Led Phosphors Market Report

Published Date: 31 January 2026 | Report Code: led-phosphors

Led Phosphors Market Size, Share, Industry Trends and Forecast to 2033

This report offers insights into the LED Phosphors market dynamics, covering trends, forecasts from 2023 to 2033, and segmentation by product type, application, technology, end-user, and properties, along with regional analyses and profiles of key global players.

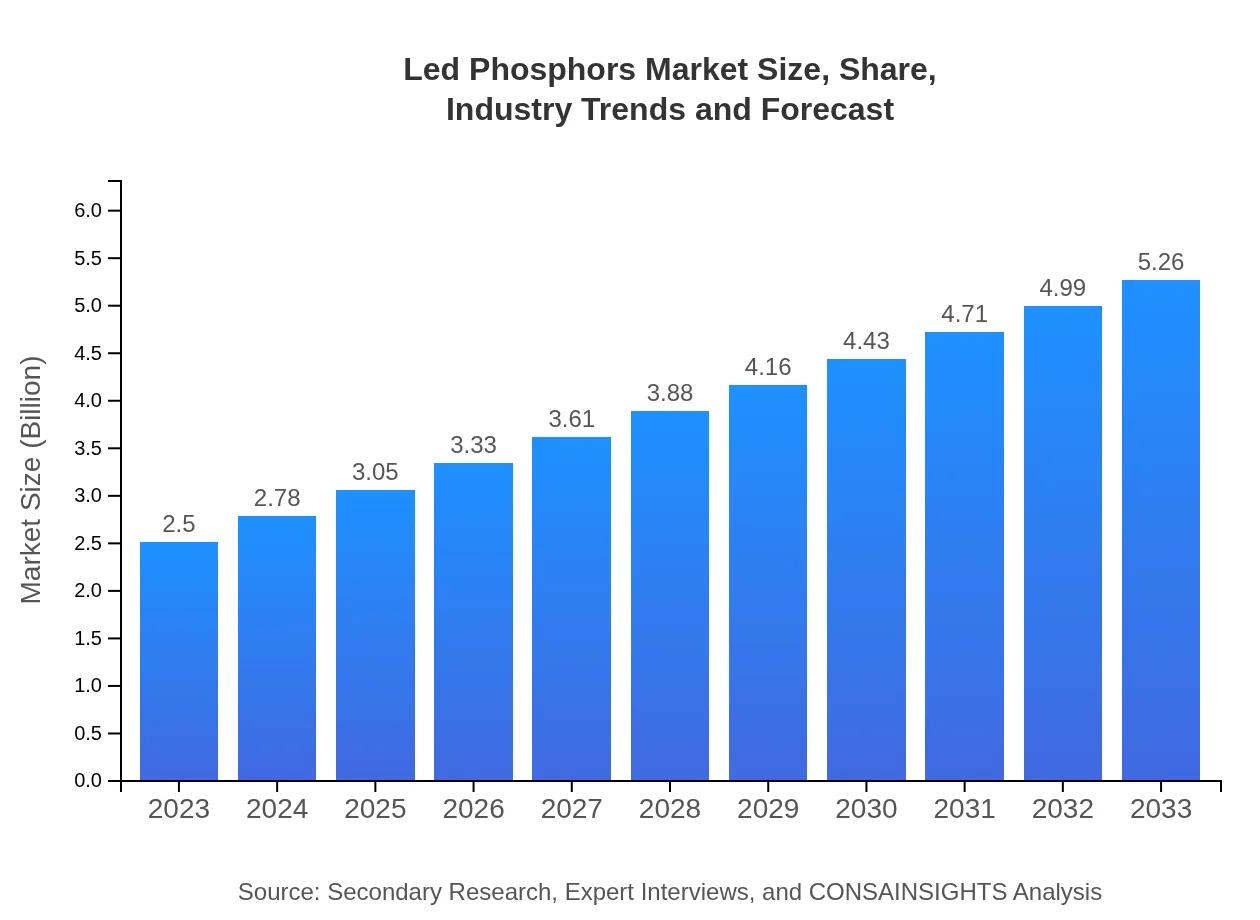

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $5.26 Billion |

| Top Companies | Osram Licht AG, Lumileds, Nichia Corporation, Samsung Electronics Co., Ltd., Seoul Semiconductor |

| Last Modified Date | 31 January 2026 |

LED Phosphors Market Overview

Customize Led Phosphors Market Report market research report

- ✔ Get in-depth analysis of Led Phosphors market size, growth, and forecasts.

