Laser Sensor Market Report

Published Date: 31 January 2026 | Report Code: laser-sensor

Laser Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Laser Sensor market, covering market dynamics, segmentation, regional insights, and technological advancements. The forecast period spans from 2023 to 2033, offering valuable insights for stakeholders and investors.

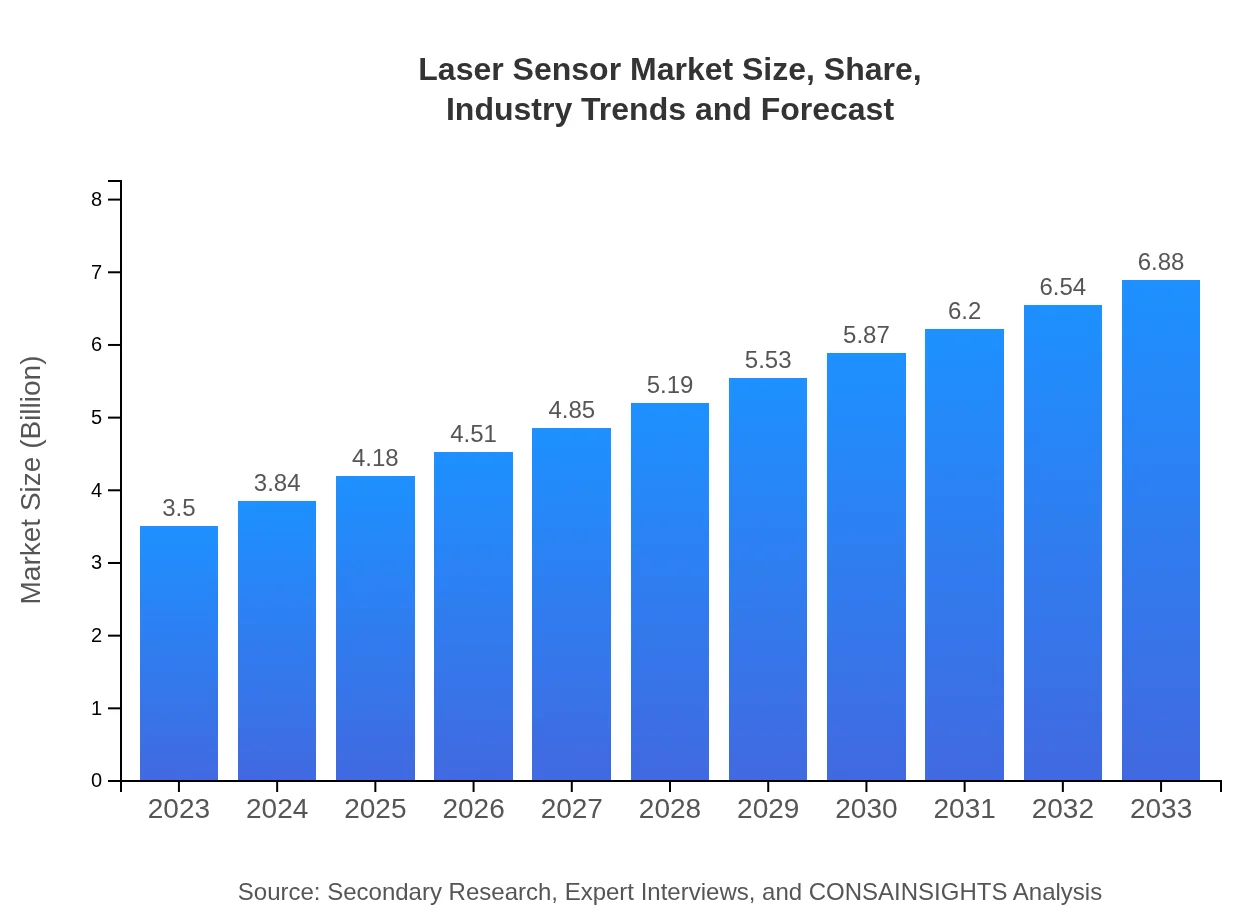

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Bosch, SICK AG, Honeywell , Keyence, Omron Corporation |

| Last Modified Date | 31 January 2026 |

Laser Sensor Market Overview

Customize Laser Sensor Market Report market research report

- ✔ Get in-depth analysis of Laser Sensor market size, growth, and forecasts.

