Led Lighting Market Report

Published Date: 31 January 2026 | Report Code: led-lighting

Led Lighting Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Led Lighting market from 2023 to 2033, focusing on market size, trends, technology innovations, and regional insights. It serves as a guide for stakeholders aiming to understand current dynamics and future growth opportunities in this rapidly evolving industry.

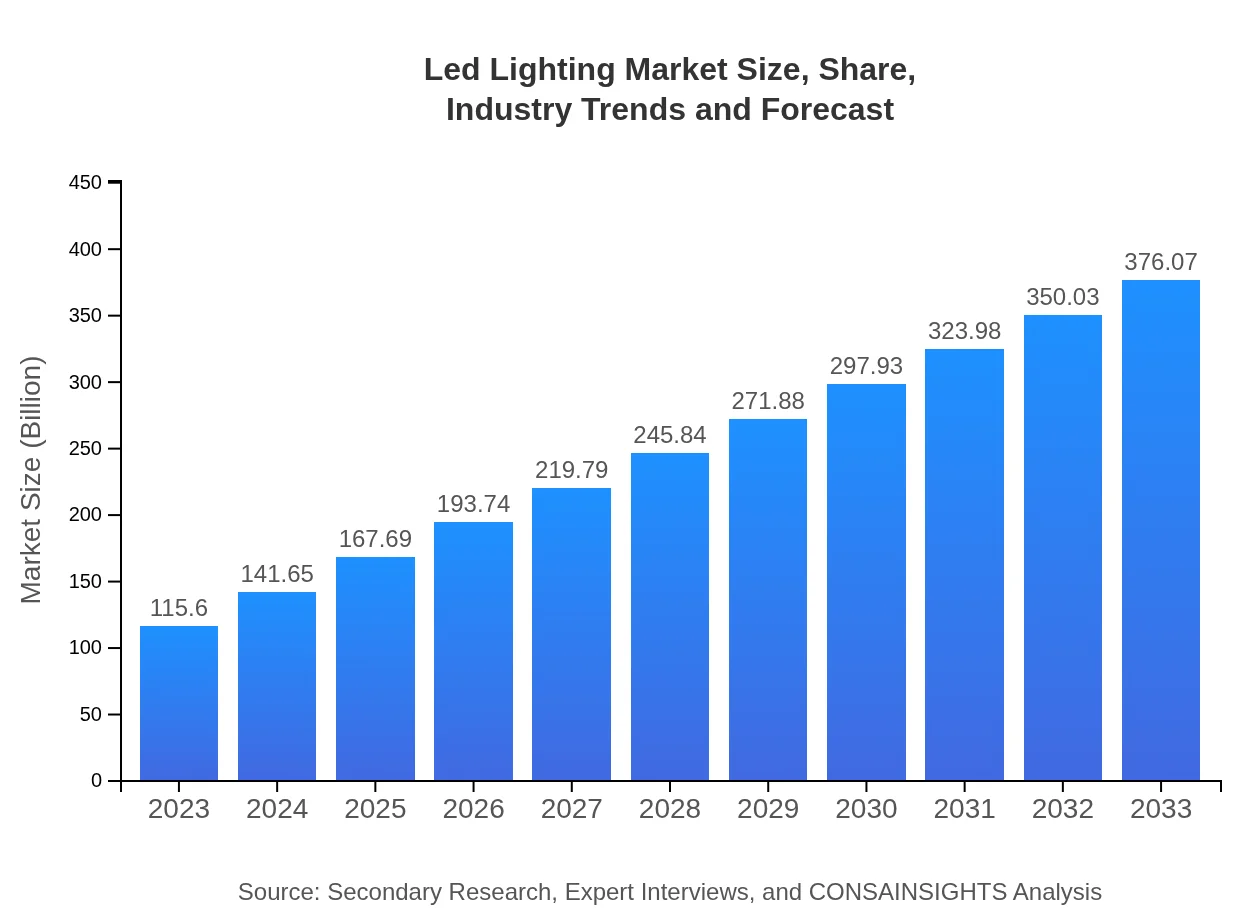

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $115.60 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $376.07 Billion |

| Top Companies | Philips Lighting, Osram, Cree, Inc., GE Lighting, Signify |

| Last Modified Date | 31 January 2026 |

Led Lighting Market Overview

Customize Led Lighting Market Report market research report

- ✔ Get in-depth analysis of Led Lighting market size, growth, and forecasts.

