Liquid Roofing Market Report

Published Date: 22 January 2026 | Report Code: liquid-roofing

Liquid Roofing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the liquid roofing market from 2023 to 2033, including market size, growth projections, segmentation, regional insights, and key players in the industry.

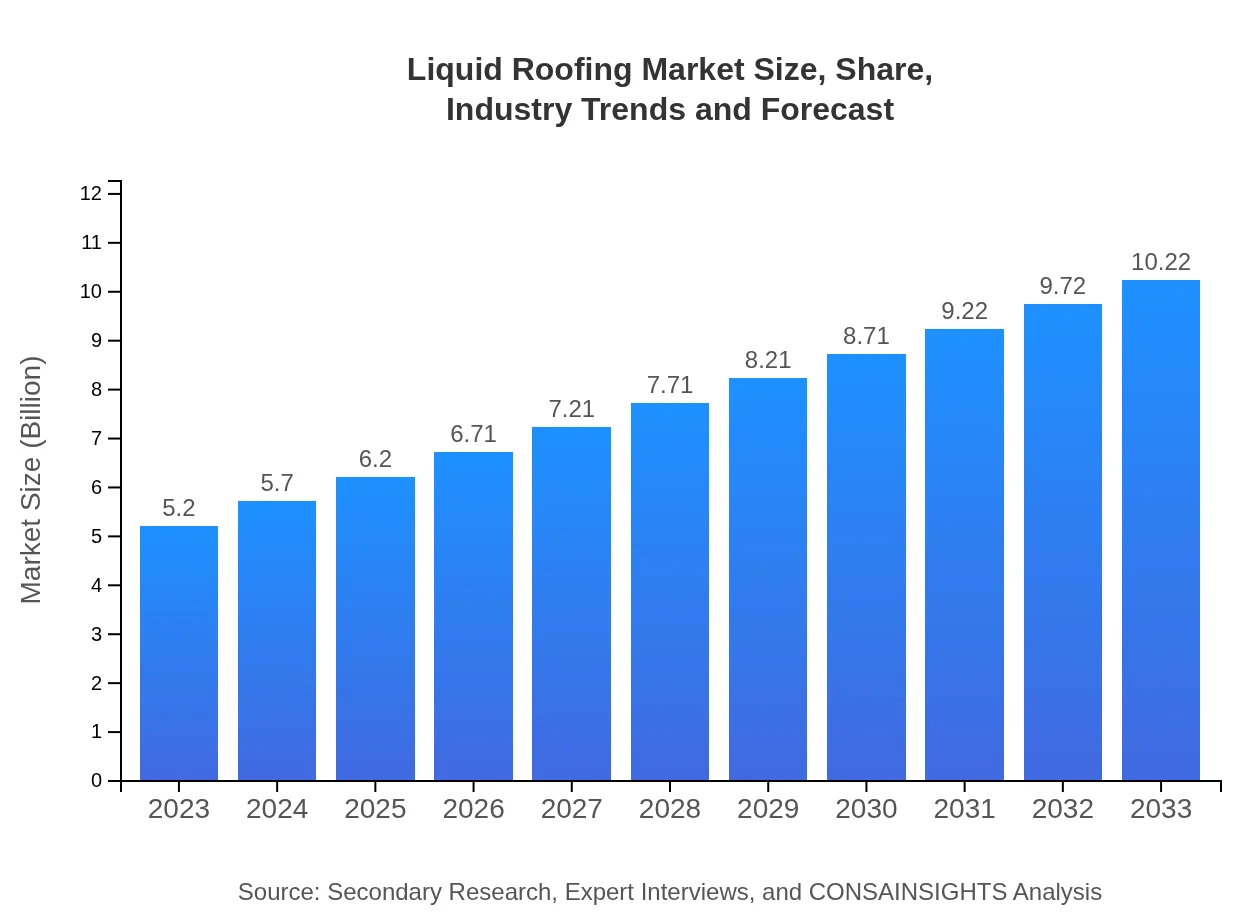

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Sika AG, BASF SE, GAF Materials Corporation, Henry Company |

| Last Modified Date | 22 January 2026 |

Liquid Roofing Market Overview

Customize Liquid Roofing Market Report market research report

- ✔ Get in-depth analysis of Liquid Roofing market size, growth, and forecasts.

