Light Commercial Vehicle Lcv Market Report

Published Date: 02 February 2026 | Report Code: light-commercial-vehicle-lcv

Light Commercial Vehicle Lcv Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Light Commercial Vehicle (LCV) market from 2023 to 2033, focusing on key insights including market size, growth forecasts, regional dynamics, and industry trends.

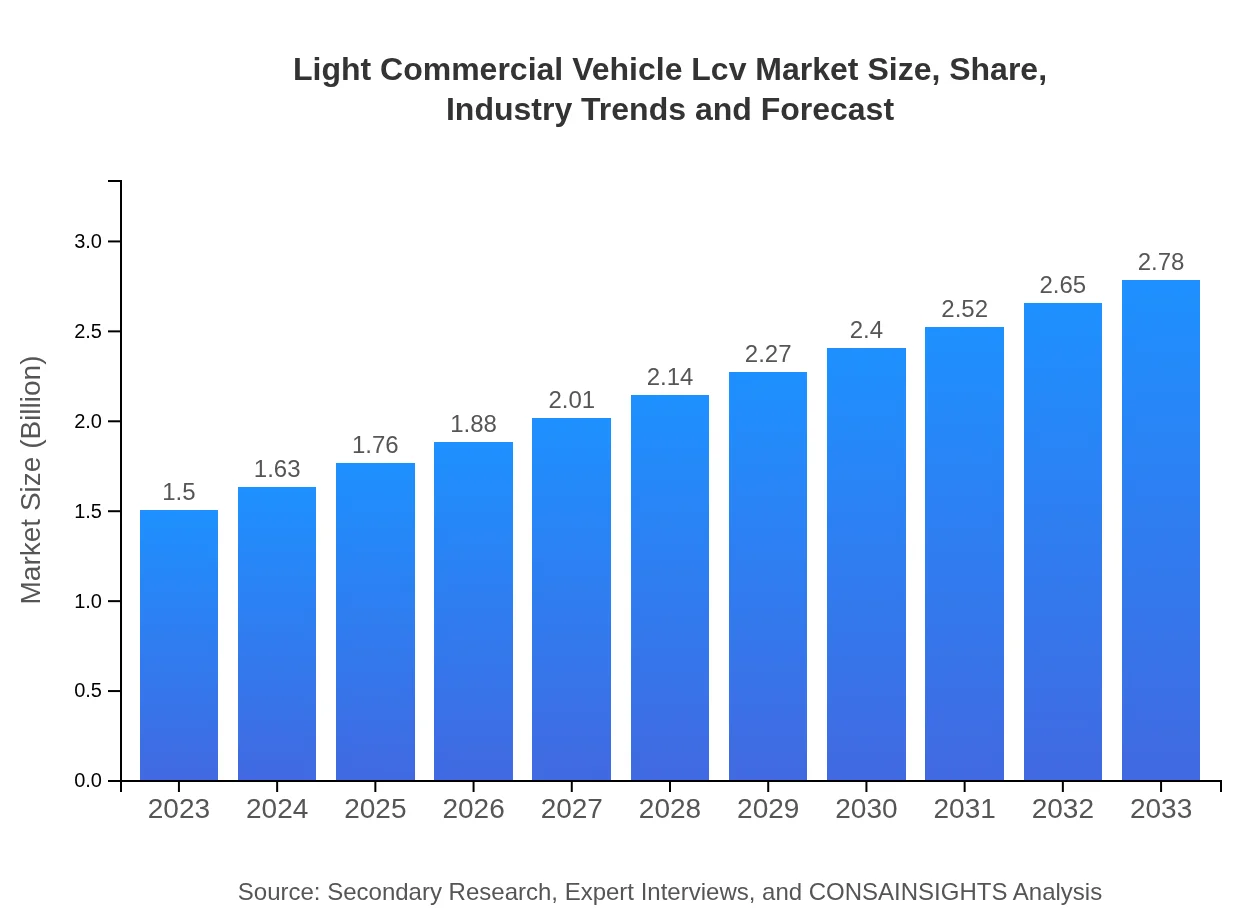

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Trillion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Trillion |

| Top Companies | Ford Motor Company, Mercedes-Benz AG, Toyota Motor Corporation, Renault Group, Nissan Motor Corporation |

| Last Modified Date | 02 February 2026 |

Light Commercial Vehicle Lcv Market Overview

Customize Light Commercial Vehicle Lcv Market Report market research report

- ✔ Get in-depth analysis of Light Commercial Vehicle Lcv market size, growth, and forecasts.

