Lighting Contactor Market Report

Published Date: 22 January 2026 | Report Code: lighting-contactor

Lighting Contactor Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Lighting Contactor market, focusing on current trends, segmentation, regional insights, and future projections from 2023 to 2033.

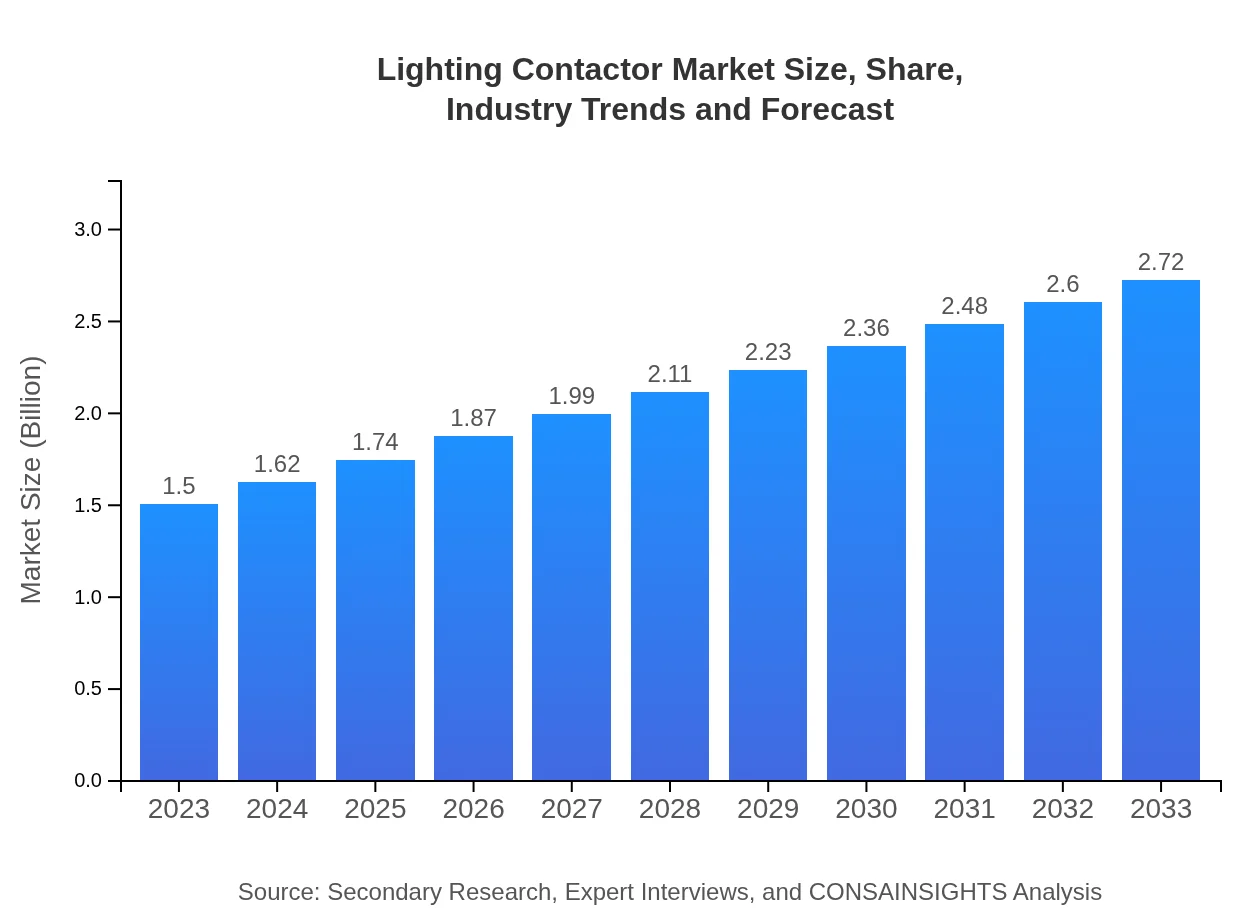

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $2.72 Billion |

| Top Companies | Schneider Electric, Siemens AG, ABB Ltd., Eaton Corporation, Honeywell International Inc. |

| Last Modified Date | 22 January 2026 |

Lighting Contactor Market Overview

Customize Lighting Contactor Market Report market research report

- ✔ Get in-depth analysis of Lighting Contactor market size, growth, and forecasts.

