Life And Non Life Insurance Market Report

Published Date: 24 January 2026 | Report Code: life-and-non-life-insurance

Life And Non Life Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Life and Non-Life Insurance market from 2023 to 2033. It covers market size, trends, regional insights, segment performance, and forecasts to help stakeholders understand future prospects in the industry.

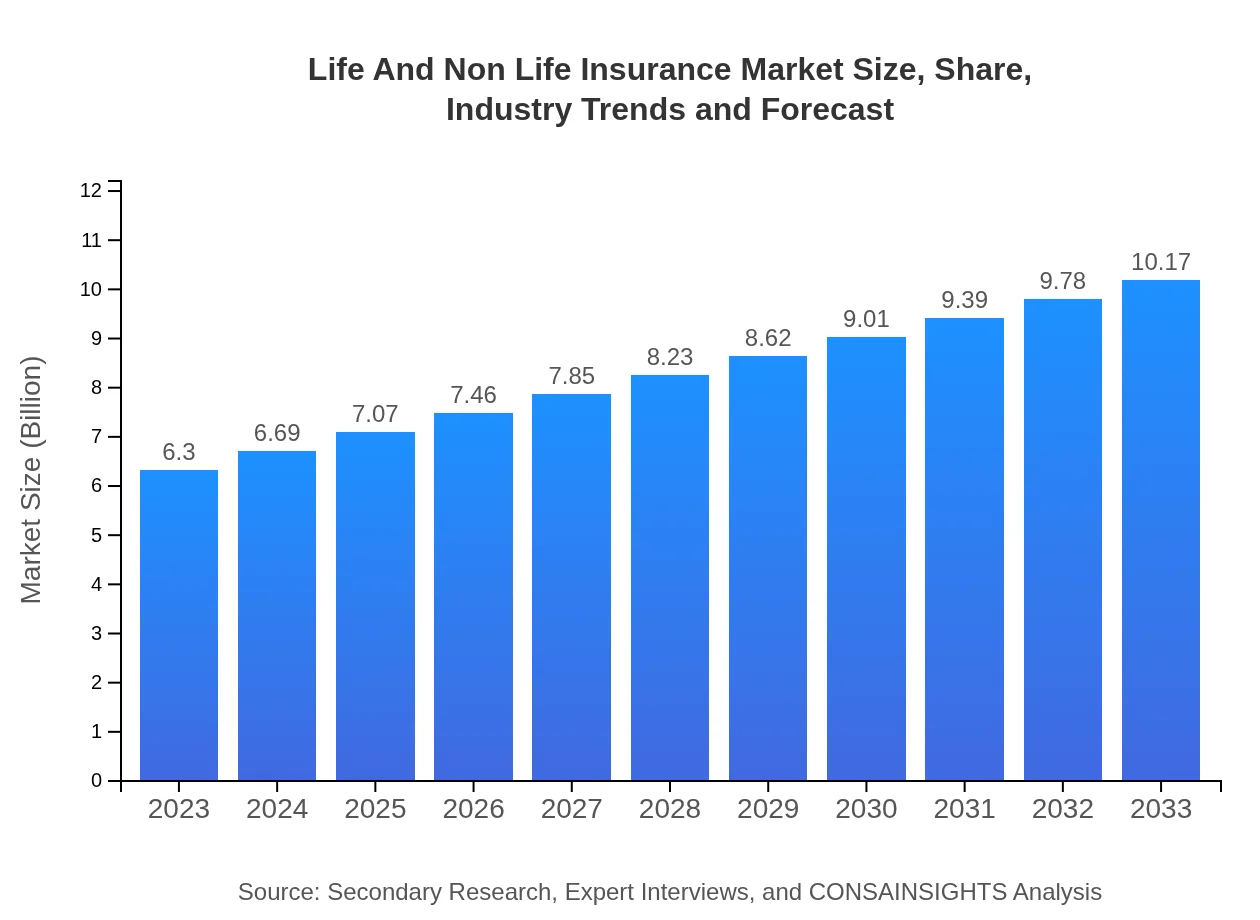

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.30 Trillion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $10.17 Trillion |

| Top Companies | AIG, MetLife, Prudential Financial, Allianz, Berkshire Hathaway |

| Last Modified Date | 24 January 2026 |

Life And Non Life Insurance Market Overview

Customize Life And Non Life Insurance Market Report market research report

- ✔ Get in-depth analysis of Life And Non Life Insurance market size, growth, and forecasts.

