Lease Management Market Report

Published Date: 24 January 2026 | Report Code: lease-management

Lease Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Lease Management market, offering insights into market size, segmentation, trends, and growth forecasts for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $10.83 Billion |

| Top Companies | IBM, SAP, Oracle, LexisNexis, LeaseQuery |

| Last Modified Date | 24 January 2026 |

Lease Management Market Overview

Customize Lease Management Market Report market research report

- ✔ Get in-depth analysis of Lease Management market size, growth, and forecasts.

- ✔ Understand Lease Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lease Management

What is the Market Size & CAGR of the Lease Management market in 2023?

Lease Management Industry Analysis

Lease Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lease Management Market Analysis Report by Region

Europe Lease Management Market Report:

The European market, valued at $1.32 billion in 2023, is expected to nearly double to $2.71 billion by 2033. Strict regulatory standards on lease management and a robust real estate market are significant contributors to this upward trajectory.Asia Pacific Lease Management Market Report:

The Asia Pacific region is projected to see substantial growth in the Lease Management market, increasing from $1.02 billion in 2023 to $2.09 billion by 2033. The expanding real estate sector and rising investments in property management technology drive this growth, particularly in countries like China and India.North America Lease Management Market Report:

The North American market will experience significant growth, escalating from $1.92 billion in 2023 to $3.92 billion by 2033. The rapid adoption of advanced lease management solutions across numerous industries, particularly in the commercial real estate sector, underpins this growth.South America Lease Management Market Report:

In South America, the market is expected to grow from $0.44 billion in 2023 to $0.89 billion by 2033. The growth is driven by the increasing adoption of lease management solutions among enterprises seeking cost-effective management and regulatory compliance.Middle East & Africa Lease Management Market Report:

In the Middle East and Africa, growth in the Lease Management market will rise from $0.60 billion in 2023 to $1.23 billion by 2033. Factors such as urbanization and increased investment in infrastructure assets stimulate demand for lease management solutions.Tell us your focus area and get a customized research report.