- ✔ Understand Lighting Contactor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lighting Contactor

What is the Market Size & CAGR of Lighting Contactor market in 2023?

Lighting Contactor Industry Analysis

Lighting Contactor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lighting Contactor Market Analysis Report by Region

Europe Lighting Contactor Market Report:

The European market is valued at $0.46 billion in 2023, set to reach $0.83 billion by 2033. Regulatory frameworks promoting energy-saving technologies and an increasing demand for automation in lighting applications support growth in this region.Asia Pacific Lighting Contactor Market Report:

In 2023, the Lighting Contactor market in the Asia Pacific is valued at $0.31 billion and is projected to grow to $0.56 billion by 2033. This region benefits from rapid urbanization, increased construction activities, and a rising focus on energy-efficient solutions, especially in emerging economies like India and China.North America Lighting Contactor Market Report:

North America holds a significant share, with the market size at $0.48 billion in 2023, forecasted to grow to $0.88 billion by 2033. The rise in smart home technology, coupled with stringent energy efficiency regulations, drives growth in this region.South America Lighting Contactor Market Report:

The South American market for Lighting Contactors stands at approximately $0.07 billion in 2023 and is expected to reach $0.13 billion by 2033. The slow adoption of advanced technologies presents a challenge, but rising infrastructure investments are expected to enhance market growth.Middle East & Africa Lighting Contactor Market Report:

In the Middle East and Africa, the Lighting Contactor market is expected to expand from $0.17 billion in 2023 to $0.31 billion by 2033. Ongoing infrastructure projects and a push towards sustainable energy solutions are key drivers of market growth in this region.Tell us your focus area and get a customized research report.