- ✔ Understand Life And Non Life Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Life And Non Life Insurance

What is the Market Size & CAGR of Life And Non Life Insurance market in 2023?

Life And Non Life Insurance Industry Analysis

Life And Non Life Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Life And Non Life Insurance Market Analysis Report by Region

Europe Life And Non Life Insurance Market Report:

The European market, valued at $1.80 trillion in 2023, is anticipated to reach $2.90 trillion by 2033. The transition to digital services and strong consumer protection regulations are key trends influencing this market.Asia Pacific Life And Non Life Insurance Market Report:

The Asia Pacific insurance market is projected to grow from $1.22 trillion in 2023 to $1.97 trillion by 2033. Factors such as increasing urbanization, a growing middle class, and regulatory reforms are driving this growth, making it a pivotal market in the global landscape.North America Life And Non Life Insurance Market Report:

North America remains the largest insurance market, with a size of $2.33 trillion expected to grow to $3.75 trillion by 2033. This strong growth is supported by robust economies, advanced regulatory environments, and high demand for comprehensive insurance solutions.South America Life And Non Life Insurance Market Report:

In South America, the market is expected to expand from $0.08 trillion in 2023 to around $0.13 trillion by 2033. Economic stability and improving regulatory frameworks are encouraging investments in insurance, although challenges such as low penetration rates persist.Middle East & Africa Life And Non Life Insurance Market Report:

The Middle East and Africa insurance market is projected to grow from $0.87 trillion in 2023 to $1.41 trillion by 2033. There is significant untapped potential in this region, despite existing economic challenges.Tell us your focus area and get a customized research report.

