Laser Welding Machines Market Report

Published Date: 22 January 2026 | Report Code: laser-welding-machines

Laser Welding Machines Market Size, Share, Industry Trends and Forecast to 2033

This report explores the market dynamics of laser welding machines, covering current trends, market growth, and forecasts from 2023 to 2033. Insights include a detailed analysis of market size, CAGR, key segments, regional markets, leading companies, and future trends.

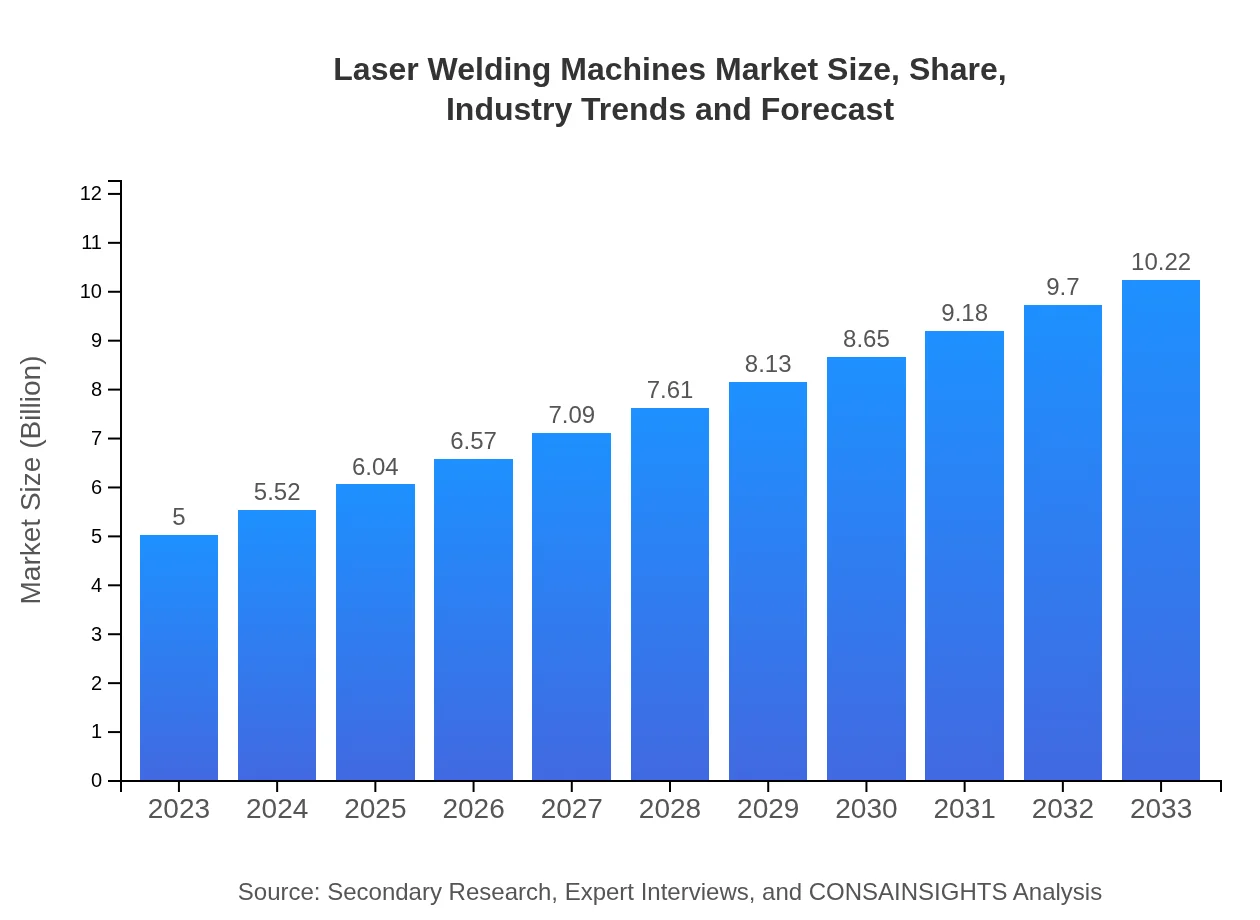

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Trumpf GmbH & Co. KG, FANUC Corporation, Mitsubishi Electric Corporation, Han’s Laser Technology Industry Group Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Laser Welding Machines Market Overview

Customize Laser Welding Machines Market Report market research report

- ✔ Get in-depth analysis of Laser Welding Machines market size, growth, and forecasts.

