Laser Direct Structuring Lds Antenna Market Report

Published Date: 31 January 2026 | Report Code: laser-direct-structuring-lds-antenna

Laser Direct Structuring Lds Antenna Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Laser Direct Structuring Lds Antenna market, including market size, trends, and forecasts from 2023 to 2033. Insights into industry dynamics, regional performance, and leading companies are also included.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

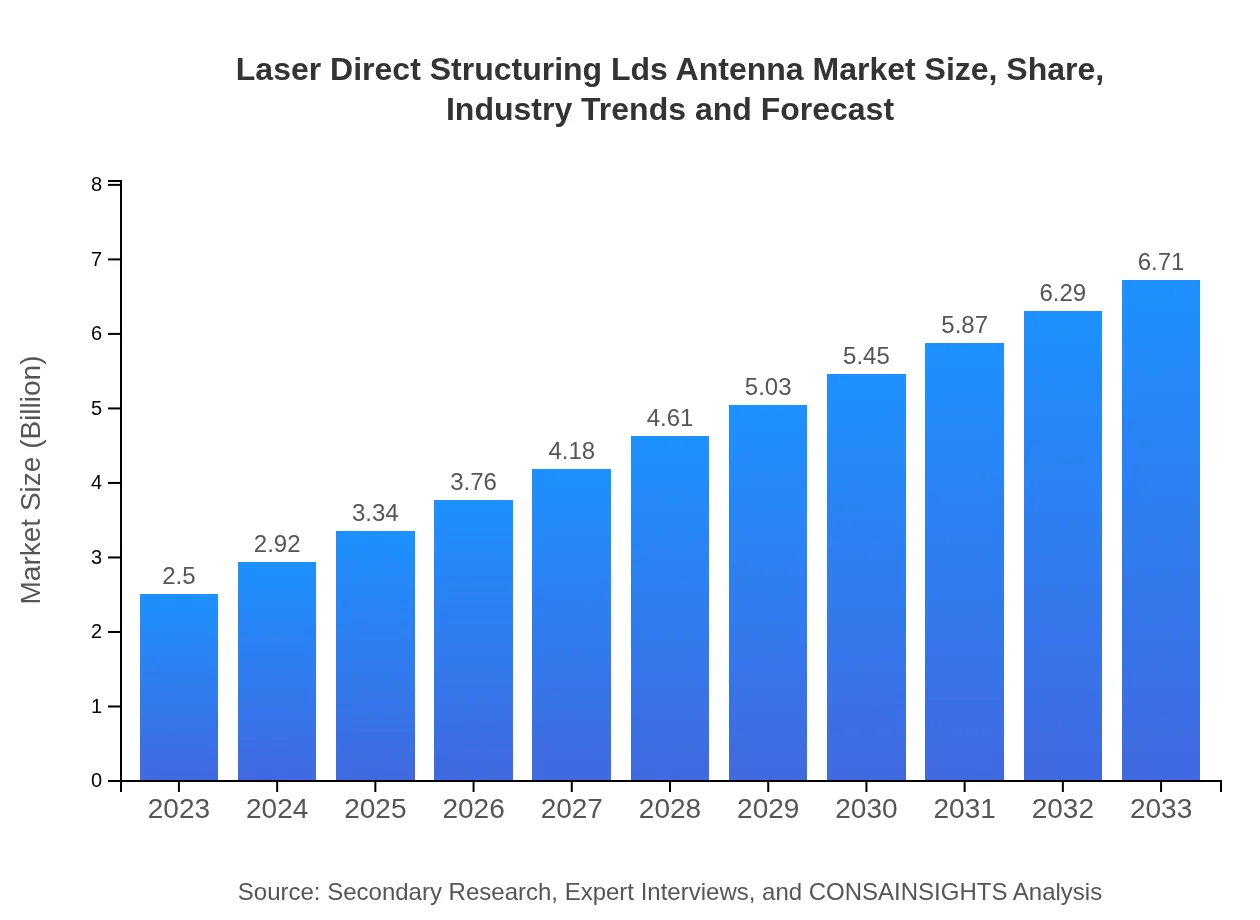

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $6.71 Billion |

| Top Companies | Rosenberger Hochfrequenztechnik GmbH & Co. KG, Sierra Wireless, Inc., PCTEL, Inc. |

| Last Modified Date | 31 January 2026 |

Laser Direct Structuring Lds Antenna Market Overview

Customize Laser Direct Structuring Lds Antenna Market Report market research report

- ✔ Get in-depth analysis of Laser Direct Structuring Lds Antenna market size, growth, and forecasts.