- ✔ Understand Laser Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Sensor

What is the Market Size & CAGR of Laser Sensor market in 2023?

Laser Sensor Industry Analysis

Laser Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Sensor Market Analysis Report by Region

Europe Laser Sensor Market Report:

The European market for laser sensors is projected to expand from USD 0.92 billion in 2023 to USD 1.81 billion by 2033. The growth is fueled by stringent regulations for safety and efficiency in manufacturing processes, alongside the increasing adoption of Industry 4.0 practices.Asia Pacific Laser Sensor Market Report:

The Asia Pacific region is anticipated to emerge as a leading market for laser sensors, projected to grow from USD 0.71 billion in 2023 to USD 1.40 billion by 2033. This growth is driven by rapid industrialization, increasing investments in automation, and a burgeoning manufacturing sector in countries like China and India.North America Laser Sensor Market Report:

North America represents a significant segment of the laser sensor market, projected to grow from USD 1.28 billion in 2023 to USD 2.51 billion by 2033. The United States is leading in terms of market share, largely due to advancements in technology and a high rate of automation in industries.South America Laser Sensor Market Report:

In South America, the laser sensor market is expected to witness steady growth from USD 0.16 billion in 2023 to USD 0.31 billion by 2033. The market is primarily driven by the construction and agricultural sectors, which are increasingly adopting advanced measurement tools for efficiency.Middle East & Africa Laser Sensor Market Report:

In the Middle East and Africa, the market is expected to experience growth from USD 0.42 billion in 2023 to USD 0.84 billion by 2033. The expansion is driven by infrastructural developments and a rising focus on innovative solutions in countries like the UAE and South Africa.Tell us your focus area and get a customized research report.

