Laser Photomask Market Report

Published Date: 31 January 2026 | Report Code: laser-photomask

Laser Photomask Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Laser Photomask market, highlighting key trends, growth forecasts from 2023 to 2033, and detailed insights into market size, segmentation, and regional dynamics.

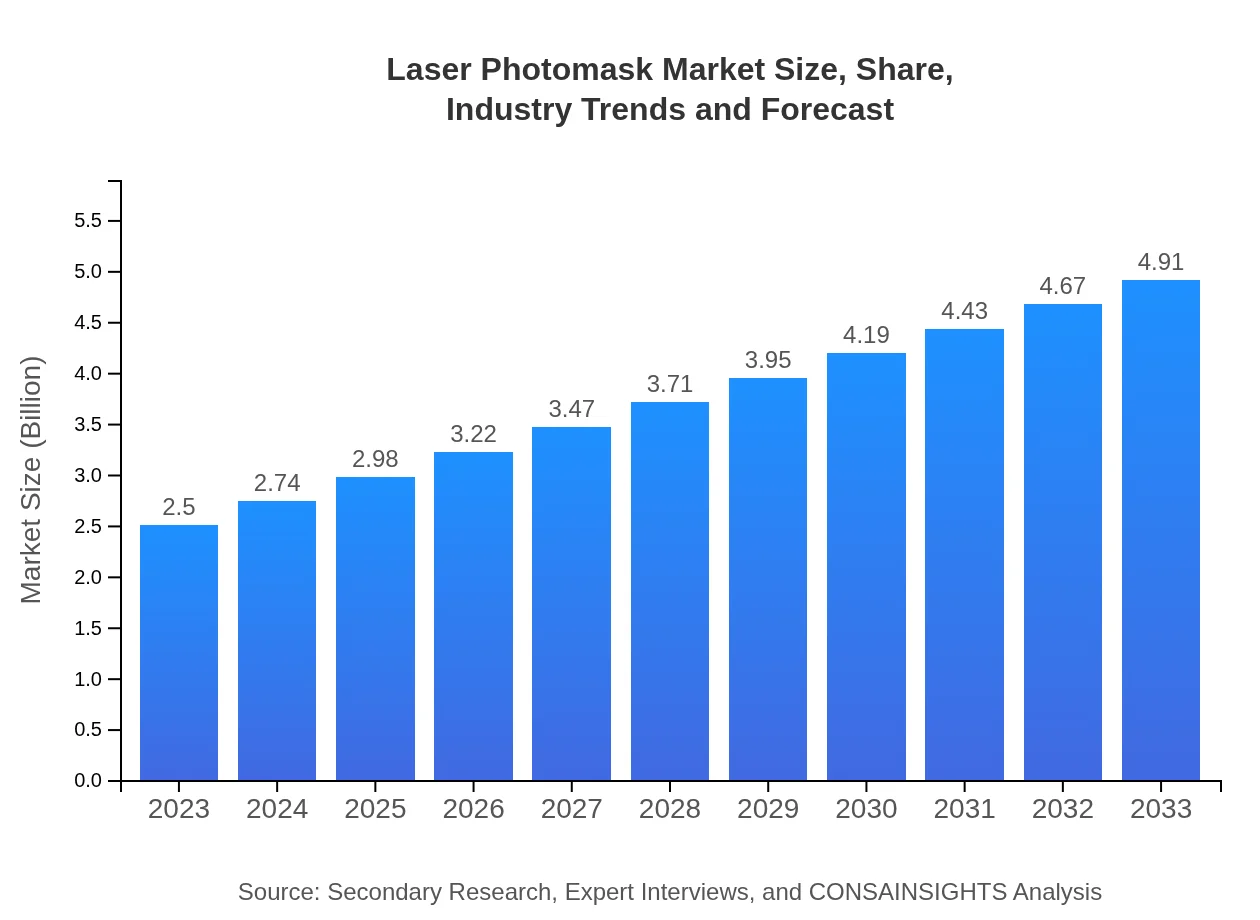

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Photronics, Inc., Toppan Photomasks, Inc., SK-Electronics, Dai Nippon Printing Co., Ltd., LG Innotek |

| Last Modified Date | 31 January 2026 |

Laser Photomask Market Overview

Customize Laser Photomask Market Report market research report

- ✔ Get in-depth analysis of Laser Photomask market size, growth, and forecasts.

