Large Volume Parenteral Lvp Market Report

Published Date: 31 January 2026 | Report Code: large-volume-parenteral-lvp

Large Volume Parenteral Lvp Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Large Volume Parenteral (LVP) market, highlighting key trends, regional insights, market size, and growth forecasts from 2023 to 2033, including a detailed segmentation analysis and profiles of major players.

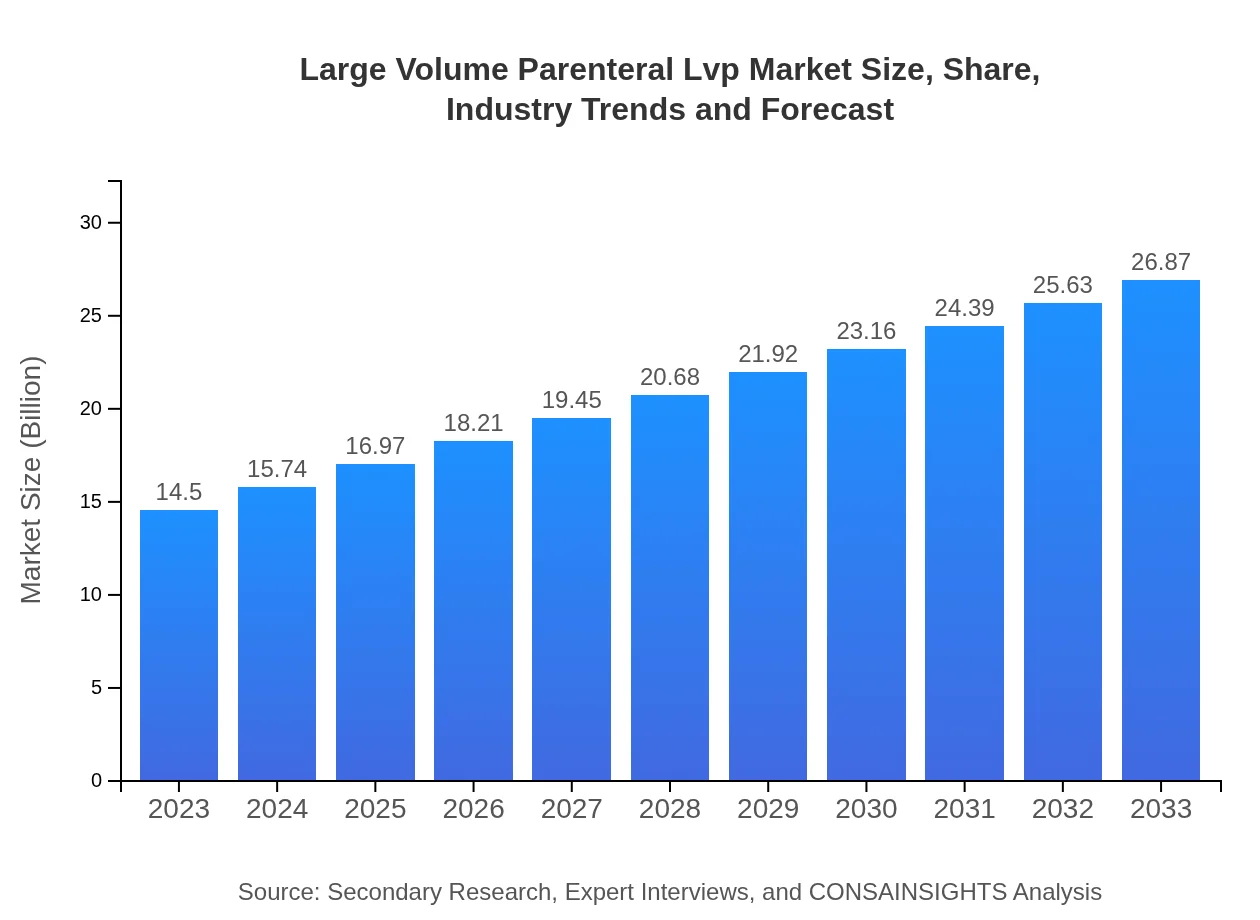

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $26.87 Billion |

| Top Companies | Baxter International Inc., Fresenius Kabi AG, Teva Pharmaceutical Industries Ltd., B. Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

Large Volume Parenteral Lvp Market Overview

Customize Large Volume Parenteral Lvp Market Report market research report

- ✔ Get in-depth analysis of Large Volume Parenteral Lvp market size, growth, and forecasts.

