Laser Diode Market Report

Published Date: 31 January 2026 | Report Code: laser-diode

Laser Diode Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Laser Diode market, providing insights on size, growth trends, and forecasts from 2023 to 2033. Key areas covered include market segmentation, regional performance, and profiles of leading companies shaping the industry.

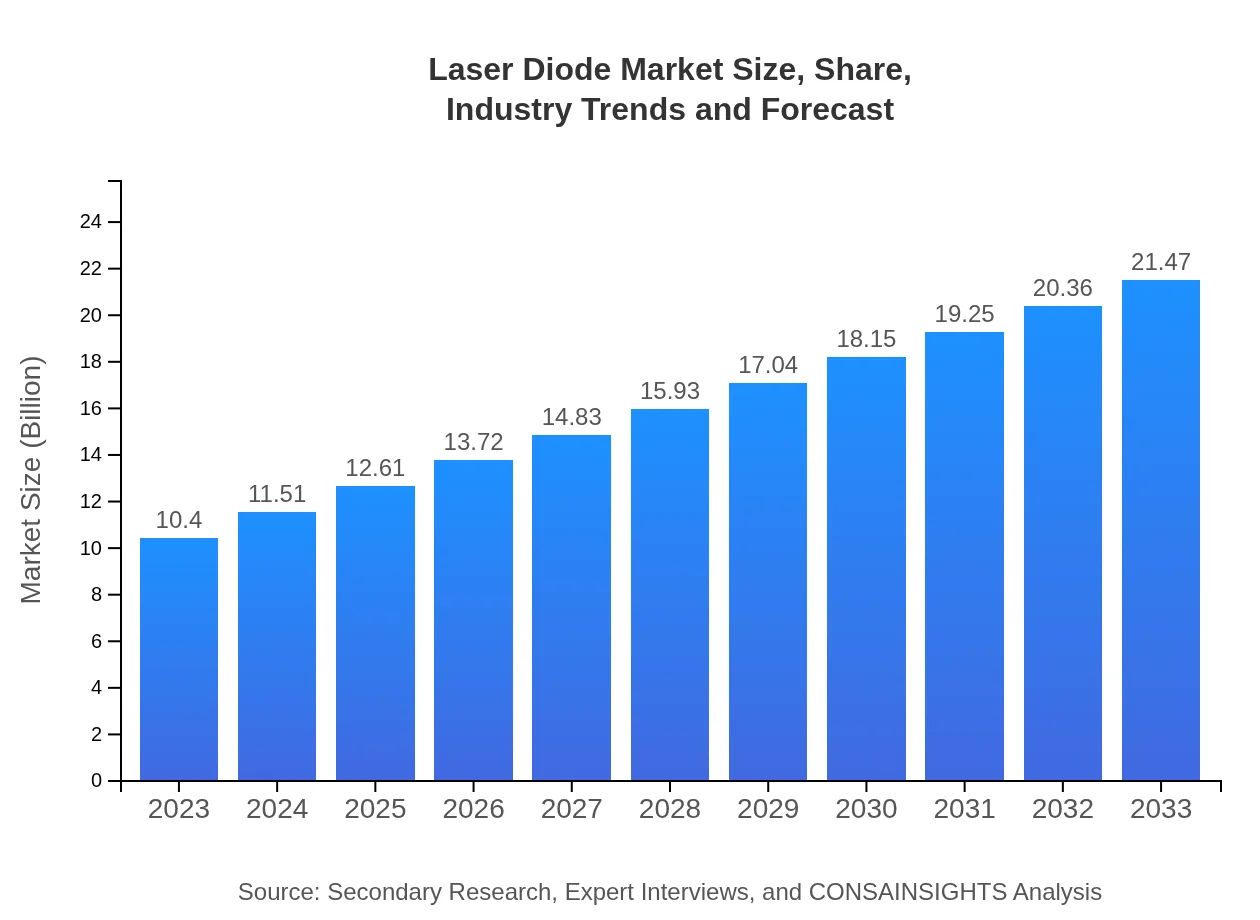

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.40 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $21.47 Billion |

| Top Companies | Osram Opto Semiconductors, Mitsubishi Electric, Coherent, Inc., Thorlabs, Inc. |

| Last Modified Date | 31 January 2026 |

Laser Diode Market Overview

Customize Laser Diode Market Report market research report

- ✔ Get in-depth analysis of Laser Diode market size, growth, and forecasts.

