Light Duty Vehicle Market Report

Published Date: 02 February 2026 | Report Code: light-duty-vehicle

Light Duty Vehicle Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Light Duty Vehicle market, covering key insights, trends, and forecasts for the years 2023 to 2033. It explores market dynamics, regional analyses, market segmentation, and identifies leading companies in the industry.

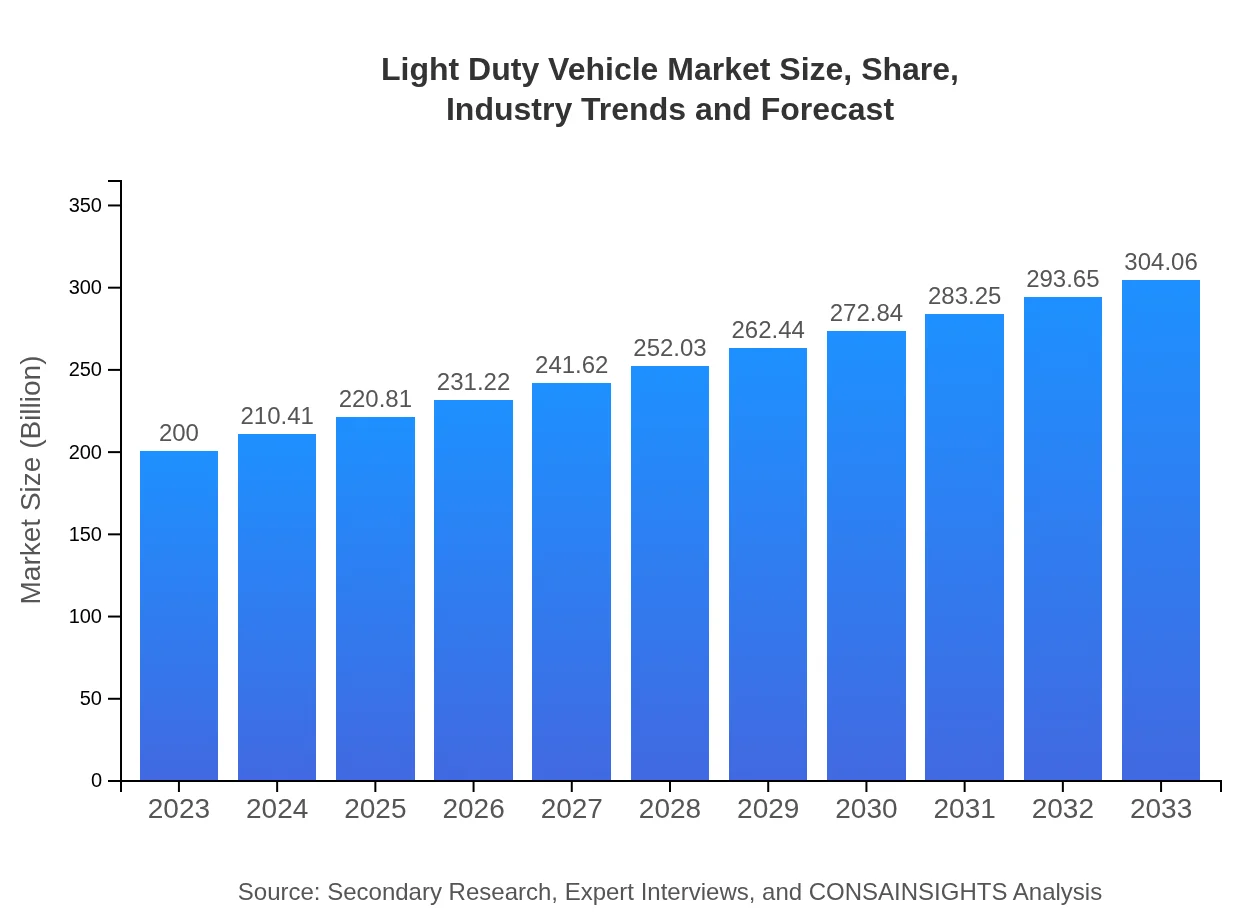

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $304.06 Billion |

| Top Companies | Toyota Motor Corporation, Volkswagen AG, Ford Motor Company, General Motors, Honda Motor Co., Ltd. |

| Last Modified Date | 02 February 2026 |

Light Duty Vehicle Market Overview

Customize Light Duty Vehicle Market Report market research report

- ✔ Get in-depth analysis of Light Duty Vehicle market size, growth, and forecasts.

