Light Sensors Market Report

Published Date: 31 January 2026 | Report Code: light-sensors

Light Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Light Sensors market from 2023 to 2033, covering market trends, size, growth forecasts, segmentations, and regional insights to guide stakeholders in strategic planning.

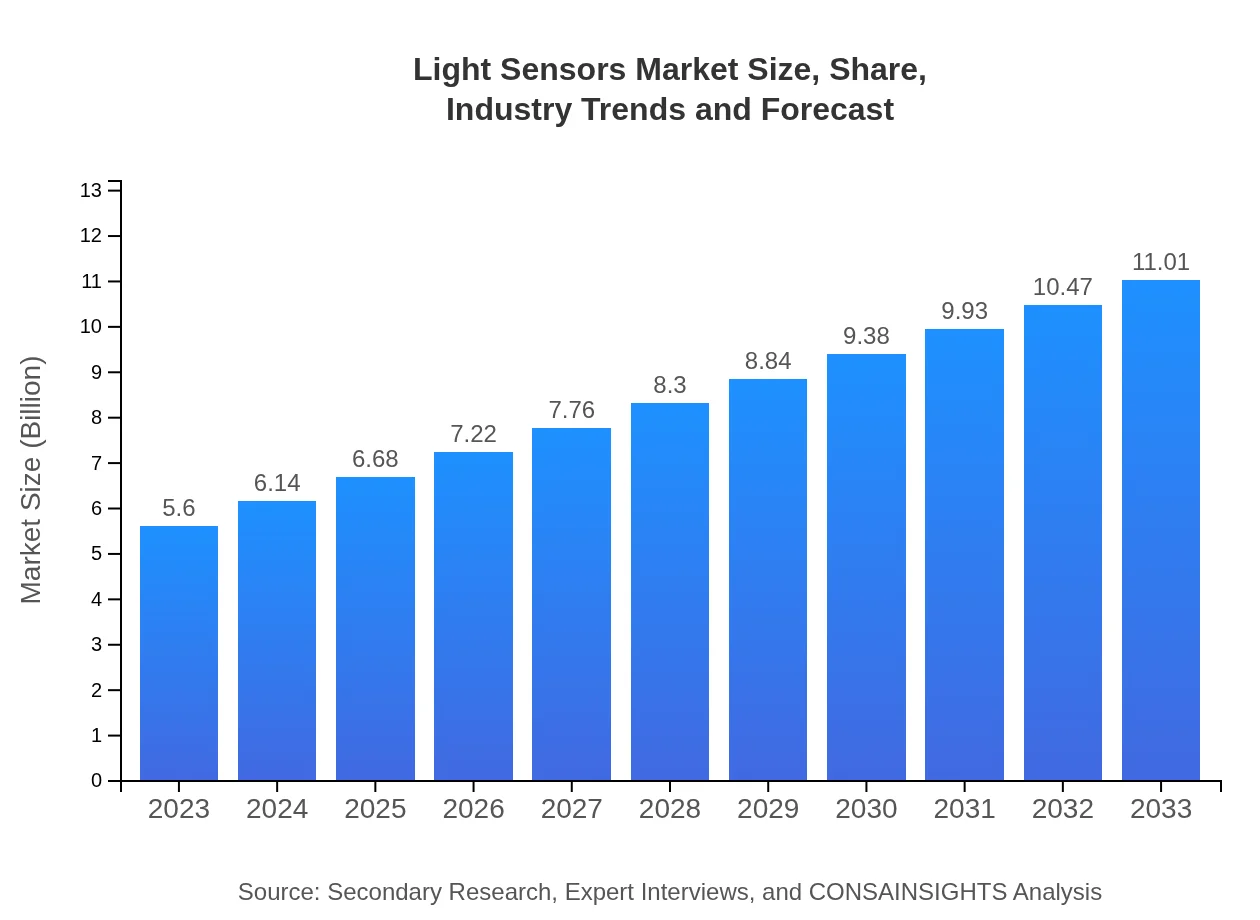

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Texas Instruments, ON Semiconductor, AMS AG, Maxim Integrated |

| Last Modified Date | 31 January 2026 |

Light Sensors Market Overview

Customize Light Sensors Market Report market research report

- ✔ Get in-depth analysis of Light Sensors market size, growth, and forecasts.

