Land Survey Equipment Market Report

Published Date: 31 January 2026 | Report Code: land-survey-equipment

Land Survey Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Land Survey Equipment market, including growth trends, market segmentation, and regional insights. It covers the period from 2023 to 2033, offering crucial data for stakeholders and decision-makers.

| Metric | Value |

|---|---|

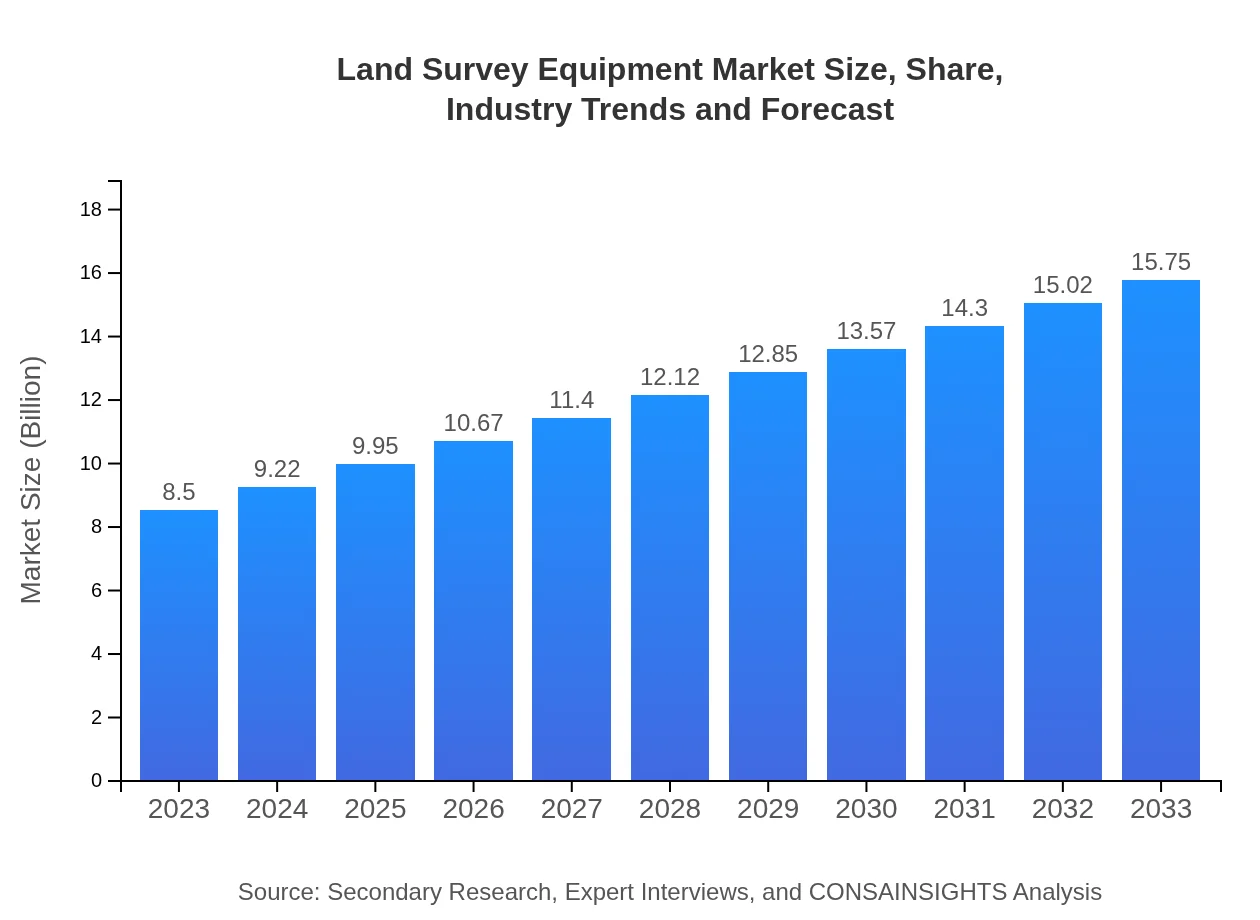

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | Leica Geosystems, Topcon Corporation, Trimble Inc., Sokkia |

| Last Modified Date | 31 January 2026 |

Land Survey Equipment Market Overview

Customize Land Survey Equipment Market Report market research report

- ✔ Get in-depth analysis of Land Survey Equipment market size, growth, and forecasts.

