Large Caliber Ammunition Market Report

Published Date: 03 February 2026 | Report Code: large-caliber-ammunition

Large Caliber Ammunition Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Large Caliber Ammunition market from 2023 to 2033, providing a thorough analysis of market trends, growth factors, and regional dynamics. It offers crucial insights, forecasts, and an overview of competitive landscapes in the industry.

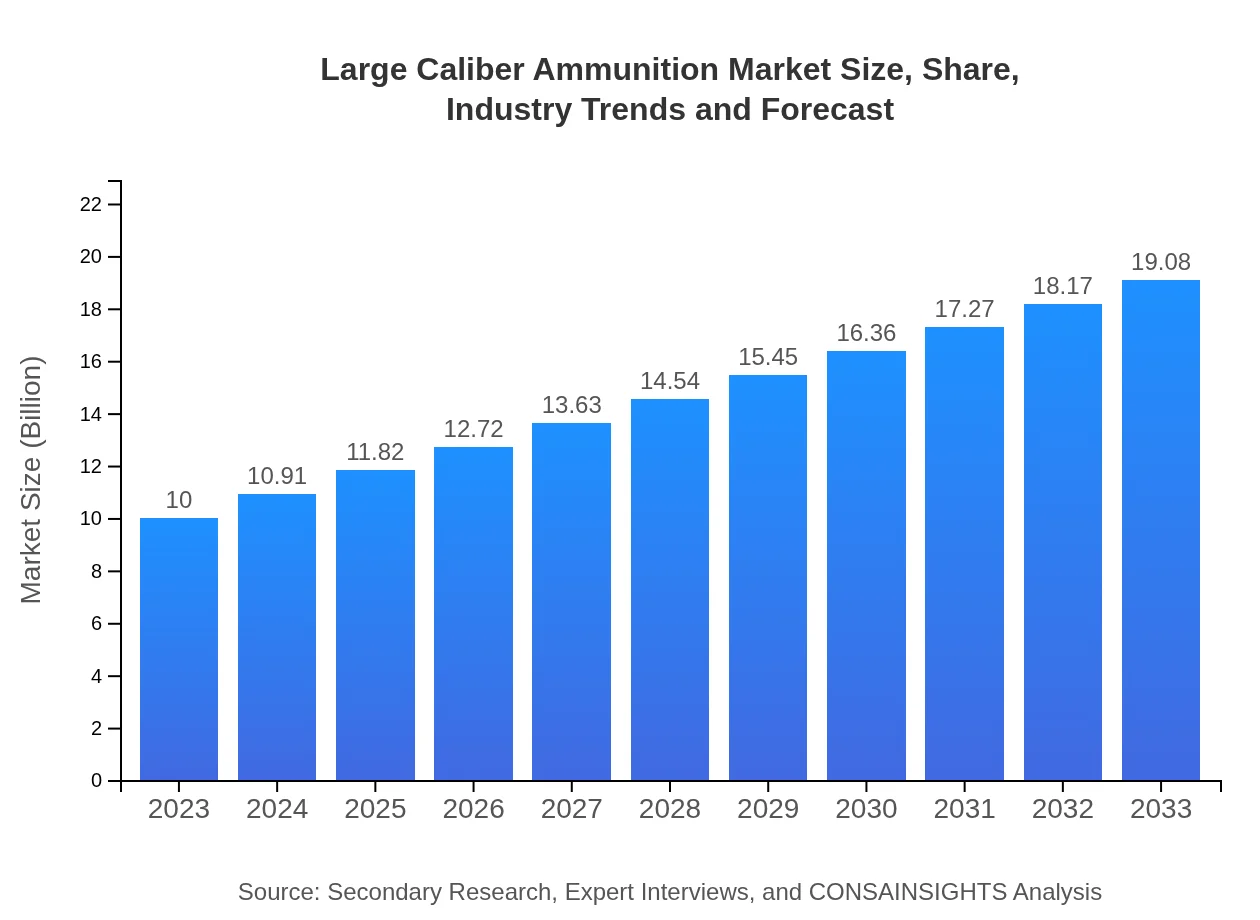

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Northrop Grumman, BAE Systems, General Dynamics, Rheinmetall AG |

| Last Modified Date | 03 February 2026 |

Large Caliber Ammunition Market Overview

Customize Large Caliber Ammunition Market Report market research report

- ✔ Get in-depth analysis of Large Caliber Ammunition market size, growth, and forecasts.

