Left Atrial Appendage Devices Laa Market Report

Published Date: 31 January 2026 | Report Code: left-atrial-appendage-devices-laa

Left Atrial Appendage Devices Laa Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Left Atrial Appendage Devices (LAA) market, covering market size, industry insights, technology trends, and forecasts from 2023 to 2033.

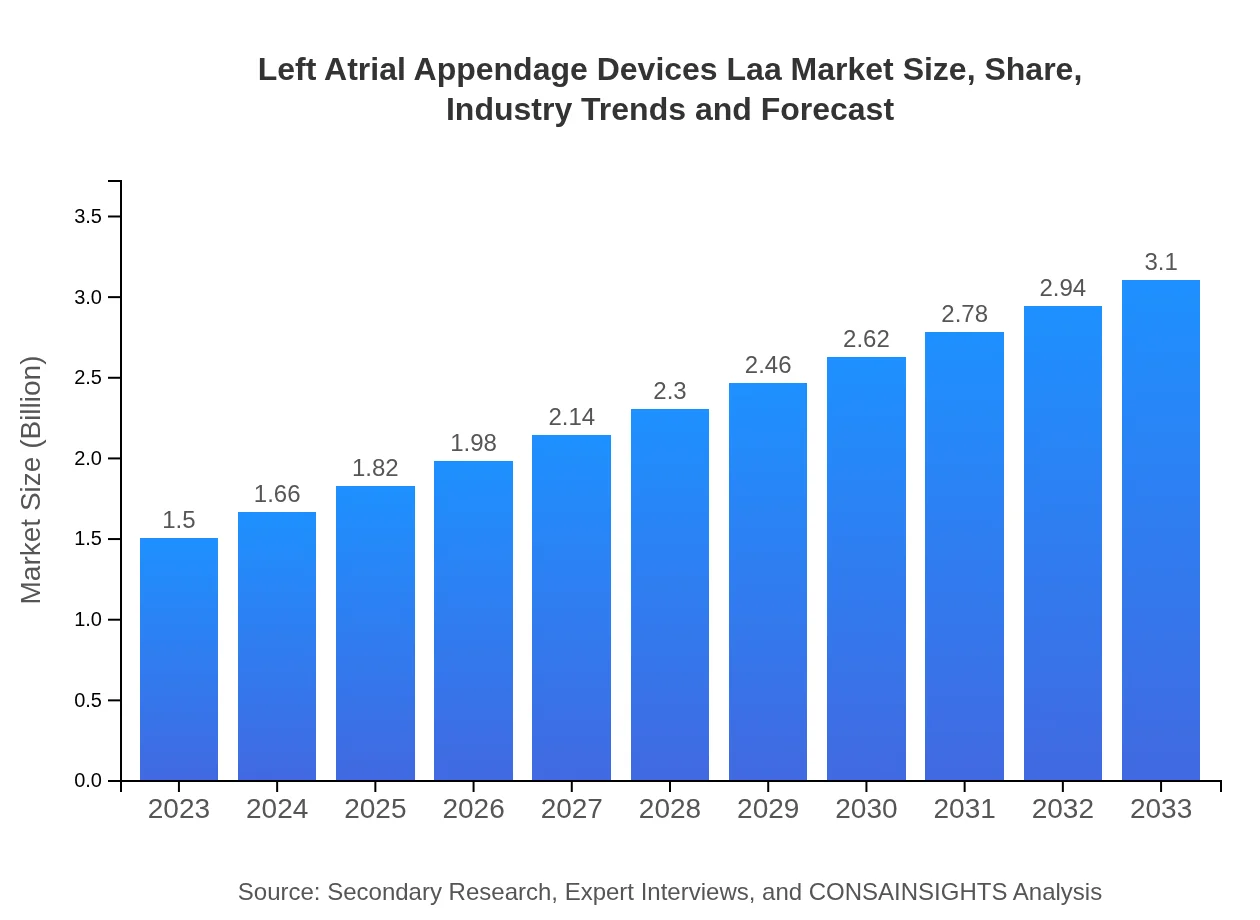

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $3.10 Billion |

| Top Companies | AtriCure, Inc., Boston Scientific Corporation, Abbott Laboratories, Medtronic plc, Lepu Medical Technology |

| Last Modified Date | 31 January 2026 |

Left Atrial Appendage Devices Laa Market Overview

Customize Left Atrial Appendage Devices Laa Market Report market research report

- ✔ Get in-depth analysis of Left Atrial Appendage Devices Laa market size, growth, and forecasts.

