Led Driver Market Report

Published Date: 31 January 2026 | Report Code: led-driver

Led Driver Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Led Driver market, covering market size, growth forecasts, and trends from 2023 to 2033. It offers insights into segmentation, regional dynamics, key players, and future projections to guide industry stakeholders.

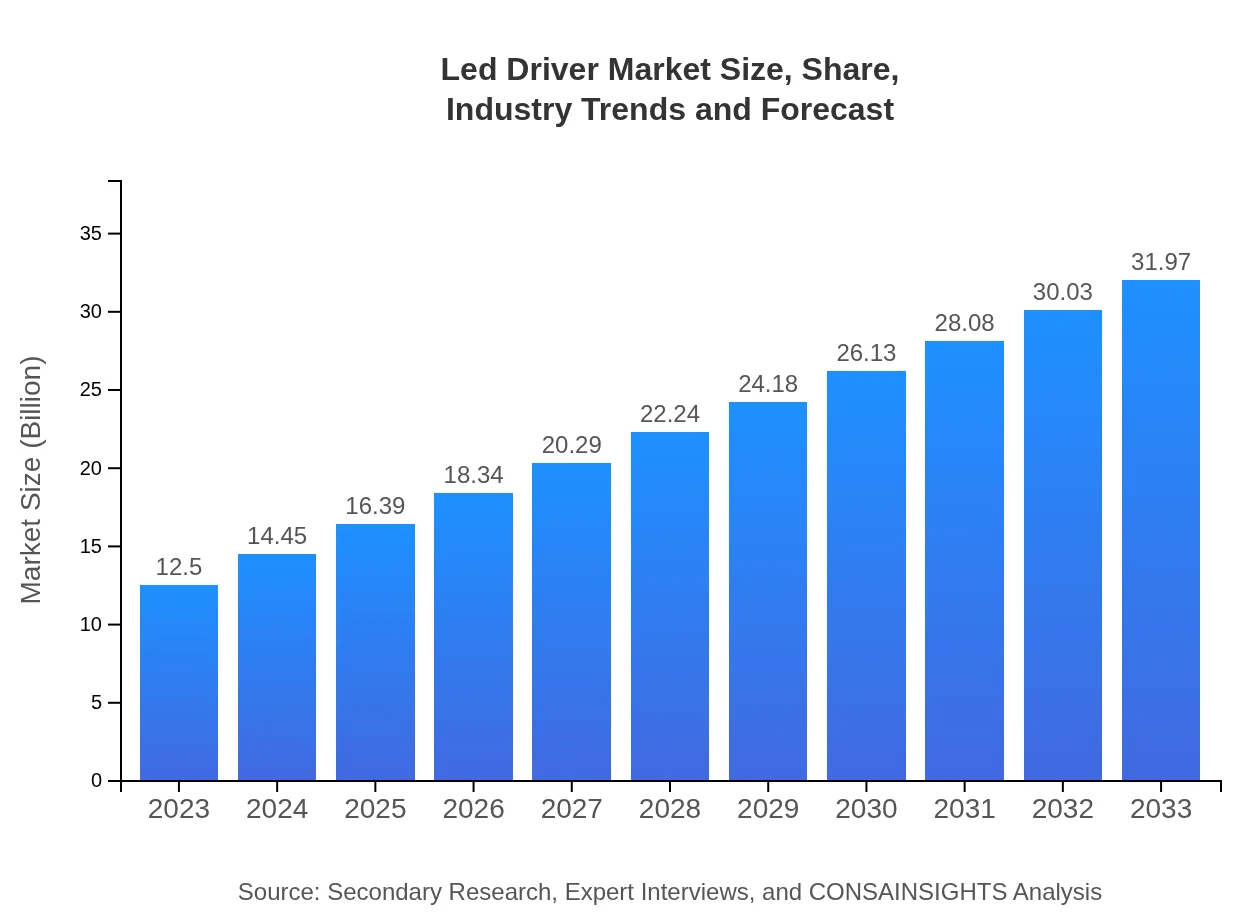

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $31.97 Billion |

| Top Companies | Philips Lighting, Osram, Mean Well, Texas Instruments |

| Last Modified Date | 31 January 2026 |

Led Driver Market Overview

Customize Led Driver Market Report market research report

- ✔ Get in-depth analysis of Led Driver market size, growth, and forecasts.