- ✔ Understand Led Lighting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Lighting

What is the Market Size & CAGR of Led Lighting market in 2023?

Led Lighting Industry Analysis

Led Lighting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Led Lighting Market Analysis Report by Region

Europe Led Lighting Market Report:

In Europe, the Led Lighting market is forecasted to escalate from $34.80 billion in 2023 to $113.20 billion by 2033. The EU's stringent energy consumption policies and commitment to reducing greenhouse gas emissions drive the adoption of LED solutions, with countries such as Germany and the UK spearheading innovation in energy-efficient lighting technology.Asia Pacific Led Lighting Market Report:

In the Asia Pacific region, the Led Lighting market is projected to grow from $23.09 billion in 2023 to $75.10 billion by 2033. Countries such as China and India are leading the charge owing to rapid urbanization, government initiatives promoting energy efficiency, and significant industrial growth. Increased disposable incomes and consumer awareness also aid in the adoption of innovative lighting solutions.North America Led Lighting Market Report:

North America holds a substantial share of the Led Lighting market, projected to expand from $39.45 billion in 2023 to $128.35 billion by 2033. The United States and Canada are leading markets due to stringent energy regulations, high consumer demand for eco-friendly products, and significant investments in smart city initiatives aimed at improving urban infrastructure.South America Led Lighting Market Report:

The South American market is estimated to grow from $9.80 billion in 2023 to $31.89 billion by 2033. Countries such as Brazil and Argentina are witnessing a shift towards Led Lighting due to financial incentives from governments and investments in green technology. However, challenges such as economic instability may hinder rapid growth in certain areas.Middle East & Africa Led Lighting Market Report:

The Middle East and Africa market is expected to grow from $8.46 billion in 2023 to $27.53 billion by 2033. Although still emerging, the region's growing urbanization and infrastructure demands, along with government initiatives to enhance energy sustainability, are poised to support market growth despite barriers like economic challenges.Tell us your focus area and get a customized research report.