- ✔ Understand Led Phosphors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Phosphors

What is the Market Size & CAGR of LED Phosphors market in 2023?

LED Phosphors Industry Analysis

LED Phosphors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

LED Phosphors Market Analysis Report by Region

Europe Led Phosphors Market Report:

Europe's LED phosphors market is anticipated to grow from $0.89 billion in 2023 to $1.86 billion by 2033, owing to stringent regulations promoting sustainability and an increase in smart lighting solutions.Asia Pacific Led Phosphors Market Report:

In the Asia Pacific region, the LED phosphors market is set to grow from $0.41 billion in 2023 to $0.87 billion by 2033, with strong demand from manufacturing industries and consumer electronics driving growth.North America Led Phosphors Market Report:

The North American market is estimated to expand from $0.85 billion in 2023 to $1.78 billion by 2033. A growing emphasis on energy efficiency in residential and commercial settings and technological advancements are key market drivers.South America Led Phosphors Market Report:

South America’s market is projected to rise from $0.02 billion in 2023 to $0.05 billion by 2033, as the region experiences an increase in investment in lighting infrastructure, particularly in urban areas.Middle East & Africa Led Phosphors Market Report:

In the Middle East and Africa, the market is expected to advance from $0.33 billion in 2023 to $0.70 billion by 2033, as growing urbanization and construction activities heighten demand for efficient lighting solutions.Tell us your focus area and get a customized research report.

