Liquid Analytical Instrument Market Report

Published Date: 31 January 2026 | Report Code: liquid-analytical-instrument

Liquid Analytical Instrument Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Liquid Analytical Instrument market, highlighting market size, growth trends, and regional insights from 2023 to 2033. It covers key industry players and future forecasts, offering valuable data for stakeholders.

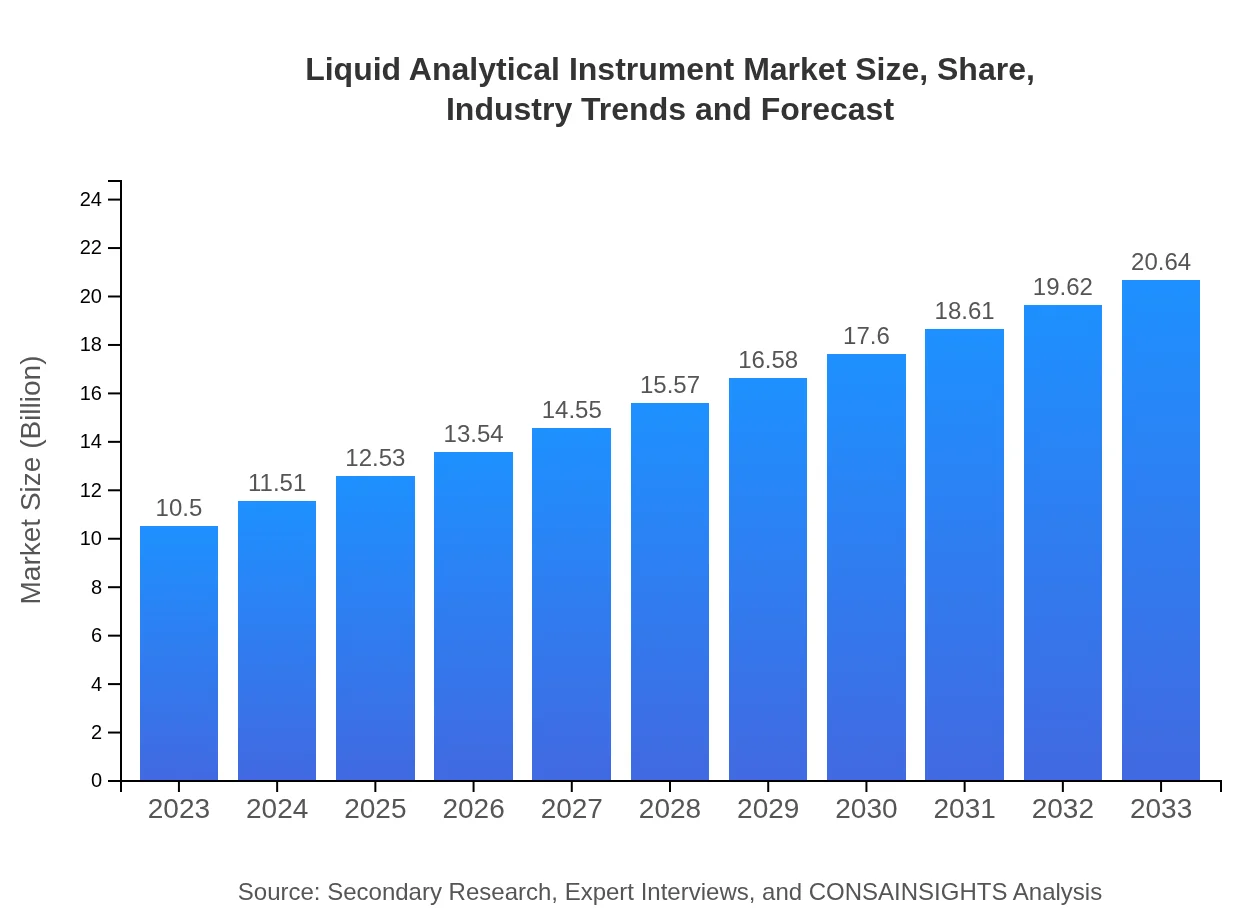

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, Horiba |

| Last Modified Date | 31 January 2026 |

Liquid Analytical Instrument Market Overview

Customize Liquid Analytical Instrument Market Report market research report

- ✔ Get in-depth analysis of Liquid Analytical Instrument market size, growth, and forecasts.

