Laser Processing Market Report

Published Date: 31 January 2026 | Report Code: laser-processing

Laser Processing Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Laser Processing market, providing a comprehensive analysis of market trends, segmentation, regional insights, and forecasts for the years 2023 to 2033.

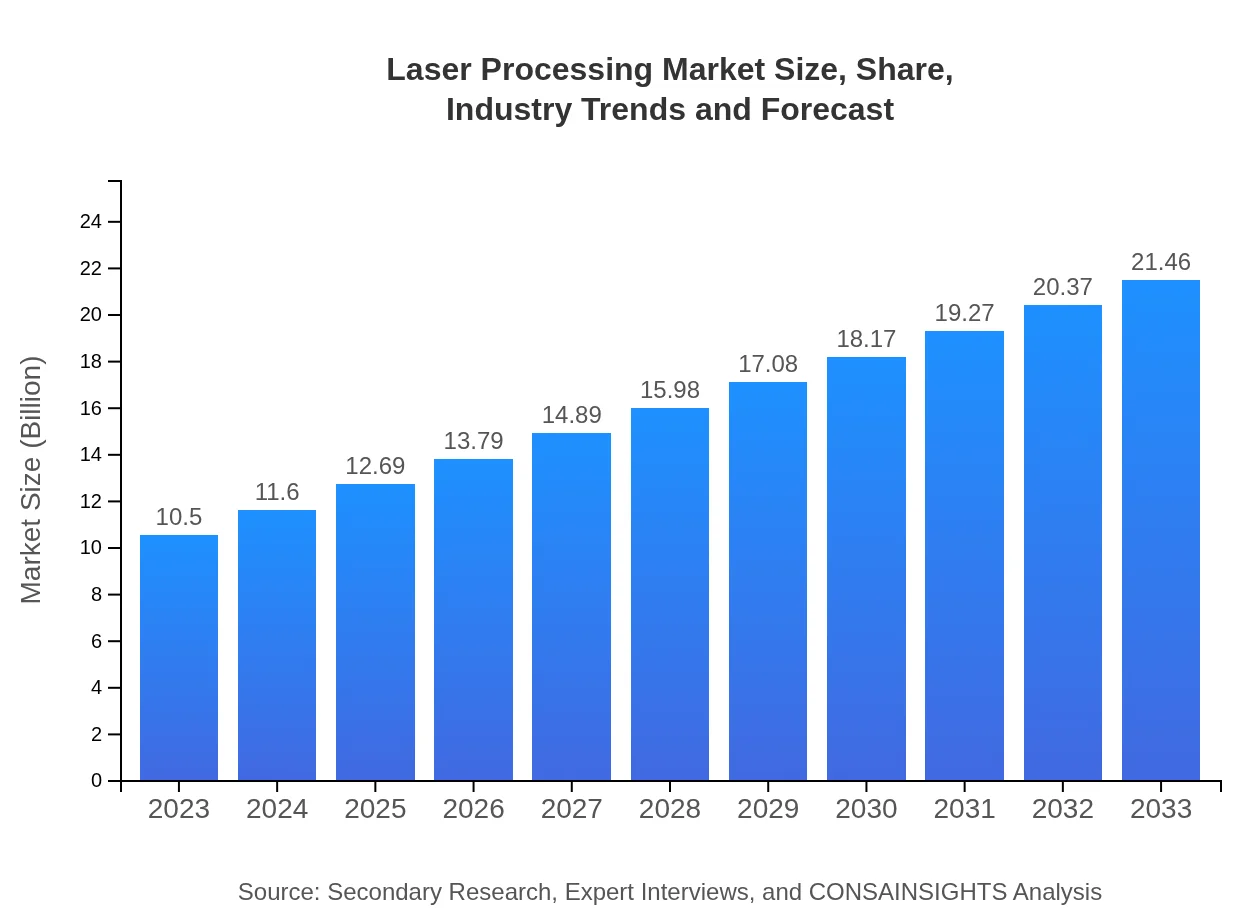

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Trumpf, Coherent, IPG Photonics, Lumentum, Han's Laser |

| Last Modified Date | 31 January 2026 |

Laser Processing Market Overview

Customize Laser Processing Market Report market research report

- ✔ Get in-depth analysis of Laser Processing market size, growth, and forecasts.