- ✔ Understand Laser Welding Machines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Laser Welding Machines

What is the Market Size & CAGR of Laser Welding Machines market in 2023?

Laser Welding Machines Industry Analysis

Laser Welding Machines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

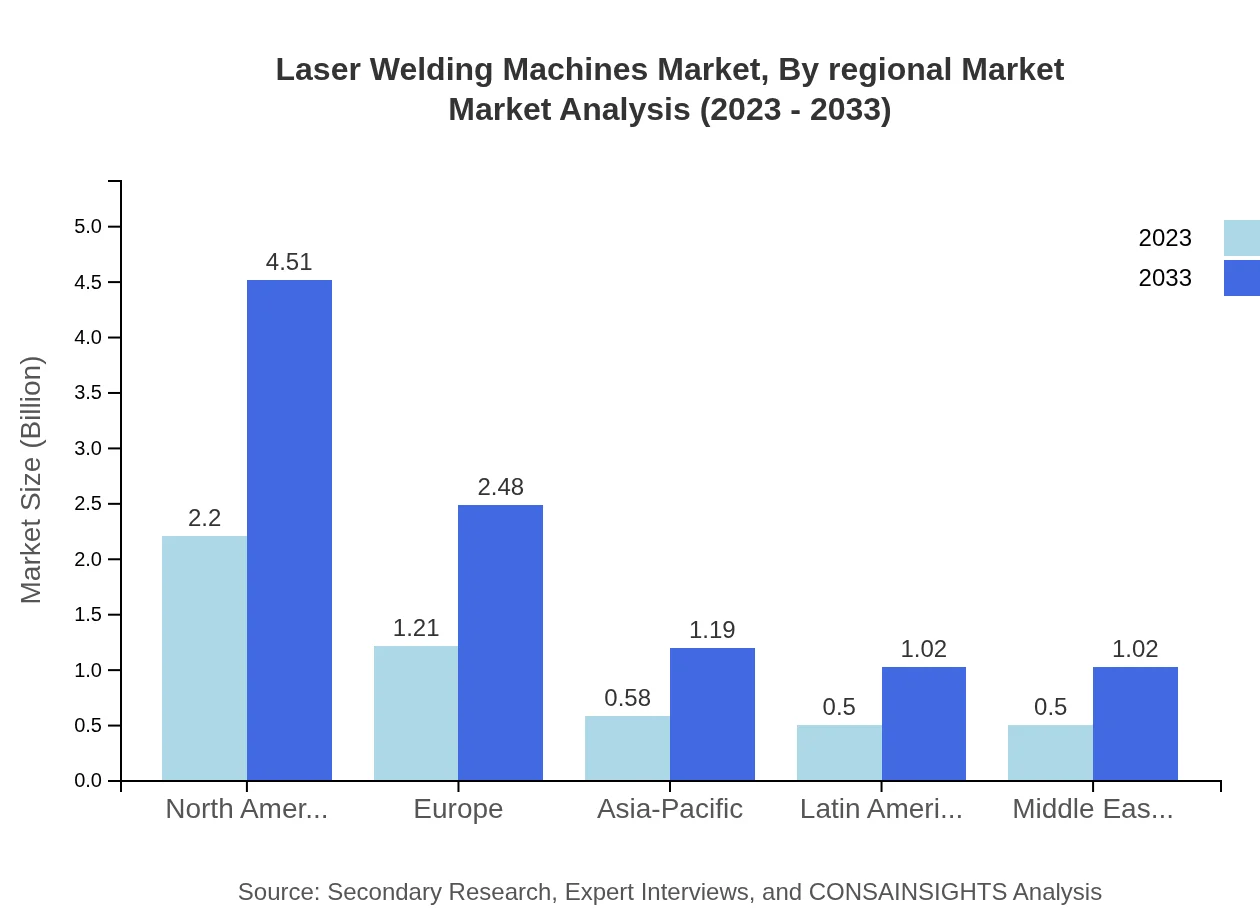

Laser Welding Machines Market Analysis Report by Region

Europe Laser Welding Machines Market Report:

The European market size for laser welding machines is forecasted to grow from $1.23 billion in 2023 to $2.51 billion by 2033. Europe remains a leading hub for automotive innovation and manufacturing, thus sustaining the demand for advanced welding technologies.Asia Pacific Laser Welding Machines Market Report:

The Asia Pacific region is anticipated to experience robust growth, with the market size projected to rise from $1.01 billion in 2023 to $2.06 billion by 2033. The surge in manufacturing activities, coupled with governmental initiatives promoting advanced manufacturing technologies in countries like China and India, supports this growth trajectory.North America Laser Welding Machines Market Report:

North America is projected to witness significant growth, with market size increasing from $1.63 billion in 2023 to $3.34 billion by 2033. The region's advanced manufacturing base and emphasis on technological innovation, particularly in the automotive and aerospace sectors, will drive this growth.South America Laser Welding Machines Market Report:

In South America, the market is expected to grow from $0.46 billion in 2023 to $0.93 billion by 2033. This growth is facilitated by rising industrial activities and the increasing adoption of laser welding in various sectors, including automotive and construction, supported by economic recovery.Middle East & Africa Laser Welding Machines Market Report:

The Middle East and Africa market is set to rise from $0.68 billion in 2023 to $1.38 billion by 2033, as investments in industrial infrastructure and a focus on diversifying economies drive the adoption of laser welding technologies across major industries.Tell us your focus area and get a customized research report.