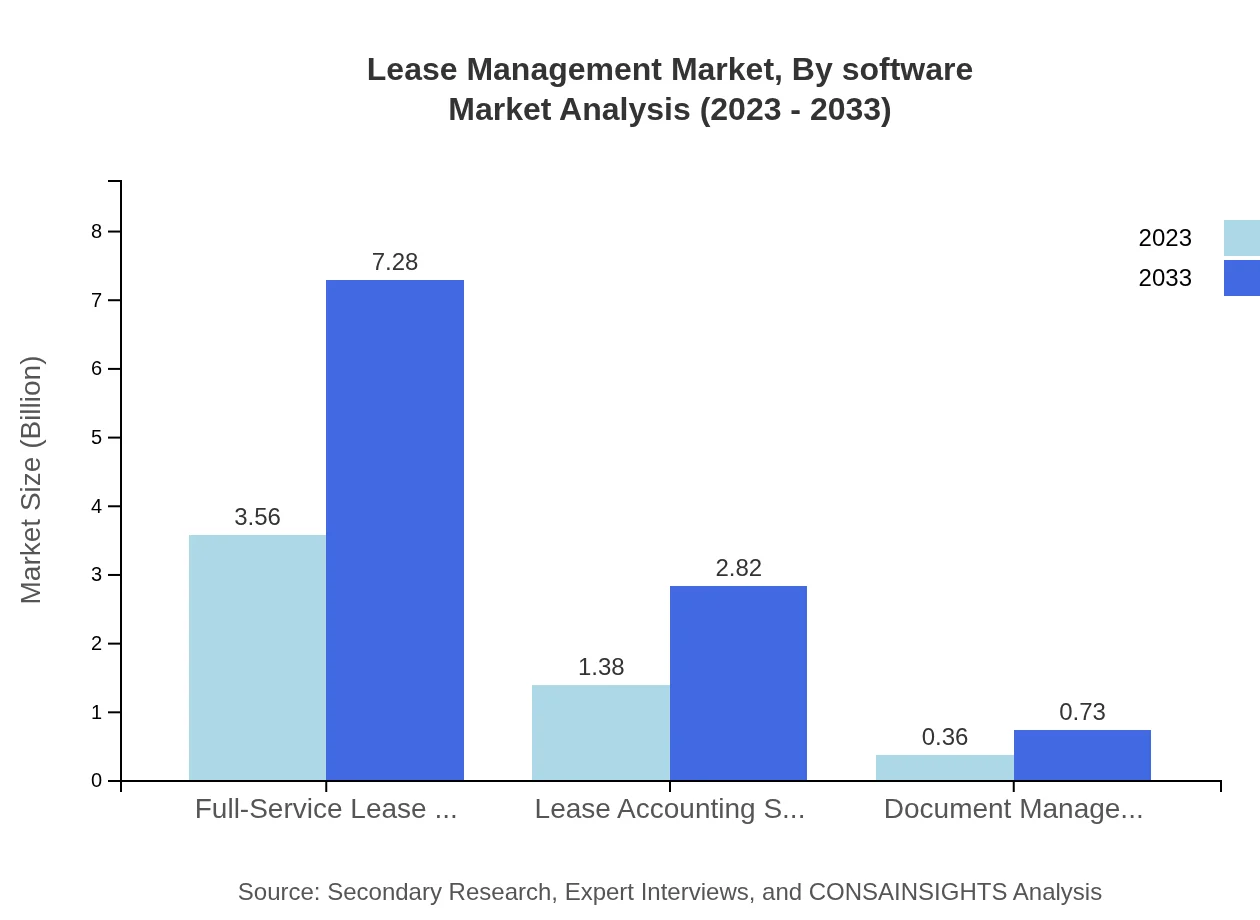

Lease Management Market Analysis By Type

The Lease Management Market is characterized by various segments, including residential leasing, commercial leasing, and specialty leasing. In 2023, residential leasing accounts for the largest share, valued at $3.56 billion, and is projected to expand to $7.28 billion by 2033, maintaining a stable market share of about 67.21%. Commercial leasing, standing at $1.38 billion in 2023, is anticipated to grow to $2.82 billion by 2033 with a consistent share of 26.04%. Specialty leasing, while smaller, is also expected to see growth, advancing from $0.36 billion to $0.73 billion within the same period.

Lease Management Market Analysis By Software

The Lease Management market is also segmented by software type, majorly distinguishing between full-service lease management software, lease accounting software, and document management systems. Full-service lease management software leads the market with a size of $3.56 billion in 2023, thriving on comprehensive functionalities, and projected to reach $7.28 billion by 2033. Lease accounting software represents a significant contribution as well, valued at $1.38 billion in 2023 and expected to reach $2.82 billion by 2033, reinforcing a share of 26.04%. Document management systems, though smaller, are also maintaining a robust growth trajectory.