- ✔ Understand Liquid Roofing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Liquid Roofing

What is the Market Size & CAGR of Liquid Roofing market in 2023?

Liquid Roofing Industry Analysis

Liquid Roofing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Liquid Roofing Market Analysis Report by Region

Europe Liquid Roofing Market Report:

The European liquid roofing market is forecasted to grow from $1.30 billion in 2023 to $2.55 billion by 2033, driven by stringent regulations promoting energy efficiency and sustainable construction practices. The adoption of new technologies and materials is expected to enhance the performance of liquid roofing solutions, boosting market demand.Asia Pacific Liquid Roofing Market Report:

In the Asia Pacific region, the liquid roofing market is anticipated to grow from $1.13 billion in 2023 to $2.21 billion by 2033. This growth is driven by rapid urbanization and increased construction activities, particularly in countries like China and India. Moreover, government investments in infrastructure development and a shift towards modern roofing solutions are expected to bolster demand.North America Liquid Roofing Market Report:

The North America region is projected to experience substantial growth, with the market expected to increase from $1.84 billion in 2023 to $3.62 billion in 2033. The growth drivers include a booming construction sector, a shift toward energy-efficient buildings, and the introduction of advanced liquid roofing systems. The U.S. and Canada lead the market due to their high development standards and a focus on sustainable practices.South America Liquid Roofing Market Report:

In South America, the market is expected to rise from $0.41 billion in 2023 to $0.81 billion by 2033. The growth is primarily fueled by increasing construction and renovation projects, alongside the adoption of innovative roofing solutions. The focus on durability and aesthetics in roofing is also significant in this region.Middle East & Africa Liquid Roofing Market Report:

In the Middle East and Africa, the liquid roofing market is expected to grow from $0.52 billion in 2023 to $1.02 billion by 2033. The region's expanding construction projects, particularly in the Gulf Cooperation Council (GCC) countries, are significant growth contributors. Growing awareness of water conservation and climate resilience is also expected to enhance market dynamics.Tell us your focus area and get a customized research report.

