Laser Technology Market Report

Published Date: 31 January 2026 | Report Code: laser-technology

Laser Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Laser Technology market from 2023 to 2033, focusing on market trends, size, growth opportunities, and insights across various segments and regions.

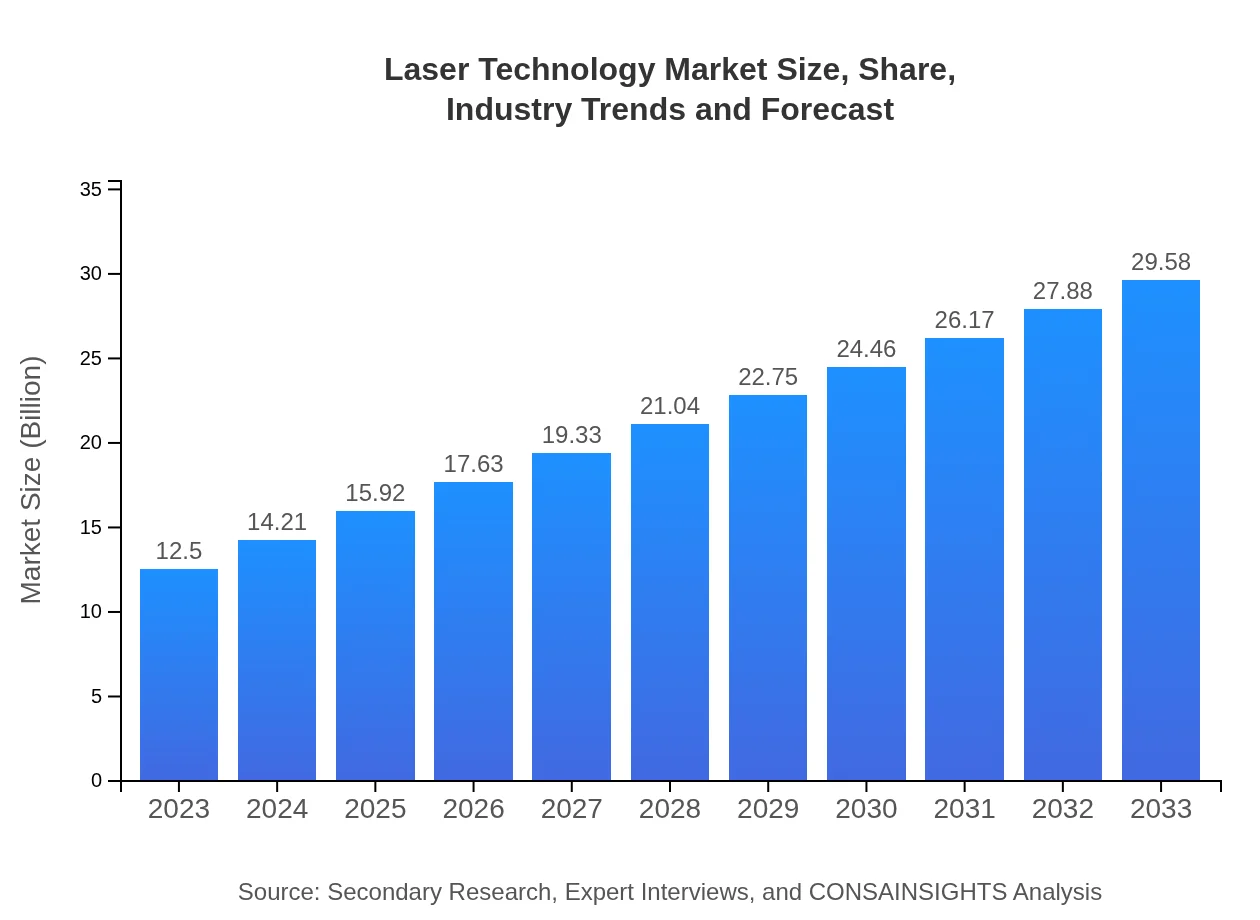

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $29.58 Billion |

| Top Companies | Coherent Inc., IPG Photonics Corporation, Trumpf GmbH + Co. KG, Lumentum Holdings Inc., MKS Instruments Inc. |

| Last Modified Date | 31 January 2026 |

Laser Technology Market Overview

Customize Laser Technology Market Report market research report

- ✔ Get in-depth analysis of Laser Technology market size, growth, and forecasts.