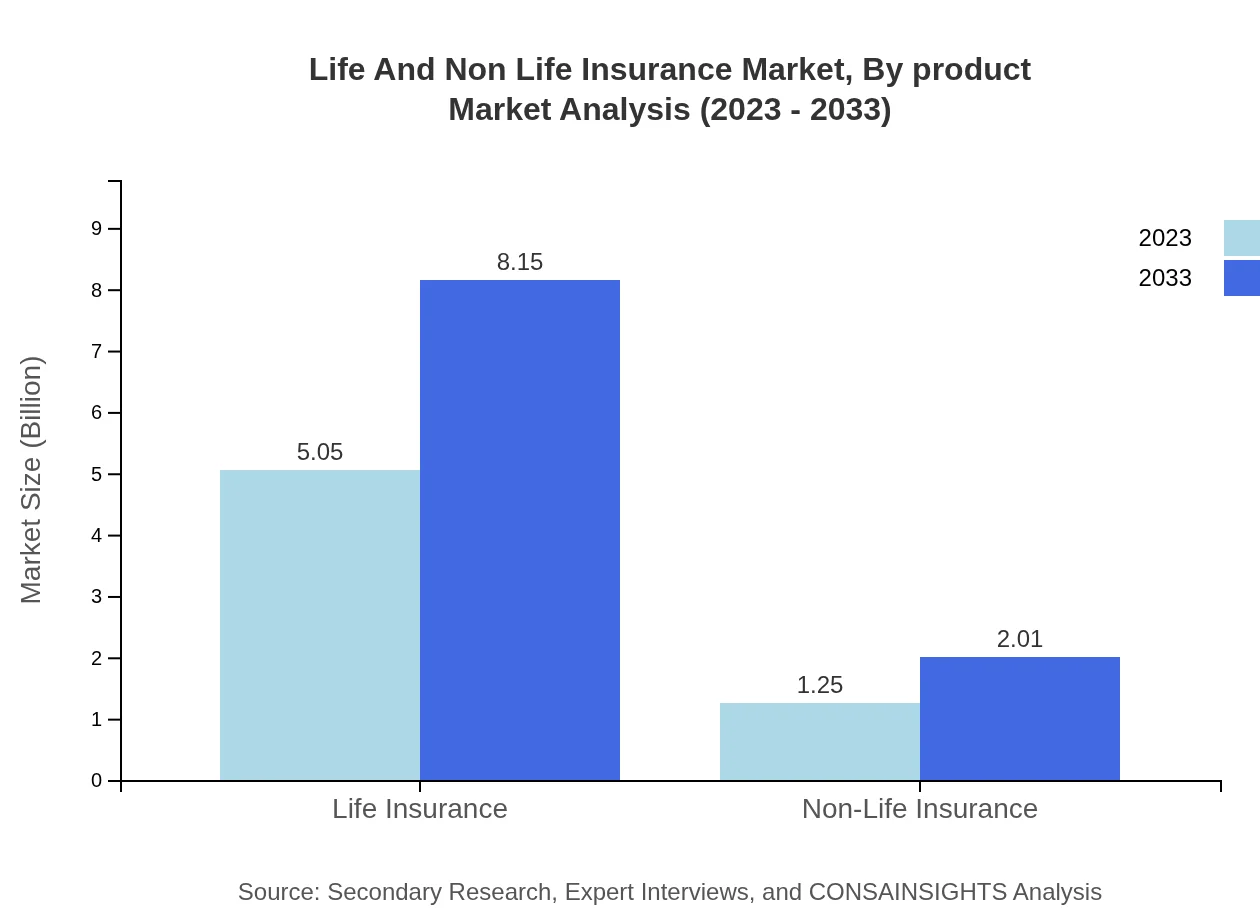

Life And Non Life Insurance Market Analysis By Product

Life Insurance is significantly larger at $5.05 trillion in 2023, forecasted to expand to $8.15 trillion by 2033, accounting for about 80.18% of the market share. Non-Life Insurance is projected to increase from $1.25 trillion in 2023 to $2.01 trillion in 2033, retaining 19.82% of the market share.