- ✔ Understand Light Duty Vehicle's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Light Duty Vehicle

What is the Market Size & CAGR of Light Duty Vehicle market in 2023?

Light Duty Vehicle Industry Analysis

Light Duty Vehicle Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Light Duty Vehicle Market Analysis Report by Region

Europe Light Duty Vehicle Market Report:

Valued at $65.48 billion in 2023, Europe's Light Duty Vehicle market is expected to reach $99.55 billion by 2033. Europe's stringent emission regulations and consumer preference for electric vehicles significantly influence this market's growth.Asia Pacific Light Duty Vehicle Market Report:

In 2023, the Asia Pacific Light Duty Vehicle market is valued at approximately $35.76 billion, projected to grow to $54.37 billion by 2033. This growth stems from increasing economic growth, a burgeoning middle class, and evolving infrastructure, particularly in electric vehicle adoption.North America Light Duty Vehicle Market Report:

The North American Light Duty Vehicle market is anticipated to be valued at $71.58 billion in 2023, expected to grow to $108.82 billion by 2033. Strong demand for trucks and a high per capita income, combined with a growing interest in fuel-efficient vehicles, drive this market.South America Light Duty Vehicle Market Report:

The South American market for Light Duty Vehicles in 2023 is projected at $17.76 billion, reaching around $27.00 billion by 2033. The growth in this region is supported by increasing urbanization and a shift towards more efficient vehicles, but constrained by economic factors.Middle East & Africa Light Duty Vehicle Market Report:

In 2023, the market size in the Middle East and Africa stands at $9.42 billion, likely to grow to $14.32 billion by 2033. Increasing investments in automotive manufacturing and shifts towards more sustainable vehicle options contribute to this growth.Tell us your focus area and get a customized research report.