- ✔ Understand Large Volume Parenteral Lvp's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Large Volume Parenteral Lvp

What is the Market Size & CAGR of Large Volume Parenteral Lvp market in 2023?

Large Volume Parenteral Lvp Industry Analysis

Large Volume Parenteral Lvp Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Large Volume Parenteral Lvp Market Analysis Report by Region

Europe Large Volume Parenteral Lvp Market Report:

The European market is robust, estimated at USD 5.32 billion in 2023, and expected to expand to USD 9.86 billion by 2033. This growth reflects the emphasis on chronic disease management and innovative healthcare solutions.Asia Pacific Large Volume Parenteral Lvp Market Report:

In 2023, the Asia Pacific region's LVP market is valued at approximately USD 2.50 billion and is expected to grow to USD 4.62 billion by 2033. The rise is attributed to the increasing healthcare expenditure and the expanding pharmaceutical sector in countries like China and India.North America Large Volume Parenteral Lvp Market Report:

In North America, the market is valued at USD 4.75 billion in 2023 and anticipated to rise to USD 8.80 billion by 2033. The growth is driven by advanced healthcare systems and increasing rates of chronic diseases across the population.South America Large Volume Parenteral Lvp Market Report:

South America’s LVP market stands at USD 1.30 billion in 2023, projected to reach USD 2.41 billion by 2033. The region is notable for its growing emphasis on healthcare infrastructure improvements and increased healthcare spending.Middle East & Africa Large Volume Parenteral Lvp Market Report:

The Middle East and Africa LVP market is valued at USD 0.63 billion in 2023, projected to rise to USD 1.17 billion by 2033. Increasing investments in healthcare infrastructure and a rise in illness prevalence are key growth drivers.Tell us your focus area and get a customized research report.