- ✔ Understand Light Commercial Vehicle Lcv's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Light Commercial Vehicle Lcv

What is the Market Size & CAGR of Light Commercial Vehicle Lcv market in 2023?

Light Commercial Vehicle Lcv Industry Analysis

Light Commercial Vehicle Lcv Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Light Commercial Vehicle Lcv Market Analysis Report by Region

Europe Light Commercial Vehicle Lcv Market Report:

In Europe, the market was valued at $0.37 trillion in 2023, projected to increase to $0.69 trillion by 2033. The European market is characterized by stringent emissions standards, fostering investments in alternative fuel technologies, including electric and hybrid solutions. The growth of e-commerce logistics is anticipated to further bolster the market.Asia Pacific Light Commercial Vehicle Lcv Market Report:

In the Asia Pacific region, the LCV market was valued at approximately $0.31 trillion in 2023, anticipated to grow to $0.58 trillion by 2033. Key growth drivers include rapid urbanization, rising disposable income, and a surge in logistics activities due to the e-commerce boom. The region is seeing increased investments in infrastructure, which is expected to further accelerate market growth.North America Light Commercial Vehicle Lcv Market Report:

North America boasts a substantial LCV market, standing at $0.57 trillion in 2023, with forecasts estimating growth to $1.06 trillion by 2033. This rapid expansion is supported by technological advancements, high consumer spending, and increasing adoption of electric vehicles. Additionally, the region's emphasis on reducing carbon footprints aligns with green vehicle initiatives.South America Light Commercial Vehicle Lcv Market Report:

The South American LCV market, valued at $0.07 trillion in 2023, is projected to reach $0.13 trillion by 2033. The growth is primarily fueled by improving economic conditions, government investments in public infrastructure, and a growing need for delivery services in urban areas, leading to increased demand for versatile light commercial vehicles.Middle East & Africa Light Commercial Vehicle Lcv Market Report:

The Middle East and Africa (MEA) region had a market value of $0.17 trillion in 2023, expected to double to $0.32 trillion by 2033. Key drivers include infrastructural developments and increasing trade activities. The rise of mobile commerce in the region is also catalyzing demand for LCVs, specifically for last-mile delivery.Tell us your focus area and get a customized research report.