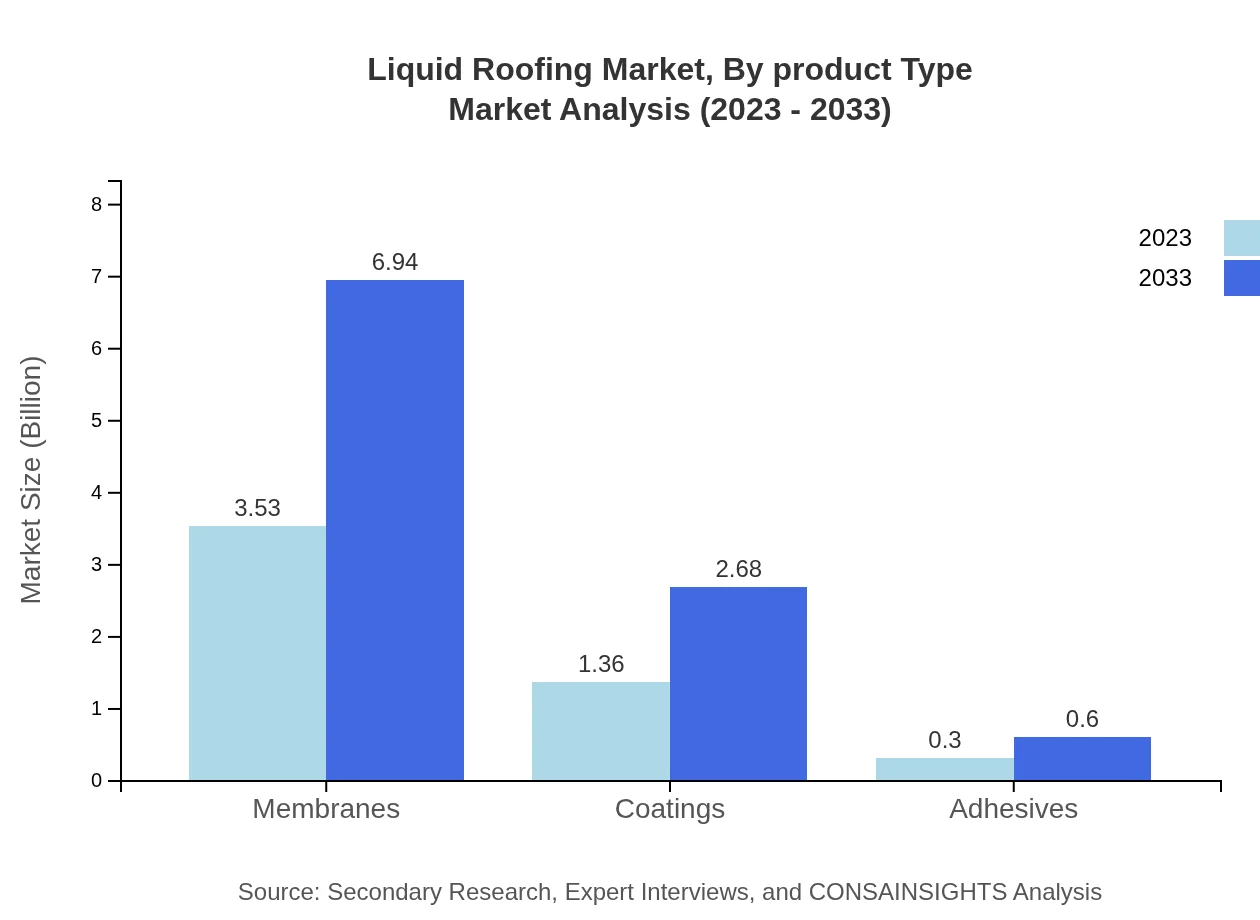

Liquid Roofing Market Analysis By Product Type

The Liquid Roofing market by product type includes membranes, coatings, and adhesives. Membranes dominate the market, accounting for approximately 67.95% of the share in 2023, with their size projected to grow from $3.53 billion to $6.94 billion by 2033. Coatings follow with a 26.19% market share, expected to increase from $1.36 billion to $2.68 billion, while adhesives are anticipated to maintain a smaller share at 5.86%, rising from $0.30 billion to $0.60 billion.