- ✔ Understand Liquid Analytical Instrument's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Liquid Analytical Instrument

What is the Market Size & CAGR of Liquid Analytical Instrument market in 2023 and 2033?

Liquid Analytical Instrument Industry Analysis

Liquid Analytical Instrument Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Liquid Analytical Instrument Market Analysis Report by Region

Europe Liquid Analytical Instrument Market Report:

The European Liquid Analytical Instrument market is valued at $2.74 billion in 2023, expected to rise to $5.39 billion by 2033. Europe’s growth is driven by stringent regulatory frameworks focused on safety and quality in pharmaceuticals and food sectors leading to higher demand for analytical instruments.Asia Pacific Liquid Analytical Instrument Market Report:

In 2023, the Asia Pacific market is valued at $2.04 billion, anticipated to reach $4.02 billion by 2033. The region's growth is supported by rapid industrialization, rising research activities, and a growing number of laboratories in countries like China and India, alongside government initiatives to boost analytical capabilities.North America Liquid Analytical Instrument Market Report:

North America is a significant player with a market valuation of $3.54 billion in 2023, expected to grow to $6.95 billion by 2033. The region benefits from advanced manufacturing infrastructure, robust R&D investments, and stringent regulatory environments ensuring quality and safety in liquid measurements.South America Liquid Analytical Instrument Market Report:

South America shows a slower growth rate with a market size of $0.92 billion in 2023, projected to reach $1.80 billion by 2033. Economic development and increasing investments in agriculture and environmental testing are key factors contributing to growth in this region.Middle East & Africa Liquid Analytical Instrument Market Report:

The Middle East and Africa market is anticipated to grow from $1.26 billion in 2023 to approximately $2.48 billion by 2033. Increasing investments in healthcare and industrial processes accompanied by a growing emphasis on environmental concerns are enhancing the demand for liquid analytical instruments.Tell us your focus area and get a customized research report.

