Legal Analytics Market Report

Published Date: 02 February 2026 | Report Code: legal-analytics

Legal Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Legal Analytics market, including insights on market size, segmentation, regional analysis, technology trends, and competitive landscape. Forecasting from 2023 to 2033, it highlights growth opportunities and challenges for stakeholders in the industry.

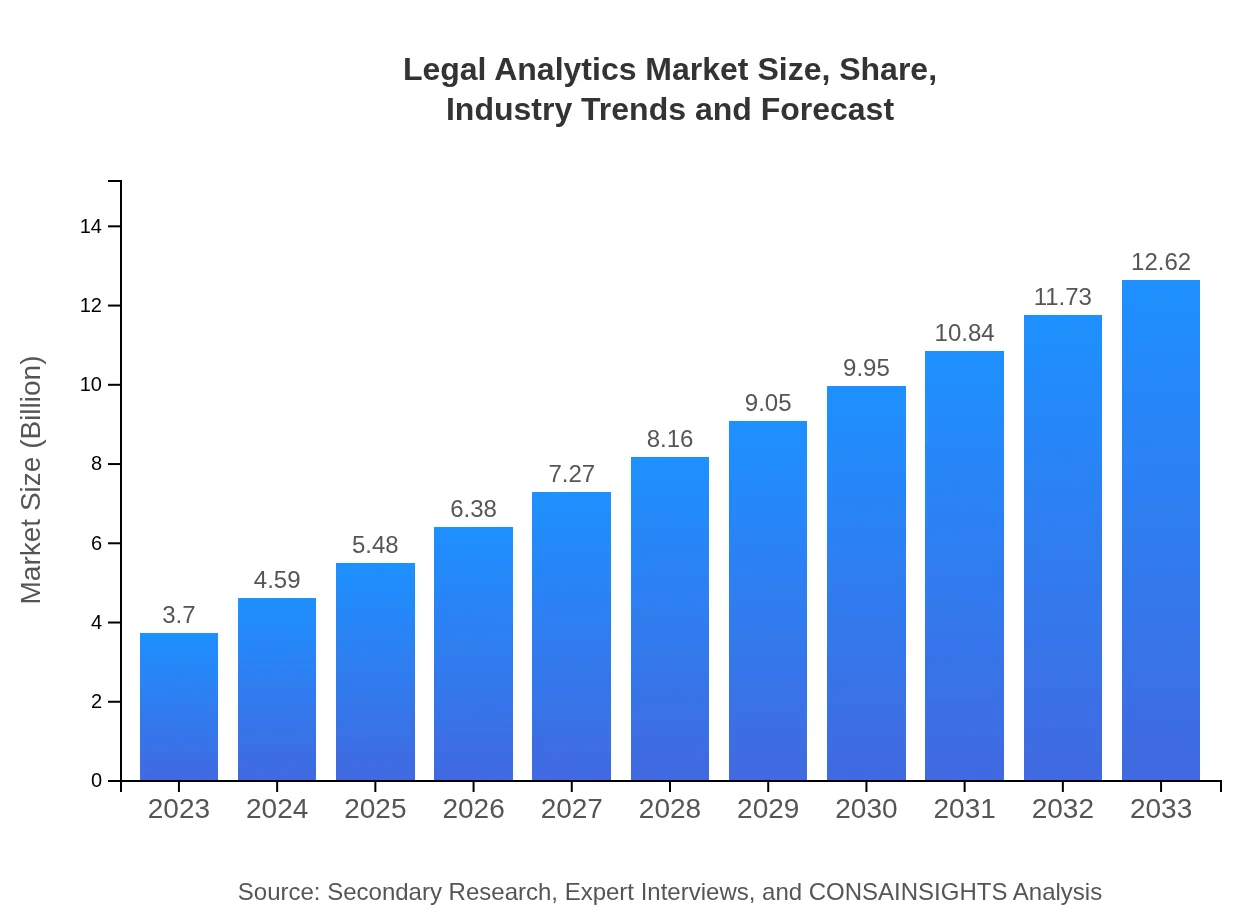

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.70 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $12.62 Billion |

| Top Companies | LexisNexis, Thomson Reuters, Everlaw, Bloomberg Law |

| Last Modified Date | 02 February 2026 |

Legal Analytics Market Overview

Customize Legal Analytics Market Report market research report

- ✔ Get in-depth analysis of Legal Analytics market size, growth, and forecasts.