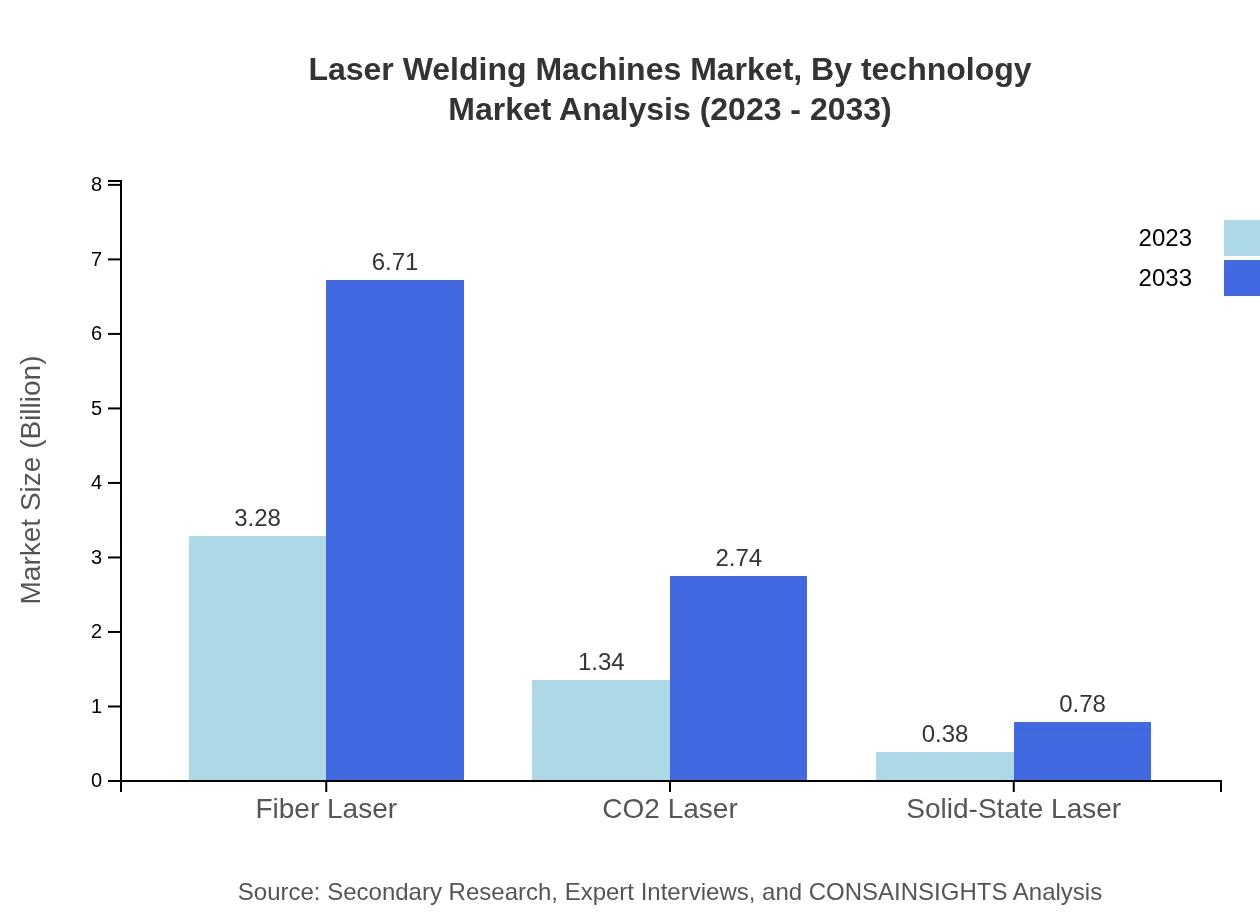

Laser Welding Machines Market Analysis By Technology

The laser welding machines market is heavily influenced by technology advancements. Fiber lasers dominate the segment, with market size projected to reach $6.71 billion in 2033 from $3.28 billion in 2023, capturing a significant share of 65.61%. CO2 lasers and solid-state lasers follow, with significant market shares driven by their unique capabilities suitable for distinct applications.

