Led Materials Market Report

Published Date: 31 January 2026 | Report Code: led-materials

Led Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the LED materials market, covering market size, trends, regional analysis, and key players. The forecast period spans from 2023 to 2033, offering a detailed outlook on growth and opportunities in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

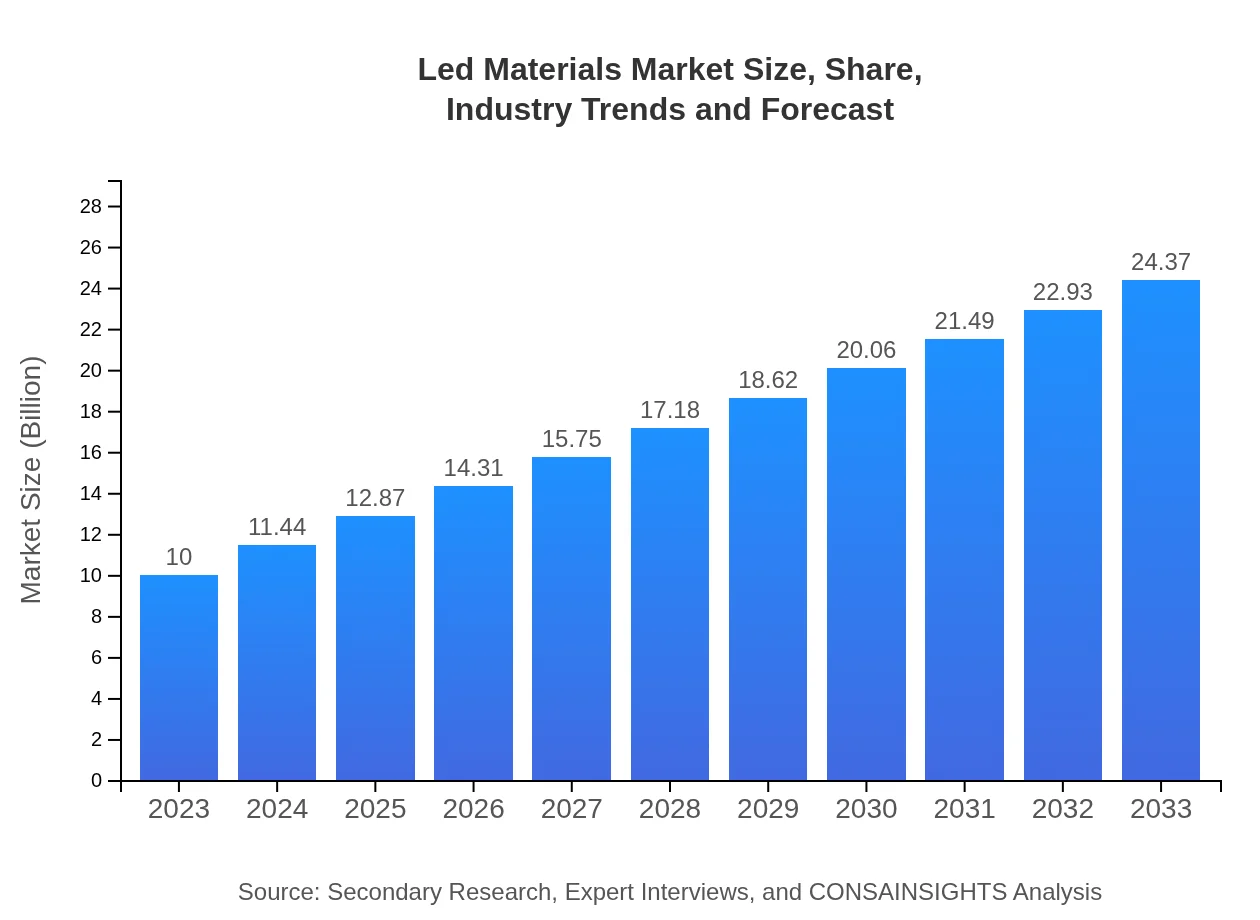

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $24.37 Billion |

| Top Companies | Cree, Inc., Osram Licht AG, Royal Philips Electronics, General Electric Company, Samsung Electronics |

| Last Modified Date | 31 January 2026 |

LED Materials Market Overview

Customize Led Materials Market Report market research report

- ✔ Get in-depth analysis of Led Materials market size, growth, and forecasts.

