Lithium Ion Energy Accumulator Market Report

Published Date: 31 January 2026 | Report Code: lithium-ion-energy-accumulator

Lithium Ion Energy Accumulator Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Lithium Ion Energy Accumulator market, covering current trends, market size, growth forecasts, and regional analyses for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

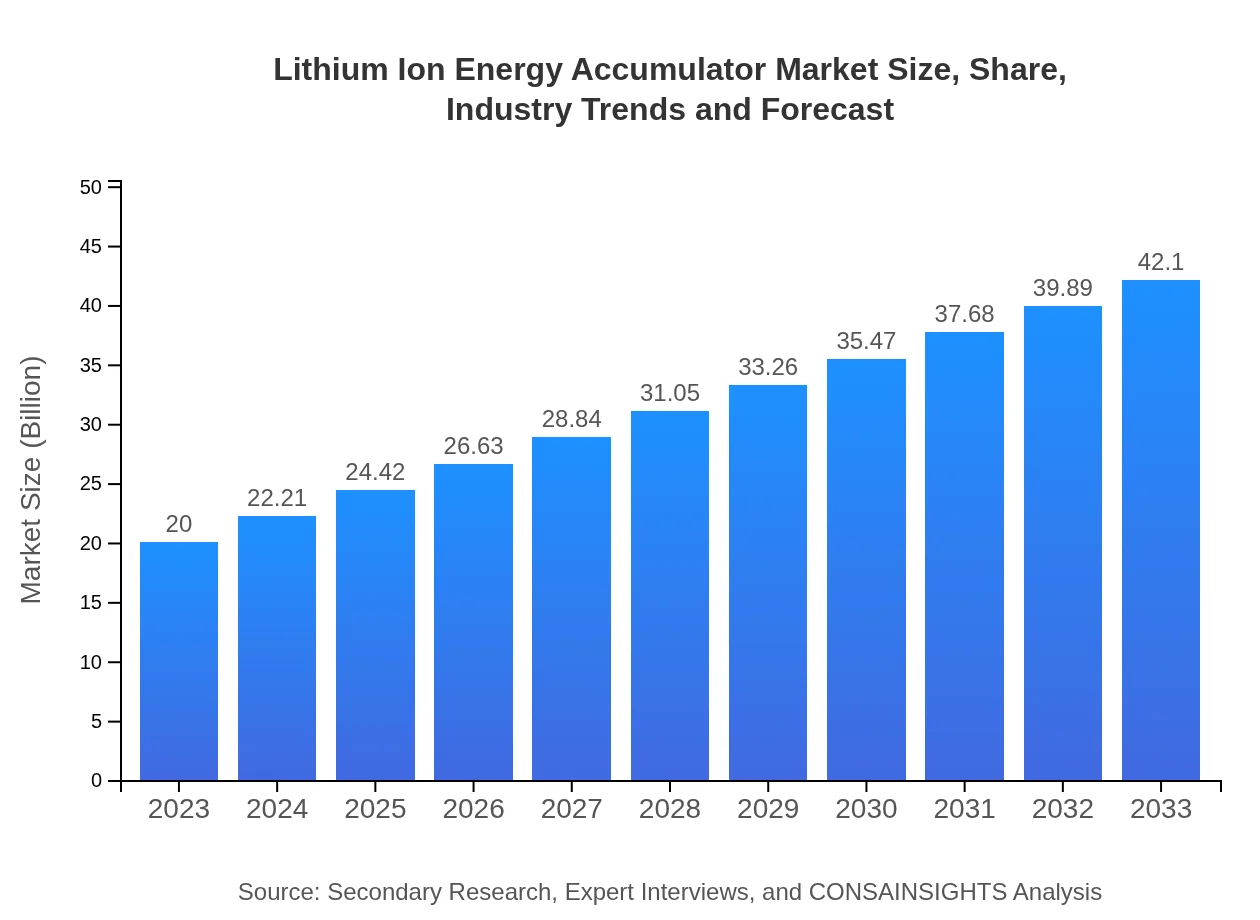

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $42.10 Billion |

| Top Companies | Tesla, Inc., Panasonic Corporation, LG Chem, CATL (Contemporary Amperex Technology Co., Limited) |

| Last Modified Date | 31 January 2026 |

Lithium Ion Energy Accumulator Market Overview

Customize Lithium Ion Energy Accumulator Market Report market research report

- ✔ Get in-depth analysis of Lithium Ion Energy Accumulator market size, growth, and forecasts.