- ✔ Understand Laser Diode's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Diode

What is the Market Size & CAGR of Laser Diode market in 2033?

Laser Diode Industry Analysis

Laser Diode Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Diode Market Analysis Report by Region

Europe Laser Diode Market Report:

The European Laser Diode market is projected to expand from $3.06 billion in 2023 to $6.31 billion by 2033, owing to increasing demand for laser technologies in manufacturing and medical applications, along with stringent regulations aimed at improving energy efficiency.Asia Pacific Laser Diode Market Report:

In the Asia Pacific region, the Laser Diode market is expected to grow from $1.92 billion in 2023 to $3.97 billion by 2033, driven by rising electronic consumption and industrial automation. Countries like China and Japan are leading in technological advancements and manufacturing capabilities, making this region a focal point for market players.North America Laser Diode Market Report:

North America is expected to witness substantial growth from $3.98 billion in 2023 to $8.21 billion by 2033, fueled by robust investments in healthcare and telecommunications sectors. The presence of significant industry players and technological innovations further strengthens this market position.South America Laser Diode Market Report:

The South America Laser Diode market is projected to rise from $0.45 billion in 2023 to $0.94 billion in 2033. Growth in telecommunications and emerging industries is anticipated to bolster demand in this region, alongside increased investments in infrastructure.Middle East & Africa Laser Diode Market Report:

The Middle East and Africa market is anticipated to grow from $0.99 billion in 2023 to $2.04 billion by 2033, as countries invest in enhancing telecommunication infrastructure and industrial capabilities. Emerging economies in this region are adopting laser technologies to advance their growth strategies.Tell us your focus area and get a customized research report.

