Light Weapons Market Report

Published Date: 03 February 2026 | Report Code: light-weapons

Light Weapons Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Light Weapons market, offering insights into market trends, sizes, growth forecasts, and key players from 2023 to 2033. A detailed examination of regional markets, technologies, and segment-specific dynamics is provided.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

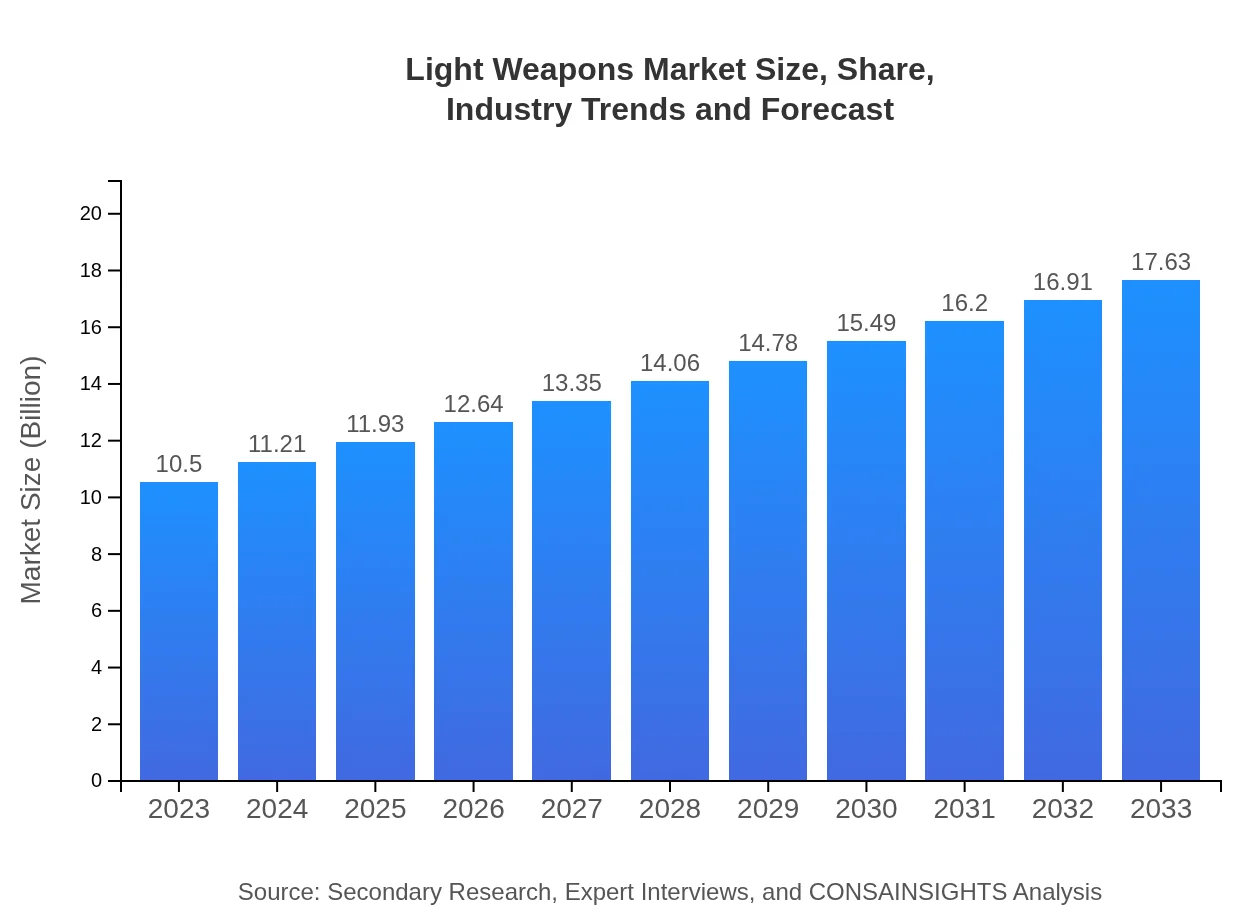

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Lockheed Martin, Smith & Wesson, Ruger, Heckler & Koch, Beretta |

| Last Modified Date | 03 February 2026 |

Light Weapons Market Overview

Customize Light Weapons Market Report market research report

- ✔ Get in-depth analysis of Light Weapons market size, growth, and forecasts.

