Life Sciences Software Market Report

Published Date: 31 January 2026 | Report Code: life-sciences-software

Life Sciences Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Life Sciences Software market from 2023 to 2033. It includes insights on market size, trends, regional performance, technological advances, and key players, providing a comprehensive forecast for stakeholders in the life sciences sector.

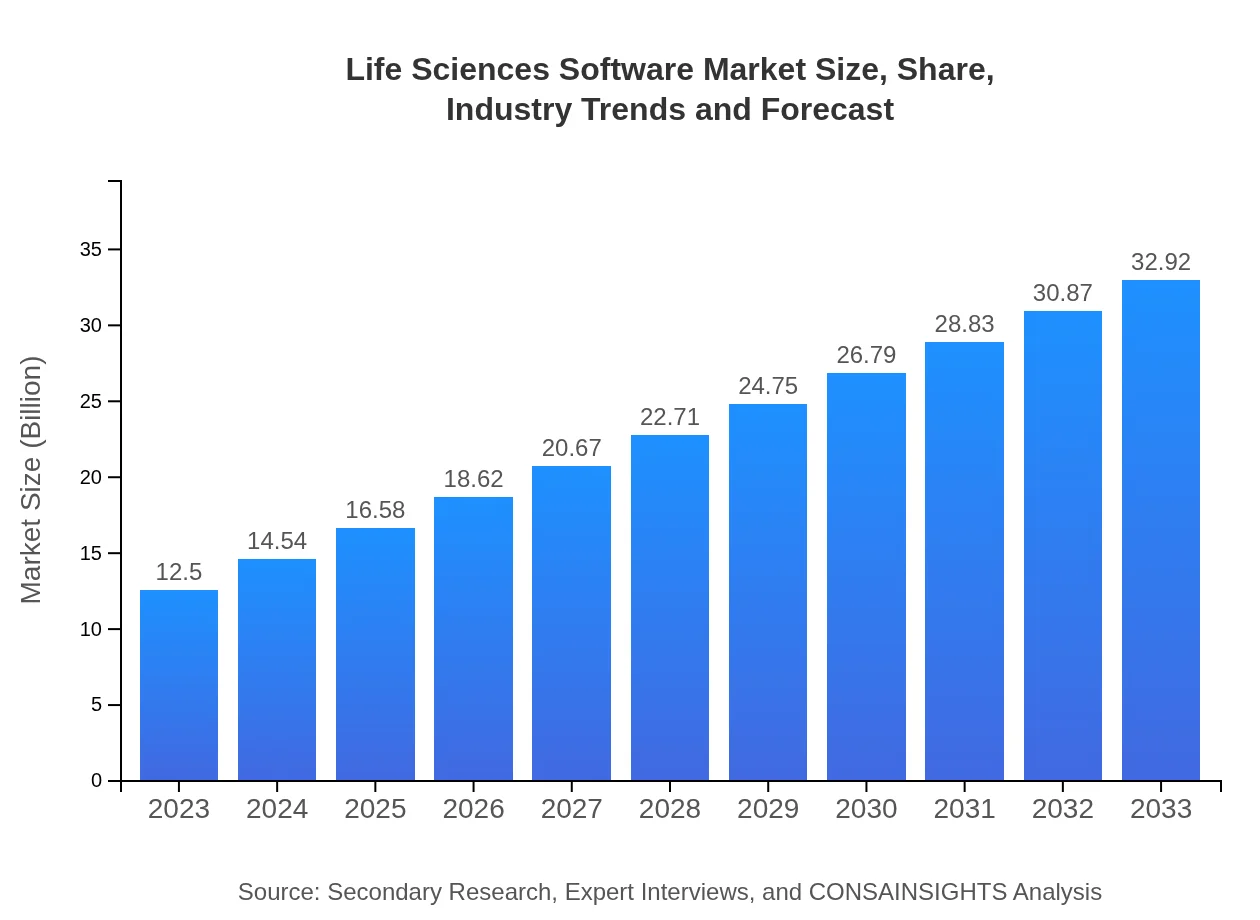

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Oracle Corporation, SAP SE, Veeva Systems Inc., IBM Watson Health, Medidata Solutions, Inc. |

| Last Modified Date | 31 January 2026 |

Life Sciences Software Market Overview

Customize Life Sciences Software Market Report market research report

- ✔ Get in-depth analysis of Life Sciences Software market size, growth, and forecasts.

