Lithiumion Battery Cathode Material Market Report

Published Date: 02 February 2026 | Report Code: lithiumion-battery-cathode-material

Lithiumion Battery Cathode Material Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Lithiumion Battery Cathode Material market, covering trends, forecasts, and insights from 2023 to 2033. It encompasses market size, segmentation, regional insights, and key players in the industry.

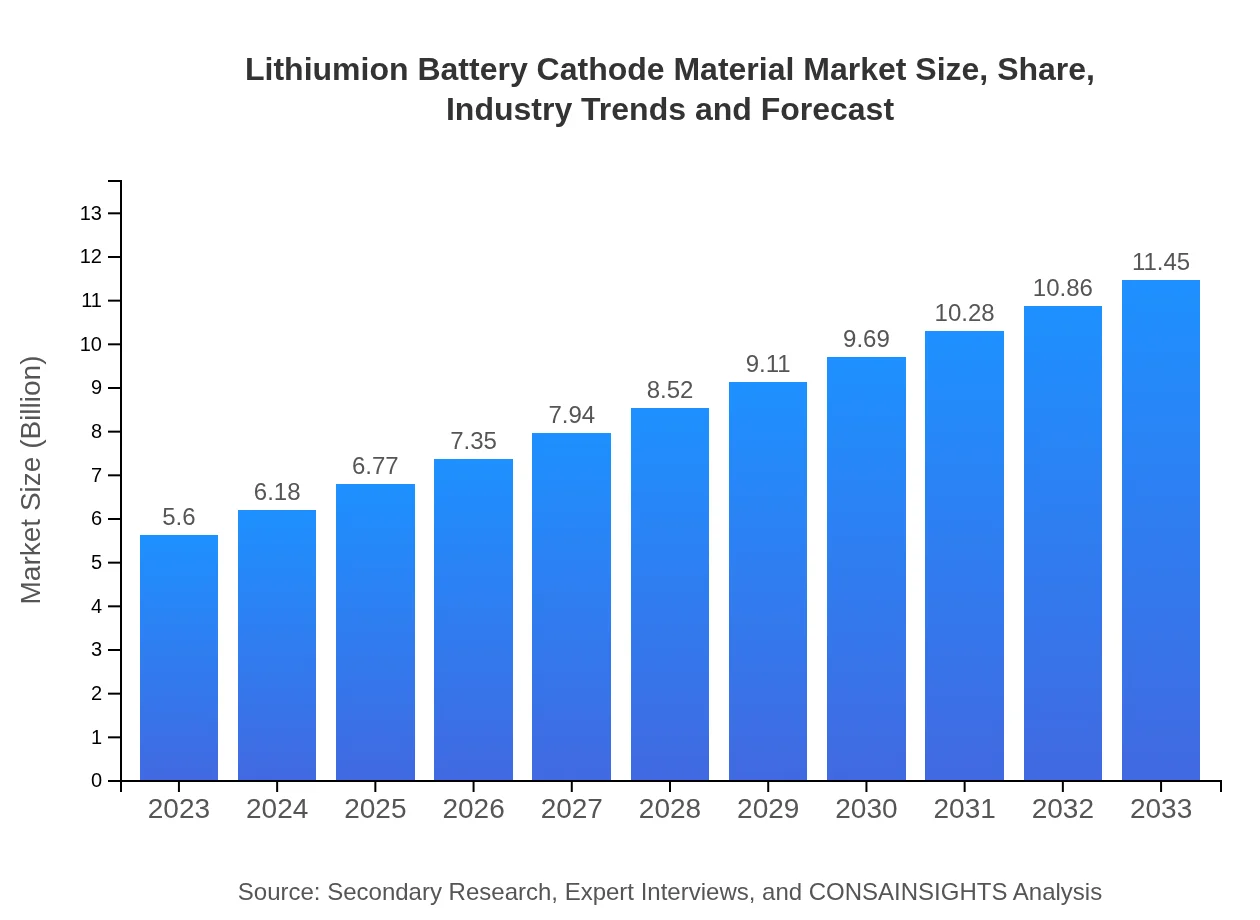

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | LG Chem, Panasonic Corporation, SK Innovation, Samsung SDI, Contemporary Amperex Technology Co., Limited (CATL) |

| Last Modified Date | 02 February 2026 |

Lithiumion Battery Cathode Material Market Overview

Customize Lithiumion Battery Cathode Material Market Report market research report

- ✔ Get in-depth analysis of Lithiumion Battery Cathode Material market size, growth, and forecasts.