- ✔ Understand Laser Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Technology

What is the Market Size & CAGR of the Laser Technology market in 2023?

Laser Technology Industry Analysis

Laser Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Laser Technology Market Analysis Report by Region

Europe Laser Technology Market Report:

The European market is significant, starting at $3.80 billion in 2023 and projected to grow to $8.99 billion in 2033, showcasing a CAGR of 9.2%. The presence of major automotive and aerospace industries supports the strong adoption of laser technology, focused on efficiency and precision.Asia Pacific Laser Technology Market Report:

In 2023, the Asia Pacific region is valued at $2.28 billion and is projected to grow to $5.39 billion by 2033, exhibiting a CAGR of about 9.2%. This region is witnessing increased investments in the electronics manufacturing and medical sectors, creating demand for advanced laser technologies for production processes.North America Laser Technology Market Report:

North America has a market size of $4.82 billion in 2023, anticipated to expand to $11.41 billion by 2033, reflecting a robust CAGR of 9.3%. Advancements in healthcare technology and increased defense applications drive this growth, with strong contributions from established players in the region.South America Laser Technology Market Report:

The South American market is valued at $0.10 billion in 2023, expected to reach $0.24 billion by 2033, with a CAGR of 9.3%. Governments in this region are initiating projects to enhance infrastructure, and with the growing healthcare sector, the need for laser technology is expected to rise significantly.Middle East & Africa Laser Technology Market Report:

This market, valued at $1.50 billion in 2023, is expected to increase to $3.55 billion by 2033, reflecting a CAGR of 9.1%. The growing focus on healthcare and infrastructure development in this region is boosting the adoption of advanced laser solutions.Tell us your focus area and get a customized research report.