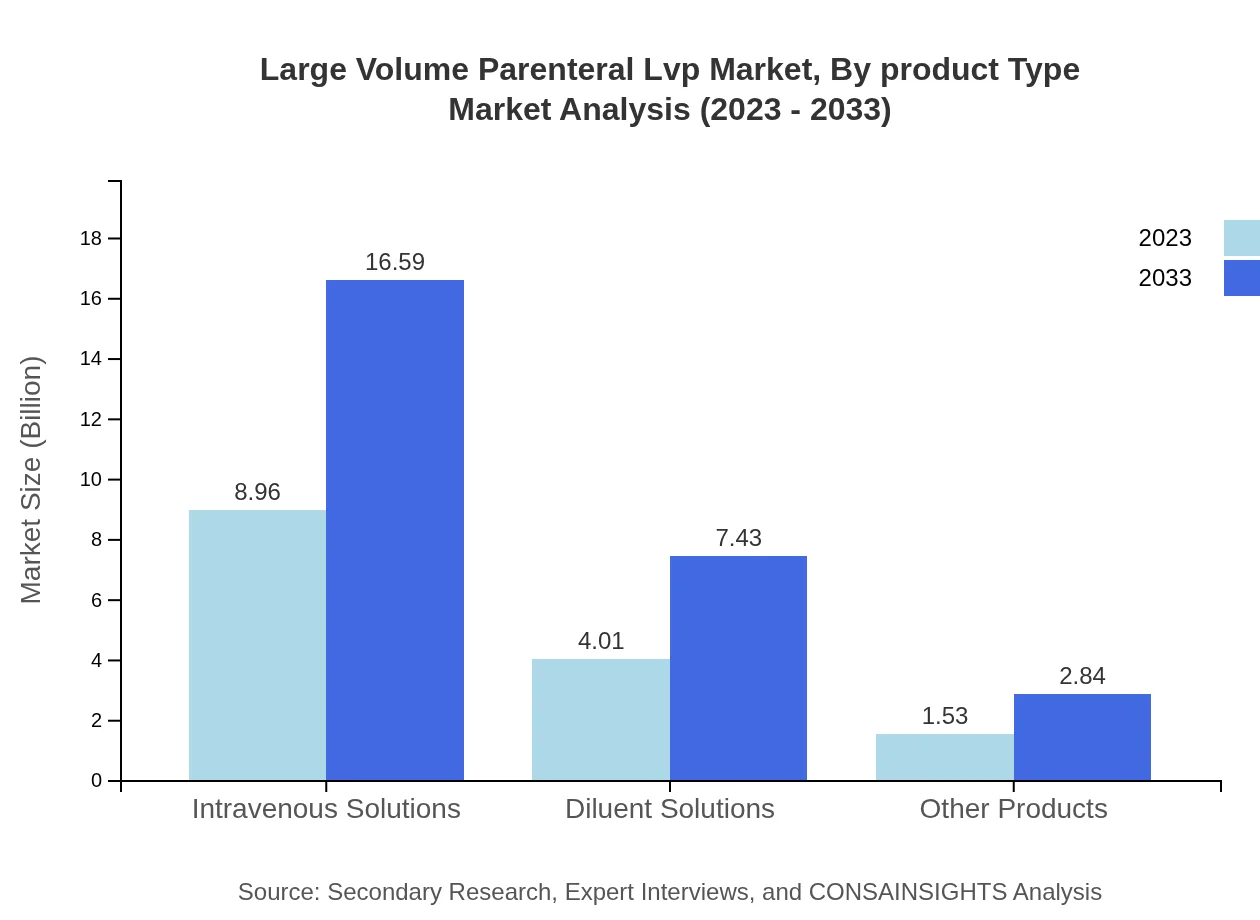

Large Volume Parenteral Lvp Market Analysis By Product Type

The primary product types within the LVP market include Intravenous Solutions, Diluent Solutions, and other specialized solutions. Intravenous solutions dominate the market share, accounting for 61.77% in 2023 and maintaining similar levels through 2033. Diluent solutions comprise approximately 27.67% of the total market share.