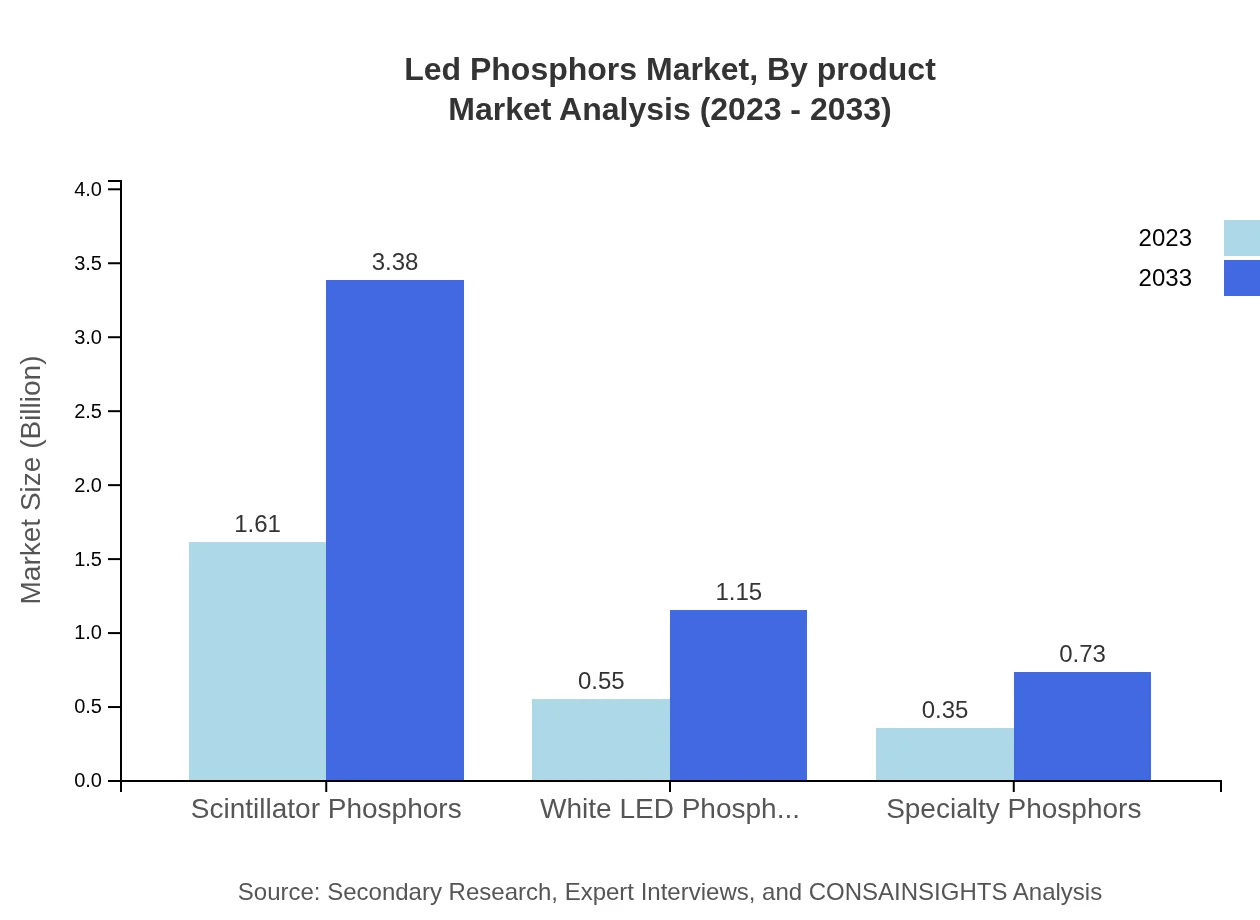

Led Phosphors Market Analysis By Product

The market analysis reveals scintillator phosphors leading with a significant size of $1.61 billion in 2023, expected to grow to $3.38 billion by 2033, maintaining a share of 64.25%. White LED phosphors follow, starting at $0.55 billion and projected to increase to $1.15 billion with a share of 21.87%. Specialty phosphors are anticipated to expand from $0.35 billion to $0.73 billion, holding 13.88% of the market.