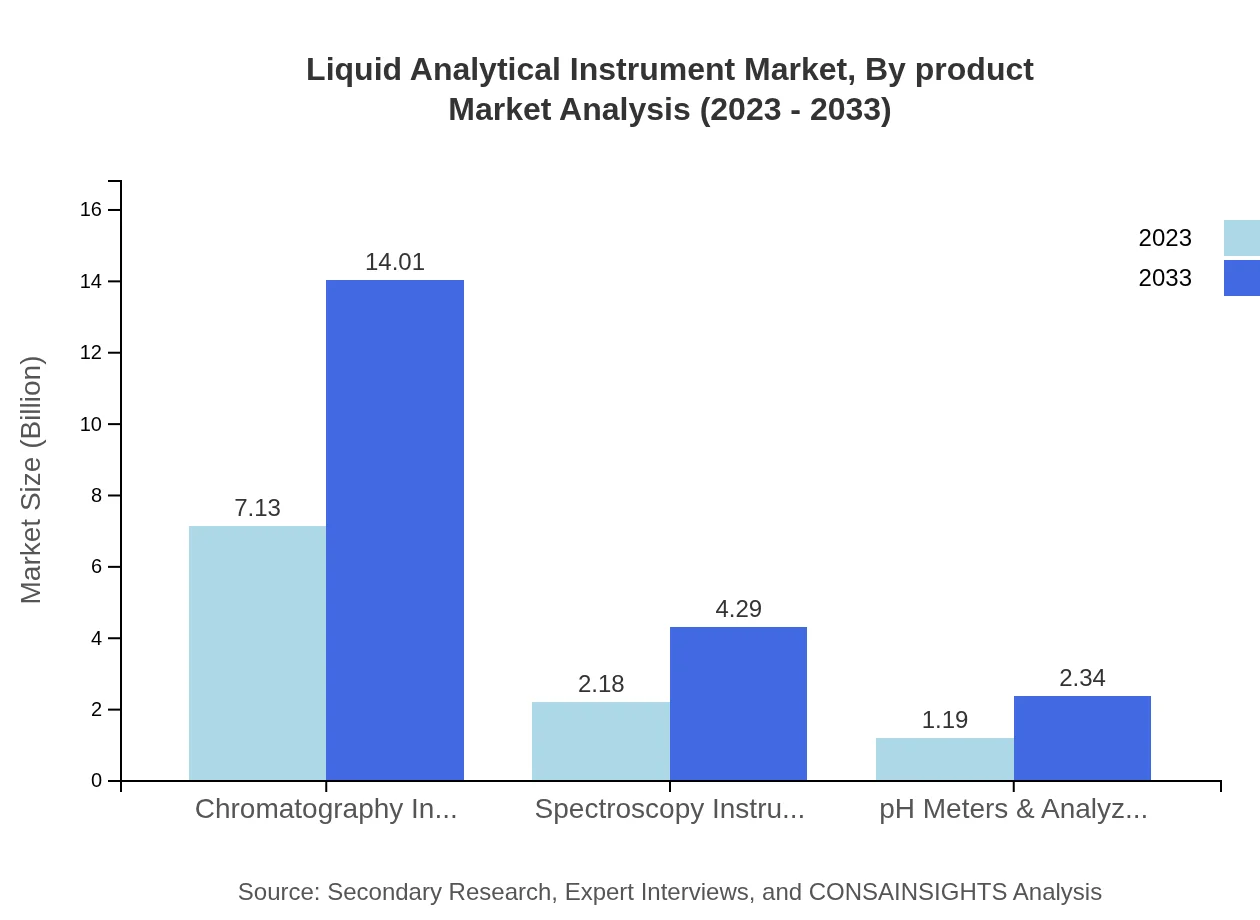

Liquid Analytical Instrument Market Analysis By Product

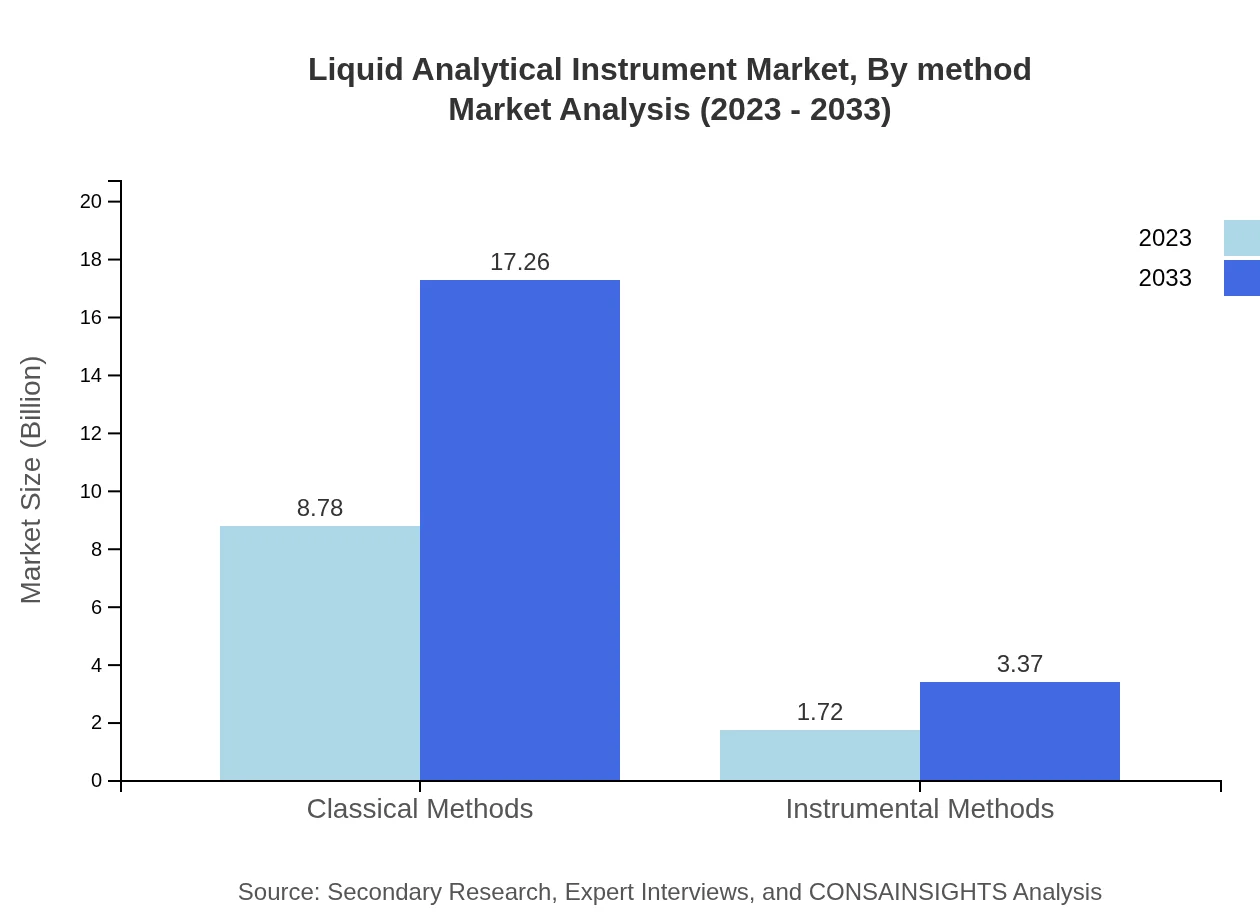

The Liquid Analytical Instrument market by product type highlights two main categories: Classical Methods and Instrumental Methods. In 2023, Classical Methods dominate with a market size of $8.78 billion, expected to grow to $17.26 billion by 2033, illustrating a trend towards established analytical methods. Instrumental Methods, while smaller, show potential growth from $1.72 billion to $3.37 billion during the same period, indicating an inclination toward modern and efficient analytical technologies.