- ✔ Understand Left Atrial Appendage Devices Laa's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Left Atrial Appendage Devices Laa

What is the Market Size & CAGR of Left Atrial Appendage Devices Laa market in 2023?

Left Atrial Appendage Devices Laa Industry Analysis

Left Atrial Appendage Devices Laa Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Left Atrial Appendage Devices Laa Market Analysis Report by Region

Europe Left Atrial Appendage Devices Laa Market Report:

The European LAA devices market is estimated at USD 530 million in 2023, expected to nearly double to USD 1.1 billion by 2033. An aging population and enhanced regulatory approvals are key growth factors.Asia Pacific Left Atrial Appendage Devices Laa Market Report:

In 2023, the Asia-Pacific market is estimated at USD 250 million, expected to grow to approximately USD 520 million by 2033. The growth is driven by the increasing prevalence of cardiovascular diseases and improvements in healthcare infrastructure.North America Left Atrial Appendage Devices Laa Market Report:

North America dominates the LAA devices market with a valuation of USD 500 million in 2023, projected to grow to USD 1.03 billion by 2033. This growth is supported by high healthcare expenditure and an established reimbursement framework.South America Left Atrial Appendage Devices Laa Market Report:

The South American market for LAA devices is currently valued at USD 70 million in 2023 and is anticipated to reach USD 140 million by 2033. The region's healthcare sector is gradually advancing, with rising investments in medical technology.Middle East & Africa Left Atrial Appendage Devices Laa Market Report:

In the Middle East and Africa, the market is valued at USD 140 million in 2023, forecasted to rise to USD 300 million by 2033. Increasing awareness of AF management and growing healthcare investments are driving growth in this region.Tell us your focus area and get a customized research report.