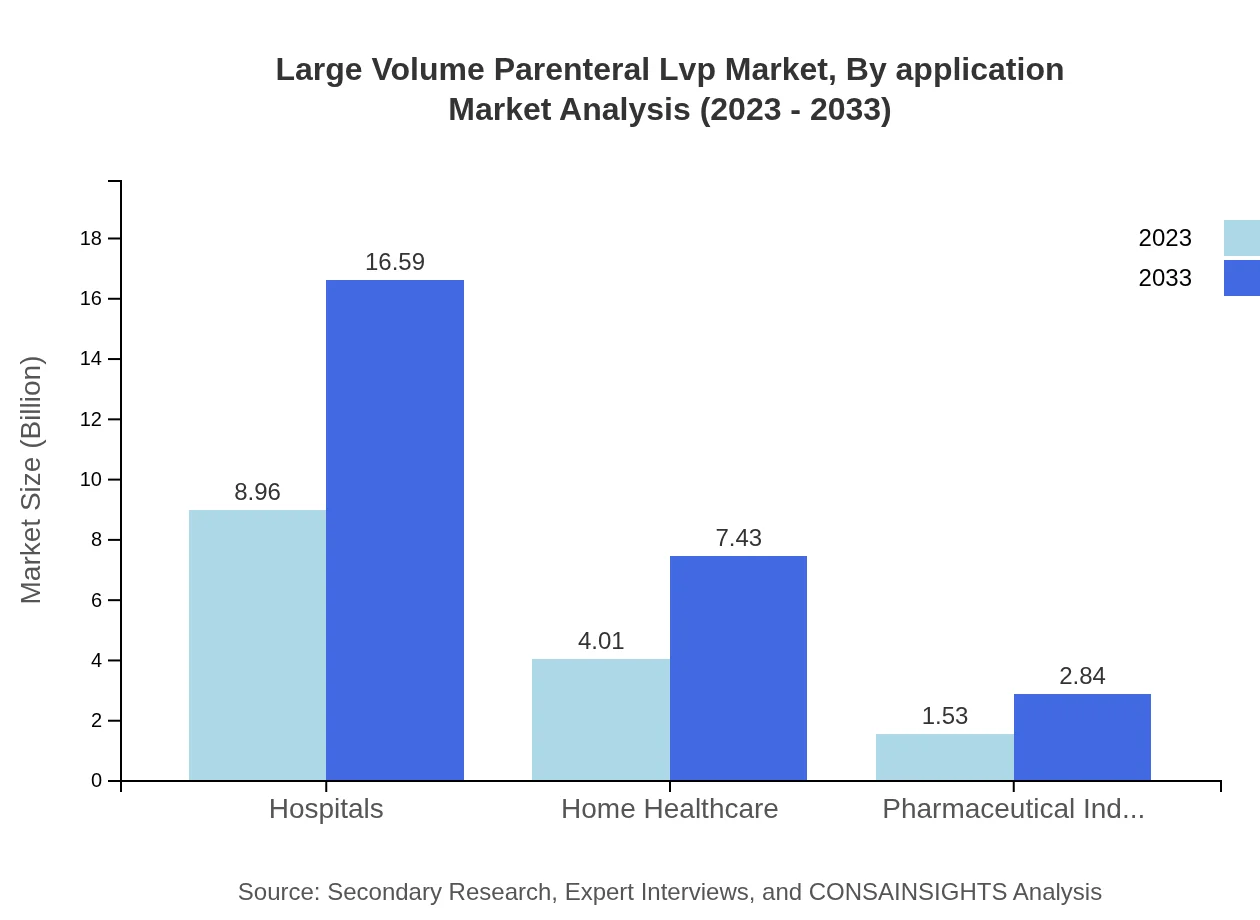

Large Volume Parenteral Lvp Market Analysis By Application

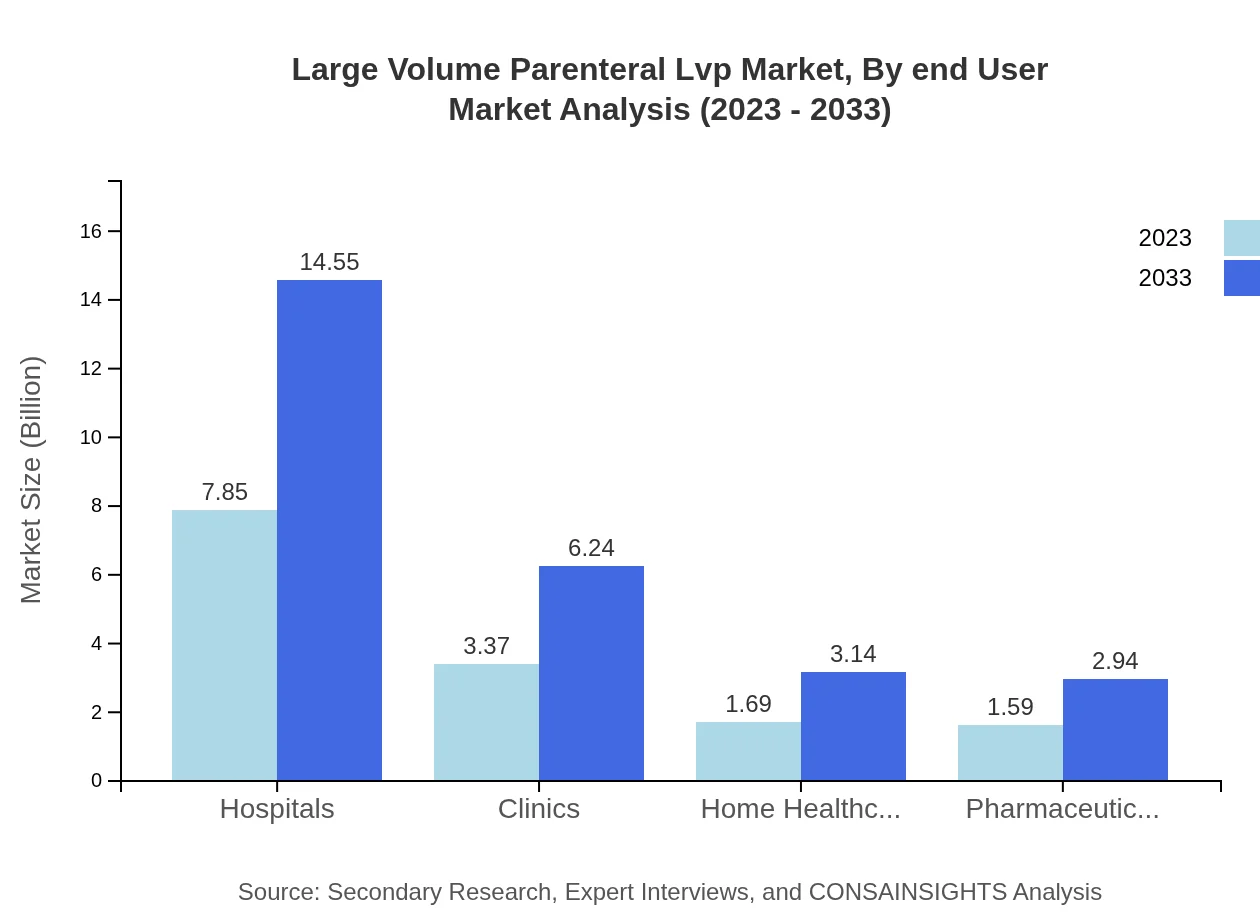

Applications for LVP solutions are primarily in Hospitals, Clinics, and Home Healthcare Providers. Hospitals lead with a market size of USD 7.85 billion in 2023, expected to grow to USD 14.55 billion by 2033, making up a significant portion of the market share.