- ✔ Understand Light Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Light Sensors

What is the Market Size & CAGR of Light Sensors market in 2023 and 2033?

Light Sensors Industry Analysis

Light Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Light Sensors Market Analysis Report by Region

Europe Light Sensors Market Report:

The European market for Light Sensors is expected to rise from $1.69 billion in 2023 to $3.33 billion by 2033, thanks to strict energy regulations and a stronger emphasis on sustainability. The region is seeing a spike in demand for smart building technologies, which significantly incorporate light sensors.Asia Pacific Light Sensors Market Report:

The Asia-Pacific region, valued at $1.05 billion in 2023, is expected to witness substantial growth, reaching approximately $2.06 billion by 2033. Factors driving this growth include increasing urbanization, government incentives for smart infrastructure, and rising consumer electronics manufacturing. Countries like China and Japan are leading the market with significant investments in technology.North America Light Sensors Market Report:

North America is projected to expand from $2.05 billion in 2023 to around $4.03 billion by 2033, fueled by technological advancements in smart sensors and a higher rate of adoption in automotive and healthcare sectors. The U.S. remains a substantial contributor to this growth due to its emphasis on smart technologies.South America Light Sensors Market Report:

In South America, the Light Sensors market is expected to grow from $0.45 billion in 2023 to $0.88 billion by 2033. The growth will be driven by the increasing adoption of energy-efficient solutions and government initiatives aimed at promoting sustainable technologies in key industries.Middle East & Africa Light Sensors Market Report:

In the Middle East and Africa, the market is projected to grow from $0.36 billion in 2023 to $0.72 billion by 2033. Growth in this region is primarily driven by infrastructural developments and a gradual shift towards smart technologies in urban planning and construction.Tell us your focus area and get a customized research report.