- ✔ Understand Land Survey Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Land Survey Equipment

What is the Market Size & CAGR of Land Survey Equipment market in 2023?

Land Survey Equipment Industry Analysis

Land Survey Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Land Survey Equipment Market Analysis Report by Region

Europe Land Survey Equipment Market Report:

The European market is forecasted to grow from $2.58 billion in 2023 to $4.78 billion by 2033. The emphasis on sustainability and environmental assessments is driving the demand for sophisticated surveying tools, particularly in the construction and environmental sectors across Western Europe.Asia Pacific Land Survey Equipment Market Report:

In Asia Pacific, the Land Survey Equipment market is projected to grow from $1.57 billion in 2023 to $2.90 billion by 2033. The region is witnessing a surge in infrastructure projects driven by urbanization and government initiatives, particularly in countries like India and China, which are investing heavily in road and rail networks.North America Land Survey Equipment Market Report:

North America dominates the Land Survey Equipment market with a size of $3.20 billion in 2023, anticipated to reach $5.92 billion by 2033. The growth is attributed to advanced technological integration and a strong focus on infrastructure resilience and modernization due to government funding and private investments.South America Land Survey Equipment Market Report:

The South American market is expected to grow from $0.48 billion in 2023 to $0.89 billion by 2033. The demand is primarily fueled by mining activities and real estate development. Brazil and Argentina are at the forefront of these developments, focusing on improving their surveying capabilities.Middle East & Africa Land Survey Equipment Market Report:

The Middle East and Africa market is projected to grow from $0.68 billion in 2023 to $1.26 billion by 2033. Significant investment in infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, along with urban expansion projects, is expected to boost equipment adoption in this region.Tell us your focus area and get a customized research report.