- ✔ Understand Led Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Materials

What is the Market Size & CAGR of the LED Materials market in 2023?

LED Materials Industry Analysis

LED Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

LED Materials Market Analysis Report by Region

Europe Led Materials Market Report:

Europe is projected to see substantial growth in the LED materials market, with revenues anticipated to rise to $7.05 billion by 2033, facilitated by stringent environmental regulations and an increasing preference for energy-efficient products.Asia Pacific Led Materials Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market size projected to reach $4.88 billion by 2033, driven by increasing urbanization, industrialization, and the growing adoption of energy-efficient lighting solutions across countries like China and India.North America Led Materials Market Report:

North America is forecasted to command a sizable share of the LED materials market, estimated to reach $8.29 billion by 2033. The region's growth is attributed to the strong focus on sustainability, regulatory support, and the prevalence of advanced technologies in the U.S. and Canada.South America Led Materials Market Report:

The South American LED materials market is expected to grow at a steady pace, reaching $0.92 billion by 2033 as energy-conscious policies and technological advancements propel the adoption of LED lighting solutions in countries such as Brazil and Argentina.Middle East & Africa Led Materials Market Report:

The Middle East and Africa region is forecast to grow, reaching $3.22 billion by 2033, driven by infrastructural developments and government initiatives aimed at promoting sustainable lighting solutions in various sectors.Tell us your focus area and get a customized research report.