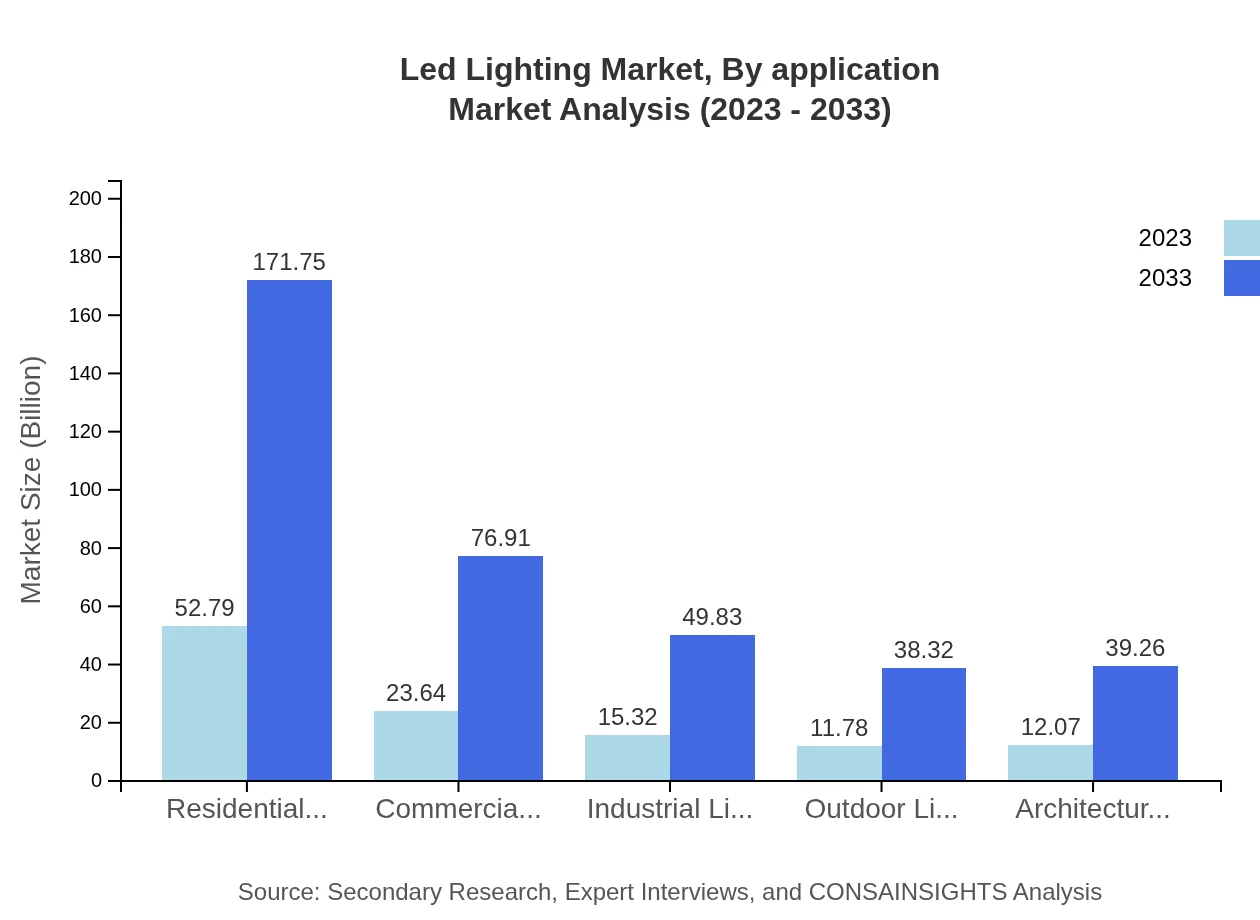

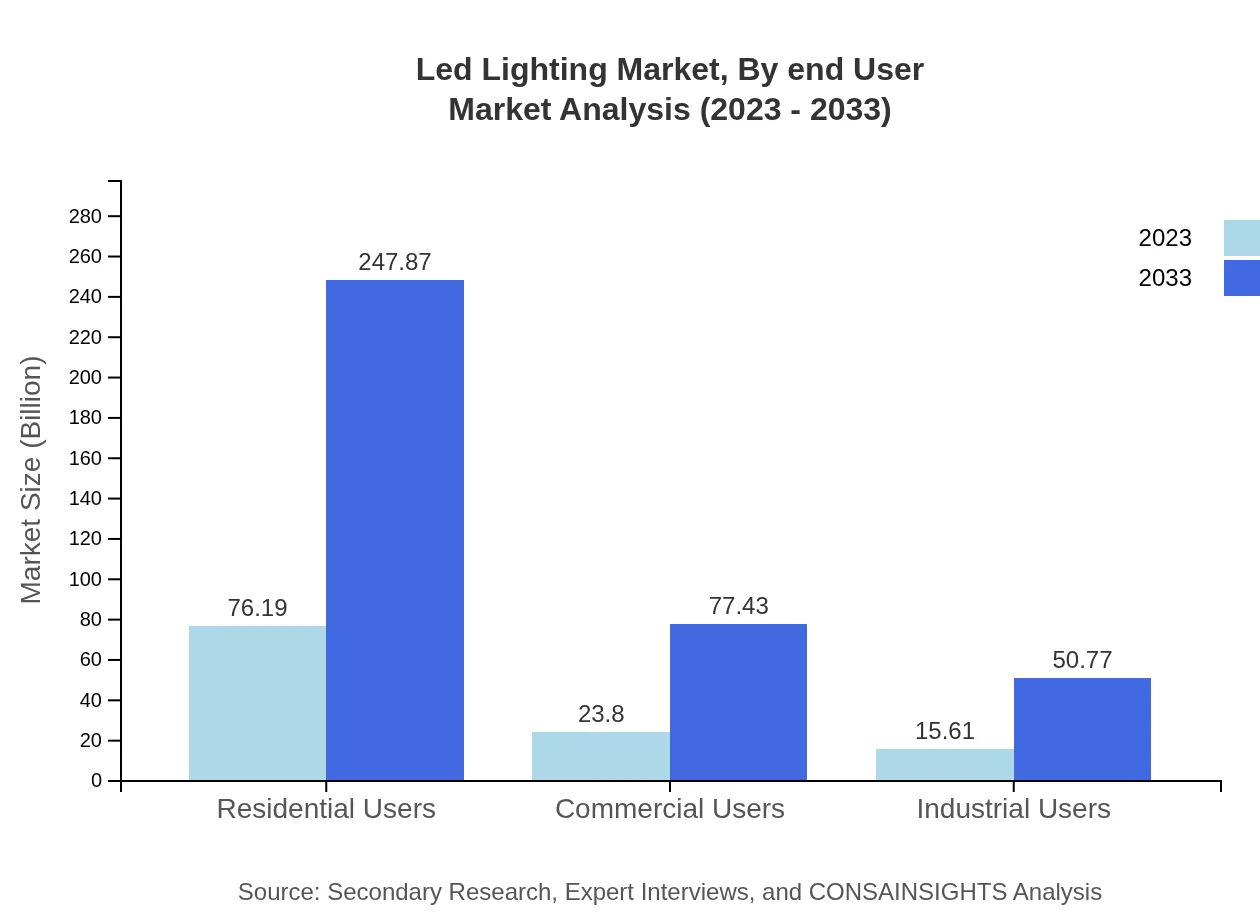

Led Lighting Market Analysis By Application

The segmentation by application shows that the residential sector occupies a significant share of the market, with a size of $76.19 billion in 2023, projected to reach $247.87 billion by 2033. Commercial users follow with $23.80 billion in 2023, expanding to $77.43 billion by 2033. Industrial users also play a vital role, growing from $15.61 billion to $50.77 billion in the same timeframe. This illustrates the diversified use of LED products across various sectors.