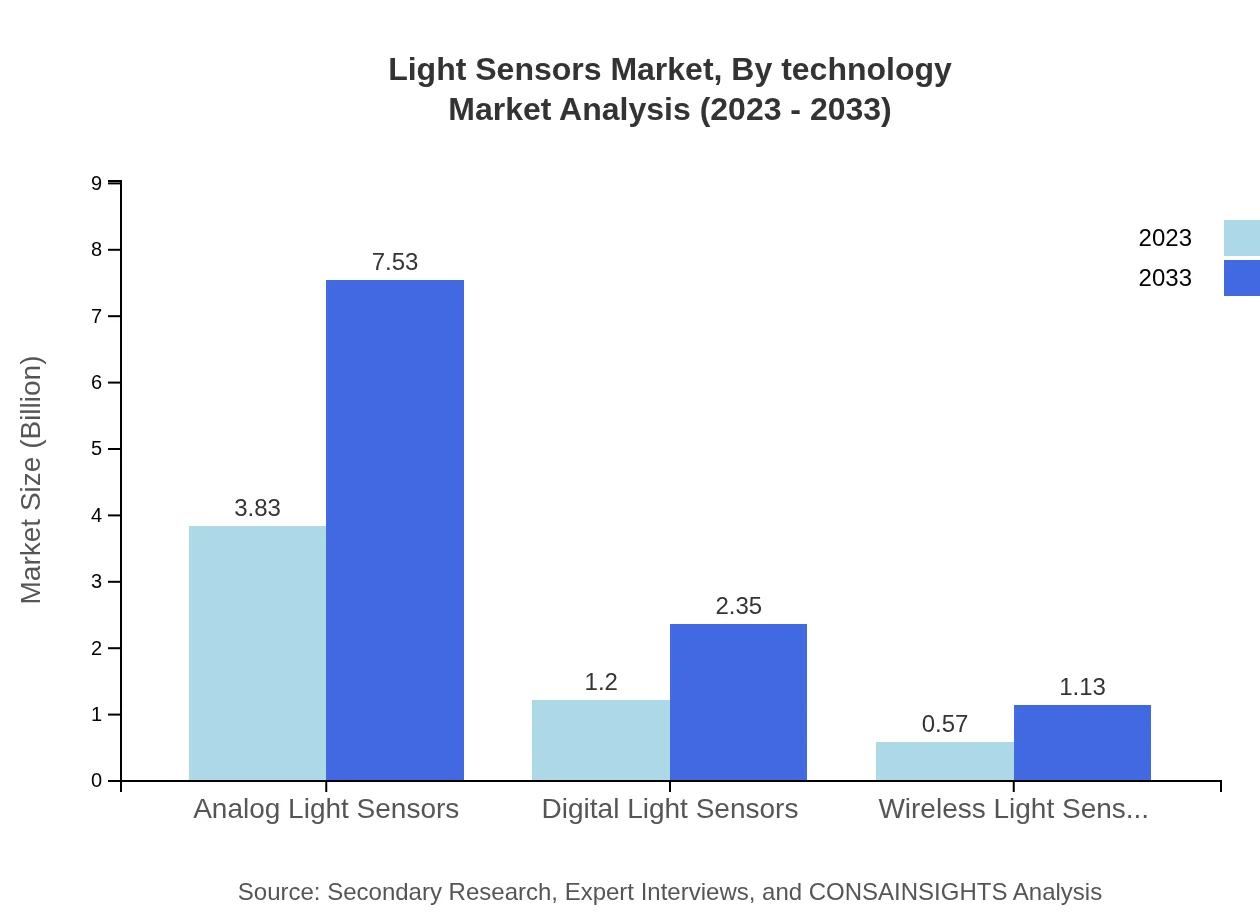

Light Sensors Market Analysis By Type

The Light Sensors market by type includes Analog Light Sensors, Digital Light Sensors, and Wireless Light Sensors. In 2023, Analog Light Sensors accounted for approximately $3.83 billion, expected to grow to $7.53 billion by 2033, maintaining a share of around 68.41%. Digital Light Sensors represent a smaller share but show significant growth potential, moving from $1.20 billion in 2023 to $2.35 billion by 2033 at a 21.34% market share.