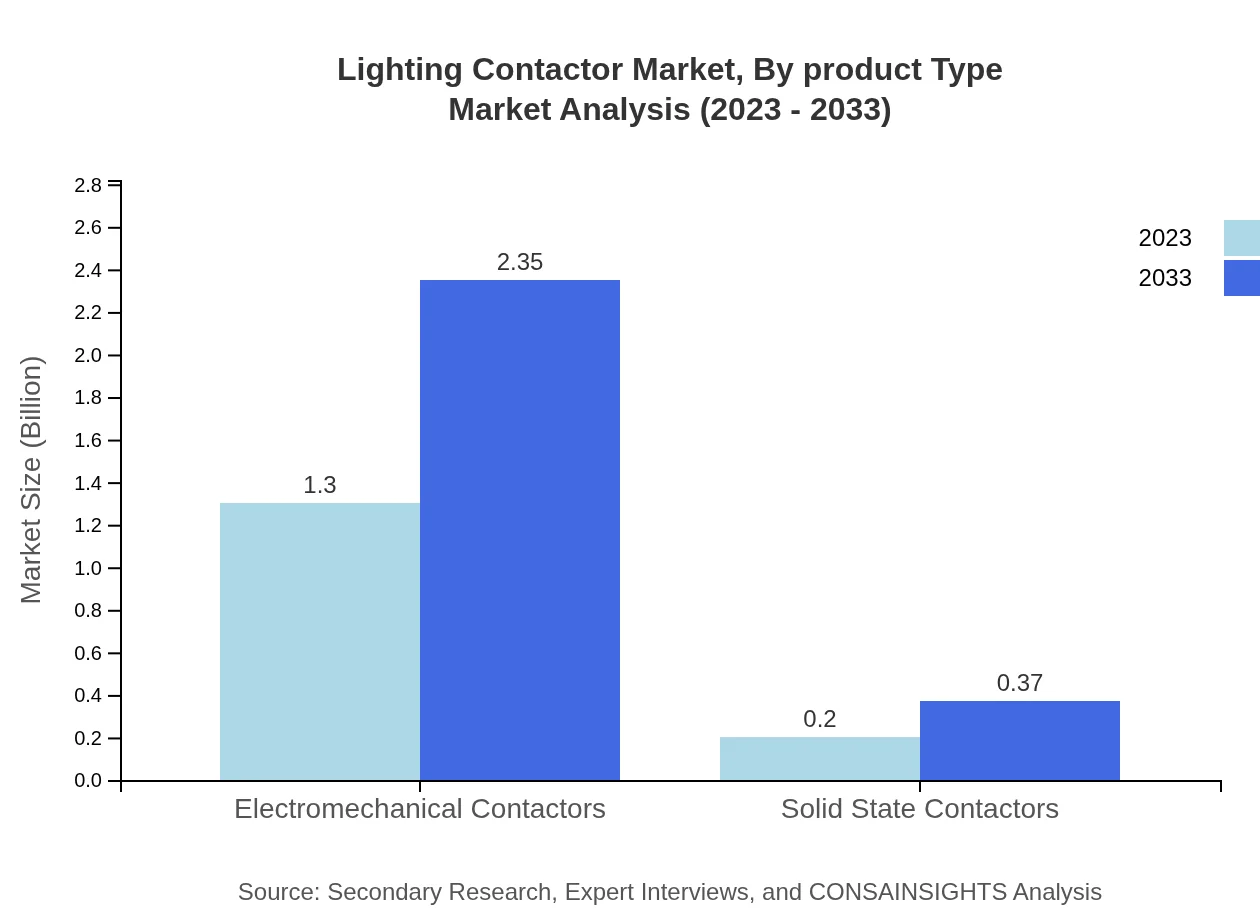

Lighting Contactor Market Analysis By Product Type

The market is predominantly led by electromechanical contactors, expected to maintain a market size of $1.30 billion in 2023 and grow to $2.35 billion by 2033. Solid-state contactors, while a smaller segment presently at $0.20 billion, are projected to increase to $0.37 billion, driven by technological advancements.

