Land Based Smart Weapons Market Report

Published Date: 03 February 2026 | Report Code: land-based-smart-weapons

Land Based Smart Weapons Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Land Based Smart Weapons market, covering market size, growth forecasts, industry insights, and regional dynamics from 2023 to 2033.

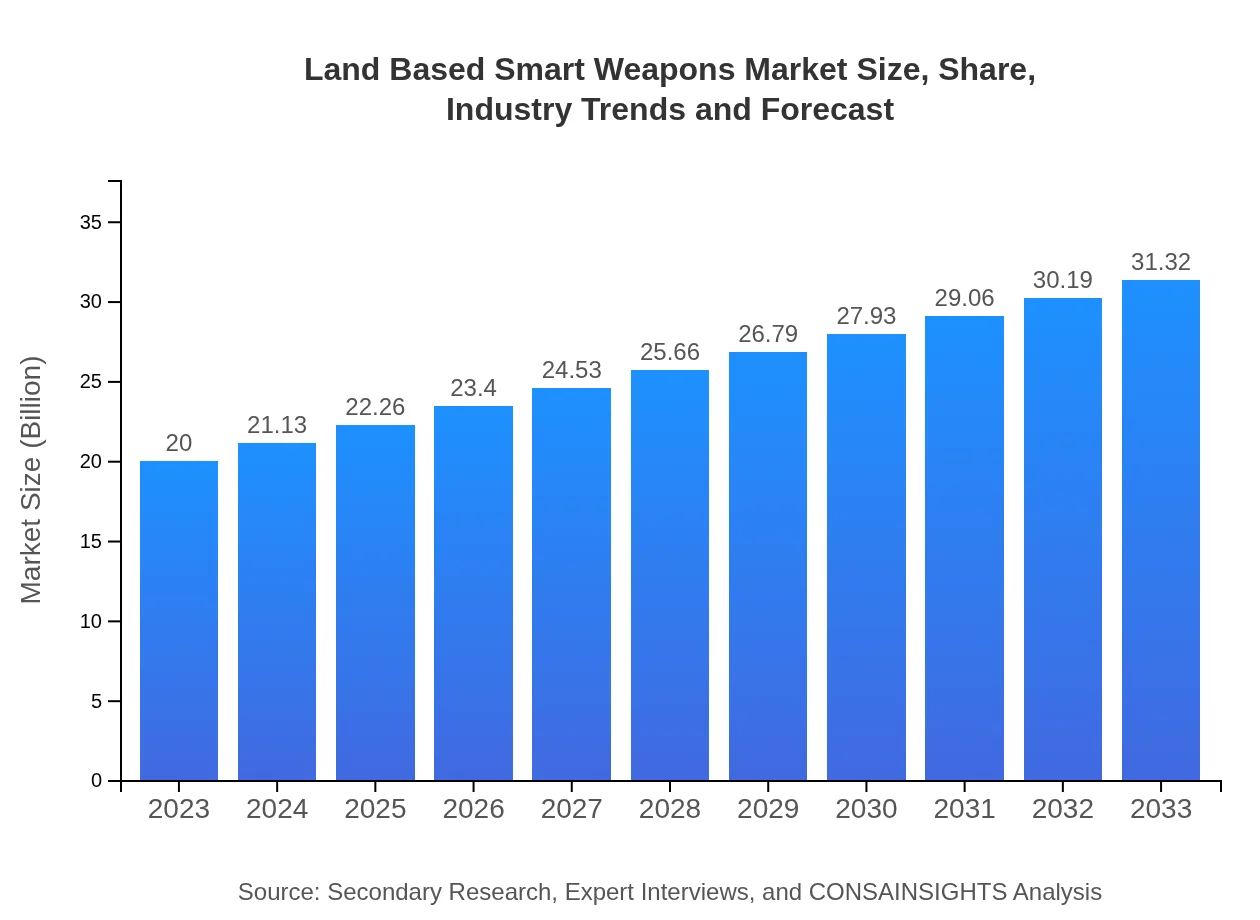

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $31.32 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, BAE Systems, Northrop Grumman, General Dynamics |

| Last Modified Date | 03 February 2026 |

Land Based Smart Weapons Market Overview

Customize Land Based Smart Weapons Market Report market research report

- ✔ Get in-depth analysis of Land Based Smart Weapons market size, growth, and forecasts.