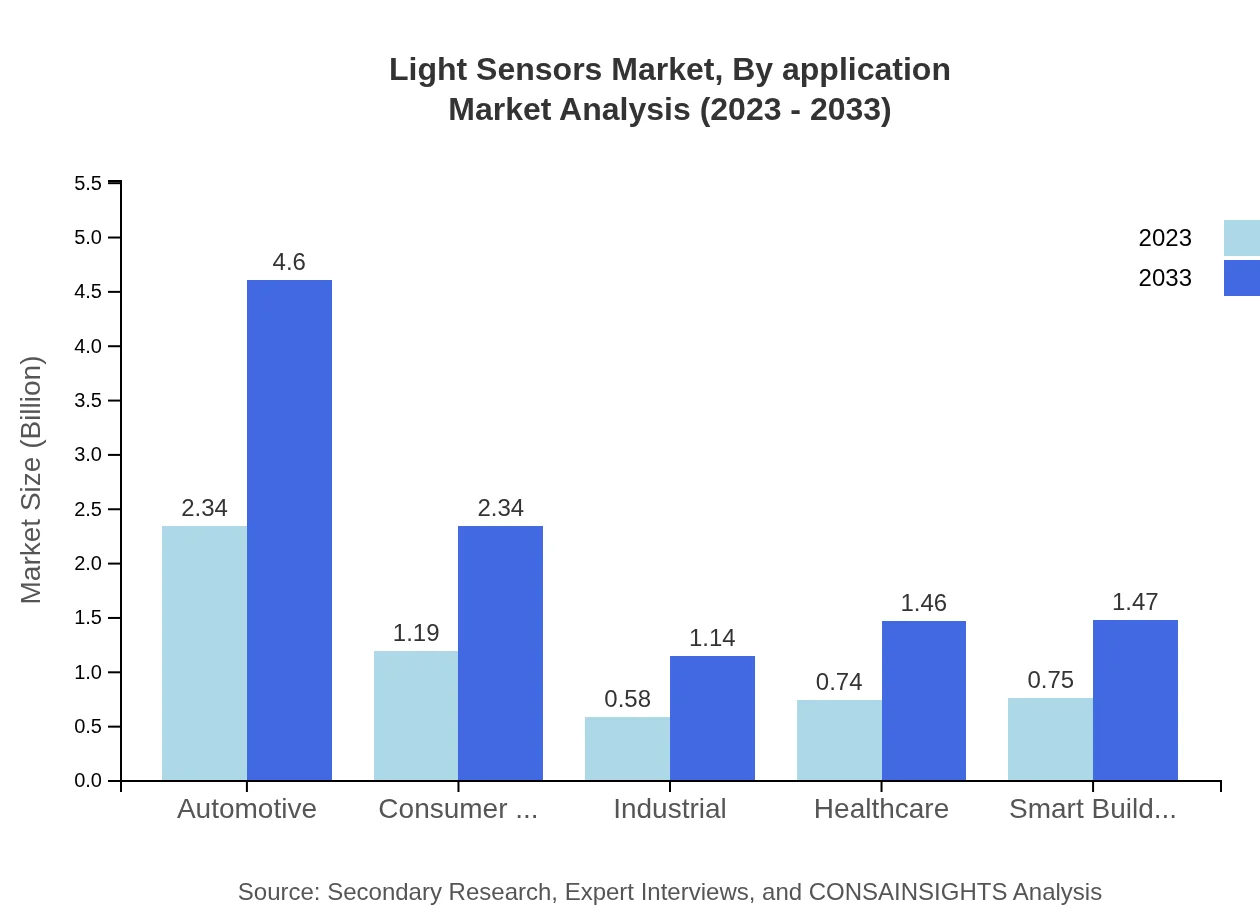

Light Sensors Market Analysis By Application

Applications of Light Sensors are segmented into Consumer Goods, Automotive, Industrial, Healthcare, and Smart Buildings. Consumer Goods lead the market with $2.34 billion in 2023, growing to $4.60 billion by 2033. The Automotive sector follows closely, showcasing a sharp rise from $2.34 billion to $4.60 billion, driven by increased automation and safety features.

