Lidar Sensor Automotive Market Report

Published Date: 31 January 2026 | Report Code: lidar-sensor-automotive

Lidar Sensor Automotive Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Lidar Sensor Automotive market, covering market trends, segmentation, and regional insights, along with a forecast extending from 2023 to 2033. It highlights industry dynamics and key player contributions within the sector.

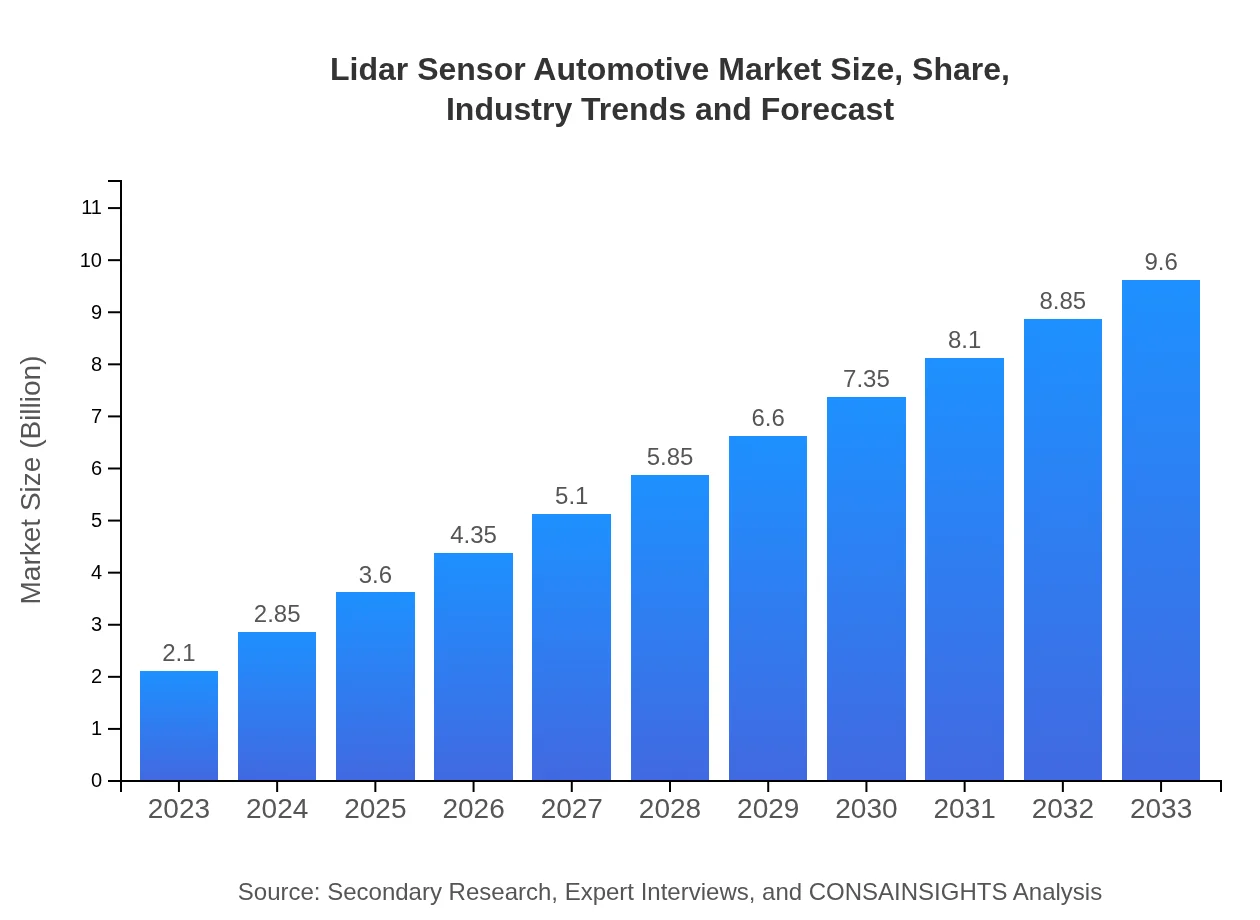

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 15.6% |

| 2033 Market Size | $9.60 Billion |

| Top Companies | Velodyne LiDAR Inc., Luminar Technologies, Inc., Waymo, Aeva, Inc., Innoviz Technologies |

| Last Modified Date | 31 January 2026 |

Lidar Sensor Automotive Market Overview

Customize Lidar Sensor Automotive Market Report market research report

- ✔ Get in-depth analysis of Lidar Sensor Automotive market size, growth, and forecasts.