- ✔ Understand Land Based Smart Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Land Based Smart Weapons

What is the Market Size & CAGR of Land Based Smart Weapons market in 2023?

Land Based Smart Weapons Industry Analysis

Land Based Smart Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Land Based Smart Weapons Market Analysis Report by Region

Europe Land Based Smart Weapons Market Report:

In Europe, the Land Based Smart Weapons market is set to increase from $5.87 billion in 2023 to $9.19 billion by 2033. This growth is driven by heightened geopolitical tensions, particularly in Eastern Europe, and initiatives to enhance collective defense capabilities among NATO members.Asia Pacific Land Based Smart Weapons Market Report:

The Asia Pacific region is witnessing significant investments in defense modernization, with the Land Based Smart Weapons market expected to grow from $3.53 billion in 2023 to $5.53 billion by 2033. Countries like India and China are focusing on enhancing their military capabilities, prioritizing the acquisition of advanced weapon systems and technologies.North America Land Based Smart Weapons Market Report:

The North American market for Land Based Smart Weapons is forecasted to grow from $7.75 billion in 2023 to $12.14 billion by 2033. The U.S. military remains a significant contributor to market growth, with ongoing investments in next-generation weapon systems, focusing on precision and technological superiority.South America Land Based Smart Weapons Market Report:

In South America, the Land Based Smart Weapons market is poised to grow from $1.58 billion in 2023 to $2.47 billion by 2033. Increasing regional tensions and rising defense budgets in countries such as Brazil and Colombia are driving investments in smart weapon systems, aiming to improve national security and military effectiveness.Middle East & Africa Land Based Smart Weapons Market Report:

The Middle East and Africa market are expected to expand from $1.28 billion in 2023 to $2.00 billion by 2033. Countries in this region are investing heavily in military modernization programs, established procurement policies, and engagements with defense contractors to acquire advanced weaponry solutions.Tell us your focus area and get a customized research report.