- ✔ Understand Large Caliber Ammunition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Large Caliber Ammunition

What is the Market Size & CAGR of Large Caliber Ammunition market in 2023 and 2033?

Large Caliber Ammunition Industry Analysis

Large Caliber Ammunition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Large Caliber Ammunition Market Analysis Report by Region

Europe Large Caliber Ammunition Market Report:

The European market for Large Caliber Ammunition is anticipated to expand from $3.10 billion in 2023 to $5.92 billion by 2033, reflecting growing security concerns and NATO's commitment to defense spending.Asia Pacific Large Caliber Ammunition Market Report:

The Asia Pacific Large Caliber Ammunition market is projected to grow from $1.89 billion in 2023 to $3.61 billion by 2033, driven by increased militarization and defense initiatives, particularly in countries like India and China.North America Large Caliber Ammunition Market Report:

North America remains a dominant player, with the market growing from $3.51 billion in 2023 to $6.70 billion by 2033. The U.S. government's substantial defense budget continues to propel this growth.South America Large Caliber Ammunition Market Report:

In South America, the market size is estimated to increase from $0.43 billion in 2023 to $0.81 billion by 2033. Demand is primarily driven by internal security challenges and the need for modernization of the defense forces.Middle East & Africa Large Caliber Ammunition Market Report:

The Middle East and Africa market is expected to rise from $1.06 billion in 2023 to $2.03 billion by 2033, influenced by geopolitical tensions and the ongoing conflicts in various regions, which necessitate the procurement of advanced ammunition.Tell us your focus area and get a customized research report.