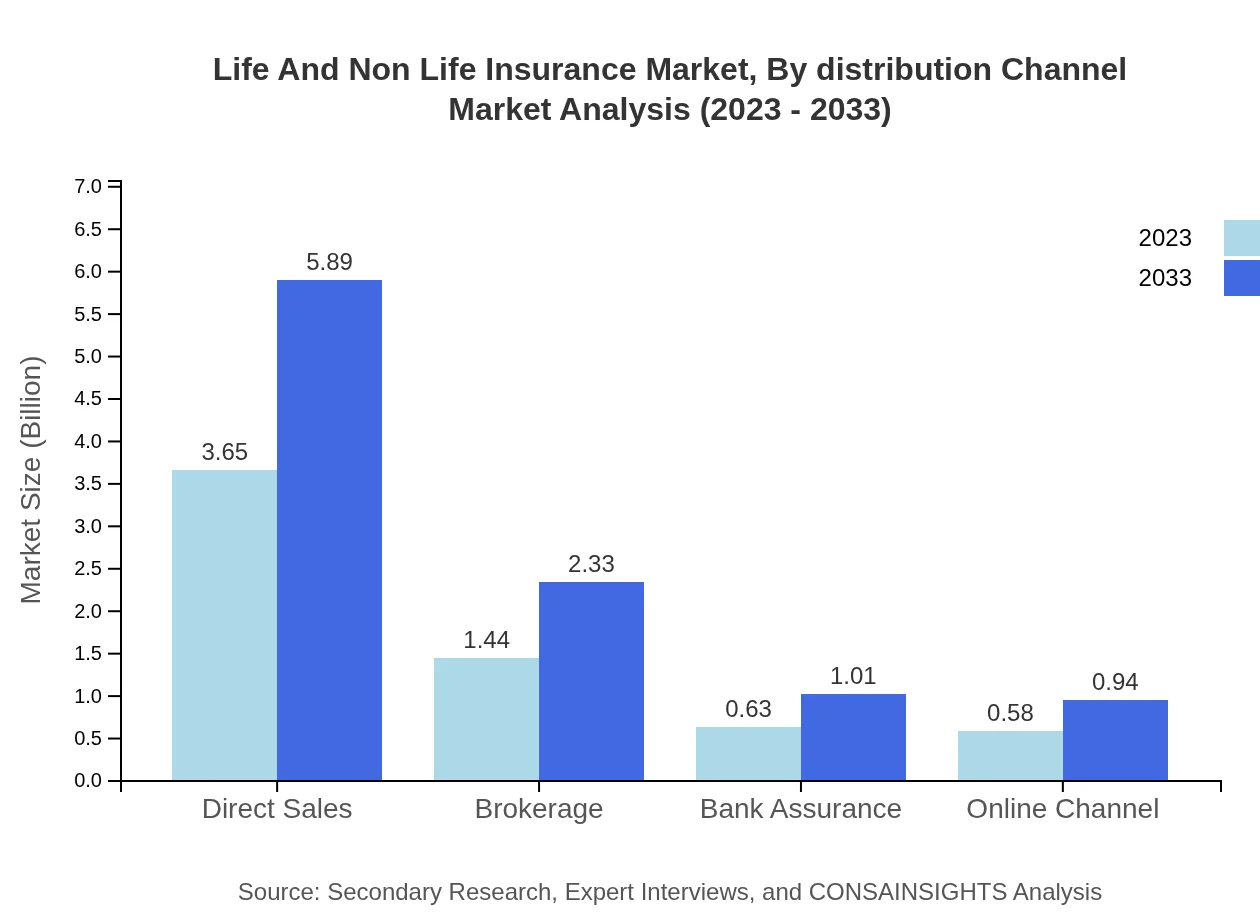

Life And Non Life Insurance Market Analysis By Distribution Channel

Direct sales channels dominate the market at $3.65 trillion in 2023, projected to grow to $5.89 trillion by 2033 (57.91% share). Additionally, brokerages and bank assurance channels continue to be essential for expanding market reach.

