Life Insurance Policy Administration System Market Report

Published Date: 31 January 2026 | Report Code: life-insurance-policy-administration-system

Life Insurance Policy Administration System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Life Insurance Policy Administration System market, encompassing market size, growth trends, and key players. It includes insights and forecasts spanning from 2023 to 2033, with detailed explorations of technology, segmentation, and regional dynamics.

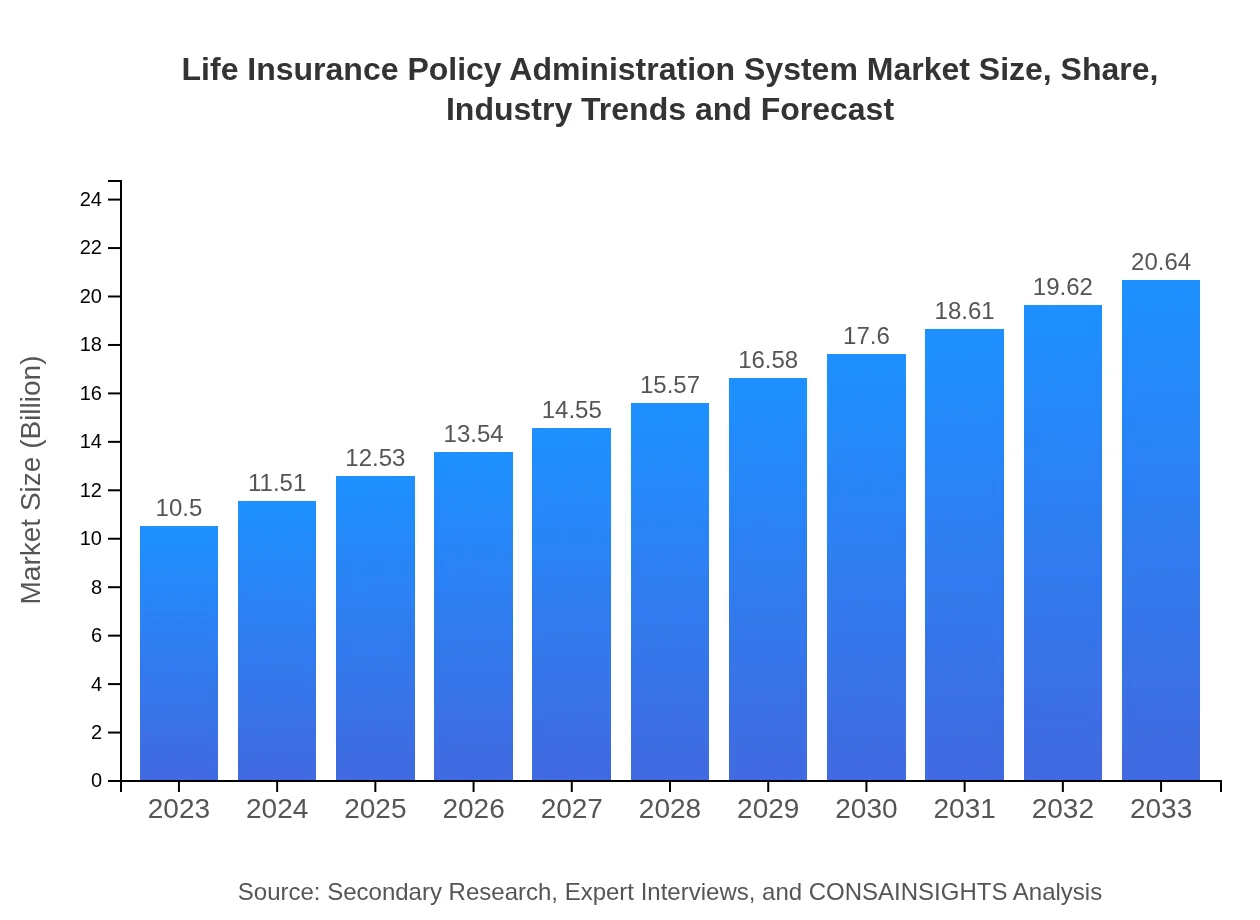

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Oracle Corporation, SAP SE, FIS Global, IBM Corporation, SS&C Technologies |

| Last Modified Date | 31 January 2026 |

Life Insurance Policy Administration System Market Overview

Customize Life Insurance Policy Administration System Market Report market research report

- ✔ Get in-depth analysis of Life Insurance Policy Administration System market size, growth, and forecasts.