- ✔ Understand Lidar Sensor Automotive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lidar Sensor Automotive

What is the Market Size & CAGR of Lidar Sensor Automotive market in 2023?

Lidar Sensor Automotive Industry Analysis

Lidar Sensor Automotive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lidar Sensor Automotive Market Analysis Report by Region

Europe Lidar Sensor Automotive Market Report:

In Europe, the Lidar Sensor Automotive market is expected to expand from $0.51 billion in 2023 to $2.33 billion by 2033. The region’s strong emphasis on environmental sustainability and stringent vehicle safety standards significantly catalyze the demand for advanced sensor technologies.Asia Pacific Lidar Sensor Automotive Market Report:

In the Asia Pacific region, the Lidar Sensor Automotive market is poised to grow from $0.41 billion in 2023 to $1.85 billion by 2033. The growth is driven by rising electric vehicle adoption, robust automotive production, and increased investments from manufacturers focused on automated solutions in countries such as China and Japan.North America Lidar Sensor Automotive Market Report:

North America is projected to see a robust increase from $0.81 billion in 2023 to $3.68 billion in 2033. The region is a leader in automotive innovation, with major automotive companies investing heavily in LiDAR technologies to enhance safety systems and advancements in autonomous driving.South America Lidar Sensor Automotive Market Report:

The South American market is expected to grow from $0.17 billion in 2023 to $0.79 billion by 2033. Limited but growing interest in advanced automotive technology, coupled with rising automotive safety regulations, is likely to contribute to market growth.Middle East & Africa Lidar Sensor Automotive Market Report:

The Middle East and Africa market is projected to grow from $0.21 billion in 2023 to $0.94 billion by 2033. Increasing government initiatives towards smart transportation and developing infrastructure for road safety are pivotal for the growth of the Lidar Sensor Automotive market in this region.Tell us your focus area and get a customized research report.