- ✔ Understand Laser Photomask's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Photomask

What is the Market Size & CAGR of Laser Photomask market in 2023?

Laser Photomask Industry Analysis

Laser Photomask Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Photomask Market Analysis Report by Region

Europe Laser Photomask Market Report:

Europe's market is set to increase from $0.77 billion in 2023 to $1.51 billion by 2033. The shift towards III-V compound semiconductors for high-performance applications in various industries, including automotive and telecommunications, significantly boosts market demand.Asia Pacific Laser Photomask Market Report:

In the Asia-Pacific region, the Laser Photomask market is projected to grow from $0.46 billion in 2023 to $0.90 billion by 2033. This growth is driven by the booming electronics manufacturing sector, notably in countries like China, Japan, and South Korea. The increase in semiconductor fabrication facilities (fabs) and growing adoption of advanced electronic devices are key factors influencing market expansion.North America Laser Photomask Market Report:

In North America, the market is expected to expand from $0.91 billion in 2023 to $1.78 billion by 2033. The United States remains a major consumer of Laser Photomasks due to its robust semiconductor and advanced manufacturing sectors. Ongoing investments in technology innovation further support this growth.South America Laser Photomask Market Report:

The South American Laser Photomask market is anticipated to grow modestly from $0.10 billion in 2023 to $0.20 billion by 2033. The region is beginning to show interest in developing its semiconductor manufacturing capabilities, which could drive demand for Laser Photomasks as local industries seek to establish themselves in the global supply chain.Middle East & Africa Laser Photomask Market Report:

The Middle East and Africa market for Laser Photomask is projected to grow from $0.26 billion in 2023 to $0.51 billion by 2033. With a focus on enhancing digital infrastructure and initiating local manufacturing capabilities, demand for photomasks is expected to rise.Tell us your focus area and get a customized research report.