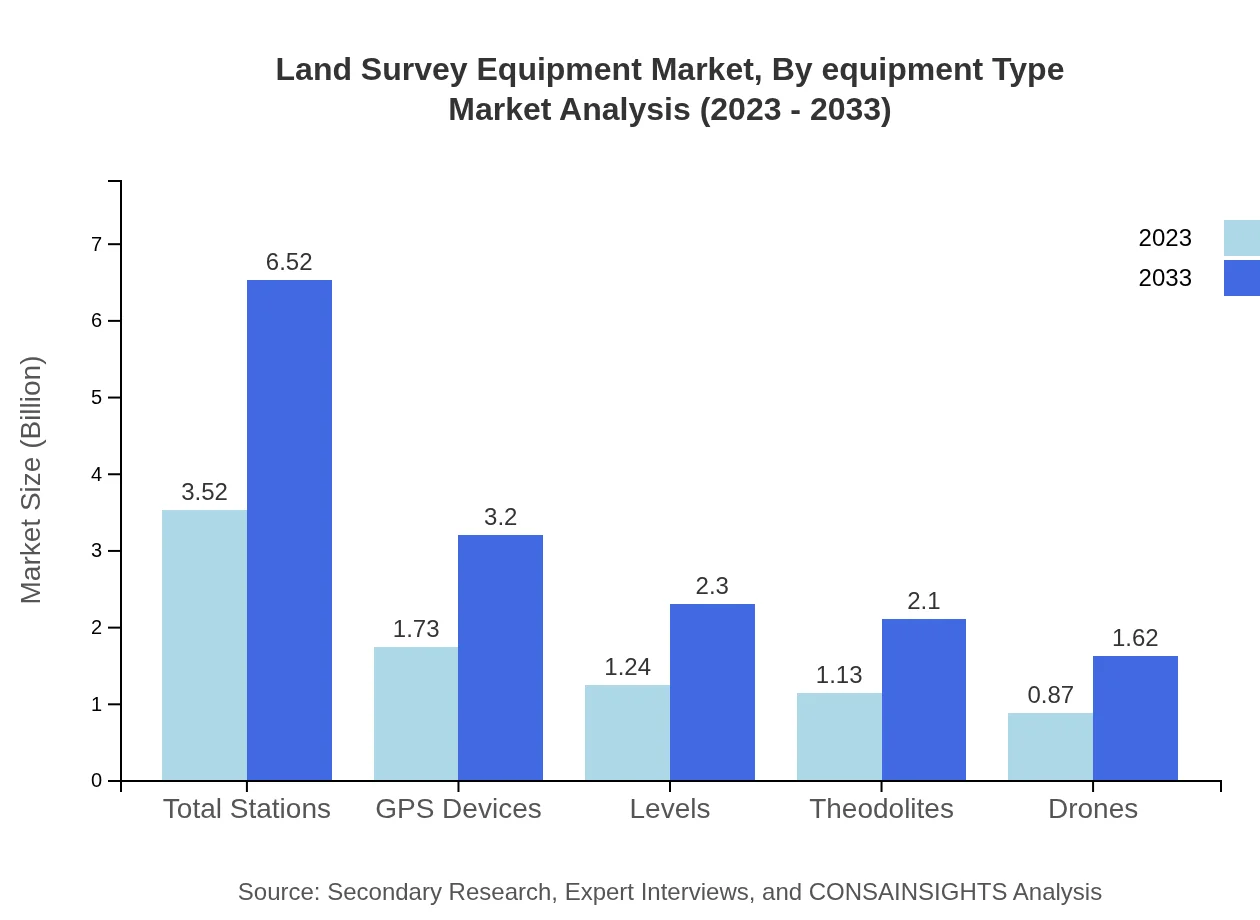

Land Survey Equipment Market Analysis By Equipment Type

In 2023, the total stations dominate the market segment with a size of $3.52 billion, expected to rise to $6.52 billion by 2033. GPS devices account for $1.73 billion currently, forecasted to reach $3.20 billion. Other equipment such as levels and theodolites play important roles, with levels at $1.24 billion and theodolites at $1.13 billion in 2023.