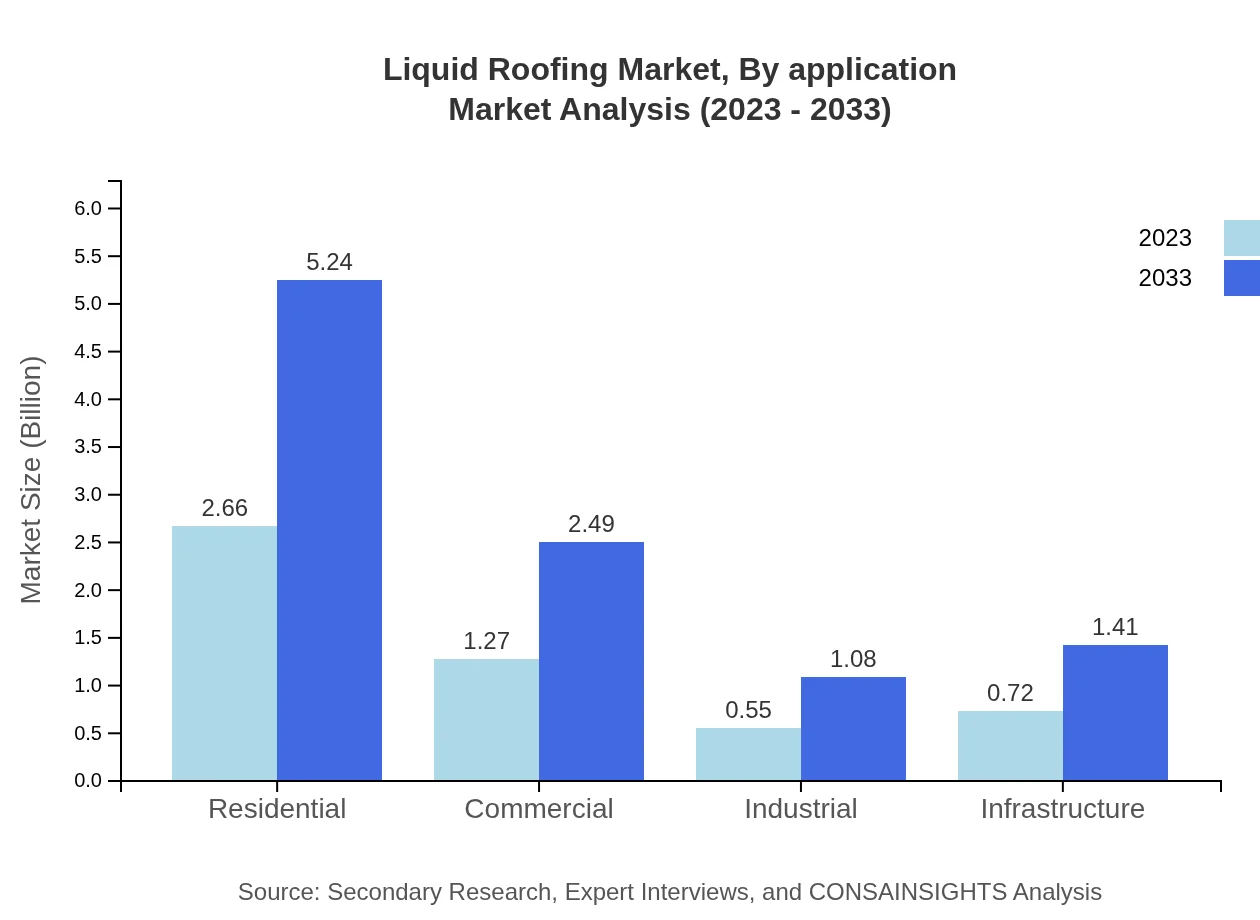

Liquid Roofing Market Analysis By Application

The application segment includes Residential, Commercial, Industrial, and Infrastructure sectors. The residential sector holds the largest market share at 51.23% in 2023, expanding from $2.66 billion to $5.24 billion by 2033. The commercial sector represents 24.37% of the market, growing from $1.27 billion to $2.49 billion, while industrial and infrastructure applications cover 10.57% and 13.83% respectively.