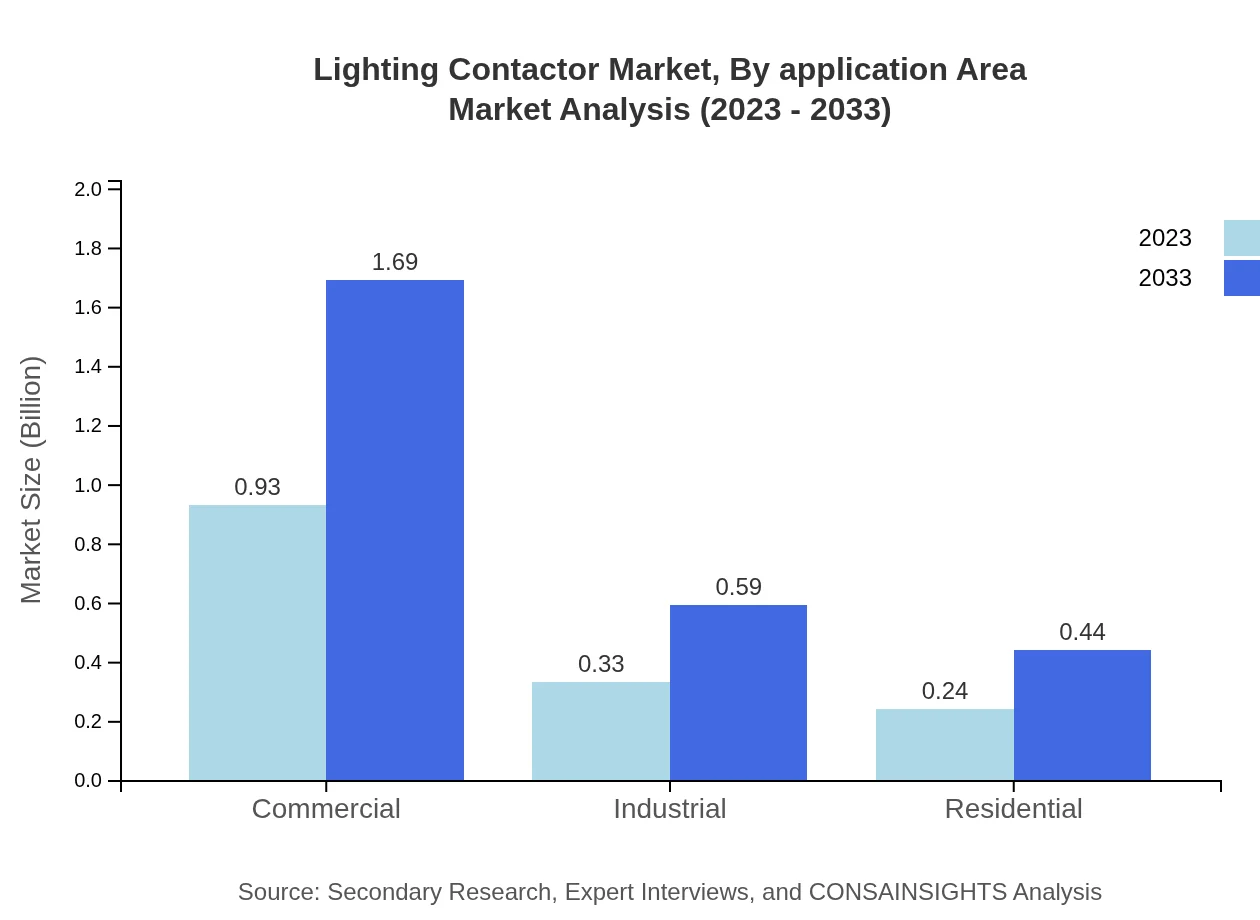

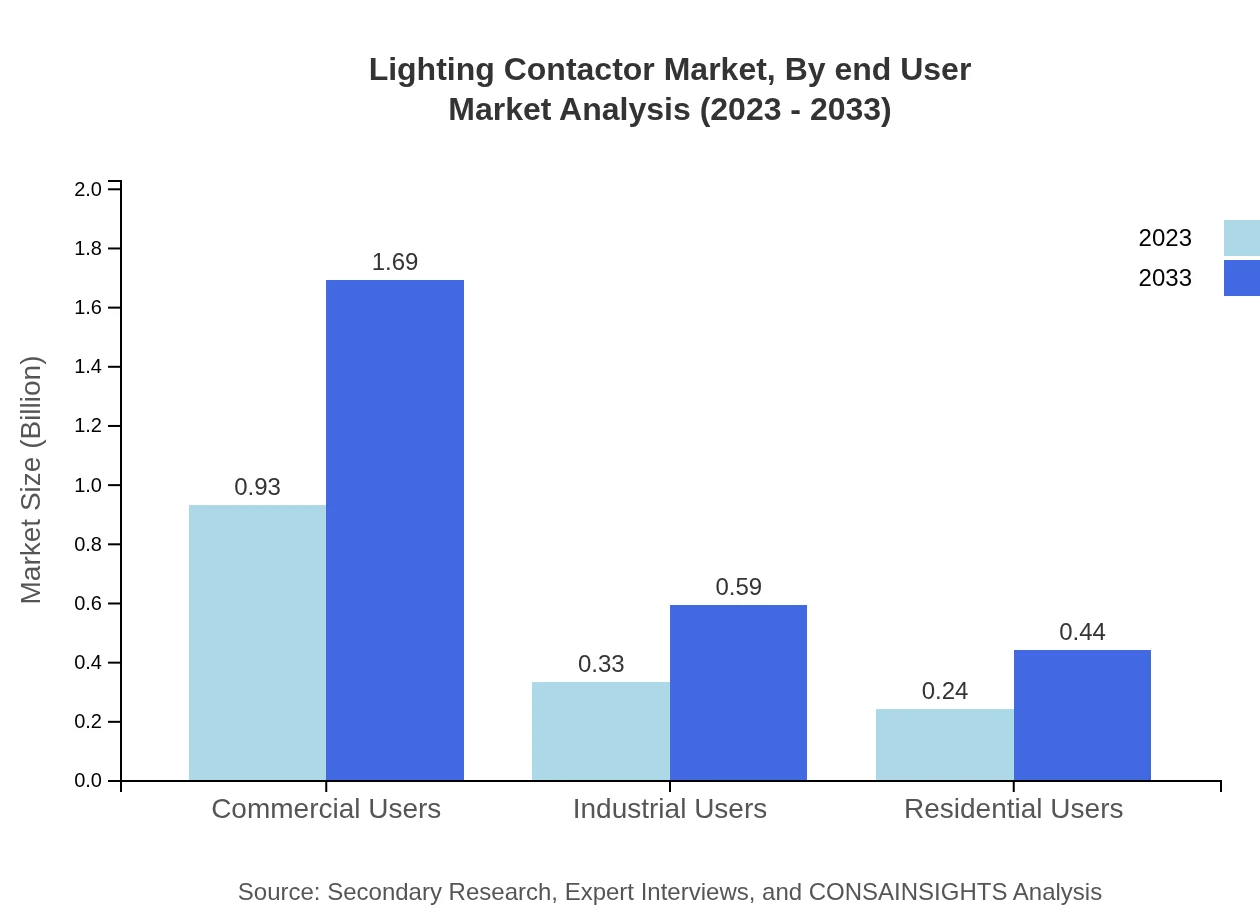

Lighting Contactor Market Analysis By Application Area

Commercial users dominate the market with a projected size of $0.93 billion in 2023, expected to increase to $1.69 billion by 2033, retaining a market share of 62.09%. Industrial and residential segments follow with sizes of $0.33 billion and $0.24 billion respectively in 2023, evidencing significant growth opportunities.

