Led Encapsulation Market Report

Published Date: 31 January 2026 | Report Code: led-encapsulation

Led Encapsulation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Led Encapsulation market, covering trends, insights, and forecasts for the years 2023 to 2033. It encompasses an in-depth look at market size, growth rates, segmentation, regional analysis, and key industry players.

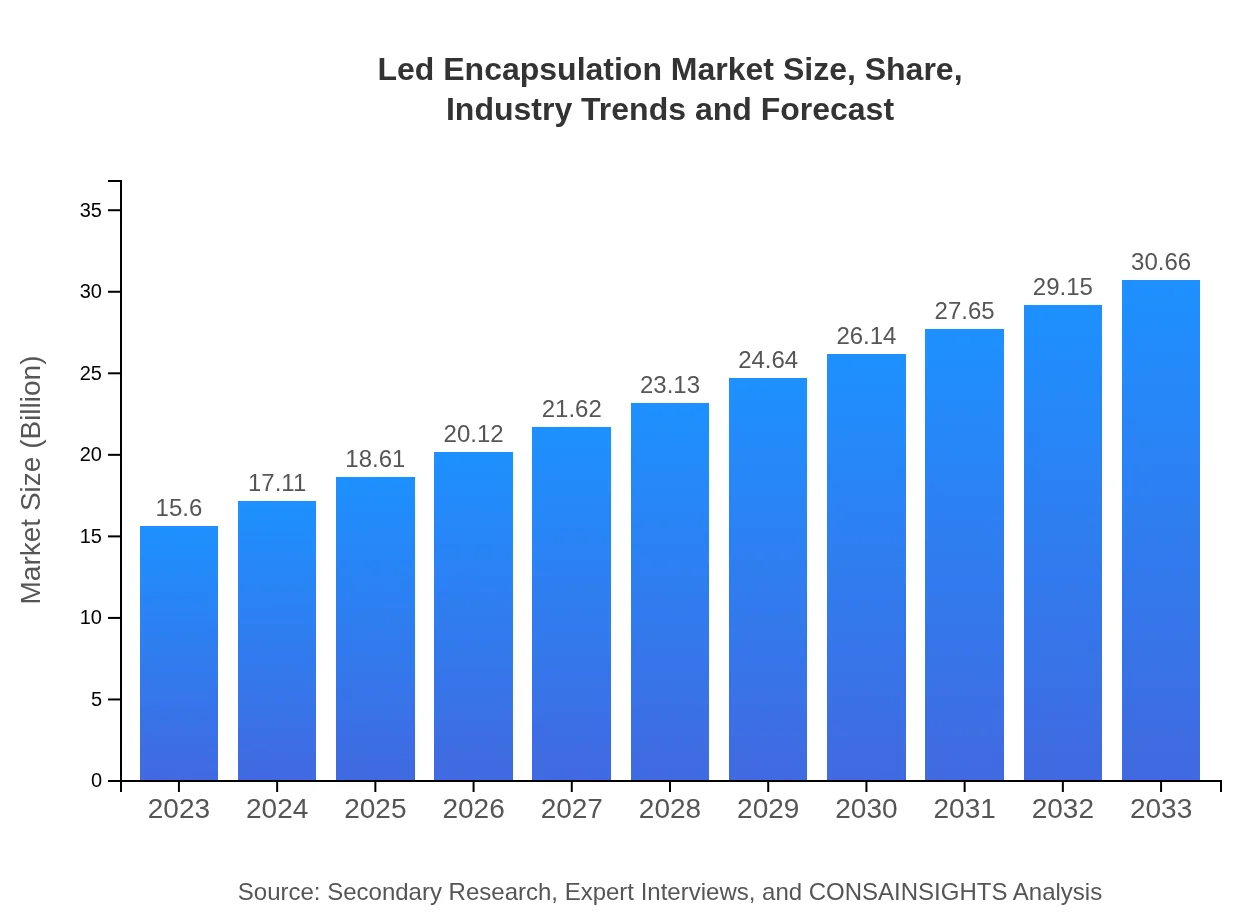

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Dow Silicones, Momentive Performance Materials, Henkel AG, 3M Company |

| Last Modified Date | 31 January 2026 |

Led Encapsulation Market Overview

Customize Led Encapsulation Market Report market research report

- ✔ Get in-depth analysis of Led Encapsulation market size, growth, and forecasts.