- ✔ Understand Laser Direct Structuring Lds Antenna's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Direct Structuring Lds Antenna

What is the Market Size & CAGR of Laser Direct Structuring Lds Antenna market in 2023?

Laser Direct Structuring Lds Antenna Industry Analysis

Laser Direct Structuring Lds Antenna Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Direct Structuring Lds Antenna Market Analysis Report by Region

Europe Laser Direct Structuring Lds Antenna Market Report:

Europe's Laser Direct Structuring Lds Antenna market, at $0.69 billion in 2023, is anticipated to increase to $1.85 billion by 2033. The region's stringent regulations and high standards drive innovation in technology applications.Asia Pacific Laser Direct Structuring Lds Antenna Market Report:

In 2023, the Asia Pacific region's Laser Direct Structuring Lds Antenna market is valued at $0.53 billion, expected to reach $1.43 billion by 2033. The growth is driven by the increasing proliferation of technology in consumer electronics and the automotive sector, particularly in countries like China, Japan, and South Korea.North America Laser Direct Structuring Lds Antenna Market Report:

North America represents a significant market, starting at $0.90 billion in 2023 and expanding to $2.43 billion by 2033 due to increased investments in telecommunications and the growing demand for smart devices.South America Laser Direct Structuring Lds Antenna Market Report:

The South American market for Laser Direct Structuring Lds Antenna is projected to grow from $0.21 billion in 2023 to $0.56 billion by 2033. Factors such as urbanization and the enhancement of telecommunications infrastructure are influencing this growth.Middle East & Africa Laser Direct Structuring Lds Antenna Market Report:

The Middle East and Africa market is projected to rise from $0.17 billion in 2023 to $0.44 billion by 2033, supported by advancements in communication technologies and increasing mobile device usage.Tell us your focus area and get a customized research report.