- ✔ Understand Lithium Ion Energy Accumulator's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lithium Ion Energy Accumulator

What is the Market Size & CAGR of Lithium Ion Energy Accumulator market in 2023?

Lithium Ion Energy Accumulator Industry Analysis

Lithium Ion Energy Accumulator Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lithium Ion Energy Accumulator Market Analysis Report by Region

Europe Lithium Ion Energy Accumulator Market Report:

Europe's market size is projected to grow from $6.15 billion in 2023 to $12.94 billion by 2033. The continent's focus on sustainability and renewable energy, along with robust support for electric vehicle infrastructures, drives this growth.Asia Pacific Lithium Ion Energy Accumulator Market Report:

The Asia Pacific region leads the Lithium Ion Energy Accumulator market with a size of approximately $3.68 billion in 2023, projected to grow to $7.76 billion by 2033. The region's growth is driven by substantial investments in electric vehicle manufacturing and a strong consumer electronics market, particularly in countries like China, Japan, and South Korea.North America Lithium Ion Energy Accumulator Market Report:

North America holds a significant market share, with a size of $7.28 billion in 2023, anticipated to expand to $15.33 billion by 2033. The region’s growth is fueled by technological advancements in battery technology and increasing electric vehicle sales, particularly in the United States and Canada.South America Lithium Ion Energy Accumulator Market Report:

In South America, the Lithium Ion Energy Accumulator market was valued at $0.51 billion in 2023 and is expected to reach $1.08 billion by 2033. The slow but steady growth can be attributed to rising electric vehicle adoption and governmental support for renewable energy initiatives.Middle East & Africa Lithium Ion Energy Accumulator Market Report:

The Middle East and Africa market is relatively smaller, valued at $2.38 billion in 2023 and expected to grow to $5.00 billion by 2033. The growth potential here lies in the expanding telecommunications sector and energy storage applications.Tell us your focus area and get a customized research report.