- ✔ Understand Laser Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Processing

What is the Market Size & CAGR of Laser Processing market in 2023?

Laser Processing Industry Analysis

Laser Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Processing Market Analysis Report by Region

Europe Laser Processing Market Report:

Europe's Laser Processing market is projected to increase from $3.24 billion in 2023 to $6.62 billion by 2033. The region's growth is largely influenced by stringent regulations demanding quality and efficiency in manufacturing, alongside a robust automotive sector. Countries such as Germany and France are leading the expansion due to technological innovations and investments in laser systems.Asia Pacific Laser Processing Market Report:

In the Asia-Pacific region, the Laser Processing market is expected to grow from $2.24 billion in 2023 to $4.58 billion by 2033. This growth is primarily driven by increased manufacturing activities and rising investments in automation across countries such as China and India. The burgeoning automotive and electronics sectors significantly contribute to the demand for laser processing technologies.North America Laser Processing Market Report:

North America is anticipated to see substantial growth from $3.38 billion in 2023 to $6.92 billion by 2033. The growth in this region is fueled by advanced manufacturing practices, particularly in the automotive and aerospace industries, where precision and efficiency are paramount. The US remains the largest consumer of laser processing technologies, leveraging innovation to enhance production capabilities.South America Laser Processing Market Report:

The South American market is projected to expand from $1.01 billion in 2023 to approximately $2.07 billion by 2033. The growth is supported by rising industrialization and the need for modernized manufacturing processes, although the market remains relatively small compared to other regions. Brazil and Argentina are key markets in this domain.Middle East & Africa Laser Processing Market Report:

In the Middle East and Africa, the market is expected to rise from $0.63 billion in 2023 to $1.29 billion by 2033. The growth is relatively slower compared to other regions, driven by increasing industrialization and investments in infrastructural development. The UAE and South Africa are emerging as key players for laser processing technology.Tell us your focus area and get a customized research report.