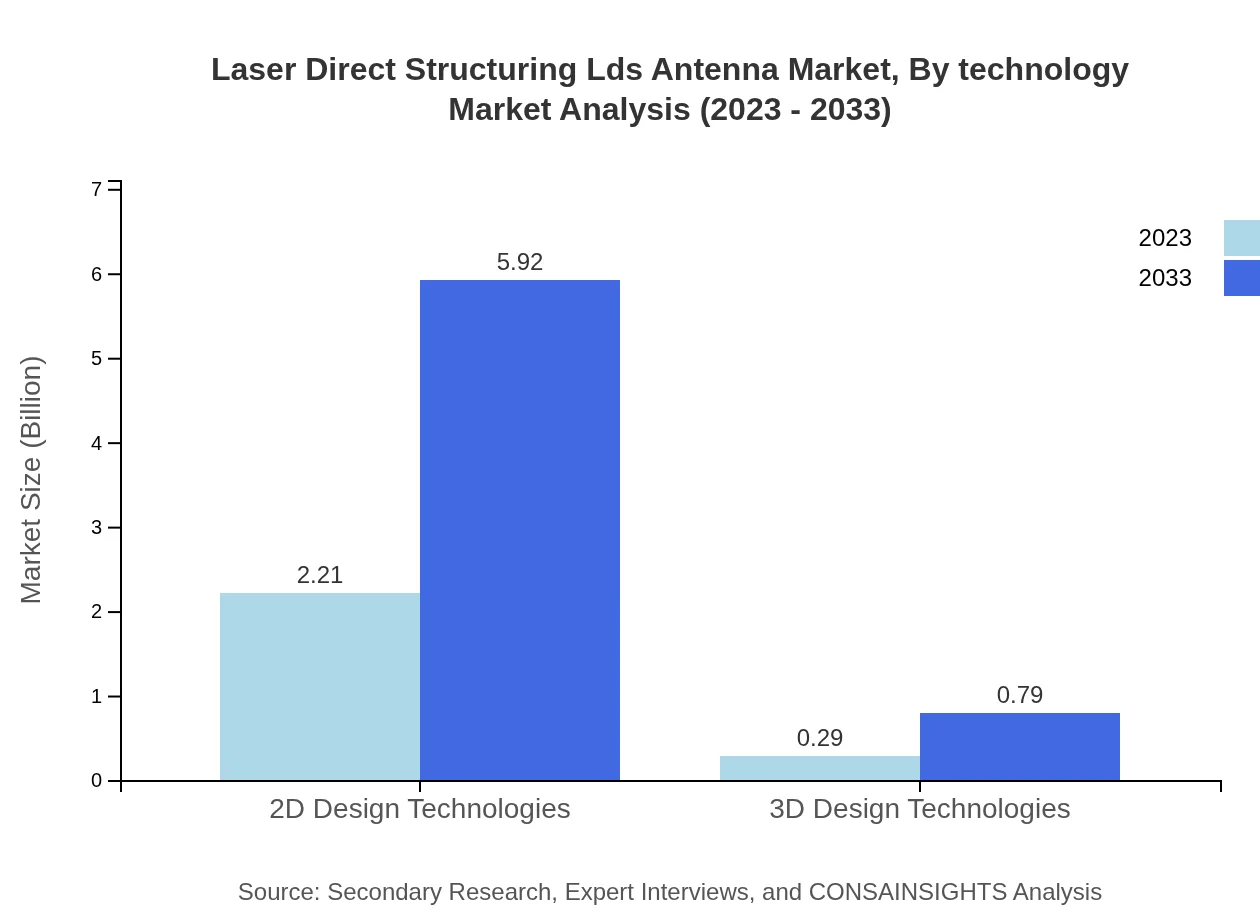

Laser Direct Structuring Lds Antenna Market Analysis By Technology

The market is extensively divided into 2D and 3D design technologies. The 2D design segment currently dominates the market due to its long-established applications in various sectors, while 3D design is gaining traction for offering superior flexibility and miniaturization, thus, driving significant market expansion.