- ✔ Understand Life Insurance Policy Administration System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Life Insurance Policy Administration System

What is the Market Size & CAGR of Life Insurance Policy Administration System market in 2023?

Life Insurance Policy Administration System Industry Analysis

Life Insurance Policy Administration System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Life Insurance Policy Administration System Market Analysis Report by Region

Europe Life Insurance Policy Administration System Market Report:

Europe's market is forecasted to grow from $3.53 billion in 2023 to $6.93 billion by 2033. The region's growth is influenced by increasing demand for personalized insurance products and rigorous regulatory frameworks requiring robust policy management systems.Asia Pacific Life Insurance Policy Administration System Market Report:

The Asia Pacific region is projected to grow from $1.97 billion in 2023 to $3.88 billion by 2033, achieving a notable CAGR driven by an increasing insurance penetration rate and a growing middle-class population seeking life insurance products. Major economies like China, India, and Japan are leading this growth, with insurers modernizing their policy administration systems to meet rising demand.North America Life Insurance Policy Administration System Market Report:

North America leads the market with size anticipated to grow from $3.59 billion in 2023 to $7.06 billion by 2033. This region's growth is predominantly driven by technological adoption, regulatory changes, and the need for enhanced customer service across insurance companies in the United States and Canada.South America Life Insurance Policy Administration System Market Report:

In South America, the market is expected to expand from $0.46 billion in 2023 to $0.90 billion by 2033. Growth in this region is bolstered by efforts to increase financial inclusion and the adoption of digital platforms among insurance providers, enhancing access to life insurance services.Middle East & Africa Life Insurance Policy Administration System Market Report:

The Middle East and Africa market is projected to increase from $0.95 billion in 2023 to $1.87 billion by 2033. Growing awareness of life insurance among the population, combined with the expansion of distribution channels and technological adoption, contributes to this growth trajectory.Tell us your focus area and get a customized research report.