- ✔ Understand Led Driver's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Driver

What is the Market Size & CAGR of Led Driver market in 2023?

Led Driver Industry Analysis

Led Driver Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Led Driver Market Analysis Report by Region

Europe Led Driver Market Report:

The European market for Led Drivers is projected at $3.66 billion in 2023, scaling up to $9.37 billion by 2033. Strict energy efficiency regulations and a strong focus on sustainability are key factors influencing market growth in this region.Asia Pacific Led Driver Market Report:

The Asia Pacific region represented the largest market share in 2023, valued at approximately $2.32 billion, with a forecast to reach $5.94 billion by 2033. Key drivers include rapid urbanization, growing consumer electronics industry, and government initiatives promoting energy efficiency.North America Led Driver Market Report:

North America holds a strong position in the Led Driver market, estimated at $4.87 billion in 2023 and expected to reach $12.45 billion by 2033. The region's growth is driven by advancements in technology and the high adoption rate of smart home solutions.South America Led Driver Market Report:

In South America, the Led Driver market was valued at $0.43 billion in 2023 and is projected to grow to $1.10 billion by 2033. The growth trajectory is supported by increasing investments in infrastructural development and the adoption of energy-efficient lighting solutions.Middle East & Africa Led Driver Market Report:

In the Middle East and Africa, the Led Driver market was valued at approximately $1.22 billion in 2023, with expectations to grow to $3.11 billion by 2033. Increasing government focus on renewable energy sources and smart city projects are essential for driving market expansion in these regions.Tell us your focus area and get a customized research report.