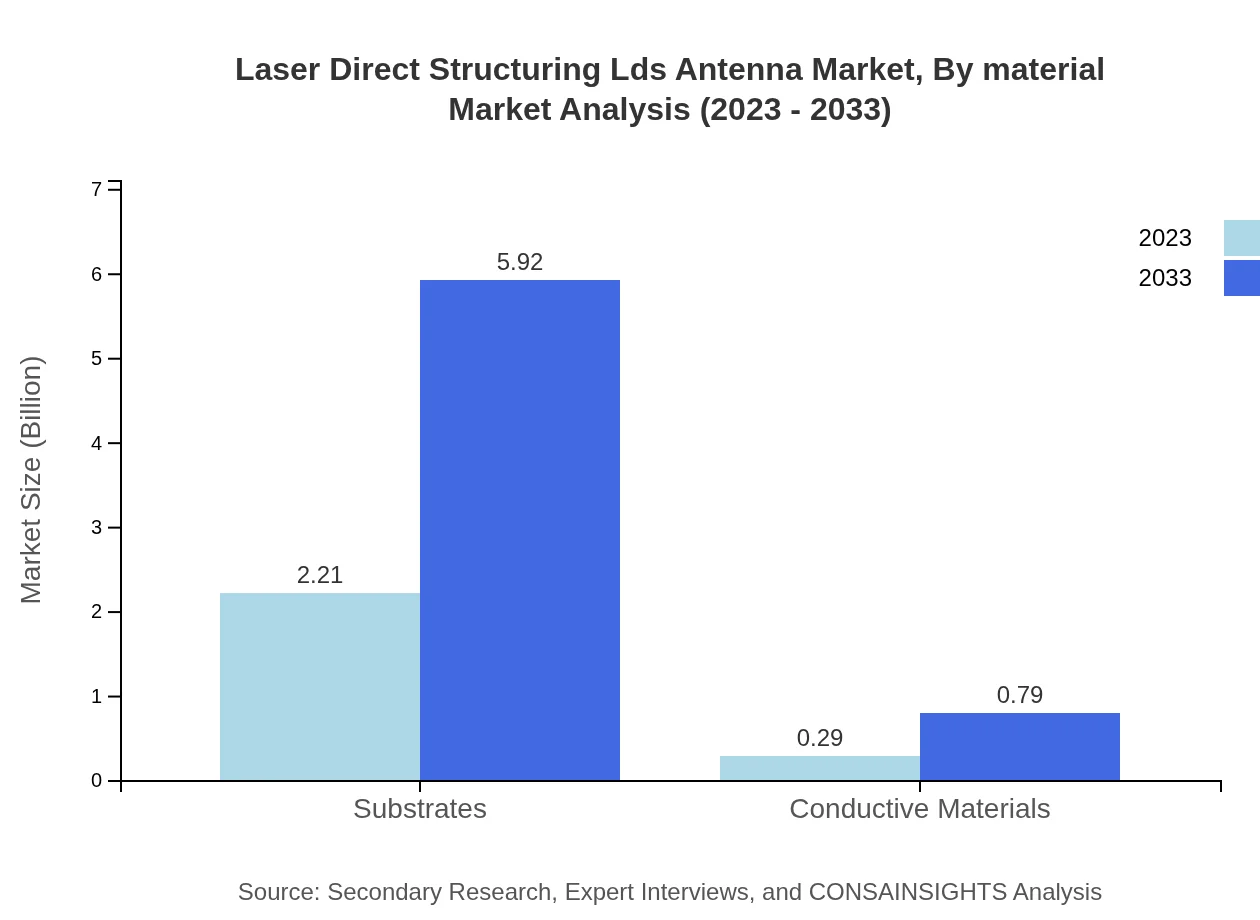

Laser Direct Structuring Lds Antenna Market Analysis By Material

Materials used in LDS antennas include conductive materials and substrates. The substrate segment is significant, capturing the largest market share due to its essential role in antenna performance, while conductive materials support functionality and improve signal reliability in critical applications.