- ✔ Understand Legal Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Legal Analytics

What is the Market Size & CAGR of Legal Analytics market in 2023?

Legal Analytics Industry Analysis

Legal Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Legal Analytics Market Analysis Report by Region

Europe Legal Analytics Market Report:

In Europe, the market is expected to rise from $1.16 billion in 2023 to $3.95 billion by 2033, fueled by stringent regulations and the increasing need for transparency in legal processes.Asia Pacific Legal Analytics Market Report:

In the Asia Pacific region, the Legal Analytics market is projected to grow from $0.70 billion in 2023 to $2.39 billion by 2033, driven by increasing investments in legal technology and a growing awareness of data-driven decision-making.North America Legal Analytics Market Report:

North America remains the leading region in terms of Legal Analytics market size, with an estimated growth from $1.29 billion in 2023 to $4.40 billion by 2033, attributed to established legal infrastructure and high tech adoption rates.South America Legal Analytics Market Report:

The South American market is anticipated to expand from $0.32 billion in 2023 to $1.09 billion by 2033, as regional law firms adopt analytics solutions to improve operational efficiency with a growing emphasis on compliance and risk management.Middle East & Africa Legal Analytics Market Report:

The Middle East and Africa market is projected to grow from $0.23 billion in 2023 to $0.80 billion by 2033, as local firms begin adopting technology solutions to enhance service delivery and client engagement.Tell us your focus area and get a customized research report.