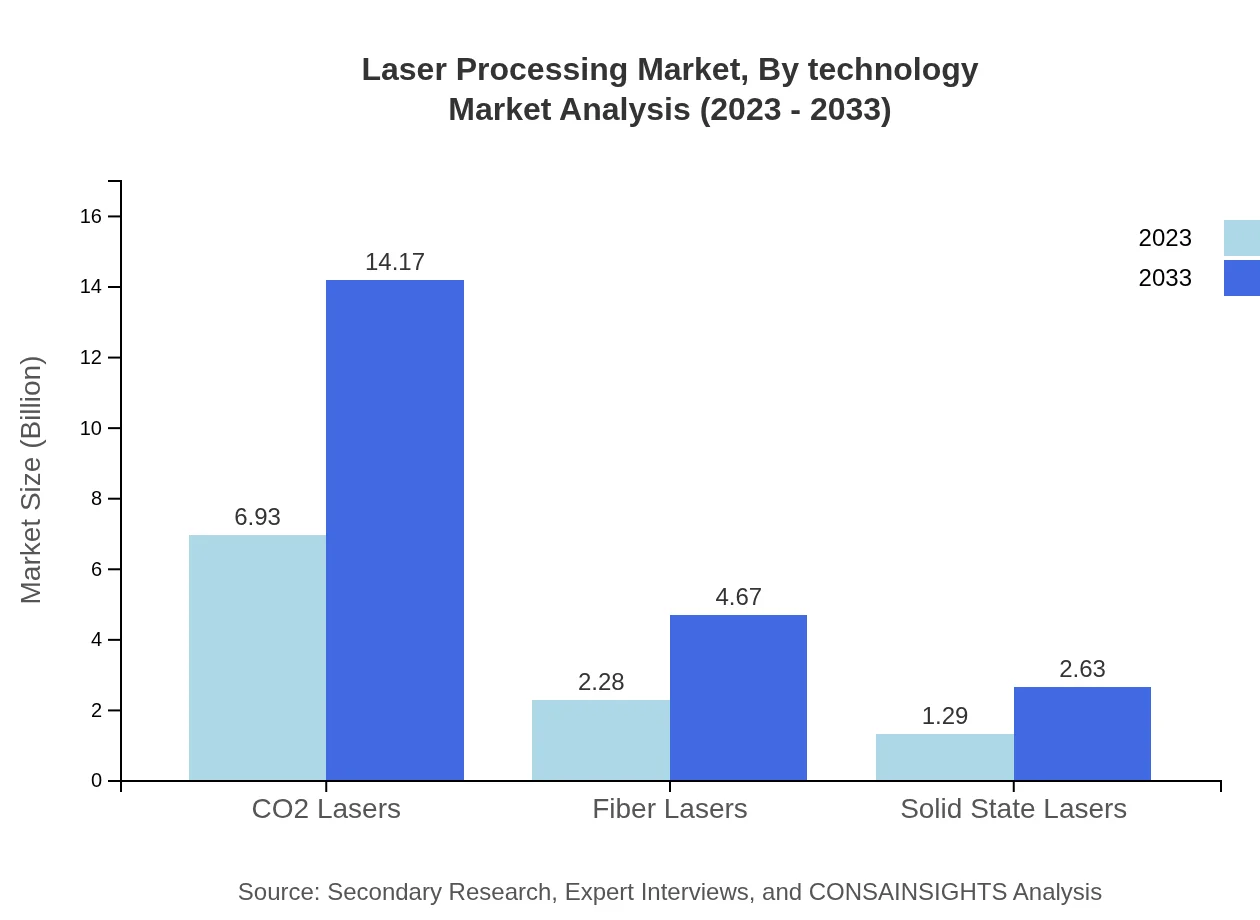

Laser Processing Market Analysis By Technology

The Laser Processing market is dominated by CO2 lasers, which account for a significant market share with a size of $6.93 billion in 2023 and projected to grow to $14.17 billion by 2033. Fiber lasers follow, with a market size of $2.28 billion in 2023 expected to increase to $4.67 billion by 2033. Solid-state lasers also contribute to the market with a size of $1.29 billion in 2023, growing to $2.63 billion by 2033. Each technology exhibits unique properties suited for specific applications, influencing their adoption in different sectors.