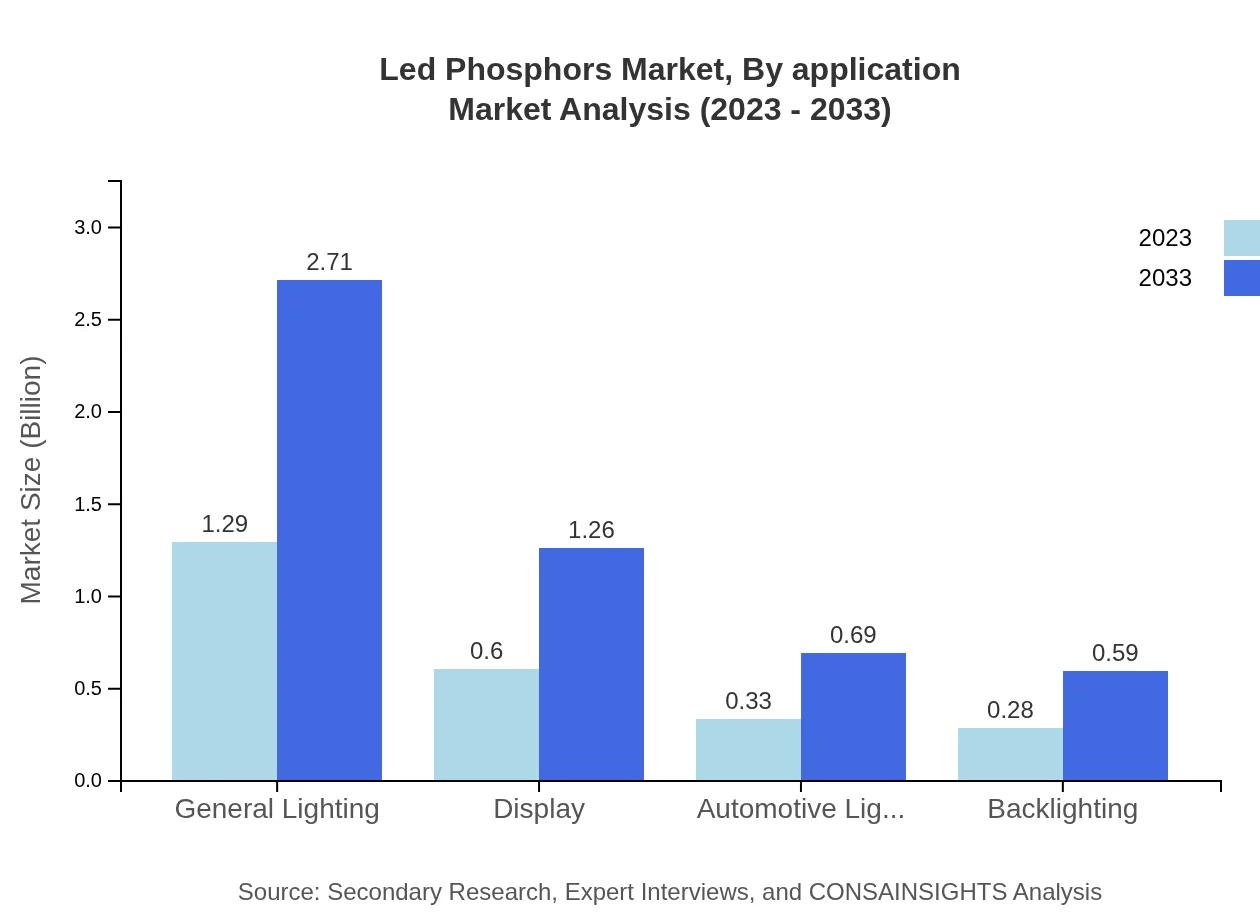

Led Phosphors Market Analysis By Application

By application, electronic manufacturing leads with a market size of $1.29 billion in 2023, forecasted to reach $2.71 billion by 2033, capturing 51.57% market share. General lighting and automotive applications hold shares of 51.57% and 24.03%, respectively, reflecting their significance in the overall market.