- ✔ Understand Led Encapsulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Encapsulation

What is the Market Size & CAGR of the Led Encapsulation market in 2023?

Led Encapsulation Industry Analysis

Led Encapsulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Led Encapsulation Market Analysis Report by Region

Europe Led Encapsulation Market Report:

Europe's Led Encapsulation market is forecasted to grow from USD 3.99 billion in 2023 to USD 7.85 billion by 2033. The region is characterized by stringent regulations regarding energy efficiency, which drive the adoption of LED products across various sectors, particularly in infrastructure.Asia Pacific Led Encapsulation Market Report:

In the Asia Pacific region, the Led Encapsulation market is poised to grow from USD 2.98 billion in 2023 to approximately USD 5.86 billion by 2033, driven by strong manufacturing bases in countries like China and Japan. The rise of energy-efficient products and governmental initiatives focusing on sustainable development are instrumental in this growth.North America Led Encapsulation Market Report:

In North America, the market is projected to increase from USD 6.04 billion in 2023 to USD 11.88 billion in 2033. This growth is largely attributed to advancements in automotive lighting and the push for smart lighting solutions, benefitting from technological innovations.South America Led Encapsulation Market Report:

The South American market for Led Encapsulation is expected to expand from USD 0.96 billion in 2023 to USD 1.89 billion by 2033, propelled by increasing urbanization and the adoption of LEDs in commercial and residential lighting applications. However, economic challenges may moderate growth rates.Middle East & Africa Led Encapsulation Market Report:

The Middle East and Africa market, starting at USD 1.62 billion in 2023 and aiming for USD 3.18 billion by 2033, is expected to benefit from ongoing modernization projects and the increased use of LEDs in both commercial and residential sectors.Tell us your focus area and get a customized research report.