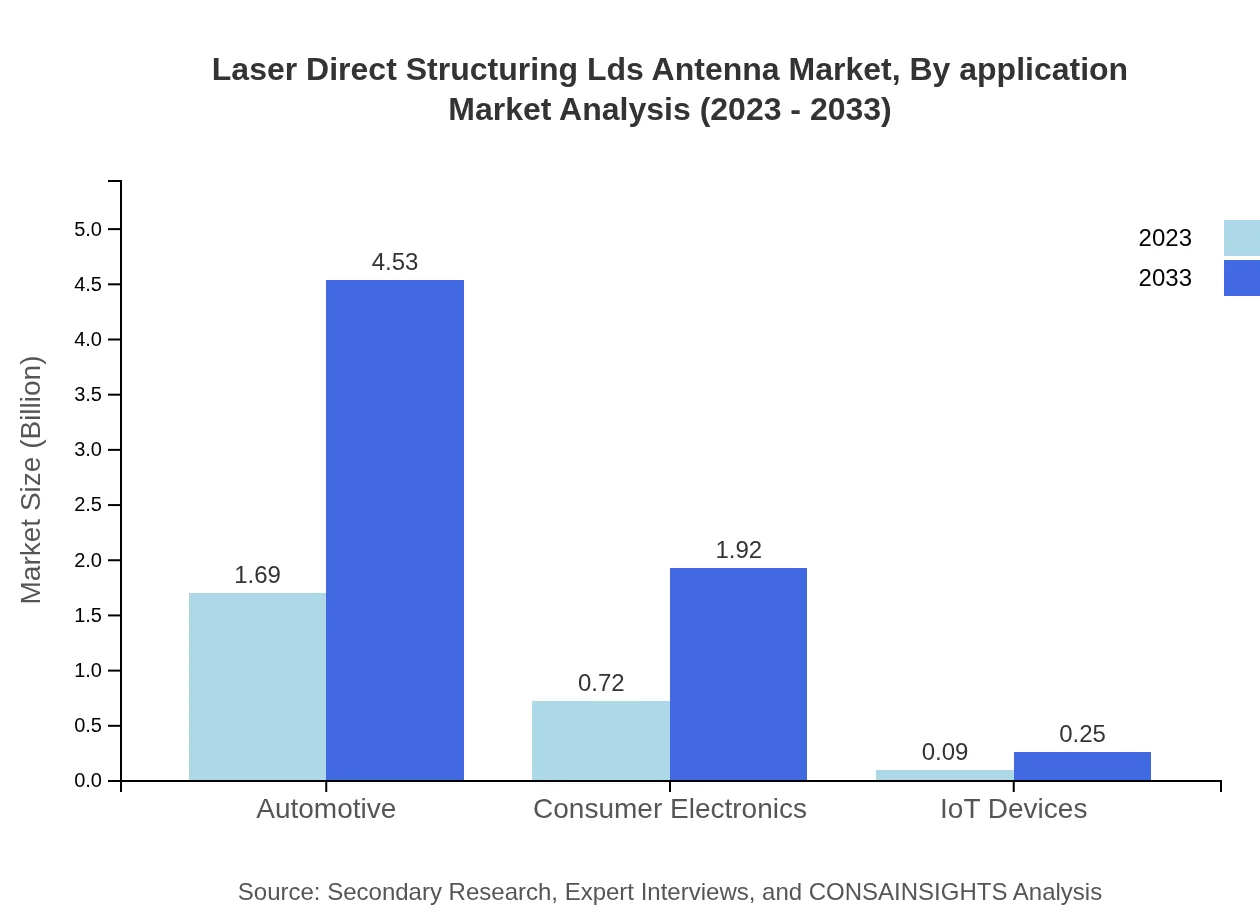

Laser Direct Structuring Lds Antenna Market Analysis By Application

Applications for LDS antennas span across various sectors, including telecommunications, automotive, healthcare, and consumer electronics. Telecommunications is the leading application, projected to grow strongly alongside the expansion of 5G infrastructure and the demand for high-speed communication technologies.