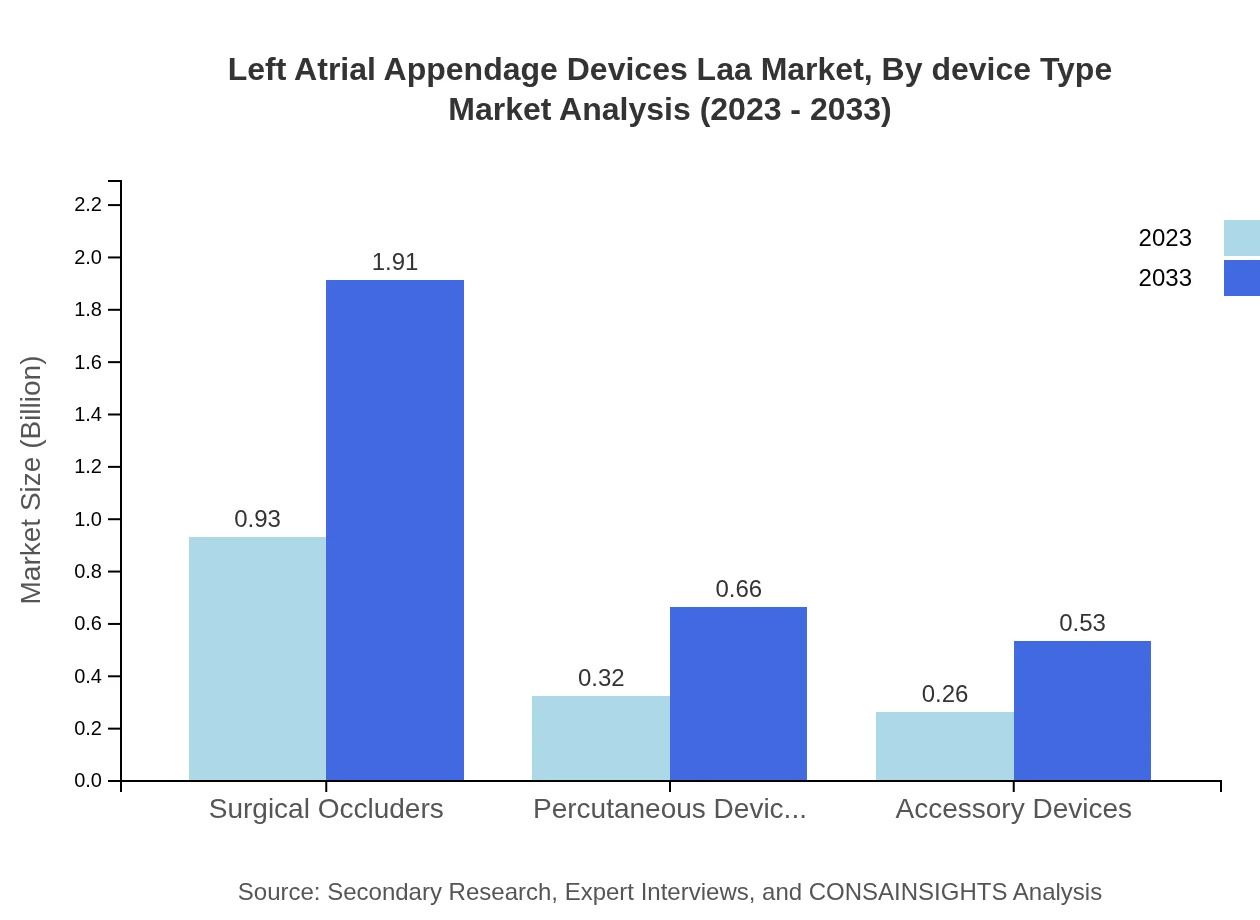

Left Atrial Appendage Devices Laa Market Analysis By Device Type

The Left Atrial Appendage Devices market is divided into surgical occluders, percutaneous devices, and accessory devices. Surgical occluders dominate with USD 930 million in 2023 and projected growth to USD 1.91 billion by 2033 due to their effectiveness in directly addressing AF risks. Percutaneous devices and accessory devices also show positive growth trends, supported by increasing minimally invasive procedures.