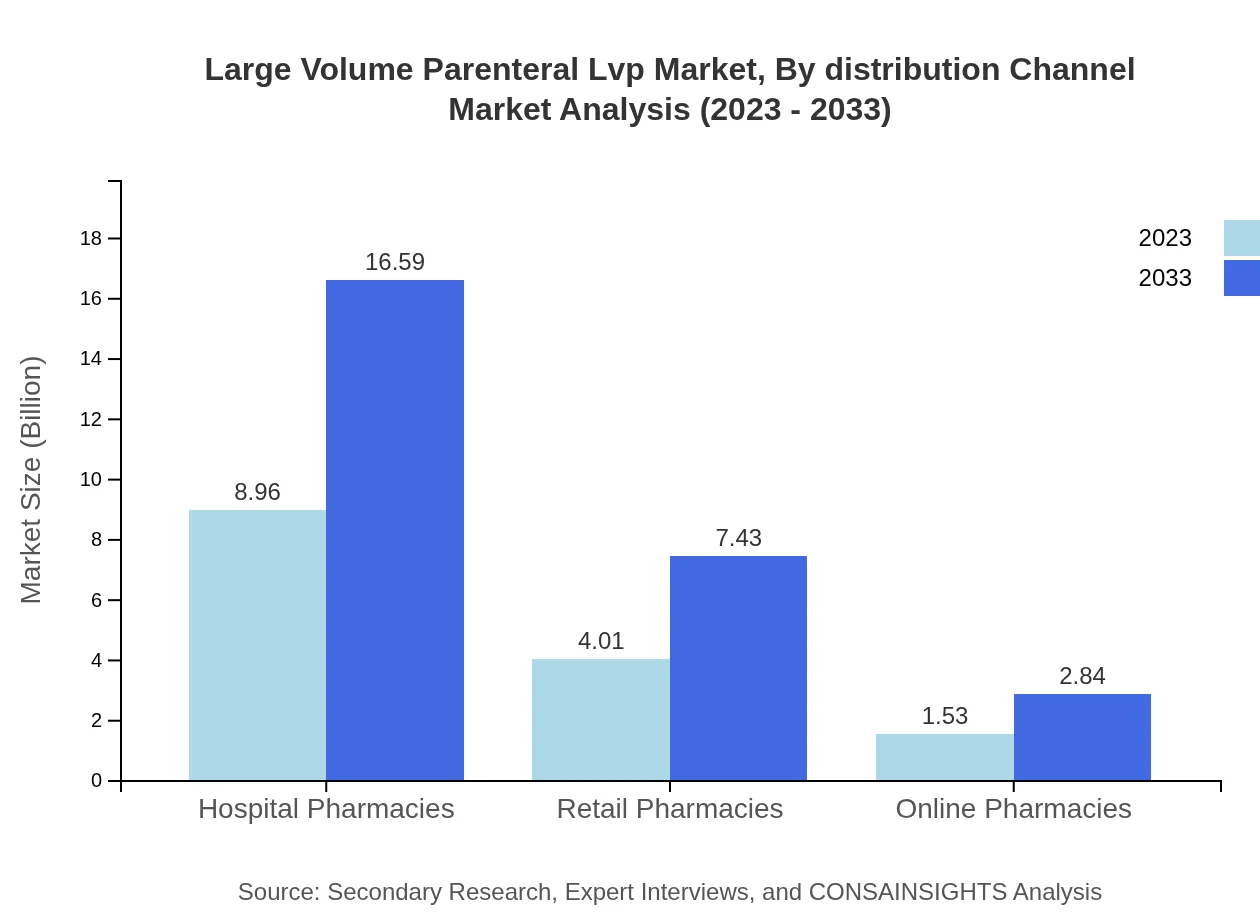

Large Volume Parenteral Lvp Market Analysis By Distribution Channel

Distribution channels for LVP products include Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. In 2023, Hospital Pharmacies account for roughly 61.77% of the market share, with ongoing growth expected.