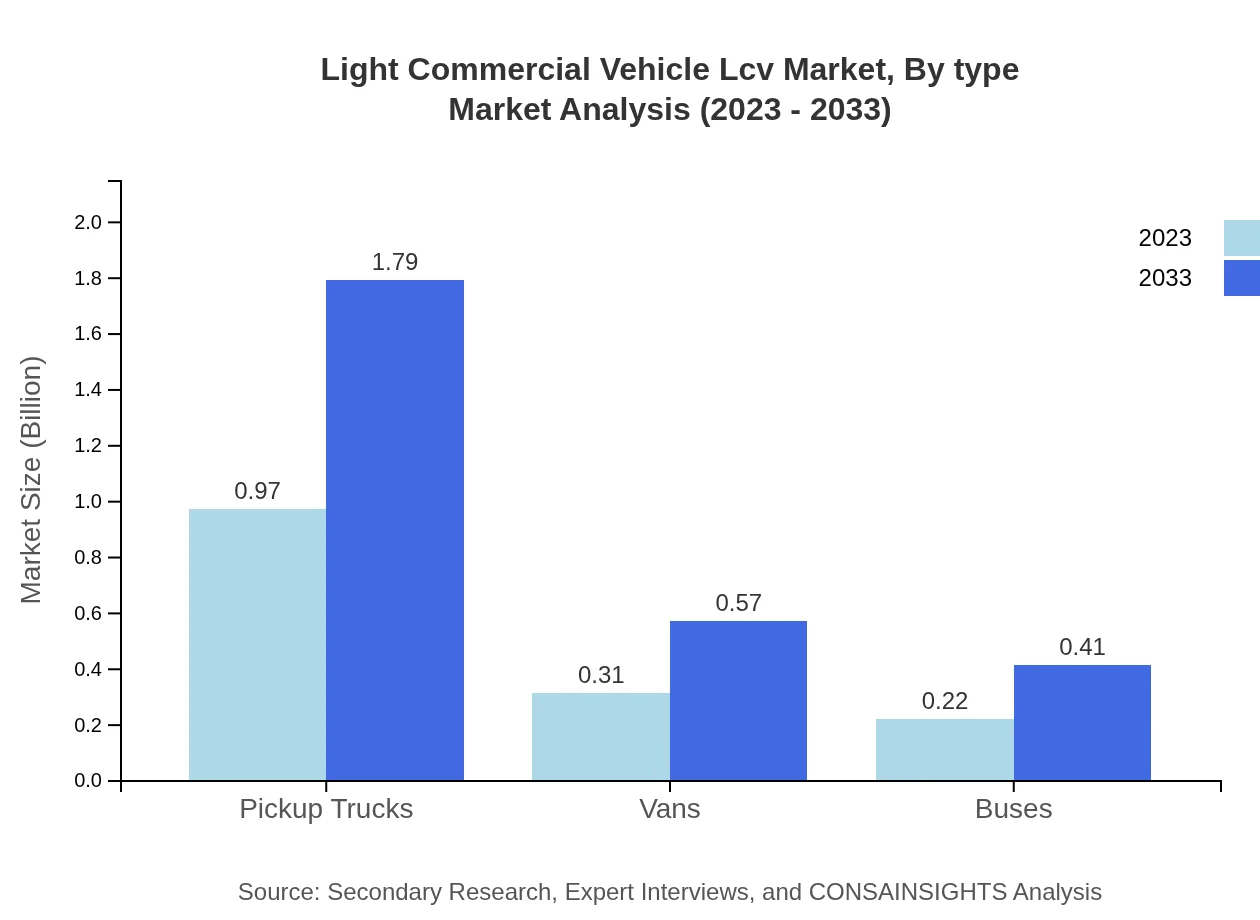

Light Commercial Vehicle Lcv Market Analysis By Type

In terms of vehicle type, the Light Commercial Vehicle market is dominated by Pickup Trucks, accounting for $0.97 trillion in 2023, projected to grow to $1.79 trillion by 2033. They hold a significant share of 64.57%. Vans follow with a size of $0.31 trillion in 2023 and projected growth to $0.57 trillion, representing 20.67% share. Buses contribute with a size of $0.22 trillion in 2023 and are expected to grow to $0.41 trillion.