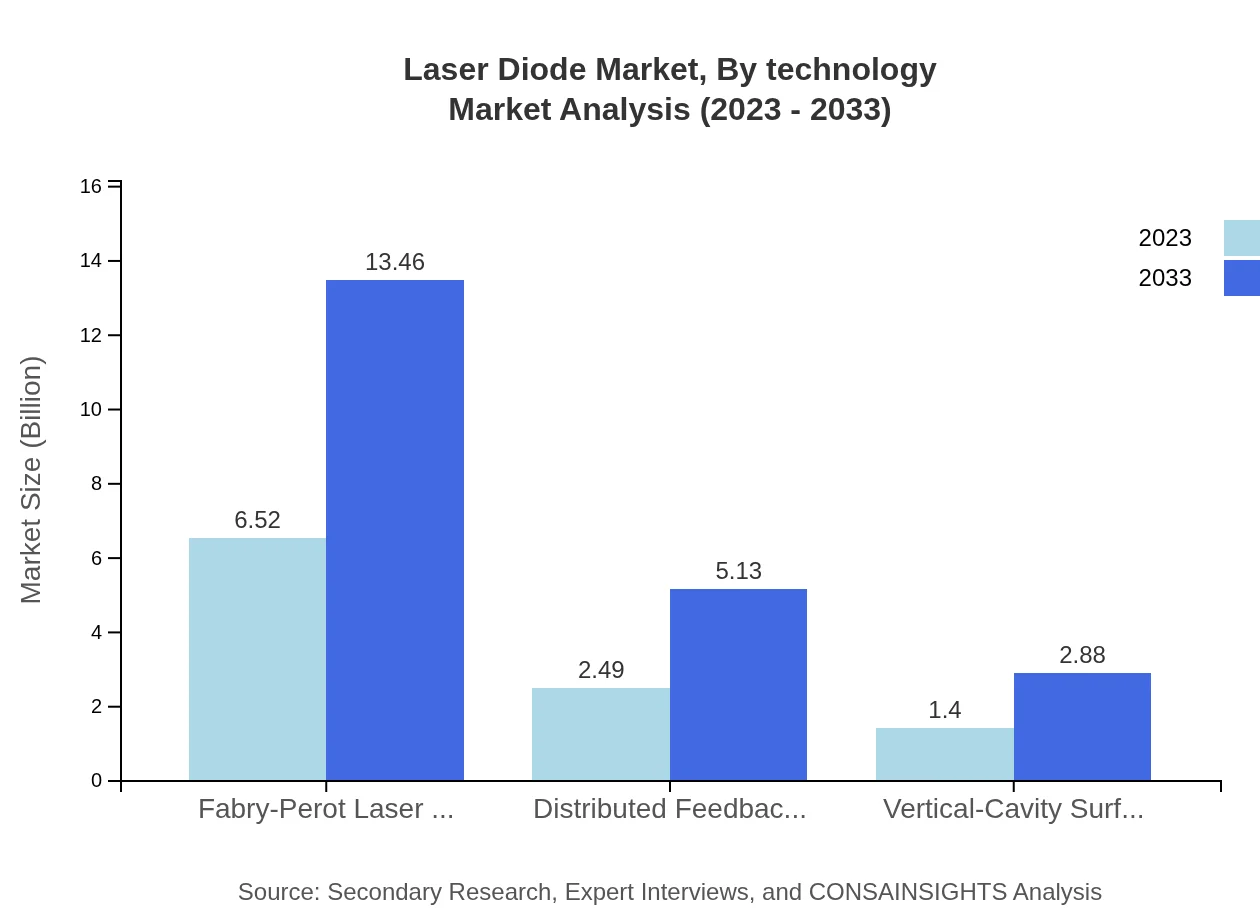

Laser Diode Market Analysis By Technology

The Laser Diode market, categorized by technology, includes Fabry-Perot laser diodes, distributed feedback laser diodes, and vertical-cavity surface-emitting laser (VCSEL) diodes. Fabry-Perot laser diodes dominate the market due to their broad application range in telecommunications and consumer electronics, expected to achieve $13.46 billion by 2033.