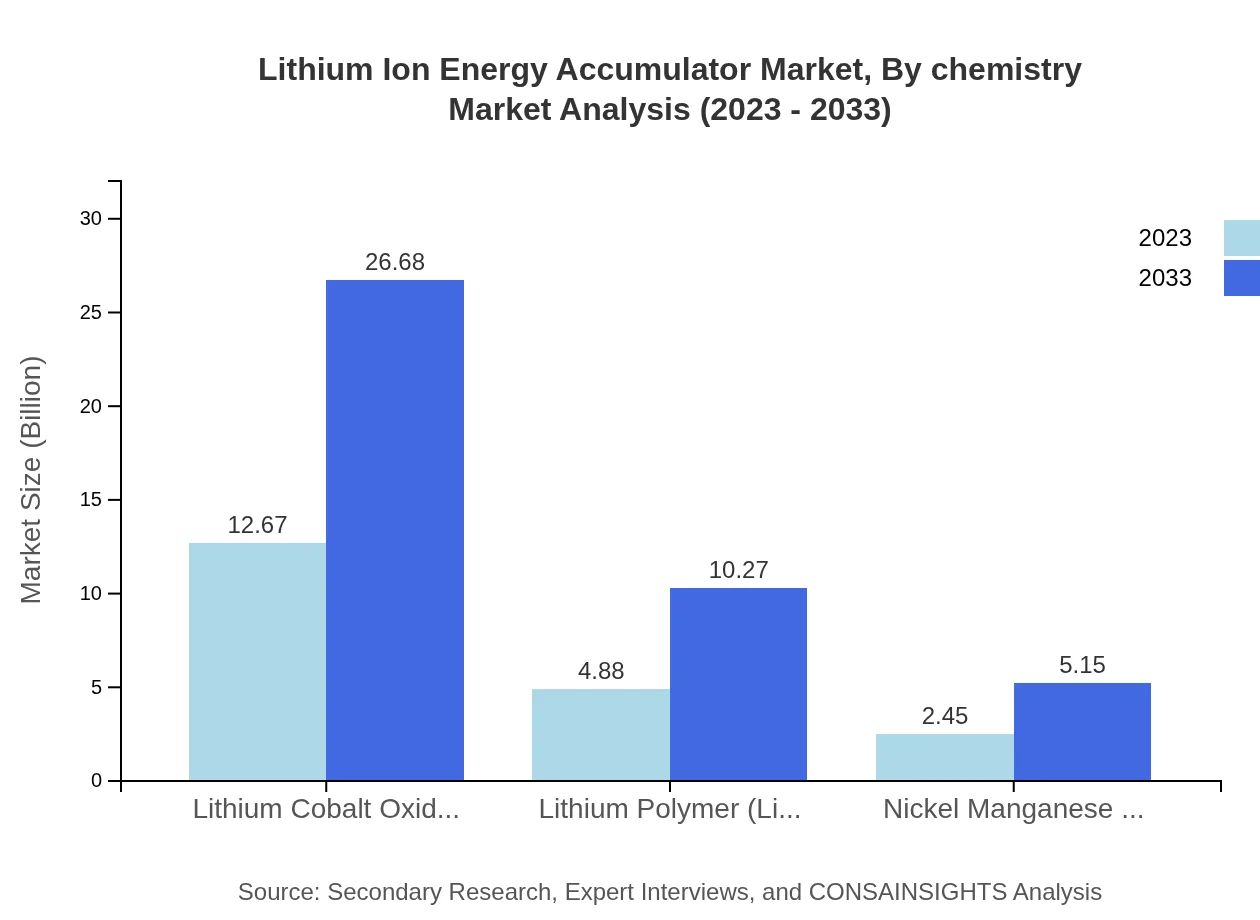

Lithium Ion Energy Accumulator Market Analysis By Chemistry

The market is significantly influenced by chemistry variations, with Lithium Cobalt Oxide (LCO) leading in size from $12.67 billion in 2023 to $26.68 billion in 2033, holding a market share of 63.37%. Lithium Polymer (LiPo), worth $4.88 billion in 2023, is projected to reach $10.27 billion by 2033, accounting for 24.39% of the market. Nickel Manganese Cobalt (NMC) is also gaining traction, with its market size expanding from $2.45 billion to $5.15 billion over the same period.

Lithium Ion Energy Accumulator Market Analysis By Application

Electric Vehicles constitute the largest application segment, with market size growing from $10.69 billion in 2023 to $22.50 billion in 2033, representing 53.44% of the market share. Energy Storage Systems and Consumer Electronics also hold significant positions, valued at $4.42 billion and $2.07 billion in 2023, respectively, with growth projections indicating substantial future contributions.