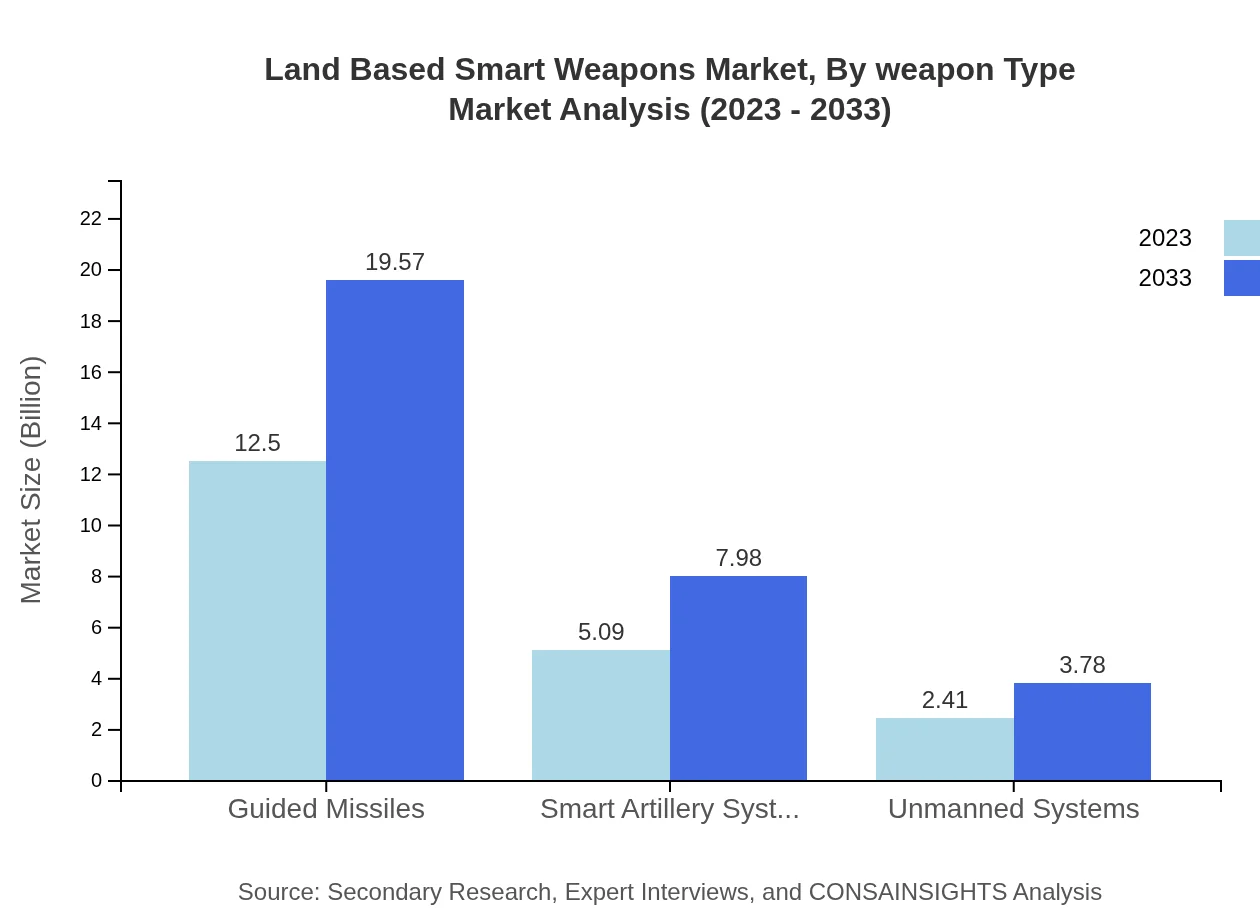

Land Based Smart Weapons Market Analysis By Weapon Type

The Land-Based Smart Weapons market, segmented by weapon type, is dominated by ground vehicles, contributing significantly to the market size. In 2023, the segment accounted for $12.50 billion, with expectations to reach $19.57 billion by 2033. Guided missiles and smart artillery systems also represent substantial portions of the market, reflecting the trend towards higher efficiency in military operations.