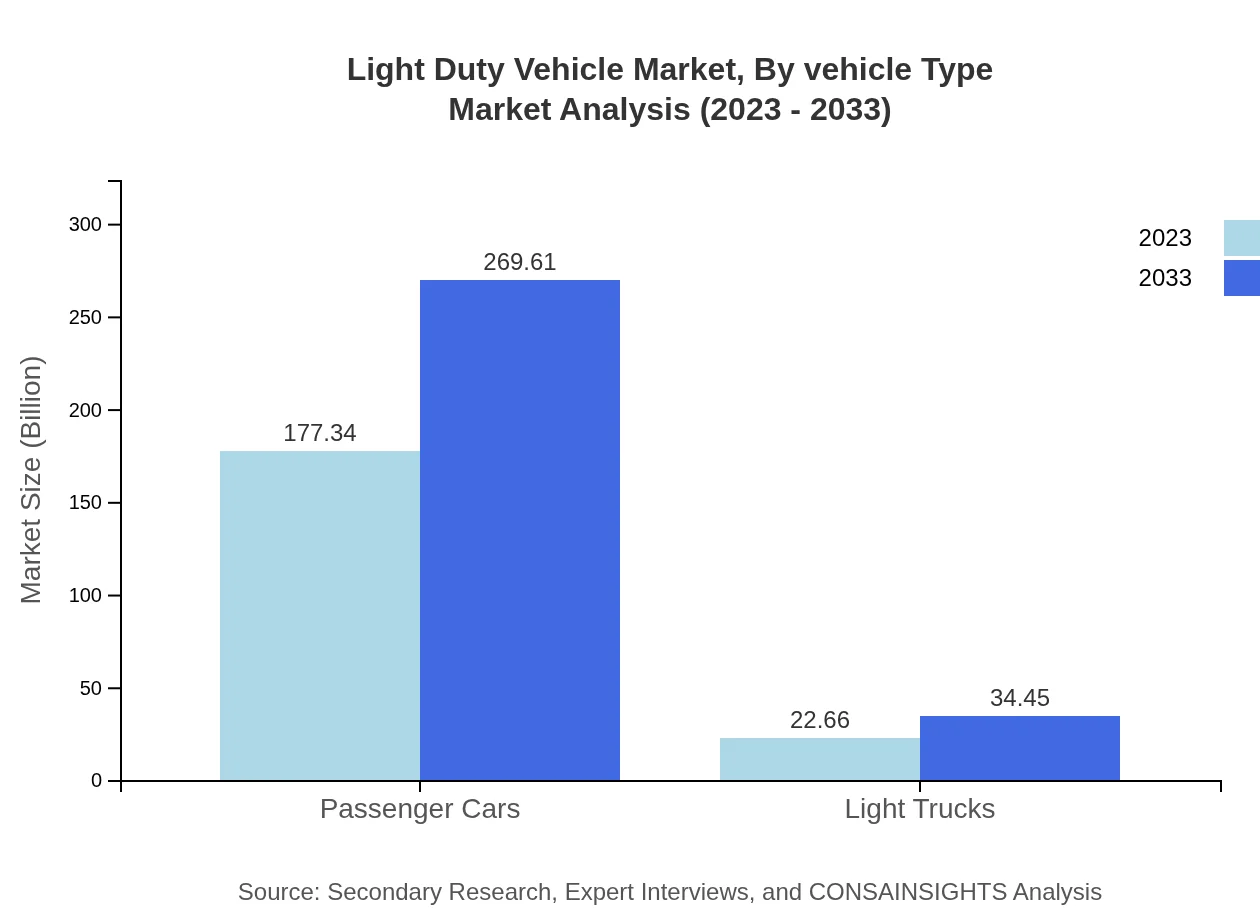

Light Duty Vehicle Market Analysis By Vehicle Type

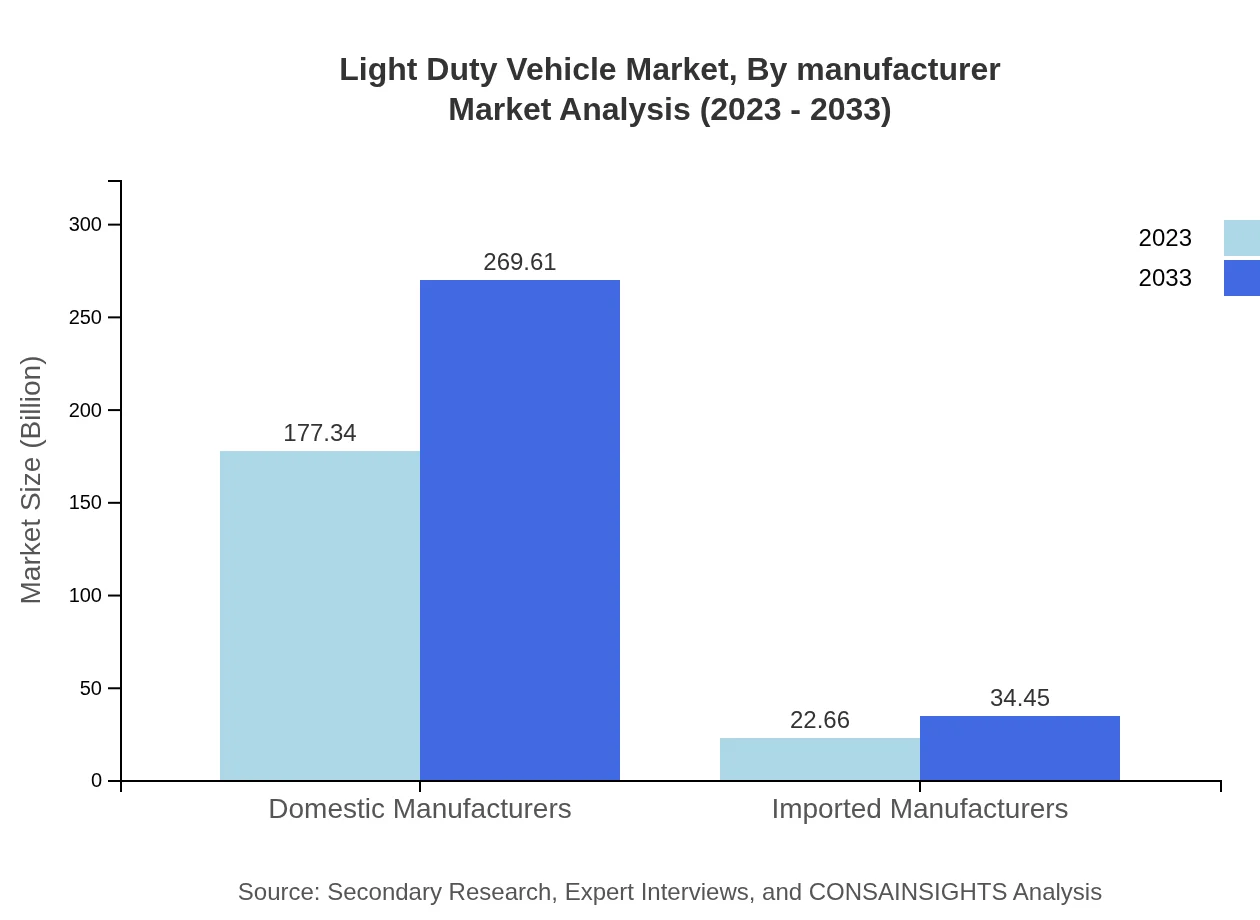

The passenger cars segment is prominent, accounting for a significant portion of the market with estimated sizes of $177.34 billion in 2023, growing to $269.61 billion by 2033. Light trucks, with a size of $22.66 billion in 2023 set to reach $34.45 billion by the end of the forecast period, also play a critical role in this segment.

