billion by 2033.

Does ConsaInsights provide customized market report data for this industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Land Based Military Electro Optical and Infrared Systems industry.

What deliverables can I expect from this market research project?

Deliverables include detailed market analysis, segmentation insights, key growth drivers, and forecasts, providing a comprehensive understanding of the market landscape.

What are the market trends of Land Based Military Electro Optical and Infrared Systems?

Market trends include increased investment in border security, urban warfare technologies, and an emphasis on advanced surveillance and targeting systems, reflecting the needs of modern military operations.