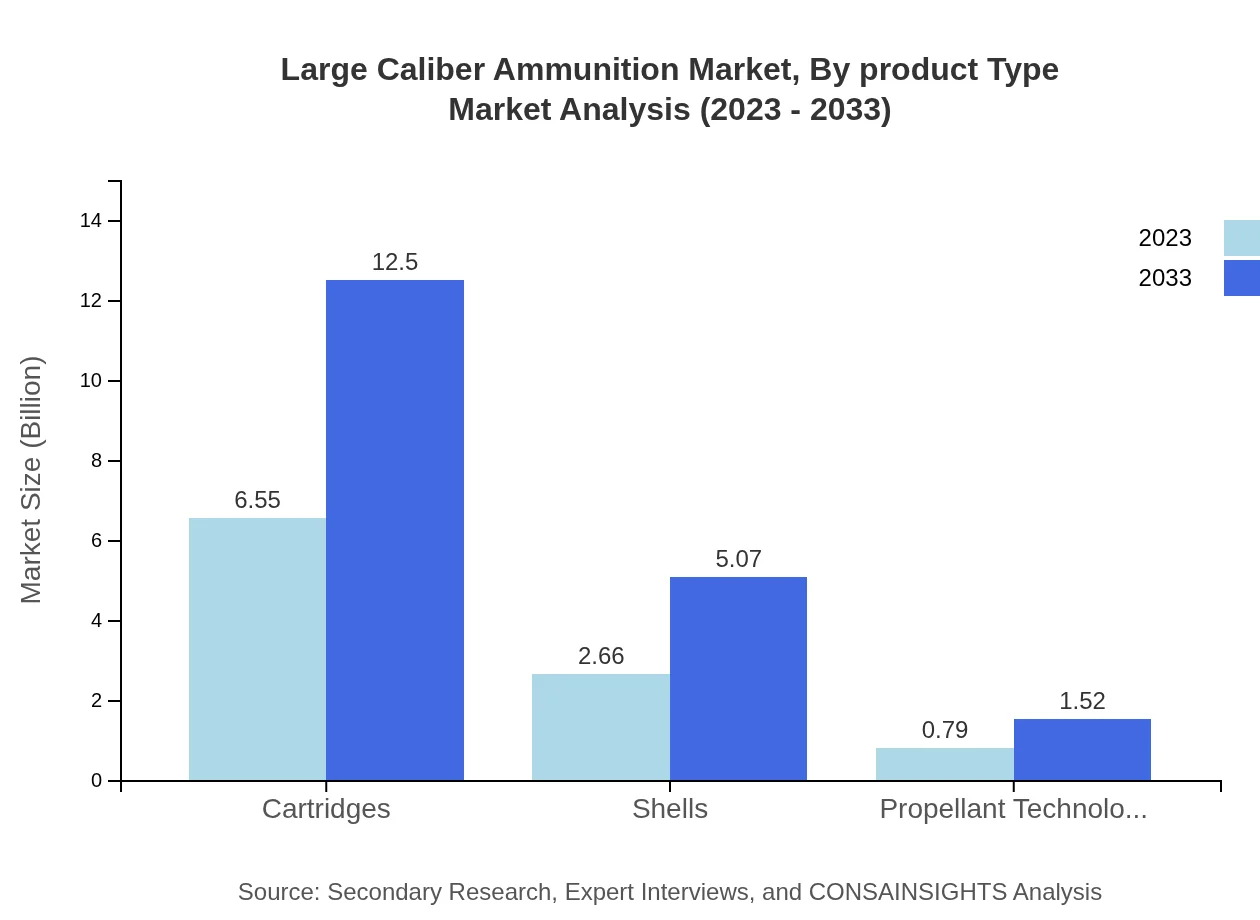

Large Caliber Ammunition Market Analysis By Product Type

Within the product type segmentation, cartridges dominate with a market share of 65.48% in 2023, which is expected to remain stable by 2033. Shells hold a 26.58% share, accompanied by innovative propellant technologies, gaining a 7.94% share due to increasing demands for enhanced weapon performance.