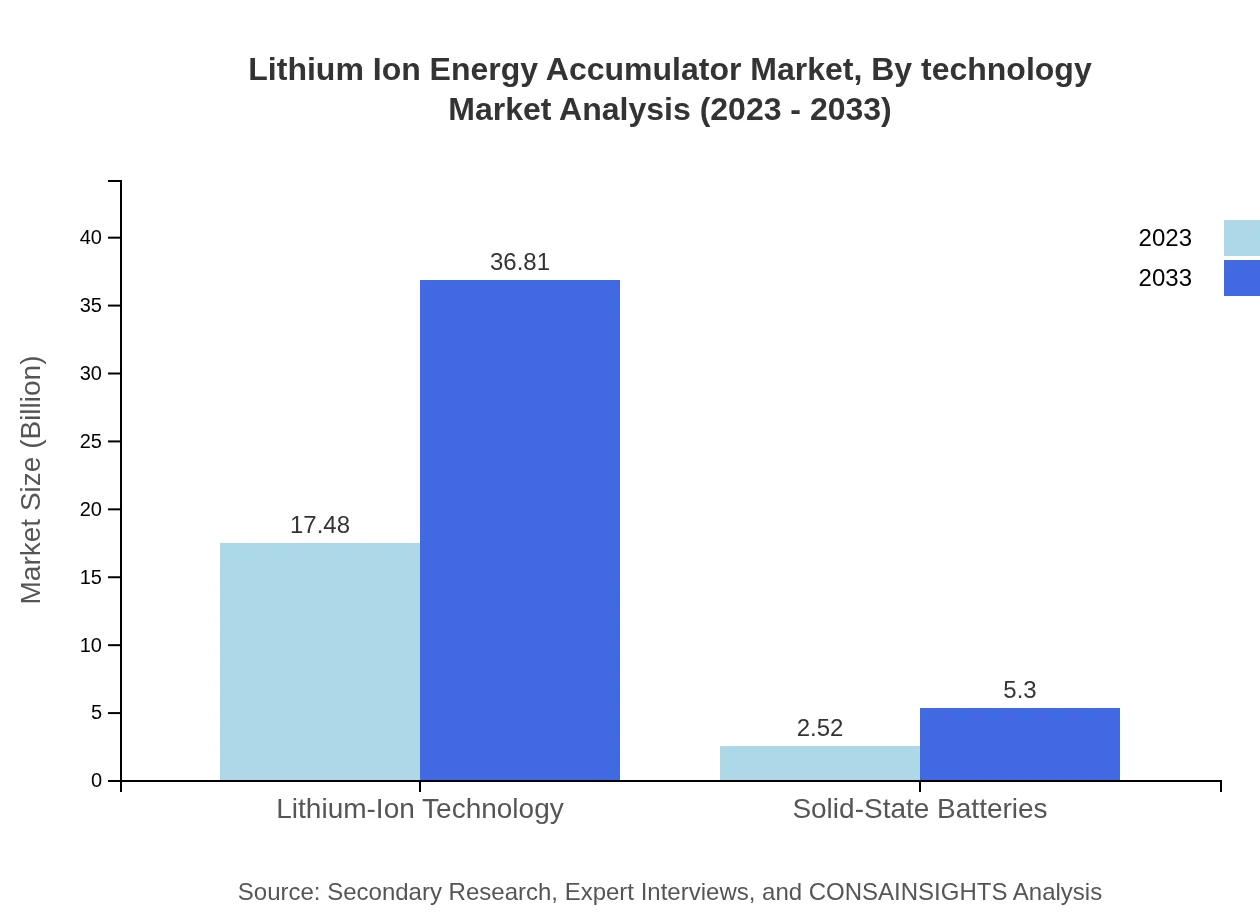

Lithium Ion Energy Accumulator Market Analysis By Technology

With a strong emphasis on innovation, the Lithium-ion Technology segment dominates, anticipated to increase from $17.48 billion in 2023 to $36.81 billion by 2033, commanding 87.42% market share. Solid-State Batteries also present a growing opportunity, projected to rise from $2.52 billion in 2023 to $5.30 billion by 2033.