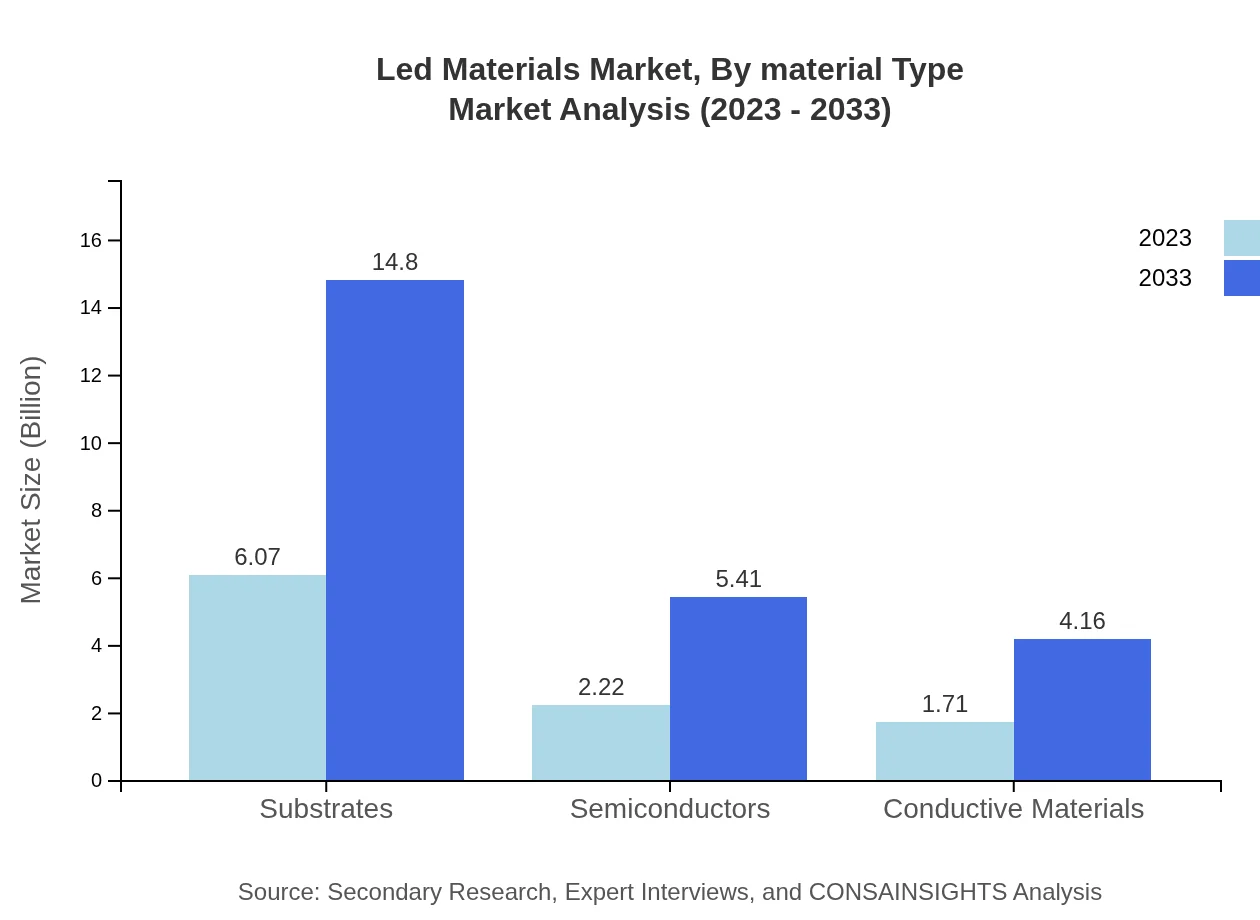

Led Materials Market Analysis By Material Type

The LED materials market by material type includes traditional LED technology, OLED, and quantum dot technology. Traditional LED technology accounts for the largest market share, estimated at $6.07 billion in 2023, and is expected to maintain this position through 2033. OLED technology, while smaller in size at $2.22 billion in 2023, is projected to grow due to its use in consumer electronics and displays. Quantum dot LED technology is also emerging, with a market size of $1.71 billion in 2023, indicating a growing interest in advanced display technologies.