- ✔ Understand Life Sciences Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Life Sciences Software

What is the Market Size & CAGR of Life Sciences Software market in 2023?

Life Sciences Software Industry Analysis

Life Sciences Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Life Sciences Software Market Analysis Report by Region

Europe Life Sciences Software Market Report:

The European market, projected to grow from $4.11 billion in 2023 to $10.81 billion by 2033, is influenced by stringent regulatory requirements and an increasing number of clinical trials. Countries like Germany, France, and the UK are at the forefront of this growth as they invest heavily in biotechnology and sustainable healthcare solutions.Asia Pacific Life Sciences Software Market Report:

The Asia Pacific region is witnessing rapid adoption of life sciences software due to increasing government investments in healthcare infrastructure. The market is expected to grow from $2.36 billion in 2023 to $6.21 billion in 2033. Countries like China and India are leading this growth, fueled by a burgeoning pharmaceutical industry and a focus on improving healthcare delivery systems.North America Life Sciences Software Market Report:

North America holds a sizable share of the Life Sciences Software market, expected to expand from $4.56 billion in 2023 to $12.00 billion by 2033. The presence of numerous established pharmaceutical companies and advanced healthcare systems fosters high demand for innovative software solutions that enhance operational efficiency and regulatory compliance.South America Life Sciences Software Market Report:

In South America, the market is anticipated to increase from $1.00 billion in 2023 to $2.64 billion in 2033. Efforts to modernize healthcare systems and improve operational efficiencies within pharmaceutical and biotech firms are driving this trend, alongside an increasing need for compliance with international regulations.Middle East & Africa Life Sciences Software Market Report:

The Middle East and Africa market is expected to rise from $0.47 billion in 2023 to $1.25 billion in 2033. Growth in this region is propelled by investments in healthcare technologies and initiatives to improve healthcare delivery, especially in nations like South Africa and the UAE.Tell us your focus area and get a customized research report.