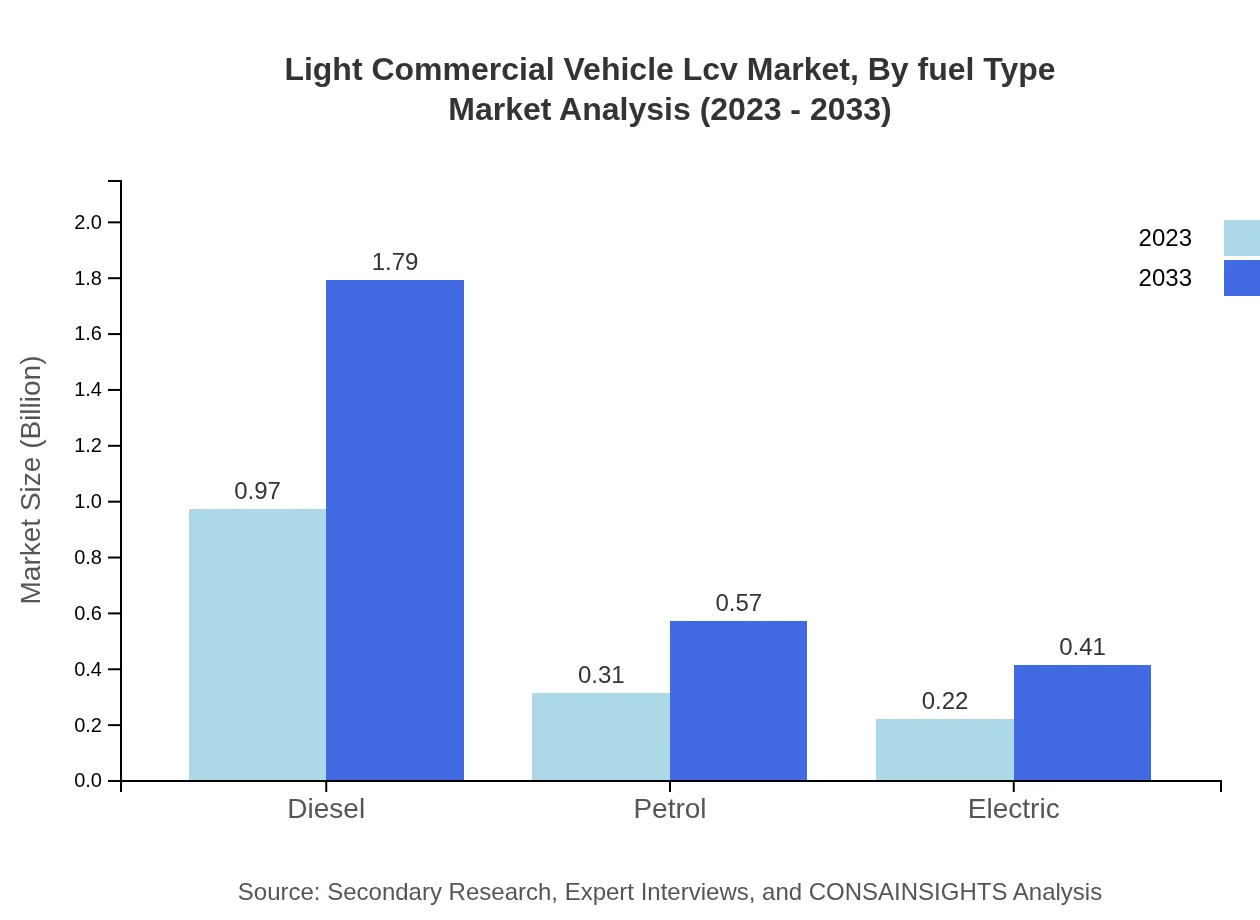

Light Commercial Vehicle Lcv Market Analysis By Fuel Type

The fuel type analysis reveals Diesel as the predominant fuel with a market size of $0.97 trillion in 2023 and a share of 64.57%. It is followed by Petrol at $0.31 trillion and a share of 20.67%. Electric vehicles are gaining traction with a size of $0.22 trillion, signifying a 14.76% share and an upward trend expected in the coming years as more consumers look for sustainable options.