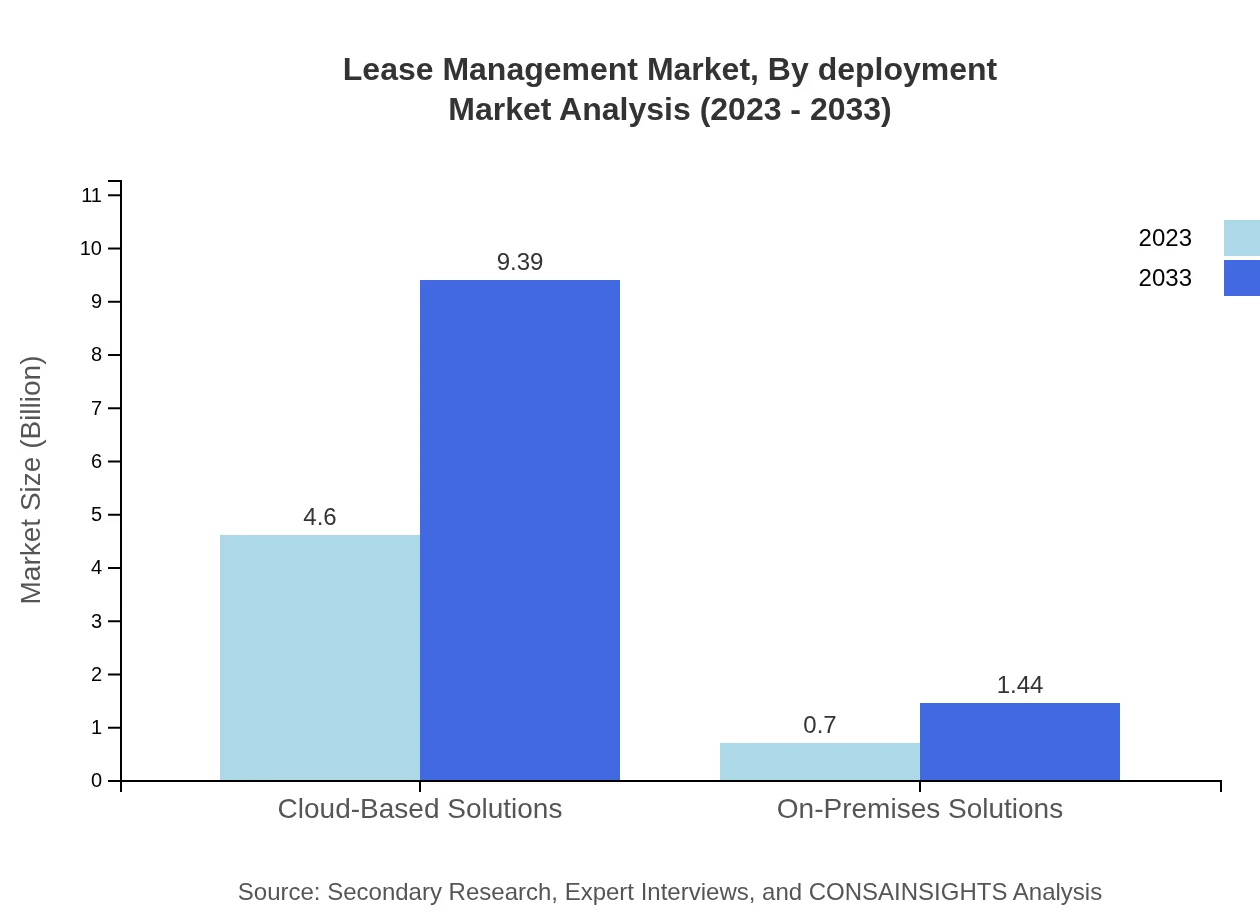

Lease Management Market Analysis By Deployment

The deployment analysis of the Lease Management market showcases a clear preference for cloud-based solutions, which are projected to experience growth from $4.60 billion in 2023 to $9.39 billion by 2033. As organizations shift towards cloud environments for enhanced accessibility and collaboration, cloud-based solutions command an impressive market share of 86.7%. In contrast, on-premises solutions modify gradually, growing from $0.70 billion to $1.44 billion, yet only account for 13.3% of the market due to their limited flexibility.