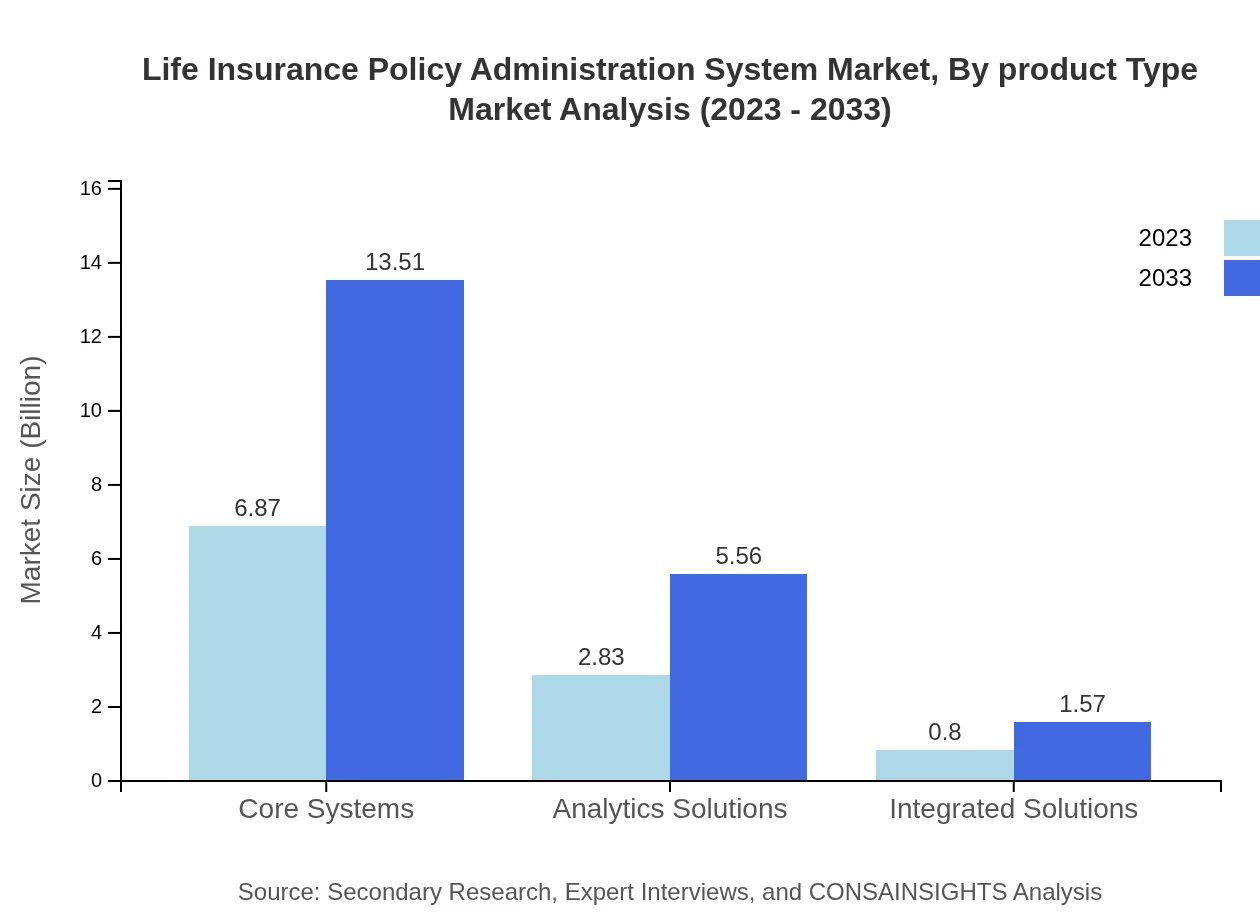

Life Insurance Policy Administration System Market Analysis By Product Type

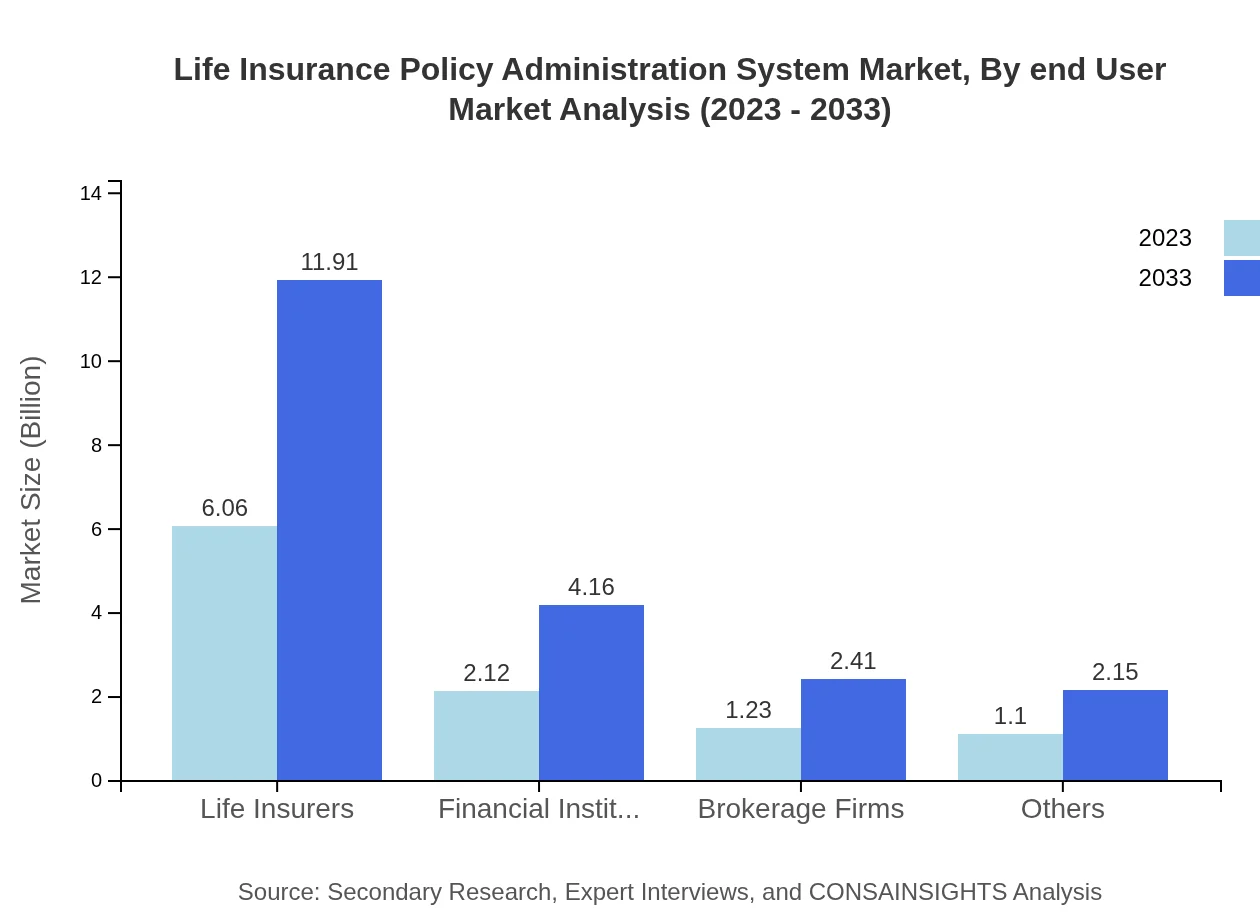

The Life Insurance Policy Administration System market, by product type, holds a substantial size of $6.06 billion in 2023 and is anticipated to grow to $11.91 billion by 2033. Life insurers dominate this segment, accounting for a 57.71% share in 2023, reflecting their extensive use of policy management systems to optimize operations.