- ✔ Understand Lithiumion Battery Cathode Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Lithiumion Battery Cathode Material

What is the Market Size & CAGR of Lithiumion Battery Cathode Material market in 2023?

Lithiumion Battery Cathode Material Industry Analysis

Lithiumion Battery Cathode Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Lithiumion Battery Cathode Material Market Analysis Report by Region

Europe Lithiumion Battery Cathode Material Market Report:

The European market, valued at $1.75 billion in 2023, is projected to reach $3.58 billion by 2033. The shift toward sustainable transport and stringent regulations on emissions are key drivers. Europe is increasingly investing in local battery production while also emphasizing recycling and sustainability, which are vital for future growth.Asia Pacific Lithiumion Battery Cathode Material Market Report:

The Asia Pacific region is a dominant player in the Lithiumion Battery Cathode Material market, estimated to reach $1.95 billion by 2033 from $0.95 billion in 2023. Countries like China, Japan, and South Korea lead in production and consumption, driven by high demand for electric vehicles and consumer electronics. With substantial investments in battery technology and manufacturing capacities, the region is poised for robust growth.North America Lithiumion Battery Cathode Material Market Report:

The North American market is expected to witness significant growth, expanding from $2.11 billion in 2023 to $4.30 billion in 2033. The strong presence of automobile manufacturers and technological advancements in battery manufacturing contribute to this growth. Government initiatives aimed at promoting EV adoption further stimulate the market.South America Lithiumion Battery Cathode Material Market Report:

In South America, the market size is projected to grow from $0.53 billion in 2023 to $1.08 billion by 2033. Countries such as Brazil and Argentina are increasingly focusing on renewable energy solutions, including battery storage systems. The growth in the automotive sector also propels the demand for advanced battery technologies.Middle East & Africa Lithiumion Battery Cathode Material Market Report:

The market in the Middle East and Africa is relatively smaller, with sizes of $0.26 billion in 2023 expected to grow to $0.53 billion by 2033. The focus is growing on renewable energy initiatives, supported by investments in infrastructure development which will incrementally drive the adoption of electricity storage solutions including lithium-ion batteries.Tell us your focus area and get a customized research report.