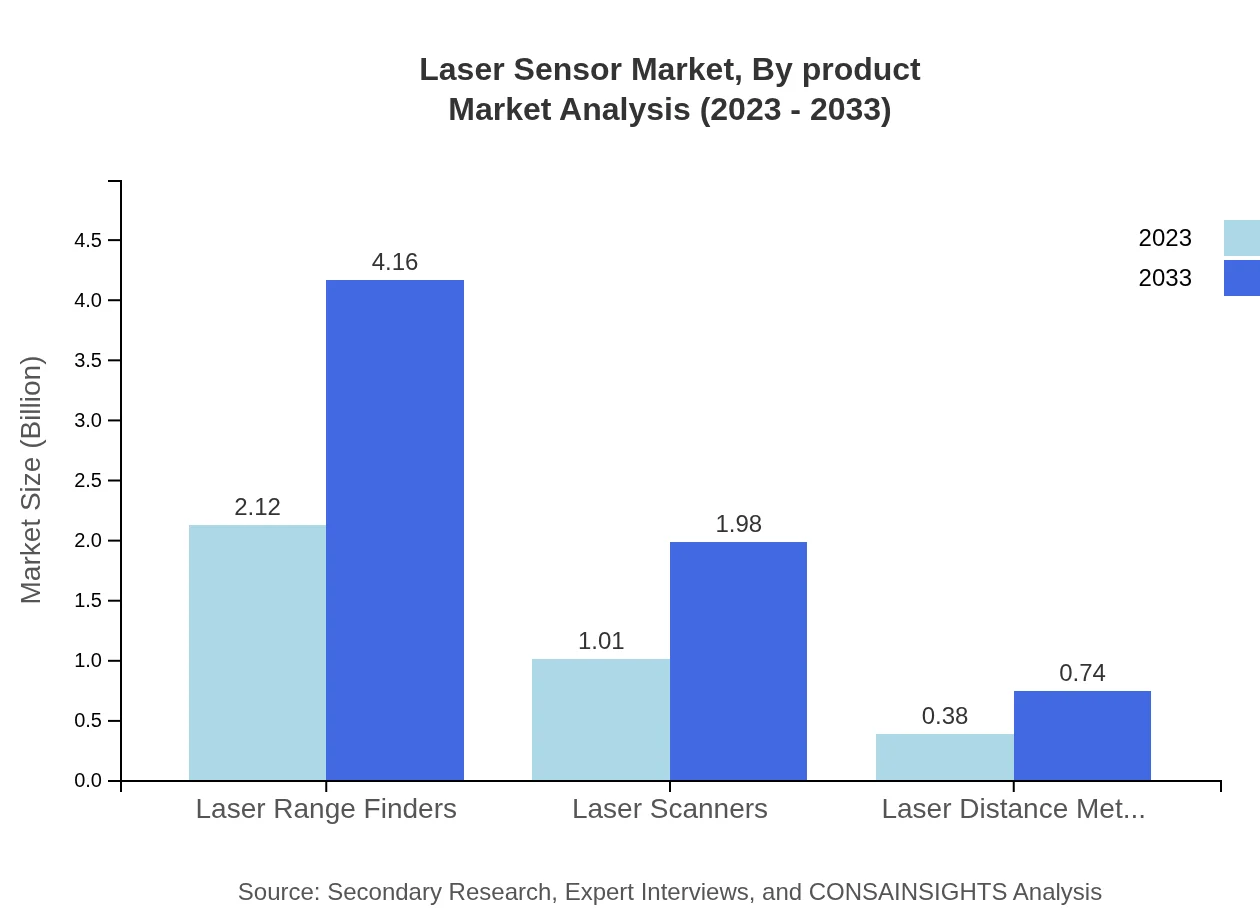

Laser Sensor Market Analysis By Product

The segment analysis indicates that the Laser Range Finders will dominate the market, with a size of USD 2.12 billion in 2023 and projected to reach USD 4.16 billion by 2033. Laser Scanners also represent significant market potential with sizes of USD 1.01 billion in 2023 and increasing to USD 1.98 billion by 2033.