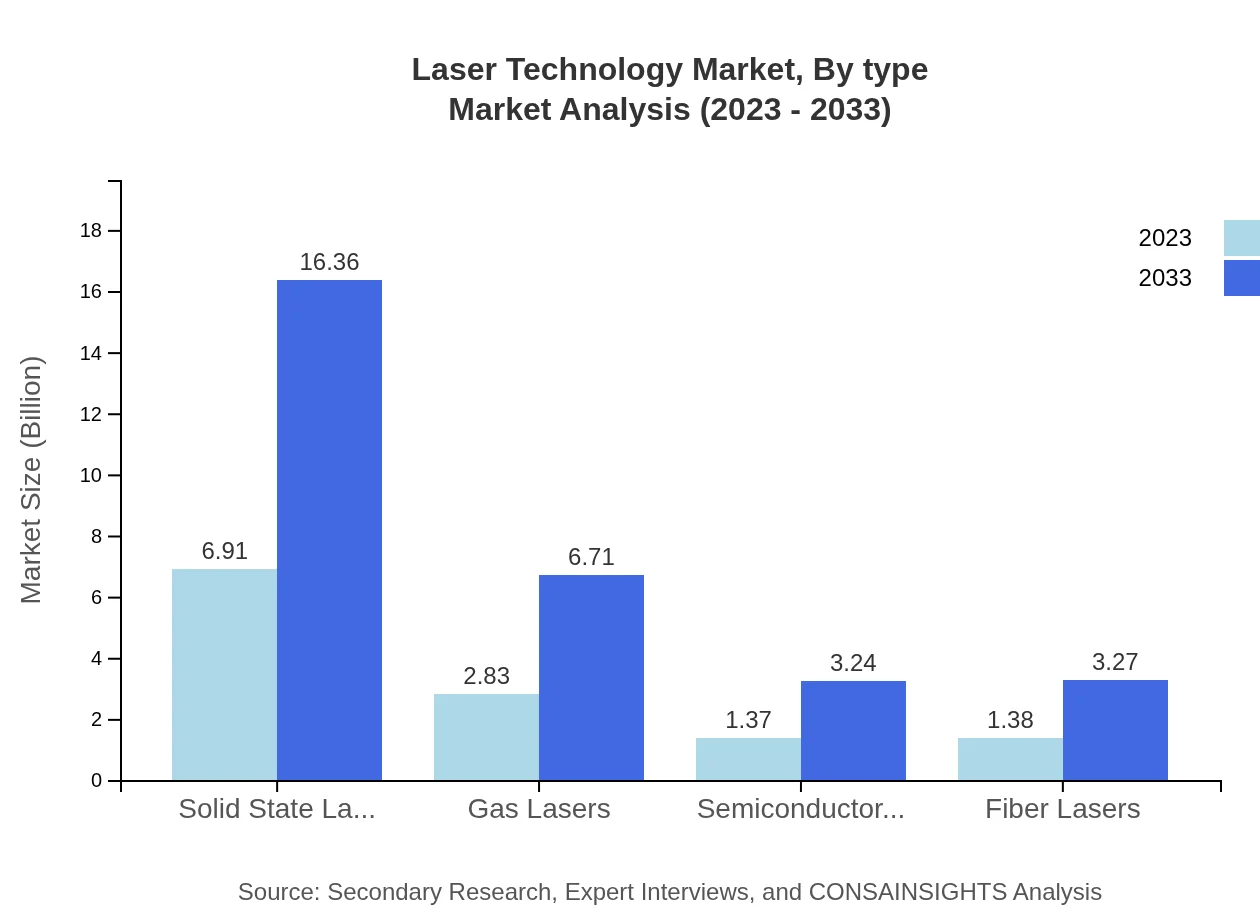

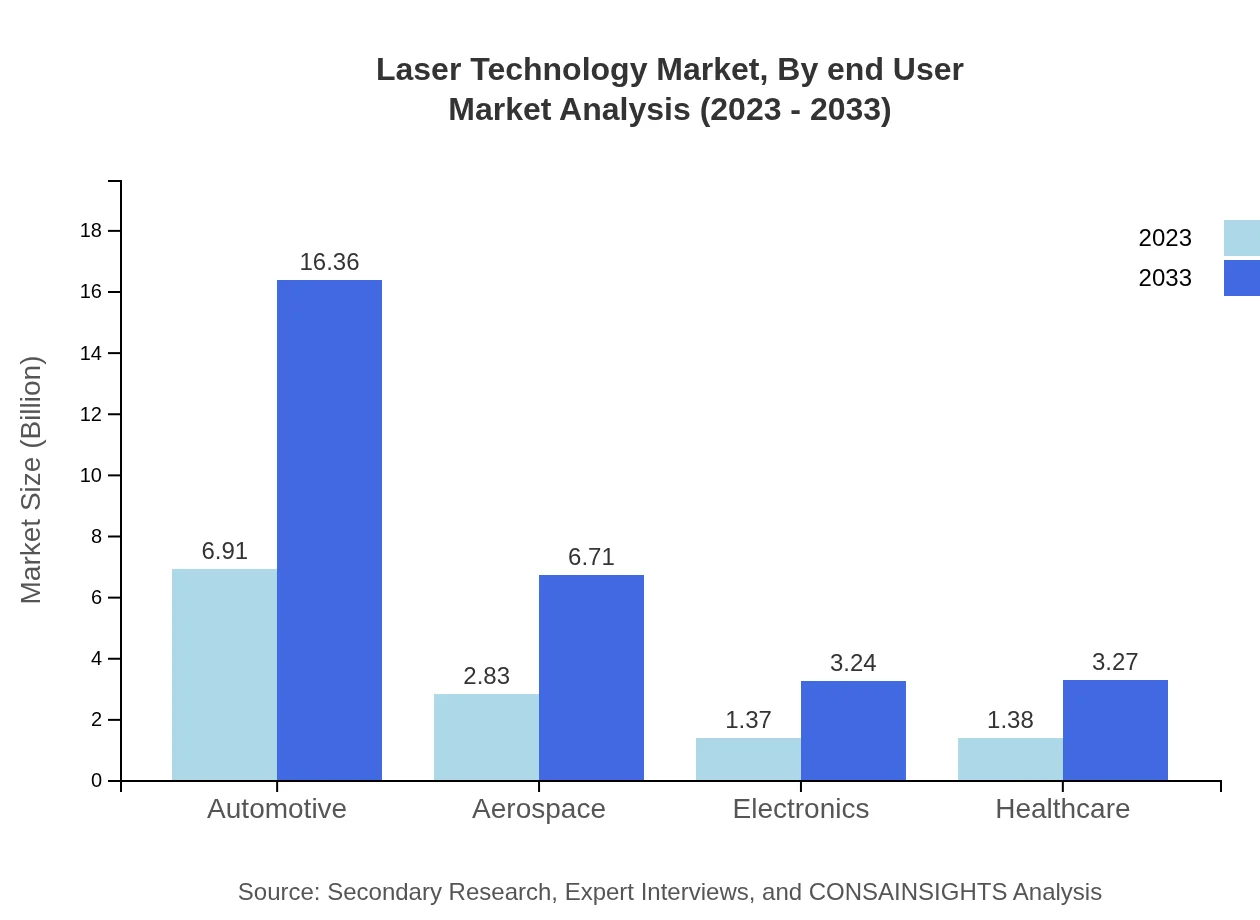

Laser Technology Market Analysis By Type

The analysis shows that Solid State Lasers dominate the market with a value of $6.91 billion in 2023, expected to grow to $16.36 billion by 2033. This is followed by Gas Lasers at $2.83 billion and projected to reach $6.71 billion, and Semiconductor Lasers with market size from $1.37 billion to $3.24 billion over the same period. Fiber Lasers are also contributing with expected growth from $1.38 billion to $3.27 billion.