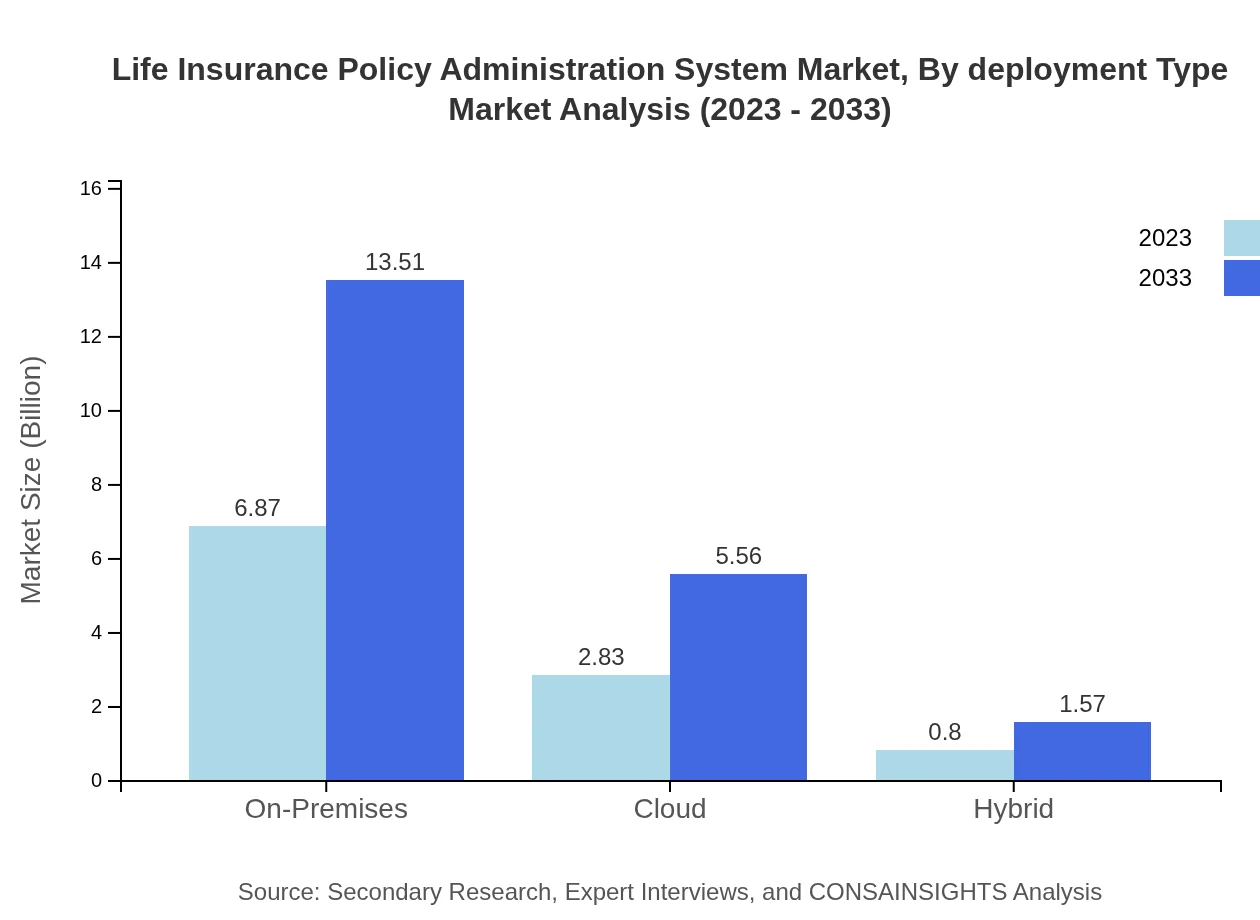

Life Insurance Policy Administration System Market Analysis By Deployment Type

The deployment type segment is bifurcated into on-premises, cloud, and hybrid solutions. On-premises solutions have a significant share of 65.45% in 2023, with projections indicating growth to $13.51 billion by 2033. Conversely, the cloud deployment type, currently accounting for 26.94%, is also set to witness enhanced adoption as more insurers transition to cloud-based solutions for flexibility and efficiency.

Life Insurance Policy Administration System Market Analysis By End User

The end-user segment includes life insurers, financial institutions, and brokerage firms. Life insurers are the largest segment, commanding a market size of $6.06 billion in 2023 and expected to reach $11.91 billion by 2033, demonstrating their lead in adopting innovative policy solutions for better operational management.