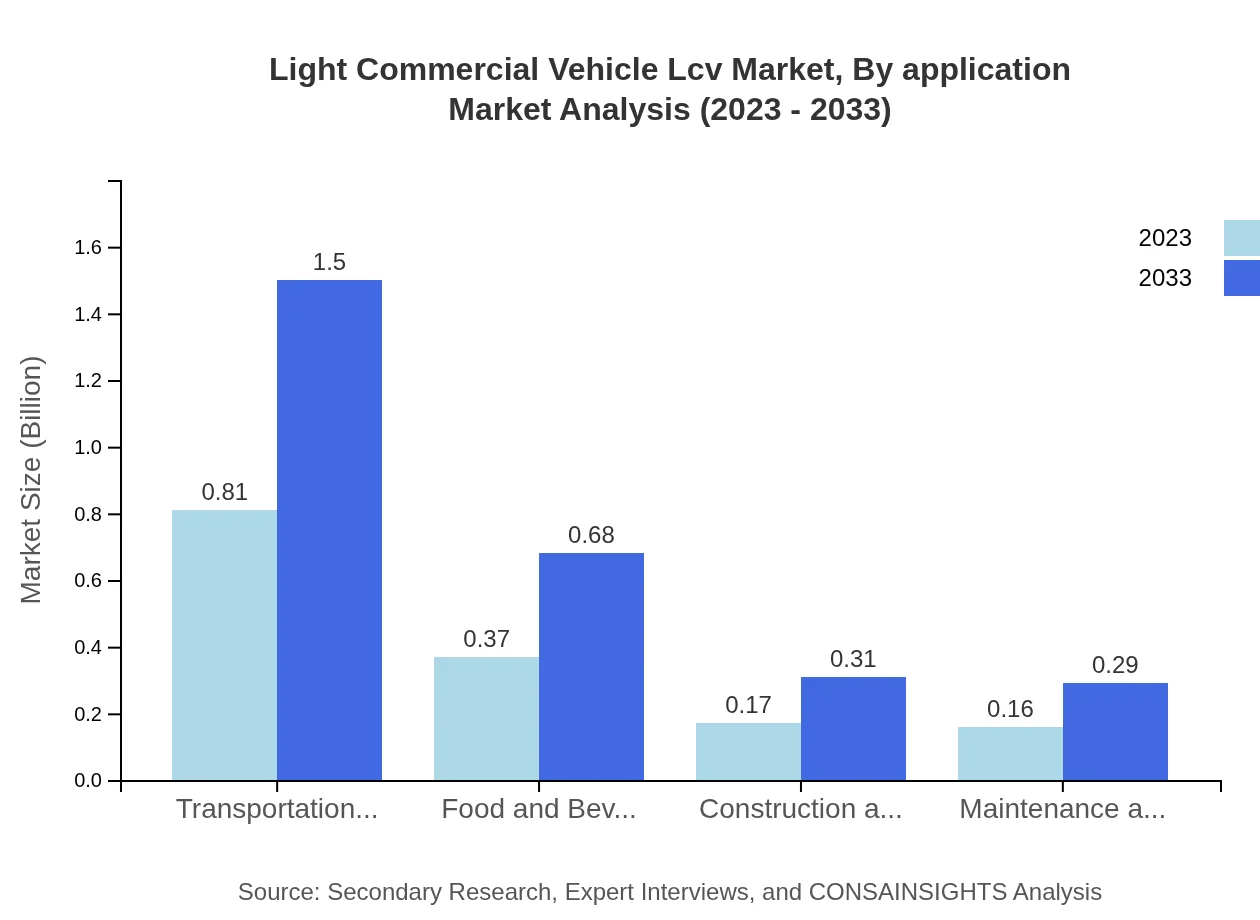

Light Commercial Vehicle Lcv Market Analysis By Application

By application, the market is led by Transportation and Logistics segment, which size was $0.81 trillion in 2023, projected at $1.50 trillion by 2033 (54.05% share). The E-commerce and Logistics segment followed, with a size of $0.22 trillion and projected growth to $0.41 trillion, while Food and Beverage Delivery accounted for $0.37 trillion in 2023, anticipated to reach $0.68 trillion.