- ✔ Understand Light Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Light Weapons

What is the Market Size & CAGR of the Light Weapons market in 2023?

Light Weapons Industry Analysis

Light Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Light Weapons Market Analysis Report by Region

Europe Light Weapons Market Report:

The European Light Weapons market is valued at $2.84 billion in 2023, projected to grow to $4.76 billion by 2033, indicating a CAGR of 6.02%. Ongoing geopolitical tensions and regulatory changes are driving military and civilian investments in light arms.Asia Pacific Light Weapons Market Report:

The Asia Pacific region's Light Weapons market is estimated at $2.06 billion in 2023, projected to grow to $3.46 billion by 2033, with a CAGR of around 6.15%. This growth is attributed to heightened military investments by countries like India and Japan, alongside the increasing commercial civilian market.North America Light Weapons Market Report:

North America holds a significant share of the global Light Weapons market, valued at $3.85 billion in 2023, expected to rise to $6.47 billion by 2033. Factors include a robust defense budget and high civilian demand for firearms, leading to a projected CAGR of 6.51%.South America Light Weapons Market Report:

In South America, the market size is projected to increase from $0.49 billion in 2023 to $0.83 billion by 2033. The growth is supported by rising security concerns and ongoing conflicts in various regions, leading to increased demand for personal and law enforcement firearms, with a CAGR of approximately 5.40%.Middle East & Africa Light Weapons Market Report:

In the Middle East and Africa, the market is expected to increase from $1.26 billion in 2023 to $2.11 billion by 2033. The region's CAGR is approximately 6.44%, driven by regional conflicts and a rising focus on defense procurement.Tell us your focus area and get a customized research report.