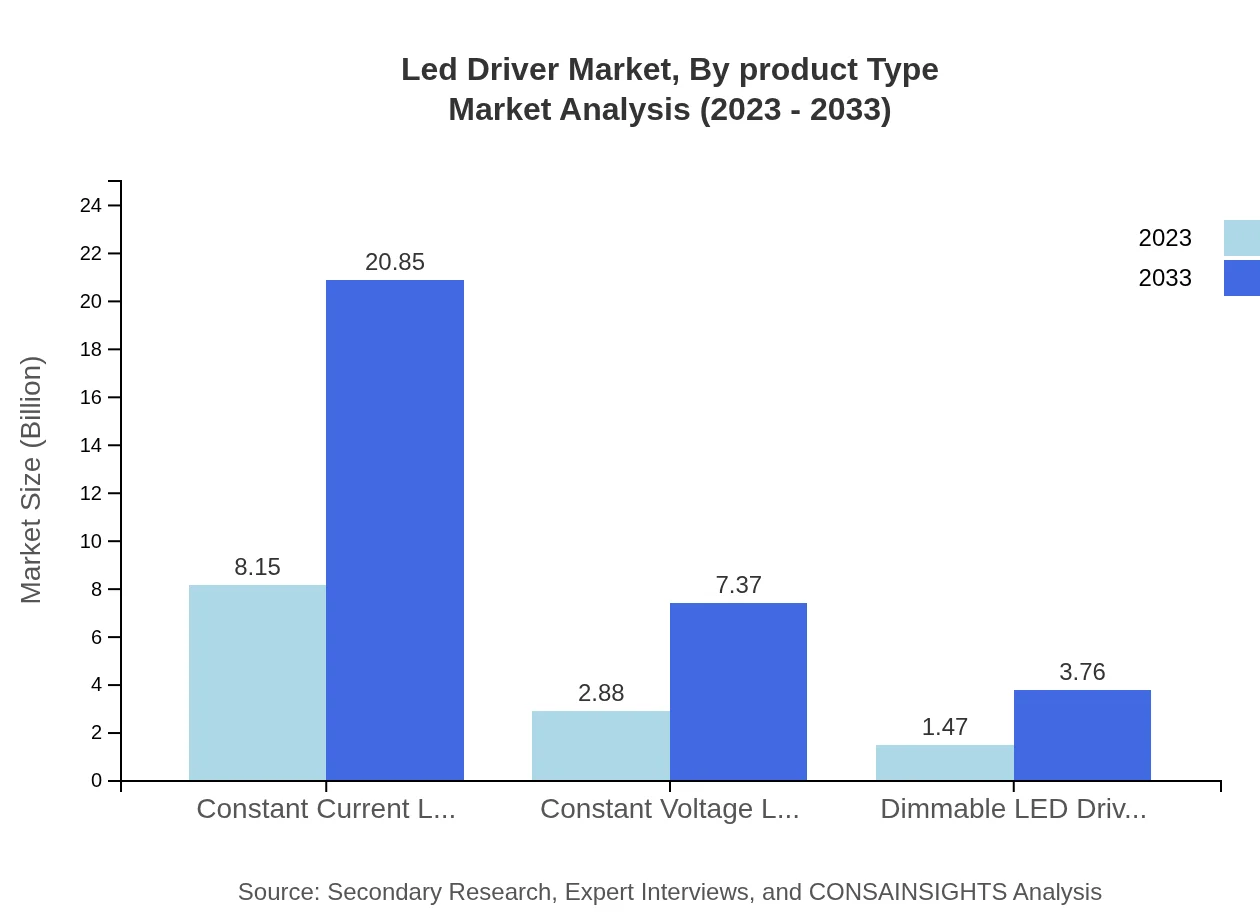

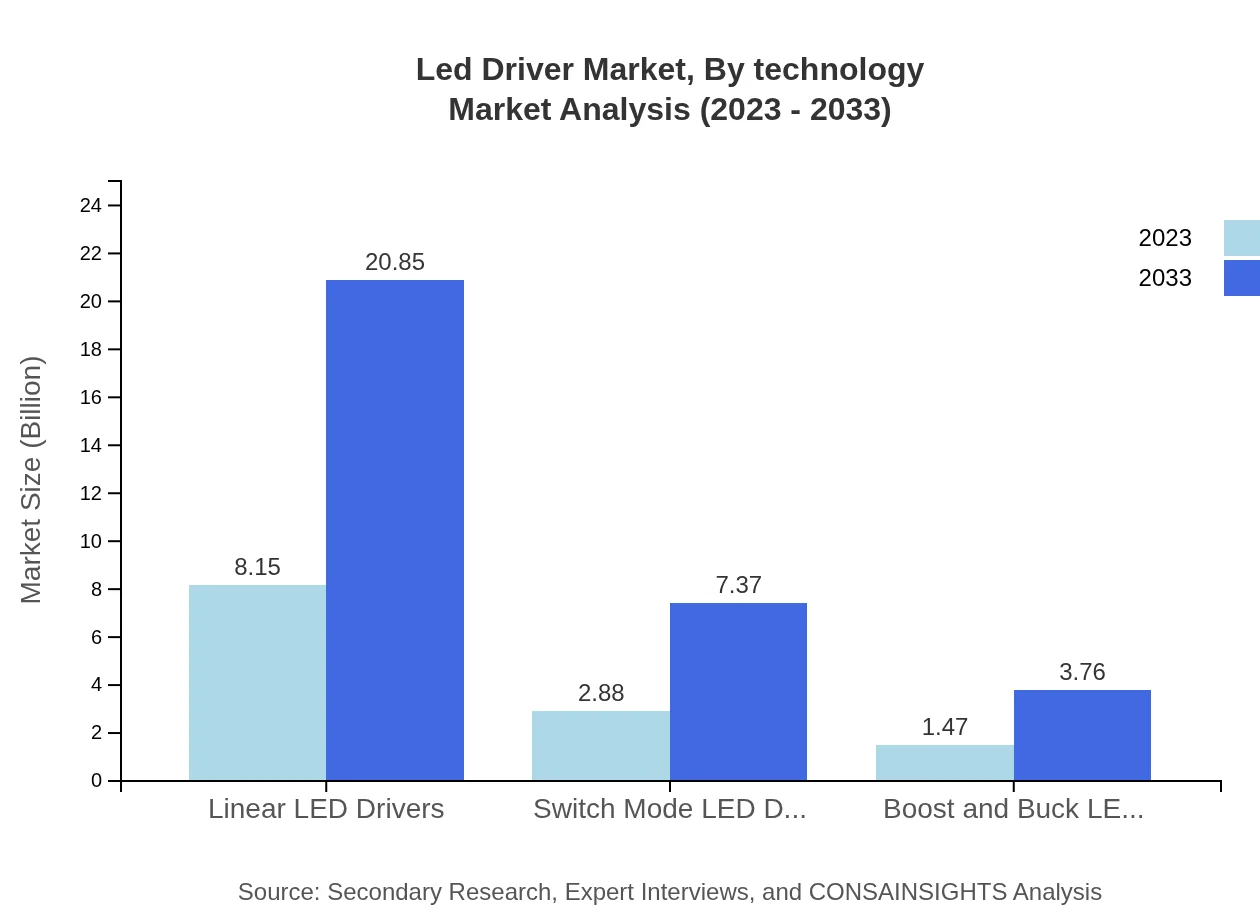

Led Driver Market Analysis By Product Type

The LED Driver market is categorized into various product types. Linear LED Drivers dominate the market with a share of 65.2% in 2023, valued at $8.15 billion and increasing to $20.85 billion by 2033. Switch Mode LED Drivers and Constant Voltage LED Drivers follow, with market growth fueled by the adoption of efficient power supply solutions in both residential and commercial lighting.