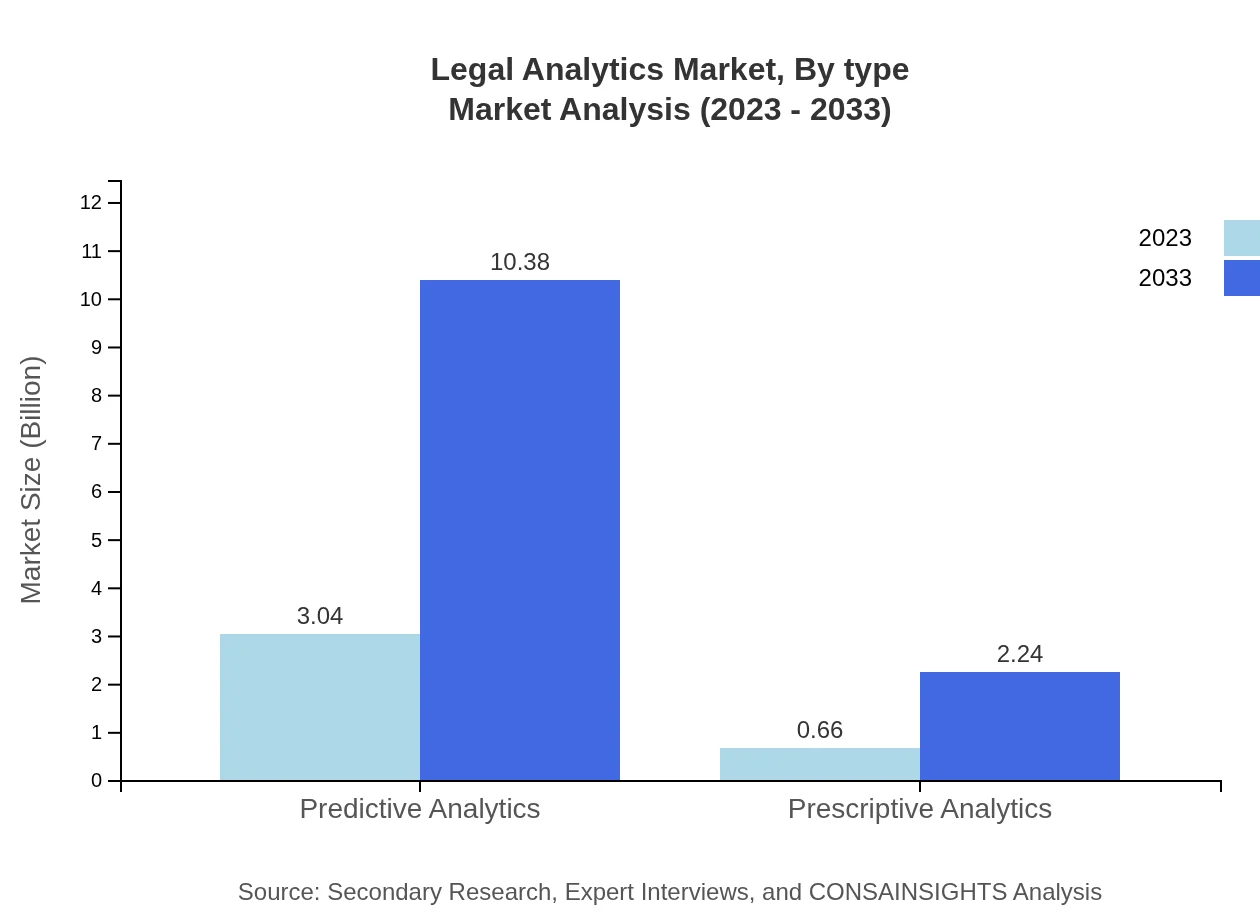

Legal Analytics Market Analysis By Type

The Predictive Analytics segment leads the Legal Analytics market, growing from $3.04 billion in 2023 to $10.38 billion in 2033, capturing 82.26% of the overall market share. Prescriptive Analytics follows, increasing from $0.66 billion to $2.24 billion, representing 17.74% of the share. This underscores the significant future potential of predictive capabilities in legal decision-making.