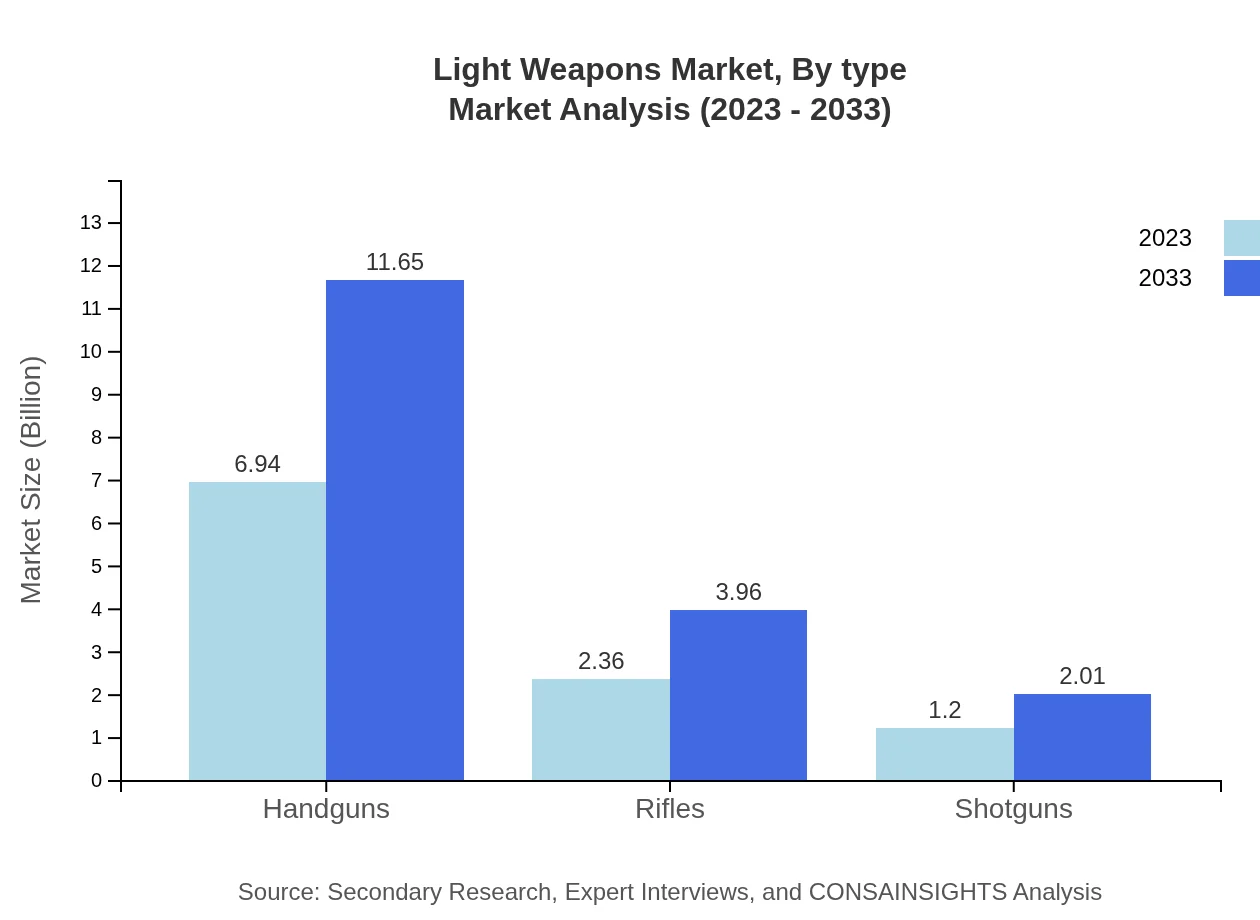

Light Weapons Market Analysis By Type

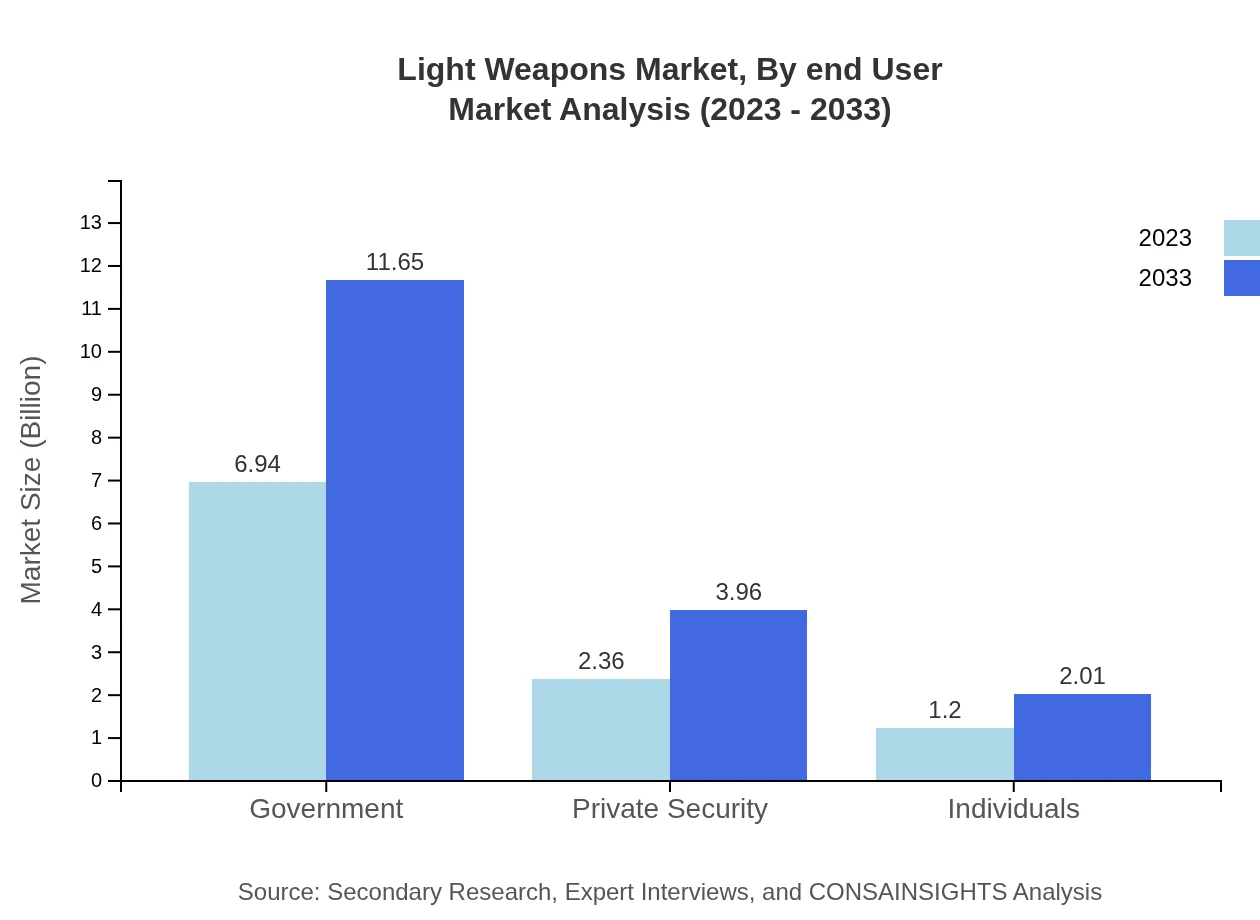

The Light Weapons market by type is dominated by Handguns, which are projected to grow from $6.94 billion in 2023 to $11.65 billion by 2033, maintaining a share of 66.1%. Rifles are the second major type, growing from $2.36 billion to $3.96 billion during the same period, and Shotguns, while smaller, will see growth from $1.20 billion to $2.01 billion.