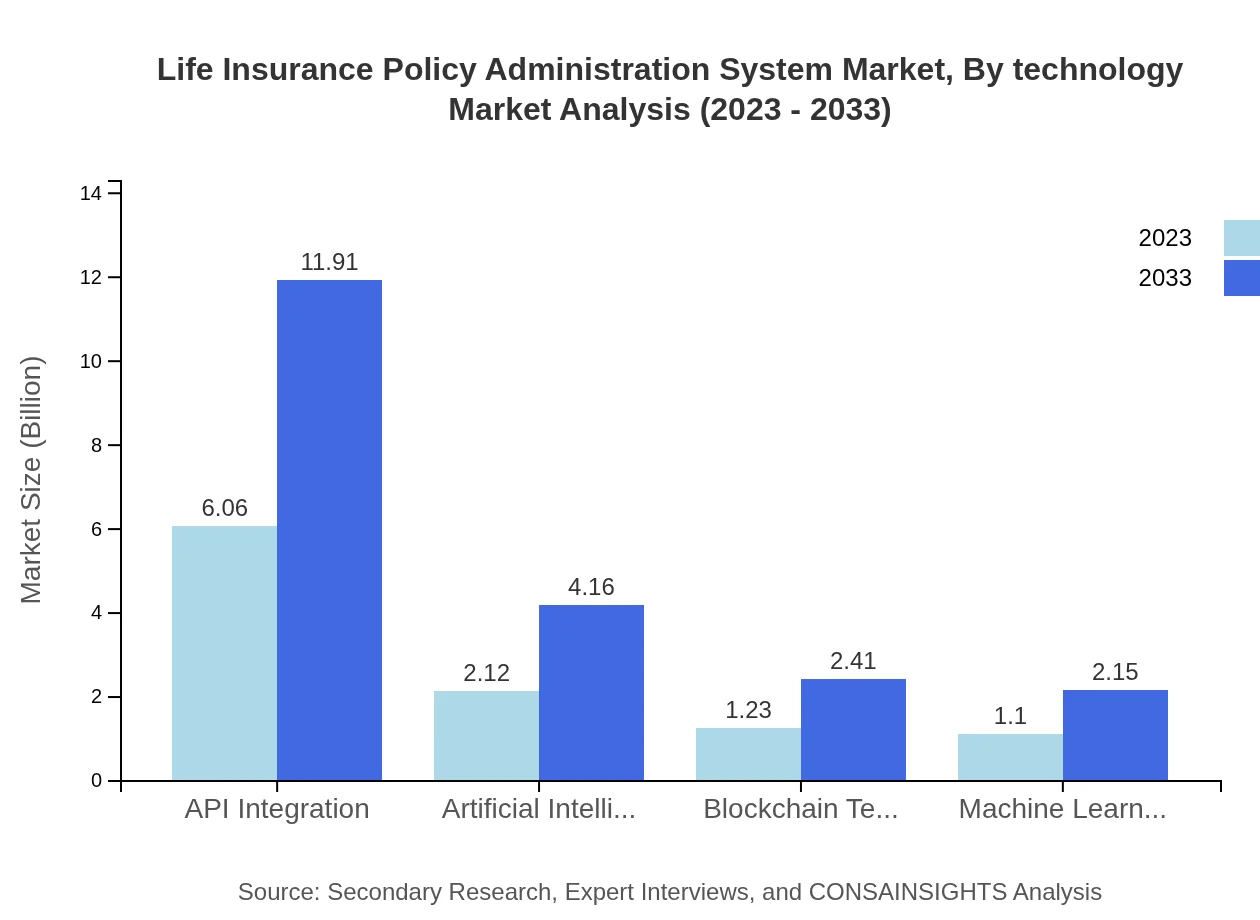

Life Insurance Policy Administration System Market Analysis By Technology

The technology segment, featuring advancements such as API Integration, Artificial Intelligence, Blockchain, and Machine Learning, is pivotal in this market's growth. By 2033, technology halls, such as Analytics Solutions, are projected to grow significantly, indicating robust investment in innovative technologies for policy management enhancement.

Life Insurance Policy Administration System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Life Insurance Policy Administration System Industry

Oracle Corporation:

Oracle offers robust solutions designed for life insurance policy administration, focusing on improving efficiency through advanced technology and analytics.SAP SE:

SAP provides innovative life insurance software solutions that automate and streamline policy administration processes, helping insurers enhance their customer service.FIS Global:

FIS Global delivers comprehensive life insurance solutions supported by advanced analytics, empowering insurers to manage their operations effectively.IBM Corporation:

IBM's insurance platforms leverage AI and machine learning technologies to optimize policy administration, mitigate risks, and provide better insights.SS&C Technologies:

SS&C Technologies specializes in technology solutions for the insurance sector, offering a suite of products that streamline policy management and enhance compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of life Insurance Policy Administration System?

The global market size for the Life Insurance Policy Administration System is estimated at $10.5 billion in 2023, with a projected CAGR of 6.8% leading to significant growth by 2033.

What are the key market players or companies in this life Insurance Policy Administration System industry?

Key players in the Life Insurance Policy Administration System market include notable software providers known for their innovative solutions tailored for life insurers, financial institutions, and brokerage firms. They leverage cutting-edge technology to enhance operational efficiency.

What are the primary factors driving the growth in the life Insurance Policy Administration System industry?

Key growth factors include increasing digital transformation in insurance processes, rising demand for automated systems, and greater focus on customer experience. Regulatory compliance and data analytics capabilities also significantly contribute to market expansion.

Which region is the fastest Growing in the life Insurance Policy Administration System?

The North America region is the fastest-growing area, projected to expand from $3.59 billion in 2023 to $7.06 billion by 2033. Europe and Asia Pacific are also experiencing robust growth during this period.

Does ConsaInsights provide customized market report data for the life Insurance Policy Administration System industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Life Insurance Policy Administration System industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this life Insurance Policy Administration System market research project?

Deliverables from the market research project include comprehensive reports detailing market size, growth forecasts, competitive landscape analysis, and regional insights, along with segmented data for key provider categories.

What are the market trends of life Insurance Policy Administration System?

Emerging trends include the increasing adoption of AI and machine learning for policy management, the shift towards cloud solutions for scalability, and the integration of blockchain technology for enhanced security and transparency.