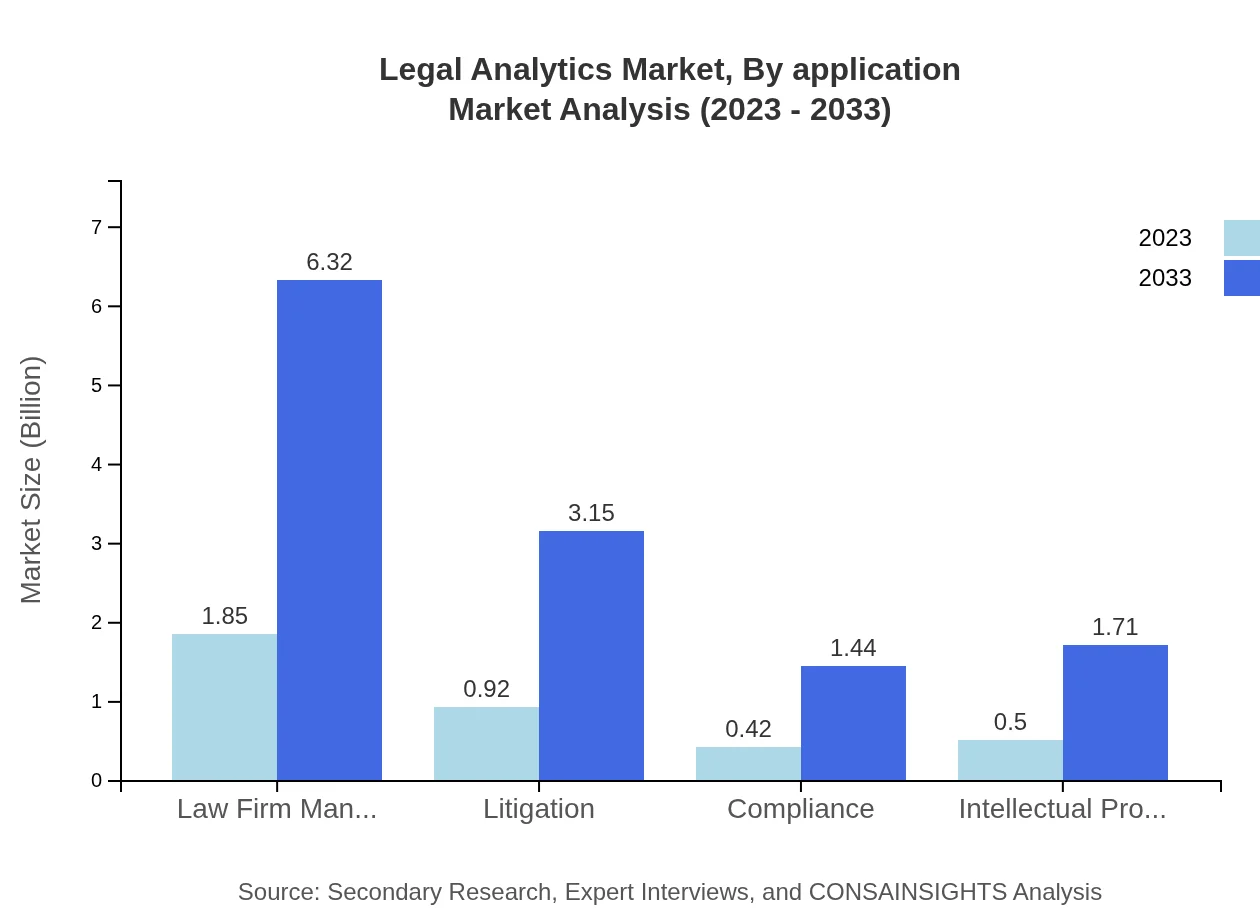

Legal Analytics Market Analysis By Application

Applications such as Law Firm Management and Litigation are paramount, with Law Firm Management expected to maintain a substantial share of 50.07%, reflecting its critical role in streamlining operations, while Compliance and Intellectual Property applications grow steadily, emphasizing the diverse applicability of analytics.