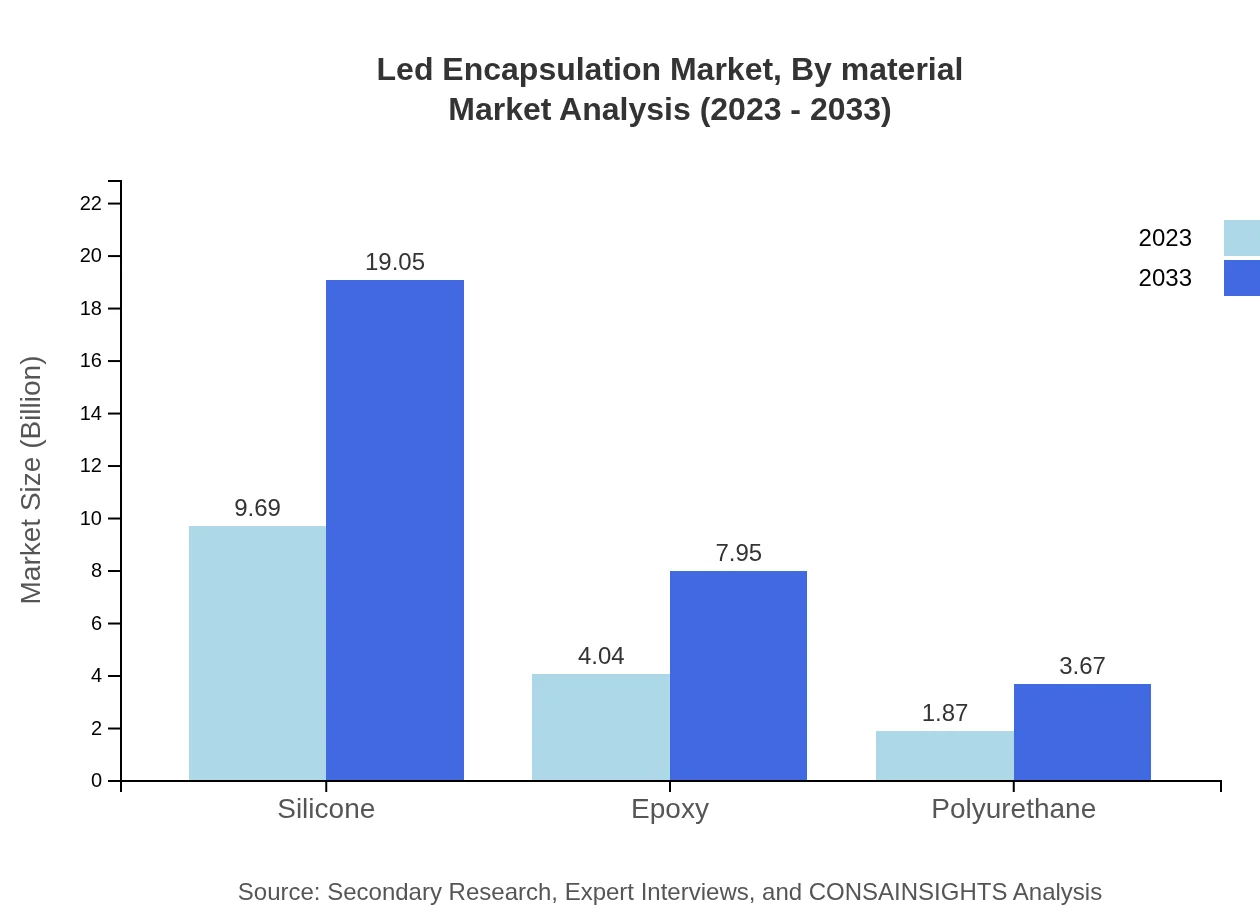

Led Encapsulation Market Analysis By Material

The LED Encapsulation market, segmented by materials, is dominated by silicone, which represents 62.12% of the market share in 2023 with a size of USD 9.69 billion, projected to increase to USD 19.05 billion by 2033. Epoxy follows with significant applications in budget-sensitive projects, maintaining a 25.92% market share. Polyurethane encapsulants command an 11.96% share, reflective of specific applications where flexibility and durability are needed.