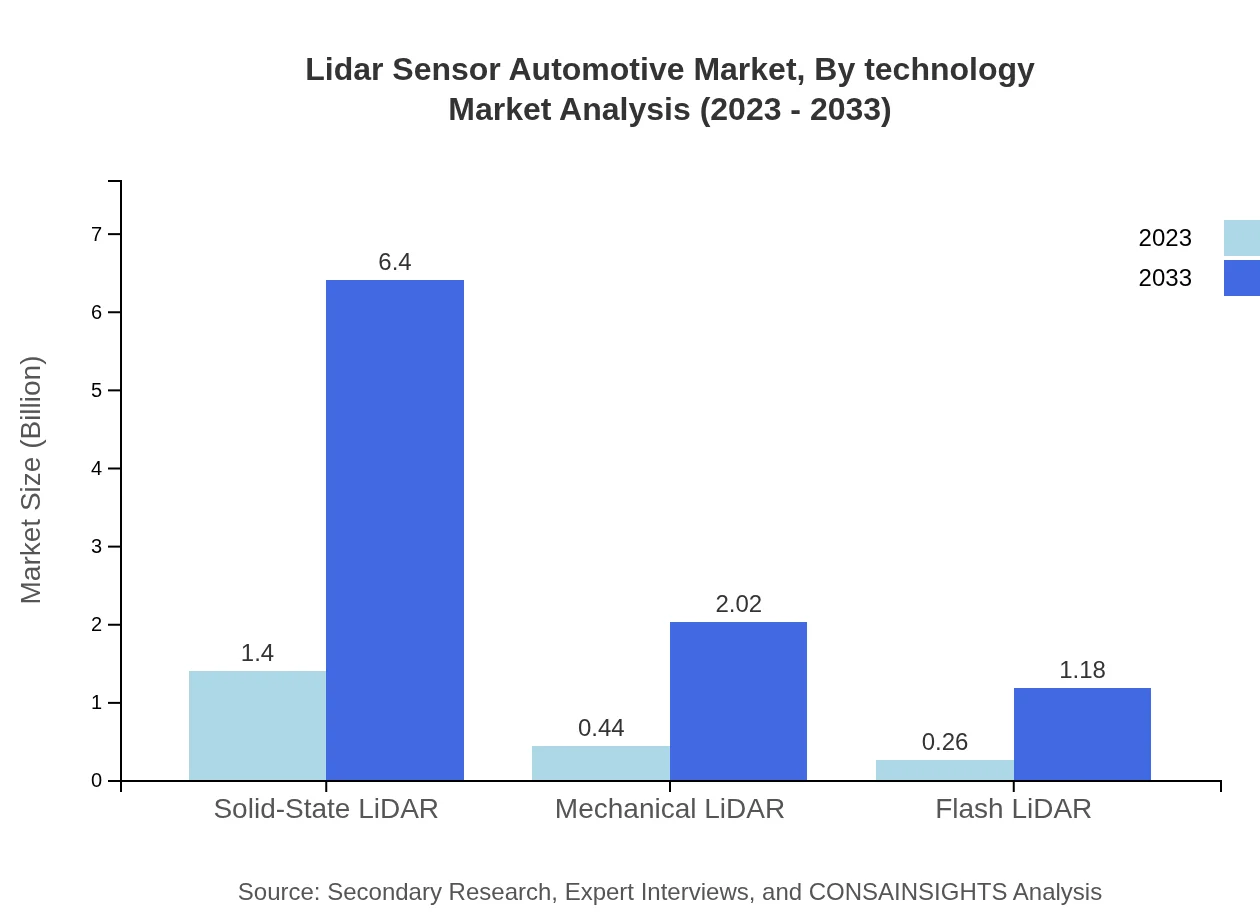

Lidar Sensor Automotive Market Analysis By Technology

The LiDAR Sensor Automotive market is segmented by technology into Solid-State LiDAR, Mechanical LiDAR, and Flash LiDAR. Solid-State LiDAR is expected to capture the largest market share due to its high reliability and operational efficiency. Mechanical LiDAR, while facing competition, serves core applications in terrain mapping and low-cost solutions. Flash LiDAR, although smaller in market share, is making strides due to its deployment in critical real-time processing applications.