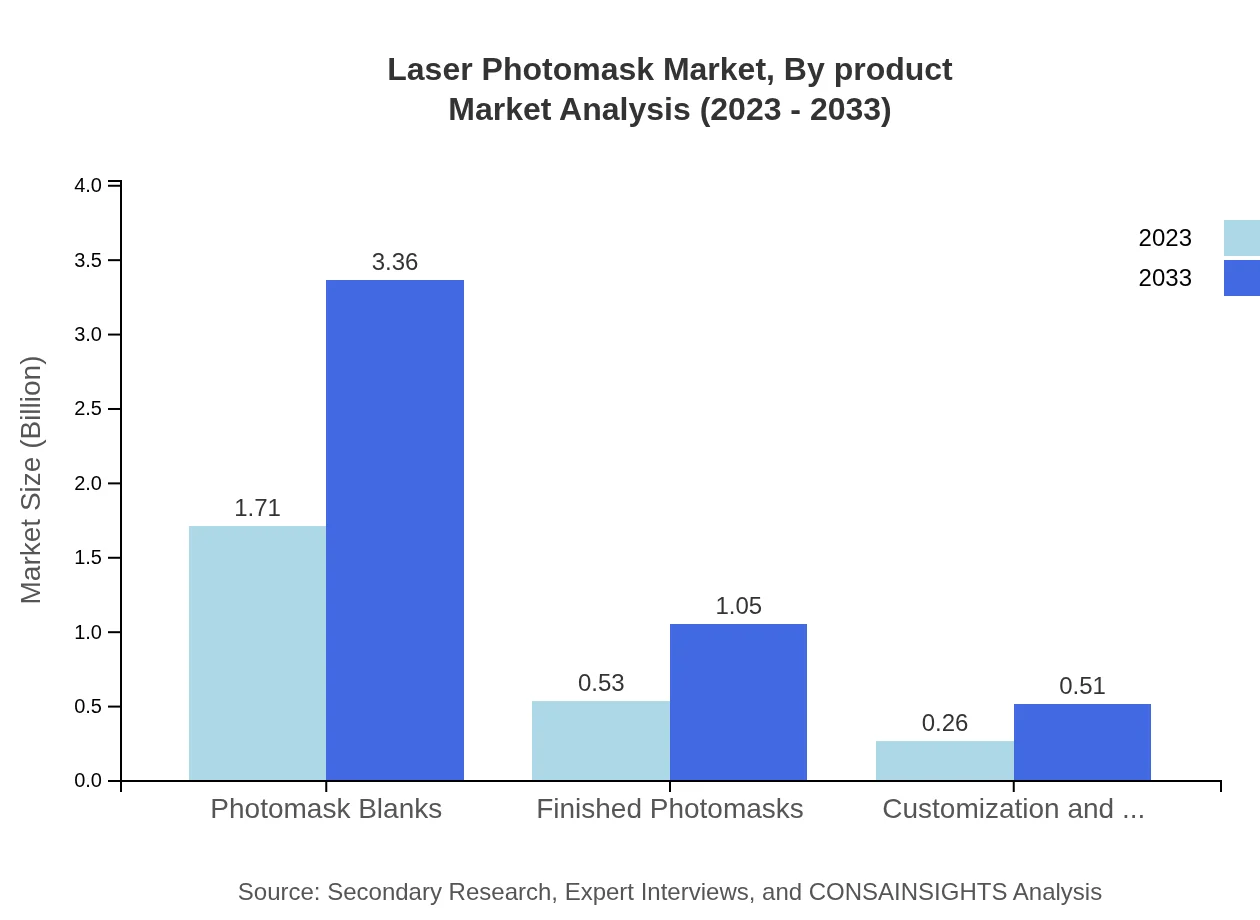

Laser Photomask Market Analysis By Product

The Laser Photomask market, by product, is primarily segmented into Photomask Blanks and Finished Photomasks. The Photomask Blanks segment is valued at approximately $1.71 billion in 2023 and is expected to grow to $3.36 billion by 2033, representing a market share of 68.4%. Finished Photomasks follow with a market size of $0.53 billion in 2023, projected to reach $1.05 billion by 2033, maintaining a steady market share of 21.3%.