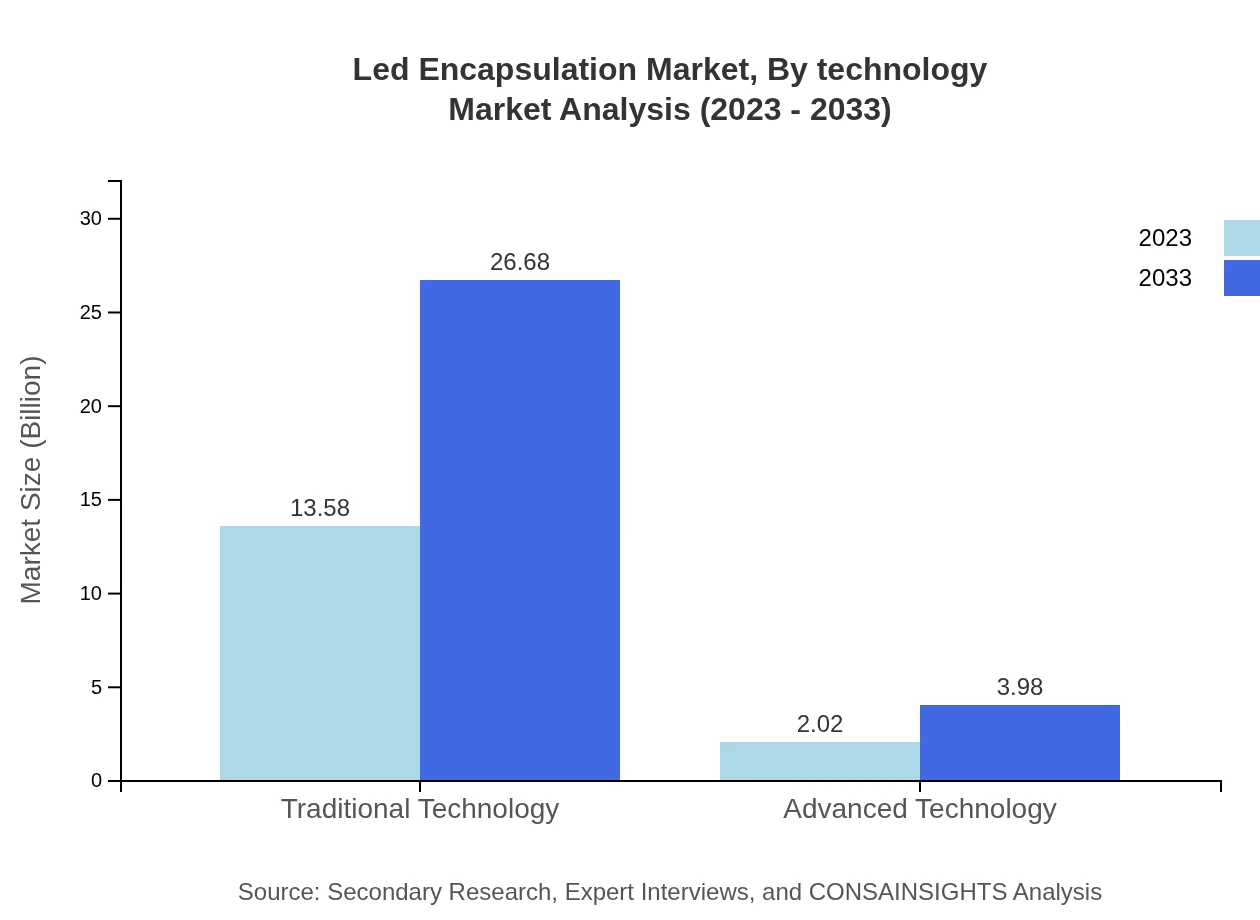

Led Encapsulation Market Analysis By Technology

Traditional technology encompasses 87.03% of the segment’s size, representing stable growth, while advanced technology is gaining traction with 12.97% of market share. This reflects the industry's gradual transition toward innovative solutions that offer longer-lasting and more efficient encapsulation alternatives.