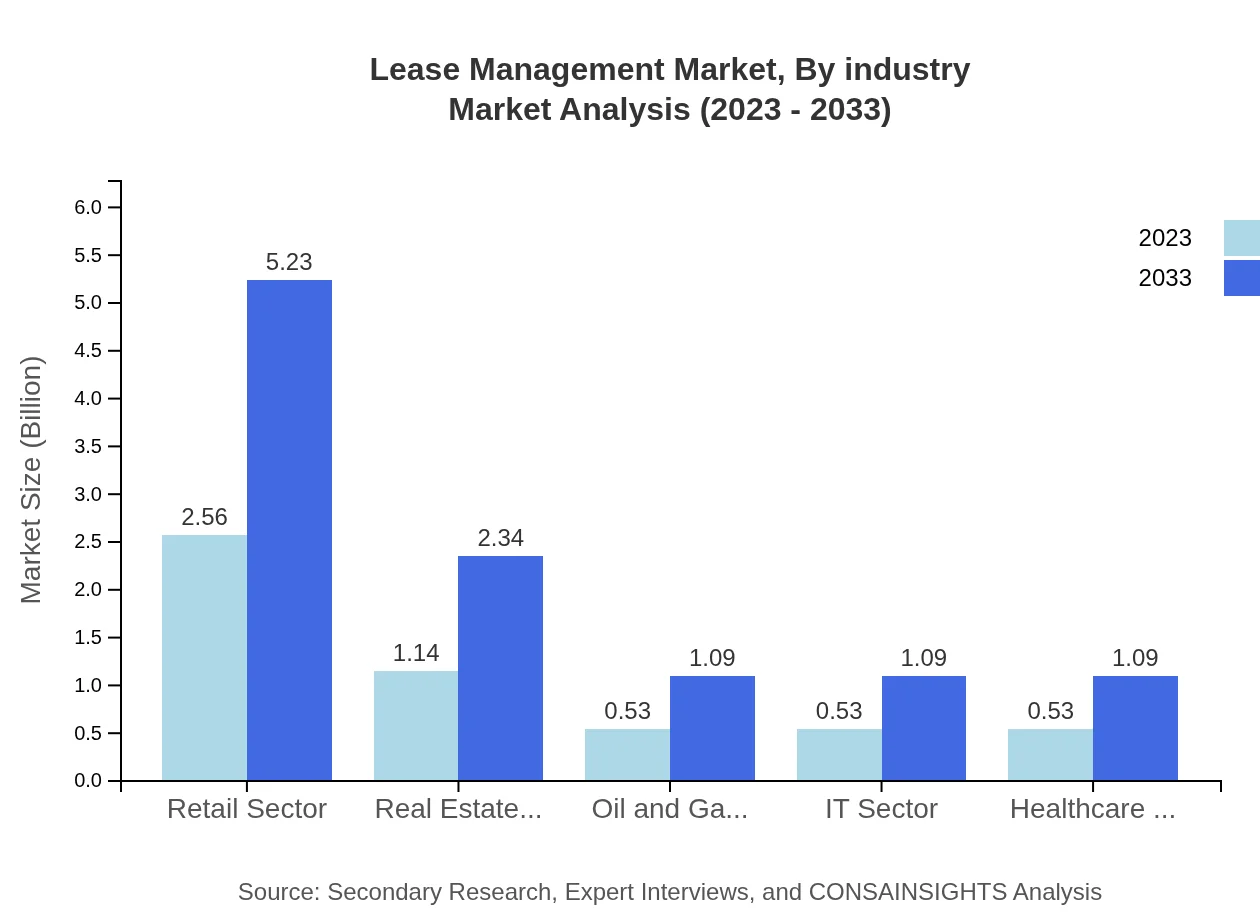

Lease Management Market Analysis By Industry

The market's industry segmentation covers various sectors, with the retail sector showing a robust performance, expanding from $2.56 billion in 2023 to $5.23 billion by 2033, accounting for 48.3% of the market. Other sectors like healthcare, oil and gas, and IT also contribute significantly, with expected growth from $0.53 billion in 2023 to $1.09 billion by 2033, establishing shares of around 10% across the board.

Lease Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lease Management Industry

IBM:

IBM offers comprehensive lease management solutions, enabling organizations to streamline their leasing processes and comply with regulatory requirements while enhancing user experience and operational efficiencies.SAP:

SAP provides innovative lease management applications that help businesses manage their lease portfolios effectively, ensuring compliance with the latest accounting standards and improving decision-making through data analytics.Oracle:

Oracle's cloud-based lease management solutions support businesses in automating their lease administration processes, offering integrated analytics to drive strategic decision-making.LexisNexis:

LexisNexis specializes in legal research and lease management software solutions that enhance compliance and risk management for companies across various sectors.LeaseQuery:

LeaseQuery focuses on lease accounting software that simplifies compliance with accounting regulations, thereby minimizing operational risks for organizations in real estate and beyond.We're grateful to work with incredible clients.

FAQs

What is the market size of lease Management?

The lease management market is currently valued at approximately $5.3 billion and is projected to grow at a CAGR of 7.2% from 2023 to 2033. This growth reflects increasing demand for efficient lease management solutions across various sectors.

What are the key market players or companies in the lease Management industry?

In the lease management industry, key players include prominent software providers specializing in lease accounting and management solutions. These companies continuously innovate to enhance service offerings and address evolving customer requirements in lease administration.

What are the primary factors driving the growth in the lease Management industry?

Key growth drivers in the lease management industry include the rising adoption of cloud solutions, regulatory compliance needs, and the increasing complexity and volume of lease agreements. Additionally, organizations seek to enhance operational efficiency and transparency.

Which region is the fastest Growing in the lease Management?

The fastest-growing region in the lease management market is North America, projecting an increase from $1.92 billion in 2023 to $3.92 billion by 2033. Europe and Asia-Pacific are also significant contributors to market growth.

Does ConsaInsights provide customized market report data for the lease Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the lease management sector. This includes detailed insights, regional analysis, and market trends to aid strategic decision-making.

What deliverables can I expect from this lease Management market research project?

From the lease management market research project, clients can expect comprehensive reports, data on market trends, region-specific analysis, competitive landscape summaries, and actionable insights for strategic planning.

What are the market trends of lease Management?

Current trends in the lease management industry include the shift towards cloud-based solutions, increasing automation in lease processes, the rise of sustainability initiatives, and a growing emphasis on compliance with changing accounting standards.