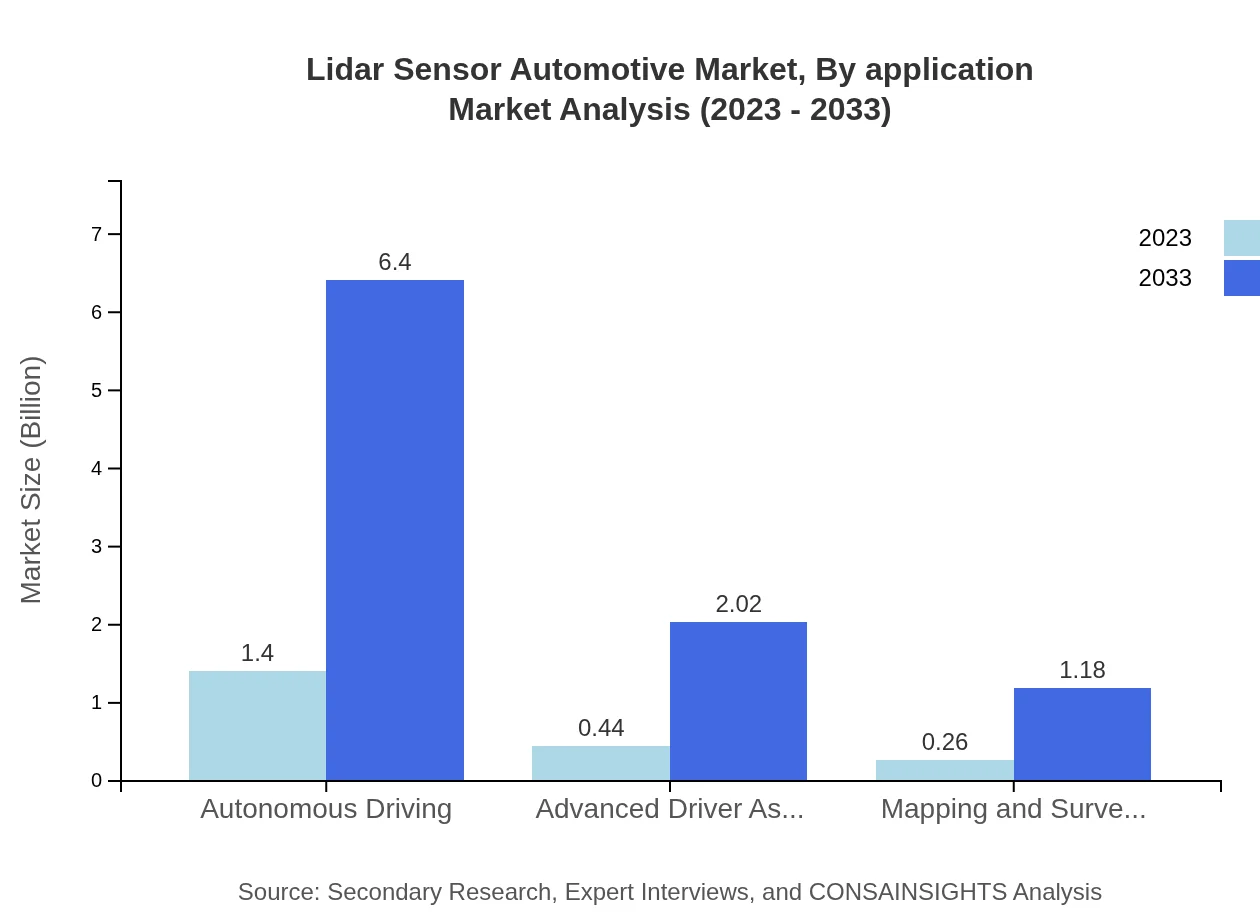

Lidar Sensor Automotive Market Analysis By Application

Applications of Lidar technology in automotive include Autonomous Driving, Advanced Driver Assistance Systems (ADAS), and Mapping and Surveying. Autonomous Driving holds the largest share, driven by increasing manufacturer focus on developing fully autonomous vehicles. ADAS is also gaining traction, emphasizing comfort and safety in vehicles. Mapping and Surveying applications serve significant roles in commercial and industrial sectors.