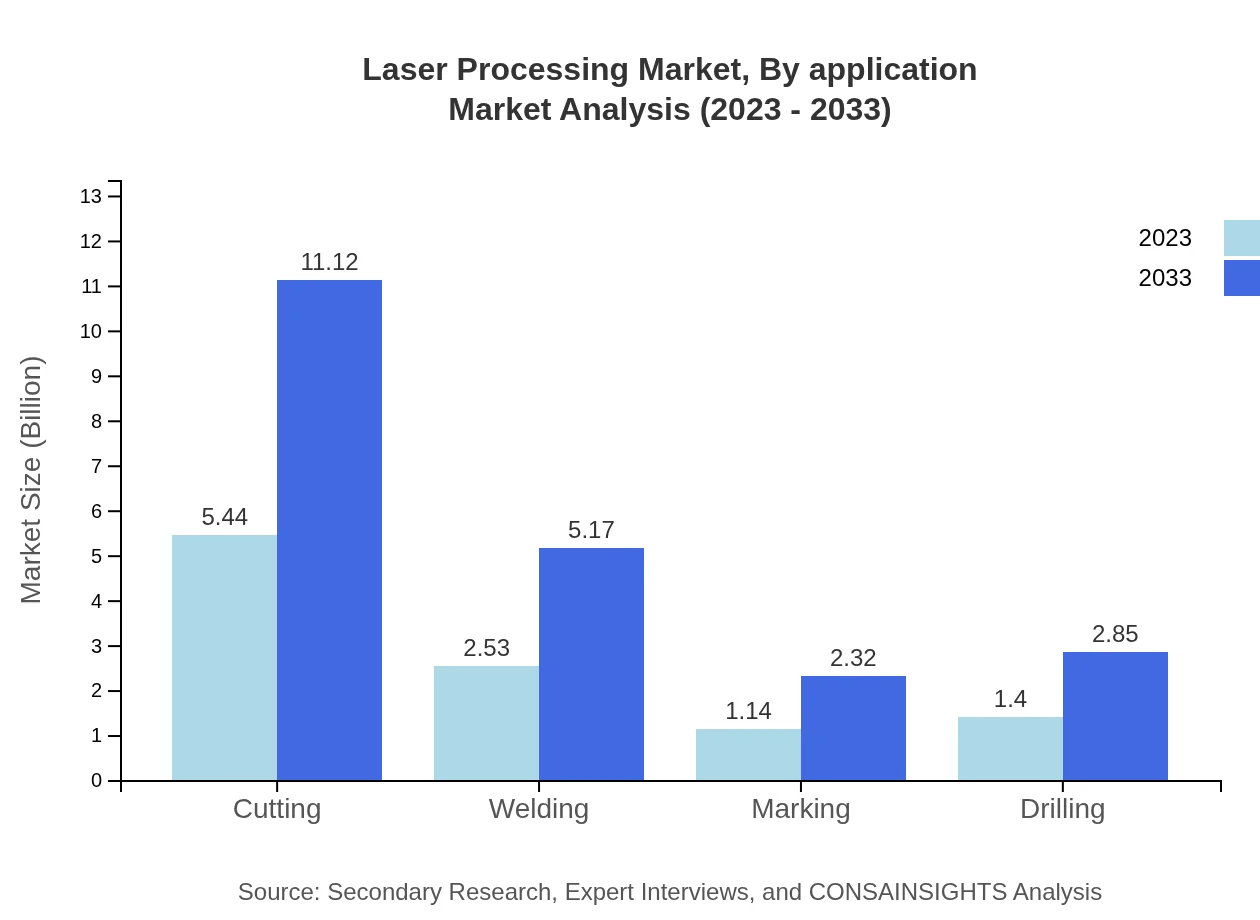

Laser Processing Market Analysis By Application

Applications of Laser Processing are varied, including cutting, welding, marking, drilling, and more. The cutting segment leads with a size of $5.44 billion in 2023, projected to reach $11.12 billion by 2033. Welding follows closely, with a size of $2.53 billion in 2023, expected to grow to $5.17 billion by 2033. Marking and drilling also show significant market potential, with sizes of $1.14 billion and $1.40 billion in 2023, respectively. These applications cater to industries such as aerospace, automotive, electronics, and medical devices.