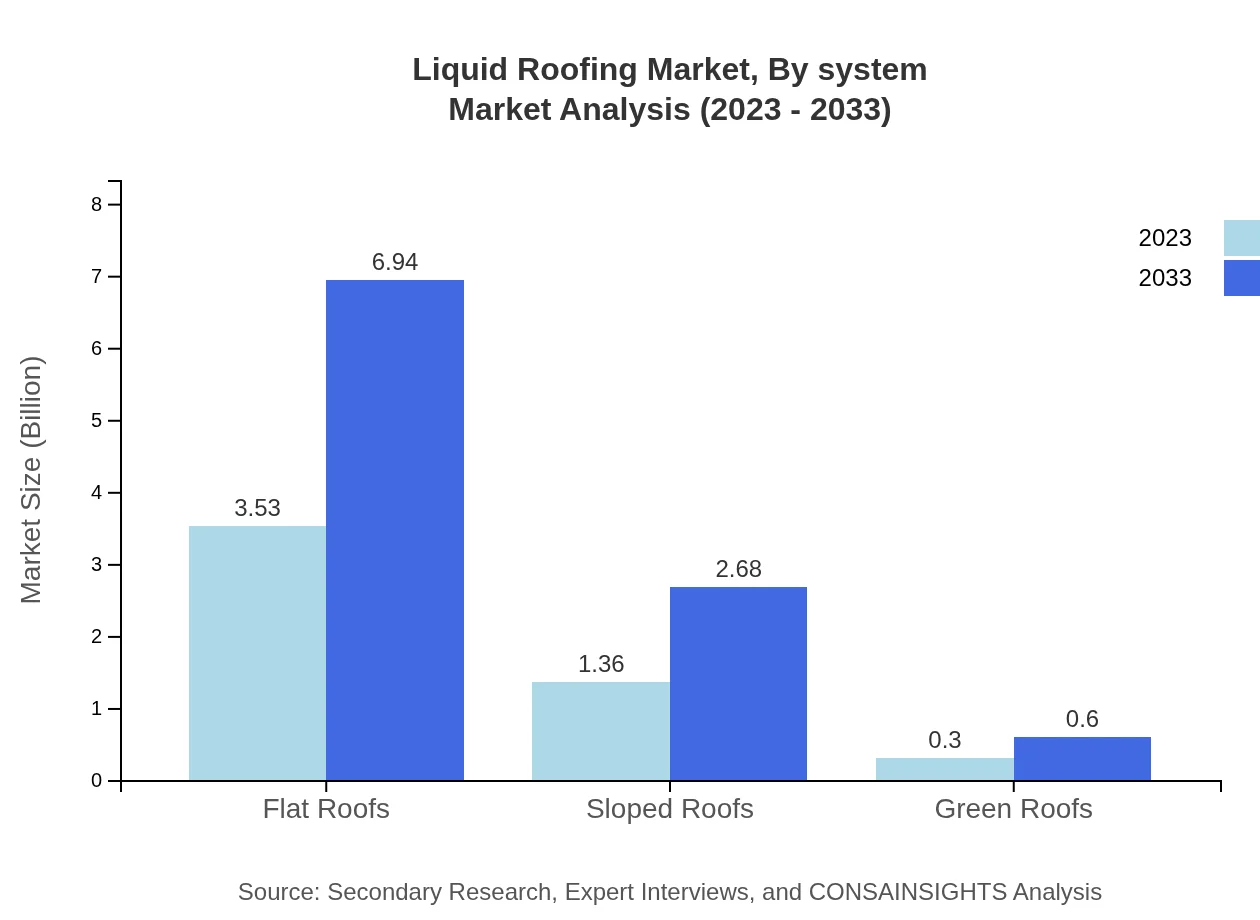

Liquid Roofing Market Analysis By System

The liquid roofing market is categorized by roofing systems such as flat roofs, sloped roofs, and green roofs. Flat roofs dominate with a market size of $3.53 billion in 2023, expected to reach $6.94 billion by 2033. Sloped roofs will grow from $1.36 billion to $2.68 billion, and green roofs will expand from $0.30 billion to $0.60 billion.