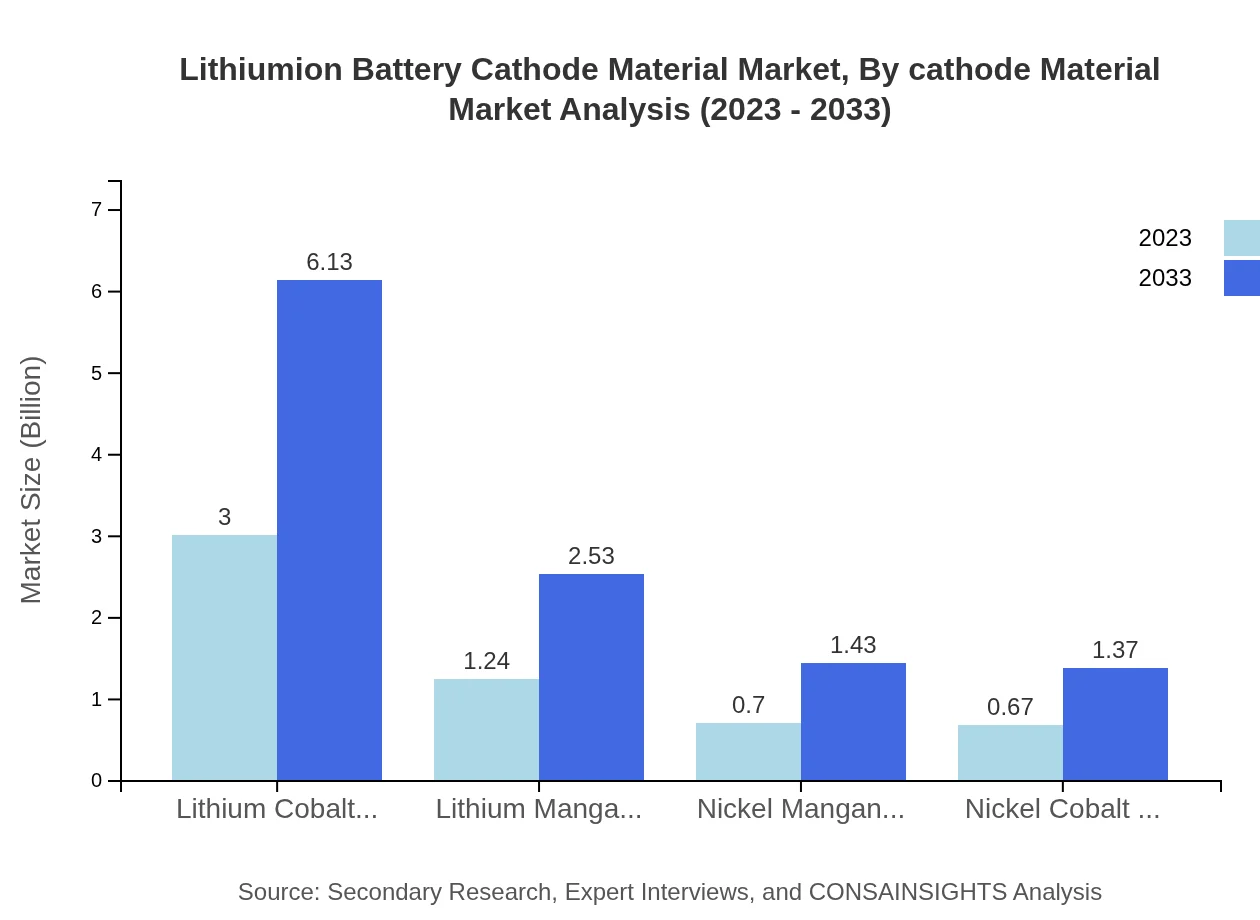

Lithiumion Battery Cathode Material Market Analysis By Cathode Material

Lithium-Ion Batteries hold a substantial market share, with sizes projected from $4.56 billion in 2023 to $9.33 billion in 2033. Lithium Cobalt Oxide dominates this segment, comprising 53.55% of the share in 2023, with the potential to maintain this lead due to its high energy density and efficiency. Other materials like Lithium Manganese Oxide and Nickel Manganese Cobalt contribute to diversification within the market.