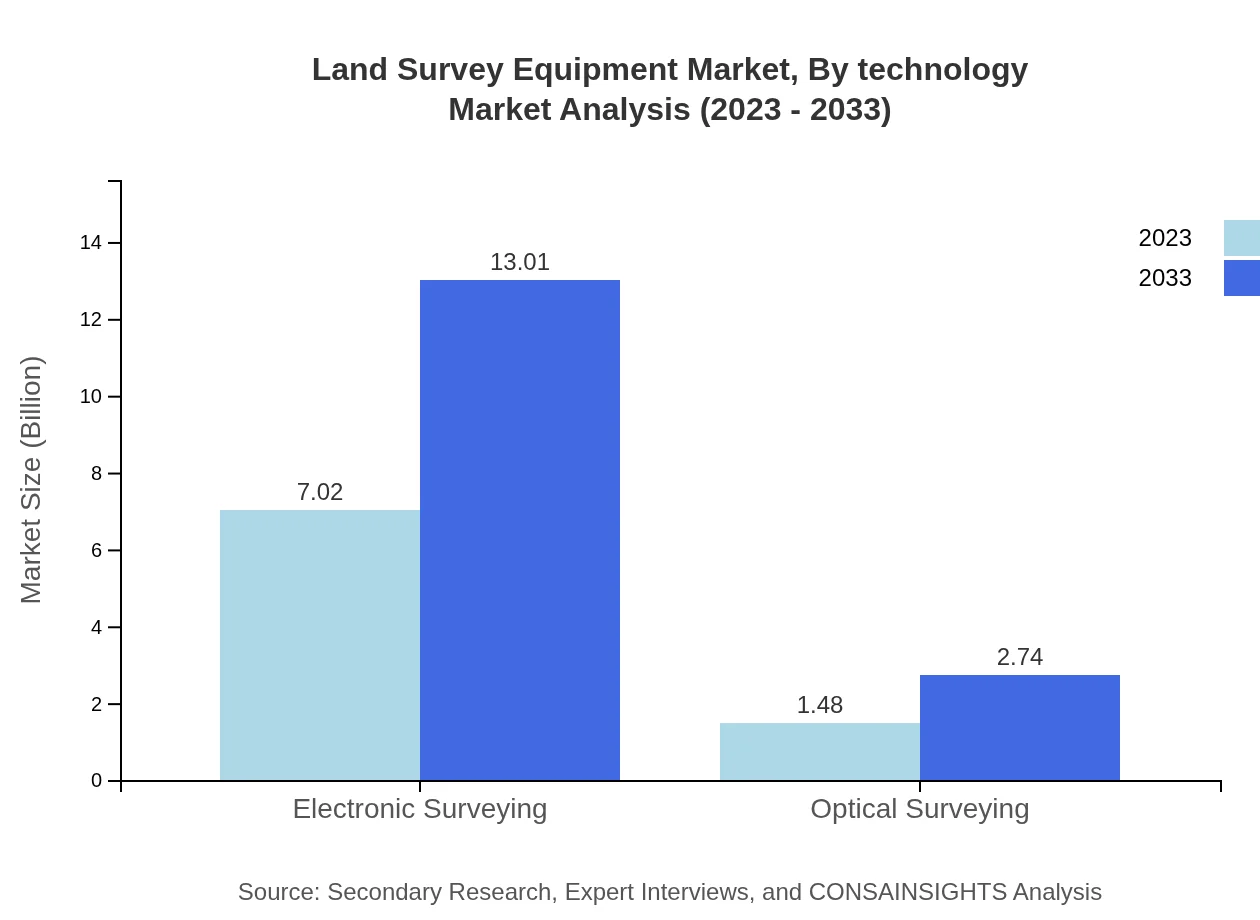

Land Survey Equipment Market Analysis By Technology

Electronic surveying technology leads the market with an 82.63% share in 2023, dominating with $7.02 billion and anticipated to grow to $13.01 billion. Optical surveying holds 17.37% of the market, valued at $1.48 billion in 2023. The preference for electronic surveys reflects the demand for accuracy and efficiency in data processing.