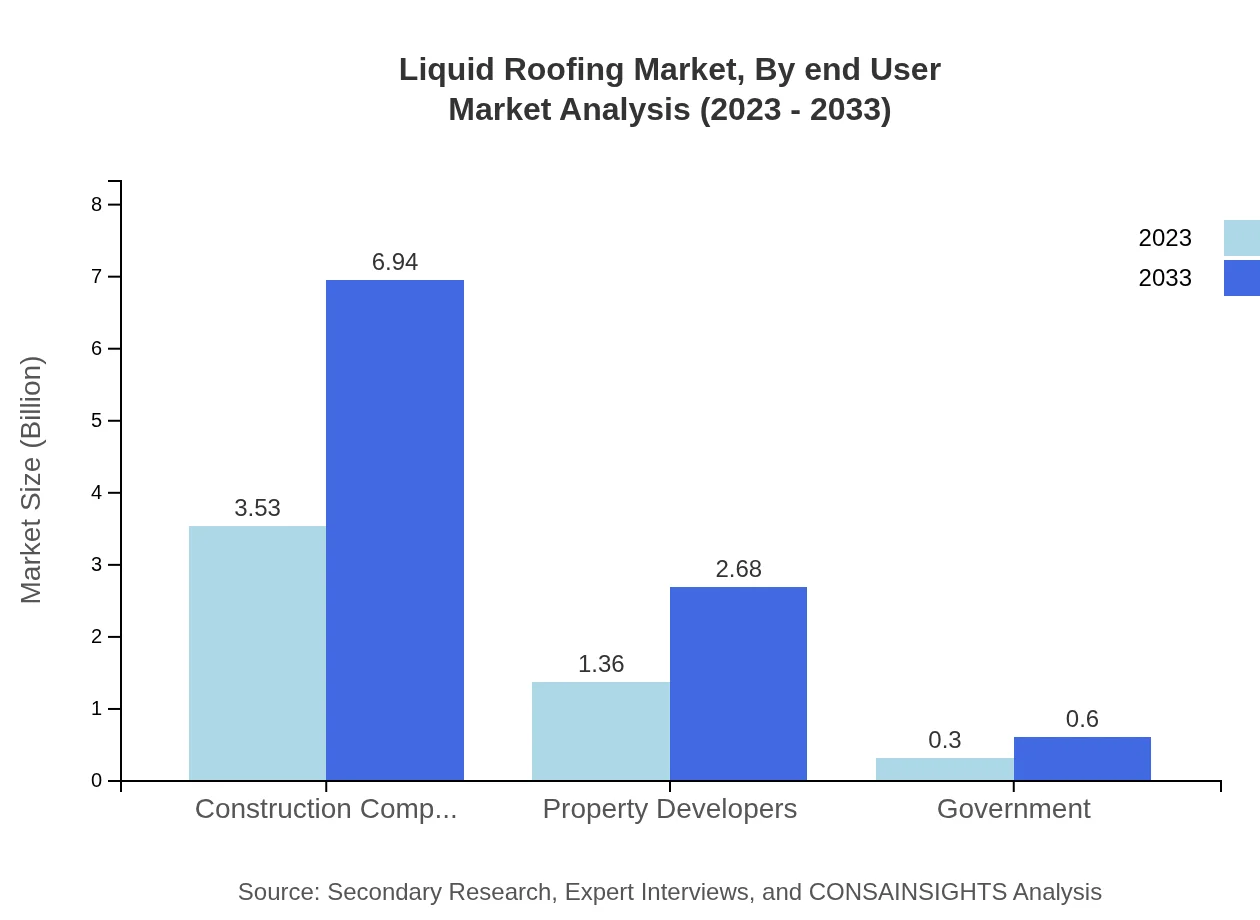

Liquid Roofing Market Analysis By End User

The end-user segment includes construction companies, property developers, governments, and private individuals. Construction companies lead at 67.95% of the market share, followed by property developers at 26.19%. Government projects account for around 5.86% of the market, emphasizing the significance of institutional contracts in driving liquid roofing adoption.