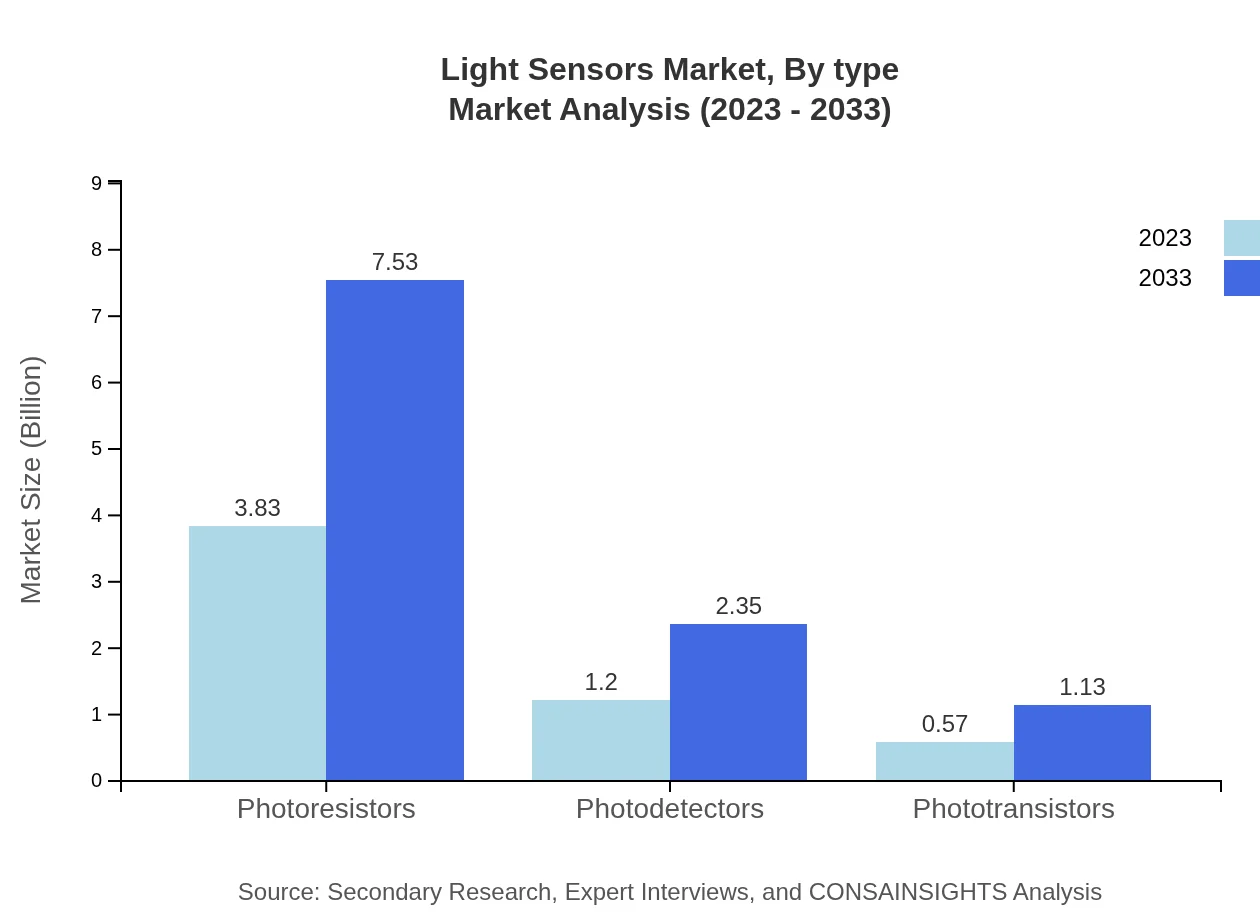

Light Sensors Market Analysis By Technology

The market is also segmented by technology, incorporating traditional and modern approaches. Photoresistors dominate, growing from $3.83 billion in 2023 to $7.53 billion by 2033. Photodetectors and Phototransistors also contribute significantly, expected to grow substantially in line with advancements in photonics technology.