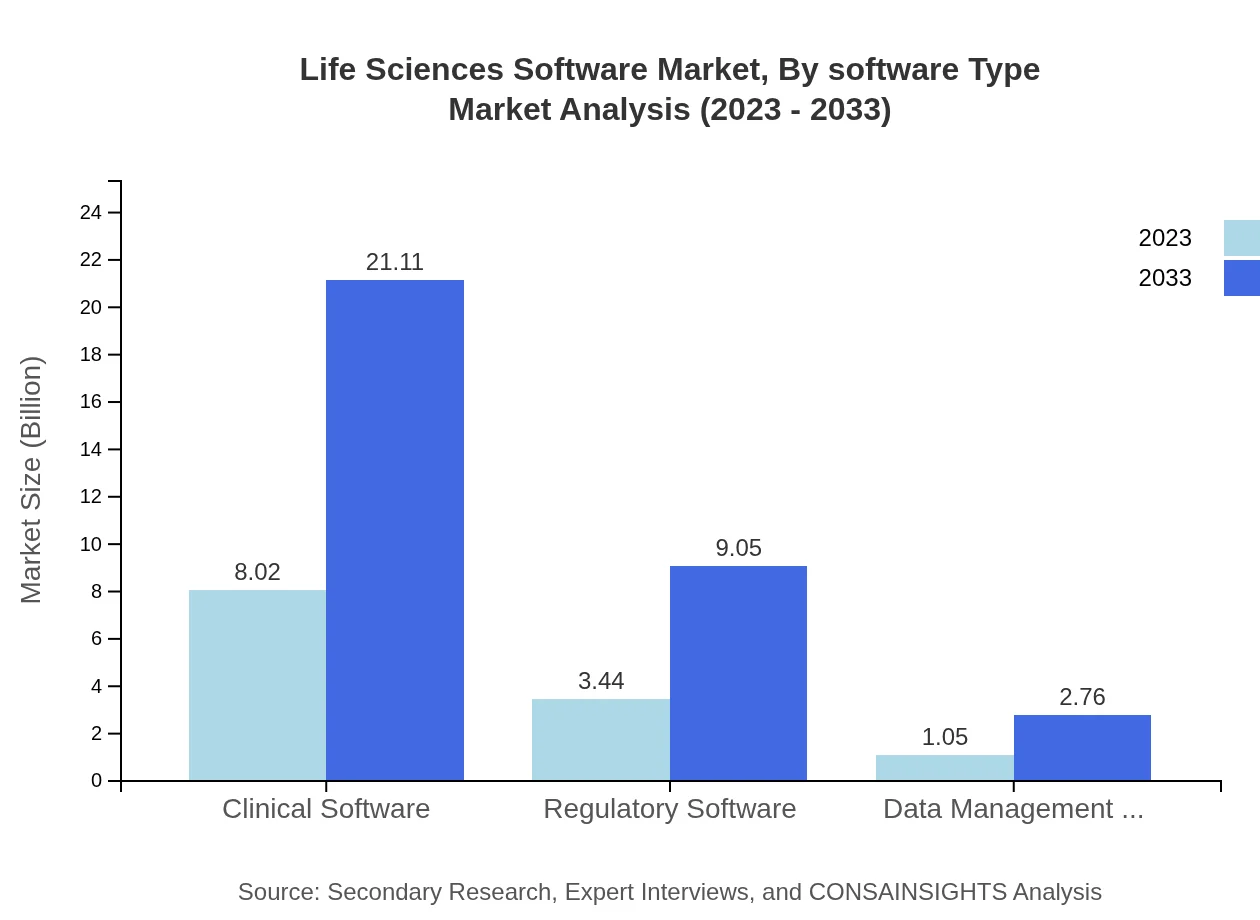

Life Sciences Software Market Analysis By Software Type

In terms of software type, pharmaceutical and biotechnology companies dominate, growing from $8.02 billion in 2023 to $21.11 billion in 2033. Regulatory software and clinical management software sectors are also significant, reflecting the ongoing need for compliance and efficient clinical trial management. Hospitals and clinics add to market demand, with projections from $3.44 billion in 2023 to $9.05 billion by 2033.