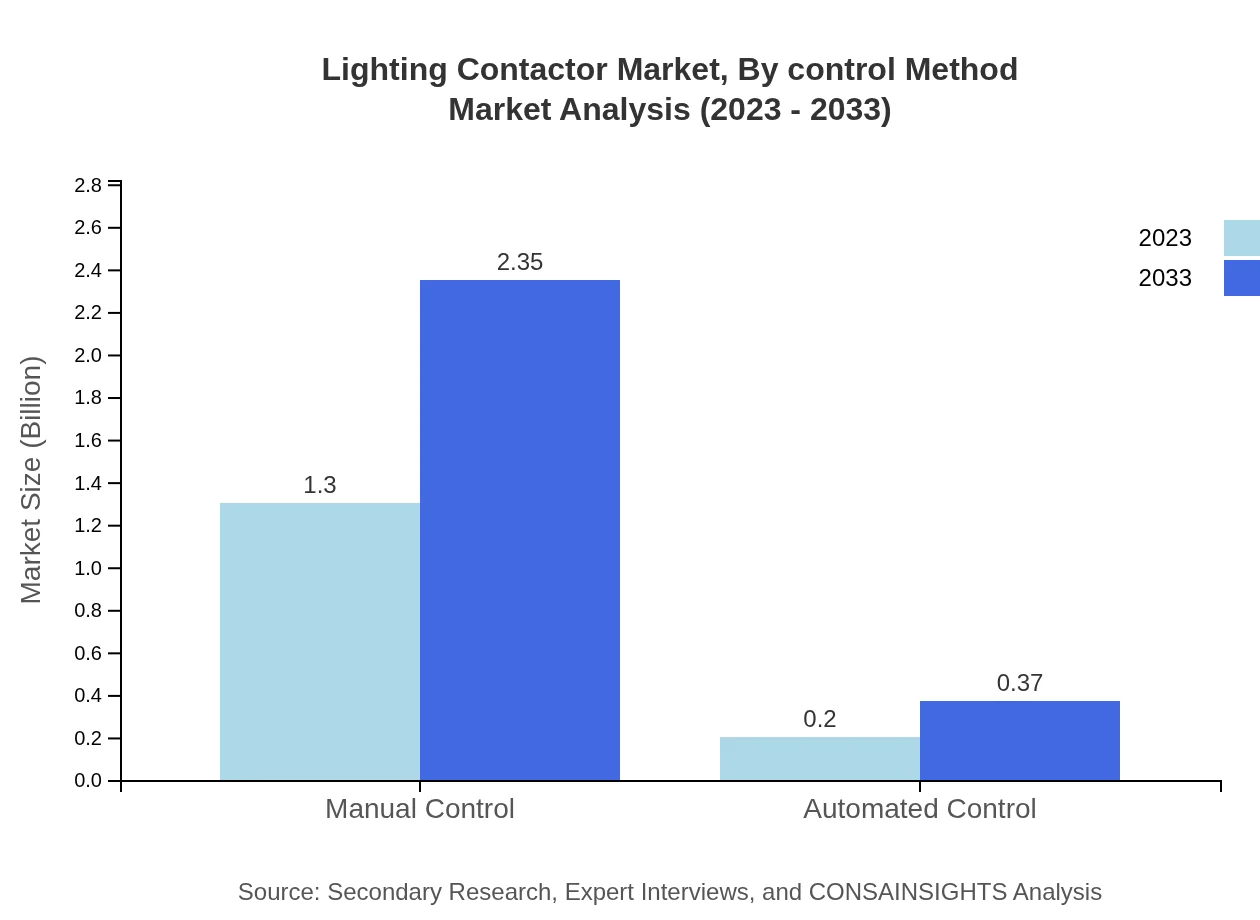

Lighting Contactor Market Analysis By Control Method

Manual control remains a strong segment at $1.30 billion in 2023, expected to grow to $2.35 billion by 2033, capturing 86.35% of the market. Automated control methods, while a smaller segment at $0.20 billion, are essential for future growth with increasing adoption rates.