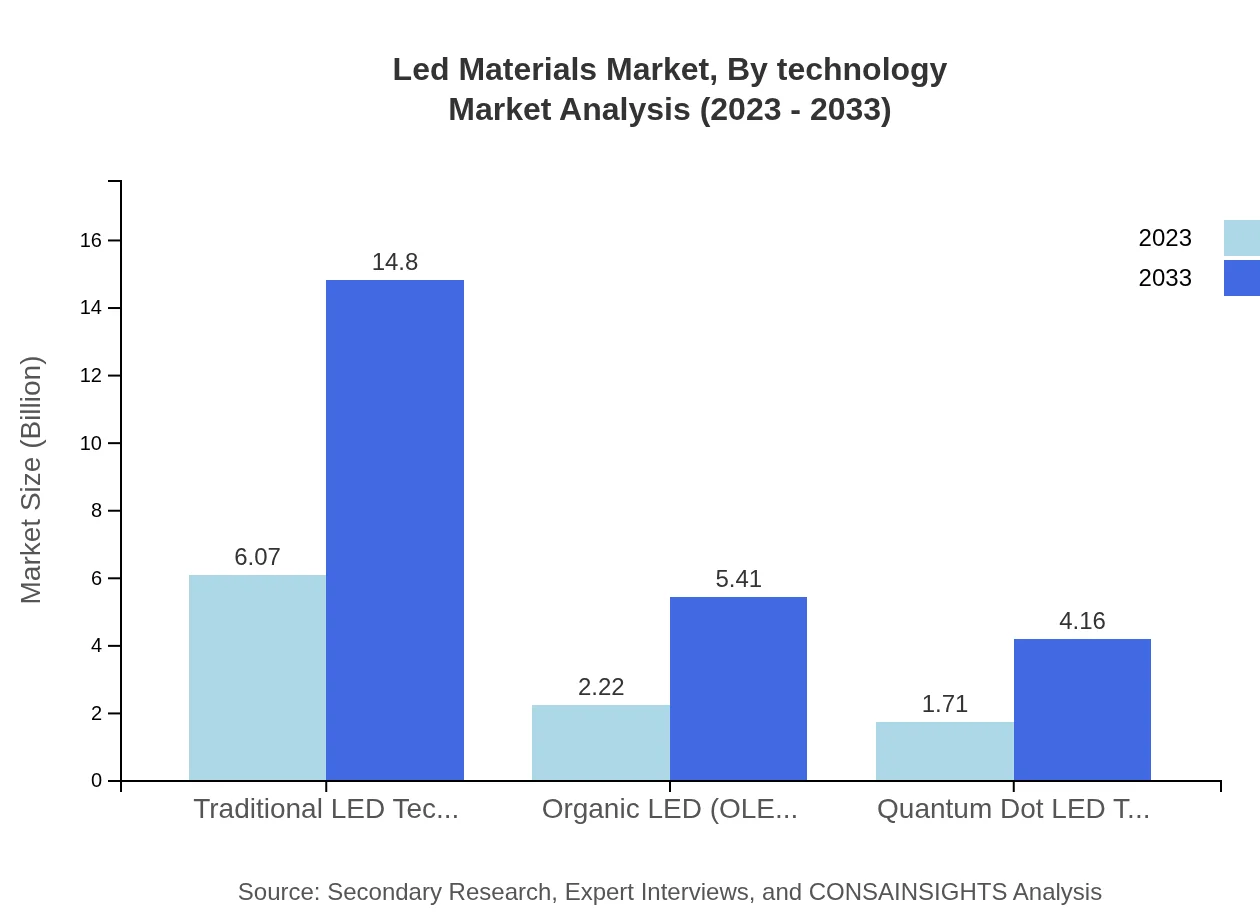

Led Materials Market Analysis By Technology

The LED materials market is characterized by technological advancements that enhance performance and efficiency. The segment focuses on innovations such as smart lighting solutions, energy harvesting technologies, and improved semiconductor materials. With applications spanning general lighting, automotive, and consumer gadgets, technological development is critical in driving market growth. Each technology contributes significantly to improving energy efficiency and reducing overall costs.