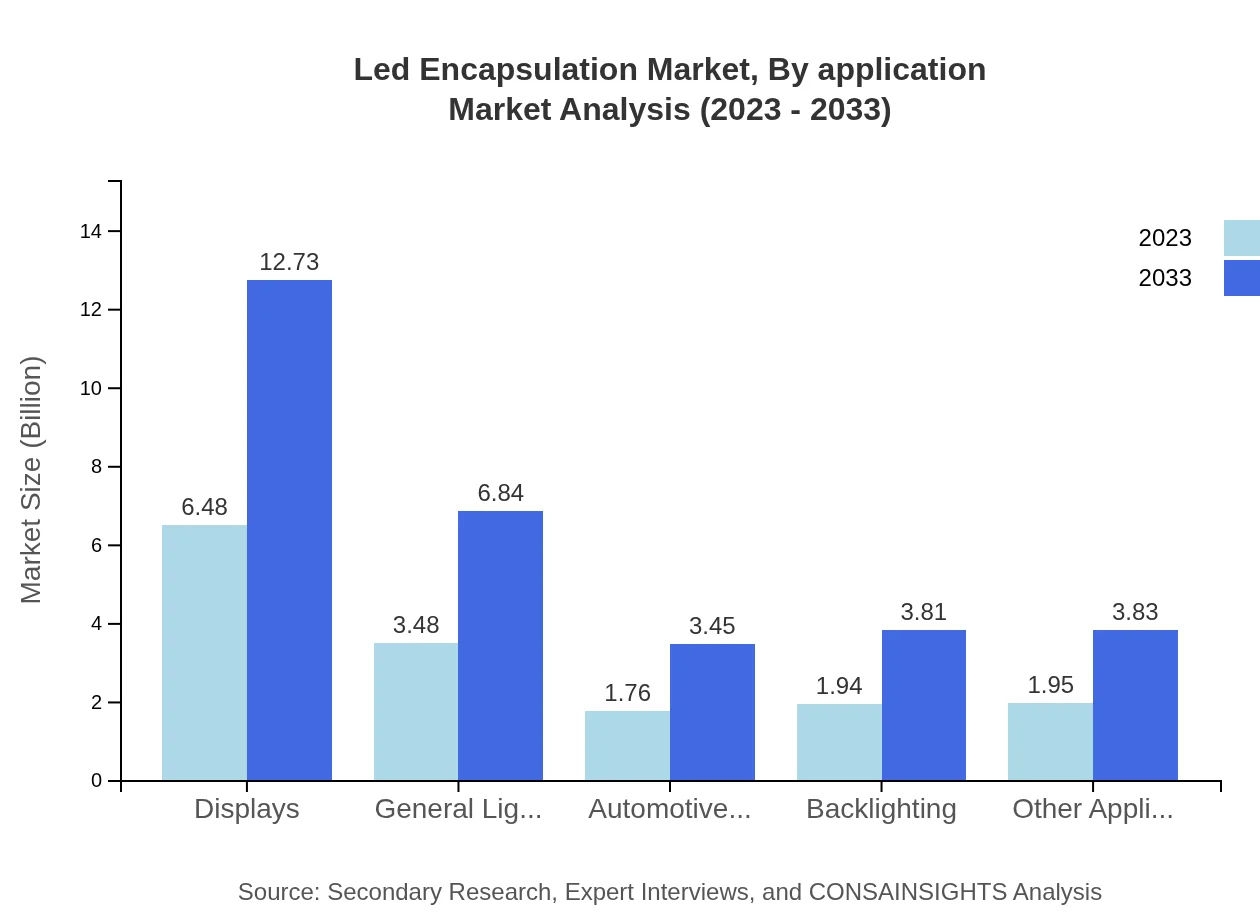

Led Encapsulation Market Analysis By Application

Approximately 41.51% of the LED Encapsulation market is attributed to consumer electronics, significantly driven by smartphone and television manufacturers. The automotive industry, while smaller at 11.26%, is rapidly evolving, especially regarding smart vehicle and lighting applications. General lighting applications contribute a notable share, alongside display technologies.