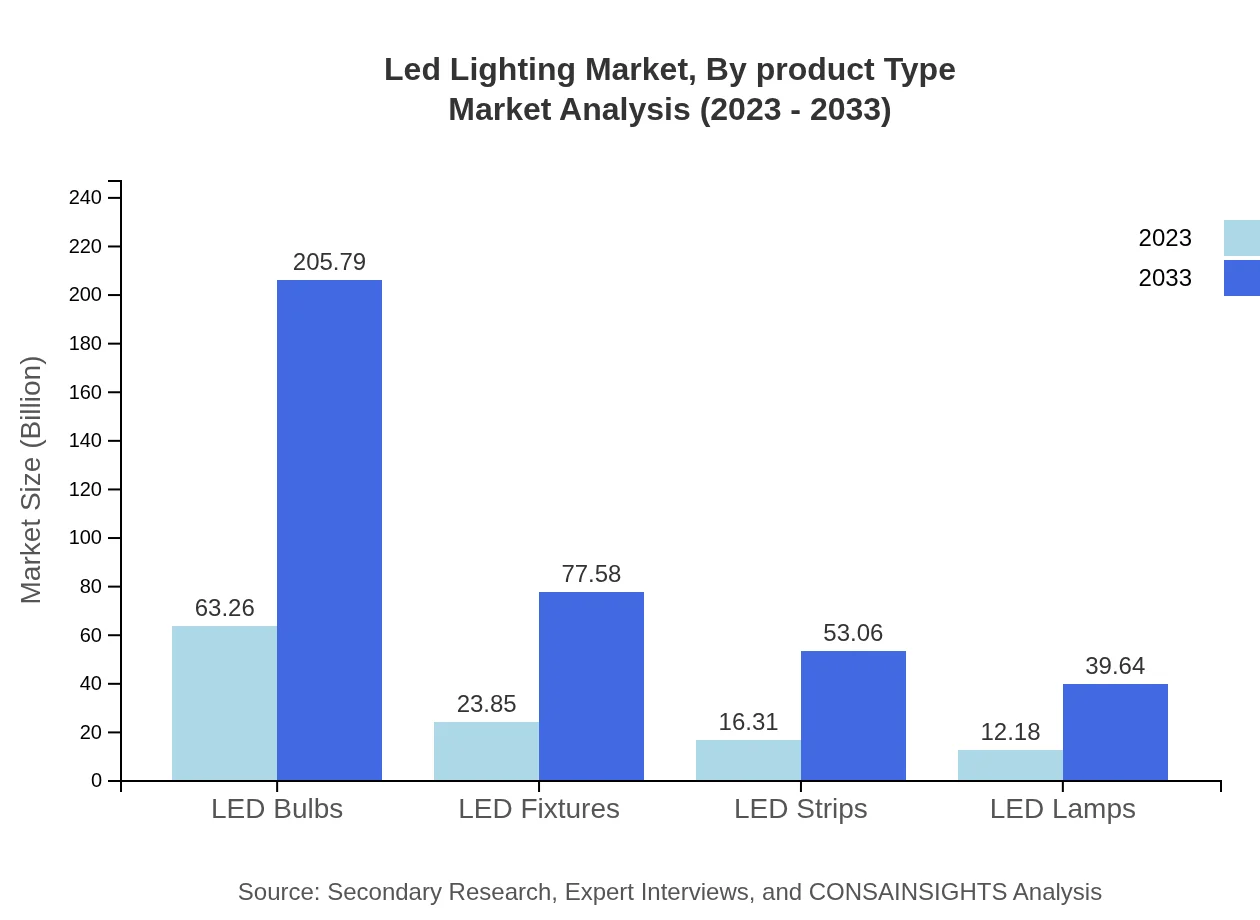

Led Lighting Market Analysis By Product Type

Product segmentation highlights LED bulbs leading the market at $63.26 billion in 2023, anticipating growth to $205.79 billion by 2033. LED fixtures are also gaining traction, moving from $23.85 billion to $77.58 billion in the same period. Other products, such as LED strips and lamps, are projected to expand significantly, indicating a healthy demand across various consumer preferences.