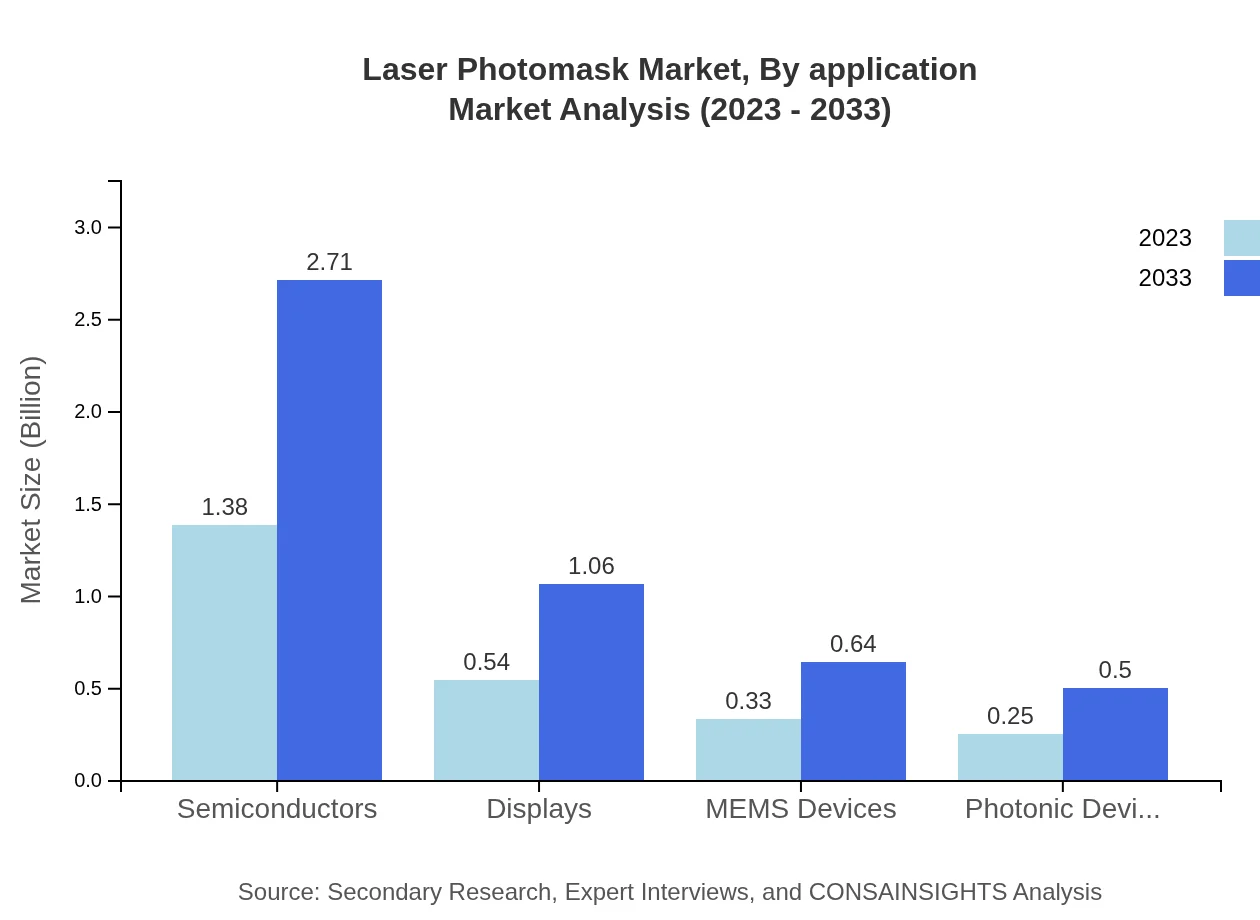

Laser Photomask Market Analysis By Application

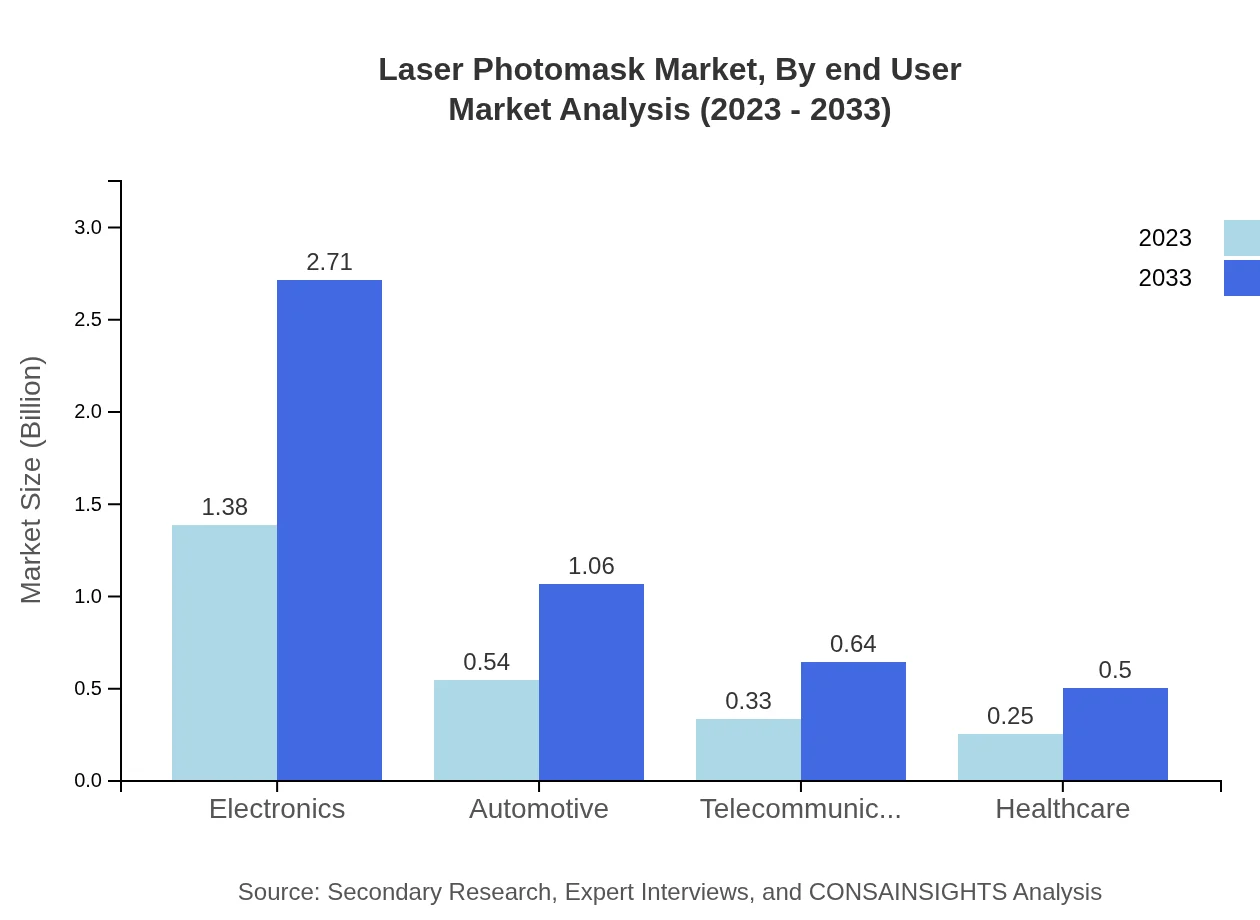

The largest share of the Laser Photomask market comes from the Electronics segment, which is valued at $1.38 billion in 2023 and expected to reach $2.71 billion by 2033, accounting for 55.24% of the total market. Other significant applications include Automotive, Telecommunications, Healthcare, and MEMS devices, with respective shares of 21.57%, 13.04%, and 10.15%.