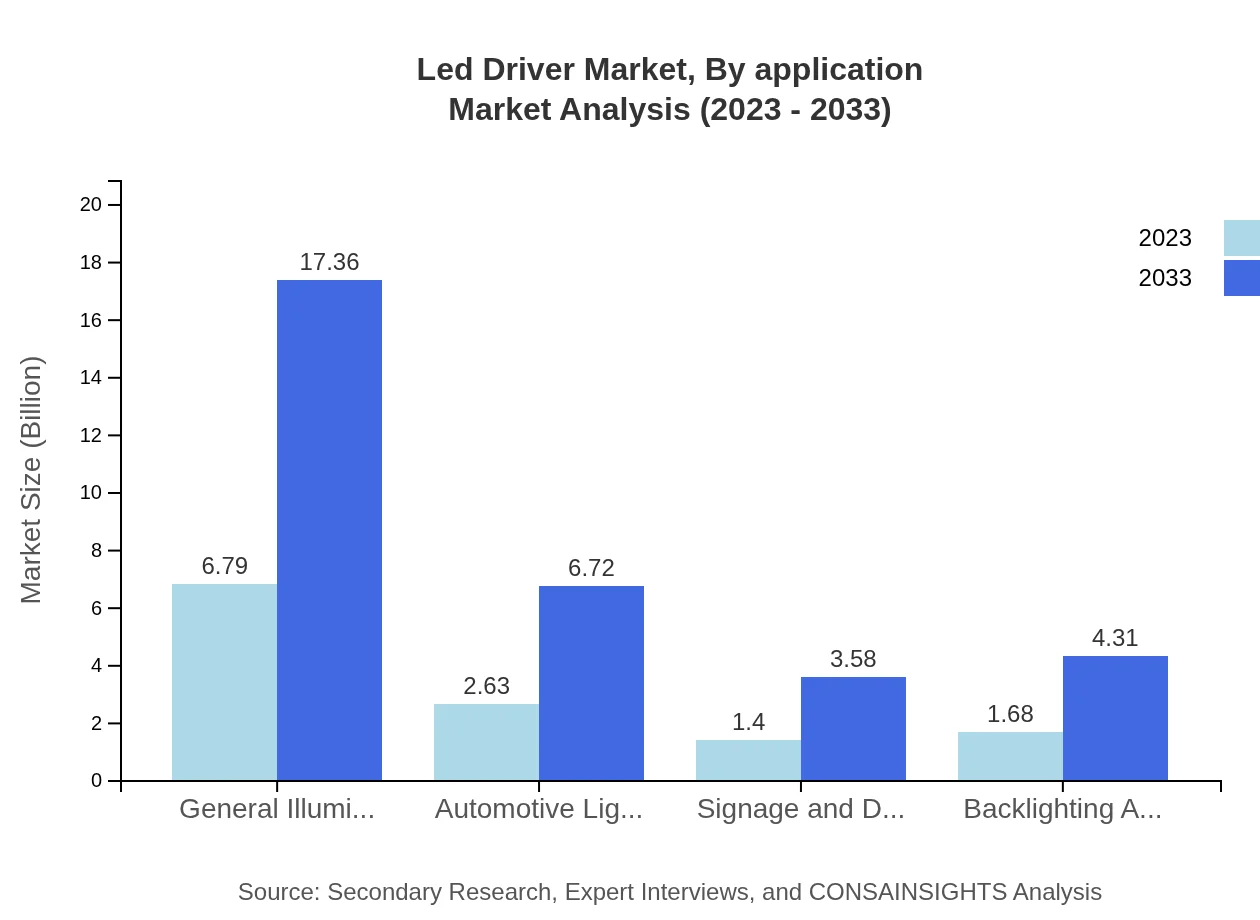

Led Driver Market Analysis By Application

General illumination holds the largest share of the application segment, accounting for 54.29% of the market. In 2023, it is valued at $6.79 billion and is expected to reach $17.36 billion by 2033. Automotive lighting and backlighting applications represent each a significant market niche, highlighting the versatility and widespread utility of LED Drivers.