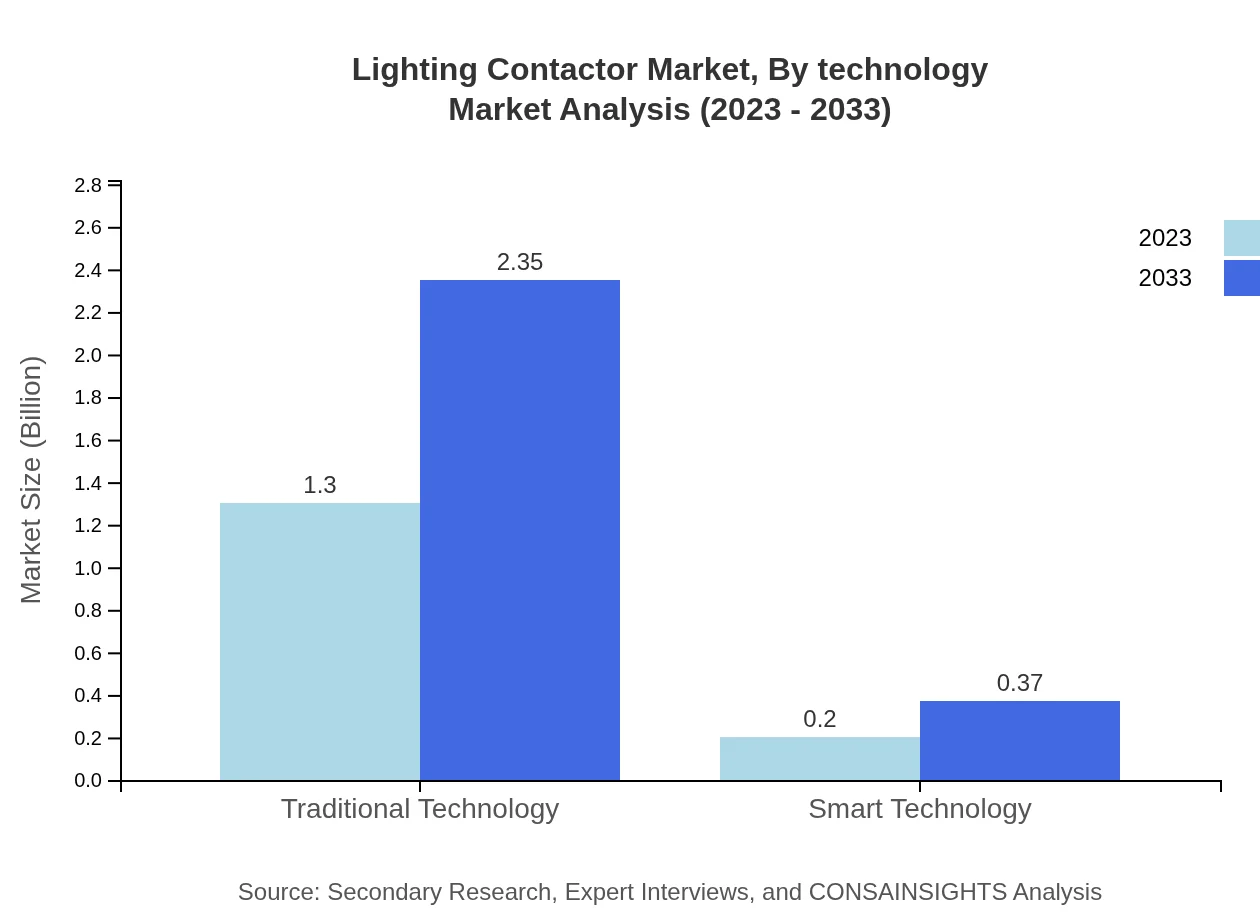

Lighting Contactor Market Analysis By Technology

The Lighting Contactor market presents strong footing for traditional technology, expected to maintain its leading status with sizes of $1.30 billion to $2.35 billion across the forecast period. In contrast, the adoption of smart technology is growing, highlighting a shift in consumer preferences.

Lighting Contactor Market Analysis By End User

Commercial users represent the majority with a market size of $0.93 billion in 2023, while industrial users will expand from $0.33 billion, reflecting the growing demand for energy management solutions across sectors.

Lighting Contactor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lighting Contactor Industry

Schneider Electric:

A leader in energy management and automation, Schneider Electric provides innovative control solutions that enhance efficiency across various industries.Siemens AG:

Siemens AG is an industrial giant known for its extensive portfolio of electrical products, including advanced lighting contactors tailored for smart infrastructures.ABB Ltd.:

ABB offers a wide range of low-voltage products, including contactors and automation solutions, supporting the shift towards energy efficiency and automation.Eaton Corporation:

Eaton specializes in power management solutions, providing a range of advanced lighting control products that improve energy utilization.Honeywell International Inc.:

Honeywell integrates technology and data to enhance building management and control systems, contributing significantly to the lighting contactor market.We're grateful to work with incredible clients.

FAQs

What is the market size of lighting Contactor?

The global lighting contactor market is valued at approximately $1.5 billion in 2023, with a projected growth rate (CAGR) of 6.0%. This indicates a robust market trajectory, highlighting increasing demand and innovation in the sector leading to sustained growth through 2033.

What are the key market players or companies in the lighting Contactor industry?

Key players in the lighting contactor industry include Schneider Electric, Siemens, ABB, and Eaton. These companies are instrumental in driving technology advancements, offering a wide range of product solutions catering to various industrial, commercial, and residential applications.

What are the primary factors driving the growth in the lighting contactor industry?

Several primary factors driving growth in the lighting contactor industry include increasing demand for energy-efficient solutions, advancements in smart technology, and significant investments in infrastructure development. Additionally, rising industrial automation and urbanization trends contribute significantly to market proliferation.

Which region is the fastest Growing in the lighting contactor market?

The Asia Pacific region is the fastest-growing market for lighting contactors, projected to increase from $0.31 billion in 2023 to $0.56 billion by 2033. This growth is fueled by rapid urbanization, industrial expansion, and increased investment in electrical infrastructure.

Does ConsaInsights provide customized market report data for the lighting contactor industry?

Yes, ConsaInsights offers customized market report data specific to the lighting contactor industry. This allows clients to access tailored insights and analysis based on their unique business requirements, enabling more informed strategic decision-making.

What deliverables can I expect from this lighting contactor market research project?

Deliverables from the lighting contactor market research project include comprehensive market analysis reports, detailed segmentation insights, competitive landscape assessments, regional market dynamics, and future growth projections. This wealth of information aids in strategic planning and execution.

What are the market trends of lighting contactor?

Current trends in the lighting contactor market include a shift toward smart technology integration, increased adoption of sustainable solutions, and a growing preference for automation in residential and commercial settings. These trends signify evolving consumer preferences and advances in system capabilities.