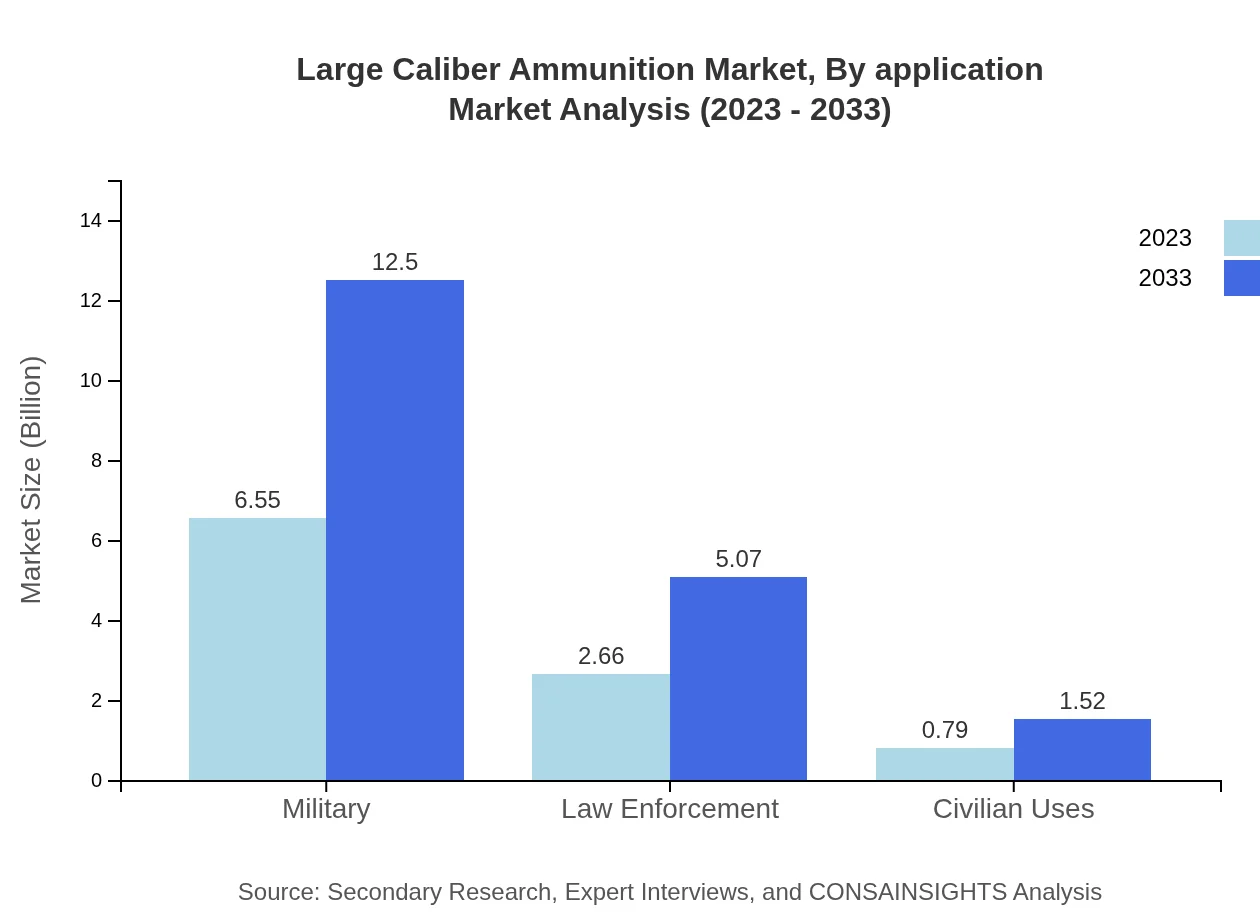

Large Caliber Ammunition Market Analysis By Application

The application segment reflects a significant market for government and military usage, accounting for 65.48% in 2023. This segment is anticipated to maintain its dominance through 2033, underpinned by escalating defense expenditures and global military engagements.