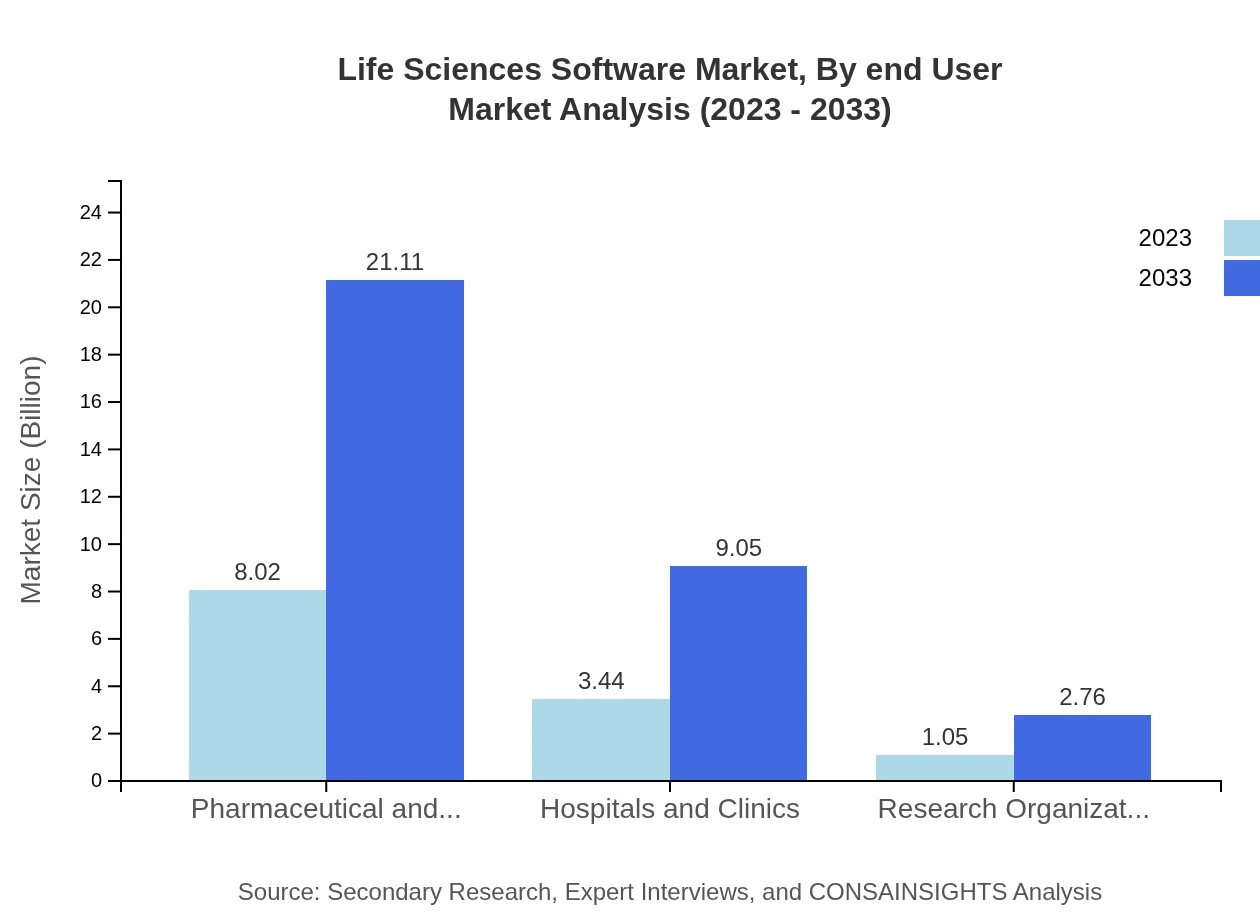

Life Sciences Software Market Analysis By End User

Pharmaceutical and biotechnology companies hold a leading share of the Life Sciences Software market, expected to remain at approximately 64.12% throughout the forecast period. Hospitals and clinics also represent a crucial segment, holding a 27.5% share. Research organizations contribute to market diversity but hold a smaller percentage at 8.38%.