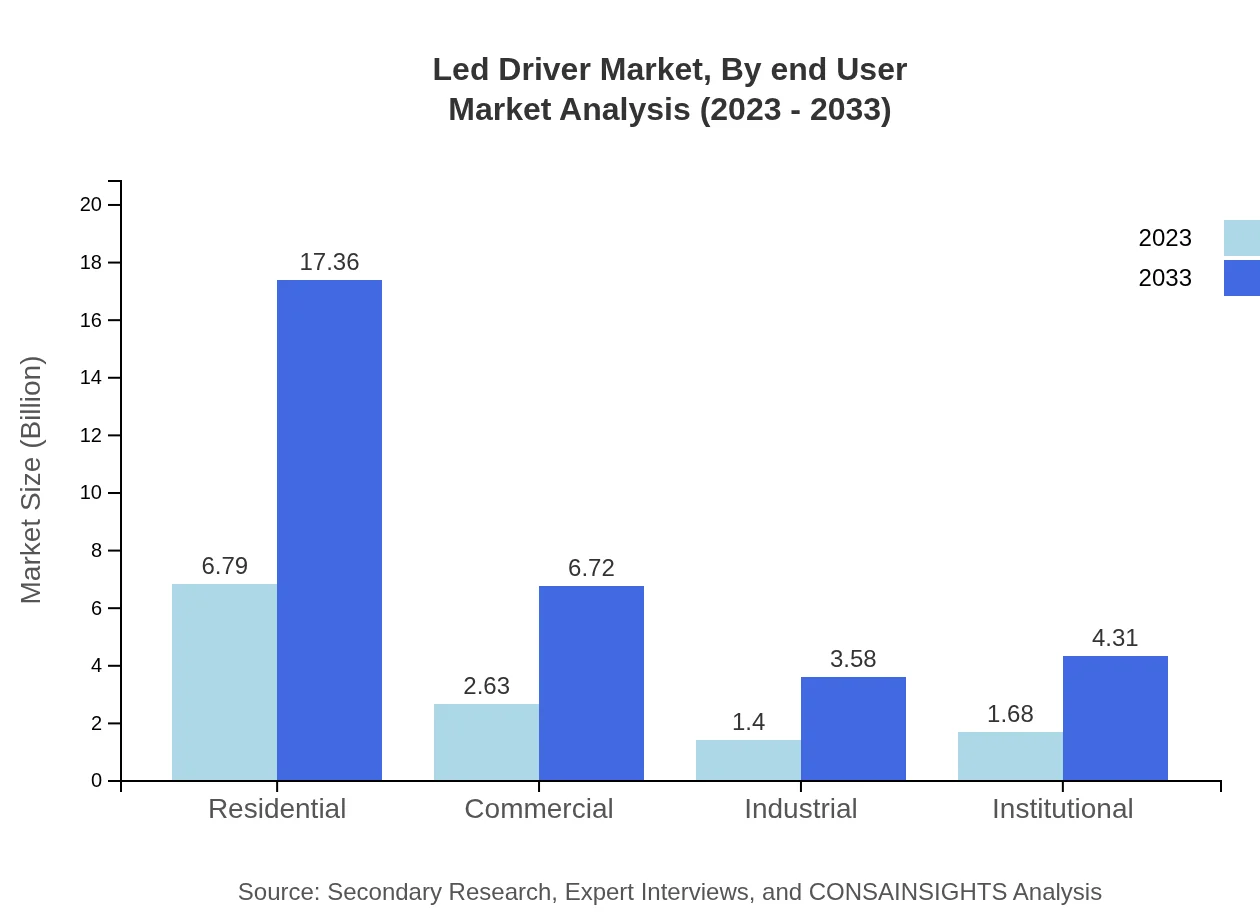

Led Driver Market Analysis By End User

The end-user segmentation illustrates strong demand across various sectors. The residential sector stands as a leading consumer, demonstrating consistent revenue growth from $6.79 billion in 2023 to $17.36 billion by 2033. This is followed closely by commercial and industrial segments, reflecting the universal applicability of LED technology.

Led Driver Market Analysis By Technology

In terms of technology, Constant Current and Dimmable LED Drivers are increasingly preferred due to their enhanced performance and flexibility. The Constant Current segment constitutes a significant share of the market, with a valuation of $8.15 billion in 2023, likely to reach $20.85 billion by 2033.