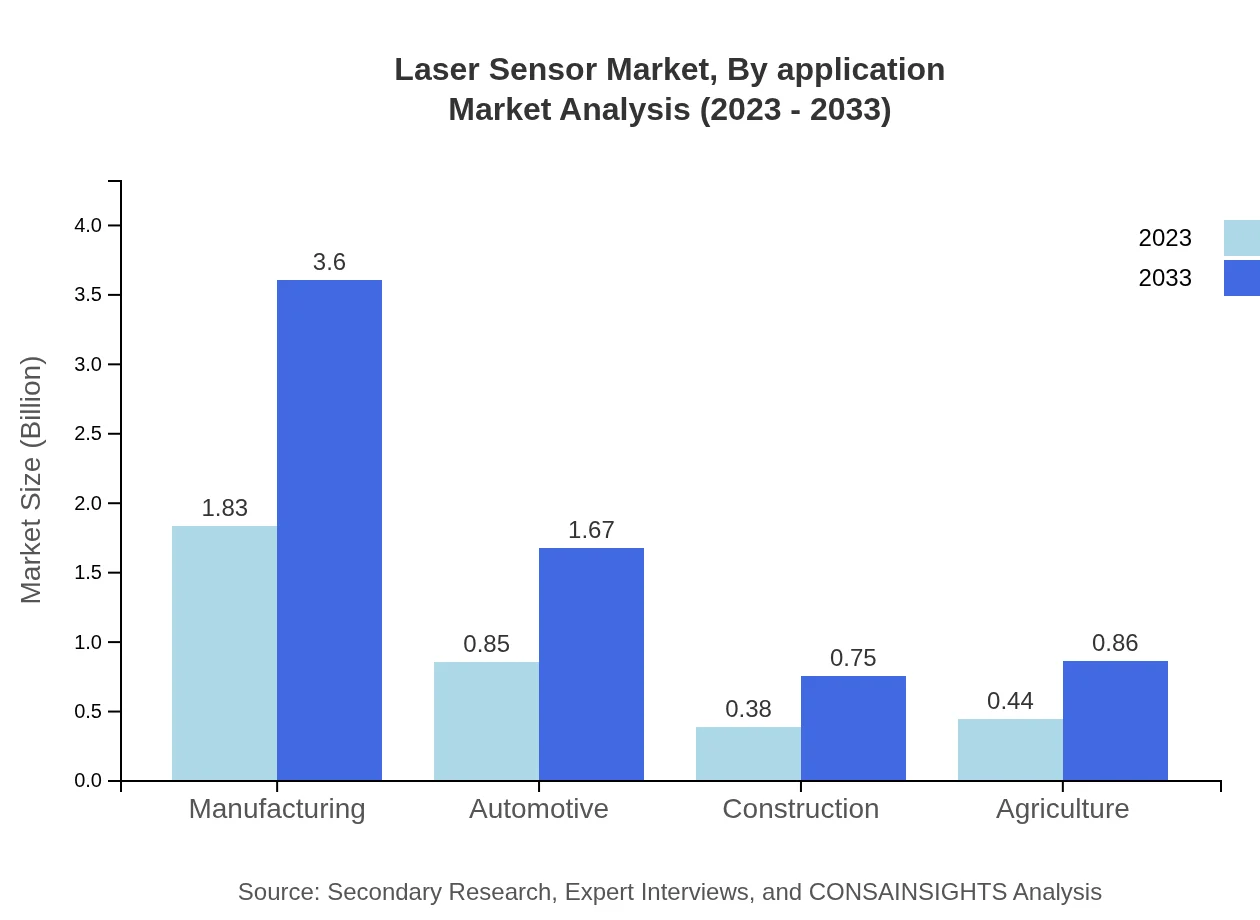

Laser Sensor Market Analysis By Application

In terms of applications, the Industrial sector holds a dominant share, representing 52.37% of the market with a size of USD 1.83 billion in 2023. The Automotive sector is also notable, accounted for 24.22% of the market share and is expected to grow in alignment with advancements in automated vehicles.