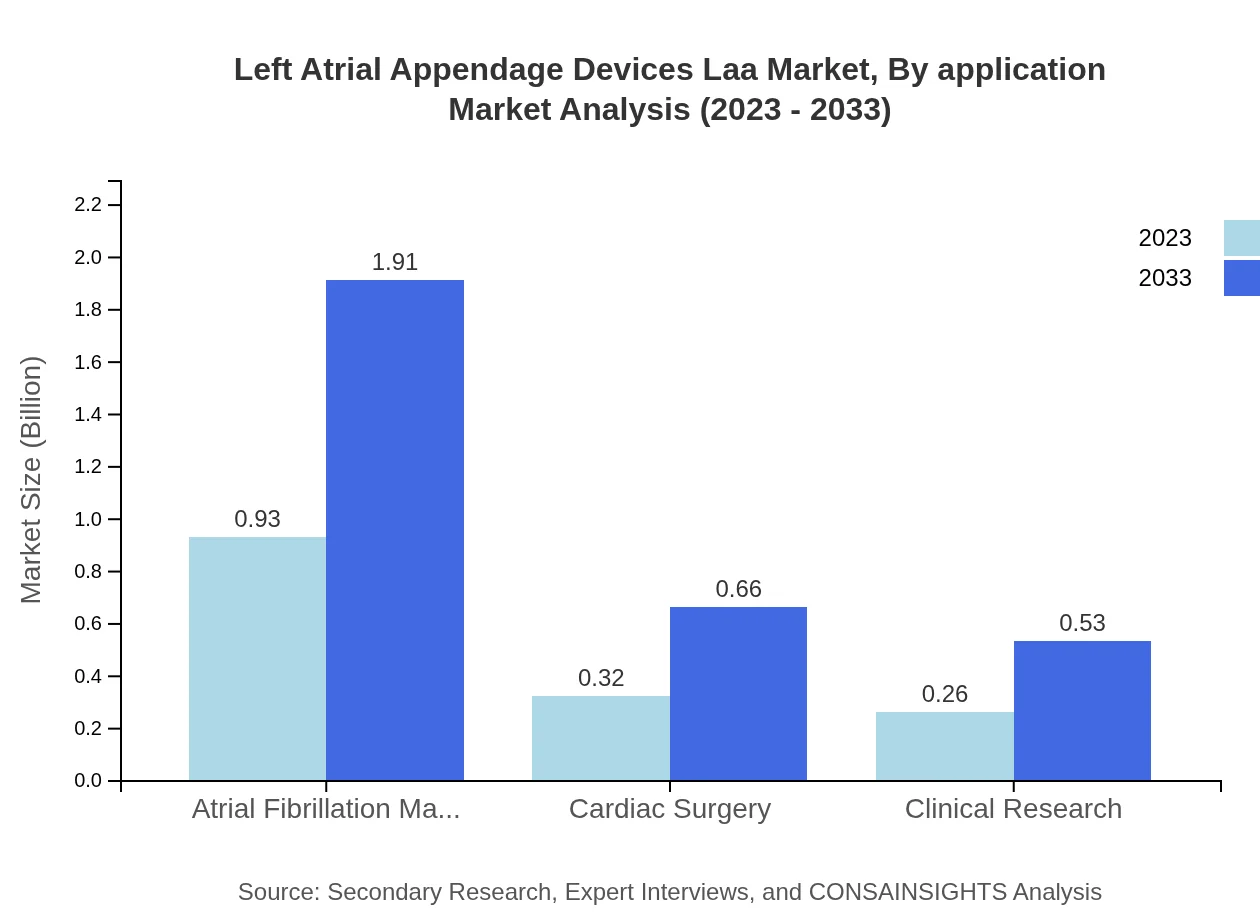

Left Atrial Appendage Devices Laa Market Analysis By Application

The market is segmented based on applications such as atrial fibrillation management, cardiac surgery, and clinical research. Atrial fibrillation management accounts for the largest share at 61.71%, and significant growth is expected as awareness of stroke prevention increases. Cardiac surgery applications also play a crucial role, highlighting the versatility and necessity of LAA devices.