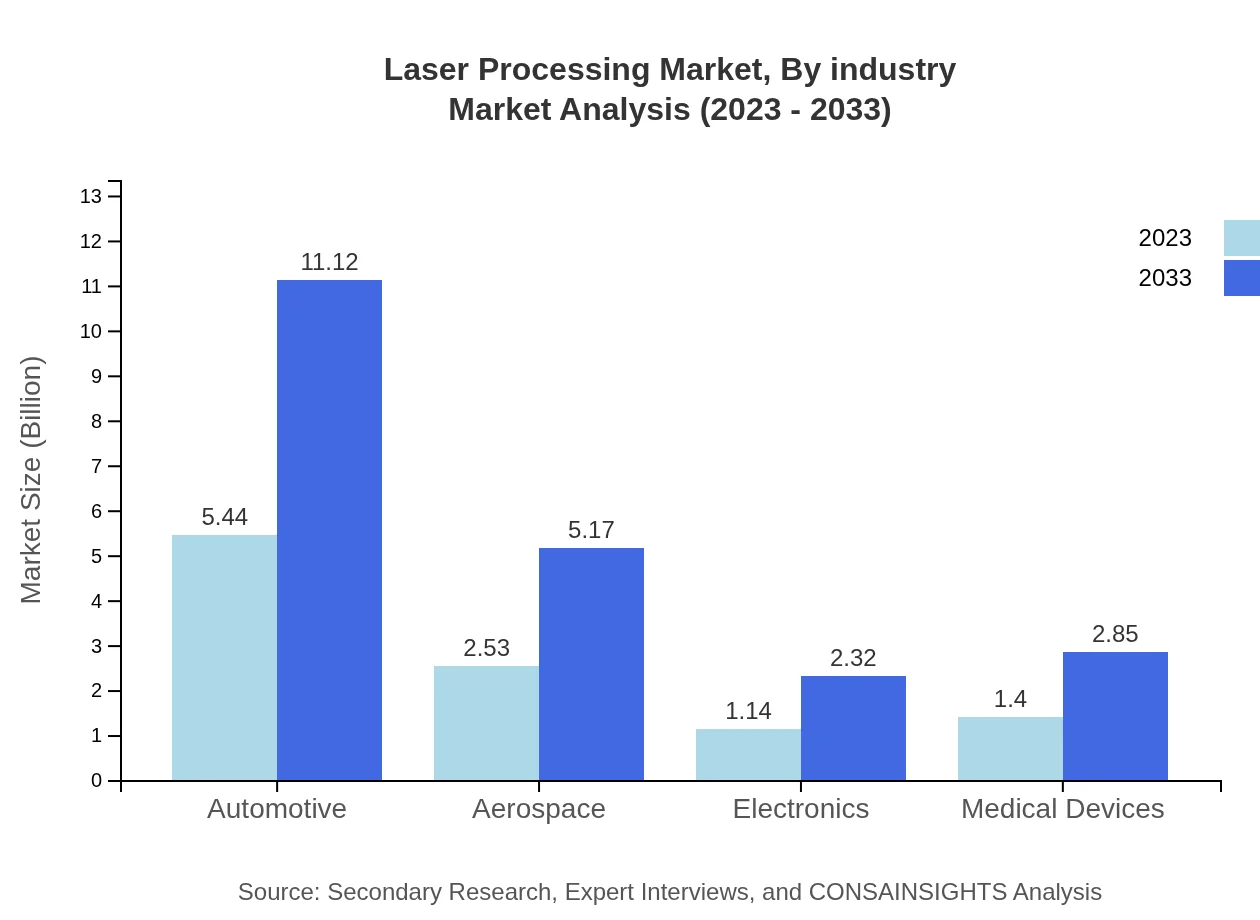

Laser Processing Market Analysis By Industry

The key industries utilizing Laser Processing include automotive, aerospace, electronics, medical devices, and construction. The automotive sector leads the market, capturing a 51.79% share in 2023, growing from $5.44 billion to $11.12 billion by 2033. Aerospace follows with a 24.08% share, growing from $2.53 billion to $5.17 billion. These industries rely heavily on laser technologies for precise manufacturing and efficient production, driving overall market growth.