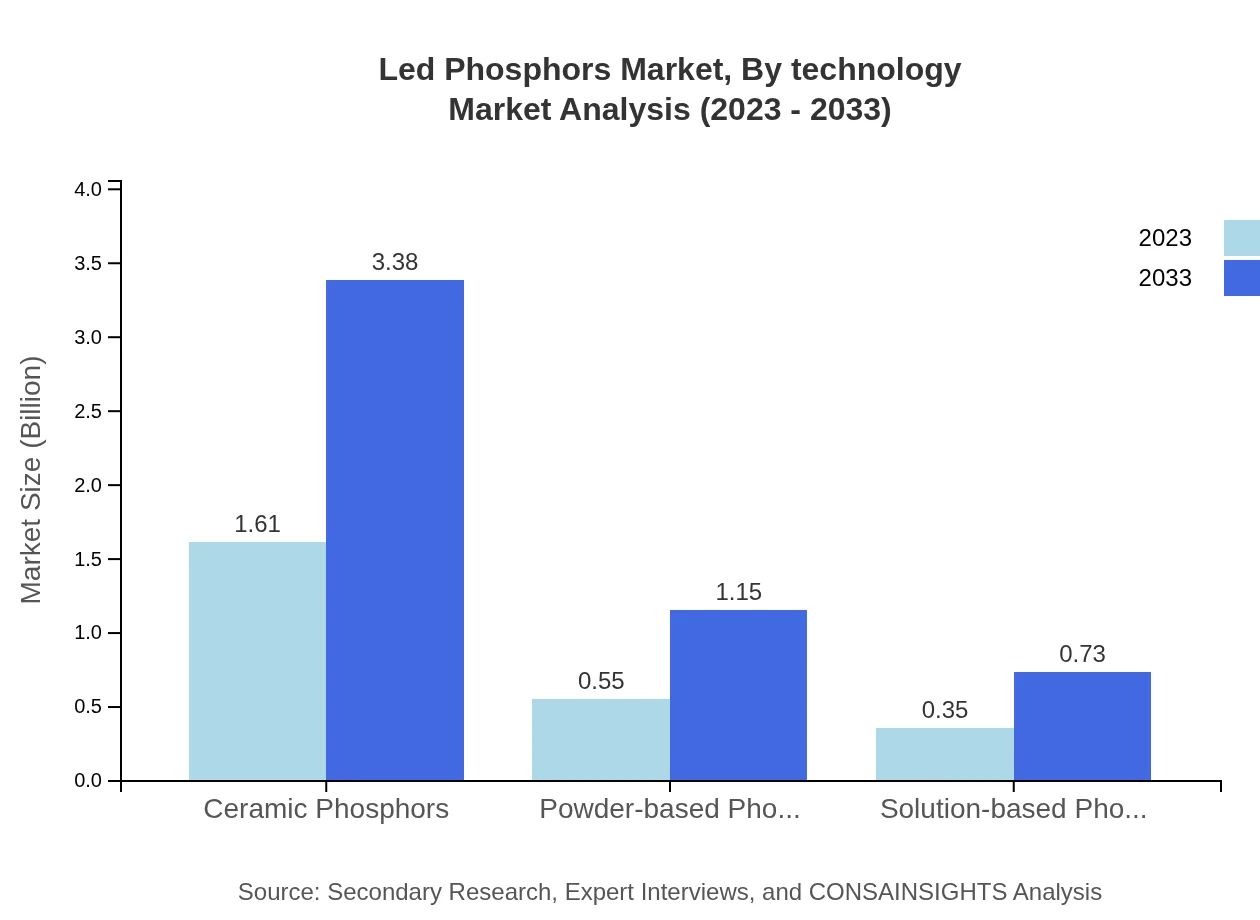

Led Phosphors Market Analysis By Technology

In terms of technology, ceramic phosphors dominate, valued at $1.61 billion in 2023 and expected to reach $3.38 billion by 2033 with a market share of 64.25%. Powder-based phosphors and solution-based phosphors together represent notable segments, enhancing the product range and efficiency in applications.