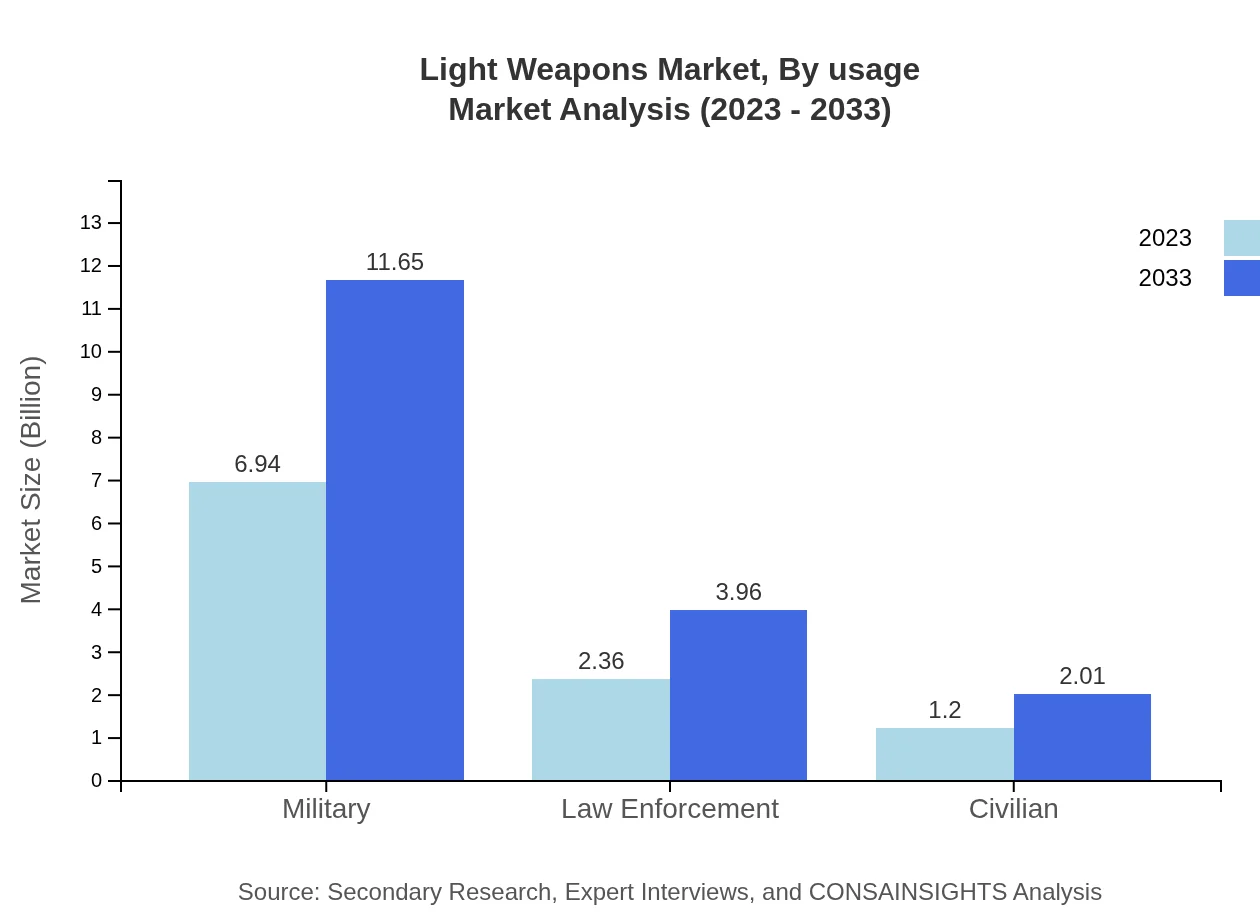

Light Weapons Market Analysis By Usage

Military usage dominates the market, accounting for $6.94 billion in 2023 with growth to $11.65 billion by 2033. Law Enforcement, with a size of $2.36 billion in 2023 and rising to $3.96 billion, and Civilian use increasing from $1.20 billion to $2.01 billion also play significant roles in market dynamics.