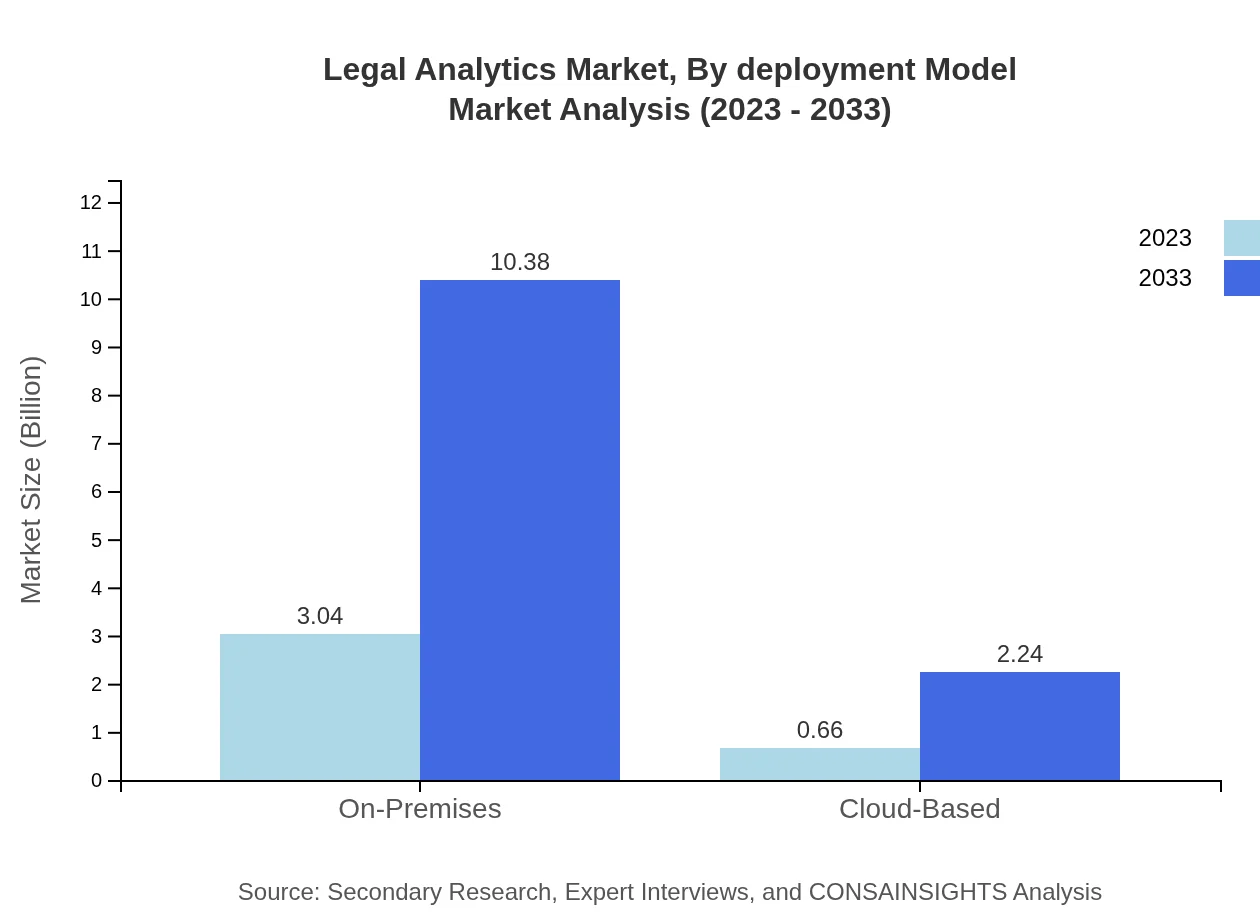

Legal Analytics Market Analysis By Deployment Model

The market is predominantly driven by On-Premises solutions, valued at $3.04 billion in 2023 and growing to $10.38 billion by 2033, comprising 82.26% of the overall market. Cloud-based solutions are also gaining traction, with expectations to rise from $0.66 billion to $2.24 billion, indicating a shift towards flexible, accessible solutions in the legal arena.