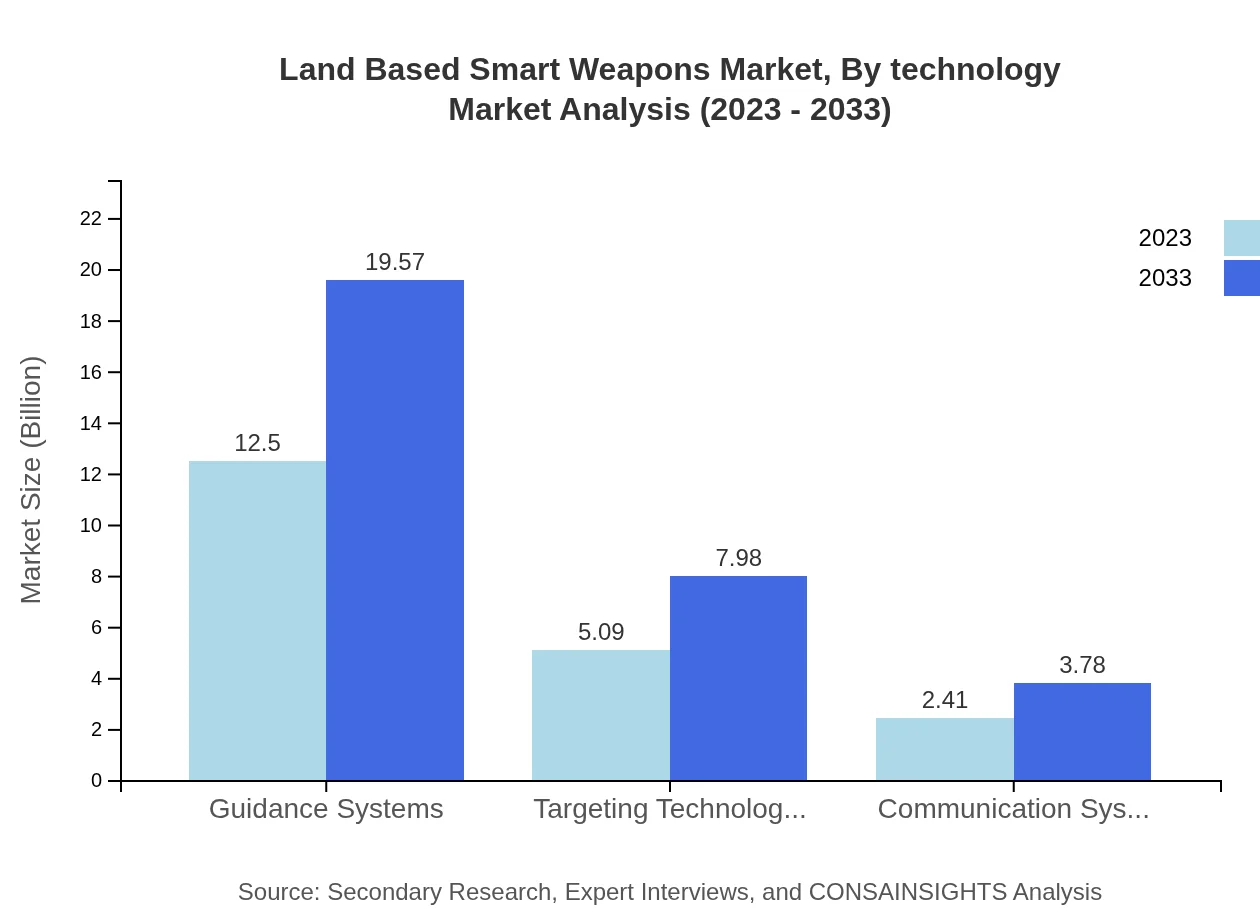

Land Based Smart Weapons Market Analysis By Technology

By technology, the market is being driven by advancements in guidance systems and targeting technologies, enabling precision strikes with minimal collateral damage. The growth from $5.09 billion in 2023 to $7.98 billion by 2033 highlights the industry's focus on incorporating smarter, more intuitive technologies into land warfare.