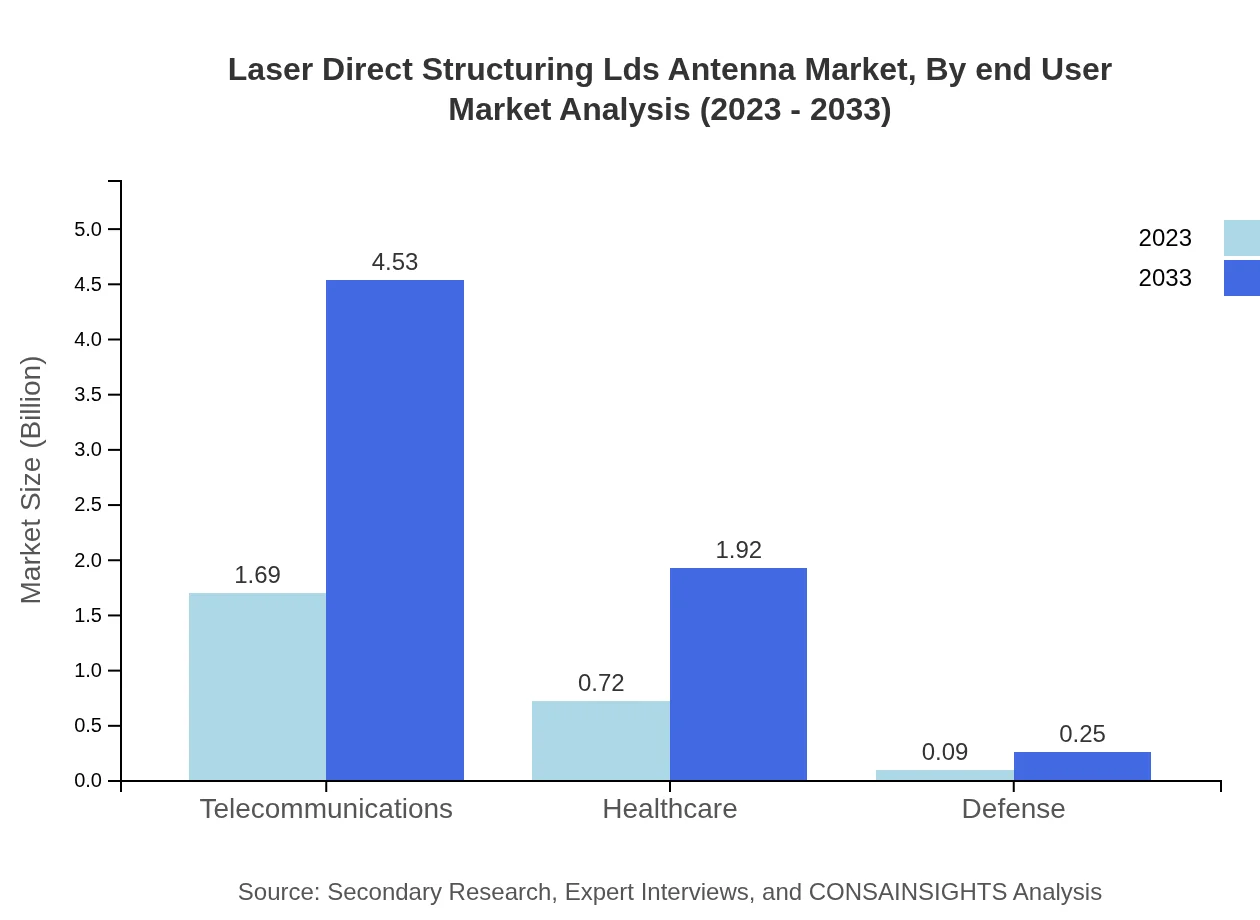

Laser Direct Structuring Lds Antenna Market Analysis By End User

The key end-user industries for LDS antennas are telecommunications, automotive, and IoT devices. The telecommunications sector leads with increasing investments in infrastructure, followed closely by automotive due to advancements in vehicle connectivity.