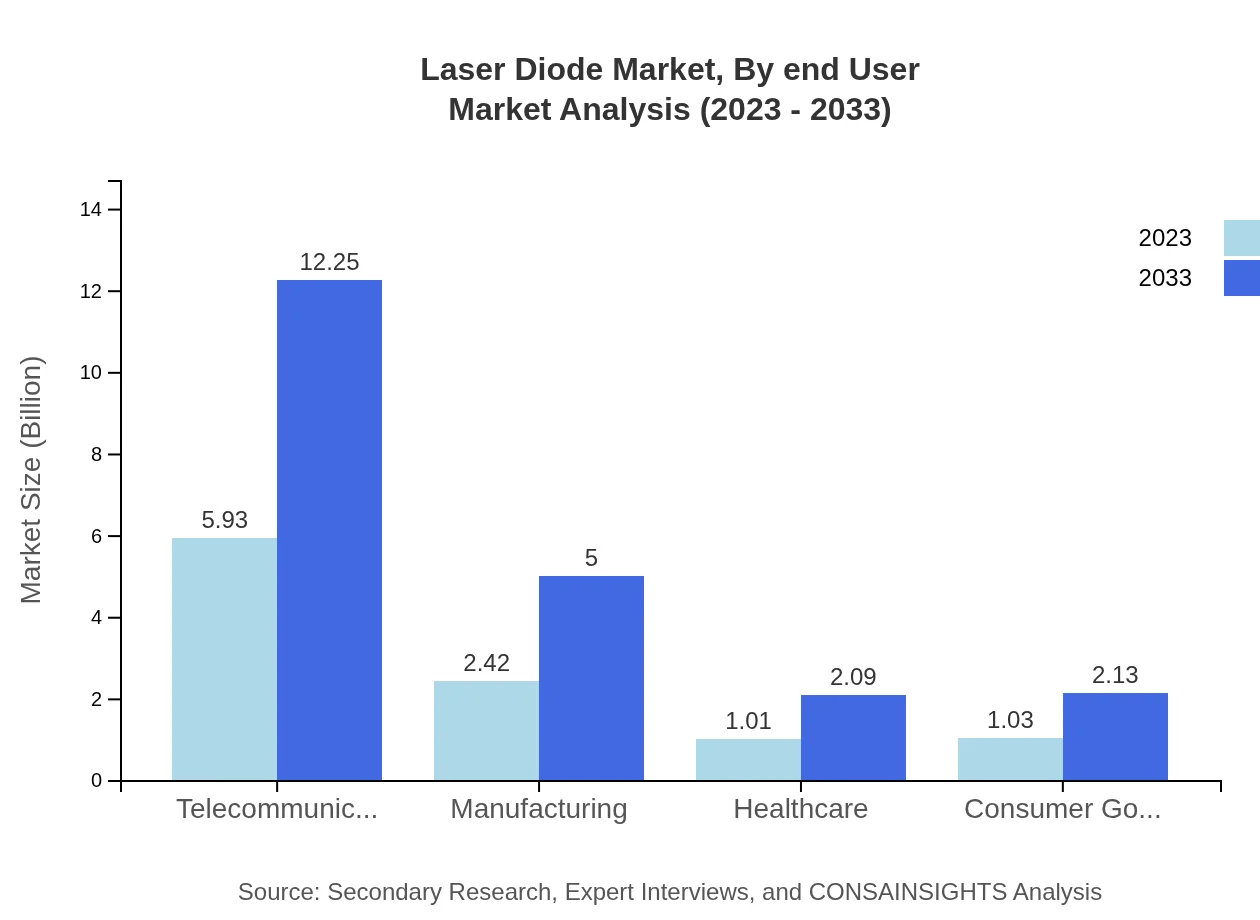

Laser Diode Market Analysis By Application

In terms of application segments, telecommunications lead with a market size rising from $5.93 billion in 2023 to $12.25 billion by 2033. This is closely followed by manufacturing and healthcare sectors, which are also seeing substantial growth due to increased automation and minimally invasive surgeries.

Laser Diode Market Analysis By End User

The Laser Diode market by end-user showcases strong performances in telecommunications, industrial applications, and healthcare. With telecommunications accounting for 57.05% market share in 2023, the ongoing shift toward high-speed data transmission continues to drive demand.