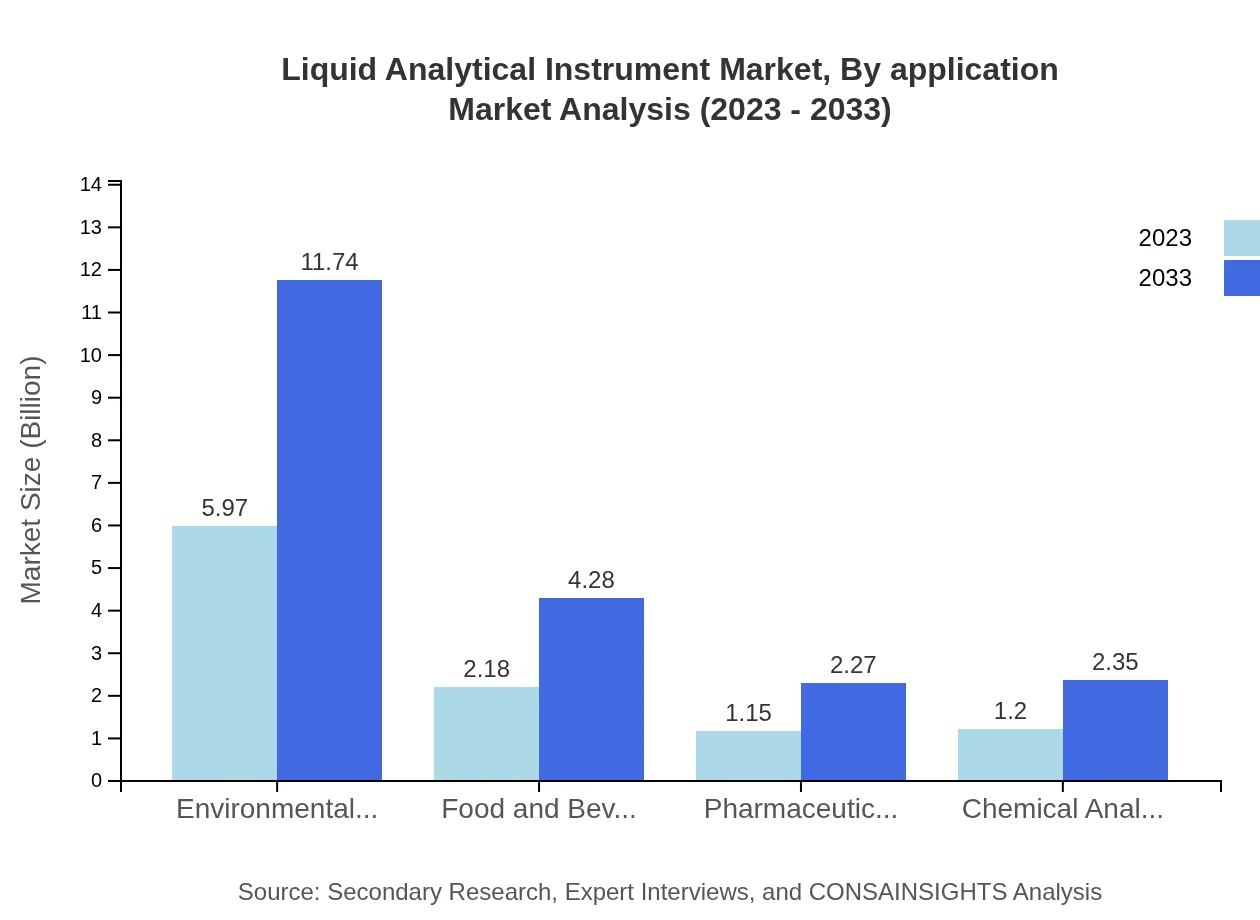

Liquid Analytical Instrument Market Analysis By Application

Applications across various sectors are pivotal in determining market dynamics. The Pharmaceutical and Biotechnology sector holds the largest share at 40.18% in 2023, likely maintaining this level into 2033. Environmental Testing and Food and Beverage Testing also represent significant shares, with values of 56.87% and 20.75% respectively, pointing to an ongoing demand for rigorous testing standards in safety and quality assurance.