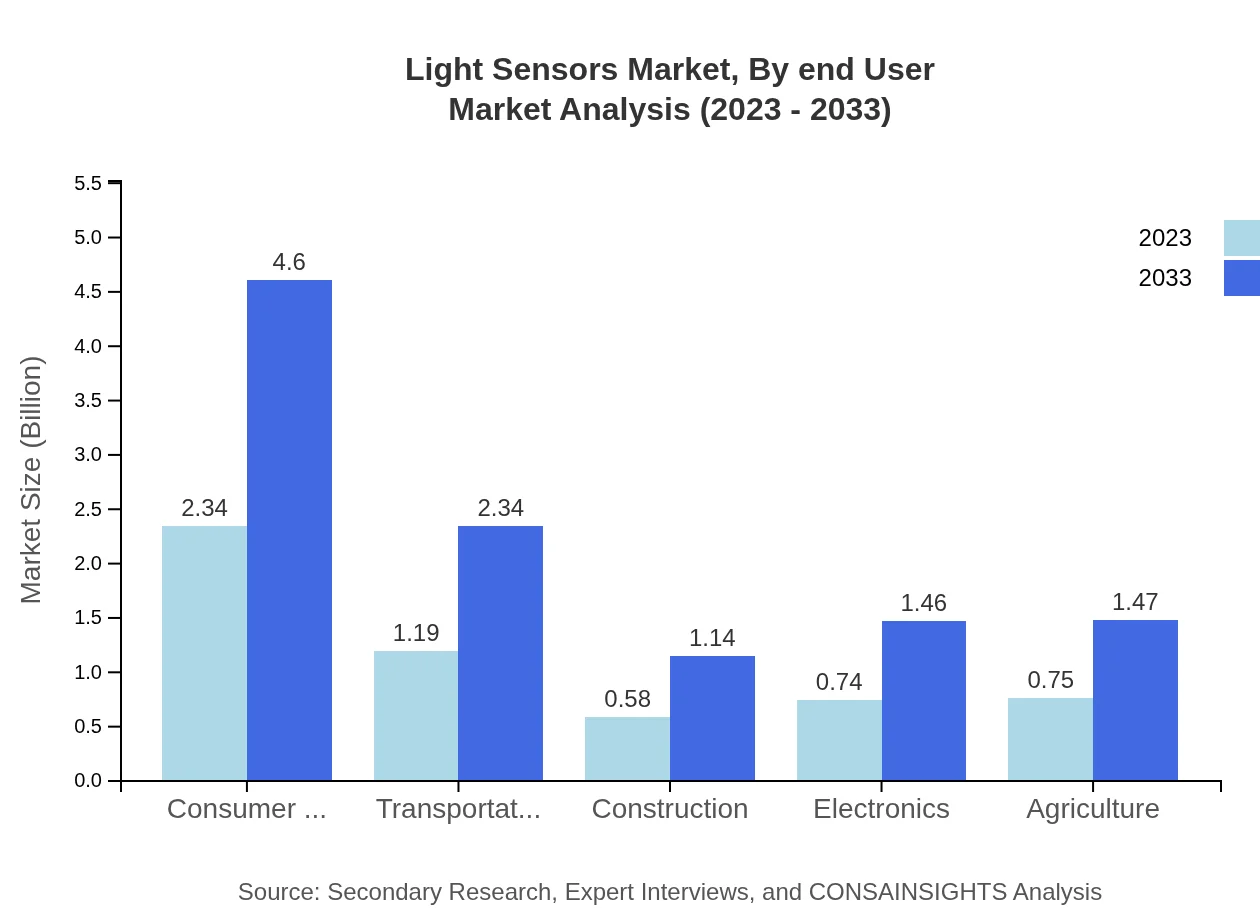

Light Sensors Market Analysis By End User

End-user segmentation highlights growth in sectors like Consumer Electronics, Automotive, and Healthcare. Consumer Electronics consume a significant share, while the Automotive sector is rapidly evolving with the integration of smart sensor technologies, enhancing safety and automation functions.