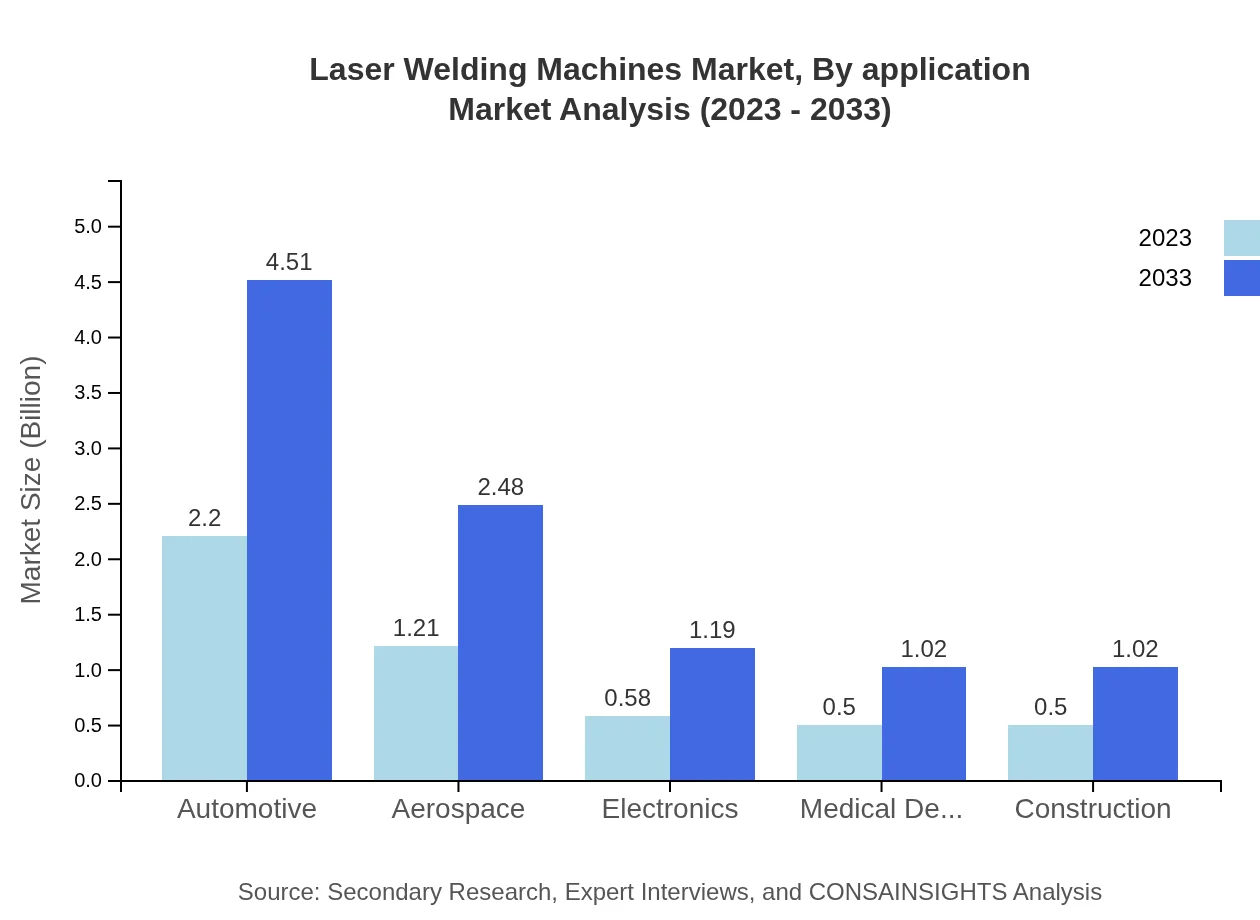

Laser Welding Machines Market Analysis By Application

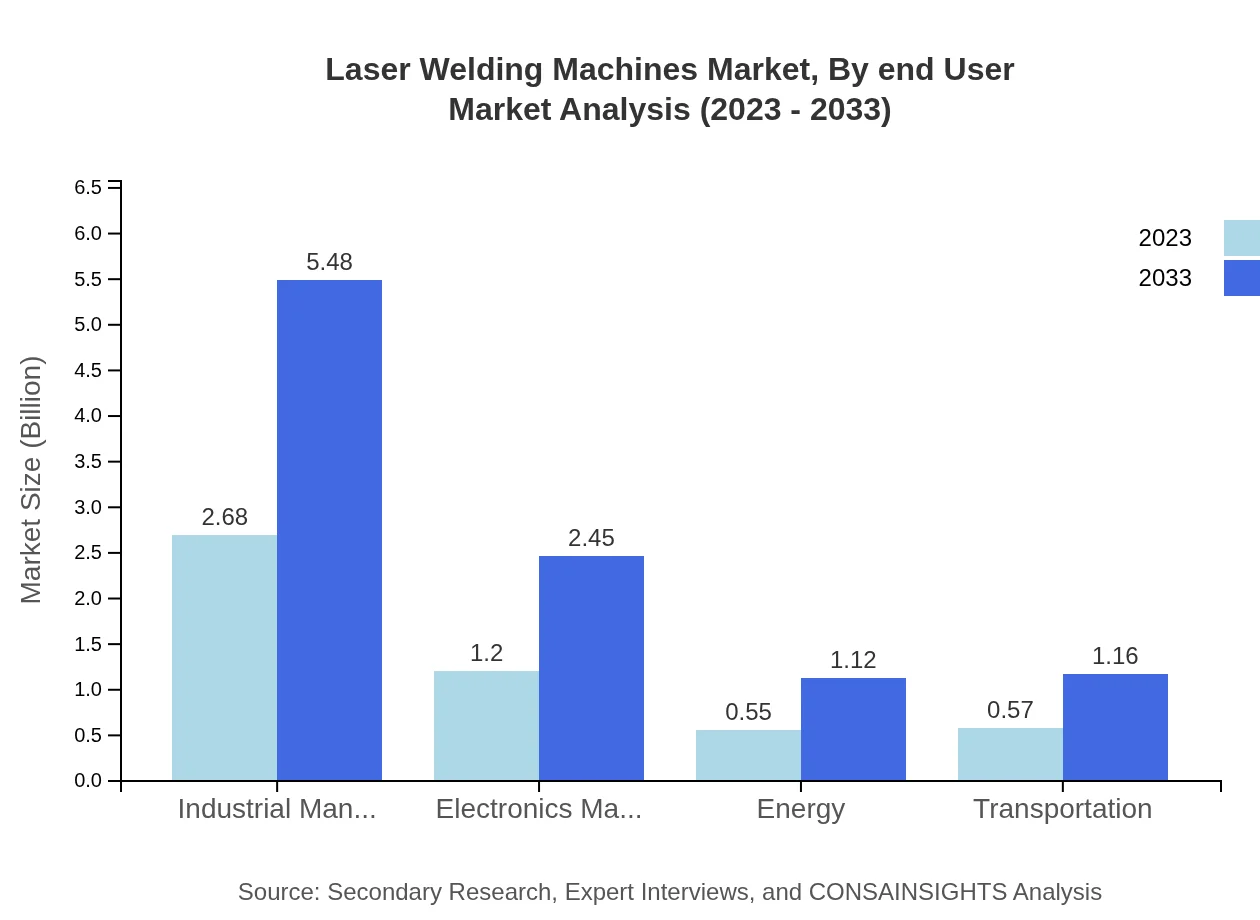

Analyzing the application segment reveals significant growth in industrial manufacturing, projected to increase from $2.68 billion in 2023 to $5.48 billion by 2033, with a 53.63% market share. The automotive and electronics sectors are also substantial contributors, highlighting the broader applicability of laser welding technology.

Laser Welding Machines Market Analysis By Regional Market

The regional market analysis emphasizes North America's upward trajectory, while Europe remains considerably strong due to automotive innovation. The Asia-Pacific region outpaces others with extensive industrialization and increased manufacturing activities, setting the stage for sustained demand and robust growth through 2033.

Laser Welding Machines Market Analysis By End User

End-user analysis shows that the automotive industry will continue to be the leading consumer of laser welding machines, expected to grow from $2.20 billion in 2023 to $4.51 billion by 2033, maintaining a 44.09% market share. Other key sectors include aerospace and electronics, indicating a broad market appeal across diverse industries.

Laser Welding Machines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Laser Welding Machines Industry

Trumpf GmbH & Co. KG:

Leader in laser technology, offering high-quality laser welding solutions tailored for various industrial applications. Known for their innovative approach and extensive product range.FANUC Corporation:

Renowned for advanced automation solutions, FANUC's laser welding machines integrate robotics for enhanced manufacturing efficiency, serving various industries effectively.Mitsubishi Electric Corporation:

A key player in the automation sector, Mitsubishi provides cutting-edge laser welding technologies designed for precision and reliability across multiple industries.Han’s Laser Technology Industry Group Co., Ltd.:

A prominent manufacturer of laser machines, specializing in various laser welding applications, recognized for their robust and versatile products.We're grateful to work with incredible clients.