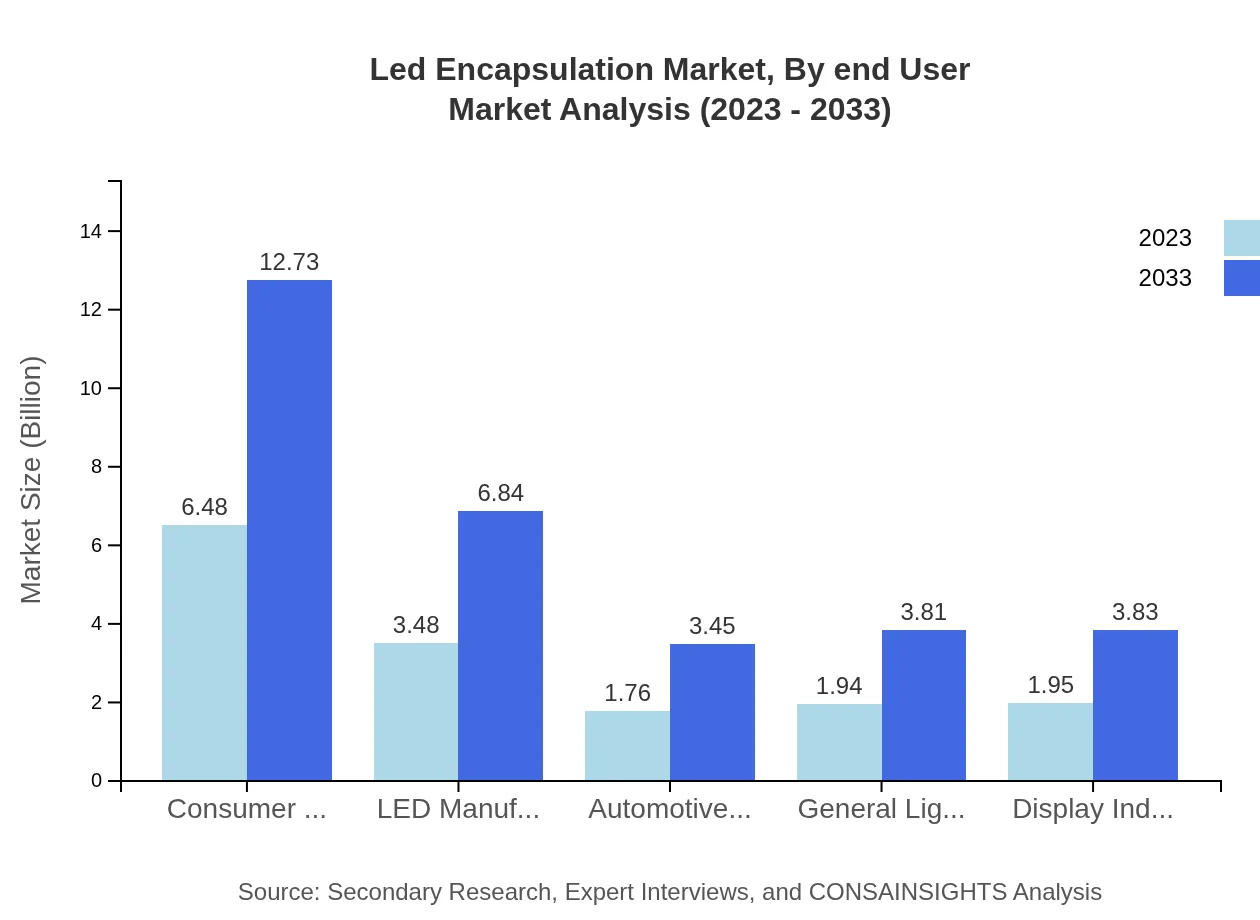

Led Encapsulation Market Analysis By End User

Noteworthy segments include consumer electronics, which dominate overall market performance, followed by automotive applications that increasingly adopt LED lighting for enhanced aesthetics and safety. The general lighting industry continues to thrive, especially with urban development initiatives promoting energy-efficient solutions.

Led Encapsulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Led Encapsulation Industry

Dow Silicones:

A leader in silicone materials for LED encapsulation, Dow Silicones focuses on developing innovative solutions that enhance performance and durability in lighting applications.Momentive Performance Materials:

Known for its silicone and epoxy technologies, Momentive is a major player providing comprehensive solutions and materials tailored for the LED encapsulation market.Henkel AG:

Henkel leverages advanced materials and cutting-edge technology in its adhesive solutions, contributing significantly to the LED encapsulation sector.3M Company:

3M is recognized for its various adhesive and encapsulant innovations that play a critical role in enhancing LED device reliability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of led Encapsulation?

The global LED encapsulation market is estimated at $15.6 billion as of 2023, with a projected compound annual growth rate (CAGR) of 6.8%, expected to expand significantly by 2033.

What are the key market players or companies in this led Encapsulation industry?

Key players in the LED encapsulation industry include major manufacturers such as OSRAM, Philips, Cree, Nichia, and Samsung, which significantly influence market trends and technological advancements.

What are the primary factors driving the growth in the led Encapsulation industry?

Growth in the LED encapsulation industry is primarily driven by increasing demand for energy-efficient lighting solutions, advancements in LED technology, and a push for sustainable products across various sectors.

Which region is the fastest Growing in the led Encapsulation?

Asia-Pacific is the fastest-growing region in the LED encapsulation market, projected to increase from $2.98 billion in 2023 to $5.86 billion by 2033, demonstrating significant growth.

Does ConsaInsights provide customized market report data for the led Encapsulation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the LED encapsulation industry, providing insights relevant to client strategies and goals.

What deliverables can I expect from this led Encapsulation market research project?

Deliverables from the LED encapsulation market research project include comprehensive market analysis, regional insights, competitive landscape details, and forecasts covering the years 2023 to 2033.

What are the market trends of led Encapsulation?

Current trends in the LED encapsulation market indicate a shift towards advanced materials, increased adoption of smart lighting systems, and a rise in demand for eco-friendly solutions.