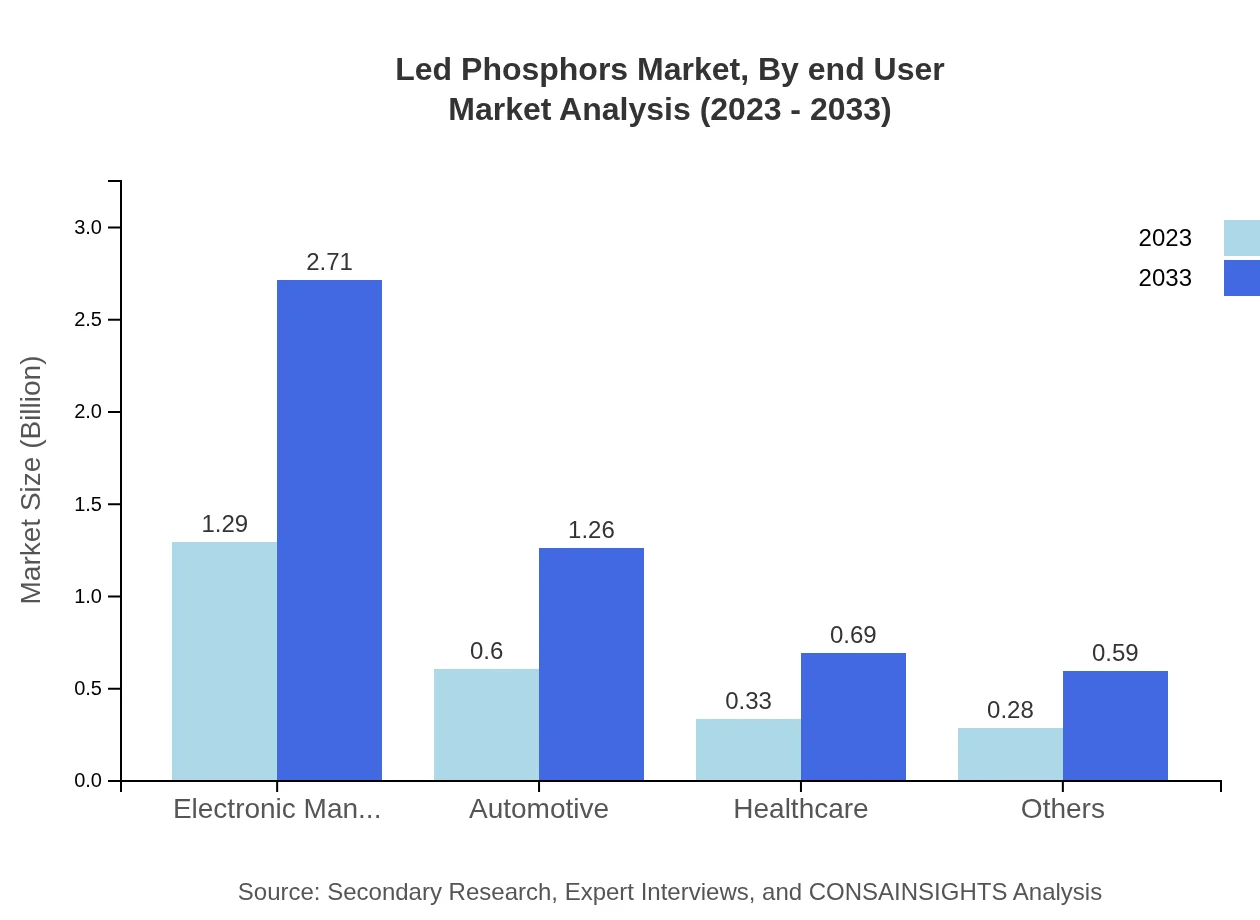

Led Phosphors Market Analysis By End User

The end-user analysis indicates electronic manufacturing and automotive sectors as the largest consumers of LED phosphors, driven by demand for high-performance lighting in displays and vehicle efficiency strategies. Significant growth in healthcare applications also emphasizes varied use cases across sectors.