FAQs

What is the market size of laser Welding Machines?

The laser welding machines market is projected to reach approximately $5 billion by 2033, growing at a CAGR of 7.2% from its current valuation. This growth indicates a robust demand across various industries globally.

What are the key market players or companies in the laser Welding Machines industry?

Key players in the laser welding machines market include leading manufacturers known for innovation in technology and production processes. Their competitive strategies, market share, and product offerings significantly influence the overall market dynamics.

What are the primary factors driving the growth in the laser Welding Machines industry?

Growth in the laser welding machines industry is primarily driven by increasing demand from manufacturing sectors, technological advancements, and the need for precision in welding applications, enhancing productivity and efficiency in operations.

Which region is the fastest Growing in the laser Welding Machines market?

The North American region is the fastest-growing market for laser welding machines, expected to expand from $1.63 billion in 2023 to $3.34 billion by 2033, outperforming other regions due to industrial advancements and increased automation initiatives.

Does ConsainInsights provide customized market report data for the laser Welding Machines industry?

Yes, Consainsights offers customized market report data for the laser welding machines industry, ensuring tailored insights that meet specific market analysis needs and strategic planning goals for businesses.

What deliverables can I expect from this laser Welding Machines market research project?

From the laser welding machines market research project, you can expect comprehensive reports detailing market size, trends, competitive analysis, forecasts, and segmentations, aiding in strategic decision-making and investment analysis.

What are the market trends of laser Welding Machines?

Market trends in laser welding machines indicate a shift towards automation, increased adoption of advanced laser technologies, and a focus on sustainability, reflecting the industry's adaptation to evolving manufacturing needs.