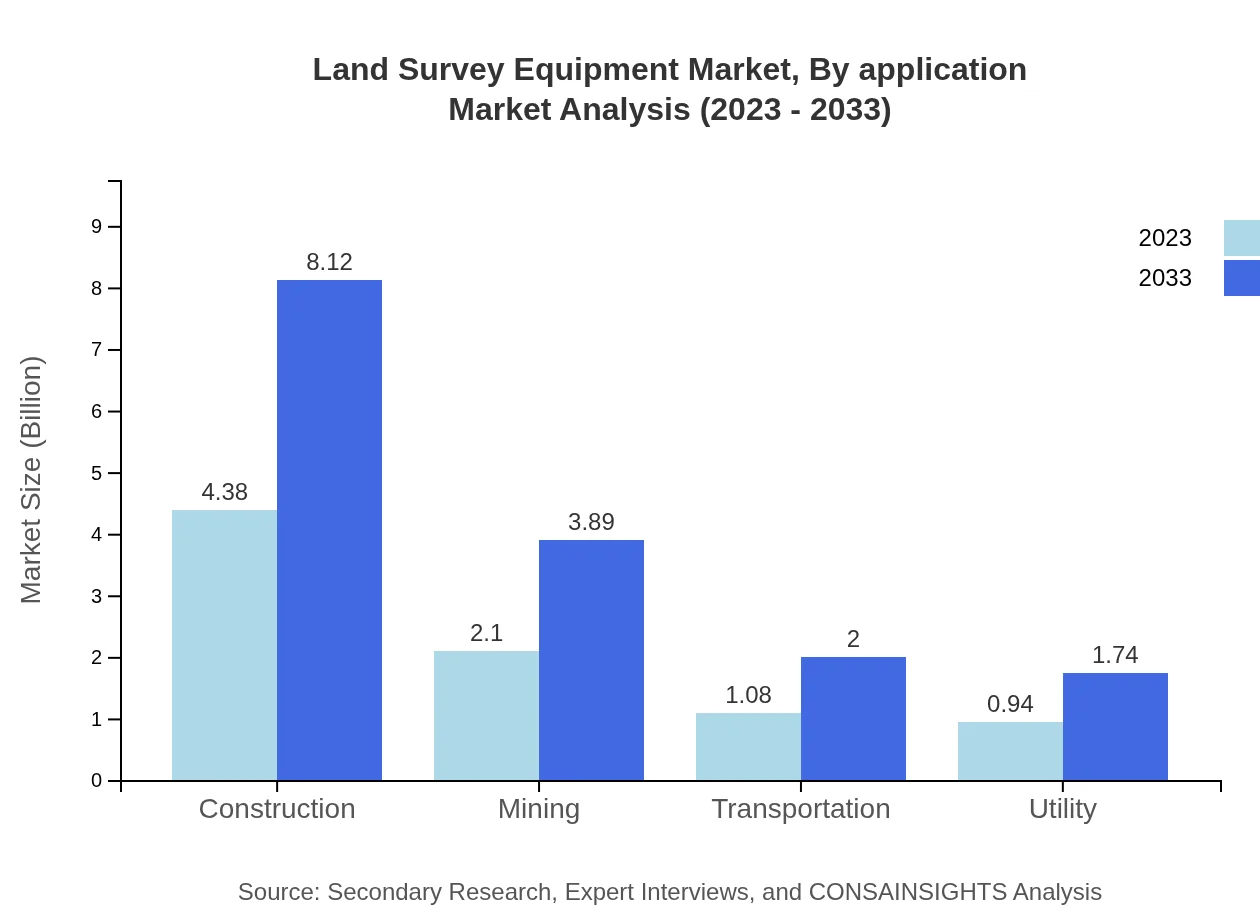

Land Survey Equipment Market Analysis By Application

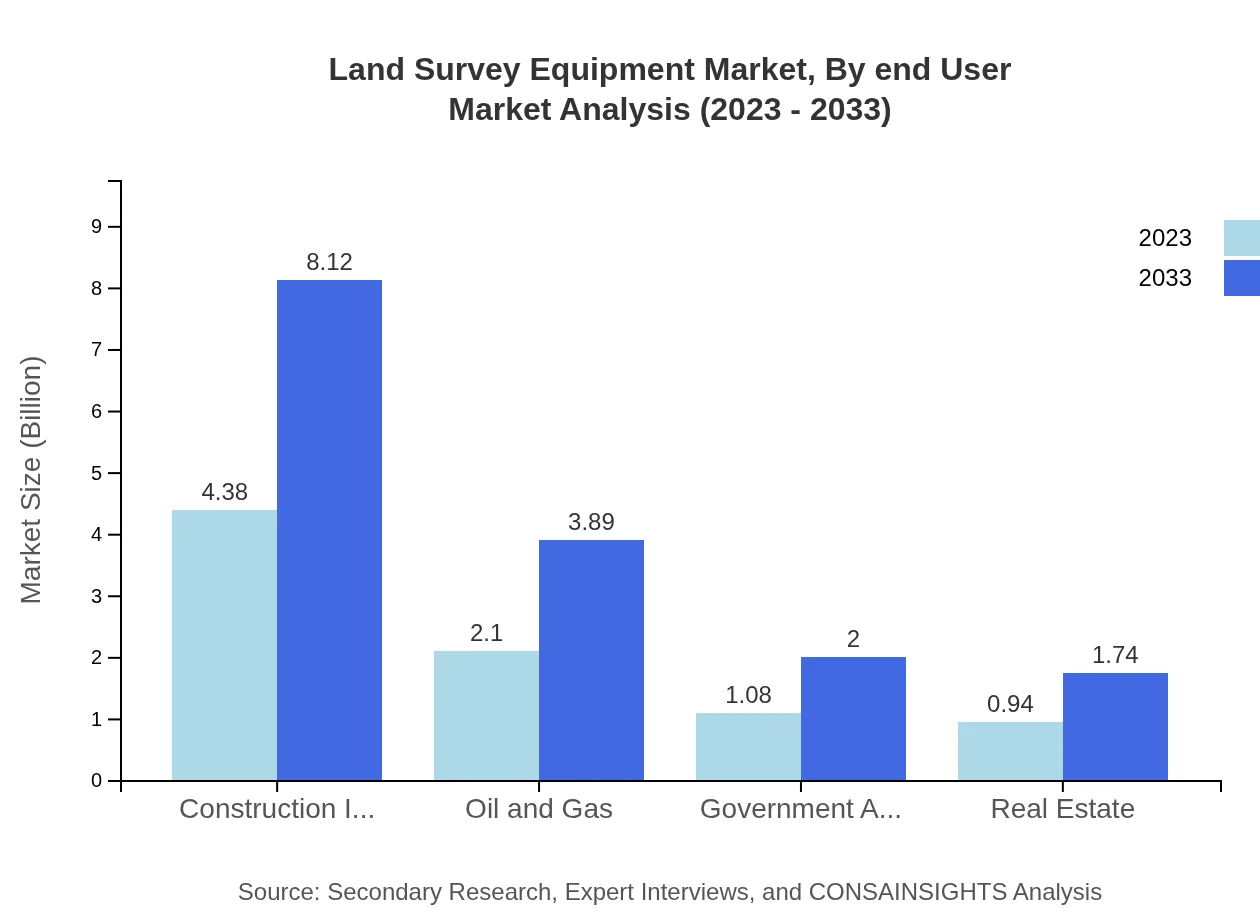

The construction sector is the largest application area, projected to expand from $4.38 billion in 2023 to $8.12 billion in 2033, maintaining a 51.56% market share. The mining industry follows, with a size of $2.10 billion in 2023, growing to $3.89 billion, representing a 24.68% share.

Land Survey Equipment Market Analysis By End User

Key end-users include construction firms, government agencies, and oil and gas companies. The government sector, with a current market size of $1.08 billion, is poised to grow to $2 billion, equating to a 12.68% share by 2033. The real estate sector, while smaller, still maintains relevance, starting at $0.94 billion and possibly reaching $1.74 billion.

Land Survey Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Land Survey Equipment Industry

Leica Geosystems:

A part of Hexagon AB, Leica Geosystems is renowned for its innovative surveying and geospatial solutions, focusing heavily on digital information management.Topcon Corporation:

A leading company in precision measurement and geospatial solutions, Topcon provides superior surveying technology for a wide range of applications.Trimble Inc.:

Trimble specializes in advanced positioning solutions and engineering software, offering a comprehensive portfolio of land survey equipment and services.Sokkia:

Sokkia is known for high-performance surveying instruments, particularly in total stations and GPS solutions, addressing diverse customer requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of land Survey Equipment?

The global land survey equipment market is projected to reach a size of approximately $8.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from its current valuation.