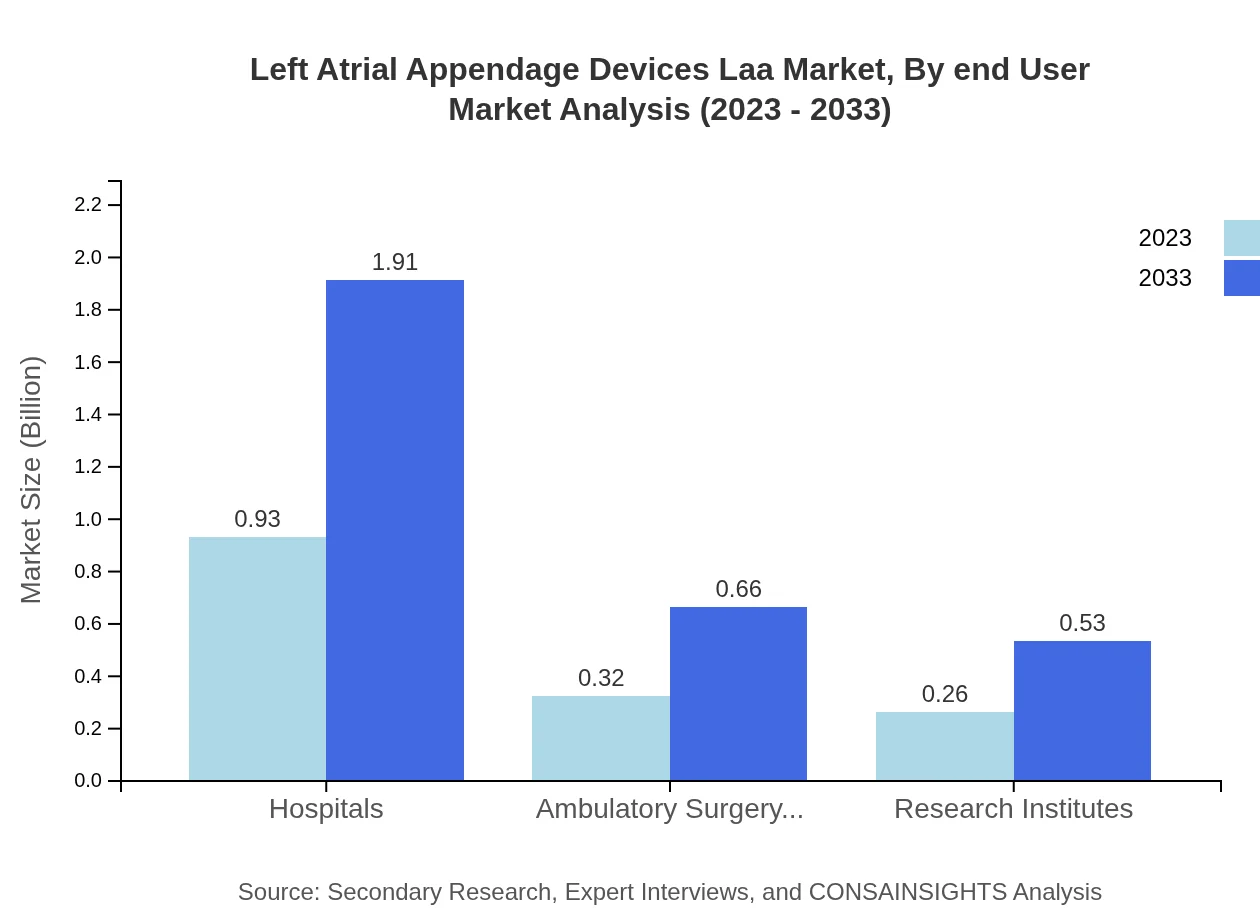

Left Atrial Appendage Devices Laa Market Analysis By End User

In terms of end-users, hospitals lead with a market size of USD 930 million in 2023, rising to USD 1.91 billion by 2033. Ambulatory surgical centers contribute significantly as well, while research institutes are essential for ongoing innovation and clinical trials.