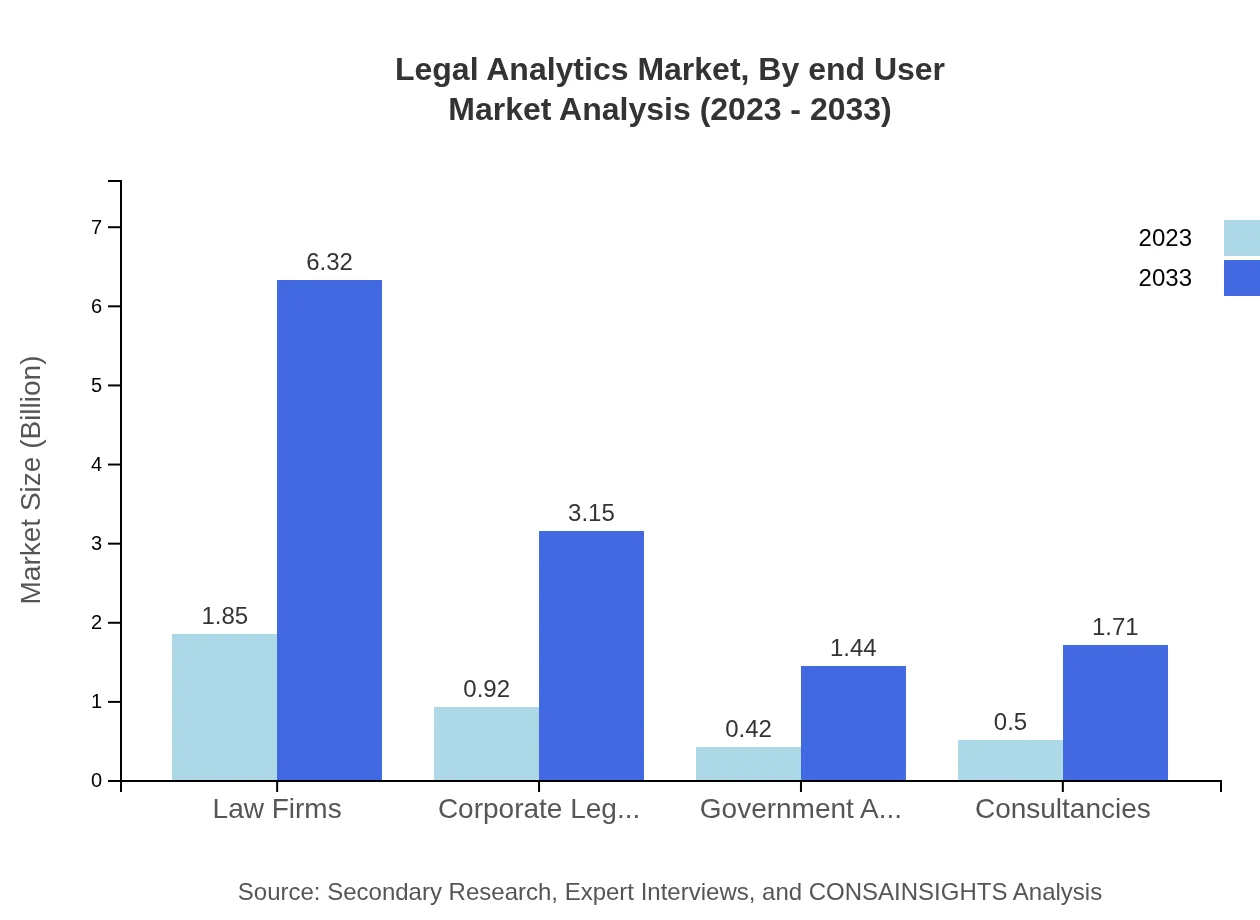

Legal Analytics Market Analysis By End User

Law Firms stand as the largest end-user in the Legal Analytics market, expanding from $1.85 billion in 2023 to $6.32 billion in 2033. Corporate Legal Departments and Government Agencies also represent significant segments, highlighting the relevance of analytics across various legal contexts.