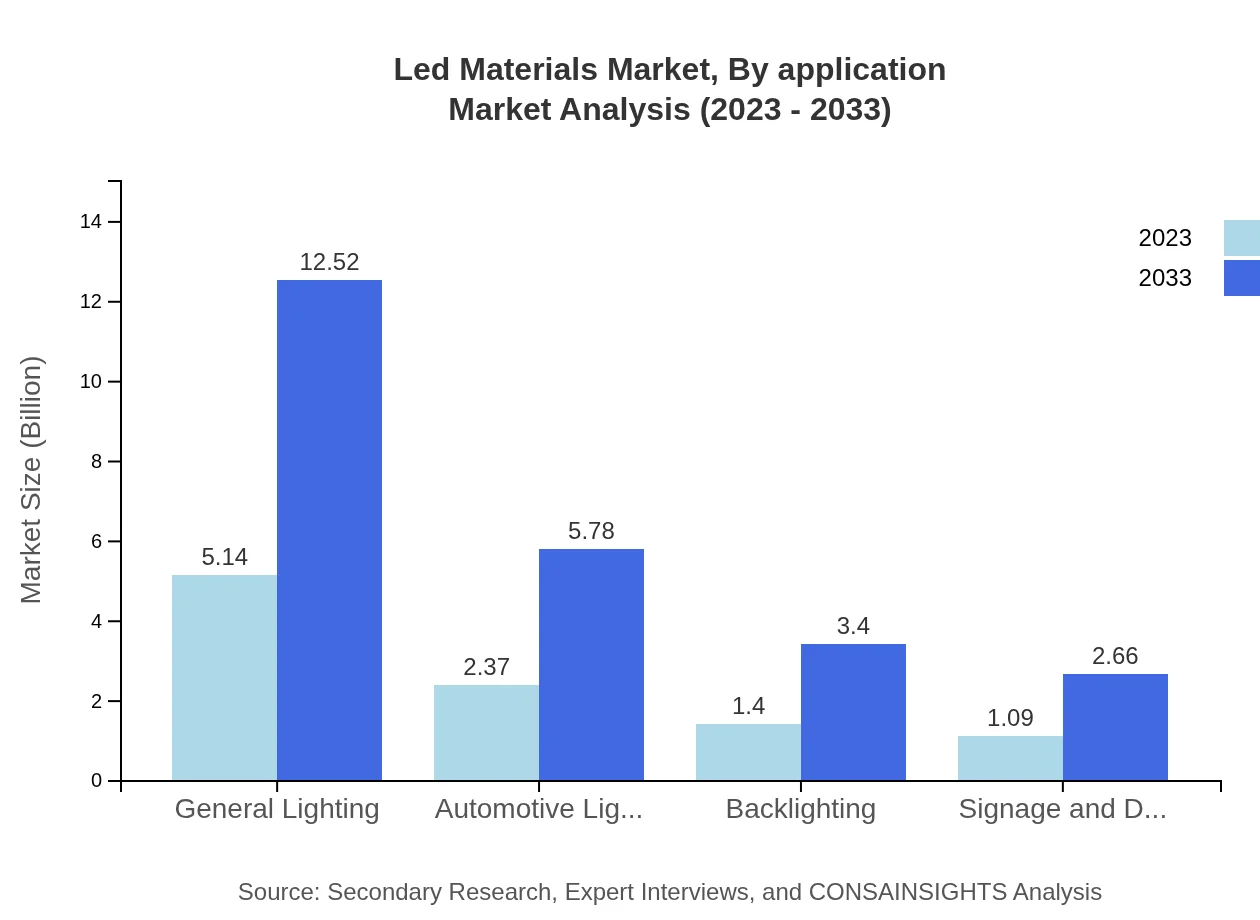

Led Materials Market Analysis By Application

The applications of LED materials cover various sectors such as general lighting, automotive lighting, consumer electronics, and signage & displays. General lighting holds a substantial share, contributing around $5.14 billion to the market in 2023, due to widespread adoption in residential and commercial spaces. Automotive lighting and backlighting are also critical segments, accounting for significant market sizes that reflect the growing demand in the automotive industry and electronic devices.