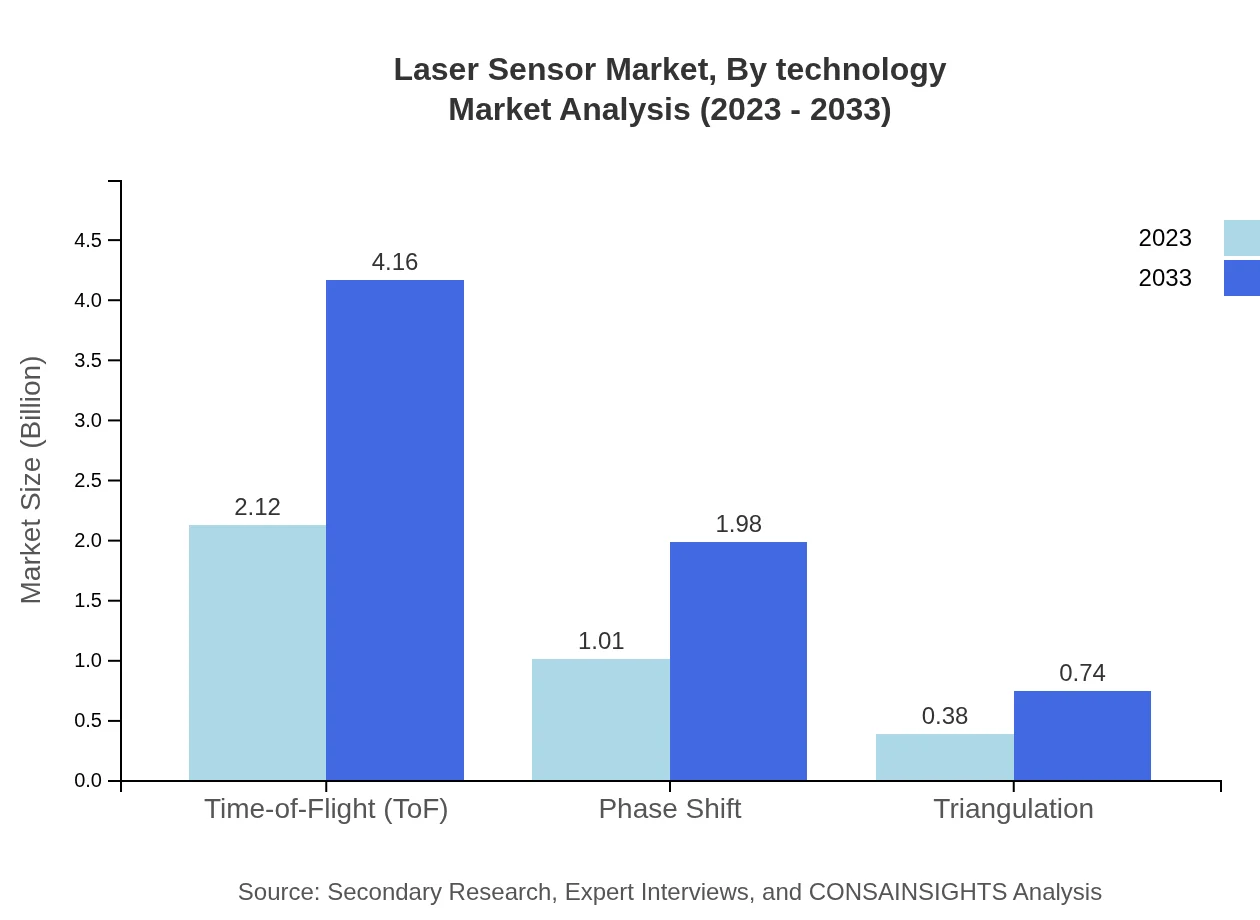

Laser Sensor Market Analysis By Technology

The Time-of-Flight (ToF) technology leads the market, commanding a share of 60.44% in 2023, while the Phase Shift and Triangulation technologies follow, with significant shares as well. This trend indicates a strong preference for ToF sensors owing to their high accuracy and efficiency.