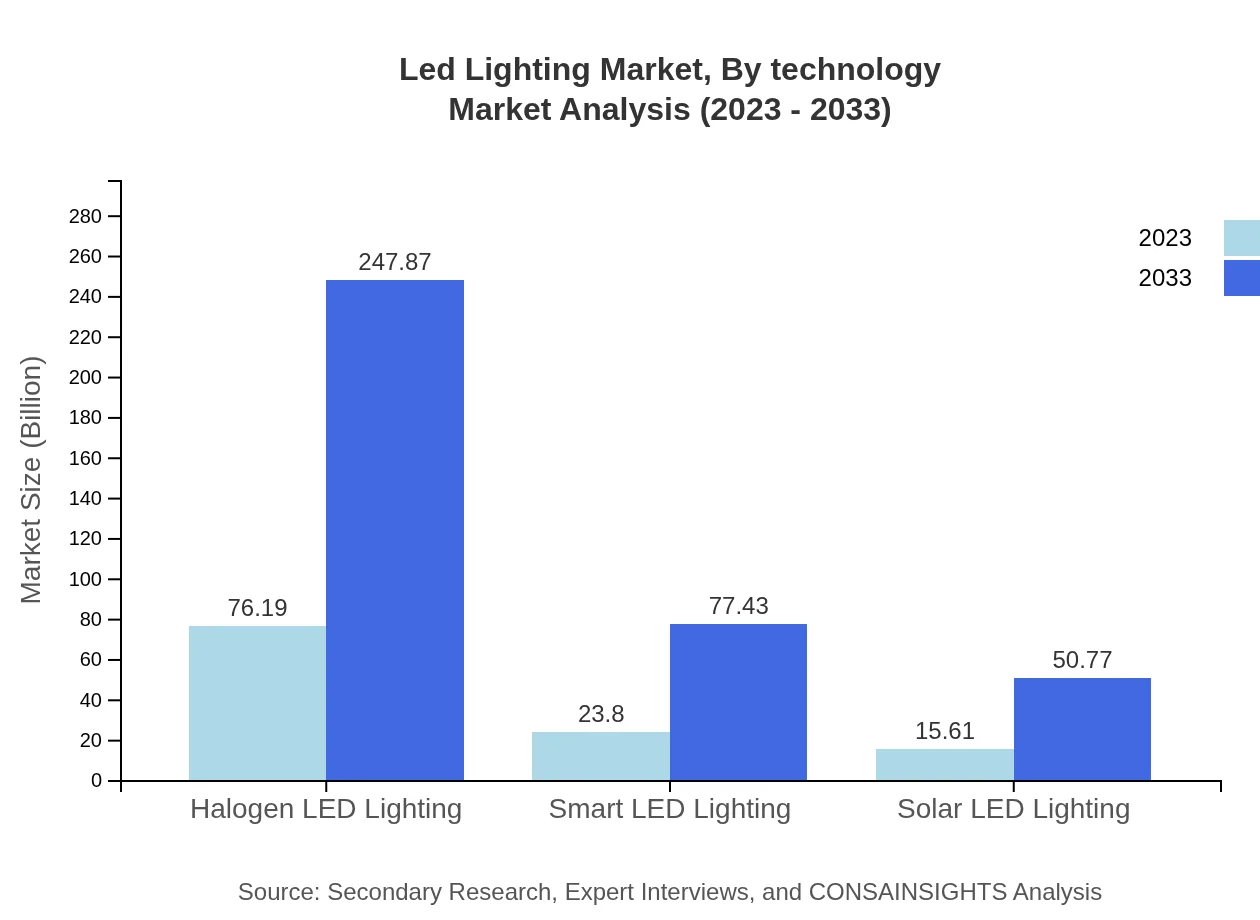

Led Lighting Market Analysis By Technology

Technological advancements in the LED Lighting market include the shift towards smart LED solutions, which is manifesting in increased market share from $23.80 billion in 2023 to $77.43 billion by 2033. This segment is driven by the demand for advanced lighting control systems and energy management solutions, reflecting the industry's focus on innovation and sustainability.

Led Lighting Market Analysis By End User

End-user segmentation indicates robust growth across residential, commercial, and industrial users. The residential sector's importance is underscored by its size of $76.19 billion in 2023, alongside significant growth prospects in commercial and industrial applications reflecting growing infrastructure needs.