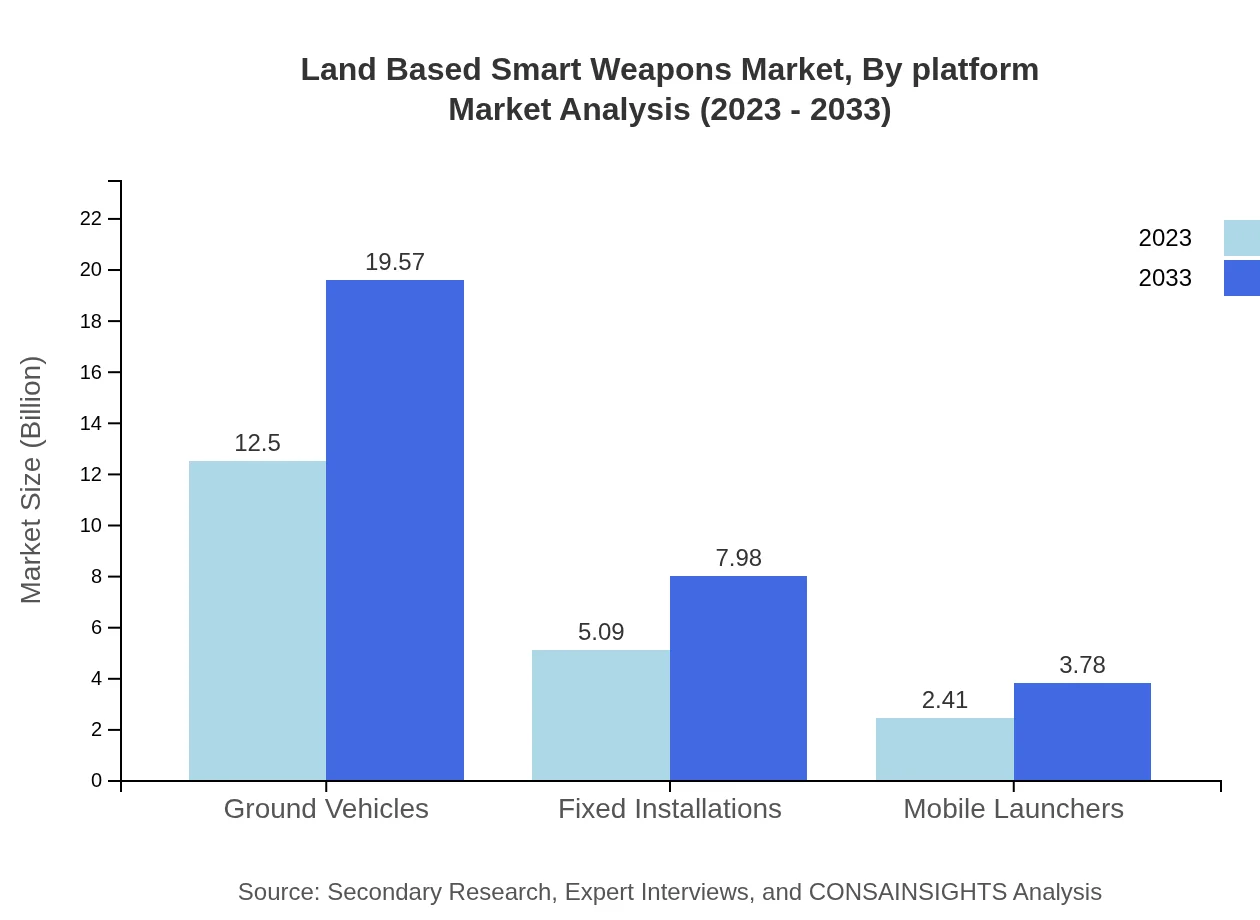

Land Based Smart Weapons Market Analysis By Platform

When analyzed by platform, the land-based smart weapons market indicates a strong presence of ground vehicles, with a market size of $12.50 billion in 2023, projected to increase to $19.57 billion by 2033. The emphasis on enhancing mobile platforms underscores the demand for adaptable and versatile weapon systems.