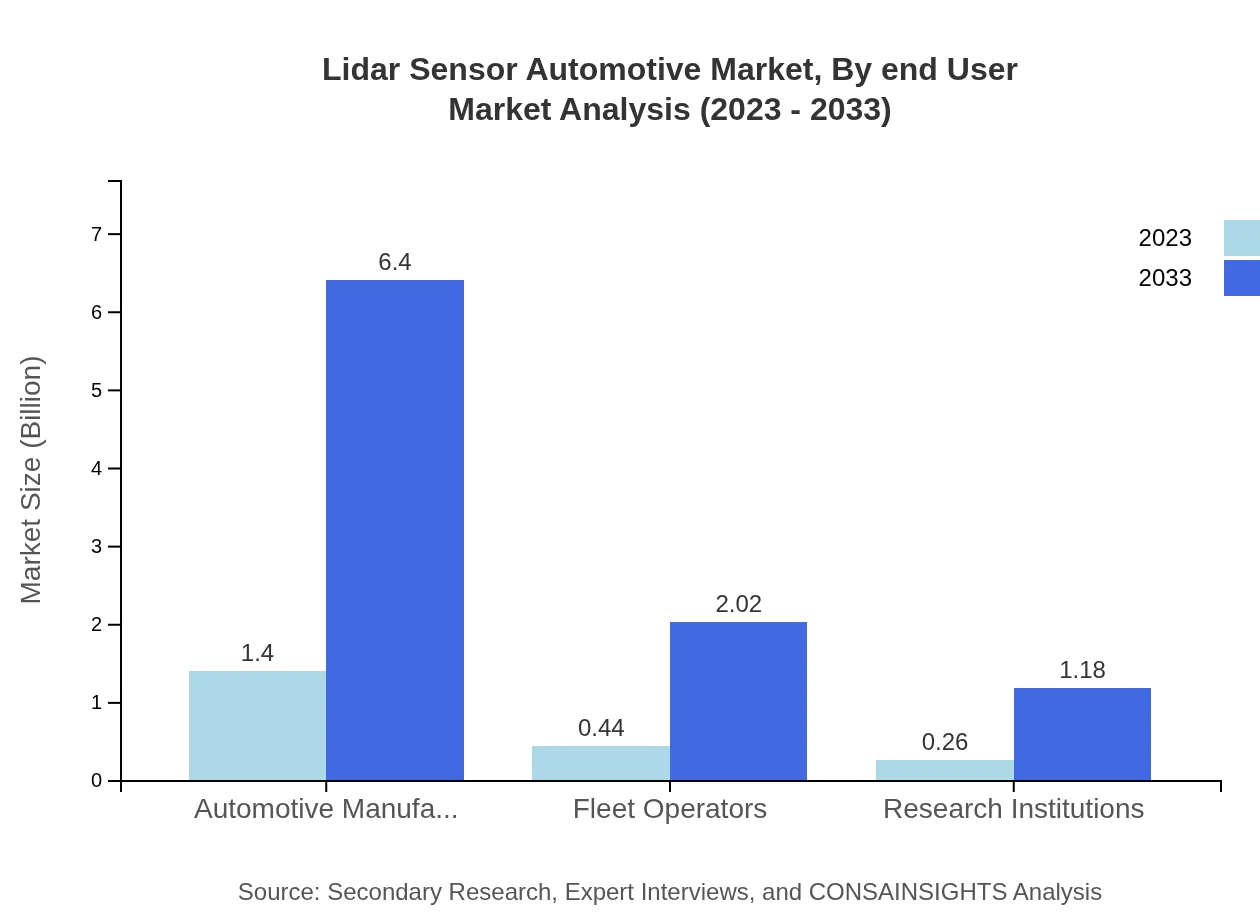

Lidar Sensor Automotive Market Analysis By End User

End-users of LiDAR sensors in the automotive sector include Automotive Manufacturers, Fleet Operators, and Research Institutions. Automotive Manufacturers dominate the market, focusing on integrating Lidar technology for safer vehicles. Fleet Operators leverage this technology for improved logistics and operational efficiency, while Research Institutions push the boundaries of Lidar applications towards future mobility solutions.