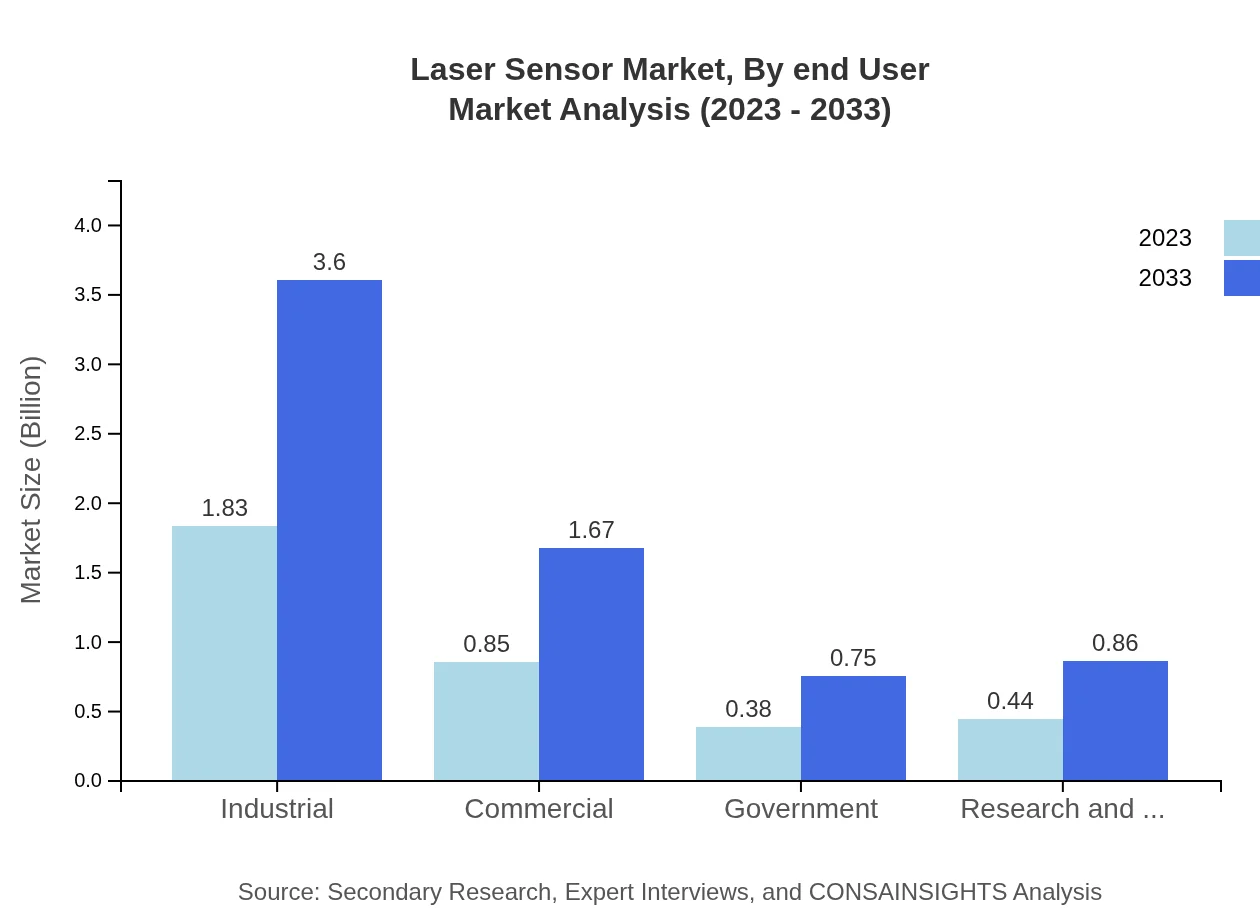

Laser Sensor Market Analysis By End User

The key end-user industries capturing market interest include Manufacturing, Automotive, and Construction. The Manufacturing segment leads with a share of 52.37% in 2023, reflecting the ongoing demand for precision measurements and quality control.

Laser Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Sensor Industry

Bosch:

A leader in sensor technology, Bosch offers a range of innovative laser sensors used in automotive and industrial applications, enhancing precision and automation.SICK AG:

Known for high-performance sensors, SICK AG specializes in laser sensors for logistics and process automation, supporting industries in achieving operational efficiency.Honeywell :

Honeywell provides cutting-edge laser sensors that cater to the aerospace and industrial sectors, focusing on safety and performance.Keyence:

Keyence is recognized for its advanced measurement systems, including laser sensors that revolutionize factory automation and process optimization.Omron Corporation:

Omron develops precise laser-based solutions for a variety of applications, enhancing functionality and reliability in industrial automation.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Sensor?

The global laser sensor market is valued at $3.5 billion in 2023 and is projected to reach substantial growth by 2033, with an expected CAGR of 6.8%. This growth reflects increasing demand across various industries.

What are the key market players or companies in the laser Sensor industry?

Key players in the laser sensor market include industry leaders such as Siemens, Honeywell, and Bosch. These companies dominate through innovation, quality products, and strategic partnerships to enhance market presence and customer satisfaction.

What are the primary factors driving the growth in the laser sensor industry?

Growth drivers for the laser sensor industry include advancements in technology, growing automation in manufacturing, and increasing applications in industries such as automotive and construction, creating a significant demand for high-precision measurements.

Which region is the fastest Growing in the laser sensor market?

The Asia Pacific region is the fastest-growing market, expected to expand from $0.71 billion in 2023 to $1.40 billion by 2033. This growth is fueled by rising industrialization and technological advancements in emerging economies.

Does ConsaInsights provide customized market report data for the laser sensor industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the laser sensor industry. This includes specialized insights, market forecasts, and competitive analysis to support strategic decision-making.

What deliverables can I expect from this laser sensor market research project?

Deliverables from the laser sensor market research project include comprehensive reports, market size analyses, competitive landscape assessments, trends overview, and tailored insights specific to client objectives and industry dynamics.

What are the market trends of laser sensors?

Current trends in the laser sensor market indicate an increase in the adoption of IoT-enabled sensors, growth in industrial automation, and a move toward more sophisticated laser scanning technologies, enhancing measurement accuracy and efficiency.