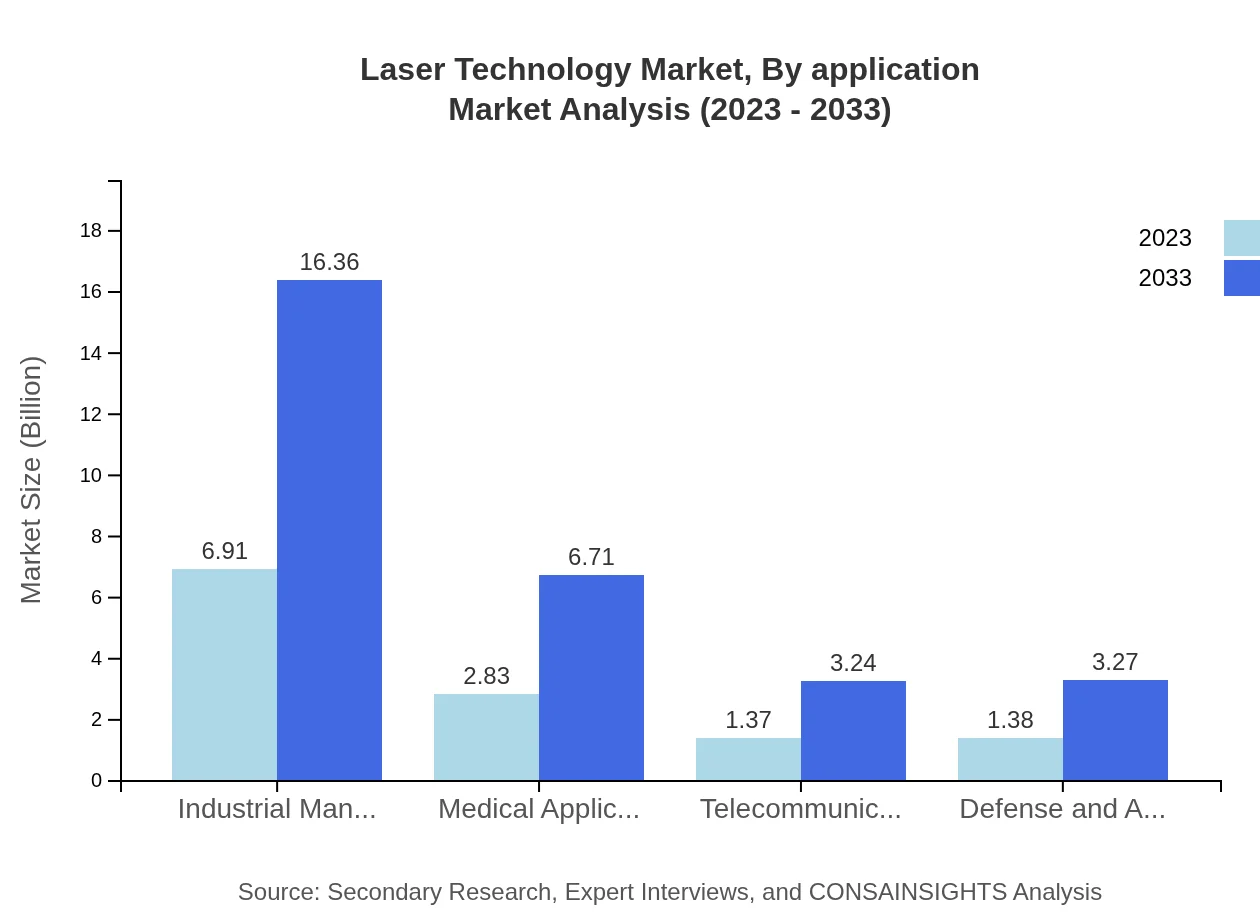

Laser Technology Market Analysis By Application

The Automotive sector leads the applications segment, starting at $6.91 billion and expected to reach $16.36 billion by 2033. Aerospace follows with a market growth trajectory from $2.83 billion to $6.71 billion. Industries like Electronics and Healthcare are also notable contributors, highlighting a shift towards laser solutions across diverse applications.