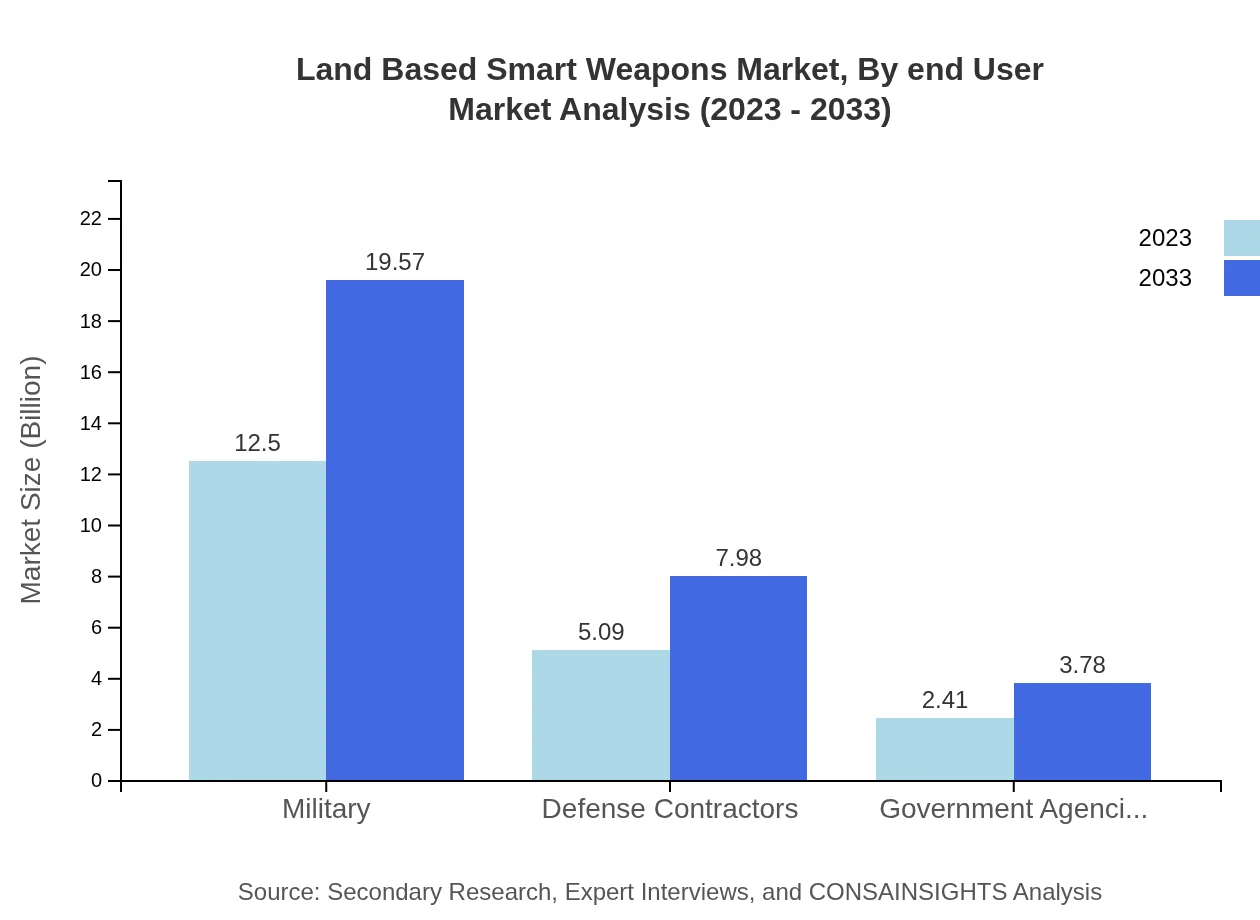

Land Based Smart Weapons Market Analysis By End User

The primary end-users of land-based smart weapons include military agencies and contractors, with military usage estimated at $12.50 billion in 2023 and anticipated to grow significantly as modernization efforts continue. The role of defense contractors remains vital in developing advanced technologies to support the military's evolving needs.