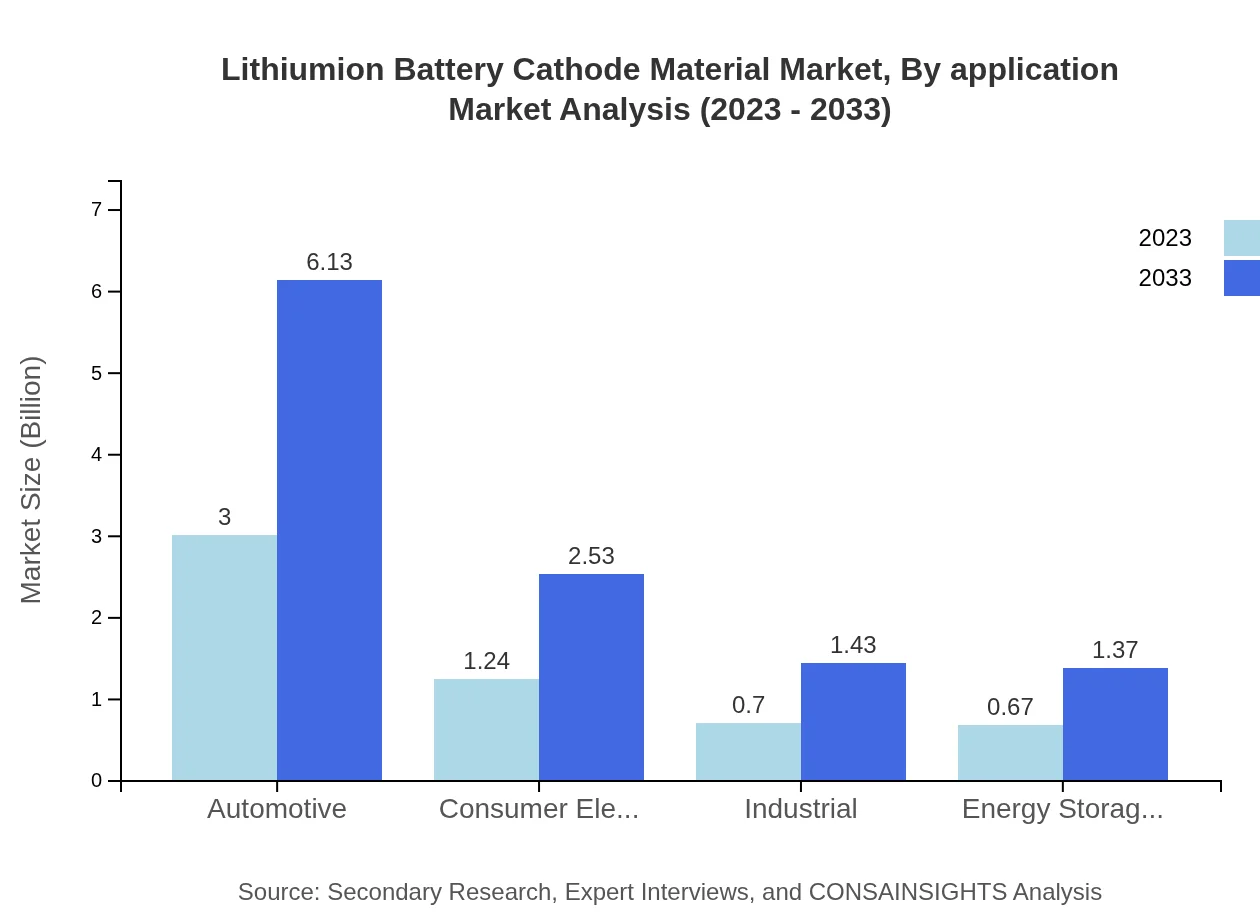

Lithiumion Battery Cathode Material Market Analysis By Application

Segmentation by application shows that the automotive sector is the largest end-user, with market sizes expected to rise from $3.00 billion in 2023 to $6.13 billion by 2033, enabling new propulsion technologies. Consumer electronics also play a significant role, with a market value increasing from $1.24 billion in 2023 to $2.53 billion by 2033. Industrial applications add diversity, while energy storage systems enhance resilience against power fluctuations.