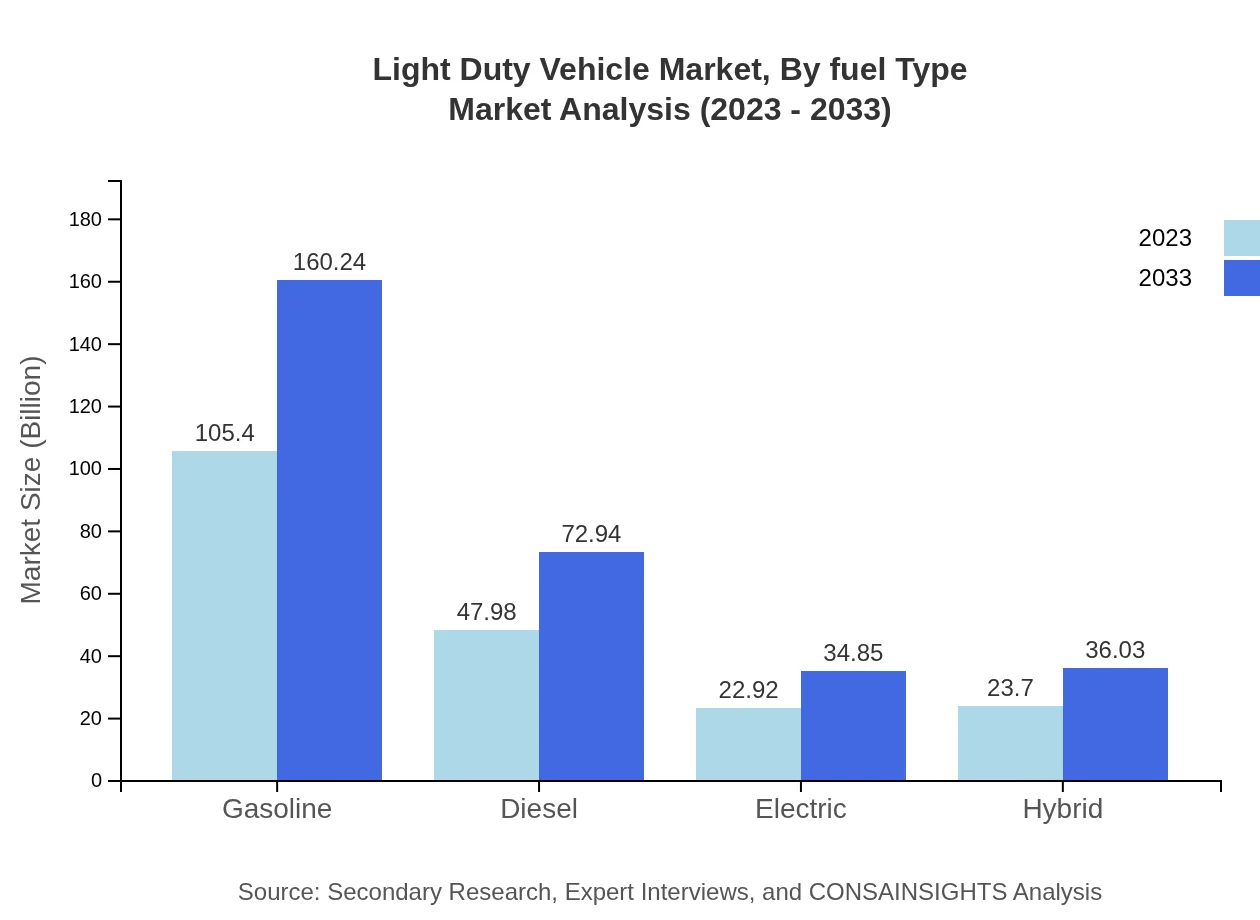

Light Duty Vehicle Market Analysis By Fuel Type

The market for gasoline-powered LDVs is projected to be the largest, showing a significant size from $105.40 billion in 2023 to $160.24 billion by 2033, maintaining a market share of 52.7%. Diesel vehicles are also substantial, estimated at $47.98 billion in 2023 growing to $72.94 billion by 2033, maintaining a share of 23.99%. The electric vehicle segment is gaining momentum projected to grow from $22.92 billion to $34.85 billion, capturing an 11.46% share, while hybrid vehicles also show promise with an increase from $23.70 billion to $36.03 billion.