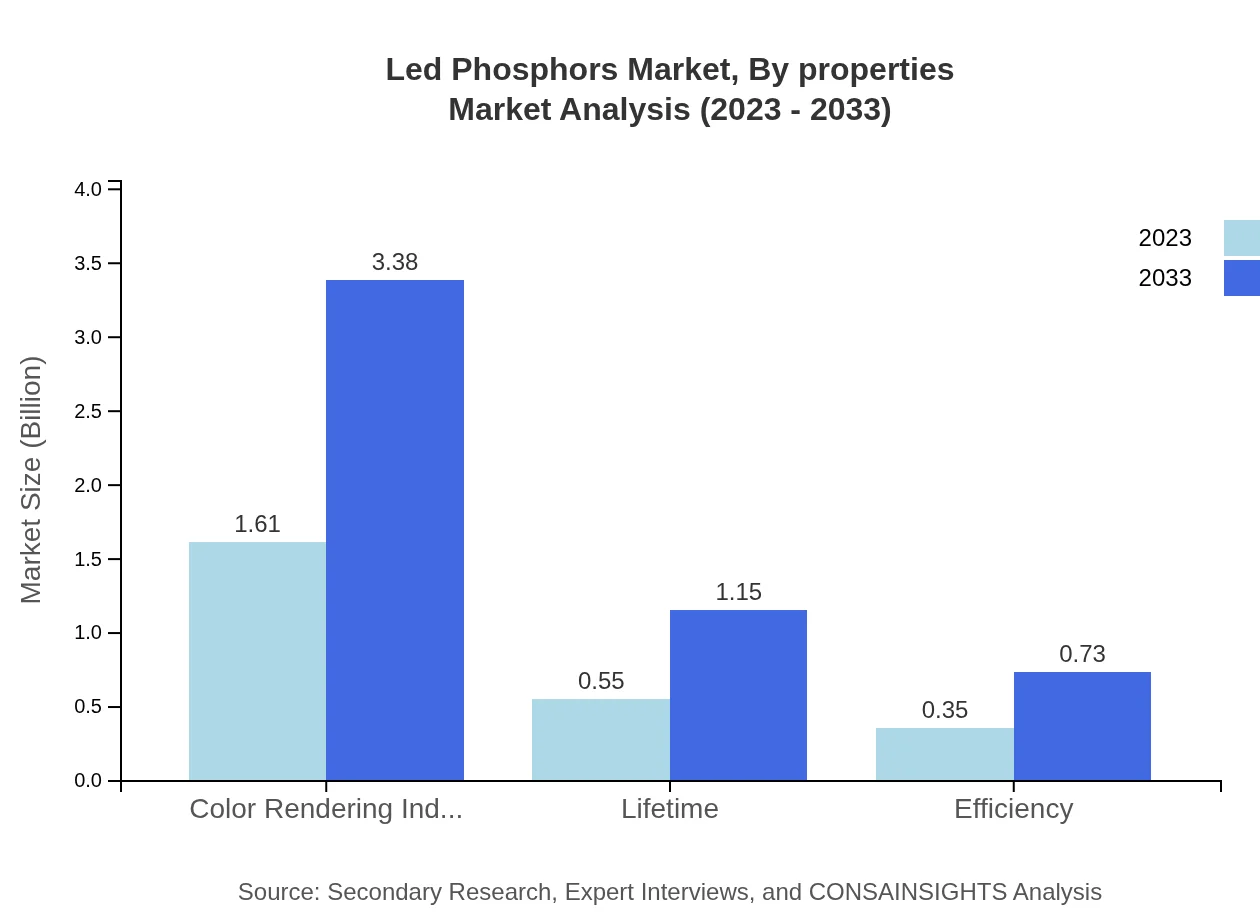

Led Phosphors Market Analysis By Properties

The market by properties reveals a promising segment for color rendering index (CRI) phosphors, projected to expand from $1.61 billion in 2023 to $3.38 billion by 2033, with an identical share of 64.25%. Other properties like lifetime and efficiency contribute to enhancing product performance across applications.

LED Phosphors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in LED Phosphors Industry

Osram Licht AG:

A leading global lighting manufacturer, Osram specializes in innovative LED solutions and phosphor technologies, contributing significantly to the enhancement of LED performance.Lumileds:

Founded in the light-emitting diode (LED) sector, Lumileds develops advanced LED and phosphor technology, focusing on energy efficiency and high-quality illumination.Nichia Corporation:

A major player in the phosphor and LED markets, Nichia is recognized for its proprietary blue LED technology and high-performance phosphors used in various applications.Samsung Electronics Co., Ltd.:

As a leader in the electronic components market, Samsung produces innovative LED solutions and phosphors, driving advancement in consumer electronics and general lighting sectors.Seoul Semiconductor:

Seoul Semiconductor is known for its innovative LED technology and phosphor products, contributing to energy-efficient lighting across diverse applications.We're grateful to work with incredible clients.

FAQs

What is the market size of led Phosphors?

The LED phosphors market is valued at approximately $2.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 7.5% through 2033, indicating strong growth opportunities in the upcoming years.

What are the key market players or companies in the led Phosphors industry?

The key companies in the LED phosphors market include major manufacturers and innovators who contribute to advancements in phosphor technology, focusing on product development and market penetration across various segments and application areas.

What are the primary factors driving the growth in the led Phosphors industry?

Growth in the LED phosphors market is driven by rising demands for energy-efficient lighting, technological advancements, and increasing applications in sectors like automotive and healthcare, as well as an overall push towards sustainability and reduced carbon footprints.

Which region is the fastest Growing in the led Phosphors?

The Asia-Pacific region is projected to demonstrate the fastest growth in the LED phosphors market, with a market size increase from $0.41 billion in 2023 to an estimated $0.87 billion by 2033, indicating a rapid expansion.

Does ConsInsights provide customized market report data for the led Phosphors industry?

Yes, ConsInsights offers customized market report data tailored to specific needs and requirements for the LED phosphors industry, ensuring detailed insights and analysis that cater to different business objectives.

What deliverables can I expect from this led Phosphors market research project?

Deliverables from the LED phosphors market research will typically include comprehensive reports on market size, segmentation analysis, regional insights, competitive landscape, and trends affecting the market's future growth.

What are the market trends of led Phosphors?

Current market trends in led-phosphors include a surge in demand for scintillator phosphors, advancements in white LED phosphor technology, and increasing applications across diverse sectors such as general lighting, displays, and automotive lighting.