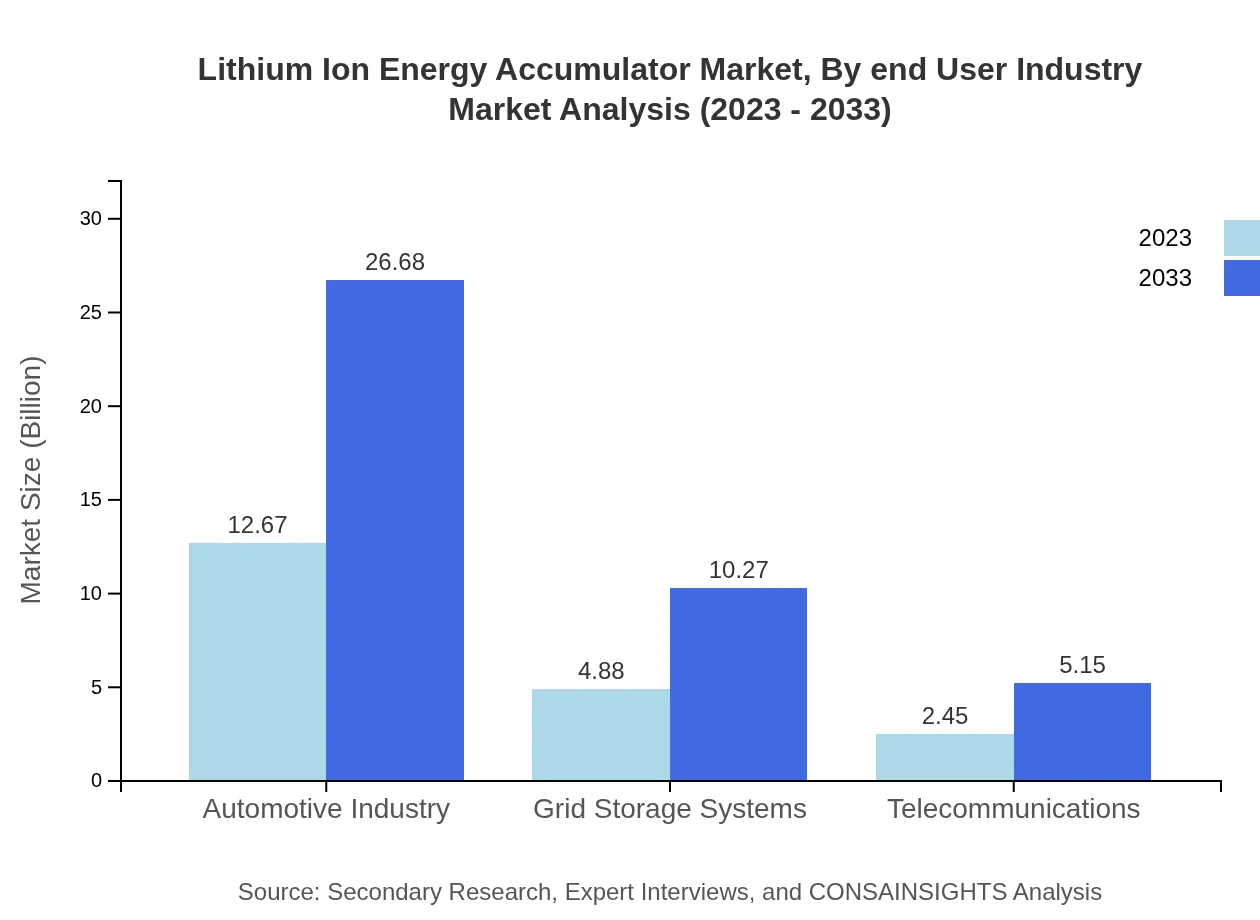

Lithium Ion Energy Accumulator Market Analysis By End User Industry

The automotive industry is the leading end-user for lithium-ion batteries, expecting growth from $12.67 billion to $26.68 billion from 2023 to 2033, with a significant market share of 63.37%. Other crucial sectors include telecommunication and industrial applications, both showing progressive growth trends.