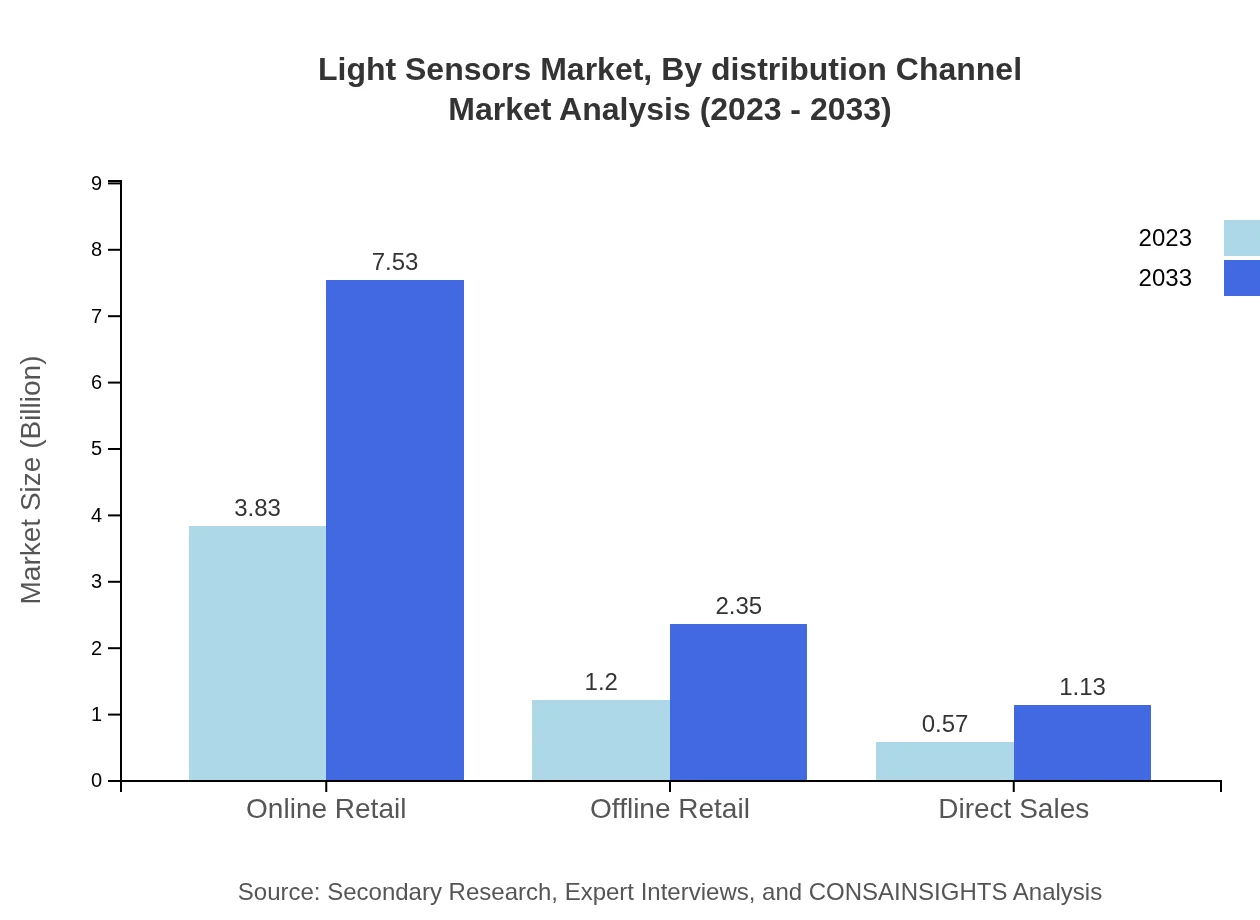

Light Sensors Market Analysis By Distribution Channel

Distribution channels include Online Retail, Offline Retail and Direct Sales. Online retailing stands out with $3.83 billion in 2023 and is expected to grow to $7.53 billion by 2033, significantly benefiting from the booming e-commerce sector.

Light Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Light Sensors Industry

Texas Instruments:

A major player in the semiconductor industry, Texas Instruments offers a broad range of light sensor solutions that are known for their high precision and reliability.ON Semiconductor:

ON Semiconductor provides innovative sensor technologies and solutions that cater to various applications in automotive and industrial sectors.AMS AG:

Specializing in sensor solutions, AMS AG is a leader in the market for light sensors, focusing on integrating advanced technologies for enhanced performance.Maxim Integrated:

Maxim Integrated designs and manufactures a comprehensive range of light sensors used in consumer electronics, further driving innovation within the sector.We're grateful to work with incredible clients.

FAQs

What is the market size of light Sensors?

In 2023, the global light sensors market is valued at approximately $5.6 billion and is projected to grow at a CAGR of 6.8%, reaching significant milestones by 2033. This growth is driven by increasing adoption across various industries.

What are the key market players or companies in the light Sensors industry?

Key players in the light sensors market include Texas Instruments, ROHM Semiconductor, Vishay Intertechnology, and Osram Opto Semiconductors. These companies are pivotal in shaping the market through innovation and product development, intensifying competition.

What are the primary factors driving the growth in the light Sensors industry?

Growth in the light sensors industry is driven by increasing demand for energy-efficient lights, the proliferation of smart devices, advancements in sensor technology, and rising environmental concerns. These factors collectively enhance the market landscape.

Which region is the fastest Growing in the light Sensors?

The Asia Pacific region is the fastest-growing market for light sensors, forecasted to grow from $1.05 billion in 2023 to $2.06 billion by 2033. Factors include growing consumer electronics demand and increased investments in smart city projects.

Does ConsaInsights provide customized market report data for the light Sensors industry?

Yes, ConsaInsights offers customized market report data for the light sensors industry tailored to specific client needs. This flexibility ensures that stakeholders receive targeted insights and analytical data for strategic decision-making.

What deliverables can I expect from this light Sensors market research project?

Deliverables from the light sensors market research project typically include detailed market analysis reports, regional insights, competitive landscape assessments, segment analysis, and forecasts with relevant market metrics to guide strategic initiatives.

What are the market trends of light sensors?

Current trends in the light sensors market include rising adoption of smart lighting solutions, integration of sensors in consumer electronics, and advancements in analog and digital sensor technologies, contributing to enhanced user experiences and energy efficiency.