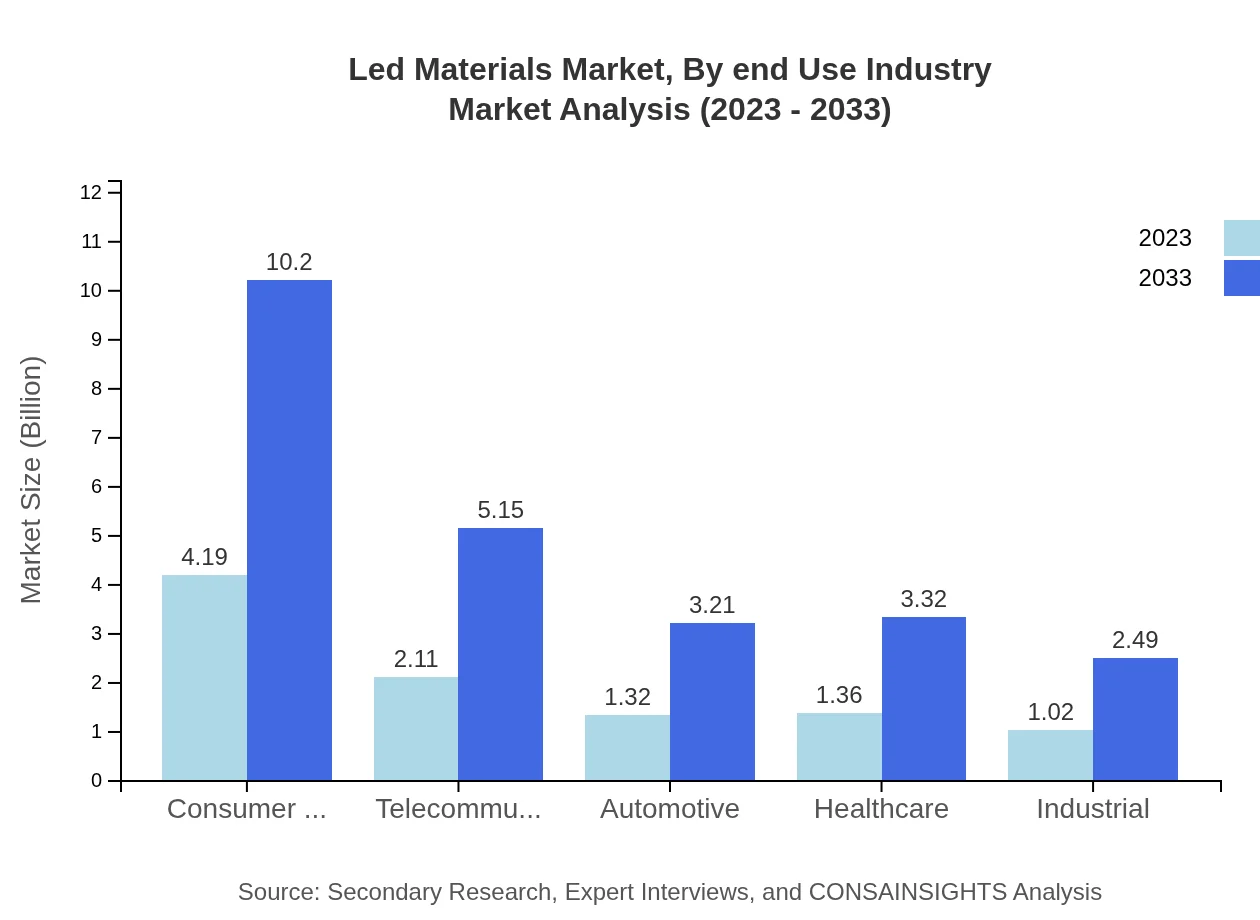

Led Materials Market Analysis By End Use Industry

End-use industries for LED materials include automotive, healthcare, telecommunications, and consumer electronics. Each industry benefits uniquely from LED technology, enhancing energy efficiency and reducing operational costs. The consumer electronics segment dominates, contributing about $4.19 billion in 2023, while healthcare displays a rising trend as LED technology improves service delivery in hospitals and clinics.

Led Materials Market Analysis By Region

Global LED Materials Market, By Region (Note: This is for reference only; segment should not be included) Market Analysis (2023 - 2033)

Analysis by region highlights the geographic distribution of market opportunities. Each region presents distinct dynamics influenced by socio-economic factors, technological adoption rates, and regulatory environments.

LED Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in LED Materials Industry

Cree, Inc.:

A leading innovator in LED technology, specializing in high-performance lighting solutions.Osram Licht AG:

A major player in the LED materials sector, known for its quality products in automotive and general lighting applications.Royal Philips Electronics:

A pioneer in the lighting industry, Philips is noted for its comprehensive range of LED products and smart lighting solutions.General Electric Company:

A diversified technology and financial services company that plays a significant role in advancing LED technologies.Samsung Electronics:

A leader in consumer electronics, Samsung is actively involved in the development and integration of advanced LED technologies in displays.We're grateful to work with incredible clients.

FAQs

What is the market size of led Materials?

The global LED materials market is valued at approximately $10 billion in 2023, with an expected compound annual growth rate (CAGR) of 9% reaching substantial growth over the coming decade.

What are the key market players or companies in this led Materials industry?

Key players in the LED materials industry include prominent firms engaged in manufacturing and technological innovation, contributing significantly to shaping and advancing the market landscape.

What are the primary factors driving the growth in the led materials industry?

Growth in the LED materials industry is driven by technological advancements, energy efficiency trends, rising demand for general lighting, and robust applications in consumer electronics and automotive lighting.

Which region is the fastest Growing in the led materials?

The fastest-growing region for LED materials from 2023 to 2033 is North America, projected to grow from $3.40 billion to $8.29 billion, followed closely by Europe and the Asia Pacific.

Does ConsaInsights provide customized market report data for the led materials industry?

Yes, ConsaInsights specializes in providing customized market report data tailored for the LED materials industry, ensuring clients receive insights specific to their needs and market dynamics.

What deliverables can I expect from this led materials market research project?

Expected deliverables from the LED materials market research project include comprehensive reports, detailed regional and segment analyses, and actionable insights to inform strategic decision-making.

What are the market trends of led materials?

Market trends for LED materials indicate a strong shift towards energy-efficient lighting solutions, increased use of organic and quantum dot LED technologies, and significant growth in new applications across various industries.