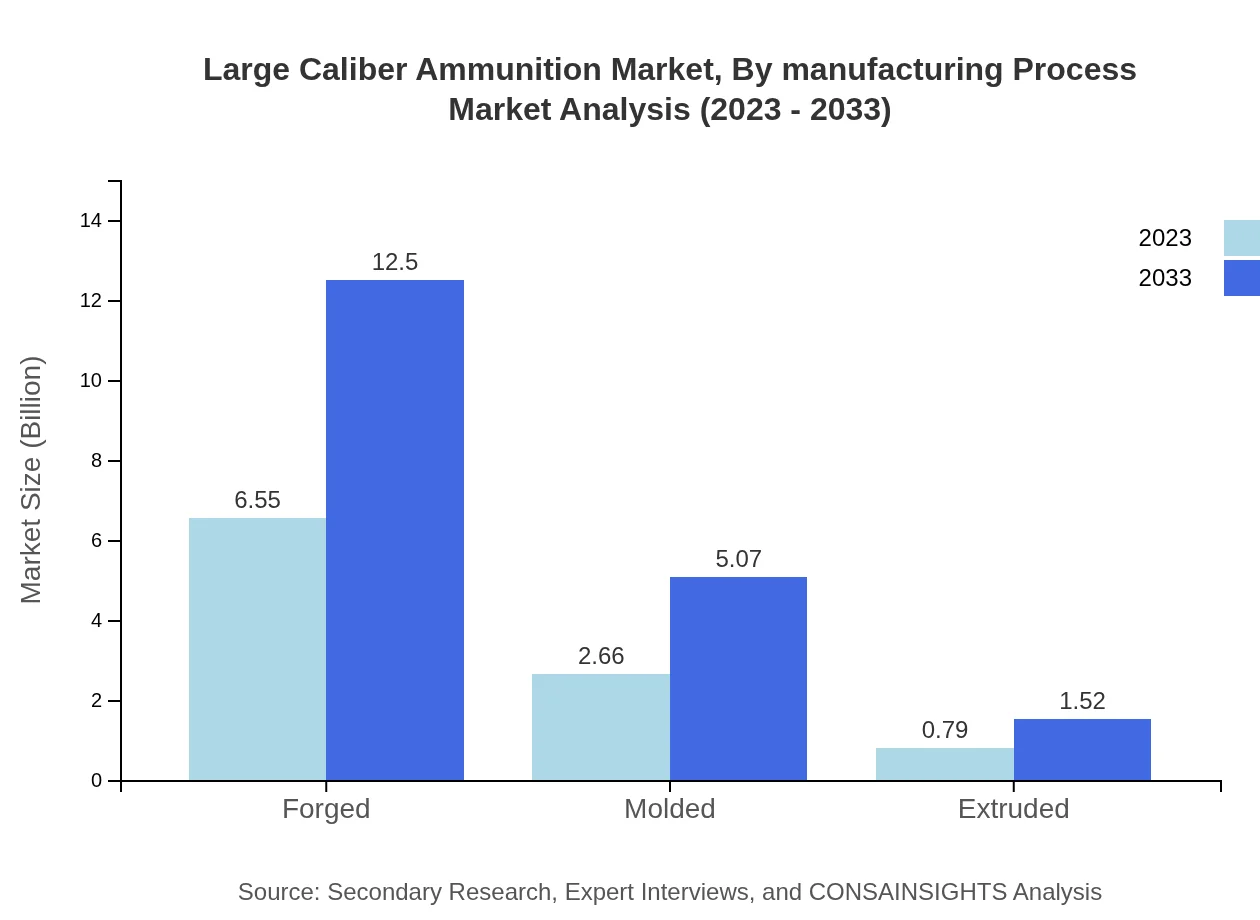

Large Caliber Ammunition Market Analysis By Manufacturing Process

Manufacturing processes are segmented into forged, molded, and extruded types. Forged ammunition retains a major share of 65.48% in 2023, with expectations of steady growth as manufacturers embrace advanced production techniques to enhance durability and performance.