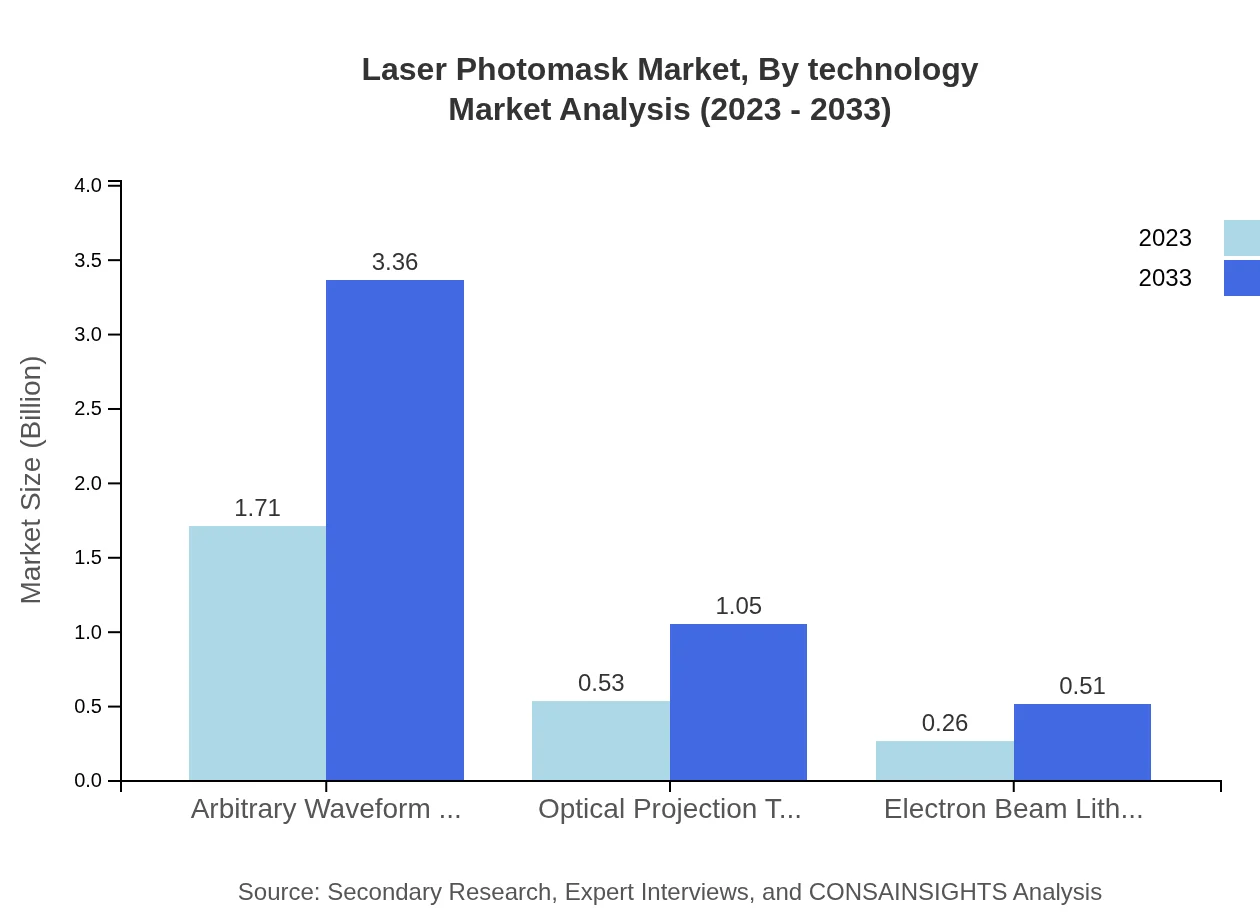

Laser Photomask Market Analysis By Technology

The Laser Photomask market, segmented by technology, includes Arbitrary Waveform Technology, Optical Projection Technology, and Electron Beam Lithography. Arbitrary Waveform Technology leads the market with a size of $1.71 billion in 2023, projected to grow to $3.36 billion by 2033, representing 68.4% of the segment's share. Likewise, Optical Projection Technology and Electron Beam Lithography are valued at $0.53 billion and $0.26 billion respectively in 2023, both showing growth in their respective applications.

Laser Photomask Market Analysis By End User

The end-user analysis of the Laser Photomask market highlights industries such as Semiconductors, Displays, and Automotive. The Semiconductor industry remains the dominant sector with a market size of $1.38 billion in 2023, growing to $2.71 billion by 2033, while the Displays sector captures a market size of $0.54 billion expected to rise to $1.06 billion over the same period.

Laser Photomask Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Photomask Industry

Photronics, Inc.:

Photronics is a leading provider of advanced photomask technology and serves as a key player in the semiconductor industry, focusing on innovating high-resolution photomasks.Toppan Photomasks, Inc.:

Toppan Photomasks is known for its high-quality photomask solutions utilized in semiconductor devices, leveraging cutting-edge technologies and vast production capabilities.SK-Electronics:

SK-Electronics specializes in producing high-precision photomask products, catering to global semiconductor manufacturing needs.Dai Nippon Printing Co., Ltd.:

Dai Nippon Printing is a major player in the photomask market, providing innovative solutions for high-performance semiconductor devices.LG Innotek:

LG Innotek focuses on advanced manufacturing technologies and is recognized for its contributions to high-quality Laser Photomasks.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Photomask?

The global laser photomask market is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 6.8%. This growth indicates a robust demand driven by technological advancements and expanding applications across various industries.

What are the key market players or companies in this laser Photomask industry?

Key players in the laser photomask industry include established semiconductor manufacturers and specialized photomask producers, contributing to innovation. They are focusing on enhancing production capabilities and technology to cater to diverse market needs.

What are the primary factors driving the growth in the laser Photomask industry?

The growth in the laser photomask industry is driven by the increasing demand for semiconductor devices, advancements in photolithography technologies, and a surge in applications in electronics and automotive sectors.

Which region is the fastest Growing in the laser Photomask?

The Asia-Pacific region exhibits significant growth, with the market projected to increase from $0.46 billion in 2023 to $0.90 billion by 2033, reflecting a robust electronics manufacturing base and rising technology investments.

Does ConsaInsights provide customized market report data for the laser Photomask industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the laser photomask industry, including insights on market segments, trends, and regional developments to support strategic decision-making.

What deliverables can I expect from this laser Photomask market research project?

From the laser photomask market research project, expect detailed reports encompassing market size forecasts, segment analysis, growth drivers, competitive landscapes, and regional insights that provide actionable intelligence for stakeholders.

What are the market trends of laser Photomask?

Current trends in the laser photomask market include increased adoption of advanced photolithography techniques, a shift toward smaller technology nodes, and growing investments in research and development within the semiconductor industry.