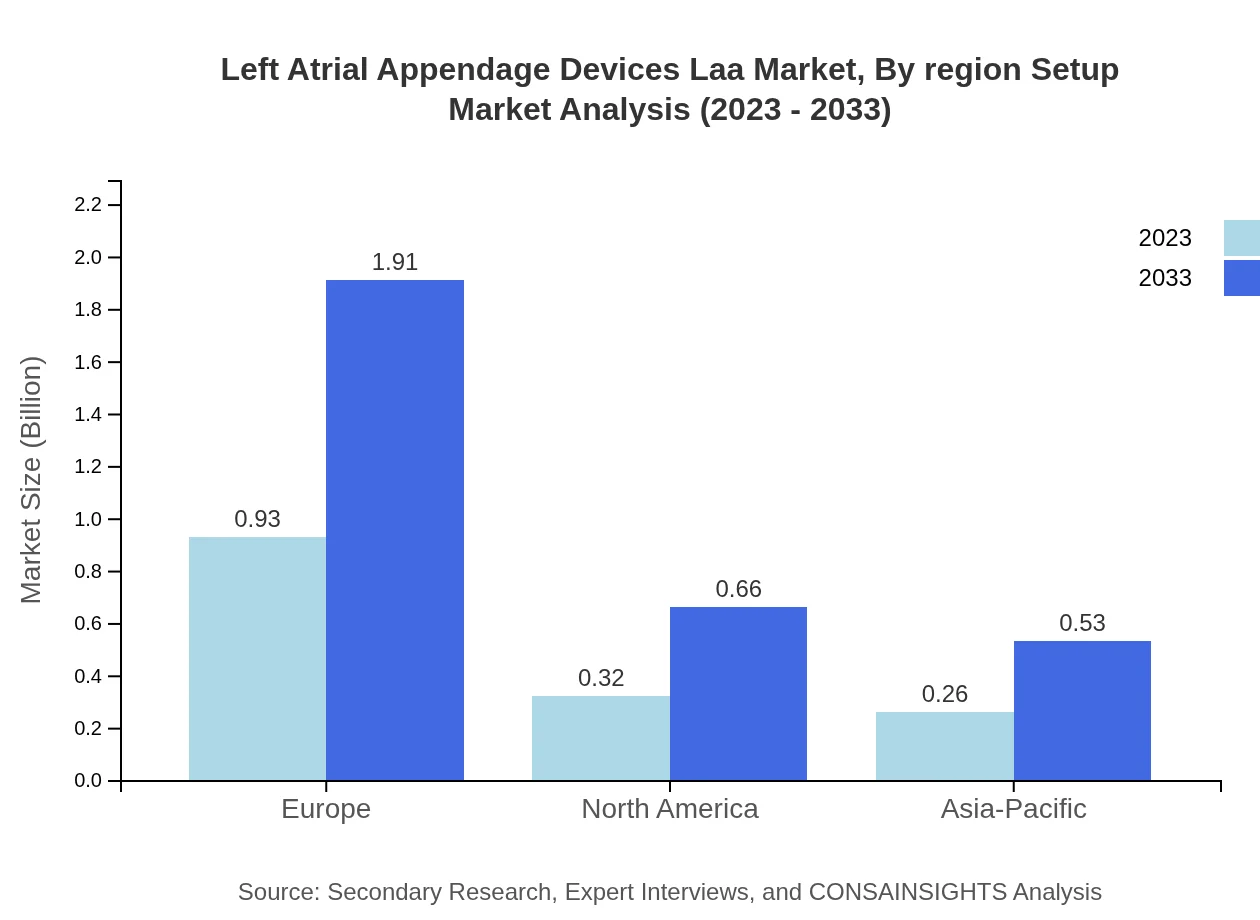

Left Atrial Appendage Devices Laa Market Analysis By Region Setup

Regional setups indicate diverse growth across North America, Europe, Asia-Pacific, and other regions. Preferences and healthcare system differences drive market performance in each area, necessitating tailored approaches for reaching healthcare providers and patients.

Left Atrial Appendage Devices Laa Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Left Atrial Appendage Devices Laa Industry

AtriCure, Inc.:

AtriCure is a leader in LAA management systems, focusing on innovative technologies that significantly enhance patient outcomes and procedural efficiency.Boston Scientific Corporation:

Boston Scientific offers a wide array of LAA devices and is known for its commitment to advancing cardiac care through groundbreaking research and development.Abbott Laboratories:

Abbott is renowned for its comprehensive cardiovascular portfolio, including a range of devices specifically designed for LAA occlusion.Medtronic plc:

Medtronic is a global leader in medical device manufacturing, offering advanced LAA solutions tailored to enhance patient management in atrial fibrillation.Lepu Medical Technology:

Lepu Medical specializes in innovative cardiac devices, including LAA closure systems, catering primarily to the Asia-Pacific market.We're grateful to work with incredible clients.

FAQs

What is the market size of Left Atrial Appendage Devices (LAA)?

The Left Atrial Appendage Devices (LAA) market is currently valued at approximately $1.5 billion, with a projected CAGR of 7.3% from 2023 to 2033. This growth is attributed to increasing incidences of atrial fibrillation and the rising demand for advanced cardiac therapies.

What are the key market players or companies in the Left Atrial Appendage Devices (LAA) industry?

Key players in the Left Atrial Appendage Devices market include Abbott Laboratories, Boston Scientific, Medtronic, AtriCure, and Edwards Lifesciences. These companies are at the forefront of innovation, focusing on device safety and efficacy for atrial fibrillation management.

What are the primary factors driving the growth in the Left Atrial Appendage Devices (LAA) industry?

The growth of the Left Atrial Appendage Devices market is primarily driven by rising atrial fibrillation cases, advancements in minimally invasive surgical techniques, increasing patient awareness, and supportive government initiatives promoting cardiac care and research.

Which region is the fastest Growing in the Left Atrial Appendage Devices (LAA)?

The fastest-growing region in the Left Atrial Appendage Devices market is anticipated to be Europe, with market size increasing from $0.53 billion in 2023 to $1.10 billion by 2033. North America follows closely due to rapid healthcare innovations and increasing procedural volume.

Does Consainsights provide customized market report data for the Left Atrial Appendage Devices (LAA) industry?

Yes, Consainsights offers customized market report data for the Left Atrial Appendage Devices industry. Clients can tailor the reports based on specific needs, focusing on key metrics, regional insights, and competitive analysis for better strategic decision-making.

What deliverables can I expect from this Left Atrial Appendage Devices (LAA) market research project?

Upon completion of the Left Atrial Appendage Devices market research project, clients can expect comprehensive reports, market forecasts, trend analyses, competitive landscapes, and segment data breakdowns to aid in strategic planning and market entry.

What are the market trends of Left Atrial Appendage Devices (LAA)?

Current trends in the Left Atrial Appendage Devices market include increasing adoption of device-assisted therapies, a rise in research for innovative materials, and a focus on improving patient outcomes through advanced technology integration in treatment protocols.