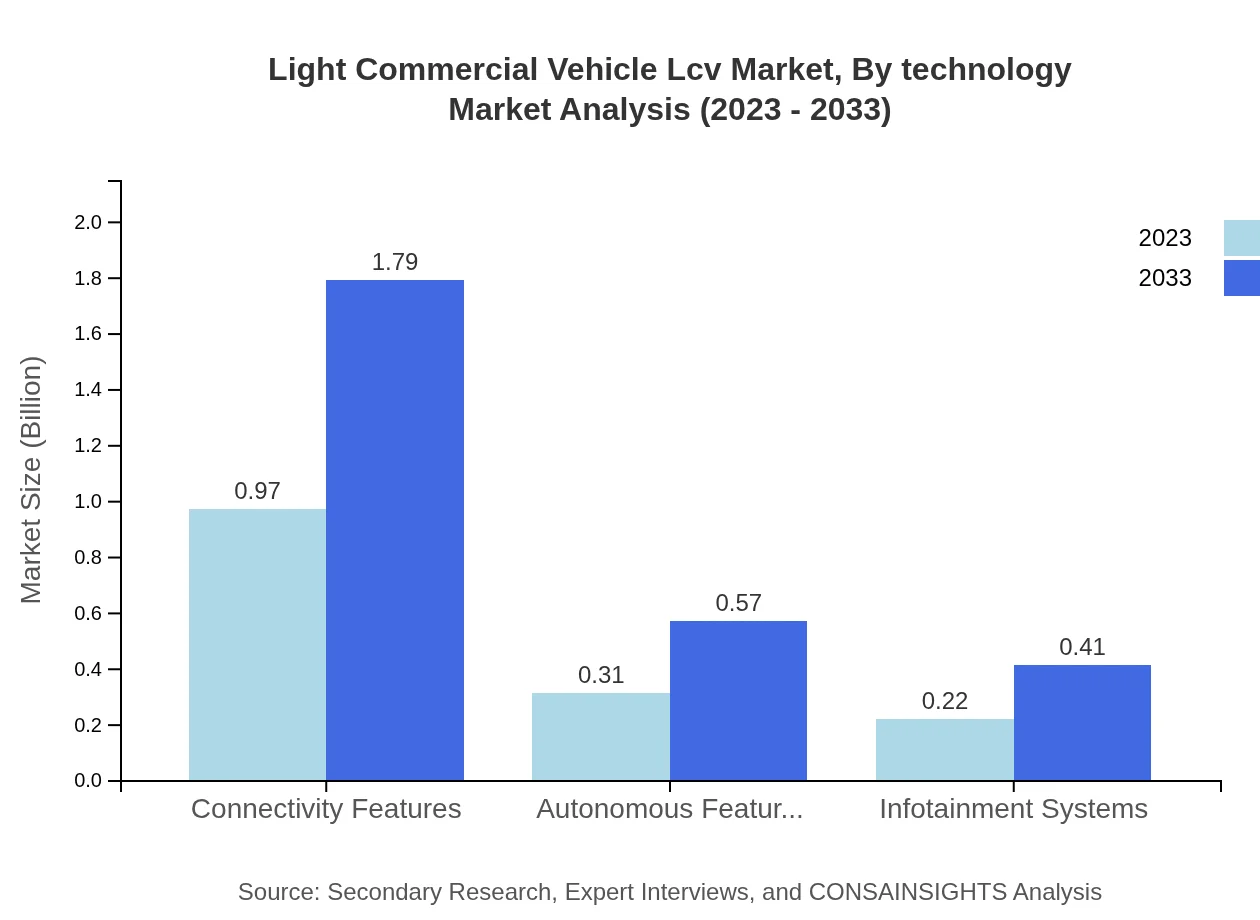

Light Commercial Vehicle Lcv Market Analysis By Technology

Technology segmentation indicates a significant focus on Connectivity Features valued at $0.97 trillion in 2023, holding a share of 64.57%, and exhibiting a keen user interest in digital integrations. Autonomous Features represent a market size of $0.31 trillion, while Infotainment Systems are gaining popularity, expected to grow from $0.22 trillion to $0.41 trillion by 2033.