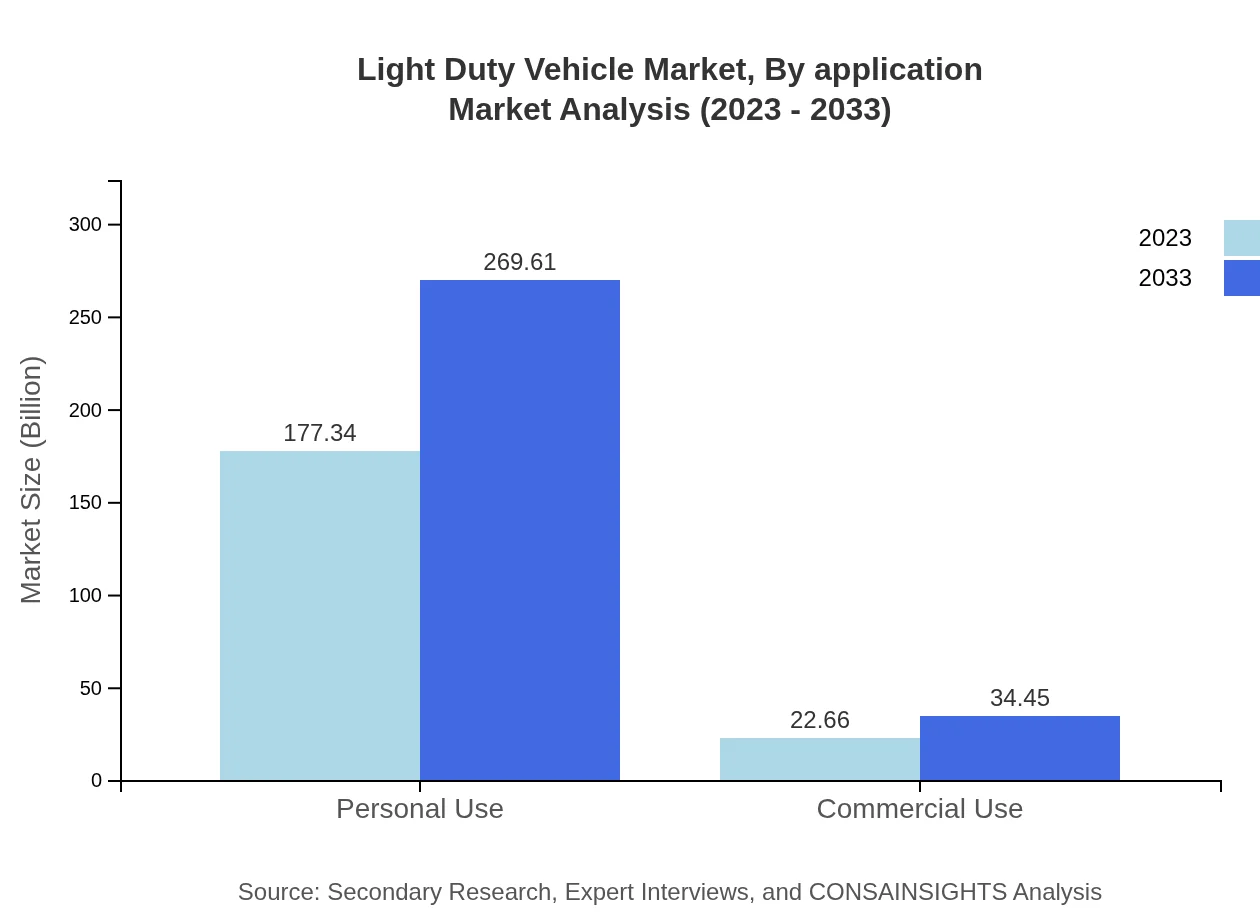

Light Duty Vehicle Market Analysis By Application

Personal use dominates the market, with values of $177.34 billion in 2023 and increasing to $269.61 billion by 2033, holding a market share of 88.67%. Commercial use, though smaller, is also growing from $22.66 billion to $34.45 billion, taking up 11.33% of the market.