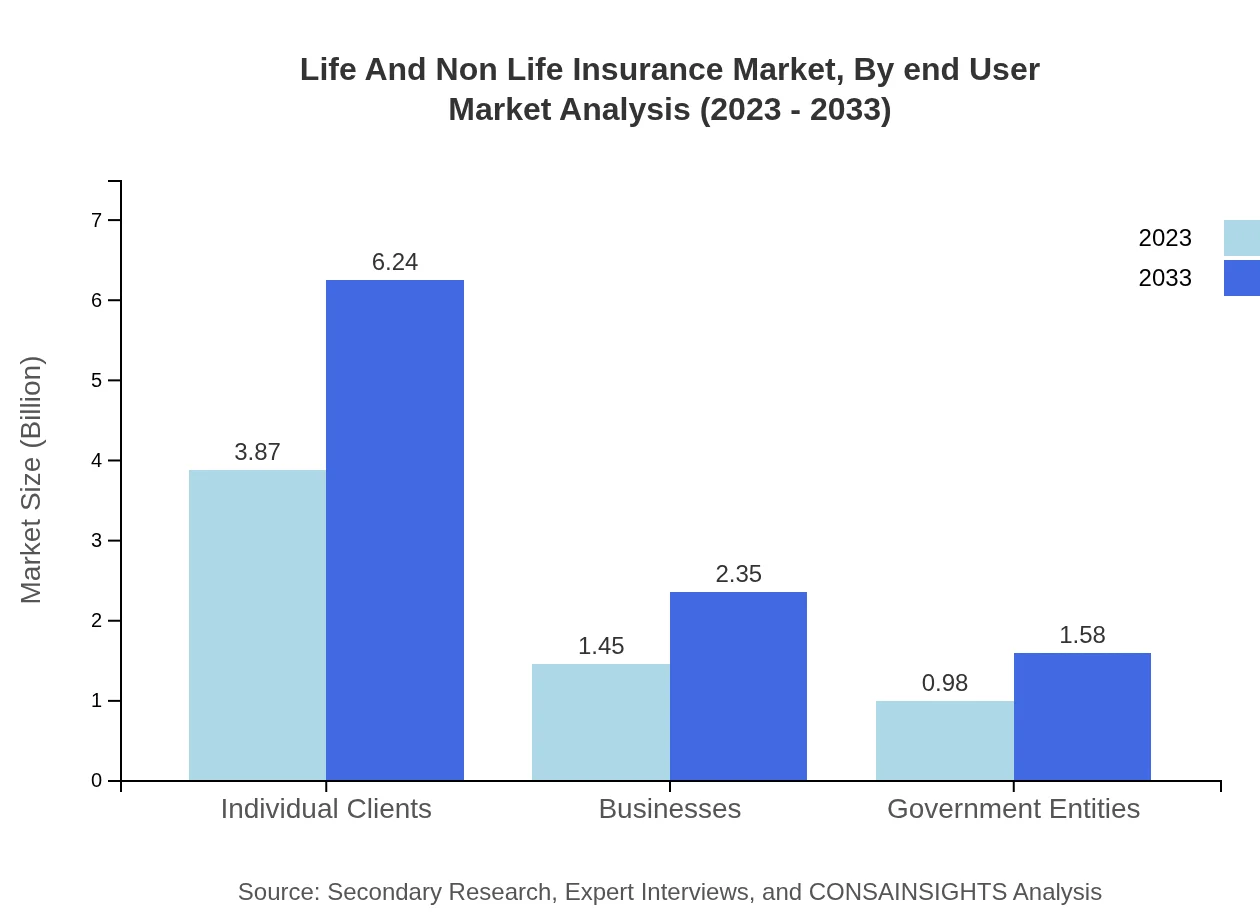

Life And Non Life Insurance Market Analysis By End User

The individual clients segment generates $3.87 trillion in 2023, expected to reach $6.24 trillion by 2033 (61.35% share). Businesses leverage insurance solutions worth $1.45 trillion currently, forecasted to rise to $2.35 trillion in 2033.