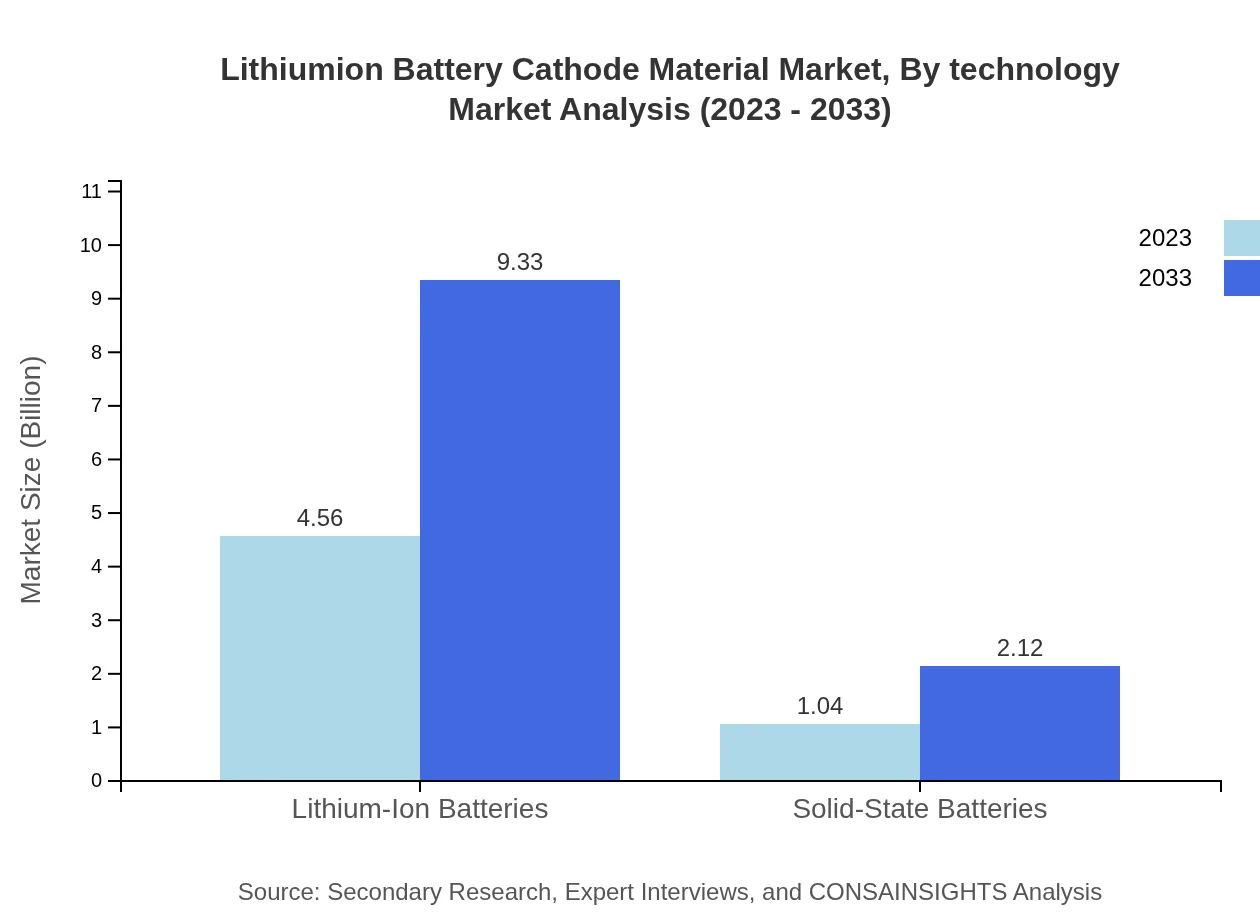

Lithiumion Battery Cathode Material Market Analysis By Technology

Technologies in the Lithium-Ion Battery Cathode Material market include traditional lithium-ion and newer solid-state battery technologies. The solid-state segment may see increased adoption, with sizes escalating from $1.04 billion in 2023 to $2.12 billion by 2033, owing to advancements that enhance safety and energy density.