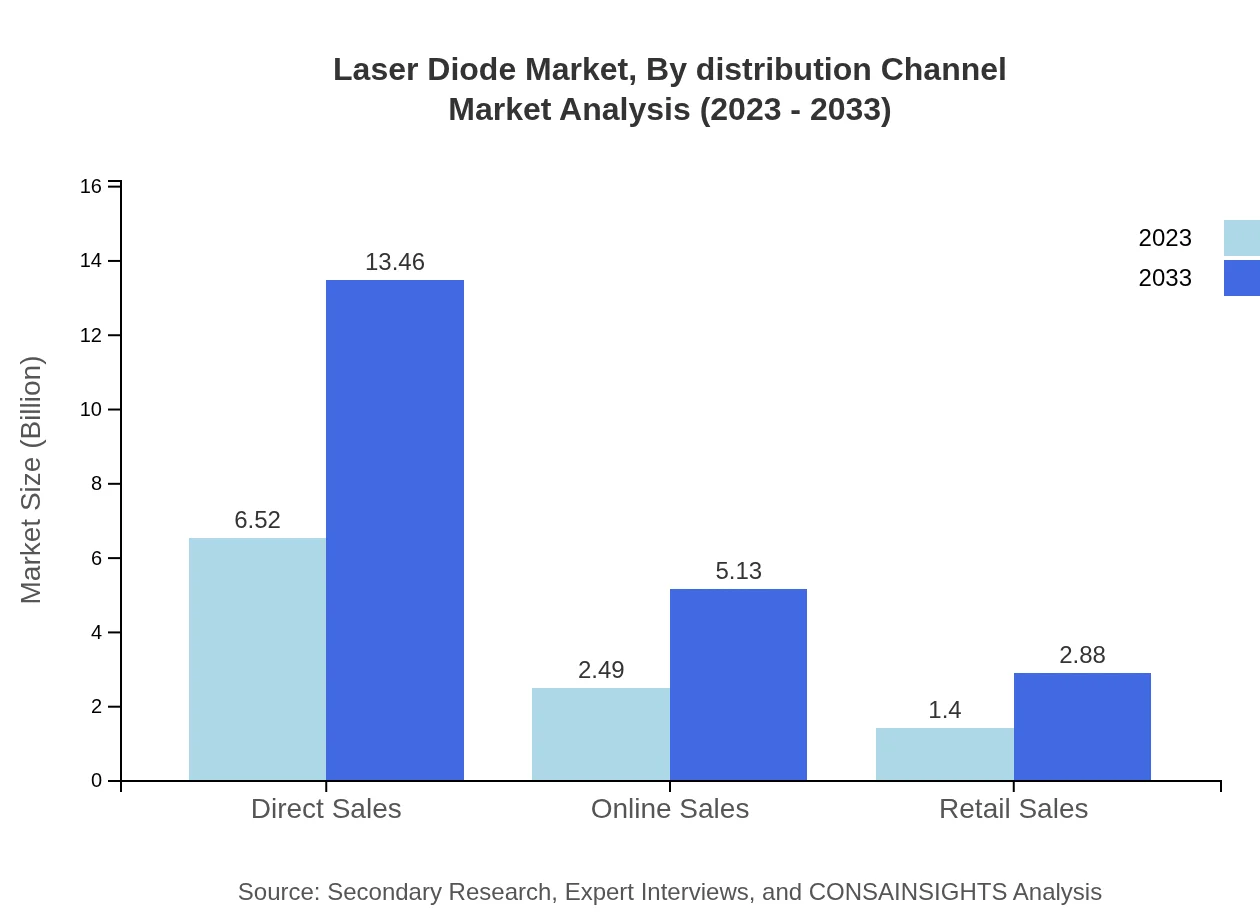

Laser Diode Market Analysis By Distribution Channel

Distribution channels for the Laser Diode market include direct sales, online sales, and retail sales. Direct sales account for a significant share, providing manufacturers with direct customer relationships that enhance market penetration and build loyalty.