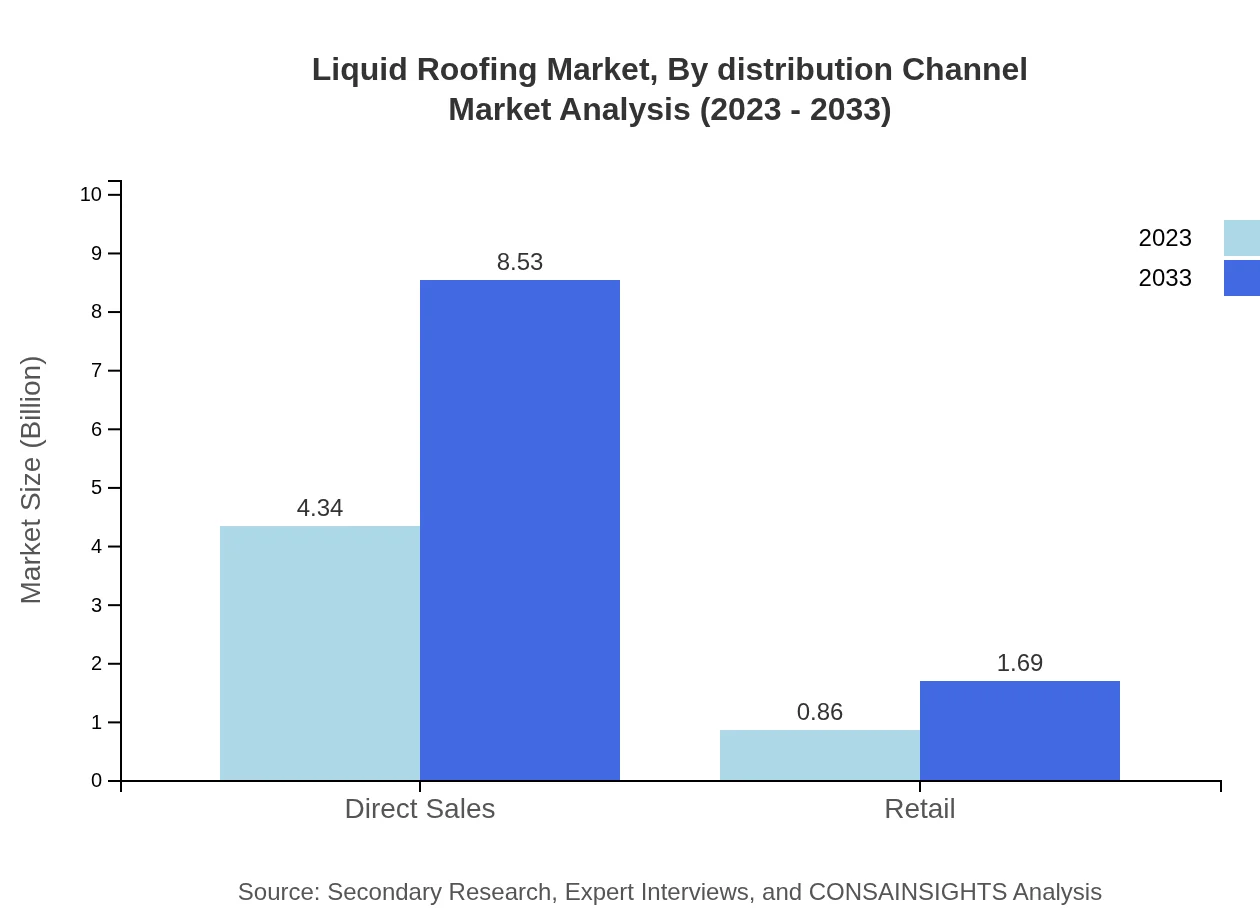

Liquid Roofing Market Analysis By Distribution Channel

Distribution channels for liquid roofing include direct sales and retail. Direct sales make up a substantial portion at 83.46% of the market, growing from $4.34 billion to $8.53 billion by 2033. Retail channels cover remaining sales dynamics, expected to increase from $0.86 billion to $1.69 billion.

Liquid Roofing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Liquid Roofing Industry

Sika AG:

Sika AG is a leading global provider of specialty chemicals used in construction and industry. With a strong portfolio in liquid roofing solutions, Sika focuses on innovation and sustainability.BASF SE:

BASF is a global chemical company that offers a range of solutions, including liquid roofing products. Their commitment to sustainable construction solutions positions them as a key player in the market.GAF Materials Corporation:

GAF is one of North America's largest roofing manufacturers, known for its innovative liquid roofing systems and commitment to quality and environmental stewardship.Henry Company:

Henry Company specializes in roofing and building envelope systems, providing a variety of liquid roofing options that cater to both residential and commercial markets.We're grateful to work with incredible clients.

FAQs

What is the market size of liquid Roofing?

The global liquid roofing market is valued at approximately $5.2 billion in 2023, projected to grow at a CAGR of 6.8% through 2033. This growth indicates increasing demand across various applications and regions.

What are the key market players or companies in the liquid Roofing industry?

Key players in the liquid roofing market include companies such as GAF, Sika AG, and Tremco Incorporated, which dominate the market with innovative products and strong distribution networks, facilitating substantial growth within the industry.

What are the primary factors driving the growth in the liquid roofing industry?

Growth in the liquid roofing industry is primarily driven by increased urbanization, the rise in construction activities, enhanced energy efficiency demands, and the growing emphasis on sustainable roofing solutions to address environmental concerns.

Which region is the fastest Growing in the liquid roofing market?

The Asia Pacific region is the fastest-growing area for liquid roofing, with a market growth from $1.13 billion in 2023 to $2.21 billion by 2033, reflecting the significant construction boom and urban development in this area.

Does ConsaInsights provide customized market report data for the liquid roofing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the liquid roofing industry, ensuring clients receive relevant insights that align with their particular interests and business strategies.

What deliverables can I expect from the liquid roofing market research project?

From the liquid roofing market research project, you can expect comprehensive reports, detailed regional analyses, market forecasts, competitive analysis, and insights into key trends and consumer behavior within the market.

What are the market trends of liquid roofing?

Current trends in the liquid roofing market include a shift towards eco-friendly materials, increased adoption of advanced roofing technologies, and a growing preference for liquid-applied roofing systems for their durability and efficiency.