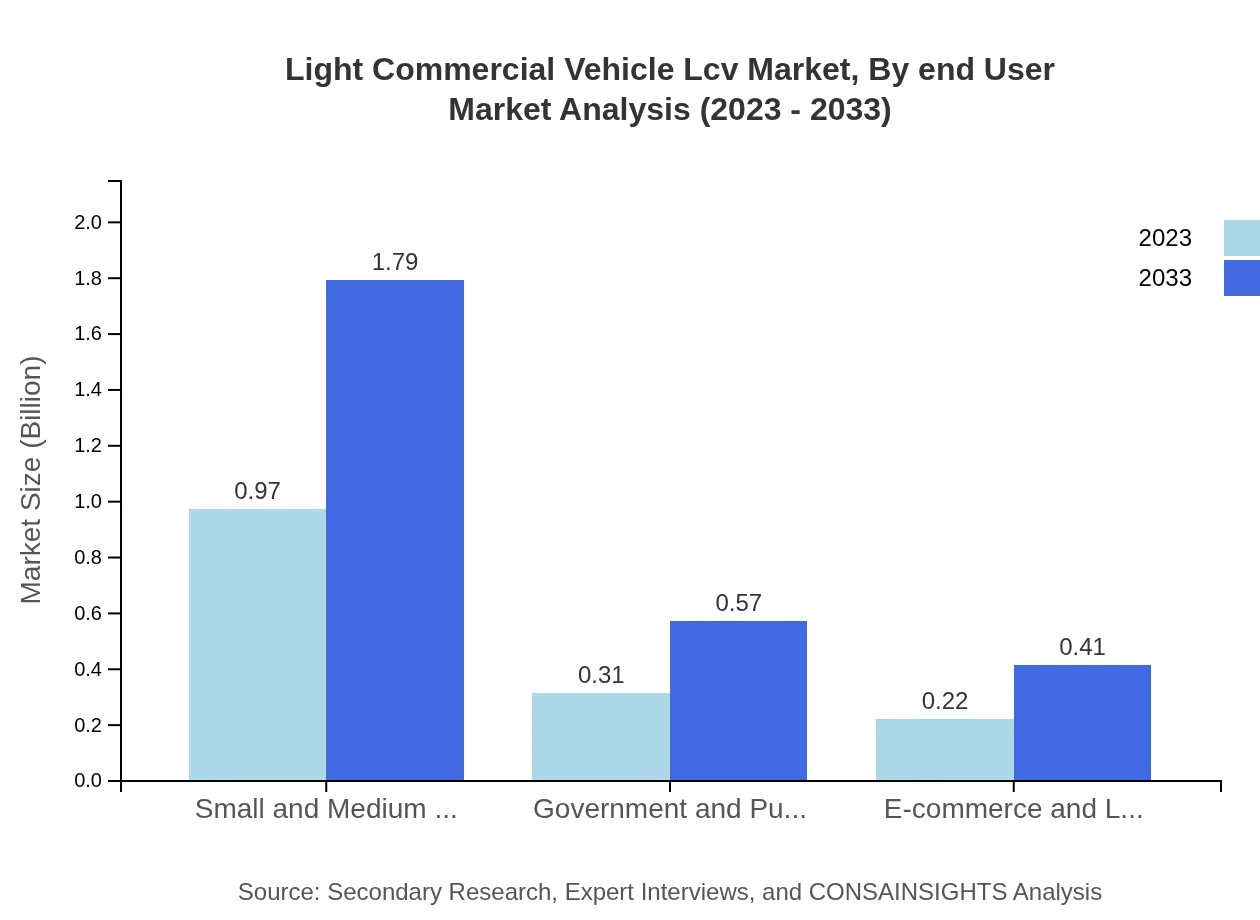

Light Commercial Vehicle Lcv Market Analysis By End User

In terms of end-users, Small and Medium Enterprises (SMEs) dominate the market size with $0.97 trillion in 2023 and a share of 64.57%. The Government and Public Sector represents $0.31 trillion and 20.67%. E-commerce is rapidly growing, supported by the increasing necessity for efficient last-mile delivery systems reflected in the $0.22 trillion market size in 2023.

Light Commercial Vehicle Lcv Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Light Commercial Vehicle Lcv Industry

Ford Motor Company:

A prominent player in the LCV market, known for its diverse range of pickup trucks and vans, focusing on electrification and innovative technology.Mercedes-Benz AG:

A leading manufacturer known for its robust sprinter vans and commitment to integrating pioneering technologies in their LCV offerings.Toyota Motor Corporation:

A market leader recognized for its reliable RAV4 and Hilux trucks, focusing on hybrid and alternative fuel technologies.Renault Group:

Notable for its comprehensive LCV range tailored for urban mobility and strong emphasis on reducing emissions through electric vehicles.Nissan Motor Corporation:

A key player known for its versatility in the LCV segment, providing a wide array of options from e-NV200 electric vans to pickup trucks designed for diverse applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Light Commercial Vehicles (LCV)?

The global Light Commercial Vehicle (LCV) market is projected to reach approximately $1.5 trillion by 2033, reflecting a compound annual growth rate (CAGR) of 6.2% from 2023 to 2033. This growth indicates significant demand and an expanding market presence.

What are the key market players or companies in the Light Commercial Vehicle (LCV) industry?

Key players in the Light Commercial Vehicle (LCV) market include major automotive manufacturers that specialize in production and sales of LCVs. These include Ford, Toyota, Daimler, and Volkswagen, each holding significant market shares with innovative vehicle solutions.

What are the primary factors driving the growth in the Light Commercial Vehicles (LCV) industry?

The growth of the Light Commercial Vehicle (LCV) industry is driven by increasing urbanization, e-commerce demand, logistics expansion, and the growing need for transportation in SMEs. Technological advancements in fuel efficiency and vehicle connectivity further propel market development.

Which region is the fastest Growing in the Light Commercial Vehicles (LCV) industry?

The Asia Pacific region is rapidly growing in the Light Commercial Vehicle (LCV) market, expected to increase from $0.31 trillion in 2023 to $0.58 trillion in 2033. This growth results from rising economies and demand for logistics solutions.

Does ConsaInsights provide customized market report data for the Light Commercial Vehicles (LCV) industry?

Yes, ConsaInsights offers tailored market report data for the Light Commercial Vehicles (LCV) industry, allowing clients to gain specialized insights and analyses based on specific requirements, enhancing decision-making processes.

What deliverables can I expect from this Light Commercial Vehicles (LCV) market research project?

From the Light Commercial Vehicles (LCV) market research project, expect comprehensive deliverables including detailed reports, market forecasts, segmentation analyses, competitive landscape evaluations, and strategic recommendations tailored to your needs.

What are the market trends of Light Commercial Vehicles (LCV)?

Current market trends for Light Commercial Vehicles (LCV) include an increasing focus on electric and hybrid models, advanced connectivity features, a shift toward autonomous driving technology, and growing demand in transportation and logistics sectors.