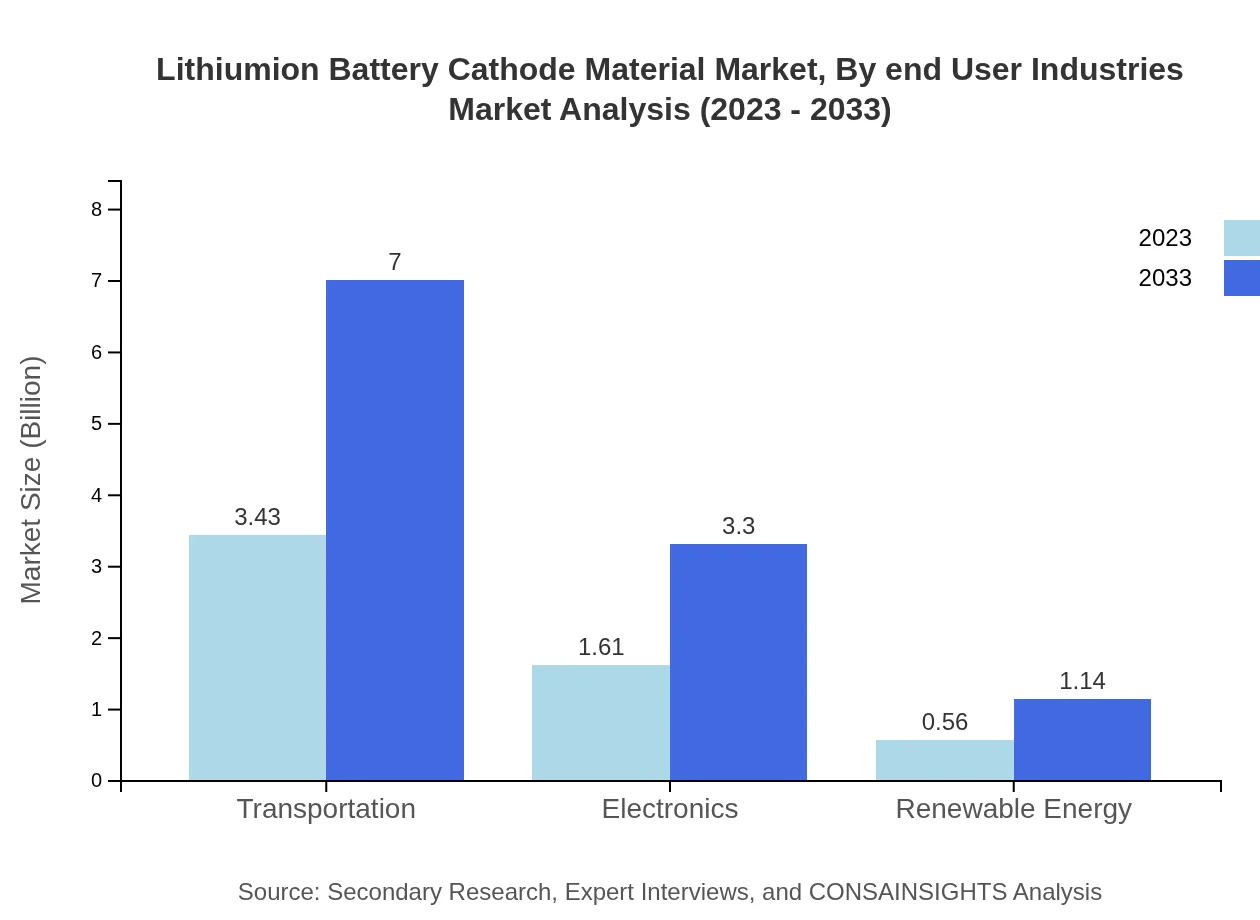

Lithiumion Battery Cathode Material Market Analysis By End User Industries

Transportation continues to dominate with a significant 61.19% market share in 2023. This segment is expected to grow from $3.43 billion to $7.00 billion by 2033. Meanwhile, the electronics sector, valued at $1.61 billion in 2023, also exhibits considerable growth potential driven by the surge in demand for mobile devices and renewable energy technologies.

Lithiumion Battery Cathode Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Lithiumion Battery Cathode Material Industry

LG Chem:

A leading chemical manufacturer, LG Chem specializes in producing cathode materials for electric vehicle batteries, driving advancements in lithium-ion technology.Panasonic Corporation:

Panasonic plays a crucial role in the battery industry, particularly in supplying advanced lithium-ion battery cells and materials, catering to automotive and consumer electronics markets.SK Innovation:

SK Innovation is a major player in lithium-ion battery materials with a focus on sustainable development and innovative energy solutions, contributing significantly to battery technology advancements.Samsung SDI:

Samsung SDI develops high-performance lithium-ion batteries and cathode materials, focusing on automotive applications and energy storage systems.Contemporary Amperex Technology Co., Limited (CATL):

As one of the world's largest manufacturers of lithium-ion batteries, CATL is at the forefront of battery research and production, playing a pivotal role in the automotive battery supply chain.We're grateful to work with incredible clients.

FAQs

What is the market size of lithium Ion battery cathode material?

The lithium-ion battery cathode material market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.2%. This growth reflects increasing demand for advanced batteries in various sectors.

What are the key market players or companies in the lithium Ion battery cathode material industry?

Key players in this industry include global companies specializing in battery materials, such as BASF, Umicore, and LG Chem. These companies are crucial in influencing market dynamics through innovation and partnerships.

What are the primary factors driving the growth in the lithium Ion battery cathode material industry?

Growth is driven by rising electric vehicle adoption, advancements in consumer electronics, and the demand for energy storage systems. Government initiatives promoting renewable energy further bolster corporate investments.

Which region is the fastest Growing in the lithium Ion battery cathode material market?

Asia Pacific is the fastest-growing region, with the market projected to grow from $0.95 billion in 2023 to $1.95 billion by 2033. This growth is fueled by increased manufacturing and technological developments.

Does ConsaInsights provide customized market report data for the lithium Ion battery cathode material industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs, providing nuanced insights into market trends, consumer behavior, and competitor strategies in the lithium-ion battery cathode material arena.

What deliverables can I expect from this lithium Ion battery cathode material market research project?

Deliverables include comprehensive market analyses, competitive landscapes, segmentation breakdowns, regional insights, and forecasts, equipping businesses with data essential for informed strategic planning.

What are the market trends of lithium Ion battery cathode material?

Current trends include a shift towards sustainable cathode materials, innovations in solid-state batteries, and a focus on recycling initiatives that enhance supply chain sustainability. Market players are innovating to improve energy density and efficiency.