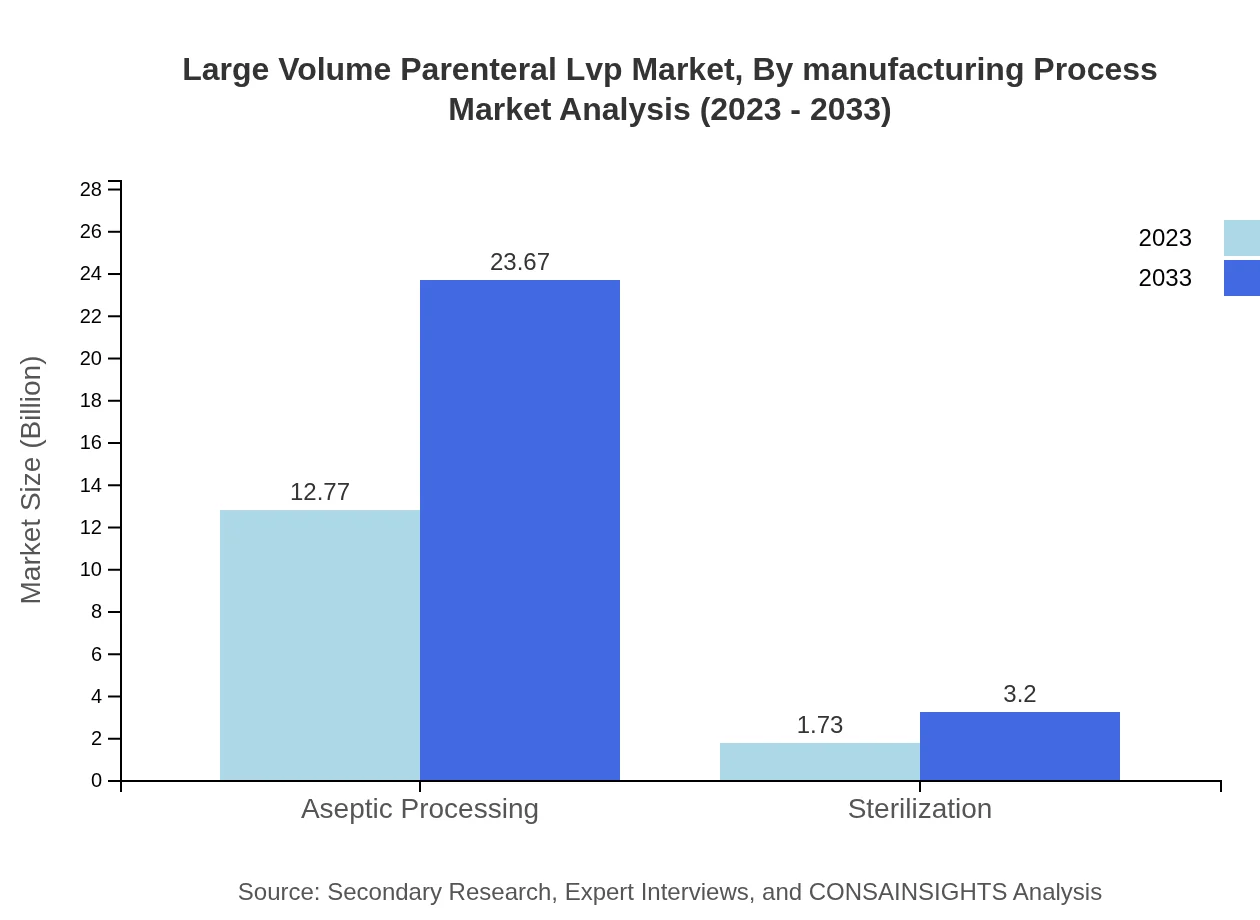

Large Volume Parenteral Lvp Market Analysis By Manufacturing Process

Manufacturing processes primarily include Aseptic Processing and Sterilization. Aseptic Processing commands a significant market presence with an 88.09% share in 2023, responding rigorously to compliance and quality standards.

Large Volume Parenteral Lvp Market Analysis By End User

End-users of LVP solutions are primarily Hospitals, Home Healthcare Providers, and Pharmaceutical Manufacturers. Hospitals lead in market size, supported by an increasing demand for IV therapies for chronic ailments.

Large Volume Parenteral Lvp Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Large Volume Parenteral Lvp Industry

Baxter International Inc.:

A leading healthcare company providing comprehensive renal and hospital products, including LVP solutions, with a focus on innovative products.Fresenius Kabi AG:

Specializes in supplying generic injectable drugs, intravenous solutions, and parenteral nutrition products, known for their commitment to quality and sustainability.Teva Pharmaceutical Industries Ltd.:

A global leader in generic medicine, providing effective LVP products and continuously investing in R&D for innovative solutions.B. Braun Melsungen AG:

Offers a wide range of intravenous solutions and has a global presence, ensuring quality and regulatory compliance in its product offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of large Volume Parenteral Lvp?

The global market size for Large Volume Parenteral (LVP) is projected to reach $14.5 billion by 2033, growing at a CAGR of 6.2%. This growth reflects the increasing demand for intravenous therapies and hospital care.

What are the key market players or companies in this large Volume Parenteral Lvp industry?

Key players in the LVP market include major pharmaceutical companies such as Fresenius Kabi, Baxter International, and B. Braun. These companies are significant contributors to innovations, supply chain reliability, and expanding product portfolios in LVP.

What are the primary factors driving the growth in the large Volume Parenteral Lvp industry?

Key growth factors include the rising prevalence of chronic diseases, an aging population, advancements in intravenous treatments, and increased investments in healthcare infrastructure, which collectively enhance the demand for LVP solutions.

Which region is the fastest Growing in the large Volume Parenteral Lvp?

The Asia Pacific region is projected to be the fastest-growing for LVP, increasing from $2.5 billion in 2023 to $4.62 billion by 2033. This growth is driven by healthcare expansion and increased treatment accessibility.

Does ConsaInsights provide customized market report data for the large Volume Parenteral Lvp industry?

Yes, Consainsights offers customized market reports tailored to specific needs in the LVP industry, enabling detailed analysis and insights based on client requirements across various parameters and metrics.

What deliverables can I expect from this large Volume Parenteral Lvp market research project?

Deliverables include comprehensive market analysis reports, segmented data insights, competitive landscape assessments, growth forecasts, and actionable recommendations tailored to specific industry needs and objectives.

What are the market trends of large Volume Parenteral Lvp?

Current trends in the LVP market include a shift towards aseptic processing, increasing preference for home healthcare, technological advancements, and heightened demand for personalized and patient-centric care solutions.