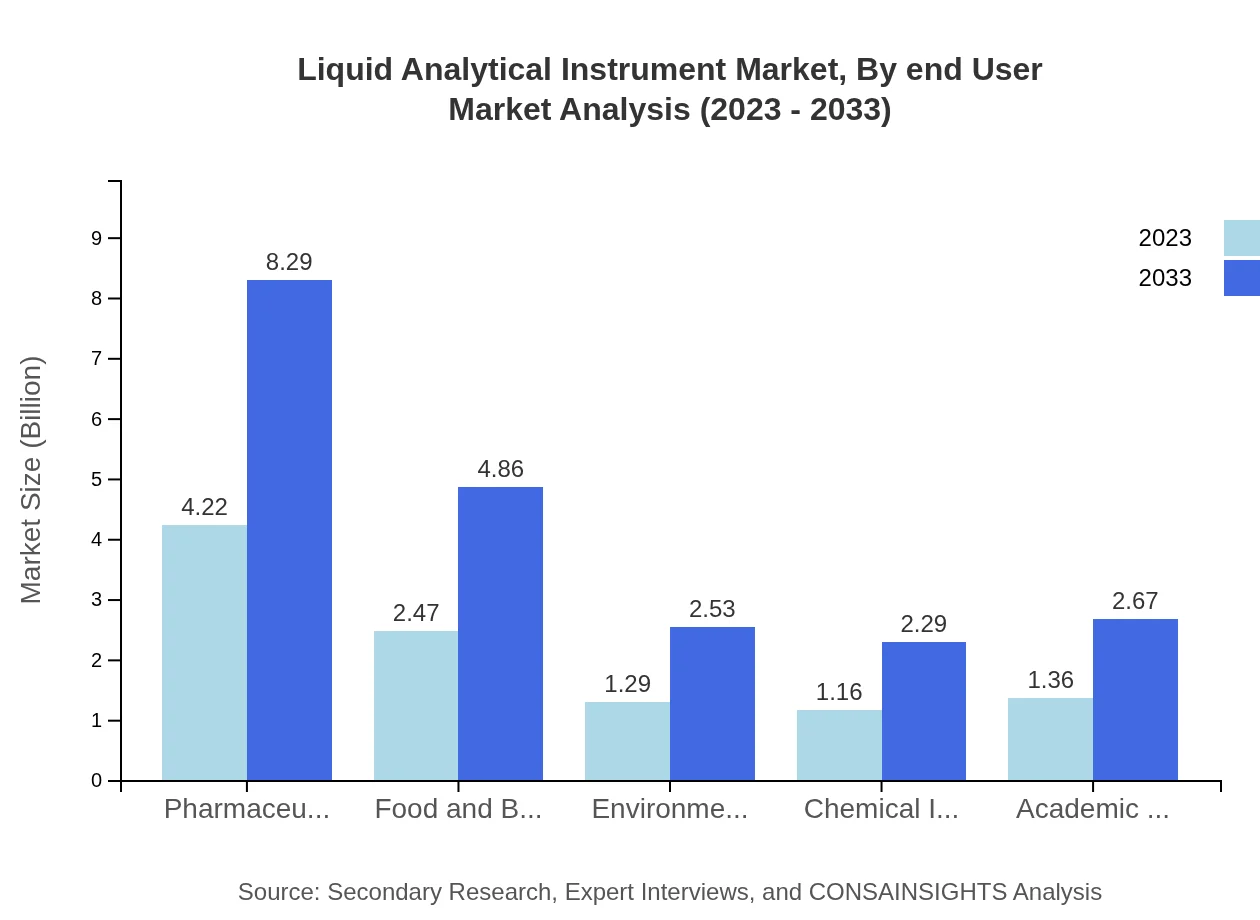

Liquid Analytical Instrument Market Analysis By End User

End-user segmentation reveals critical industries that utilize liquid analytical instruments extensively. The pharmaceutical sector leads the charge, leveraging advanced analysis for drug development and quality control. Academic and Research Institutions, Environmental Testing facilities, and chemical industries collectively rely on these instruments to maintain regulatory compliance and research integrity, highlighting the tools' importance across diverse scientific fields.

Liquid Analytical Instrument Market Analysis By Method

The market is also segmented by analysis methods, where Environmental Testing methods see prevailing use, reflecting significant societal emphasis on environmental sustainability. Parallelly, Food and Beverage Testing and Pharmaceutical Analysis maintain substantial relevance, ensuring safety standards and compliance across critical sectors, thereby underpinning the importance of liquid analytical instrumentation.

Liquid Analytical Instrument Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Liquid Analytical Instrument Industry

Thermo Fisher Scientific:

A global leader in serving science, Thermo Fisher Scientific provides an extensive range of analytical instruments that offer precision and reliability for liquid analysis, playing a pivotal role in various scientific and industrial applications.Agilent Technologies:

Agilent Technologies specializes in providing innovative analytical solutions, including chromatography and spectroscopy systems, catering to the diverse needs of the liquid analytical instrumentation market.PerkinElmer:

PerkinElmer excels in providing detection and analytical solutions across multiple industry segments, focusing on health, safety, and environmental monitoring, thus contributing significantly to liquid analytical instrumentation advancements.Horiba:

Horiba is a prominent player in the global market, known for developing high-performance analytical and measuring instruments, including pH meters and other liquid analysis tools, enhancing quality control across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of liquid Analytical Instrument?

The global Liquid Analytical Instrument market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching notable growth in various segments by 2033, signifying a robust expansion in demand.

What are the key market players or companies in this liquid Analytical Instrument industry?

Key players in the Liquid Analytical Instrument market include industry leaders known for innovation and product diversity. Companies include those specializing in chromatography, spectroscopy, and pH measurement technologies, driving advancements and competitive insights in this sector.

What are the primary factors driving the growth in the liquid Analytical Instrument industry?

The growth of the Liquid Analytical Instrument market is driven by increasing demand for quality assurance across industries, advancements in analytical technologies, regulatory requirements, and the rising focus on environmental monitoring, enhancing market prospects.

Which region is the fastest Growing in the liquid Analytical Instrument?

The North American region represents the fastest growth in the Liquid Analytical Instrument market, projecting from $3.54 billion in 2023 to $6.95 billion in 2033. This growth is supported by technological advancements and increased regulations in environmental testing.

Does ConsaInsights provide customized market report data for the liquid Analytical Instrument industry?

Yes, ConsaInsights offers tailored market report data for the Liquid Analytical Instrument industry, catering to specific needs and insights required by stakeholders for strategic decision-making and market analysis.

What deliverables can I expect from this liquid Analytical Instrument market research project?

Expected deliverables from the Liquid Analytical Instrument market research project include comprehensive market analysis, trend forecasting, competitive landscape assessment, and detailed segmentation insights, empowering informed decision-making.

What are the market trends of liquid Analytical Instrument?

Recent trends in the Liquid Analytical Instrument market indicate a shift towards automation, integration of AI technologies, increased adoption in pharmaceuticals and environmental sectors, along with a heightened focus on environmental compliance.