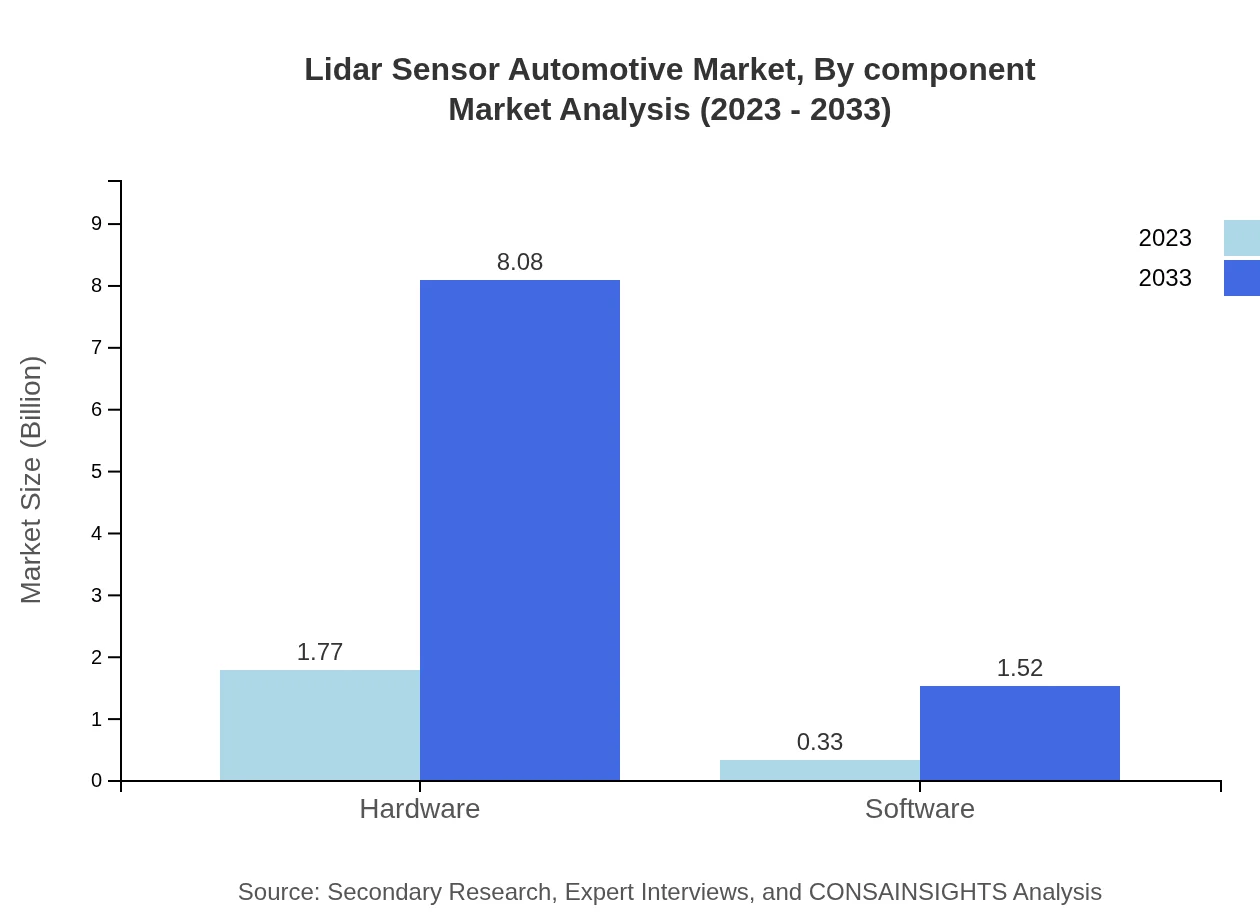

Lidar Sensor Automotive Market Analysis By Component

Key components include Hardware and Software. Hardware significantly contributes with a market share of 84.19%, while Software plays a supporting role. The expansion of software solutions aligns with the increasing capability of hardware to process complex data for real-time automotive applications.