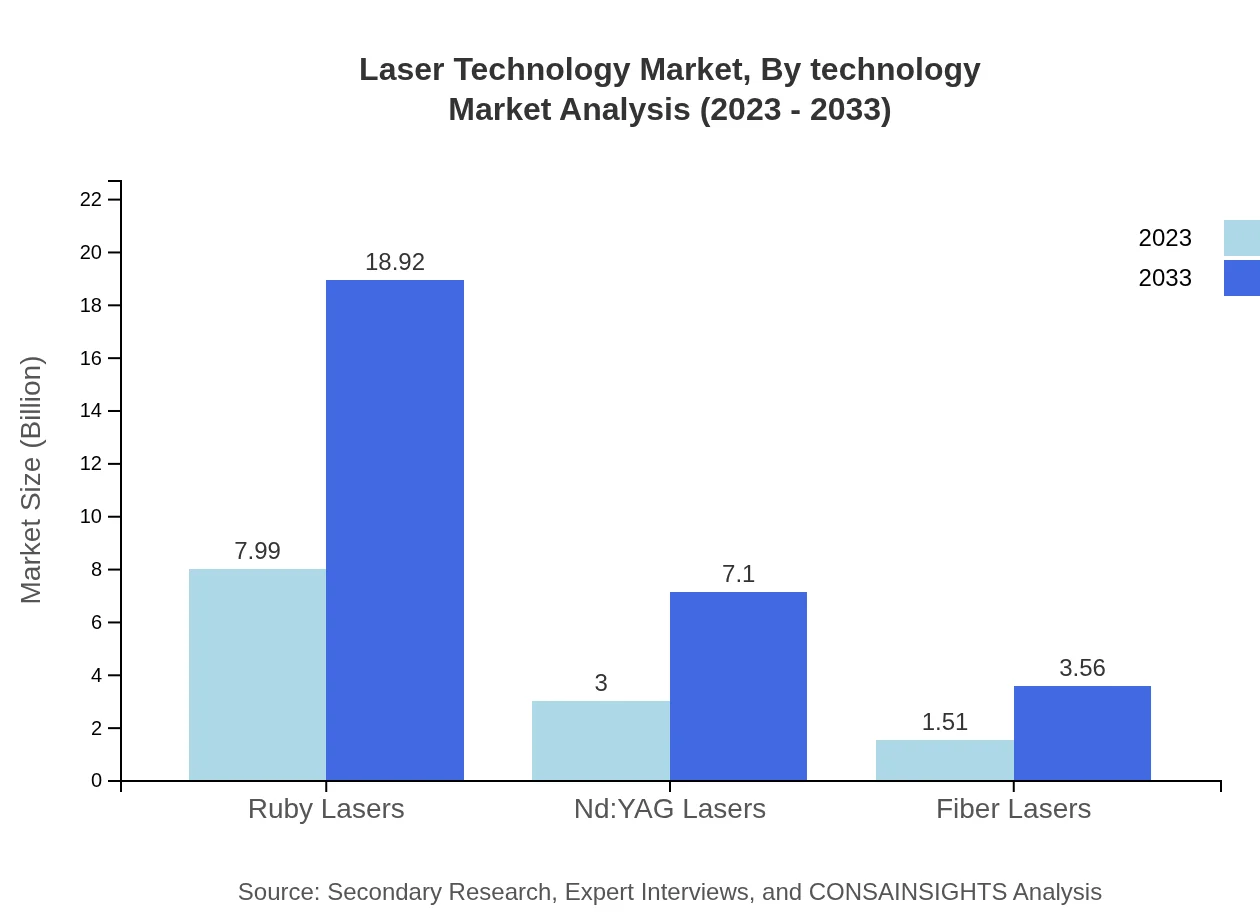

Laser Technology Market Analysis By Technology

Significant advancements in laser technologies such as solid state and fiber lasers are central to market evolution. Solid State Lasers, particularly Nd:YAG and Ruby Lasers, play critical roles in both industrial and medical applications. Innovations lead to enhanced performance and energy efficiency, thus driving adoption rates across applications.

Laser Technology Market Analysis By End User

Market segmentation by end-user illustrates the healthcare and industrial manufacturing sectors as key drivers. Investments in laser systems for surgical applications and manufacturing processes are leading to heightened demand, prompting companies to diversify their offerings for varied applications.

Laser Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Laser Technology Industry

Coherent Inc.:

A leading provider of lasers and laser-based technology, Coherent specializes in high-precision laser applications in various fields, including industrial and scientific research.IPG Photonics Corporation:

A global leader in high-power fiber lasers, IPG Photonics Corporation is renowned for its technological advancements in laser engineering, catering to industrial manufacturing and healthcare.Trumpf GmbH + Co. KG:

As one of the largest industrial machine manufacturers, Trumpf focuses primarily on manufacturing lasers for industrial applications, with an emphasis on cutting-edge technology.Lumentum Holdings Inc.:

Lumentum provides innovative laser products for telecommunications, datacom, and industrial markets, focusing on next-generation optical systems.MKS Instruments Inc.:

MKS Instruments is a prominent player in providing laser solutions for various high-growth markets, including semiconductor manufacturing and healthcare.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Technology?

The global laser technology market is expected to reach approximately $12.5 billion by 2033, growing at a CAGR of 8.7% from its 2023 valuation. This steady growth reflects rising demand across diverse sectors.

What are the key market players or companies in the laser Technology industry?

Key players in the laser technology market include reputable manufacturers like Coherent, Inc., TRUMPF GmbH + Co. KG, and IPG Photonics Corporation. These companies spearhead innovations and hold significant market shares in laser solutions.

What are the primary factors driving the growth in the laser Technology industry?

Growth in the laser technology market is influenced by increasing automation in manufacturing processes, advancements in medical applications, and the rising demand for laser systems in telecommunications and defense sectors.

Which region is the fastest Growing in the laser technology?

The Asia Pacific region is currently the fastest-growing market, projected to grow from $2.28 billion in 2023 to $5.39 billion by 2033, driven by industrial expansion and technological advancements.

Does ConsaInsights provide customized market report data for the laser Technology industry?

Yes, ConsaInsights offers customized market reports tailored to client-specific needs in the laser-technology sector, allowing businesses to access insights that suit their strategic goals.

What deliverables can I expect from this laser Technology market research project?

Expect detailed reports comprising market analysis, trends, competitive landscape overviews, and projections on segment performance, ensuring a comprehensive understanding of the laser technology market.

What are the market trends of laser technology?

Current trends in the laser technology market include an emphasis on sustainable manufacturing practices, increased integration of AI in laser systems, and advancements in fiber lasers for enhanced efficiency.