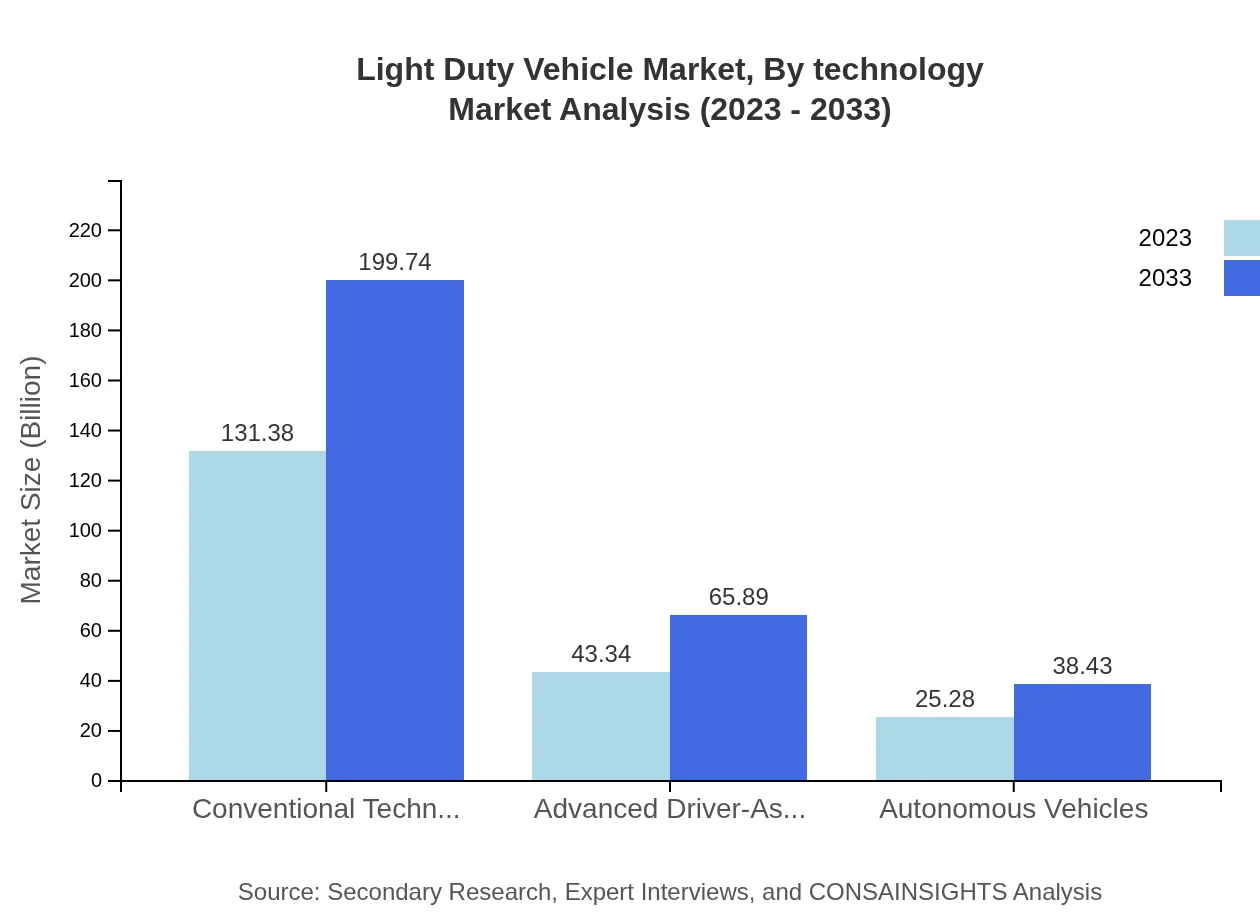

Light Duty Vehicle Market Analysis By Technology

The segment for conventional technology is substantial, currently at $131.38 billion, growing to $199.74 billion, depicting a share of 65.69%. Advanced Driver-Assistance Systems (ADAS) hold considerable relevance, moving from $43.34 billion to $65.89 billion with a 21.67% market share, while autonomous vehicles are growing steadily from $25.28 billion to $38.43 billion.

Light Duty Vehicle Market Analysis By Manufacturer

Domestic manufacturers dominate the market with $177.34 billion in 2023, predicted to increase to $269.61 billion by 2033, realizing an 88.67% market share. Imported manufacturers currently hold a market share of 11.33%, increasing from $22.66 billion to $34.45 billion.

Light Duty Vehicle Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Light Duty Vehicle Industry

Toyota Motor Corporation:

A leader in the automotive industry known for its production of energy-efficient vehicles, including a strong portfolio of hybrids and electrics.Volkswagen AG:

A global automotive powerhouse renowned for its broad range of passenger and commercial vehicles, with significant investments in electric mobility.Ford Motor Company:

An iconic American automaker making strides in electrification and connected vehicle technologies.General Motors:

A leading manufacturer pushing boundaries in electric mobility, heavily investing in sustainable vehicle technologies.Honda Motor Co., Ltd.:

A recognized player in the light-duty vehicle sector, focusing on advanced technologies and fuel efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of light Duty Vehicle?

The global market size for light-duty vehicles is projected to reach approximately $200 billion in 2033, growing at a CAGR of 4.2% from its current valuation.

What are the key market players or companies in this light Duty Vehicle industry?

Key players in the light-duty vehicle market include major automotive manufacturers and suppliers, particularly those focusing on gasoline, diesel, and electric vehicle technologies.

What are the primary factors driving the growth in the light Duty Vehicle industry?

Growth factors in the light-duty vehicle industry include increasing urbanization, demand for advanced driver-assistance systems (ADAS), and heightened consumer focus on fuel efficiency and environmental sustainability.

Which region is the fastest Growing in the light Duty vehicle market?

The Asia Pacific region is forecasted as the fastest-growing market for light-duty vehicles, with market size increasing from $35.76 billion in 2023 to $54.37 billion by 2033.

Does ConsaInsights provide customized market report data for the light Duty Vehicle industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the light-duty vehicle sector, enabling clients to make informed decisions.

What deliverables can I expect from this light Duty vehicle market research project?

Deliverables from the light-duty vehicle market research project typically include detailed market analysis, segmentation data, trends, forecasts, and actionable insights.

What are the market trends of light Duty Vehicle?

Current market trends in light-duty vehicles include a significant shift towards electric and hybrid models, integration of smart technology, and increasing consumer preference for sustainability.