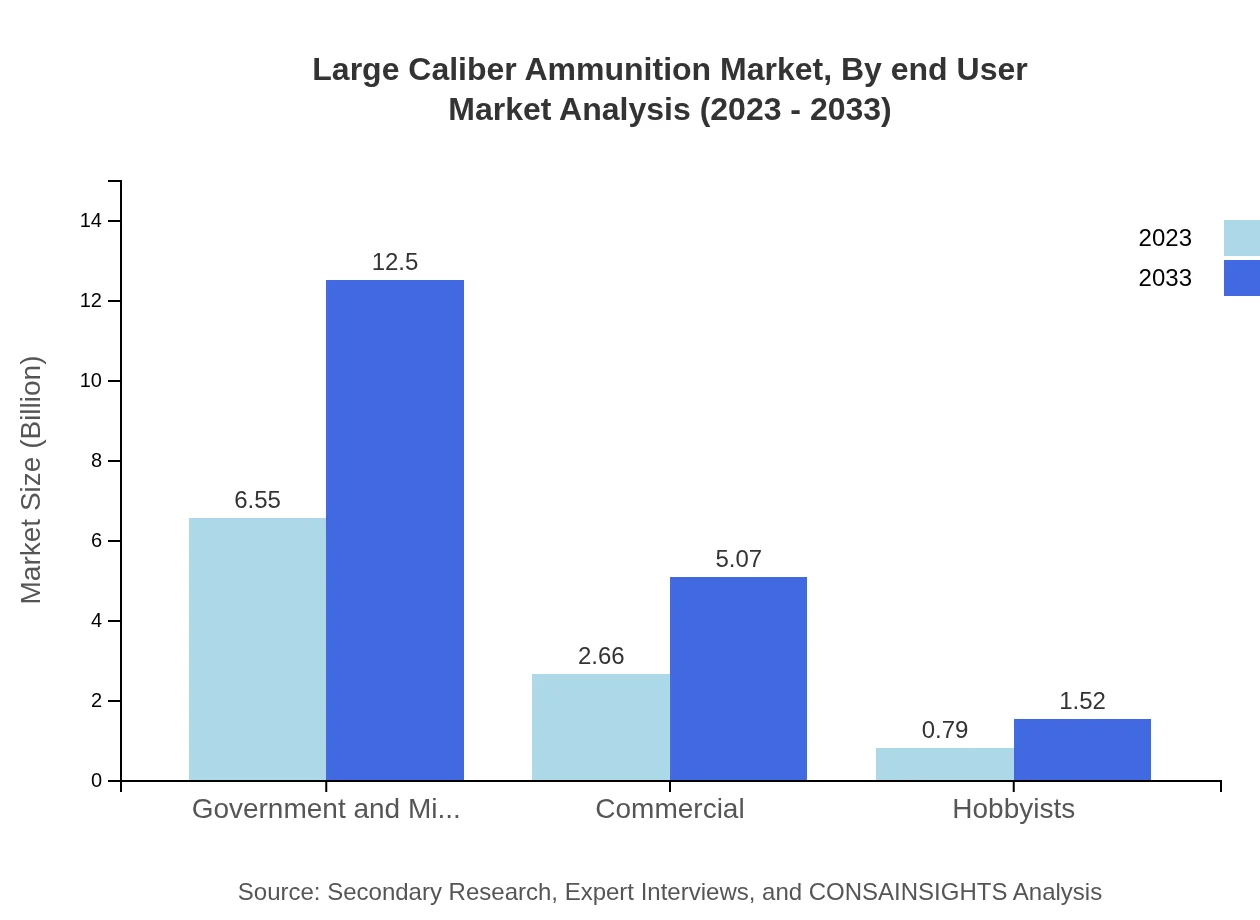

Large Caliber Ammunition Market Analysis By End User

End-user segmentation showcases military forces representing a market size of 6.55 billion starting in 2023, with projections of 12.50 billion by 2033. Law enforcement and civilian markets are also pertinent but grow at a comparatively slower rate.

Large Caliber Ammunition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Large Caliber Ammunition Industry

Northrop Grumman:

A leading aerospace and defense contractor known for innovative munition technologies including large caliber munitions for U.S. armed forces.BAE Systems:

One of the largest defense contractors globally, specializing in various types of ammunition including large caliber for armed forces and security agencies.General Dynamics:

An American aerospace and defense company, offering high-quality large caliber ammunition for military applications and known for its expanding developmental capabilities.Rheinmetall AG:

German defense contractor specializing in military technologies and leading manufacturer of large caliber munitions for NATO and European defense forces.We're grateful to work with incredible clients.

FAQs

What is the market size of large Caliber Ammunition?

The global market size of large-caliber ammunition is currently valued at approximately $10 billion. The market is expected to grow at a CAGR of 6.5%, indicating solid expansion and increasing demand in defense and commercial sectors.

What are the key market players or companies in this large Caliber Ammunition industry?

Key players in the large-caliber ammunition industry include notable companies such as Rheinmetall AG, BAE Systems, and General Dynamics. These companies are recognized for their expertise in defense and security systems, contributing significantly to market innovations.

What are the primary factors driving the growth in the large Caliber Ammunition industry?

The growth of the large-caliber ammunition industry is driven by increasing defense budgets, geopolitical tensions, advancements in ammunition technology, and rising investments in military modernization programs, especially in countries enhancing their armed forces.

Which region is the fastest Growing in the large Caliber Ammunition?

The North American region is currently the fastest-growing market for large-caliber ammunition, projected to rise from $3.51 billion in 2023 to $6.70 billion by 2033, driven by military expenditure and arms procurement.

Does Consainsights provide customized market report data for the large Caliber Ammunition industry?

Yes, Consainsights offers customized market report data for the large-caliber ammunition industry, catering to specific requirements regarding regional analysis, market segmentation, and competitive landscape tailored to client needs.

What deliverables can I expect from this large Caliber Ammunition market research project?

Deliverables from the large-caliber ammunition market research project include detailed market analysis reports, regional insights, competitive assessments, and future growth predictions, all designed to support strategic decision-making.

What are the market trends of large Caliber Ammunition?

Current trends in the large-caliber ammunition market include increased focus on smart munitions, rising collaborations among manufacturers for technological advancement, and greater emphasis on sustainability and recycling efforts within the industry.