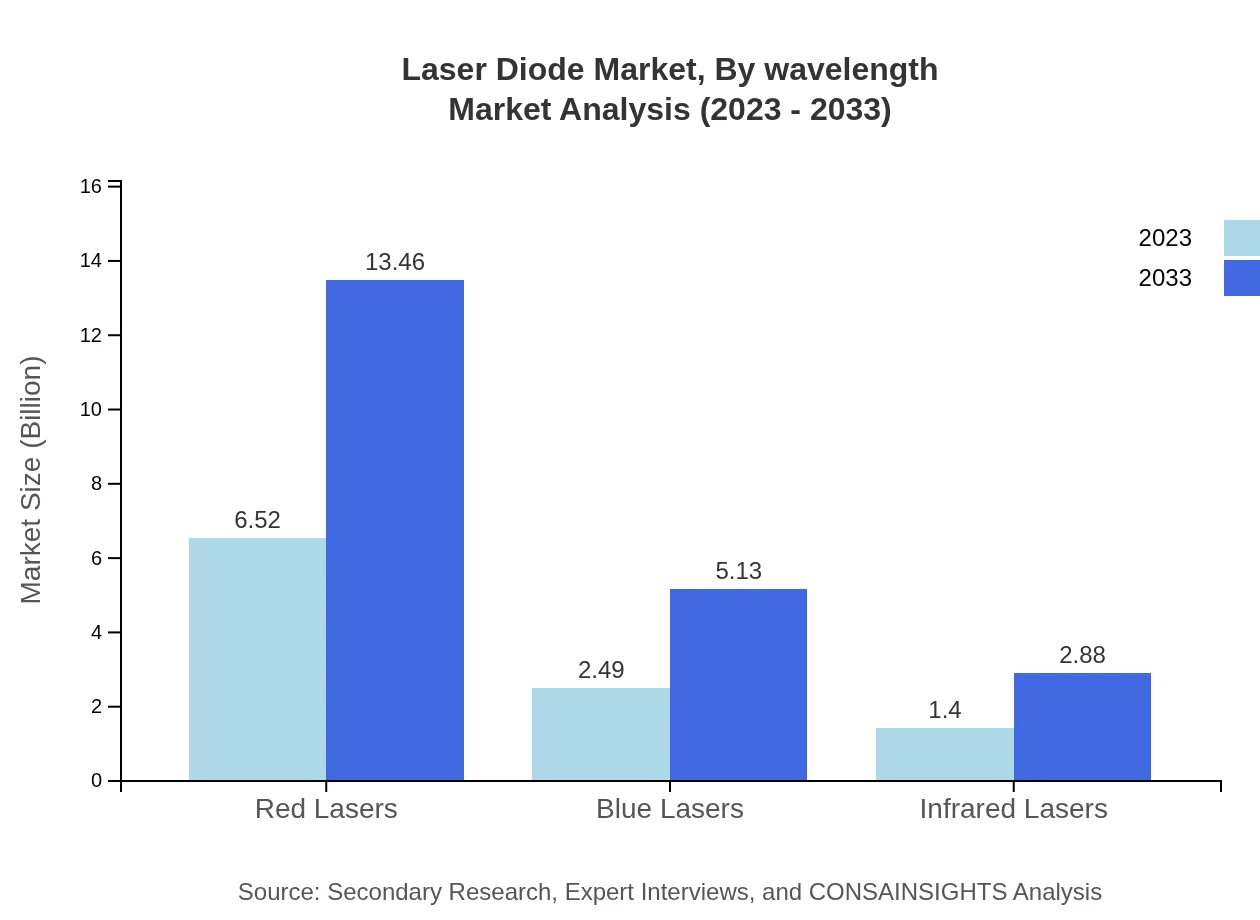

Laser Diode Market Analysis By Wavelength

Market analysis by wavelength indicates a preference for red and blue laser diodes, used extensively in communications and specific applications like laser lighting and displays. The anticipated growth reflects their adaptability to multiple technological applications.

Laser Diode Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Diode Industry

Osram Opto Semiconductors:

A leading manufacturer of optoelectronic components, specializing in high-quality laser diodes for diverse applications including automotive and healthcare.Mitsubishi Electric:

Renowned for its comprehensive portfolio in the laser diode sector, providing solutions that cater to the telecommunications and industrial markets.Coherent, Inc.:

A top player focused on laser solutions with an extensive product range, recognized for innovation in manufacturing techniques and laser applications.Thorlabs, Inc.:

A leading supplier of laser diodes and optical components, catering to research, academic, and industrial markets globally.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Diode?

The global laser diode market is estimated at $10.4 billion in 2023, with a projected CAGR of 7.3%, reaching significantly higher valuations by 2033, showcasing its robust growth trajectory in various applications.

What are the key market players or companies in the laser Diode industry?

Key players in the laser diode industry include prominent companies like Coherent, Inc., Hamamatsu Photonics, and Osram Opto Semiconductors. These firms are engaged in extensive R&D to enhance laser technology and expand their market footprint.

What are the primary factors driving the growth in the laser Diode industry?

Growth factors for the laser-diode market include rising demand in telecommunications for high-speed data transmission, advancements in medical laser applications, and increasing adoption of laser technology in consumer electronics for better performance.

Which region is the fastest Growing in the laser Diode market?

The fastest-growing region in the laser diode market is North America, projected to grow from $3.98 billion in 2023 to $8.21 billion by 2033. Europe and Asia Pacific also show significant growth, indicating regional opportunities.

Does ConsaInsights provide customized market report data for the laser Diode industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the laser diode industry, ensuring insights are relevant to businesses, stakeholders, and market dynamics.

What deliverables can I expect from this laser Diode market research project?

Deliverables from the laser diode market research project may include comprehensive market reports, segment analysis, competitive landscapes, growth forecasts, and actionable insights to assist in strategic decision-making.

What are the market trends of laser Diode?

Trends in the laser diode market include technological advancements in efficiency and power output, increasing use of laser diodes in industrial automation, and growth in consumer electronics driving demand for innovative laser applications.