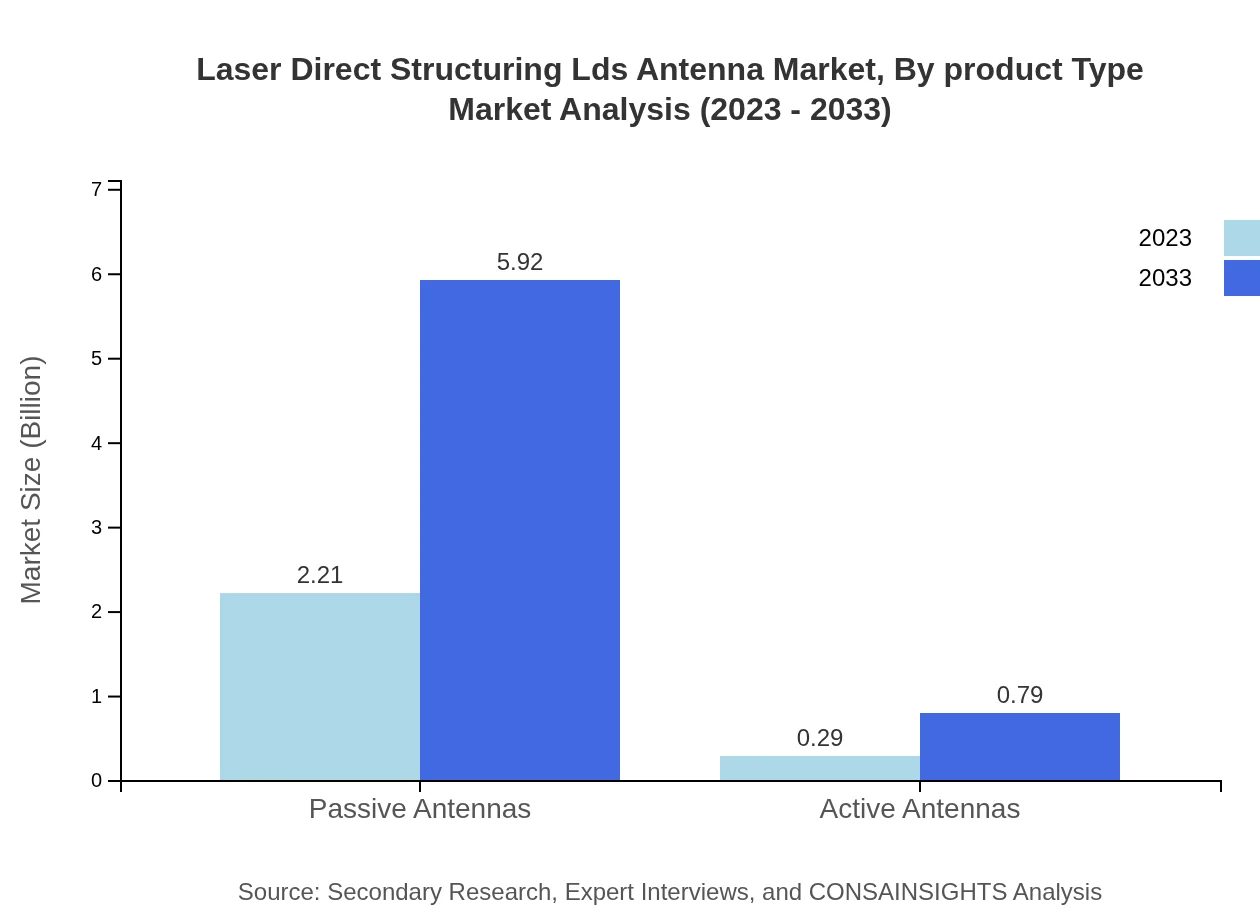

Laser Direct Structuring Lds Antenna Market Analysis By Product Type

Laser Direct Structuring antennas are categorized into active and passive types. Passive antennas dominate the market due to their widespread use in consumer electronics, while active antennas are gaining ground in applications requiring signal amplification and enhanced communication capabilities.

Laser Direct Structuring Lds Antenna Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Direct Structuring Lds Antenna Industry

Rosenberger Hochfrequenztechnik GmbH & Co. KG:

A global leader in RF technology, Rosenberger specializes in high-frequency connectors and custom solutions for antennas, playing a pivotal role in advancing LDS antenna applications.Sierra Wireless, Inc.:

Known for its innovative connectivity solutions, Sierra Wireless drives LDS antenna technology through its commitment to developing IoT and cellular modules suitable for advanced telecommunication systems.PCTEL, Inc.:

PCTEL is a leading provider of antenna solutions and RF technology, contributing to LDS antenna developments, particularly for telecommunications and automotive applications.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Direct Structuring Lds Antenna?

The Laser Direct Structuring (LDS) Antenna market is currently valued at approximately $2.5 billion in 2023, with a projected CAGR of 10%, suggesting significant growth and expansion leading up to 2033.

What are the key market players or companies in this laser Direct Structuring Lds Antenna industry?

Key players in the Laser Direct Structuring Antenna market include major electronics manufacturers, telecommunications companies, and innovative design technology firms that drive advancements and demand in this growing industry.

What are the primary factors driving the growth in the laser Direct Structuring Lds Antenna industry?

Factors contributing to market growth include rising demand for miniaturized electronics, the increasing applications in telecommunications, healthcare, automotive, and a push towards innovative designs for improved performance.

Which region is the fastest Growing in the laser Direct Structuring Lds Antenna?

The fastest-growing region in the Laser Direct Structuring Antenna market is North America, expected to grow from $0.90 billion in 2023 to $2.43 billion by 2033, indicating strong market dynamics and increased demand.

Does Consainsights provide customized market report data for the laser Direct Structuring Lds Antenna industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the Laser Direct Structuring Antenna industry, enabling clients to obtain relevant insights and actionable intelligence.

What deliverables can I expect from this laser Direct Structuring Lds Antenna market research project?

Deliverables from this market research project will include in-depth reports, market size analysis, growth forecasts, competitive landscape assessments, and segmentation details for the Laser Direct Structuring Antenna market.

What are the market trends of laser Direct Structuring Lds Antenna?

Current market trends in the Laser Direct Structuring Antenna sector include increasing utilization in telecommunications, advancements in design technologies, and a shift towards more efficient and compact antennas across various applications.