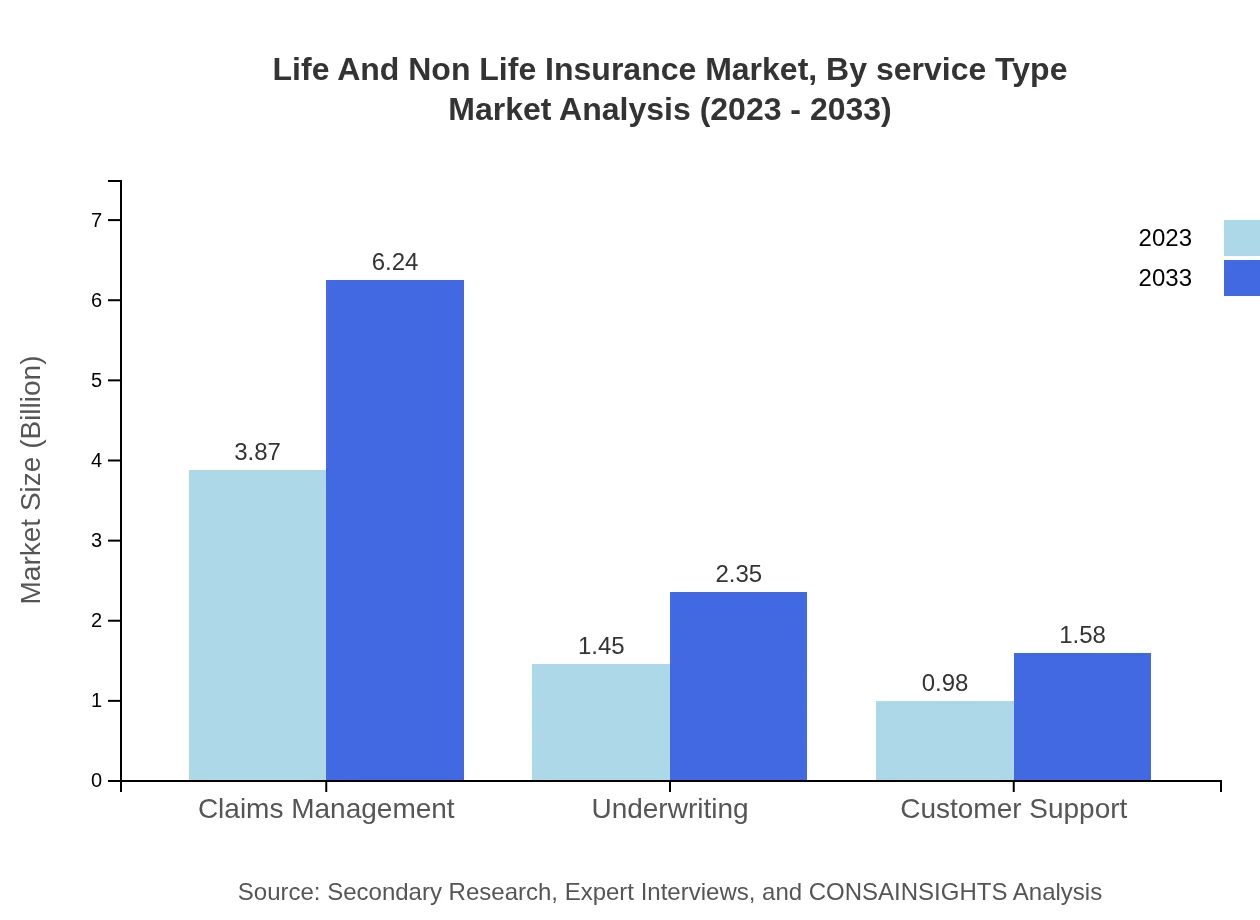

Life And Non Life Insurance Market Analysis By Service Type

Key services in the industry include insurance underwriting and claims management, each of which reflects a market size of $1.45 trillion and $3.87 trillion in 2023 respectively, with similar growth trajectories leading to $2.35 trillion and $6.24 trillion by 2033.