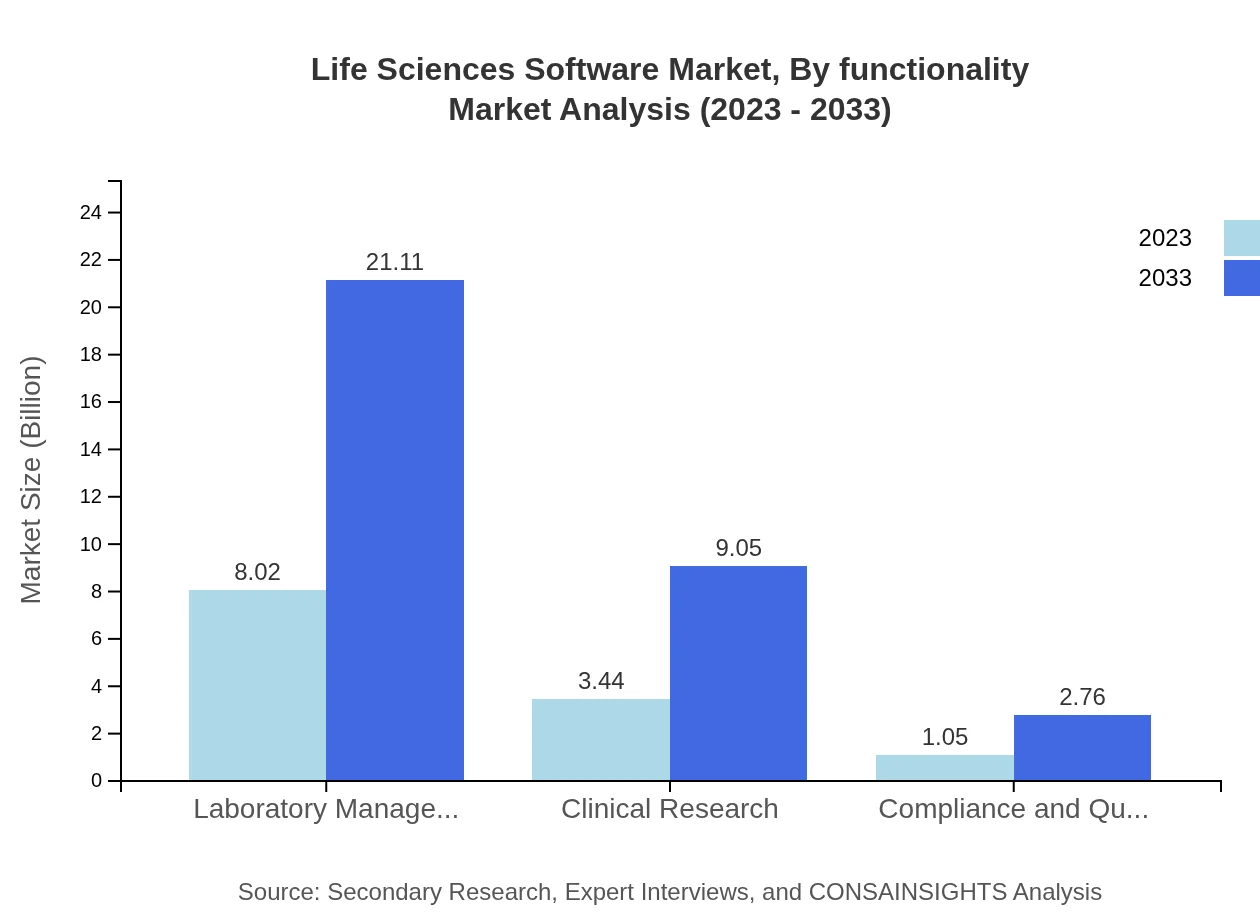

Life Sciences Software Market Analysis By Functionality

Functionality-wise, clinical software and laboratory management software are driving growth, consistent with a market size increase anticipated from $8.02 billion in 2023 to $21.11 billion in 2033. Compliance and quality management software will also see consistent demand, with a modest share in the growing market landscape.