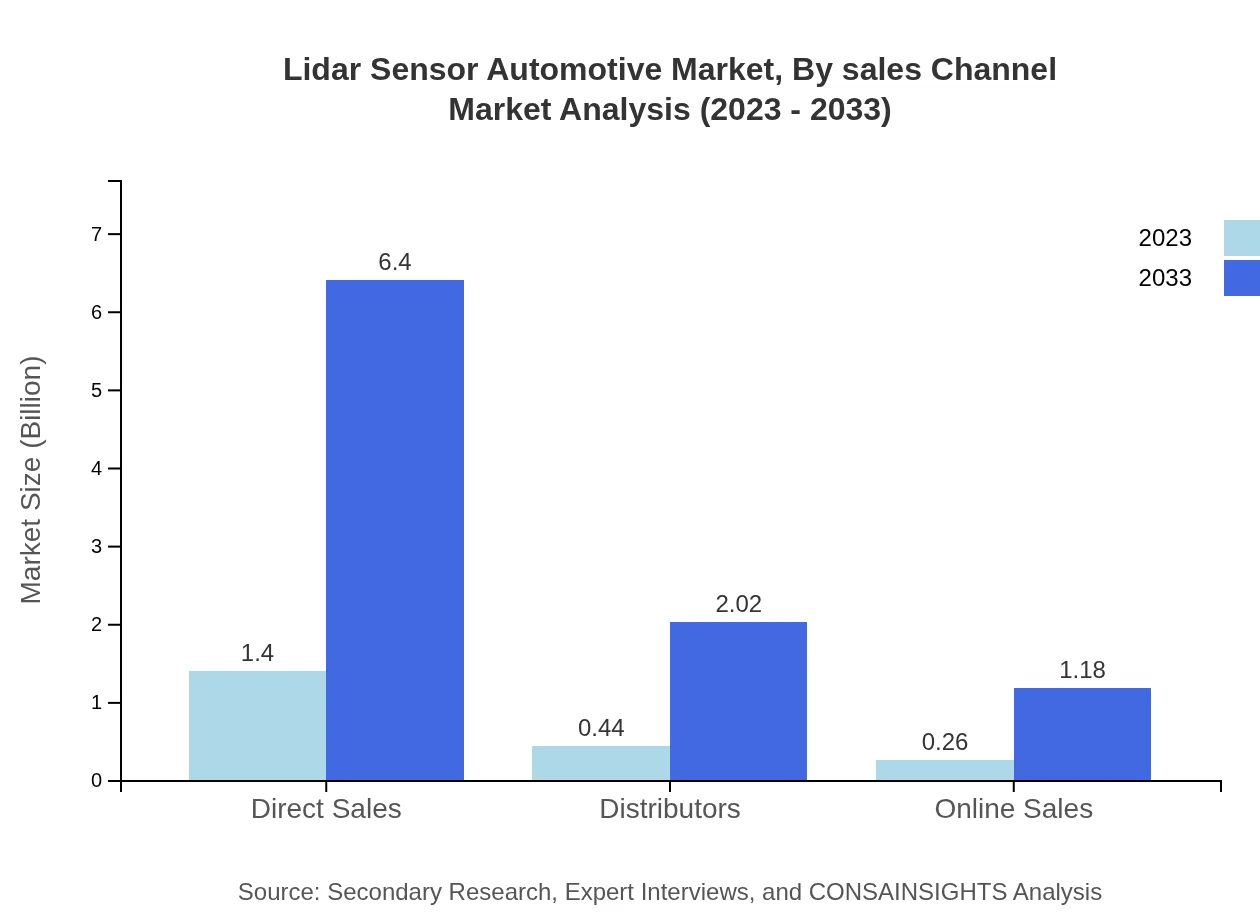

Lidar Sensor Automotive Market Analysis By Sales Channel

Sales channels include Direct Sales, Distributors, and Online Sales. Direct Sales lead the market with a share of 66.68%, as manufacturers prefer direct contact with high-volume automotive customers. Distributors and Online Sales channels are also important, catering to niche markets and supplementary products.

Lidar Sensor Automotive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lidar Sensor Automotive Industry

Velodyne LiDAR Inc.:

A pioneer in LiDAR technology, offering a broad range of sensors for automotive and autonomous applications.Luminar Technologies, Inc.:

Known for its innovative LiDAR solutions, focusing on enhancing safety in autonomous driving through high-resolution imaging.Waymo:

As a subsidiary of Alphabet Inc., Waymo is a leader in self-driving technology, leveraging proprietary LiDAR systems extensively in its fleet.Aeva, Inc.:

Aeva provides advanced sensing technology aimed at enabling autonomous vehicles with enhanced perception and safety.Innoviz Technologies:

Specializes in LiDAR sensors and perception software, aiming to facilitate safer autonomous driving.We're grateful to work with incredible clients.

FAQs

What is the market size of lidar Sensor Automotive?

The global Lidar Sensor Automotive market is valued at approximately 2.1 billion in 2023, with an expected compound annual growth rate (CAGR) of 15.6%, projected to grow significantly over the next decade.

What are the key market players or companies in this lidar Sensor Automotive industry?

Key market players include companies specializing in lidar technology, automotive manufacturers integrating lidar in vehicles, and tech firms focused on autonomous driving solutions.

What are the primary factors driving the growth in the lidar Sensor Automotive industry?

Major growth drivers include increasing adoption of autonomous vehicles, advancements in lidar technology, and rising demand for safety features in vehicles.

Which region is the fastest Growing in the lidar Sensor Automotive?

The fastest-growing region is projected to be North America, increasing from $0.81 billion in 2023 to $3.68 billion by 2033, fueled by high investment in automotive technology.

Does ConsaInsights provide customized market report data for the lidar Sensor Automotive industry?

Yes, ConsaInsights offers customized market report options tailored to specific needs within the lidar sensor automotive industry to provide actionable insights.

What deliverables can I expect from this lidar Sensor Automotive market research project?

Deliverables typically include comprehensive market analysis reports, segment data insights, regional forecasts, and competitive landscape assessments.

What are the market trends of lidar Sensor Automotive?

Key trends include the rise of solid-state lidar technology, increasing market share for autonomous driving applications, and the integration of lidar in advanced driver assistance systems.