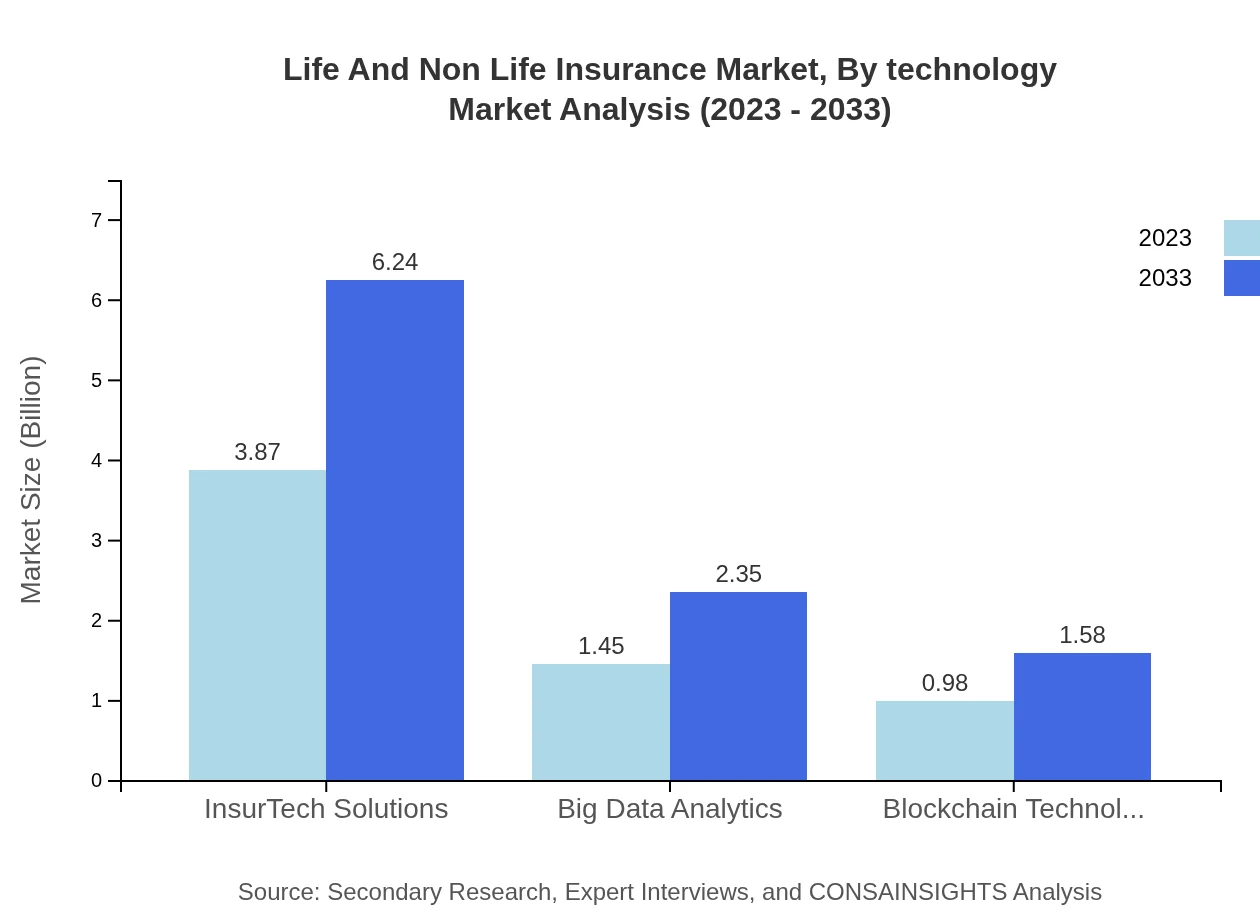

Life And Non Life Insurance Market Analysis By Technology

Emerging technologies significantly affect the market, with Big Data Analytics at $1.45 trillion expected to rise to $2.35 trillion by 2033. Innovations like blockchain technology are also projected to shape future trends, with growth anticipated to reach $1.58 trillion.

Life And Non Life Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Life And Non Life Insurance Industry

AIG:

American International Group, Inc., is a leading global insurer providing a wide range of property casualty and life insurance solutions.MetLife:

MetLife, Inc. is a global provider of insurance, annuities, and employee benefit programs serving 90 million customers across 60 countries.Prudential Financial:

Prudential Financial, Inc. offers a diverse range of financial products including life insurance, asset management, and retirement solutions.Allianz:

Allianz SE is a large global insurance and asset management company headquartered in Germany, offering various insurance and financial services.Berkshire Hathaway:

Berkshire Hathaway Inc. is a multinational conglomerate holding company known for its insurance and reinsurance services in various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of life And Non Life Insurance?

The global life and non-life insurance market is valued at approximately $6.3 trillion in 2023, with a compound annual growth rate (CAGR) of 4.8% expected until 2033. This sector encompasses both life insurance products and various non-life insurance offerings.

What are the key market players or companies in this industry?

Key players in the life and non-life insurance industry include large corporations such as Allianz, AXA, Prudential, MetLife, and Zurich. These companies are recognized for their comprehensive coverage options and commitment to innovation in insurance solutions.

What are the primary factors driving the growth in the insurance industry?

Growth in the life and non-life insurance industry is primarily driven by increasing awareness of financial security, technological advancements like InsurTech, and rising disposable incomes globally. Additionally, regulatory changes and an increasing aging population contribute significantly to market expansion.

Which region is the fastest Growing in the insurance market?

The Asia Pacific region is the fastest-growing market for life and non-life insurance, projected to increase from $1.22 trillion in 2023 to $1.97 trillion by 2033. This growth is fueled by economic development and expanding middle-class populations.

Does ConsaInsights provide customized market report data for the insurance industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the life and non-life insurance industry. Our experts collaborate with stakeholders to ensure insightful and relevant data.

What deliverables can I expect from this market research project?

Expect comprehensive deliverables including detailed market analysis reports, regional insights, segmented data breakdowns, and forecasts. We also provide insights into trends, consumer behavior, and competitive analysis tailored to your requirements.

What are the market trends of life And Non Life Insurance?

Current market trends in life and non-life insurance include the rise of digital platforms for insurance distribution, the integration of big data analytics, enhanced customer service approaches, and the development of innovative products to meet changing consumer needs.