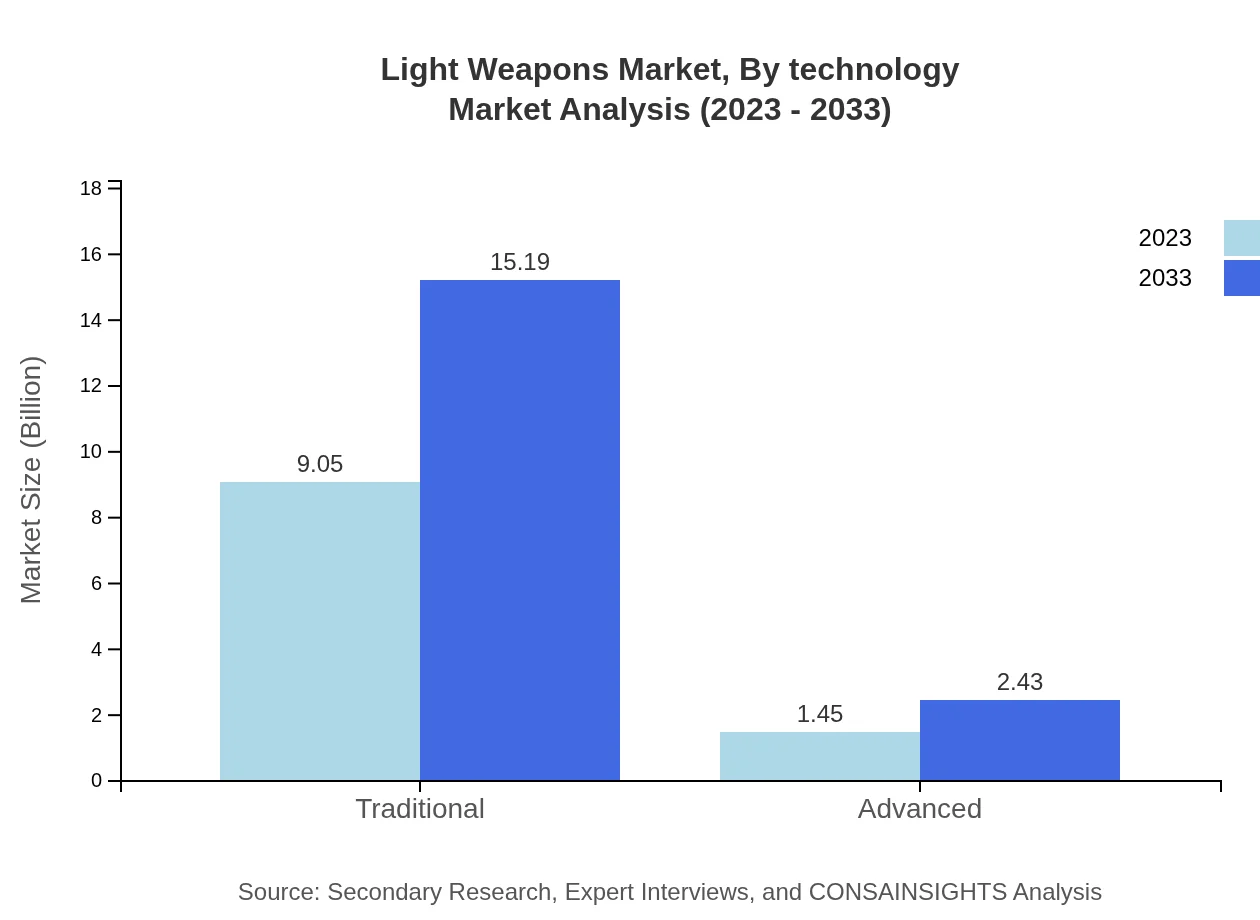

Light Weapons Market Analysis By Technology

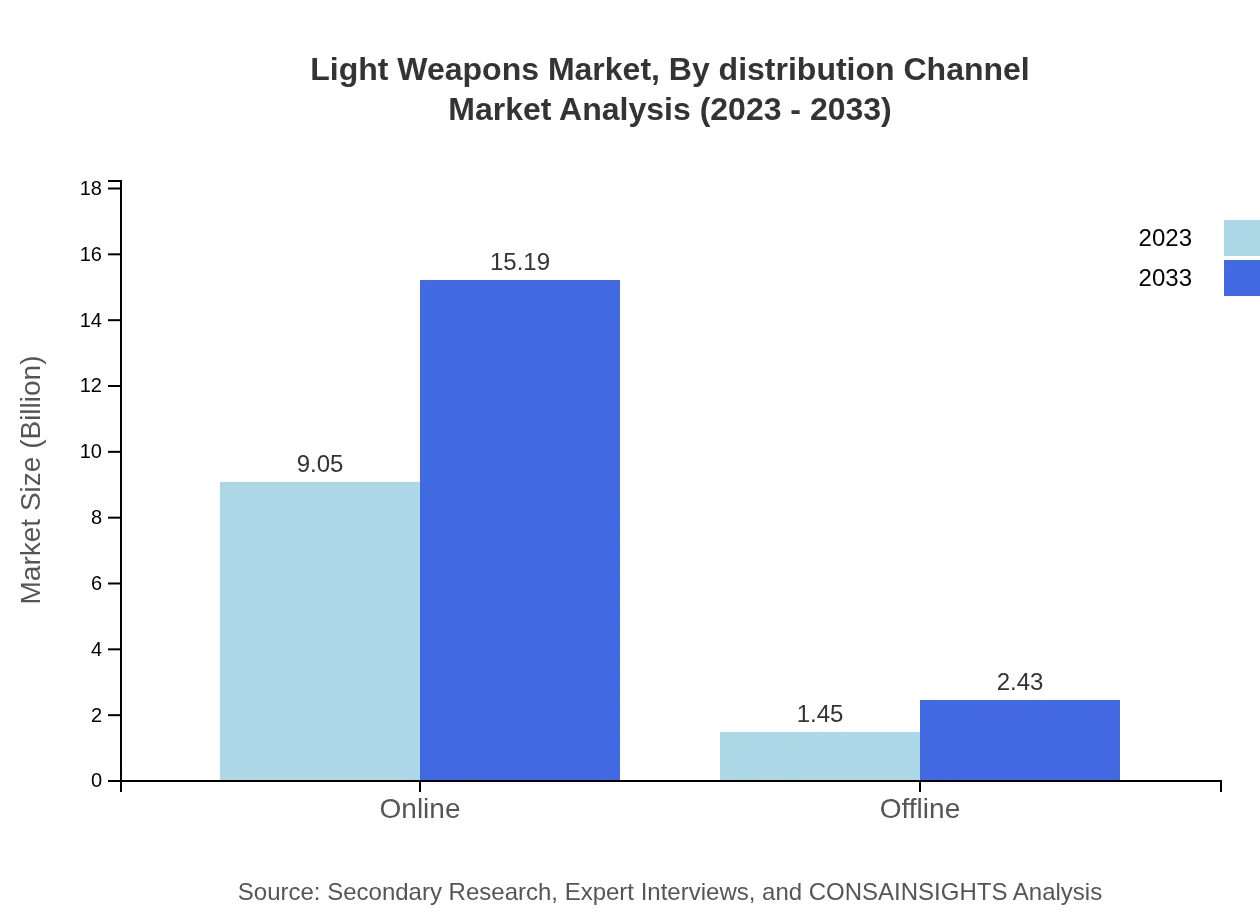

The segmented analysis by technology shows a strong preference for Traditional weapons, maintaining a market size of $9.05 billion in 2023 and expected to reach $15.19 billion by 2033. In contrast, Advanced weapons, valued at $1.45 billion initially, are projected to grow to $2.43 billion, representing innovative advancements in weaponry.

Light Weapons Market Analysis By Distribution Channel

Online channels dominate the distribution of light weapons, holding a size of $9.05 billion in 2023 and projected to grow to $15.19 billion by 2033. Offline channels, starting at $1.45 billion in 2023, are also growing, but at a slower pace, expected to reach $2.43 billion.

Light Weapons Market Analysis By End User

Government and military sectors are the largest end-users, demonstrating stable growth from $6.94 billion to $11.65 billion over the forecast period. In contrast, the Private Security sector, with sizes of $2.36 billion to $3.96 billion, and individual consumers, increasing from $1.20 billion to $2.01 billion, showcase the expanding market beyond traditional military applications.

Light Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Light Weapons Industry

Lockheed Martin:

A leading defense contractor that designs and manufactures advanced weapons systems, including light weapons, focusing on innovation and high-performance technologies.Smith & Wesson:

A prominent manufacturer of firearms, particularly known for its handguns, leading the civilian and law enforcement markets with a strong emphasis on quality and reliability.Ruger:

An established player in the firearms market, renowned for its expansive range of pistols and rifles, emphasizing personalized service and product development.Heckler & Koch:

A German defense manufacturer acclaimed for producing a broad array of firearms for military and law enforcement with a strong reputation for quality and effectiveness.Beretta:

An Italian firearm maker with a legacy of excellence and craftsmanship, known for its pistols and shotguns utilized by military and law enforcement worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of Light Weapons?

The light weapons market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2%, indicating strong potential for growth and expansion through 2033.

What are the key market players or companies in this Light Weapons industry?

Key players in the light weapons industry include major military contractors and firearms manufacturers. Companies like Smith & Wesson, Heckler & Koch, and Remington are pivotal, providing essential products for military and law enforcement sectors.

What are the primary factors driving the growth in the Light Weapons industry?

Growth factors include increased defense budgets, rising global conflicts, and heightened security concerns. Innovations in weapon technology and expanding civilian markets also contribute to the demand for light weapons.

Which region is the fastest Growing in the Light Weapons market?

North America is the fastest-growing region in the light weapons market, expected to grow from $3.85 billion in 2023 to $6.47 billion by 2033, supported by strong military expenditures and a robust civilian market.

Does ConsaInsights provide customized market report data for the Light Weapons industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the light weapons industry, enabling clients to obtain precise information relevant to their strategic objectives.

What deliverables can I expect from this Light Weapons market research project?

Deliverables include comprehensive market analysis reports, segmentation insights, competitive landscape evaluations, and regional data forecasts, all essential for informed decision-making in the light weapons sector.

What are the market trends of Light Weapons?

Current trends in the light weapons market include the rise of non-lethal weapons, increased integration of smart technology, and a shift towards more customizable options for law enforcement and military applications.