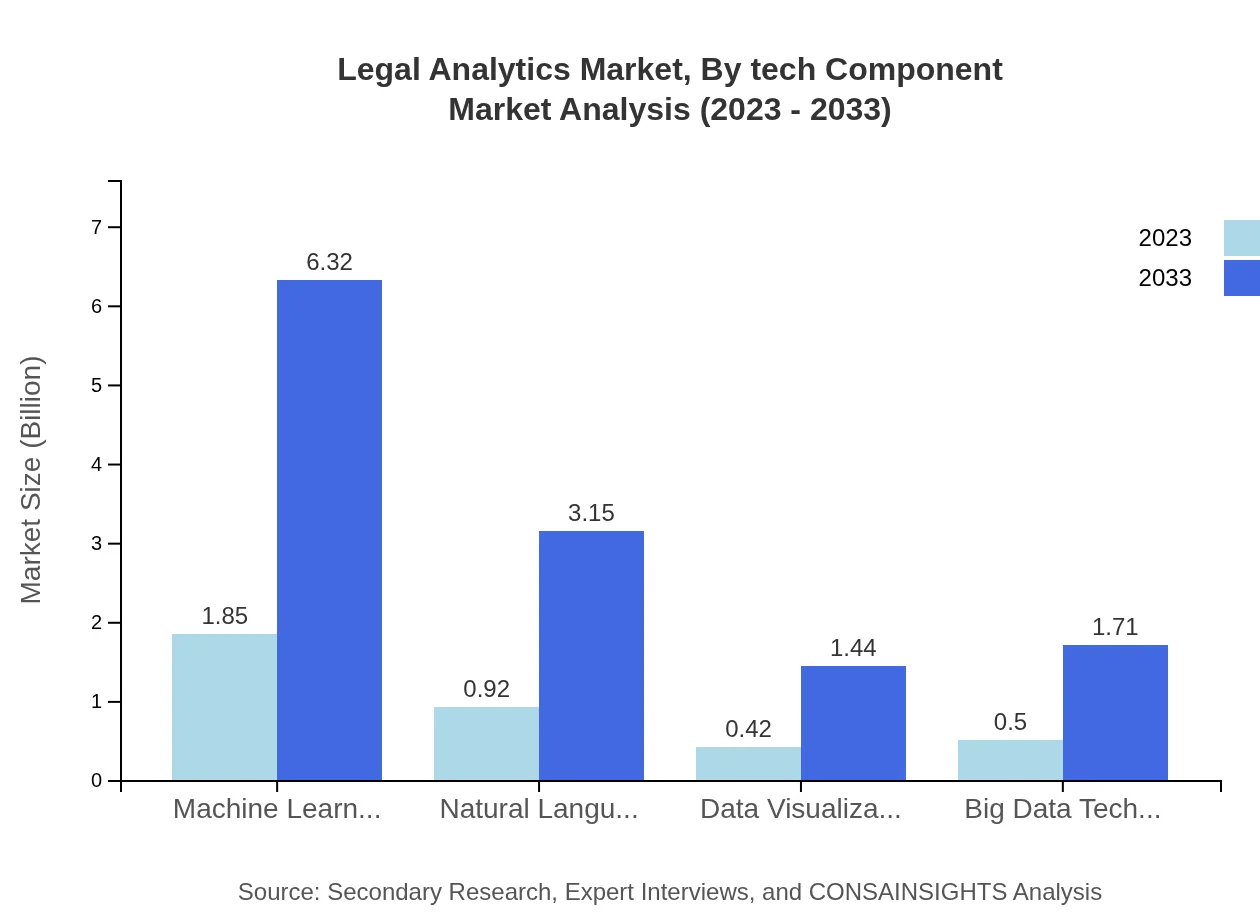

Legal Analytics Market Analysis By Tech Component

Key technological components such as Machine Learning and Natural Language Processing hold crucial positions in the market. Machine Learning is projected to grow significantly, reflecting its role in facilitating predictive analytics, while Data Visualization is expected to see steady growth, enhancing user interface and decision-making.

Legal Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Legal Analytics Industry

LexisNexis:

A leader in legal technology, LexisNexis provides comprehensive legal research and analytics solutions to law firms and corporate legal departments.Thomson Reuters:

Known for its innovative solutions in legal research and data analytics, Thomson Reuters enables law firms to leverage data for strategic decision-making.Everlaw:

Everlaw focuses on litigation support and offers powerful analytics tools that help law firms manage cases more effectively.Bloomberg Law:

Bloomberg Law merges legal research with data analytics, providing insights and compliance tools tailored for legal practitioners.We're grateful to work with incredible clients.

FAQs

What is the market size of legal Analytics?

The global legal analytics market is projected to grow from approximately $3.7 billion in 2023 to an estimated figure in 2033, with a CAGR of 12.5%. This growth indicates increasing demand for data-driven legal insights.

What are the key market players or companies in this legal Analytics industry?

Key players in the legal analytics industry include major firms providing analytics solutions tailored for law firms, corporate legal departments, and government agencies. They leverage data for predictive analytics, improving legal outcomes and operational efficiencies.

What are the primary factors driving the growth in the legal Analytics industry?

Growth in the legal analytics industry is driven by the increasing need for data-driven decision-making, advancements in AI and machine learning, and the rising complexity of legal cases. Firms seek analytics to enhance efficiency and improve client service.

Which region is the fastest Growing in the legal Analytics?

Asia Pacific is the fastest-growing region in the legal-analytics market, expected to expand from $0.70 billion in 2023 to $2.39 billion by 2033. This growth is fueled by digital transformation and increased legal service demand in emerging markets.

Does ConsaInsights provide customized market report data for the legal Analytics industry?

Yes, ConsaInsights offers customized market report data for the legal-analytics industry. Clients can obtain tailored insights based on specific requirements, including market size, trends, and competitive landscape, ensuring relevance to their strategic goals.

What deliverables can I expect from this legal Analytics market research project?

Clients can expect comprehensive deliverables such as detailed market reports, trend analyses, competitive benchmarking, customized data sets, and strategic recommendations tailored to aid in decision-making within the legal-analytics sector.

What are the market trends of legal Analytics?

Key trends in legal-analytics include the rise of predictive and prescriptive analytics, growth of cloud-based solutions, and the integration of AI technologies. Increasing reliance on data visualization tools is also shaping the market landscape.