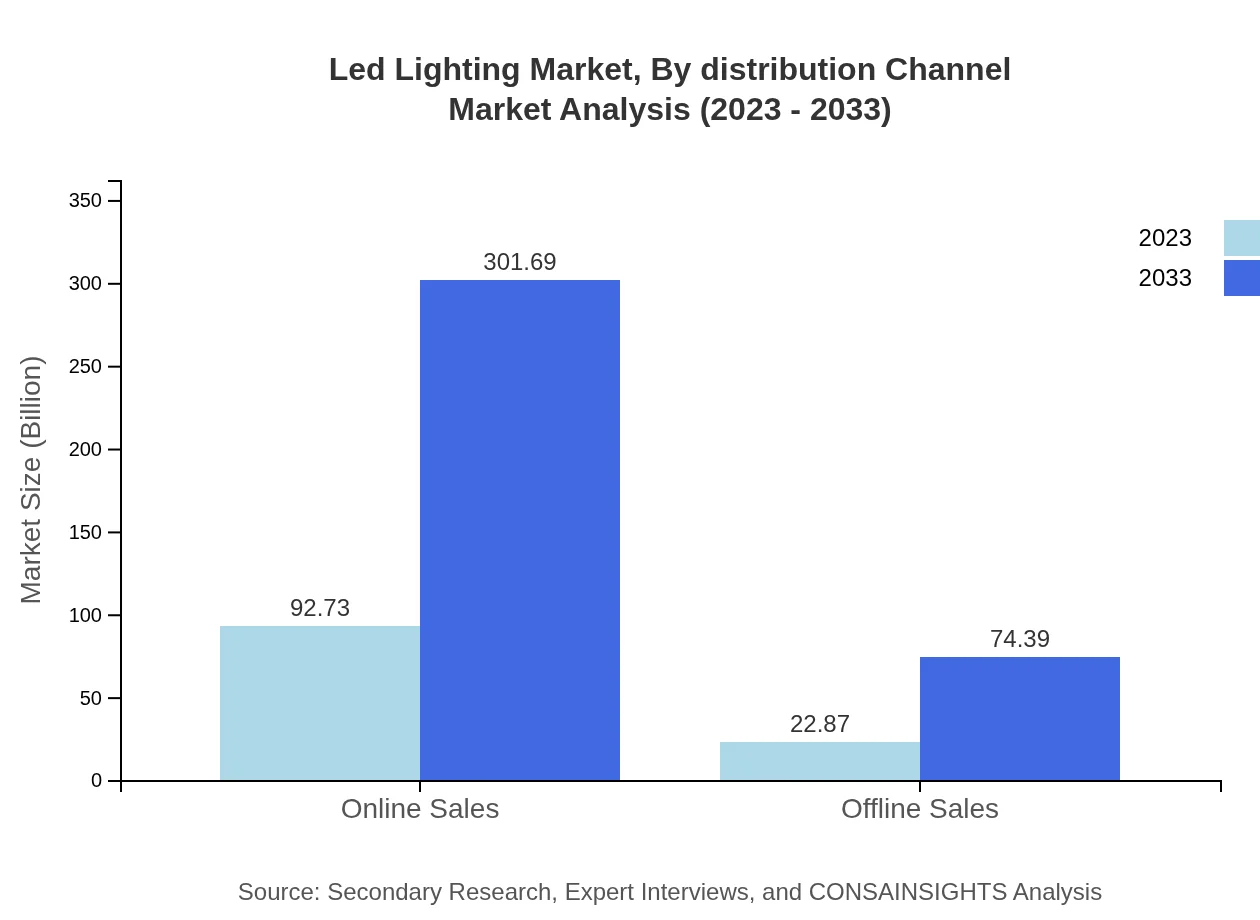

Led Lighting Market Analysis By Distribution Channel

The distribution of LED products indicates a strong preference for online sales, which are projected to surge from $92.73 billion in 2023 to $301.69 billion by 2033. Offline sales, while still important, are set to increase from $22.87 billion to $74.39 billion, indicating a shift towards e-commerce and convenience in purchasing habits.

Led Lighting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Led Lighting Industry

Philips Lighting:

Philips Lighting is a global leader in lighting products, known for its innovative LED solutions and commitment to sustainability.Osram:

Osram is a prominent player in the lighting industry, specializing in high-quality LED products and smart lighting solutions.Cree, Inc.:

Cree, Inc. is renowned for its cutting-edge LED technology and extensive range of energy-efficient lighting products for various applications.GE Lighting:

GE Lighting, part of General Electric, is a long-standing provider of innovative LED lighting solutions with a focus on energy efficiency.Signify:

Formerly Philips Lighting, Signify is a leader in connected LED lighting technologies and energy-efficient solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of led Lighting?

The global LED lighting market is projected to reach approximately $115.6 billion by 2033, growing at a CAGR of 12% from its current size.

What are the key market players or companies in the led Lighting industry?

Key players in the LED lighting market include Philips Lighting, Osram, Cree, GE Lighting, and Acuity Brands, which significantly influence the industry landscape.

What are the primary factors driving the growth in the led Lighting industry?

Factors such as increasing energy efficiency demands, government initiatives for sustainable lighting solutions, and technological advancements in LED technology drive market growth.

Which region is the fastest Growing in the led Lighting?

The North American region is the fastest-growing market for LED lighting, projected to expand from $39.45 billion in 2023 to $128.35 billion in 2033.

Does ConsaInsights provide customized market report data for the led Lighting industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the LED lighting sector.

What deliverables can I expect from this led Lighting market research project?

Expect detailed analyses including market size, trends, segment reports, competitive landscape summaries, and regional growth forecasts for the LED lighting market.

What are the market trends of led Lighting?

Current trends include the transition to smart lighting solutions, increased adoption of solar LED options, and growing online sales channels shaping the LED lighting market.