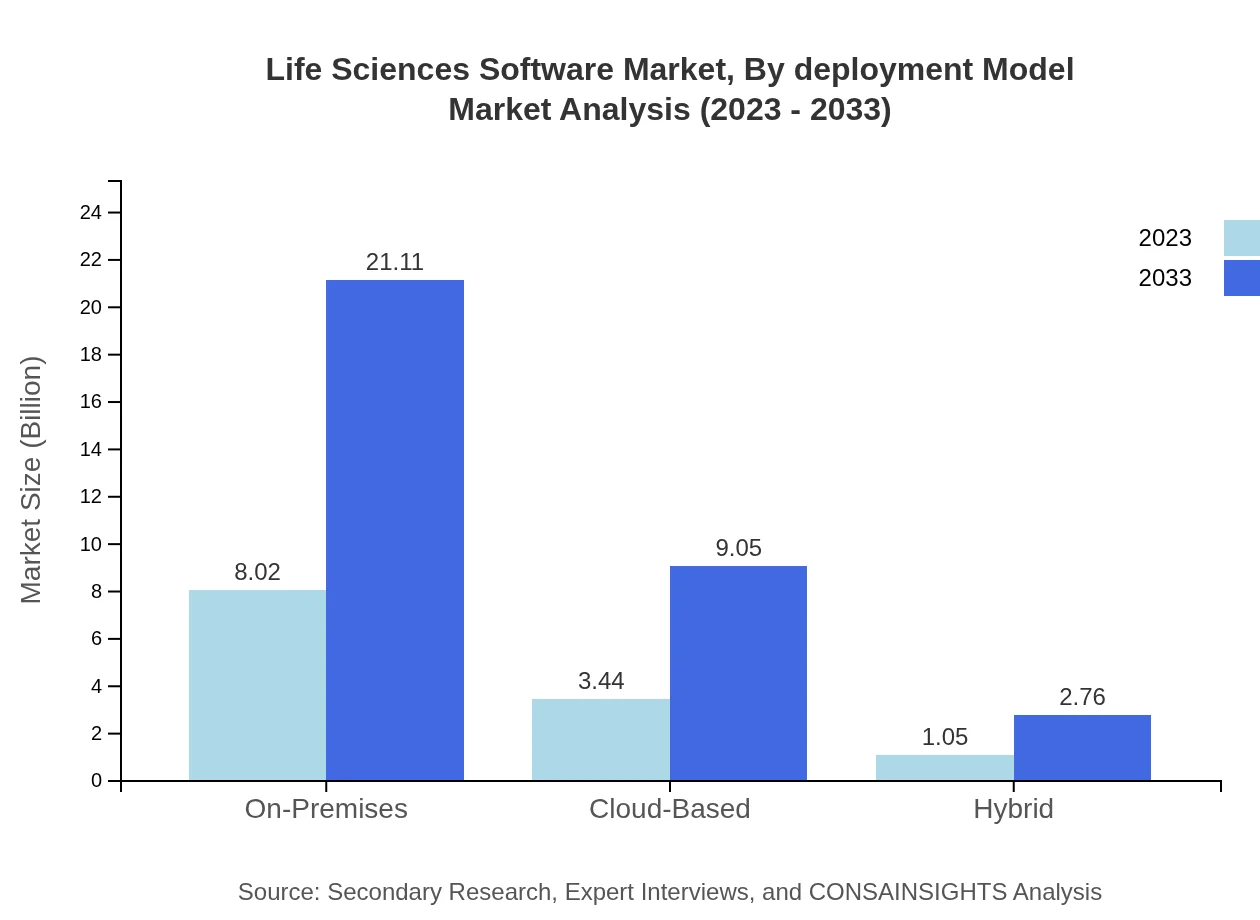

Life Sciences Software Market Analysis By Deployment Model

Deployment model analysis indicates that on-premises solutions are still prevalent, maintaining a 64.12% market share; however, cloud-based solutions are gaining traction, expected to rise from $3.44 billion in 2023 to $9.05 billion by 2033, driven by their scalability, flexibility, and lower operational costs.

Life Sciences Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Life Sciences Software Industry

Oracle Corporation:

Oracle provides well-known enterprise software solutions, including clinical trial management systems that facilitate regulatory compliance and operational efficiency in the life sciences sector.SAP SE:

SAP offers a range of software solutions that optimize pharmaceutical operations, from research and development to manufacturing and supply chain management.Veeva Systems Inc.:

Veeva specializes in cloud-based software for the life sciences industry, with a strong emphasis on regulatory compliance and clinical operations.IBM Watson Health:

Part of IBM Corporation, Watson Health leverages AI to assist in drug discovery and development, transforming data into actionable insights for healthcare providers.Medidata Solutions, Inc.:

Medidata, a Dassault Systèmes company, is a pioneer in cloud-based solutions for clinical trials, providing tools that enhance the efficiency and accuracy of research processes.We're grateful to work with incredible clients.

FAQs

What is the market size of life Sciences Software?

The global life sciences software market is projected to reach approximately $12.5 billion by 2033, growing at a CAGR of 9.8%. This maintains a robust industry landscape driven by innovation and technological advancements.

What are the key market players or companies in the life Sciences Software industry?

Key players in the life sciences software industry include major companies that develop solutions for pharmaceutical, biotechnology, and clinical research. These companies are pivotal in driving growth and innovation within the sector.

What are the primary factors driving the growth in the life Sciences Software industry?

Growth in the life sciences software industry is primarily driven by the increasing demand for advanced data analytics, regulatory compliance solutions, and the rising need for efficient automation in research environments, reflecting technological advancements.

Which region is the fastest Growing in the life Sciences Software?

The North America region, anticipated to grow from $4.56 billion in 2023 to $12.00 billion by 2033, holds the title of the fastest-growing segment in the life sciences software market, reflecting demanding innovation requirements.

Does ConsaInsights provide customized market report data for the life Sciences Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the life sciences software industry, aiding stakeholders in making informed decisions based on comprehensive data analysis.

What deliverables can I expect from this life Sciences Software market research project?

From the market research project, expect detailed reports including market size analysis, trends, forecasts, segment breakdowns, and insights about key players, providing a comprehensive overview of the life sciences software landscape.

What are the market trends of life Sciences Software?

Trends in the life sciences software market include growing adoption of cloud-based platforms, increased focus on automation, and the integration of artificial intelligence technologies, all driving efficiency and innovation across the industry.