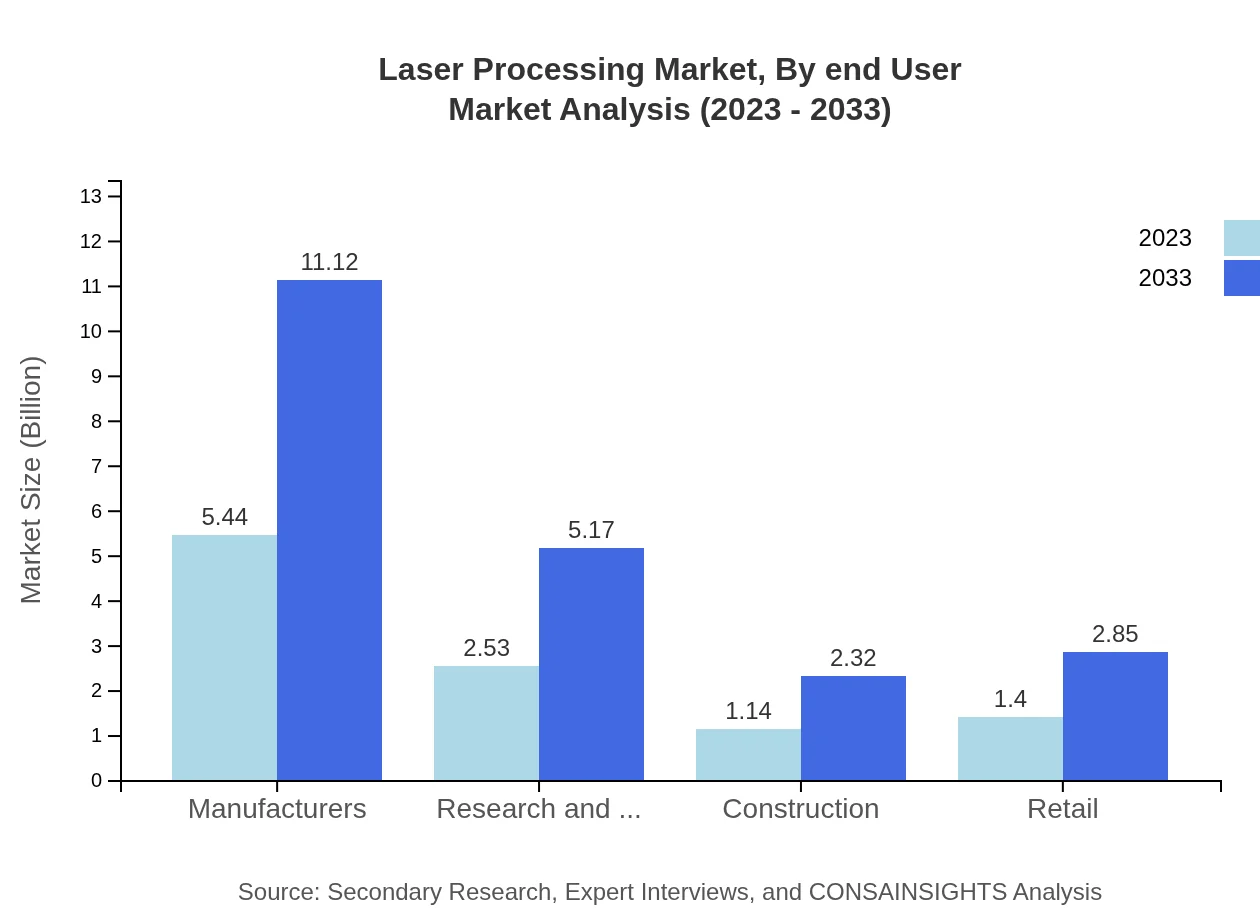

Laser Processing Market Analysis By End User

The end-users of Laser Processing technologies span various sectors, including manufacturers, research and development, construction, and retail. Manufacturers dominate the market with a 51.79% share, forecasted to grow from $5.44 billion in 2023 to $11.12 billion by 2033. The retail sector represents a growing opportunity, with a market size of $1.40 billion in 2023, expected to reach $2.85 billion by 2033. Understanding these end-users is vital for targeting and optimizing marketing efforts.

Laser Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Processing Industry

Trumpf:

A global leader in industrial lasers and laser systems, Trumpf’s products are renowned for their performance and precision across various manufacturing applications.Coherent:

Coherent is a leading provider of laser-based solutions for industrial laser processing applications, focusing on innovation and high-quality standards.IPG Photonics:

Specialized in high-performance fiber lasers, IPG Photonics is a key player in the market, catering to cutting, welding, and marking sectors.Lumentum:

Lumentum provides advanced laser technologies and photonic solutions, significantly influencing various markets including telecom and industrial manufacturing.Han's Laser:

Han's Laser is a prominent Chinese manufacturer known for its extensive range of laser systems and applications in various industries, including electronics and automotive.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Processing?

The global laser processing market is projected to reach a size of $10.5 billion by 2033, growing at a CAGR of 7.2% from its 2023 value. This growth indicates a robust demand across various sectors utilizing advanced laser technologies.

What are the key market players or companies in the laser Processing industry?

Key players in the laser processing industry include renowned manufacturers specializing in laser technology solutions. These companies actively participate in technological advancements and competitive strategies to enhance their market presence and drive innovation.

What are the primary factors driving the growth in the laser processing industry?

Growth in the laser processing industry is driven by rising demand for precision manufacturing, technological advancements in laser technologies, and the expansion of industries such as automotive and aerospace leveraging laser processing for efficiency and accuracy.

Which region is the fastest Growing in the laser processing market?

The fastest-growing region in the laser processing market is projected to be Asia Pacific, with market growth from $2.24 billion in 2023 to $4.58 billion by 2033, reflecting a significant demand for laser applications across various sectors.

Does ConsaInsights provide customized market report data for the laser processing industry?

Yes, ConsaInsights specializes in providing tailored market report data for the laser processing industry, allowing businesses to access customized insights that align with their specific strategic and operational needs.

What deliverables can I expect from this laser processing market research project?

Deliverables of the laser processing market research project typically include comprehensive market analysis reports, data on market size, growth trends across segments, competitive landscape insights, and forecasts to guide strategic decision-making.

What are the market trends of laser processing?

Current market trends in laser processing include increased integration of automation, advancements in laser technology, and growing application in sectors like automotive, aerospace, and manufacturing, which rely heavily on precision cutting and welding.