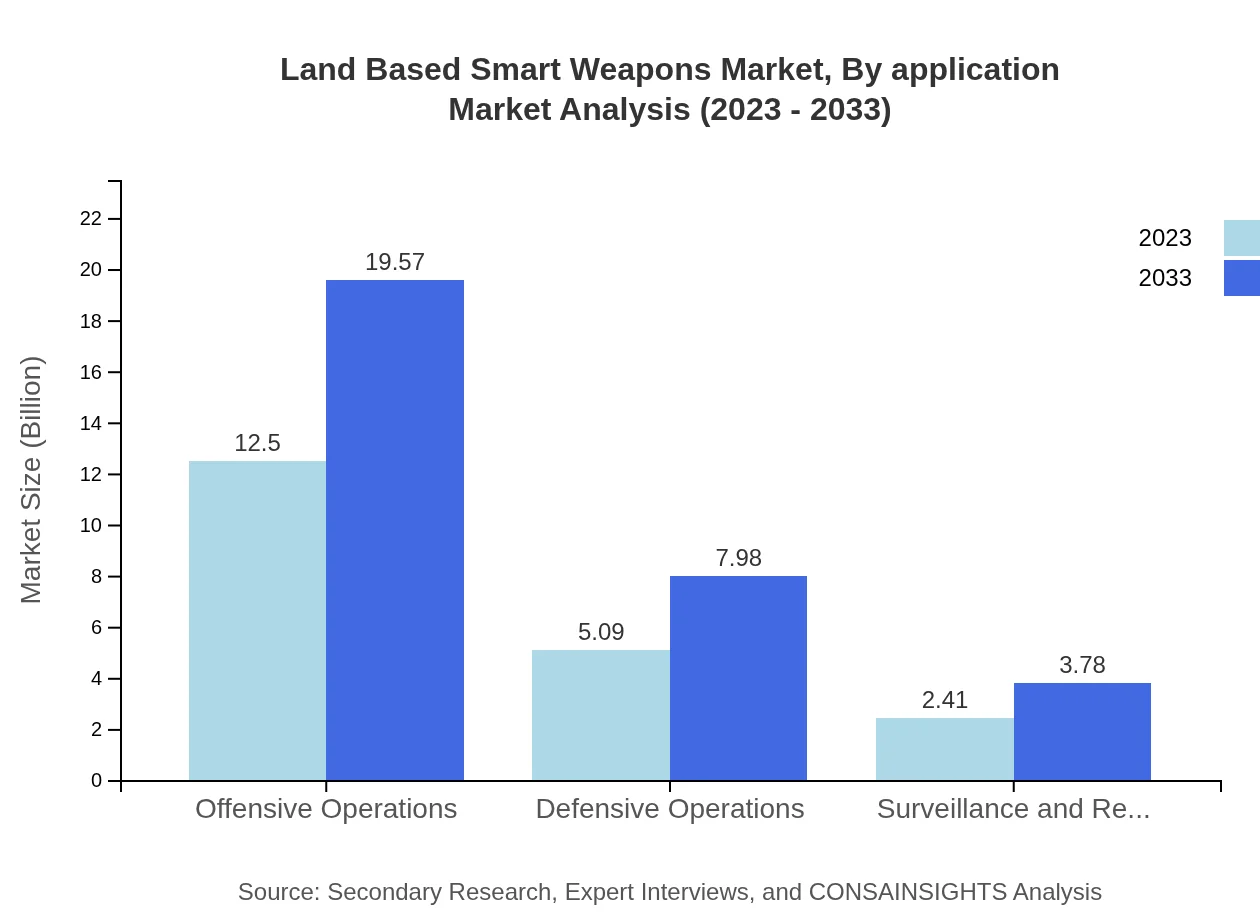

Land Based Smart Weapons Market Analysis By Application

The applications for land-based smart weapons span offensive and defensive operations, with the market for offensive operations potentially reaching $12.50 billion in 2023. Surveillance and reconnaissance applications also see growth, emphasizing the broader strategic use of smart weaponry in modern military contexts.

Land Based Smart Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Land Based Smart Weapons Industry

Lockheed Martin:

Lockheed Martin is a leading American defense contractor that develops and manufactures advanced military systems, including missile systems and smart weapon technologies.Raytheon Technologies:

Raytheon is recognized for its innovations in missile systems and precision-guided munitions, playing a vital role in the advancement of land-based smart weapons.BAE Systems:

BAE Systems is a multinational defense, security, and aerospace company that provides advanced weapon systems and supports militaries worldwide.Northrop Grumman:

Northrop Grumman specializes in aerospace and defense technology, focusing on developing unmanned systems and advanced weaponry for ground forces.General Dynamics:

General Dynamics develops a wide range of defense products, including land systems, focusing on enhancing the capabilities of military forces globally.We're grateful to work with incredible clients.

FAQs

What is the market size of land Based Smart Weapons?

The global land-based smart weapons market is valued at approximately $20 billion in 2023, with a projected CAGR of 4.5% over the next decade, highlighting a steady growth trajectory driven by military advancements.

What are the key market players or companies in this land Based Smart Weapons industry?

Prominent players in the land-based smart weapons market include major defense contractors and technology firms specializing in military applications. These organizations are crucial for innovation and development in this sector.

What are the primary factors driving the growth in the land Based Smart Weapons industry?

Growth in the land-based smart weapons sector is driven by advances in technology, rising defense budgets, increasing geopolitical tensions, and the demand for precise and effective military equipment.

Which region is the fastest Growing in the land Based Smart Weapons?

North America is currently the fastest-growing region, projected to expand from $7.75 billion in 2023 to $12.14 billion by 2033, spurred by increased military spending and the modernization of defense systems.

Does ConsaInsights provide customized market report data for the land Based Smart Weapons industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the land-based smart weapons industry, ensuring relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this land Based Smart Weapons market research project?

Deliverables include detailed market analysis reports, trends and forecasts, competitive landscape assessments, and comprehensive regional insights, all designed to support informed business strategies.

What are the market trends of land Based Smart Weapons?

Key trends in the land-based smart weapons market include increasing automation, integration of AI technologies, and a shift towards unmanned systems, reflecting changes in warfare and defense strategies.