What are the key market players or companies in this land Survey Equipment industry?

Leading companies in the land survey equipment market include Trimble, Leica Geosystems, Topcon, GIS Surveyor, and Sokkia, which dominate the landscape due to their innovative technology and comprehensive product offerings.

What are the primary factors driving the growth in the land Survey Equipment industry?

Key growth drivers for the land survey equipment industry encompass rising construction activities, advancements in surveying technologies, and increasing investments in infrastructure development and urban planning initiatives worldwide.

Which region is the fastest Growing in the land Survey Equipment?

The North American region is the fastest-growing area in the land survey equipment market, expected to increase from $3.20 billion in 2023 to $5.92 billion by 2033, fueled by technological advancements and infrastructural needs.

Does ConsaInsights provide customized market report data for the land Survey Equipment industry?

Yes, Consainsights offers tailored market report data for the land survey equipment industry, allowing clients to obtain insights specific to their needs and objectives, encompassing various parameters.

What deliverables can I expect from this land Survey Equipment market research project?

Deliverables include detailed market analysis reports, growth forecasts, competitive landscape assessment, segment insights, and regional analysis, providing comprehensive data-driven insights for informed decision-making.

What are the market trends of land Survey Equipment?

Current trends in the land survey equipment market include the integration of AI and automation, increased adoption of drones and GPS technology, and a surge in demand for electronic surveying solutions.