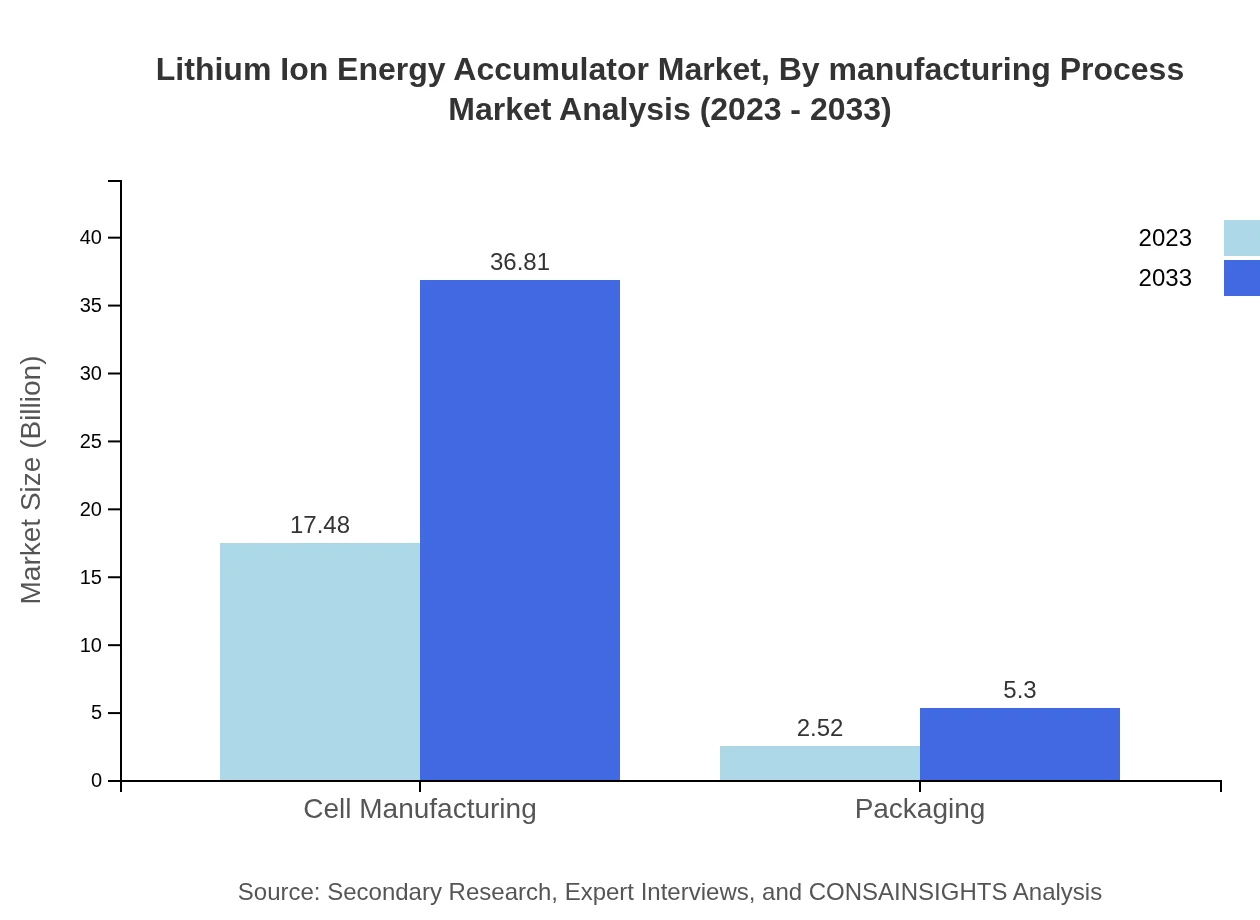

Lithium Ion Energy Accumulator Market Analysis By Manufacturing Process

Cell manufacturing contributed approximately $17.48 billion to the market in 2023, forecasted to grow to $36.81 billion by 2033, holding an 87.42% market share. Other manufacturing processes, including packaging, are also essential though contribute a comparatively smaller share.

Lithium Ion Energy Accumulator Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lithium Ion Energy Accumulator Industry

Tesla, Inc.:

Tesla is a pioneering company in energy storage and electric vehicles, heavily investing in lithium-ion battery technology for its cars and energy products.Panasonic Corporation:

Panasonic is a leading global battery manufacturer famous for its partnership with Tesla, specializing in lithium-ion batteries for electric vehicles and consumer electronics.LG Chem:

LG Chem manufactures a wide array of lithium-ion batteries and is known for its innovations in battery technology, particularly in the automotive sector.CATL (Contemporary Amperex Technology Co., Limited):

CATL is the largest lithium-ion battery manufacturer globally, focusing on R&D for higher energy density and better battery performance.We're grateful to work with incredible clients.

FAQs

What is the market size of lithium Ion Energy Accumulator?

The global lithium-ion energy accumulator market is projected to grow from $20 billion in 2023, with a CAGR of 7.5%, reaching significant milestones by 2033 as demand increases across various sectors.

What are the key market players or companies in this lithium Ion Energy Accumulator industry?

Key players in the lithium-ion energy accumulator market include top battery manufacturers and technology firms that specialize in battery development, focusing on innovation and new applications in electric vehicles and energy storage.

What are the primary factors driving the growth in the lithium Ion energy accumulator industry?

Growth in the lithium-ion energy accumulator market is driven by rising demand for renewable energy solutions, advancements in battery technology, and increased adoption of electric vehicles globally, enhancing energy efficiency.

Which region is the fastest Growing in the lithium Ion energy accumulator?

The fastest-growing region in the lithium-ion energy accumulator market is North America, projected to expand from $7.28 billion in 2023 to $15.33 billion by 2033, followed closely by Europe.

Does ConsaInsights provide customized market report data for the lithium Ion energy accumulator industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the lithium-ion energy accumulator industry, providing in-depth insights and analysis.

What deliverables can I expect from this lithium Ion energy accumulator market research project?

Deliverables include comprehensive market analysis, segmentation reports, regional data insights, forecasts, and competitive landscape assessments, all designed to support strategic decision-making.

What are the market trends of lithium Ion energy accumulator?

Current trends include the rise of solid-state batteries, increased use of lithium-ion in electric vehicles, and the focus on sustainable manufacturing practices, shaping the future of the energy accumulator market.