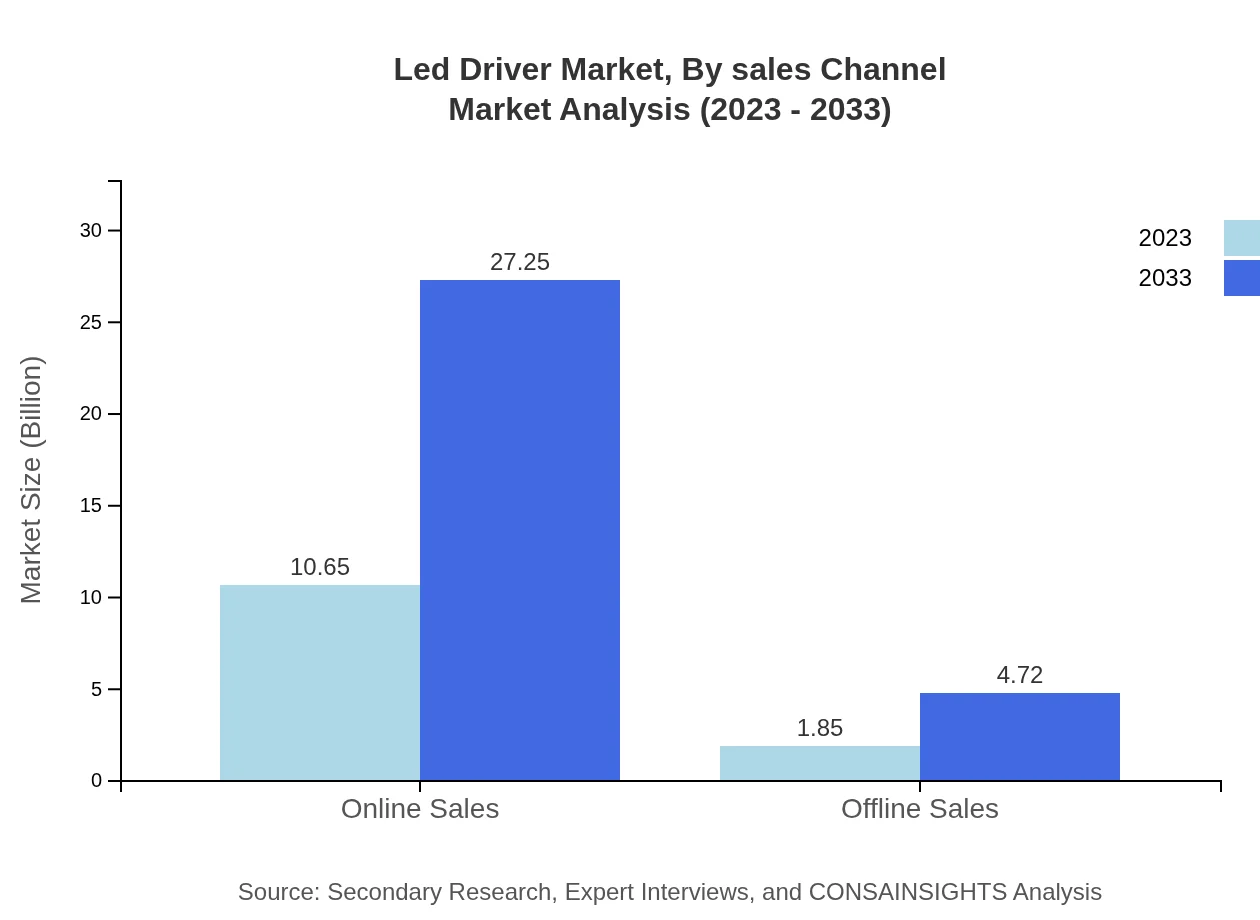

Led Driver Market Analysis By Sales Channel

Online sales channels exhibit robust growth, with projections estimating market share to soar from $10.65 billion in 2023 to $27.25 billion by 2033. The ease of access, coupled with consumer preference for online shopping, marks a pivotal change in how LED products are marketed and purchased.

Led Driver Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Led Driver Industry

Philips Lighting:

A major player in the lighting industry, Philips focuses on innovative solutions in LED technology, driving market trends towards smart lighting.Osram:

Osram offers a comprehensive range of LED products and lighting solutions, playing a vital role in the evolution of the Led Driver market.Mean Well:

Specializing in power supplies, Mean Well develops a variety of Led Drivers tailored for diverse applications, focusing on high efficiency.Texas Instruments:

Leading in semiconductor technology, Texas Instruments delivers advanced Led Drivers with integrated solutions, enhancing overall product performance.We're grateful to work with incredible clients.

FAQs

What is the market size of led Driver?

As of 2023, the global led-driver market is valued at approximately $12.5 billion, anticipating a robust CAGR of 9.5% through 2033, allowing potential growth in various sectors and geographies.

What are the key market players or companies in this led Driver industry?

Major players in the led-driver market include Philips, Osram, Cree, and STMicroelectronics, among others. These companies are key in innovation, market distribution, and product advancements.

What are the primary factors driving the growth in the led Driver industry?

Growth is driven by increasing energy efficiency demands, rising adoption of LED technology in residential and commercial lighting, along with the growing trend towards smart lighting solutions.

Which region is the fastest Growing in the led Driver?

Asia-Pacific is the fastest-growing region in the led-driver market, projected to grow from approximately $2.32 billion in 2023 to $5.94 billion by 2033, spurred by increasing infrastructure and technological advancements.

Does ConsaInsights provide customized market report data for the led Driver industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs concerning the led-driver industry, ensuring deep insights into market trends and opportunities.

What deliverables can I expect from this led Driver market research project?

Expected deliverables include detailed market analysis, competitive landscape, segment insights, growth forecasts, and actionable recommendations for market strategy, tailored to your unique requirements.

What are the market trends of led Driver?

Current trends in the led-driver market include a shift towards smart LED solutions, enhanced efficiency, and integration with IoT technologies, as well as increased focus on sustainable lighting practices.